In this post, I will focus on the best DeFi ecosystems for staking, allowing passive earning while backing blockchain networks.

There are several ecosystems available for different use cases, from liquid staking platforms to the easiest exchanges.

Even if you are a beginner, grasping the staking features as a holder will enable you to shallow deeper into crypto.

Key Points & Detailed

| DeFi Ecosystem | Key Point |

|---|---|

| Aave | Leading lending protocol offering staking through its Safety Module for securing the network and earning rewards. |

| Binance DeFi Staking | Provides simplified staking with access to multiple DeFi projects directly via Binance exchange. |

| Ankr | Offers liquid staking solutions across multiple blockchains, making staked assets tradable. |

| Rocket Pool | Decentralized Ethereum staking pool with low entry barriers and support for node operators. |

| Lido Finance | Popular liquid staking protocol for ETH and other assets, providing stETH in return. |

| Uphold | User-friendly platform offering staking rewards on multiple assets with no lock-in requirement. |

| Uniswap | Leading DEX where liquidity providers earn staking-like rewards from trading fees. |

| MakerDAO | Governance-driven DeFi protocol allowing users to stake MKR for protocol decisions and rewards. |

| Ethena | Synthetic dollar protocol enabling staking and yield generation through delta-neutral strategies. |

| Cosmos | Interoperable blockchain network with native staking of ATOM for securing the ecosystem. |

10 Best defi ecosystems for staking

1. Aave

Aave is one of the most well-known lending protocols in the DeFi space. Users can freely lend and borrow crypto assets, and also lend their AAVE tokens to the safety pool to earn staking rewards. Contributions to the pool are used to cover protocol shortfalls.

As AAVE tokens are staked, the underlying network is further secured. As AAVE offers support for staking across Ethereum, Avalanche, and Polygon, Aave ensures a broader user reach.

Liquidation pools, flash loans, and governance features seamlessly integrate and add value for users. As users gain governance and staking rewards Aave stands out as an ecosystem to consider.

Features Aave

- Safety Module Staking – Users can stake AAVE tokens to secure the protocol and earn rewards.

- Cross-Chain Support – Operates on Ethereum, Polygon, Avalanche, and more.

- Liquidity Pools – Wide range of lending/borrowing pools for multiple assets.

- Governance Rights – Stakers gain voting power in protocol upgrades and decisions.

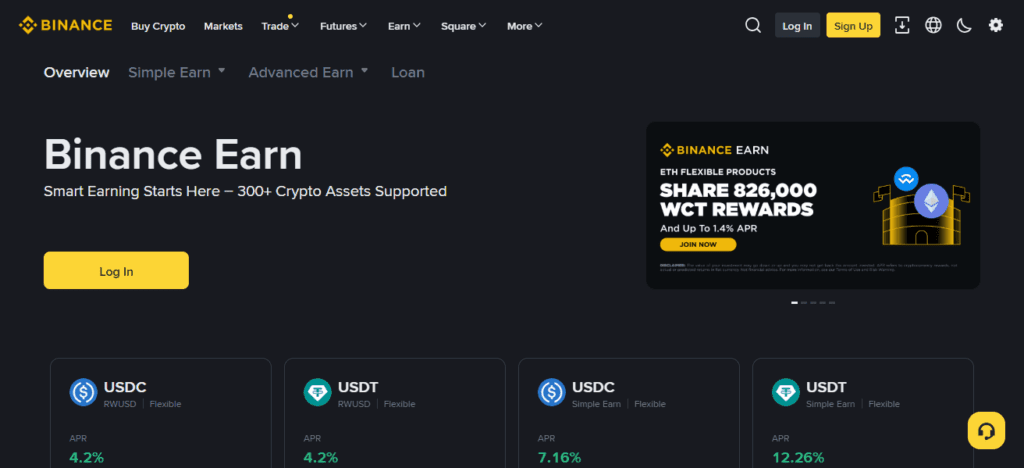

2. Binance DeFi Staking

Binance offers DeFi Staking to users who often struggle with the complexity of the underlying DeFi ecosystem. This effortless process allows users to stake without going through the hassles of step-by-step wallets and smart contract configurations.

DeFi services available directly plugged into the Binance platform dashboard come complete with ETH, DOT, and BNB to earn assets. DeFi Flex and DeFi Locked staking offer diverse and unapprotemised staking that is equally treated with Locked Staking.

