This article will discuss the Top DeFAI Projects to watch for in 2025, centering on the platforms that will pioneer the next advances in decentralized finance.

These platforms are innovating in DeFi in the areas of staking, lending, stablecoins, oracles, and trading and are making DeFi safer and more accessible around the world.

From Lido to Chainlink, each is pivotal in constructing the next financial infrastructures.

Key Points & Top DeFAI Projects For 2025 List

| Project | Key Features |

|---|---|

| Lido | Offers liquid staking for ETH and other PoS assets, issuing stETH tokens for use in DeFi. |

| Aave | Decentralized money market with variable and stable interest rates, flash loans, collateralized lending. |

| Spark | MakerDAO spin-off focusing on DAI and lending markets, integrates with Maker ecosystem. |

| Uniswap | Automated Market Maker (AMM) model, supports token swaps, liquidity pools, and concentrated liquidity (v3). |

| Curve Finance | Optimized for low-slippage stablecoin and wrapped token swaps. |

| Convex Finance | Enhances yield for Curve liquidity providers and CRV stakers. |

| Compound | Algorithmic interest rate protocol, supports major assets for borrowing and lending. |

| Summer.fi | Former Oasis app, offers automated strategies for lending, borrowing, and yield. |

| Chainlink | Provides decentralized price feeds, VRF randomness, and CCIP for cross-chain communication. |

| Ethena | Issues USDe, a synthetic dollar backed by crypto derivatives and stETH. |

10 Top DeFAI Projects For 2025

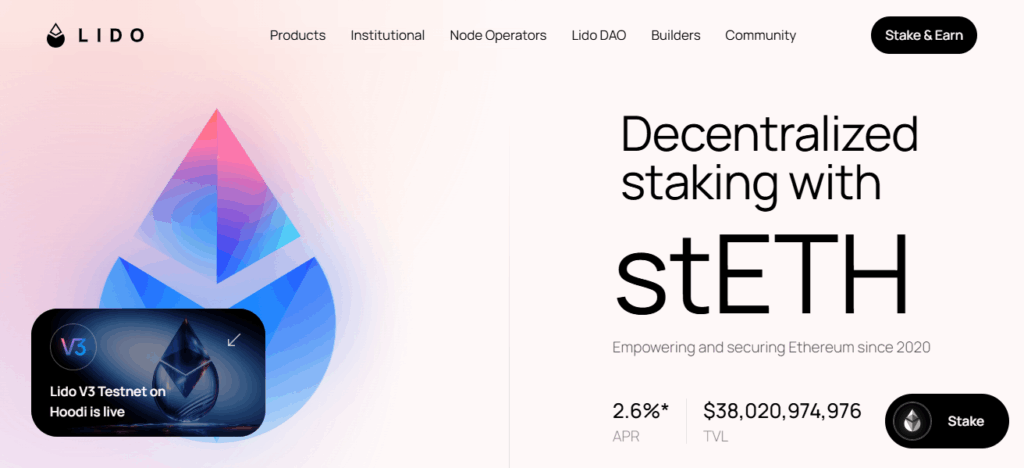

1. Lido

Founded in 2020, Lido changed Ethereum staking by launching liquid staking derivatives (LSDs), especially stETH. With stETH, users can stake ETH while also being able to maintain liquidity.

stETH can be used in DeFi lending, trading, and yield farming. This innovation addressed the liquidity-locked issue with staking, making Ethereum’s Proof-of-Stake transition further accessible for retail and institutional users.

Lido’s unique strength is the dominance of the ETH staking market and the cross- DeFi protocol integrations. As of 2025, it remains an important actor, holding billions in total value locked (TVL) and DeFi liquidity.

Features Lido

Liquid Staking Derivatives (LSDs): Staking of ETH and PoS tokens and issuance of tradeable tokens e.g. stETH.

DeFi Synergy: stETH is integrated and used in many lending, trading, and yield platforms.

Multi-Collateral Capabilities: Beyond ETH, includes SOL, MATIC and other PoS tokens.

Staking Parity: Eliminates boundaries to entry enabling retail and institutional staking.

