The expansion of blockchain networks has Best Crypto Bridges a vital resource for transferring tokens and digital assets between chains.

Whether one is looking to move liquidity between Ethereum and BNB Chain or access lower-cost DeFi opportunities on adjacent networks, bridges enable fluidity.

This guide reviews top crypto bridges and analyzes how they allow users to enter a more seamless and interconnected Web3 ecosystem.

What Are Crypto Bridges?

Crypto bridges focus on the inter-chain transfer of assets and data within decentralized frameworks. As distinct blockchains possess incorporated rules and regulations, the assets contained within Bitcoin, Ethereum, BNB Chain, and Solana networks are inherently incompatible. However, crypto bridges tackle incompatibility and transfer issues.

Assets on the source chain are locked, and their equivalents are ‘minted’ on the destination chain, or native assets are transferred through liquidity pools.

The technology facilitates the obsolescence of single-chain frameworks, and strengthens the liquidity of assets. It opens seamless multi-chain liquidity and cross-play functionalities within diverse blockchains.

Key Point

| Bridge | Key Features | Supported Chains |

|---|---|---|

| Defiway | Fast, secure, low fees, user-friendly UI | Ethereum, BNB Chain, Polygon, Avalanche |

| Portal Bridge | Powered by Wormhole, supports Solana and EVM chains | Solana, Ethereum, BNB, Polygon, Avalanche |

| Rango Exchange | Aggregates multiple bridges and DEXs for optimal routes | 50+ chains including Cosmos, EVM, Solana |

| Squid Router | Built on Axelar, supports cross-chain swaps with native token support | Cosmos, Ethereum, Avalanche, Arbitrum |

| LI.FI | Smart routing across bridges and DEXs, developer-friendly API | Ethereum, BNB, Polygon, Optimism, more |

| Synapse Protocol | Stablecoin-focused, fast bridging, low slippage | Ethereum, BNB, Polygon, Arbitrum, Optimism |

| Multichain (formerly Anyswap) | High liquidity, supports many EVM chains | Ethereum, BNB, Fantom, Avalanche, more |

| LayerZero Stargate | Omnichain messaging, instant finality, deep liquidity | Ethereum, BNB, Avalanche, Arbitrum, Optimism |

| Celer cBridge | Fast bridging with low fees, supports stablecoins and native assets | Ethereum, BNB, Polygon, Avalanche, more |

| Across Protocol | Optimized for fast L2-to-L1 transfers, low fees | Arbitrum, Optimism, Ethereum |

1️⃣ Defiway

Designed with simplicity in mind for both novice and experienced users, Defiway is a reliable cross-chain bridge and a trusted means to complete token transfers quickly and safely. It is compatible with Ethereum, BNB Chain, Polygon, Avalanche, and other prominent networks.

The step-by-step instructions provided throughout the entire process is what makes it the Best Crypto Bridges – Defiway. In addition, Defiway is DeFi integrated. It includes a non-custodial wallet, direct crypto payments, and additional functionality.

For users who need to complete transactions on multiple chains, the platform reduces complexity and balances security with simplicity. This makes it perfect for daily interactions. For effortless DeFi transactions and simple chain switching, Defiway is a preferred option.

Defiway Key Features

- Support for many chains: Ethereum, BNB Chain, and Polygon

- User-friendly interface designed for beginners

- Has a non-custodial wallet and payment functions

- Quick transactions with no hidden fees

Pros

- New DeFi users are offered a seamless onboarding process

- Risk controls and strong security audits are reassuring

- You have more steps removed from the process with low gas fees

- Wallet and payment functions are useful extras

Cons

- Other bridges have more advanced features for developers

- Compared to big aggregators such as LI.FI, this has fewer chains

2️⃣ Portal Bridge (Wormhole)

Portal Bridge comes within the Wormhole interoperability protocol, allowing token movement and messaging transport between major chains like Solana, Ethereum, Polygon, and Aptos.

It is geared towards real-time communications and, depending on the token, can facilitate wrapped and native asset transfers. As one of the leading interoperability solutions, Best Crypto Bridges – Portal Bridge enables the frictionless movement of liquidity for developers and end users engaged in cross-chain dApps, cross-chain gaming, and the DeFi space.

