Binance is one of the most trusted crypto exchanges, but many users wonder why its withdrawal fees appear so high. These costs do not come out of nowhere.

They come from blockchain congestion, fixed fee structures, and disparities of the currencies. Knowing these things leaves traders with better options to lower costs and manage their transfers better on Binance.

What is Binance?

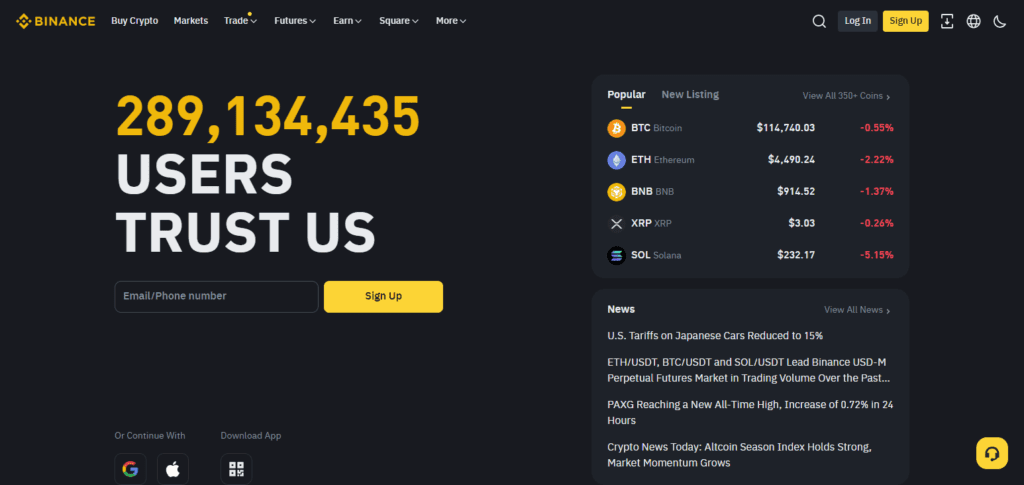

Founded in 2017 by Changpeng Zhao, Binance is among the largest cryptocurrency exchanges in the world. It offers a secure and easy-to-use trading platform for hundreds of digital assets such as Bitcoin, Ethereum, and a multitude of altcoins.

In addition to the standard spot trading, Binance offers a multitude of advanced options such as staking, futures, and a savings feature. Binance is also famous for its low trading fees and liquidity.

Apart from its trading features, Binance also has a Smart Chain, which allows users to create decentralized apps. Binance has become a focal point for global cryptocurrency investors and blockchain ingenuity.

What Are Binance Withdrawal Fees?

To understand Binance’s withdrawal fees, we must understand the concept of ‘withdrawal fees’ on crypto exchanges in general.

Binance withdrawal fees are the fees charged to users when they move their cryptocurrencies from the exchange’s wallets to outside wallets or addresses. Each crypto exchange has its own withdrawal fees and these fees change due to many factors.

Why Are Binance Withdrawal Fees So High

Withdrawal fees on Binance can get high due to network congestion, fixed costs on the exchange, and the type of cryptocurrency being withdrawn.

Reason Binance has High Withdrawal Fees.

Network-dependent attributes

The fees Binance sets is dependent on the chain. Ethereum (ERC-20) is usually congested and expensive due to high “gas fees”, however, chains like Binance Smart Chain (BSC) and Tron (TRC-20) are cheaper and faster. Thus, they are preferred by users to move smaller amounts of virtual currency back and forth between wallets.

Fixed Charges

Independent of the size of gears in a robot, Binance has a bottom-line fee on currency exodus. Thus, for smaller amounts, the cost is a higher percentage of the transfer, making it look like a hefty sum. Large quantities, on the other hand, can absorb the fee more; however, a greater impact is felt by small traders.

Network Congestion

Withdrawal fees can sometimes rise as more people actively use the chain, taking up a portion of the available data limit. Folded and Bina, for example, set the price of a transaction to compete, and sometimes users pay.

Type of Cryptocurrency

Withdrawal fees differ by cryptocurrency. BTC, ETH, and ERC-20 tokens are often more expensive than stablecoins on BSC or Tron. Users can minimize costs by withdrawing on lower-cost chains, which means BTC, ETH, and stable coin selection are the most important for transferring funds on Binance.