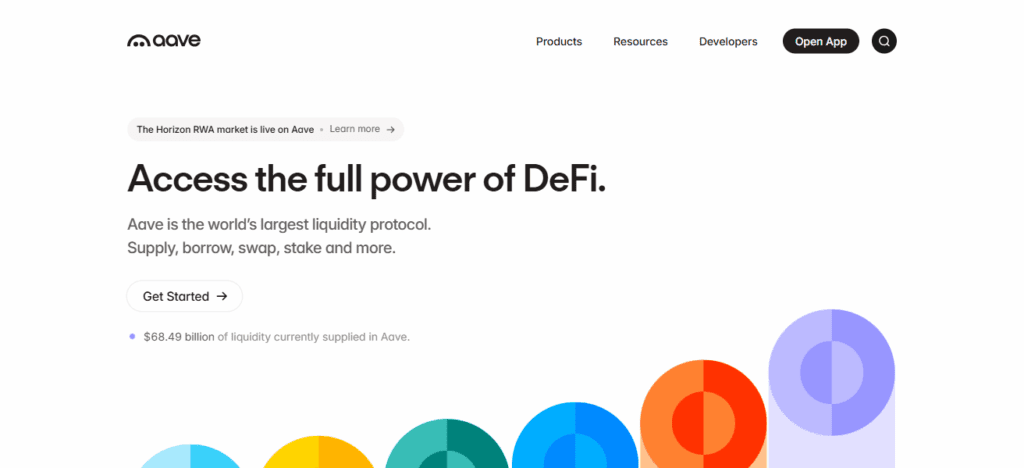

2. Aave

Aave is a protocol to lend or borrow that is decentralized and designed for earning interests and borrowing against a collateral since the year of its inception 2017.

Aave introduced the concept of flash loans which are kept because there is no collateral and can be borrowed instantly to be used for various arbitrages and DeFi strategies.

Aave ecosystem is strengthened by robust risk management, multi-chain deployment and liquidity pools that are of an institutional grade.

Aave does well to innovate and adapt in the area of credit delegation token integration or real world assets and other features.

Aave does not act as a protocol for lending because in 2025 it will serve as a DeFi financial hub and act as a principal lending market for decentralised credit. Aave has set itself a goal to be an protocol that DeFi was built around.

Features Aave

S&L Markets: Lending and borrowing of a wide range of crypto assets.

Flash Loans: Instant, collateral-free loans, pioneered by first DeFi protocol.

Multi-Chain Deployment: Operates on Ethereum, Polygon, Avalanche, and other chains.

Risk Management: Over collateralization and strong governance controls.

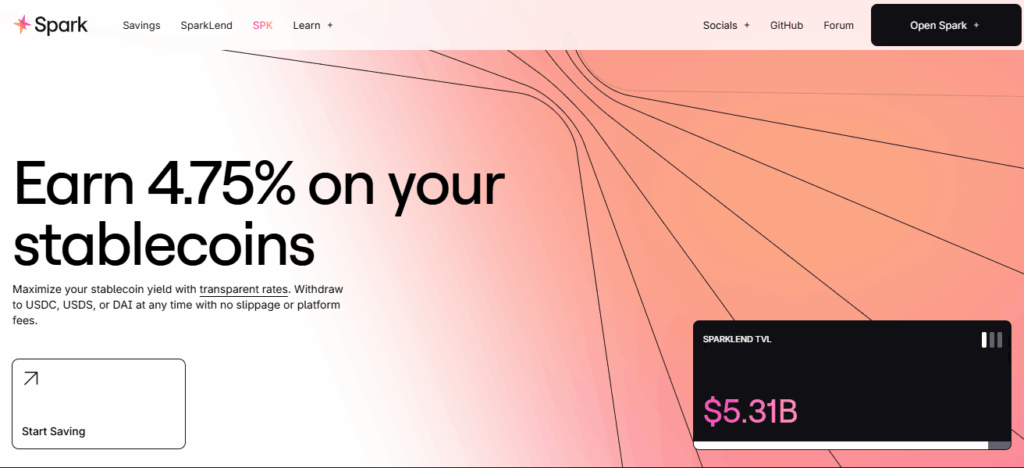

3. Spark

Established in the year 2023, Spark is a MakerDAO ecosystem project which specializes in lending, borrowing, and the adoption of the DAI stablecoin.

