In this article I will outline the most important Binance Smart Chain tokens impacting the DeFi and crypto universe.

These tokens are critical to trading, staking, governance, and liquidity on multiple platforms. Knowing their features and implementations will allow traders and investors to operate more effectively in the rapidly growing BSC ecosystem.

Key Points & Top Binance Smart Chain Tokens

| Token | Key Point |

|---|---|

| BNB (Binance Coin) | Native token of BSC, used for gas fees, staking, and ecosystem growth. |

| CAKE (PancakeSwap) | Governance and utility token for PancakeSwap DEX, supports staking and yield farming. |

| BAKE (BakerySwap) | Used for trading, NFT marketplace, and yield farming on BakerySwap. |

| XVS (Venus) | Governance token of Venus Protocol, a lending and borrowing platform on BSC. |

| ALPACA (Alpaca Finance) | Utility token for leveraged yield farming and lending protocol. |

| AUTO (Autofarm) | Token for yield optimization and governance in the Autofarm aggregator. |

| TWT (Trust Wallet Token) | Utility and reward token for Trust Wallet users on BSC. |

| EPS (Ellipsis) | Stablecoin exchange protocol token with low slippage swaps. |

| BURGER (BurgerSwap) | Token powering BurgerSwap DEX with governance and liquidity rewards. |

| BELT (Belt Finance) | Token for multi-strategy yield optimization and liquidity pools. |

10 Top Binance Smart Chain Tokens

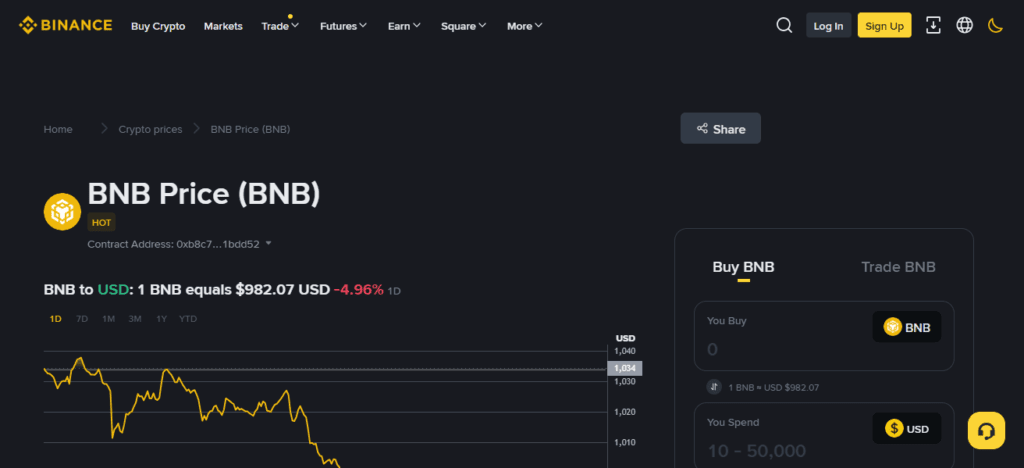

1. BNB (Binance Coin)

BNB is Binance’s cryptocurrency as well as Binance Smart Chain (BSC) cryptocurrency. It serves to pay gas fees, participate in sales of tokens, receive discounted fees on Binance Exchange, and serves as a utility within the ecosystem.

BNB is also widely used for cross-chain transfers, NFT marketplaces, and gaming. It was originally based on Ethereum as an ERC-20 token, but was later moved to BSC for speed and cheaper transaction costs.

BNB is, and will continue being, the backbone to Binance’s ecosystem in terms of scalability and strong community support across the world.

Features BNB (Binance Coin)

Gas Fees — Paying for transaction and gas fees on the Binance Smart Chain and the Binance Exchange.

Staking Utility — Staking, yield farming, and liquidity DeFi protocol incentive support.

Exchange Benefits — Discounted trading fees and exclusive access to some of Binance’s launchpads.

Ecosystem Backbone — Payment, NFT marketplace, and cross-chain interoperability support.

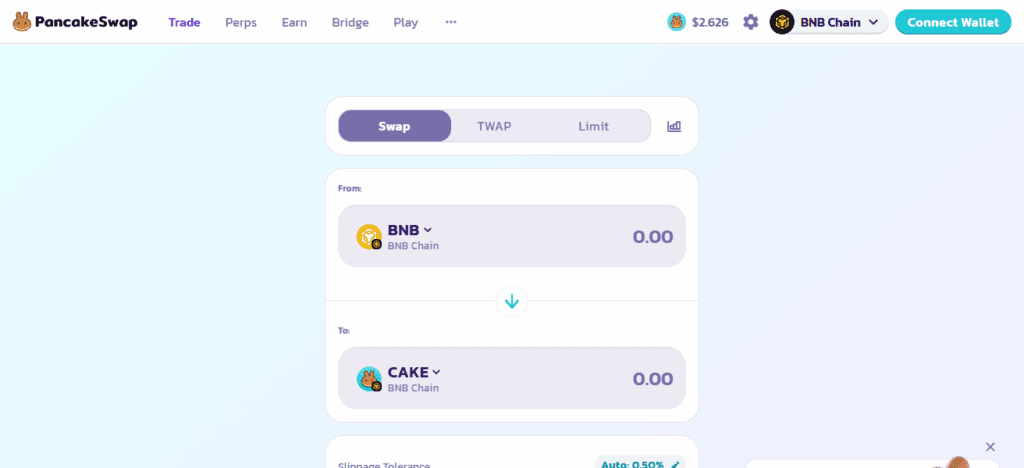

2. CAKE (PancakeSwap)

CAKE tokens are essential for governance and utility within PancakeSwap, the most popular decentralized exchange (DEX) on Binance Smart Chain. Users can partake in yield farming, staking, lotteries, and Initial Farm Offerings (IFOs) using CAKE.