Most users never relax while Binance takes ownership of Gas, stake and logistics, treaty aspects. Binance DeFi Staking is simplistic and more accessible to staking ecosystem users while offering useful ease to centrality.

Features Binance DeFi Staking

- One-Click Staking – Access to DeFi projects directly through Binance with simplified processes.

- Flexible & Locked Options – High-yield locked staking and flexible withdrawals.

- Wide Asset Support – Popular coins, ETH, BNB, DOT, and ADA available.

- Gas-Free Experience – Fee and smart contract management is taken care of by Binance.

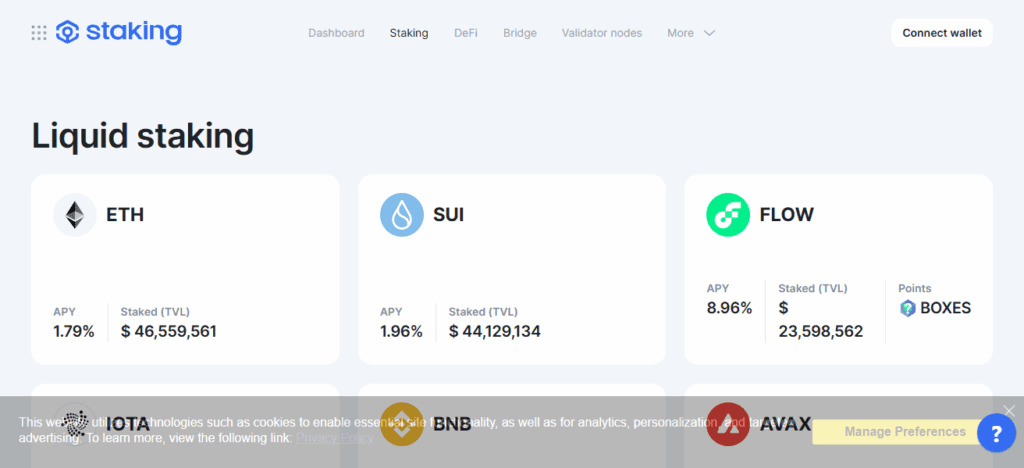

3. Ankr

Ankr is a multi-chain infrastructure provider on liquid staking across Ethereum, BNB Chain, and Polygon. Users are able to stake their assets and receive liquid staking tokens in return which gives them the ability to have their assets staked and liquid at the same time.

This is very appealing to users of Ankr who are active in the DeFi space. The additional feature of Ankr providing node hosting services helps further the decentralization of blockchain networks.

Ankr’s extensive cross-chain liquid staking support allows him to claim a reliable stake on the ecosystem.

Features Ankr

- Liquid Staking Tokens – Stakers receive tokens like ankrETH that can be used in DeFi.

- Multi-Chain Support – Works on Ethereum, BNB Chain, and other networks.

- Node Hosting Services – Decentralized infrastructure is simplified with easy access.

- Dual Earning – Users earn staking rewards and can trade liquid tokens and still earn.

4. Rocket Pool

Rocket Pool is a decentralized Ethereum staking protocol that aims to be user-friendly and foster decentralization. Unlike centralized providers, users are able to stake a minimum of 0.01 ETH while node operators can start with 16 ETH instead of the Ethereum 32 ETH requirement.

Stakers can use their staked assets to receive rETH tokens which can be used on other DeFi platforms.

The liquid staking system of Rocket Pool is a mix of decentralization and accessibility which allows and empowers smaller and individual players to take part in Ethereum’s proof-of-stake ecosystem.

It is a community-driven project that has become a substitute to the larger, centralized staking solutions like exchanges by rewarding both validators and delegators.

Features Rocket Pool

- Low ETH Entry – Stake with as little as 0.01 ETH.

- Decentralized Validators – Node operators can run validators with 16 ETH instead of 32.

- rETH Token – Liquid staking token usable in DeFi platforms.

- Community-Driven – Designed to prioritize decentralization over centralized staking providers.

5. Lido Finance

Lido Finance is a leader in the adoption of liquid staking in DeFi, especially when it comes to staking Ethereum. Users can stake ETH and mint stETH tokens, which are fluid and usable across DeFi applications.

