This article is about the Best Crypto Exchanges to offer safe, quick, and easy trading experiences to novices and experts alike. Best the best platforms for safe trading, low trading fees, and diverse coins are crucial.

Top exchanges including Binance, Bybit, Coinbase Exchange, OKX, Kucoin, Bitget, MEXC, Gate.io, Upbit, and HTX are accessible globally, offer dependable liquidity, and present numerous ways to earn.

How to Start Trading?

Use an Exchange You Can Trust

Identify an exchange that fits your needs, such as Binance, Coinbase, or Bybit. Before trading, confirm that the exchange works in your country. Look at how securely the funds are guarded and whether deposits are convenient, as these are important factors for trading crypto.

Register and Complete KYC

After selecting an exchange, create an account and complete the KYC process by presenting an identification document. This step is crucial, as it will allow the account holder secure deposits and withdrawals, and full trading capabilities. KYC verification also helps the exchange confirm to regulators that they follow the applicable laws.

Add Money

You can add money to your account balance by bank transfers, UPI, debit cards, or crypto wallets. It is a good idea to start with a small amount to limit your risk, about $50 or ₹1000 will be a good start.

Choose A Trading Pair

Identify the trading pair you are interested in, and which cryptocurrency you want to trade, such as BTC/USDT or ETH/USDT. This pair will dictate which cryptocurrency you can buy or sell in exchange for the other currency.

Learn Different Order Types

Every trader must learn the basics which consist of: Market Order (buy/sell at the current price), Limit Order (set your price), and Stop-Limit Order (cease loss and protect funds). Market Orders is the type of order that most beginners start with.

Conduct Your First Trade

On Binance for example, you can buy $20 worth of Bitcoin (BTC). Use a Market Order to buy and the trade will be executed instantly at the current market price.

Analyze and Manage Your Trades

You can manage your investment by analyzing its performance in the provided chart and analytic tools.

Configure stop-loss and take-profit parameters to control your exposure and secure prospective earnings.

Withdraw or Reinvest Profits

Profits can be withdrawn to your bank or reinvested into other cryptocurrencies to help diversify and grow your portfolio progressively.

Key Point

| Exchange | Founded Year | Native/Primary Currency |

|---|---|---|

| Binance | 2017 | BNB (Binance Coin) |

| Bybit | 2018 | USDT (Tether) |

| Coinbase | 2012 | USD (U.S. Dollar) |

| Upbit | 2017 | KRW (South Korean Won) |

| OKX | 2017 | OKB (OKX Utility Token) |

| Bitget | 2018 | BGB (Bitget Token) |

| MEXC | 2018 | MX (MEXC Token) |

| KuCoin | 2017 | KCS (KuCoin Shares) |

| Gate.io | 2013 | GT (GateToken) |

| HTX (Huobi) | 2013 | HT (Huobi Token) |

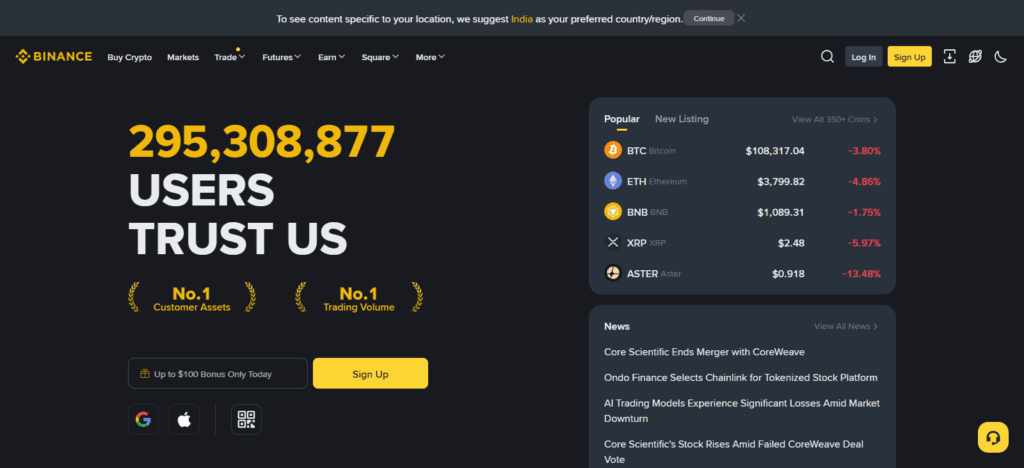

1. Binance

Binance began operations in 2017 and now provides access to more than 350 cryptocurrencies, including BNB, BTC, and ETH. It offers spot, futures, and margin trading at competitive rates, with the spot trading commission at 0.1%, which drops further with BNB payments.