Spark is deeply integrated into the Maker vault system, providing efficient DAI liquidity access and improved capital utilization.

It enhances DeFi by optimizing RWA integration and increasing stablecoin collaterals beyond crypto.

Due to its partnership with MakerDAO, Spark is able to scale rapidly within DeFi’s stablecoin economy.

Spark is expected to become a major driver of DAI’s growth by 2025, offering users inexpensive lending options and providing sustainable yields linked to real world financial instruments.

Features Spark

Focus on Stablecoin: Increases the adoption and utility of DAI in DeFi.

MakerDAO Partnership: Closely associated with the DAI stablecoin ecosystem.

Lending & Borrowing: Provides competitive crypto credit markets.

RWA (Real world assets): Merges DeFi liquidity with off-chain assets.

4. Uniswap

Launched in 2018, Uniswap is the world’s first DEX based on the Automated Market Maker (AMM) model and has the largest trading volume in the world.

Rather than needing order books, users could swap tokens through liquidity pools. Uniswap V3 is noted for the introduction of concentrated liquidity, which allows liquidity providers to allocate capital in a more efficient manner.

Uniswap is the first DEX to obtain the highest trading volume, a strong indicator of dominance in the sector.

It is expected that by 2025, Uniswap will have expanded into cross-chain functionality and Layer 2 scaling, enhancing its position as the backbone of decentralized trading and token launches. Uniswap operates in a non-custodial manner, ensuring user control over their funds.

Features Uniswap

AMM Model: Spanning peer to peer swaps.

Concentrated Liquidity: Enhanced capital efficiency for Liquidity Providers.

High trading volume: Largest decentralized exchange by volume for consistent periods.

Cross-Chain Deployment: Extends swaps to Layer-2 and multichain ecosystems.

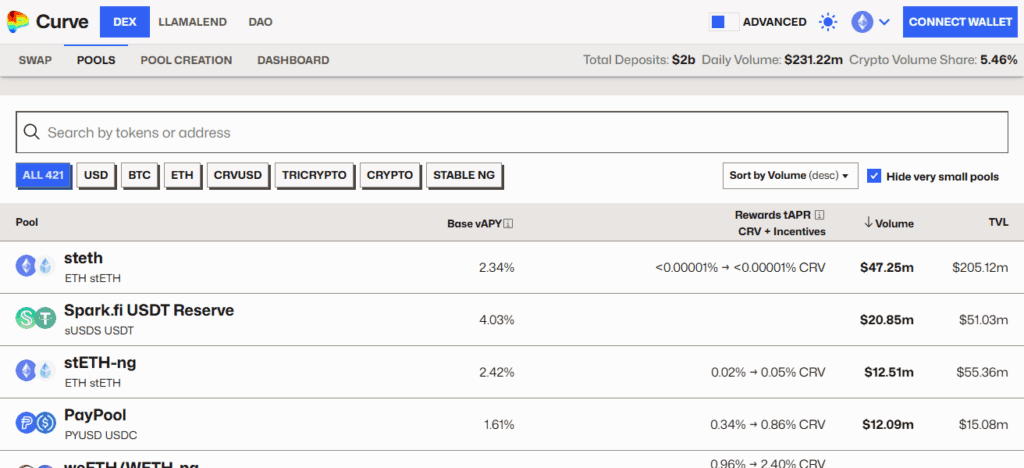

5. Curve Finance

Curve Finance started working in 2020 and has been working as a decentralized exchange for stablecoins and wrapped assets ever since.

Their Automated Market Maker (AMM) system allows for same-value assets like USDC, DAI, and USDT to be traded quickly with minimal loss.

Community-based liquidity incentive systems reward Curve users with their governance token CRV. Its unique strength in stablecoin trading has made Curve the platform for stablecoin trading.