This solves the lock-up problem Ethereum staking is known for, and creates a unique ETH staking product that is both reward and liquidity-efficient. Lido also allows staking of other assets like Polygon (MATIC) and Solana (SOL).

It’s partnered with leading DeFi applications, which enhances usability, and the protocol’s distributed governance model provides transparency and security.

Lido has billions in Total Value Locked (TVL) and is still the industry leader for liquid staking solutions.

Features Lido Finance

- Liquid Staking – Stake ETH and receive stETH for DeFi use.

- Multi-Asset Support – Supports Ethereum, Polygon, Solana, and more.

- Massive TVL – Billions locked, making the largest liquid staking provider.

- DAO Governance – Controlled by a decentralized autonomous organization for more transparency.

6. Uphold

Uphold is a centralized platform that is simple to use, providing staking opportunities across a broad range of crypto assets without requiring advanced technical skills.

Defi protocols like Uphold make staking easier by providing a simplified interface, instant staking, and no lock-in requirements on certain assets.

Users can earn competitive returns in ETH, ADA, and SOL, with the added flexibility of being able to withdraw at any time.

Uphold is regulated in multiple jurisdictions, which adds a layer of trust over unregulated DeFi solutions.

For individuals who want to stake crypto without having to use a wallet or navigate the complicated DeFi web, Uphold is a great place to start.

Features Uphold

- User-Friendly Staking – No complicated wallets or DeFi setups.

- Flexible Withdrawals – No lock-in periods for some assets.

- Multi-Asset Support – ETH, ADA, SOL, and others available for staking.

- Regulated Platform – Compliance to regulation adds further safety.

7. Uniswap

Uniswap allows users to buy or sell cryptocurrencies without the need for an intermediary. It does this through the automated market maker (AMM) model.

AMM allows users to provide liquidity to the system, much like a bank that lends tokens and earns interest in return. Uniswap’s LPs earn a share of the trading fees generated by the liquidity that is provided. LPs earn liquidity provider tokens (LPTs) in return.

Uniswap users can confer governance by holding UNI tokens. This gives them the right to vote on system improvements. Uniswap provides yield farming opportunities alongside governance influence, making it a trading hub and staking-like ecosystem.

Features Uniswap

- Liquidity Provision – Users provide assets to pools and earn fees.

- UNI Governance Token – Token holders vote on upgrades and proposals.

- AMM Model – Automated market maker for decentralized trading.

- Staking-Like Rewards – Liquidity providers earn returns similar to staking yields.

8. MakerDao

MakerDAO is a lending protocol best known for issuing the crypto stablecoin DAI. Users can actively participate in the Maker protocol by voting on the platform’s governance decisions.

Governance participants are rewarded for managing operational parameters of the DAI system. While traditional staking is often described as ‘passive

This activity by MakerDAO stakers is very much active since they are participating in one of the largest DeFi ecosystems in existence.

Features MakerDAO

- Governance Staking – MKR holders influence risk and stability parameters.

- Stablecoin System – Pledges support for DAI, a stablecoin that is decentralized and backed by collateral.

- Risk management – Staking MKR serves as a form of insurance for any potential losses that may occur.

- Decentralized Governance – Voting on improvements for the protocol is done exclusively by the community.