While Portal employs guardians alongside on-chain verification for transaction security, users must always ensure they are interacting with the official service Portal. With deep integrations in the ecosystem, Portal is best suited for complex cross-chain usage like advanced cross-chain gaming.

Portal Bridge (Wormhole) Key Features

- Cross-chain messages and wrapped/native token transfers

- Leading ecosystems supported like Ethereum, Solana, Polygon, Aptos, and more

- High liquidity along with dApp integrations

Pros

- Extremely quick bridging with a scalable architecture

- Expansive token and chain diversity

- Excellent for gaming and multi-chain dApps

Cons

- A few bridges may utilize wrapped assets, which will need to be swapped later

- Users should beware of phishing and unofficial interfaces

3️⃣ Rango Exchange

Rango Exchange is a powerful multi-chain swap aggregator that bridges assets and finds optimal price routes across DEXs, bridges, and routing protocols. Over 60 blockchains are supported including EVM, Cosmos, and non-EVM chains.

Rango Exchange operates on a strong position on DeFi and is noted as the Best Crypto Bridges because users have the ability to swap and bridge in a singular transaction. Its routing engine globally scans pools of liquidity to ensure optimal slippage and pricing.

When it comes to risk assessment, Rango does safety checks and allows users to preview transactions. Rango is a top solution for traders looking for flexibility and price efficacy spanning various ecosystems.

Rango Exchange Key Features

- Swap and bridge in a unified flow

- Retrieves multiple routes from DEXs and bridges

- 60+ blockchain support including Cosmos, EVM, and Non-EVM

Pros

- Superior pricing with optimized routing

- Extensive chain/token coverage

- Excellent for cross-chain traders

Cons

- Routing may be overly complicated for novices

- Some routes may have several fees

4️⃣ Squid Router

Partnering with Axelar Network, Squid Router provides cross-chain swaps with contract call execution and automated on-chain action execution on destination chains. Automated on-chain action execution on destination chains is executed on destination chains.

This makes Squid Router one of the best crypto bridges and a must-have for users working with DeFi protocols on Cosmos and EVM chains. Squid takes away the hassle of manual bridging and token approvals.

Squid Router’s smart cross-chain routing is user-focused, taking care of gas abstraction and liquidity sourcing for an effortless transit. Considering the needs of developers, Squid anticipates the growth of blockchain networks, providing real utility beyond transfers.

Squid Router Key Features

- Built on Axelar for cross-chain smart contract execution

- Abstraction of gas + direct approvals

- Supports DeFi actions on the destination chain

Pros

- Perfect for advanced multi-chain use cases

- Strong Axelar SDK developer integration

Cons

- Smaller bridges need more tokens to grow the ecosystem

- Primarily for Axelar-connected chains

5️⃣ LI.FI

LI.FI acts as a cross-chain liquidity aggregator. It encompasses a wide array of bridges, centralized exchanges, and decentralized exchanges which are now unified under a single routing framework.

Instead of narrowing to a single bridge, LI.FI analyzes several to determine which one offers the most secure and effective path. As stated in “Best Crypto Bridges – LI.FI”, this feature greatly minimizes risk and slippage. LI.FI works with the Ethereum Layer 2s and a variety of multi-chain ecosystems.

They are the go-to integration partners for wallets and dApps because of the API and SDK tools. LI.FI only works with audited bridges and constantly analyzes risk in real time. This provides security for user funds.

LI.FI Key Features

- Consolidates several bridges with CEX/DEX liquidity

- Risk scoring and secure routing

- Developer-friendly APIs for wallets and dApps

Pros

- Reduces exposure by not relying on a single bridge

- User protection tools (security filters & audits)

