In this article, I will cover Propex Trading Prop Firm alternatives that provide scalable accounts, more flexible evaluation processes, clear profit share and payout models.

These firms optimize flexible funding options and supportive environments, making them ideal for steady and driven traders.

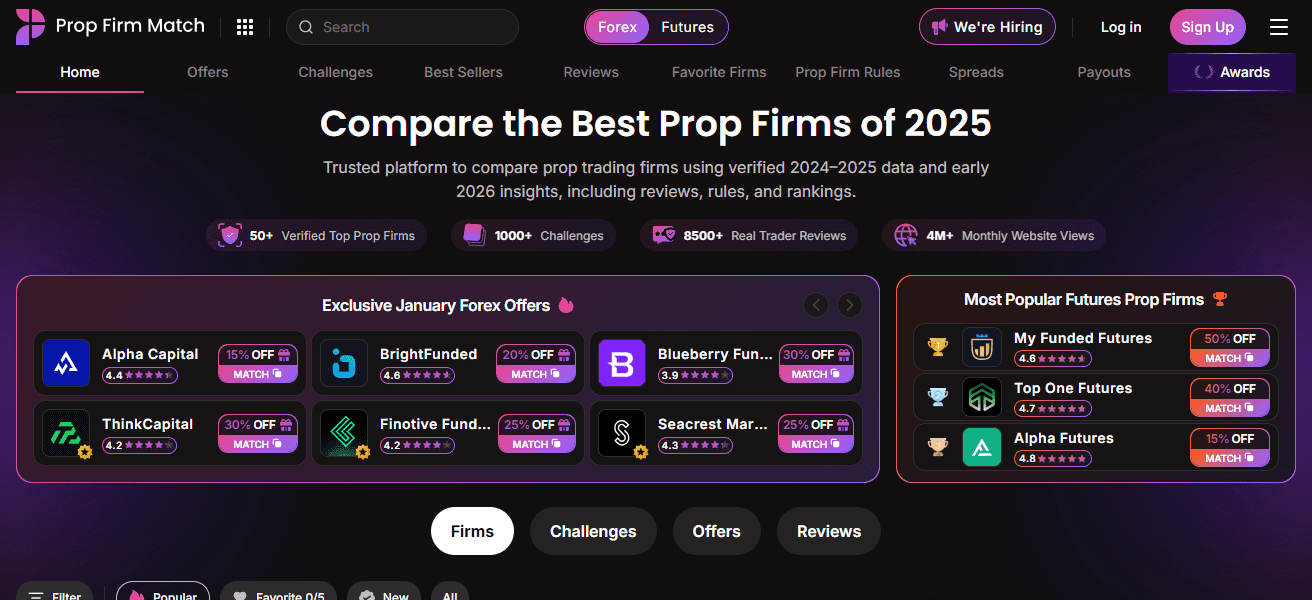

Key Points & Propex Trading Prop Firm Alternatives

FundedNext – Best overall prop firm in India with fair challenges and strong profit splits.

FXIFY – Known for instant funding programs, ideal for traders who want to skip long evaluations.

DNA Funded – Broker-backed prop firm offering stability and credibility.

BrightFunded – Rewards program for consistent traders, with strong community support.

Blueberry Funded – Good option for stock and crypto traders, not just forex.

Alpha Capital – Competitive spreads and strong reputation.

Finotive Funding – Flexible rules and high payout reliability.

Seacrest Markets – Balanced offering with fair challenges.

Top One Trader – Aggressive discounts and strong payout reputation.

Goat Funded Trader – Popular among retail traders for flexibility.

10 Propex Trading Prop Firm Alternatives

1. FundedNext

FundedNext is a good alternative to Propex Trading Prop Firm since it has different funding options that are flexible and cater to novice and more seasoned traders.

Different from most prop firms, it prioritizes swift scaling coupled with rapid evaluation systems, low-risk, and profit-sharing structures that reward consistent trading rather than over trading.

Additionally, It stands out from others by offering multiple accounts, good policies, quick payout systems, and great added trader support.

It is perfect for those looking for trading advancement, especially when compared to the more rigid structures from Propex Trading.

FundedNext Features

- Flexible Funding Programs – Beginners and advanced traders alike can select funding levels and account sizes that best fit their trading needs.

- Rapid Scaling – Traders are given the opportunity to grow their capital quickly.

- Low-Risk Evaluation – Winning an evaluation challenge requires traders to demonstrate skill without the high-stress components that often accompany trading assessments.