In 2025, Curve will provide deep liquidity pools to the stablecoin economy for DeFi stability. Curve will also be crucial for institutional DeFi integrations and stable yield generation.

Features Curve Finance

Stablecoin DEX: Low-slippage swaps of Stablecoins and other associated coins.

Efficient Liquidity Pools: Pools for pairs of crypto assets of a close approximate value.

CRV Governance: Rewards liquidity providers and CRV holders who participate in protocol governance.

Stablecoin Backbone: Critical liquidity provider for the DeFi stablecoin market.

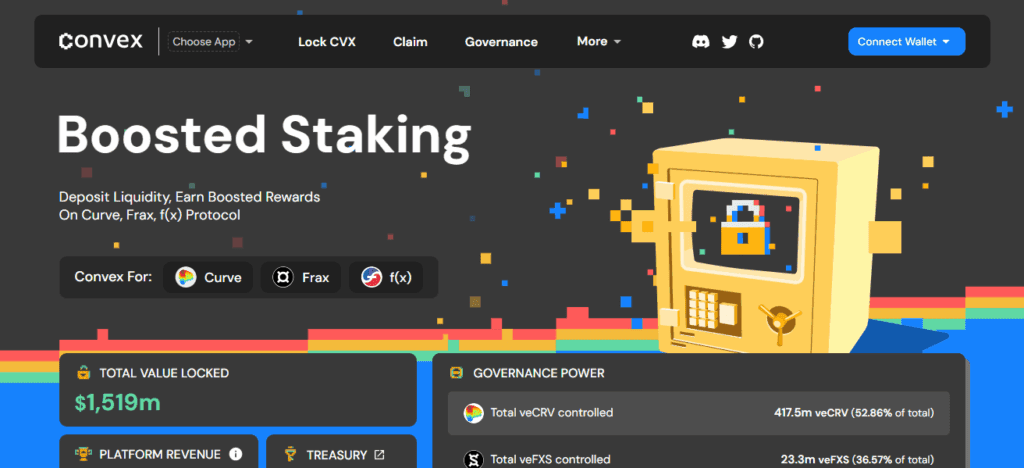

6. Convex Finance

Founded in 2021, Convex Finance is a yield optimization platform built on top of Curve Finance. It enables liquidity providers and CRV token stakers to earn boosted rewards without needing to manage the complex Curve voting system themselves.

Convex quickly became a DeFi powerhouse by aggregating liquidity and simplifying yield maximization strategies.

Its unique strength is synergy with Curve, offering users higher returns with minimal effort. In 2025, Convex still holds a high position as a yield platform, having strong TVL and passive income for users wanting stablecoin and DeFi yield exposure.

Features Convex Finance

LPs reward boosters: Lift yields for Curve LPs without the hassle of complex locking.

Yield Farming Simplification: Easing the staking and rewards silos.

CRV Distribution: Aggregated Curve governance CRV’s cloaked in shadows.

Passive Earning: Built for earners who want hassle-free approaches toward slapping interfaces.