- Price efficient

Cons

- Increased complexity of UI for casual users

- In rare instances, extra layers of routing may slow down transaction speed

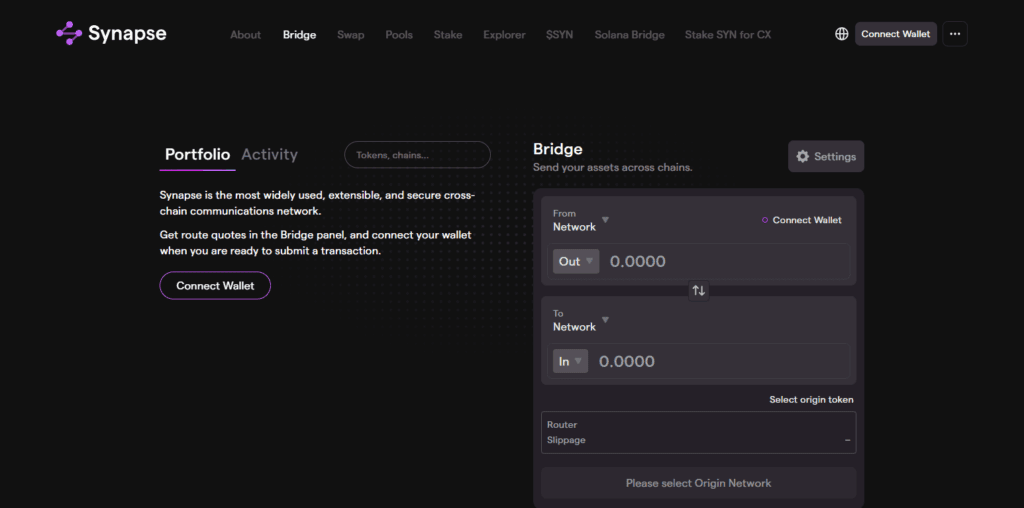

6️⃣ Synapse Protocol

Synapse Protocol has a reputation for its substantial liquidity and rapid, cross-chain, stablecoin transactions. It has its own automated market maker (AMM) system which allows for automated swaps during the transfer process, eliminating the need for additional steps on a decentralized exchange (DEX).

This level of efficiency is what keeps Best Crypto Bridges – Synapse Protocolone of the most sought after for cross-chain asset transfers for Arbitrum, Optimism, Polygon, and Avalanche. In addition to bridging, Synapse enables cross-chain messaging to support the development of multi-chain applications.

With robust community backing and supported network expansions, Synapse is built for speedy execution and low risk. This is particularly beneficial for users in the DeFi space who frequently trade stable assets, as it offers fast and hassle-free interaction.

Synapse Protocol Key Features

- AMM powered bridging with integrated swaps

- Stablecoin liquidity

- Cross-chain messaging for dApps

Pros

- Fast, low slippage stable asset transfers

- High DeFi trust and adoption

- Simple user flow, with few required actions

Cons

- Supported non-EVM chains are few

- Some pools may have low liquidity, and thus their fees may increase

7️⃣ Multichain

Multichain used to be the most popular bridging protocol, connecting over 80 chains and offering enormous liquidity. At the height of operations for the Best Crypto Bridges – Multichain, the protocol was noted for its flexible asset routing and support for almost all assets.

As of mid-2023, however, Multichain has suffered operational halts and issues with security because of the internal and system control problems Multichain is experiencing. As a result, a number of chains stopped support and liquidity and networks connected to Multichain removed their liquidity pools.

Historically, the technology was able to solve a big chunk of interoperability issues, but present-day users will need to take extreme caution and verify the technology’s current status and problems.

At this moment, the technology has crossed to the negative side of history with cross-chain technologies and added to interoperability issues. As such, it is recommended to not use the protocol until there is evidence of the restoration of official services.

Multichain Key Features

- Historically supported 80+ chains

- Flexible asset transfers:

- Router model

Pros

- Large token and network coverage

- Automated cross-chain routing

Cons

- As of mid-2023, major security concerns and operational shutdown

- Not recommended for use unless they are fully restored

- Many chains have had their liquidity withdrawn

8️⃣ LayerZero Stargate

Stargate is a messaging-based cross-chain liquidity bridge built using LayerZero’s ultra-light node architecture. It enables direct swaps of native coins rather than wrapped coins, simplifying transactions.

This directness is what earns Best Crypto Bridges – LayerZero Stargate a position among the best networks for stablecoin transfers. It operates on Ethereum, BNB, Base, Avalanche, and more.

Stargate’s liquidity pools guarantee immediate time-to-finality, meaning users don’t experience the annoying withdrawal delays of traditional lock-mint bridges.

Traders and yield farmers are particularly dependent on Stargate and trust it greatly as it captures liquidity. As LayerZero becomes more and more adopted, Stargate continues to be a vital piece of the infrastructure for multi-chain finance.