- Profit-Sharing Model – Providing traders with a consistent trading strategy is rewarded with clear and equitable profit-sharing outcomes.

2. FXIFY

FXIFY positions itself as a viable alternative to Propex Trading Prop Firm by prioritizing trader-friendly funding options and adaptable growth opportunities.

What makes FXIFY unique is the focus on realistic assessments, diverse account options, and quicker scaling opportunities, thus easing the advancement pressure on traders.

Moreover, the profit-sharing is in plain view, and so are the profit rules, low-risk strategies, and motivational materials.

FXIFY is ideal for traders who prefer a more flexible, organized trading structure, and are looking to steer clear of Propex Trading’s inflexible framework.

FXIFY Features

- Realistic Evaluation Challenges – Evaluation Accounts are designed to mirror true market conditions. Emphasis is on consistency, rather than high-risk.

- Multiple Account Options – Traders have the flexibility to select an account based on their level of risk tolerance and experience.

- Fast Scaling Opportunities – Traders are able to grow their capital quickly in an unrestricted manner after achieving a defined level of success.

- Transparent Profit Splits – Profit-sharing is conducted in a clear manner with the goal of promoting sustainable profitability.

3. DNA Funded

DNA Funded stands out among Propex Trading Prop Firms competitors, as it provides traders with flexible funding options, along with a risk management strategy.

Their straightforward evaluation, coupled with diverse account tiers and scalable capital, enables traders to DNAA to promote transparency in profit sharing

Quicker payouts, and offers a range of educational materials, making it ideal for traders who want to flexible and trader-centric model, amplified by Propex Trading’s rigid, uniform approach.

DNA Funded Features

- Scalable Capital Accounts – As traders prove their consistency, accounts will grow on a scalable basis.

- Simple Evaluation Process – Traders are provided with clear, simple, and attainable targets in order to minimize stress.

- Trader-Centric Support – Traders are provided with the tools and support necessary to develop their skills.

4. BrightFunded

Traders looking for flexible and growth-oriented funding options will find BrightFunded to be a fantastic alternative to Propex Trading Prop Firm.

For example, BrightFunded’s unique selling proposition revolves around simplistic evaluative programs combined with scalable accounts, meaning traders can increase their funding as they demonstrate ongoing capital consistency.

In addition to this, BrightFunded ensures flexible and transparent profit splits, quick payouts, and helpful educational resources that make performance the primary focus instead of more rules. Overall, BrightFunded is a more flexible and practical alternative to Propex Trading.

BrightFunded Features

- Flexible Evaluation Programs – Traders are able to balance themselves with challenges that are appropriate for their level of expertise.

- Scalable Accounts – Traders can receive greater funding thresholds depending on their achievements.

- Supportive Educational Tools – Guides and resources are available to assist traders in refining and improving their trading strategies.

- Transparent Profit Sharing – Profit sharing that is apparent and rewards steady performance.

5. Blueberry Funded

Blueberry Funded distinguishes itself as an alternative to Propex Trading Prop Firm, specifically because of its flexibility.

Different account sizes, attainable scaling opportunities, and various evaluation criteria allow traders to grow at their own pace.

Transparent profit-sharing, quick payouts, and supportive resources prioritize traders’ success, flexible adaptiveness, and consistency over rigid rules.

This makes Blueberry Funded attractive for traders looking to escape the more restrictive structures of Propex Trading.

Blueberry Funded Features

- Multiple Account Sizes – Available funding options for beginner and seasoned traders.

- Realistic Evaluation Rules – Evaluation programs that stress the importance of risk management and consistency.

- Fast Capital Scaling – Traders can receive more funding as they hit their performance targets.

- Quick Profit Withdrawals – Traders are able to access their profits without unreasonable delays

6. Alpha Capital

Alpha Capital can be considered a good alternative to Propex Trading Prop Firm as it provides a trader-centric funding model with a focus on growth and flexibility.

With multiple account tiers, scalable capital, and adjustable evaluation challenges and profit split tiers, it signifies clear competitive advantages.

Additionally, Alpha Capital’s emphasis on rapid payouts, straightforward guidelines, and educational support allow traders to concentrate on developing their skills and maintaining consistent performance.

Overall, Alpha Capital’s adaptable and supportive model provides a more practical alternative to the inflexible and controlling model of Propex Trading.

Alpha Capital Features

- Trader-Focused Funding – Designed to support growth and flexibility across all levels for all traders.

- Multiple Account Options – Accounts are available with various levels of capital and differing risk parameters.