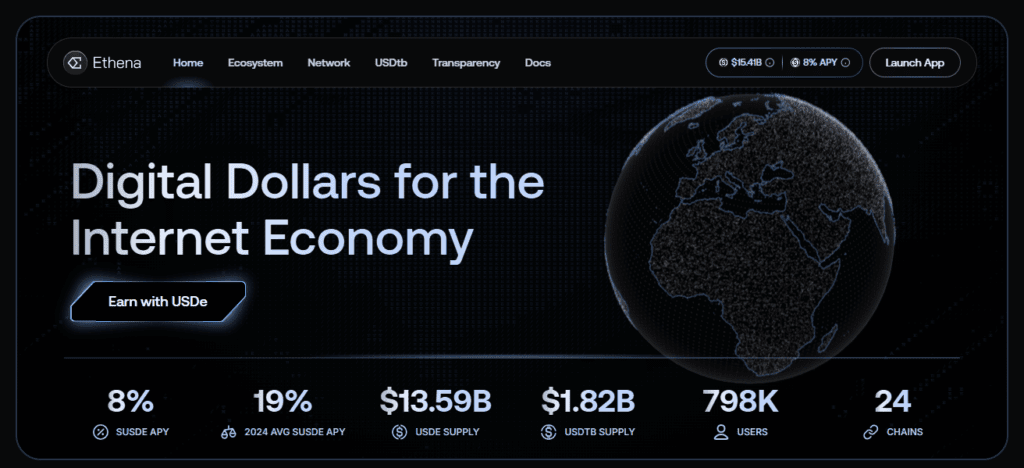

9. Ethena

Ethena is a new DeFi protocol pioneering stable yield generation alongside synthetic assets. It proposes the innovative synthetic dollar (USDe), which utilizes delta-neutral strategies to ensure stability and yield.

Users can stake assets in Ethena to receive yield and also gain exposure to synthetic financial products. Its unique design combines strategic high-yield risk with intelligent high-reward risks.

Ethena has gained substantial attention in a very short period of time due to its unique approach synthesizing DeFi with stable yield generation. Ethena is a strong candidate for users looking for innovative strategies in DeFi.

Features Ethena

- Synthetic Dollar (USDe) – Owns a stablecoin that is backed by hedging.

- Delta-Neutral Strategy – Contains strategies that mitigate risks and ensures stable returns.

- Staking Yields – Assets can be staked and will earn rewards in the Ethena ecosystem.

- Innovative Design – Merges stablecoin with staking in a single system.

10. Cosmos

Cosmos is an interoperable network of multiple blockchains connected through an Inter-Blockchain Communication Protocol (IBC). Users can stake their ATOM tokens, which helps secure the network while earning passive income.

ATOM can also be used to vote for votes on network upgrades, and users can stake ATOM across the myriad connected blockchains in the growing Cosmos ecosystem.

Recognized for its innovative approach to blockchains, Cosmos aims to develop an “internet of blockchains” and also offers flexible and secure staking options which combine governance and interoperability.

Features Cosmos

- ATOM Staking – Users stake ATOM as a form of securing the Cosmos Hub.

- IBC Protocol – Allows different blockchains to work together seamlessly.

- Validator & Delegator Roles – Both serve the purpose of securing the network.

- Governance Voting – Stakers of ATOM can vote on system upgrades and new propositions to the ecosystem.

How To Choose The Best DeFi Ecosystems for Staking

Check Security & Reputation: Choose platforms that have strong audits, a strong history, and transparent frameworks. Check for partnerships, community trust, and open-source code.

Understand Reward Rates: Compare the different APYs across various platforms. Be careful of ‘too good to be true deals or very high offers since they usually have high risks.

Evaluate Liquidity Options: Choose platforms that have liquid staking and staked tokens like StETH or rETH so that your funds are still accessible in DeFi. Avoid ecosystems with long lock-up periods unless you’re comfortable holding.

Consider Supported Assets: Some platforms are limited to ETH only while others have a variety like ATOM, SOL, and MATIC. Choose a platform that is in alignment with your crypto portfolio.

Check Fees & Accessibility: Evaluate the staking and gas fees and restrictions to entry. Some platforms like Rocket Pool have very low ETH staking requirements while Ethereum directly has a staked requirement of 32 ETH.

Review Governance & Control: If you take the value of ecosystem governance and control more seriously, you have the freedoms to take governance rights in ecosystems like MakerDAO, Aave, or Cosmos.

Conclsuion

In conclusion, in choosing the best DeFi ecosystems for staking, factors such as objectives, risk appetite, and the assets involved are decisive.

Platforms such as Lido, Aave, and Cosmos, as well as Rocket Pool, all have distinctive advantages, from liquid staking to even governance rights.

The strategic ecosystems allow investors to stake networks, earning passive income. Moreover, investors can actively grow decentralized finances.

FAQ

DeFi staking means locking crypto assets in decentralized protocols to earn rewards while securing the network.

Top options include Aave, Lido Finance, Rocket Pool, Cosmos, Ankr, and Binance DeFi Staking.

Liquid staking lets users stake tokens and receive tradeable tokens (like stETH, rETH) while still earning rewards.

Yes, risks include smart contract bugs, slashing, and market volatility. Choose audited and trusted platforms.

Yes, user-friendly platforms like Binance DeFi Staking or Uphold make it simple for newcomers.