Deposit and withdrawal methods are flexible, and deposits are free, while withdrawal fees depend on the chosen cryptocurrency.

As for geographical reach, Binance provides services in more than 100 countries, although some parts of the EU and the U.S. have more limited access. It is in the Best Crypto Exchanges Binance.

Binance Features

- Over 350 cryptocurrencies

- Spot, margin, futures, and options trading

- Binance Launchpad for token sales

- BNB for token fee discounts

Pros

- Trading fees are the lowest (0.1% spot)

- Deep liquidity, ultra-high volume

- Advanced APIs and trading tools

- Multilingual support and global reach

Cons

- Not available in the U.S (Binance US is separate)

- For beginners, the interface is complex

- Scrutiny and regulatory complexity in several countries

- KYC for full access

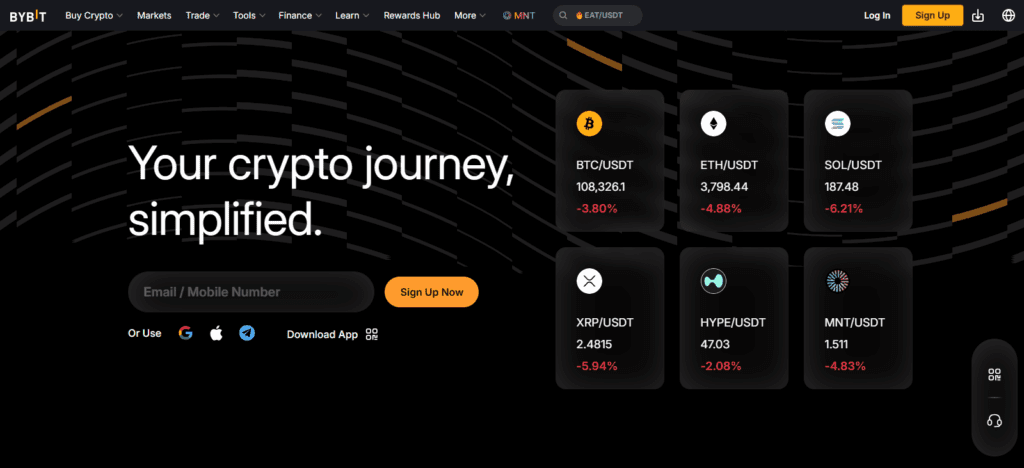

2. Bybit

Bybit launched in 2018 and now supports BTC, ETH, USDT, and 300 other assets. They have a spot, futures, and copy trading and charge competitive trading fees (0.1% spot, 0.02% futures).

Deposits in crypto and fiat (Visa, Mastercard, wire) are free, while withdrawals will have network fees. It is available in 160+ countries but the U.S. and the EU.

Advanced users appreciate the trading bots and high leverage (up to 100x). Named one of the Best Crypto Exchanges Bybit stands out for automation and derivatives trading.

Bybit

Features:

- Derivatives and perpetual contracts

- Copy trading and trading bots

- Up to 100x trading leverage

- USDT, USDC, and coin-margined contracts

Pros

- Excellent UI for both pro and novice traders

- Trading fees are low (0.01% maker, 0.06% taker)

- Strong security (cold storage, 2FA)

- Outstanding execution speed and guaranteed uptime

Cons

- Not available in the U.S., France, Netherlands

- Restricted options to deposit fiat

- No staking or DeFi

- Regulatory uncertainty

3. Coinbase Exchange

Launched in 2012, Coinbase was the first largest U.S.-regulated exchange and it was first to offer 240+ assets such as BTC, ETH, and USD. It now offers spot and derivatives trading all which incur high fees (0.5% spread + variable commission).