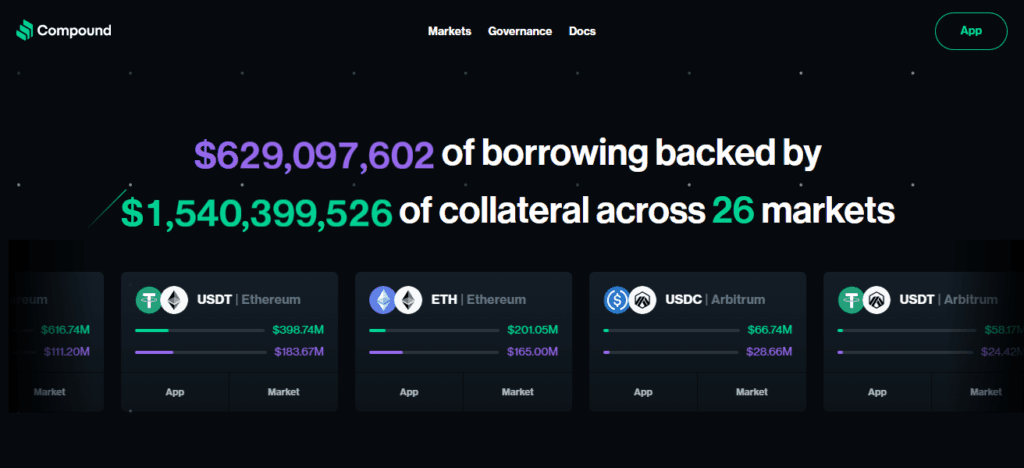

7. Compound

Compound revolutionized the use of DeFi primitives by developing an algorithmic money market that lends and borrows without the use of intermediaries.

They also pioneered an automated money market that algorithmically adjusts interest rates based on supply and demand.

These innovations became the bedrock of Compound’s entrustment for algorithmic and decentralized credit market.

Compound also maintains its edge by allowing autonomic governance through the COMP token. They continue to streamline lending processes along Aave, and by 2025,

Both are expected to compete on the lower interest rate of lending offered, with Compound retaining its favor with developers as a principal component for DeFi lending.

Features Compound

Dynamic Interest Rates: Modifies borrowing and lending rates internally.

Collateral Lending: Lending against provided crypto assets.

COMP Governance: Governance and upgrades by the community of users.

Integrator Friendly: Forms the base for many extending DeFi applications.

8. Summer.fi

Established in 2021 and previously known as Oasis, Summer.fi is a DeFi Automation Platform that services its users with effortless management of lending and borrowing along with farming yields.

Supported protocols like MakerDAO and AAVE to enhance their automated step-by-step strategies, thus allowing users to lower their risks while simultaneously increasing their revenues.

The core of Summer.fi’s unique prowess is in the domain of Accessibility, aimed at uninitiated users in the DAO space and seeking effortless simplification of DeFi’s complex electronic ecosystems.

They are a step closer to DeFi’s mainstream adoption in 2025, enabling entry-level users to the powering shield of deep automated strategies along with unwavering full control on their digital assets.

Features Summer.fi

Automated DeFi: Autonomous lending and borrowing with yield strategy execution.

Multi Protocol Collab: Covers interactions with MakerDAO, Aave, and others.

Beginner Aiding: Helps stake complex DeFi strategies.

Yield Protection: Helps in minimizing the chances of liquidation.

9. Chainlink

Founded in 2017, Chainlink is the leading decentralized oracle network that connects external data, APIs, and other off-chain systems to blockchain smart contracts.

Chainlink powers price feeds, weather data, and VRF randomness for countless DeFi protocols. Chainlink has also recently introduced Cross-Chain Interoperability Protocol (CCIP) and is now the central hub for secure cross-chain communications.

Their unique strength is reliability, as they are the industry standard oracle that DeFi projects adopt the most.

By 2025, Chainlink will be securing billions in smart contracts across DeFi, and expanding into traditional finance, serving as Web3’s data backbone.

Features Chainlink

Decentralized Oracles: Bound smart contracts to real-world data securely.

Price Feeds: Supports lending, trading, and stablecoin systems.

CCIP: Cross blockchain communication.: Supplies proof of randomness for gaming and NFTs.