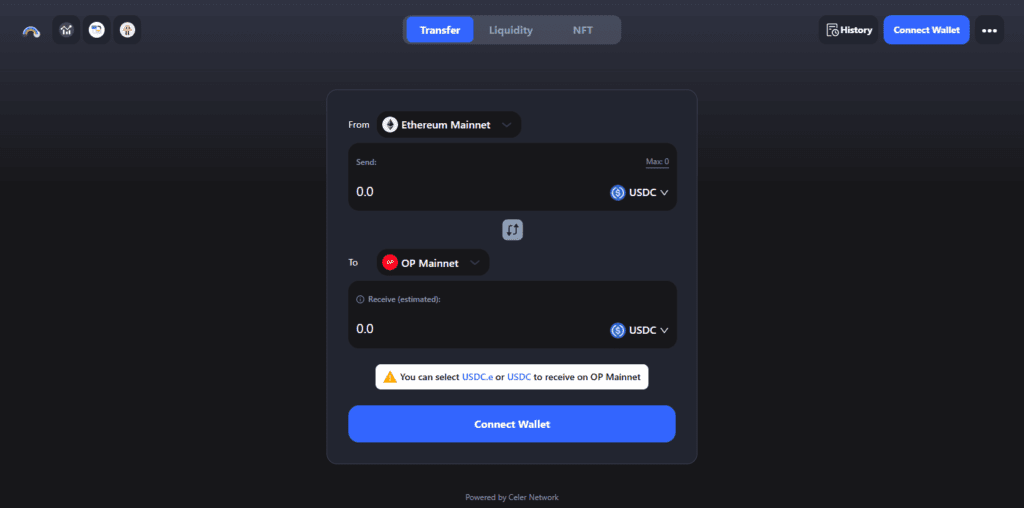

9️⃣ Celer cBridge

Celer cBridge prioritize speed, low costs, and a wide range of supported chains and token pairs. It exceeds billions in cumulative volume and is constantly branching out to new networks.

In the DeFi sector, Best Crypto Bridges – Celer cBridge gets attention for cross-chain native token transfers and for having the best developed SDK integrations.

It employs State Guardian Network (SGN) validators for secured message signing and provides liquidity-based bridging to ensure rapid bridging confirmations.

For transparent, chain-specific fee interfaces, cBridge uses a compliant bridging model. for bridging ETH, USDT, or rare tokens, cBridge to cBridge is smooth and well protected

Celer cBridge Key Features

- Liquidity bridging

- Multi-chain and token support

- SGN security layer

Pros

- Low cost and quick confirmation

- Native token transfers are great for this service

- Nice tutorials and user-centric design are great

Cons

- Some routes are wrapped

- Liquidity is different on various networks

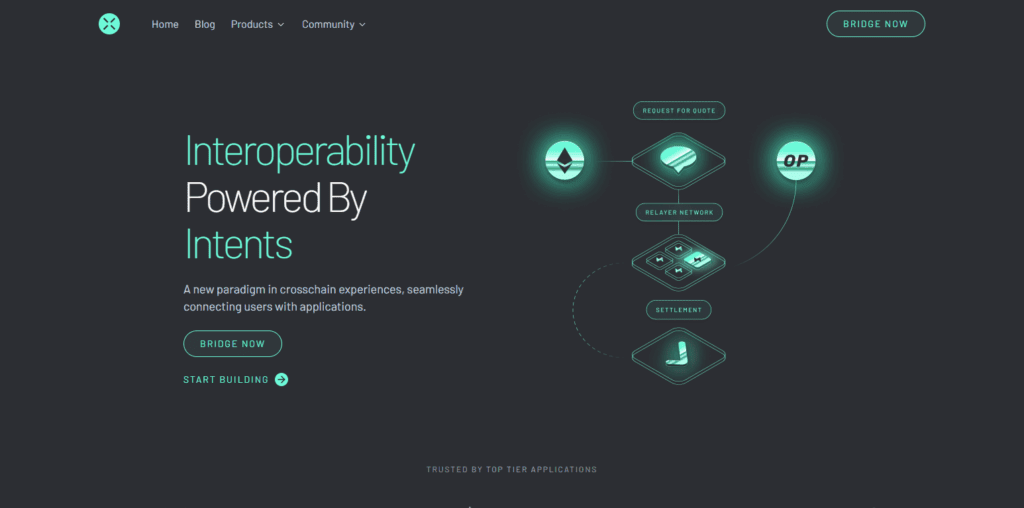

10️⃣ Across Protocol

Across Protocol uses an intent-based model and relayers for liquidity and is built for ultra-fast roll-up to roll-up bridging. It focuses on Ethereum Layer-2s like Arbitrum, Optimism, and Base, which is why Across Protocol is one of the Best Crypto Bridges – Across Protocol for users wanting cost-efficient L2 ecosystem transfers.