Deposit via ACH, wire, and card and withdraw via bank and PayPal. Their services are available in 100+ countries there are intended for beginners and institutions.

It was first to offer insured wallets and is one of the Best Crypto Exchanges Coinbase and was first to offer it regulatory trust.

Coinbase Exchange Key Features

- U.S. exchange

- Supports over 240 cryptocurrencies

- Coinbase Wallet and Vault

- High institutional-grade custody

Pros:

- Beginner-friendly

- Compliance and security

- Fiat (ACH, PayPal) off/on ramps

- Insurance on your assets

Cons:

- High fees (upwards of 3.99%)

- No advanced trading tools

- Slow customer support

- Altcoins availability is poor

4. Upbit

Launched in 2017 and based in South Korea, Upbit is one of the largest crypto exchanges in the world and offers trading in over 150 cryptocurrencies including Bitcoin, Ethereum, and the South Korean Won.

Upbit is known for its strong fiat integration and competitive trading fees of around 0.25%. Deposits and withdrawals of fiat currency are bank transfers in KRW and crypto options are available.

Upbit is known for its security and regulatory compliance and dominates the Korean market while expanding to Southeast Asia. It is heavily relied on by Korean retail traders and offers great trading options for Upbit exchange.

Upbit Key Features

- KRW fiat integration

- 150+ crypto assets

- Developed with Bittrex tech

- South Korea strong compliance

Pros:

- KRW deposits/withdrawals seamless

- High trust Korean market

- Clean and simple UI

- Strong security protocols

Cons:

- Poor global expansion

- No margin or futures trading

- Language barrier

- Poor fiat options outside Korea

5. OKX

Also established in 2017, OKX is available in over 180 countries and offers crypto trading in over 350 cryptocurrencies, including the highly traded Bitcoin, Ethereum, and OKB.

OKX has various trading options available and offers trading in futures, staking, and DeFi tools in addition to spot trading with very competitive trading fees of 0.08 for spot trading and 0.02 for futures.

Although OKX is available globally, it is still restricted in the US. Aside from its trading options, OKX is praised for its Web3 wallet and NFT marketplace and is highly regarded in the crypto field. OKX has strong DeFi integration and is highly relied on for trading along with OKX.

OKX Key Features

- Spot, futures, options, and DeFi

- OKB token ecosystem

- Web3 wallet and NFT marketplace

- Copy trading and bots

Pros:

- Low fees (0.08% spot, 0.02% futures)

- High asset support (350+ coins)

- Strong mobile and desktop platforms

- DeFi and staking integration

Cons:

- Not available in U.S.

- Complicated for beginners

- Limited fiat deposit options

- Some delays in withdrawals

6. Bitget

Established in 2018, Bitget also supports BGB, BTC, ETH, and 250 more coins. Comfortably specializing in futures and copy trading, the platform has extremely low 0.02% trading fees on futures. Users receive the ability to deposit crypto, use Visa and Mastercard, and offer 13 fiat currencies.

Withdrawing funds is subject to network and fiat fees. Located in over 100 countries, Bitget lacks a U.S. presence. Users receive advanced automation and risk management. Social and leveraged trading make Bitget special.

Bitget Key Features

- Copy trading with over 55K pro traders

- Consolidated trading account

- Access to futures and spot markets

- Utilization of the BGB token

Pros:

- Competitive futures trading fees (0.02% for makers)

- Strategic partnerships with notable global brands (Messi, Juventus)

- Generous leverage options

- Fast and secure platform

Cons:

- Limited options for converting crypto to dollars

- Services unavailable in the United States

- Limited altcoins compared to other exchanges

- KYC for full platform use

7. MEXC

MEXC was also founded in 2018 and supports over 2800 coins including MX, BTC, ETH, and other niche altcoins. Users receive spot, futures, and staking from the platform with zero maker fees and 0.05% taker fees with available 0.05%. Users receive the option to deposit crypto and limited fiat via card and bank.

Withdrawing funds is subject to network fee. With minimal KYC for basic access, MEXC is available in more than 170 countries. Dominating altcoin diversity, MEXC is also listed among the Best Crypto Exchanges.