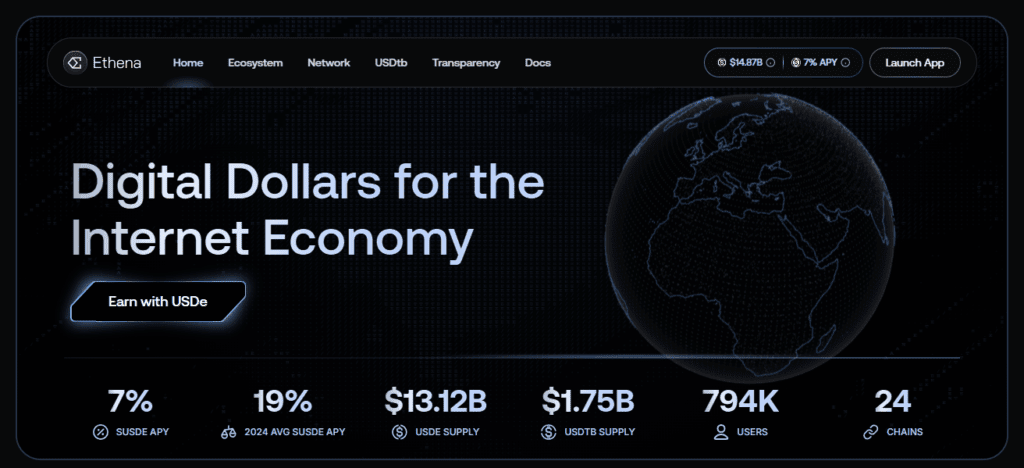

10. Ethena

Founded in 2023, Ethena is a DeFi yield-bearing stablecoin that issues USDe, a synthetic dollar backed by crypto derivatives and staked ETH.

Ethena staked USDe and generates yield from the Ethereum perpetual futures market, unlike most stablecoin protocols that rely on fiat reserves.

Ethena’s unique strength is that it offers both yield and stability, satisfying the two most critical needs in DeFi.

By 2025, Ethena will be one of the most decentralized stablecoin protocols available, driving adoption for decentralized stablecoins and sustainable yield opportunities in global DeFi.

Features Ethena

Synthetic Dollar (USDe): Stable asset backed by Ether derivatives.

Yield Stablecoin: Stablecoin with Yield and Staking/Perpetual funding.

Decentralized Collateral: Less dependent on fiat-based reserves.

Counter to Centralized Stablecoins: Dollar exposure with censorship resistance.

How We Choose Top DeFAI Projects

Total Value Locked (TVL):: The amount of capital that is deposited within a project is showcased by the following statistic: TVL. TVL is higher due to the general adherence, liquidity, and trust within DeFi. TVL provides real-time ranking and can be viewed on sites such as DefiLlama and DeFiPulse.

Utility & Use Case: Recognize what the project is solving (staking, lending, oracles, stablecoins, DEX). Projects that provide essential infrastructure are more valuable and integrated across DeFi.

Security & Audits:: Check if the project is still alive and active, while also ensuring it is audit-secure from reputable firms. Investigate the project for a series of unchecked exploits, hacks, and vulnerabilities. A project that is highly secure builds trust with the users for a longer time.

Adoption & Partnerships: Assess the number of users and dApps that are dependent on it. Important integrations, such as Chainlink by Lido across numerous protocols, enhance the trustworthiness of the system.

Innovation & Unique Strength: See if the project provides its customers and users with something that’s new (i.e. Aave’s flash loans, Uniswap’s AMM).

Cocnlsuion

In summarry, the most important DeFI projects for 2025 like Lido, Aave, Uniswap, Chainlink, and others will most likely primary focus on developing unique innovations for staking, lending, trading, and cross-chain data.

Their unique positions, substantial market adoption, and extensive security provides the waterproof foundation of decentralized finance.

These DeFi projects will together set the course for the future of decentralized economies as the DeFi seactor expands to encompass real world assets and stablecoins.

FAQ

The top projects include Lido, Aave, Spark, Uniswap, Curve Finance, Convex Finance, Compound, Summer.fi, Chainlink, and Ethena, each excelling in areas like staking, lending, stablecoins, or oracles.

Key factors include Total Value Locked (TVL), security audits, real-world adoption, tokenomics, governance, and innovation. Reliable platforms also integrate widely with other DeFi protocols.

They provide the core infrastructure for decentralized finance, supporting liquidity, cross-chain transactions, staking, stablecoins, and yield optimization. With growing adoption of real-world assets and synthetic dollars, these projects ensure scalability and trust.

Most top projects undergo multiple security audits, but risks like smart contract bugs and market volatility remain. Users should research, use trusted wallets, and apply risk management strategies.

Platforms like Lido, Convex Finance, and Ethena are popular for yield-focused users, while Curve and Aave are preferred for stablecoin and lending strategies.