Across enables near-instant deliveries without waiting for optimistic roll-up finality, while Ethereum security anchors it. Its capital-efficient design lowers fees, benefiting active traders, and DeFi users significantly. Reliable Across is increasing both quickly in volume and in the chain support it offers.

Across Protocol Key Features

- Optimized for Rollups, Arbitrum, Base, Optimism, zkSync, etc.

- Instant delivery with intent-based relayers

- Security on Ethereum mainnet

Pros

- Cheapest and fastest L2-to-L2 transfers

- Reliable and capital efficient

- Integrated UI for average users

Cons

- Ethereum-based networks only

- Non-EVM chains are unsupported

How to Swap Tokens Across Chains?

Pick Token & Target Blockchain

Identify the asset you wish to transfer and the blockchain it will go to. Make sure your target network supports the asset to avoid fakes or unsupported versions.

Pick a Secure Bridge

Utilize trusted services like Defiway, Stargate, Portal Bridge, Rango, or cBridge. Make sure to check the real URL to avoid fake bridges and phishing scams.

Wallet Connection

Connect a MetaMask or any other compatible Web3 wallet. Make sure the wallet network is set to the source chain or you’ll have errors in token approval or transaction processes.

Check Gas Fees

Ensure you have enough native coin in the source chain to pay the gas fees. If you don’t, the bridging process will fail during the approval transaction.

Approve Token Access

Approve the spending of the ERC-20 token to allow the smart contract to transfer the funds. This way, it safely executes the transfer without revealing your private keys.

Enter Amount & Destination Details

Please specify how much you will be sending, and verify the destination address. Funds will be lost forever if you send to the wrong address or if you choose the wrong network, as blockchain transfers are final.

Review Route, Fees & Format

Assess if the tokens you will be receiving are wrapped or native, assess the fees, and assess how long the transfer will take. Select the fastest route with the most protection.

Confirm Bridge Transaction

Approve the transfer from your wallet and complete any required signatures. If there are multiple “Approve” steps, followed by “Bridge” steps to complete your transfer, the bridge may be broken into multiple steps.

Wait for Cross-Chain Finality

How long it takes to process your request varies a lot. A Rollup bridge will complete the transfer quicker while an L1 network will take longer. You will be able to track the progress on the bridge’s transaction dashboard.

Verify Token Arrival

Go to the destination chain and inspect your wallet for the tokens. If the tokens are not visible, add the correct contract address. Use a local DEX to swap any wrapped assets you might have.

Conclusion

Crypto bridges are essential in facilitating asset transfers between blockchains, unlocking liquidity, and accessing DeFi opportunities that a single network cannot offer. Leading solutions like Defiway, Portal Bridge, Rango Exchange, Squid Router, LI.FI, Synapse Protocol, Stargate, Celer cBridge, and Across Protocol offer rapid, dependable, and effective cross-chain transactions that are tailored to specific requirements.

Users can seamlessly and safely switch tokens between chains by picking a reliable bridge, approving tokens, finalizing destination details, and confirming arrival. With the continuous development of Web3, bridges will be fundamental in achieving the multi-chain interoperability needed to enhance the DeFi ecosystem.

FAQ

Crypto bridges are protocols that allow users to transfer tokens and data between different blockchains that are not directly compatible, enabling multi-chain DeFi and improved asset usability.

Different dApps, DeFi platforms, fees, and yields vary across networks. Swapping tokens across chains lets users access better liquidity, staking rewards, and lower trading costs.

Yes, if you choose audited and trusted bridges like Defiway, Portal Bridge, Stargate, Rango, and cBridge. Always confirm official URLs and avoid unknown or suspended bridges like Multichain.

Defiway and Celer cBridge provide the easiest user experience with guided steps, fast transfers, and clear fee details — ideal for new users entering multi-chain trading.

Across Protocol and Stargate are known for near-instant, low-cost Layer-2 transactions thanks to optimized rollup liquidity models.