MEXC Key Features

- Over 3,000 tokens

- No-KYC for basic trading

- Decentralized Exchange (DEX+) integration

- High leverage on futures

Pros:

- No fees for makers (0%)

- Quick order execution with substantial market liquidity

- Regular token airdrops and launches

- Excellent altcoin discovery

Cons:

- User interface has a steep learning curve

- Crypto to dollars support is very low

- Services unavailable in the United States

- Some users report slow customer support

8. KuCoin

Since its establishment in 2017, KuCoin has grown to support over 900 assets, including KCS, BTC, ETH, and other stablecoins. KuCoin permits spot and futures trading, along with staking and the use of trading bots, and has relatively low fees (0.1% spot, with further discounts for using KCS).

KuCoin accepts deposits in crypto and employs third-party fiat gateways, and withdrawals depend on the coin type.

KuCoin is available in over 180 countries but has U.S. regulatory challenges. KuCoin is best for intermediate traders. KuCoin balances access to features and services and is part of the Best Crypto Exchange.

KuCoin Key Features:

- Access to over 1,000 coins and tokens

- Fee discount KCS token

- Advanced trading bots and launchpad features

- Additional staking and lending services

Pros:

- Competitive trading fees (0.1% spot)

- Advanced features available to all traders

- High market liquidity with efficient order execution

- Regular new listings

Cons:

- Services are not licensed in the U.S., UK, or Canada.

- Uncertainty in regulations

- KYC limited optional but restricts features

- Sometimes withdrawals are delayed

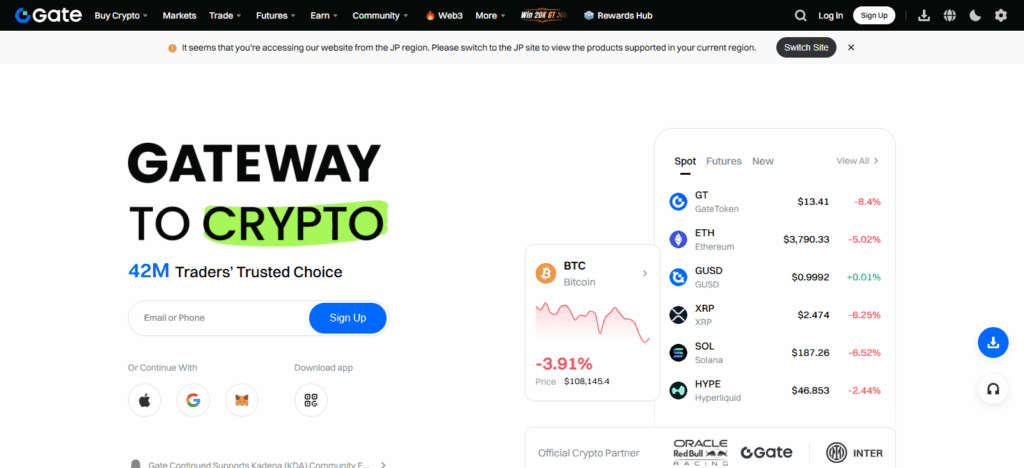

9. Gate.io

Founded in 2013, Gate.io has more than 3,800 different coins available, including GT, BTC, ETH, and other niche tokens. Gate.io has staking, NFTs, and margin services in addition to the usual spot, futures, and other crypto trading, and has a fee of 0.2%.

Gate.io accepts crypto and fiat deposits (credit/debit card and bank transfers) and has coin-agnostic withdrawals. Gate.io is available in more than 180 countries but not in the U.S. Gate.io has advanced trading tools and deep coin listings.

Gate.io Key Features

- Over 3,800 available digital assets

- Crypto copy trading

- Trading bots

- Gate Pay

- Startup launchpad

Pros:

- Wide variety of altcoins available

- Multiple features for advanced trading

- Cold wallets are provided with risk controls

- Tokens are launched frequently

Cons:

- The platform is not available in the U.S.

- Not beginner friendly

- Security incidents in the past

- Weak fiats integration

10. HTX (Huobi)

Launched in 2013 and now rebranded as HTX, it supports 700+ assets including HT, BTC, ETH. HTX provides spot trading, futures contracts, staking, and loan services and has low fees (0.2% spot trading). HTX allows deposits in crypto and fiat (bank cards and bank transfers).