- Performance-Based Profit Splits – Consistent and commendable trading is rewarded with a reasonable profit distribution.

- Educational Support – Resources are available to assist traders in refining their skills and improving their strategies.

7. Finotive Funding

Compared to trading prop firms like Propex Trading, Finotive Funding shines as an alternative because it provides flexible funding solutions for all types of traders.

Funding flexibility comes from simple evaluative programs, scalable accounts, reasonable risk rules, and quick profit withdrawals.

Steady developing trader funding focused on scalable growth is offered by Finotive Funding through supportive resources and trader development guidelines for consistent performers.

Adaptability, transparency, and trader growth fosters a more flexible funding solution as an alternative to Propex Trading.

Finotive Funding Features

- Funding Flexibility – Depending on trader skill, risk appetite, and goals, accounts can be customized.

- Realistic Evaluation Criteria – Challenges help simulate real trading scenarios without being overly stressful.

- Scalable Capital Accounts – Additional funding is available to traders who achieve their goals.

- Rapid Profit Withdrawal – Quick and dependable profit withdrawals are prioritized to build trust.

8. Seacrest Markets

Seacrest Markets stands apart from Propex Trading Prop Firm by providing traders greater flexible funding solutions tied to their performance and growth.

Flexible funding solutions tied to performance and growth help traders expand their capital. Keeping this in mind

Seacrest Markets ensures transparent profit-sharing, quick payouts, and supportive profit-sharing resources, creating a trader-friendly environment.

The combination of transparency, flexible funding, and growth potential makes Seacrest Markets a much more viable option than the more oppressive systems in place at Propex Trading.

SeaCrest Markets Features

- Beginner Friendly – Multiple account scalability offers different funding options for novice and advanced traders.

- Realistic Evaluation Programs – Focus on steady results, rather than high-stakes aggressive risk.

- Fast Scaling Opportunities – Traders can rapidly increase their capital based on their performance.

- Support for Traders – The success of trading is held through educational tools, materials, and resources.

9. Top One Trader

Top One Trader differs from Propex Trading Prop Firm by focusing on flexible funding and growth potential.

Top One Trader’s funding structure is also unique with multiple accounts available with growing capital, along with assessments and profit splits that reward consistent profitability.

The firm also focuses on fast payouts, straightforward trading guidelines, and educational resources

That allow traders to concentrate on developing their skills rather than on oppressive trading rules. Top One Trader’s focus on customer service makes it a more flexible alternative to Propex Trading.

Top One Trader Features

- Realistic Evaluation Programs – Multiple accounts offer traders the chance to evaluate their trading strategies through different account options.

- Profit Sharing on Performance – Disciplined and consistent traders are rewarded so that there is equity.

- Rapid Profit Access – Quick access to earned profits to ensure liquidity is motivation.

- Evaluation Rules – Clear and transparent regulations ensure the evaluation is as fair as possible.

10. Goat Funded Trader

Goat Funded Trader represents the most clear-cut and positive contrast to Propex Trading Prop Firm and other prop firms because of its flexible and trader-centric funding structure that prioritizes growth.

Its competitive advantage is clear: the combination of easy evaluation hurdles and multiple account tiers with scalable funding and transparent profit-sharing that enables rapid scale-up potential for consistent traders.

Additionally, Goat Funded Trader prioritizes a trader-centric structure with fast payouts, supportive resources, along clear risk parameters, rather emphasizing

a performance/development focus, as is the case with many other firms, making it a more flexible alternative to the more rigid Propex Trading.

Goat Funded Trader Features

- Multiple Accounts – Traders choose accounts based on their trading experience.

- Scalable Capital – Traders receive more funding as they achieve more.

- Transparent Profit Splits – Fair splits and grows the business in the long run.

- Supportive Resources – Offers the tools and education to help traders thrive.

Conclusion

To sum up, Propex Trading Prop Firm alternatives provide traders with flexible funding options, scalable accounts, and flexible evaluation processes.

The firm focuses on consistency, profit-sharing transparency, and rapid profit payouts, which fosters a growth-oriented environment.

For traders who want funding alternatives that are more flexible, these options, unlike Propex Trading, offer greater adaptability and value.

FAQ

Yes, many alternatives provide beginner to advanced funding levels.

Most reputable alternatives provide transparent rules and secure profit withdrawals.

It depends on your trading style; scalable accounts and supportive resources are key factors.

Profit splits are usually transparent and based on consistent trading performance.