Tips to Reduce Withdrawal Fees

Select Lower Fee Networks

When withdrawing, use a less expensive cryptocurrency network; for example, using TRC-20 for Tether is much cheaper than using ERC-20.

Withdraw Higher Quantities

Since the withdrawal fee is constant, it is a better deal to withdraw in higher quantities less often, rather than making multiple smaller withdrawals.

Evaluate Fees Before Withdrawal

Always evaluate the current withdrawal fees of the specific cryptocurrency you want to withdraw; this will help you determine whether you need to switch to a cheaper option or not.

Understanding these strategies can help Binance users manage and minimize withdrawal expenses.”

Types of Fees on Binance

Spot Trading Fee

Binance takes a commission when you buy or sell their digital coins in a spot market. The basic fee is 0.1% and is payable in the Binance Coin (BNB) which due to the Users trading volume in a month gets fee discounts. Therefore Users in a month who have traded more volume will have their fees discounted.

Futures Trading Fee

Trading on Binance for futures contracts has lower fees when trading spot. The fees are a function of the size of the position and the tier level of the user 0.02% for makers and 0.04% for takers which makes it very appealing for futures traders.

Margin Trading Fee

For trading on margin, Binance charges fees on the borrowed amount. The fee depends on the the users margin period and which cryptocurrency is being borrowed. These fees makes the users margin trading strategies more costly.

Withdrawal Fees

The User has to pay withdrawal fees with every transfer of cryptocurrency or fiat from Binance to his/ her external wallets or bank account. In comparison to stable coins, the withdrawing of Bitcoin is costly.

Fees for Deposit

Your bank may charge fees for credit card deposits or other payment methods that directly incur credit or debit card fees. Most bank deposits are charge-free or charge lower fees than credit card deposits.

Funding Fees

Keeping futures positions overnight incurs a funding fee that applies to long and short positions. These fees depend on market conditions and are used to balance prices on perpetual futures to priced on the spot market.

Fees for Conversion

Binance’s instant cryptocurrency to cryptocurrency conversion service incurs small fees which are generally higher than standard spot trading. This is worth it to the users for the convenience offered rather than paying the standard spot trading fees.

Staking Fees

Smaller platform fees may be incurred by users who stake certain tokens.

BNB Credit on Fees

Active Binance users can pay a portion of their trading fees and withdrawal fees using Binance Coin at a discount. This feature greatly appreciated by users on the market helps BNB maintain its utility token status on the platform.

Comparative Analysis

Most users see the withdrawal fees as too high. However, to place these fees in perspective, one needs to compare Binance to other cryptocurrency exchanges.

Exchanges differ in trading volume, number of supported cryptocurrencies, regulatory framework, security, or other aspects. These factors affect fees in different ways.

Conclusion

To sum up, Binance withdrawal fees appear inflated as a result factored to blockchain natwork conditions, fee structures, and the type of currency being withdrawn. Ethereum fees are particularly prone to high costs uns orderly, while Tron or BSC fee structures are unpreferable.

Binance also employs a flat fee paradigm, therefore making any withdrawal of less value disproportionate. Understanding the aforementioned aspects and making appropriate decisions can generate savings.

Ultimately, however, withdrawal fees are a triadic balance of speed, security, and the blockchain network realities.

FAQ

Binance charges withdrawal fees to cover blockchain transaction costs. These fees ensure transactions are processed securely and confirmed by miners or validators on the respective network.

Ethereum is often congested, leading to higher gas fees. Since Binance passes these costs to users, ERC-20 withdrawals usually cost more compared to Tron (TRC-20) or BSC transfers.

Yes, Binance sets fixed withdrawal fees for each cryptocurrency. This means smaller withdrawals can feel costly, as the fee takes up a larger percentage of the amount.

To save on fees, users can withdraw via lower-cost networks like Tron or BSC, consolidate transactions, or use Binance’s peer-to-peer (P2P) options when available.

Binance states that withdrawal fees mainly cover network transaction costs, not profit. However, the exchange standardizes fees to ensure consistency across users.