Withdrawals are limited. HTX has multilingual support and is recognized for high leverage. HTX operates in 170+ countries and regions outside the U.S. and China. In terms of trading volume, HTX is one of the Best Crypto Exchanges – HTX . HTX is and will always be a legacy powerhouse.

HTX (Huobi) Key Features

- 700+ digital coins

- Over 1,000 trading pairs

- HT token with utility

- Spot, futures, staking, and loans trading

- Merkle tree proof-of-reserves

Pros:

- Competitive trading fees

- High security with cold wallets and audits

- Multiple languages are supported

- The platform has been in the market for a long time

Cons:

- The platform is not available in the U.S. and China

- Security incidents in the past

- Confusion with the brand after relaunch

- Weak fiat integration

How To Choose the Best Crypto Exchanges?

Security Features

Select Binance and Coinbase Exchange as they offer cold storage, Two-Factor Authentication, and some level of audit transparency in order to shield funds from hacks and allow safe trading.

Trading Fees

Low-fee exchanges are Bybit, OKX, and Bitget as they have maker & taker fees of under 0.1%, thus allowing more cost-efficient and profitable trades.

Supported Currencies

Choose MEXC, Kucoin, and Binance as they have more than 500 cryptocurrencies, including the major ones BTC, ETH, USDT, and many altcoins as well as offer many trading options.

Deposit and Withdrawal Methods

Choose Gate.io, Upbit, and HTX as they allow instant cryptocurrency withdrawals, accept fiat deposits from bank transfers, and credit cards as well as allow quick entrance no matter the time.

Country and Regulation Support

Ensure the exchange is within your area legally. Binance and Coinbase Exchange are globally regulated, thus they offer user protection and compliance regulation.

User Interface and Experience

Great user experience is what Bybit and OKX aim for, thus they are user-friendly as they provide clean dashboards, mobile apps, and analytics in real time making trading seamless.Liquidity & Volume

For instant order execution and low slippage, use Binance, HTX, and Kucoin. These have higher trading volumes.

Customer Support

For quick issue resolution and user satisfaction, use Bitget and MEXC. Both have 24/7 live chat and multilingual customer support.

Staking & Earning Options

For earning passive income on your crypto, use OKX, Gate.io, and Binance. These have savings, staking, and yield programs.

Reputation & Community Trust

Use reputable and transparent exchanges Binance, Coinbase Exchange, and Bybit. These have strong global user bases, consistent uptime, and transparency in their operations.

Conclusion

Choosing the best crypto exchange depends on your personal goals, country, and your style of trading. For advanced trading tools and global liquidity, Binance is still the best. For those who prefer high-leverage strategies, Bybit and Bitget excel in derivatives and copy trading.

For U.S. users who value regulation and ease of use, Coinbase Exchange is the best option. Upbit is the best exchange in South Korea and has strong integration with the fiat system.

OKX and KuCoin have extensive ecosystems with multiple DeFi and staking features and access to many altcoins. MEXC and Gate.io are great for altcoin traders and have massive altcoin listings. HTX (Huobi) is still a key player in Asia.

Based on your priorities, there are trade-offs between fees, KYC, fiat support, and country access, so choose carefully.

FAQ

Coinbase Exchange is ideal for beginners due to its simple interface, strong security, and fiat support. It’s regulated in the U.S. and offers insured wallets.

Binance, Bybit, and MEXC offer some of the lowest fees. Binance charges 0.1% for spot trades, Bybit offers 0.01% maker fees, and MEXC has zero maker fees.

Bybit, Bitget, and Gate.io support copy trading. Bitget is especially popular with over 55,000 pro traders available to follow.

MEXC, KuCoin, and Gate.io allow limited trading without full KYC. However, withdrawals and advanced features may be restricted.

MEXC, Gate.io, and KuCoin offer thousands of altcoins and early access to new tokens. These platforms are ideal for altcoin hunters.

Upbit is the leading exchange in South Korea, offering KRW integration and strong regulatory compliance. Binance and HTX also have limited access.