Users can delegate governance CAKE tokens to vote on governance proposals and stake CAKE in Syrup Pools to earn PancakeSwap tokens. With its low fees and fast transactions, PancakeSwap has grown into one of the most popular DeFi platforms.

CAKE’s flexible tokenomics and consistent utility, paired with its capacity to sustain liquidity for hundreds of BSC trading pairs, ensure the token remains relevant for the foreseeable future.

Features CAKE (PancakeSwap)

Yield Farming — Earning CAKE for staking LP tokens.

Governance Role — Voting on developments and being part of the decision making.

Syrup Pools — Earning multiple tokens by staking one token.

DEX Utility — Trading, lotteries, and IFOs on PancakeSwap.

3. BAKE (BakerySwap)

BAKE is a cryptocurrency token that powers BakerySwap, BakerySwap is a decentralized exchange (DEX) and NFT marketplace that is constructed on the Binance Smart Chain.

It acts as a governance, liquidity rewards, and staking token. Users can earn BAKE by providing liquidity to various pools.

BakerySwap is famous for its NFT ecosystem where users can mint, trade, and auction digital collectibles for BAKE.

It is a decentralized exchange with unique NFT trading features which makes it appealing to traders and digital artists. BAKE also benefits from low-cost transactions on BSC, making it a versatile token for DeFi and NFT markets.

Features BAKE (BakerySwap)

DEX Token — Paying liquidity providers on the BakerySwap platform.

NFT Marketplace — Minting, trading and purchasing digital collectibles.

Governance — Decision making with BAKE holders.

Staking Rewards — Earning passive income from staking pools.

4. XVS (Venus)

XVS is a currency used for governance of Venus Protocol. Venus Protocol is a decentralized money market along with a synthetic stablecoin platform which is present on the Binance Smart Chain. Venus enables its users to borrow, lend, and mint synthetic stablecoins which are backed with crypto collateral.

Venus enables users to borrow, lend, and mint synthetic stablecoins backed with crypto collateral. XVS holders are granted governance rights which allow them to propose protocol upgrades, vote on changes to set risk parameters, and add new collaterals.

Venus is different from traditional finance. It does not use third parties which allows for instantaneous loans and other high-yield opportunities. XVS tokens are also used to provide liquidity for the protocol and incentivize borrowers

Features XVS (Venus)

Governance Power — Voting and suggesting for changes on the protocol.

Lending and Borrowing** – Offers loans based on collateral and deposits that earn interest.

Stablecoin Minting – Allows users to create synthetic stablecoins whose value is pegged to crypto.

Reward Incentives – Given to borrowers and liquidity providers to motivate participation.

5. ALPACA (Alpaca Finance)

The token of Alpaca finance is ALPACA. On the Binance Smart Chain , Alpaca Finance is a leveraged Yield Farming Protocol.

Users with ALPACA tokens have earning power from holding the token as well as voting rights on platform changes.

The protocol under-collateralized borrowing and secure liquidation. ALPACA tokens are staked and earned as farming rewards.

Alpaca finance is a unique defi service that allows its users to leverage earn and provides platform liquidity and stability.

Features Alpaca Finance (ALPACA)

Leveraged Yield Farming – Lets users borrow and farm to earn more on their investments.

Governance Token – Each ALPACA holder participates in the governance activities of the platform.

Staking Utility – Users earn rewards by staking ALPACA into various liquidity pools.

Security Mechanisms – Offers liquidation mechanisms to protect users on leveraged positions.

6. AUTO (Autofarm)

AUTO serves as the governance and utility token for the yield optimization protocol Autofarm and is built on Binance Smart Chain.

Autofarm automatically optimizes user yields by identifying the most profitable opportunities on various DeFi platforms. Holders of AUTO can participate in governance by staking their tokens and earning additional rewards.

The token is still used as an incentive to liquidity providers and participants of the platform. Autofarm reduces manual work and maximizes user earnings by automatically compounding rewards.

With its commitment to efficiency and cross-chain expansion, AUTO has proven itself to be effective for generating passive income in DeFi. Its governance and utility features also promise sustainability.

Features AUTO (Autofarm)

Yield Optimization – Automatically compounds and compounds returns across various DeFi platforms.

Governance Token – Users hold the token to vote on protocols and new features to be implemented.

Cross-Chain Utility – Grows beyond BSC to enable other blockchains.

Passive Income – Users can stake AUTO tokens to earn a steady cashflow.

7. TWT (Trust Wallet Token)

Trust Wallet is a Binance owned decentralized wallet. It is a utility token designed to keep the users engaged with the ecosystem.

The users of Trust Wallet get TWT for engaging with the ecosystem. Trust Wallet holders get a discount trading fee for the wallet’s integrated exchange as well as governance voting access.

The TWT token is usable within DeFi applications on Binance’s Smart Chain. This includes staking, liquidity farming, and within the DeFi ecosystem as a whole.

Community assets like TWT increase wallet adoption by engaging users with the TWT loyalty program. This allows Binance Smart Chain users to unlock economical, decentralized utility assets.

Features Trust Wallet Token (TWT)

Wallet Utility – Spendable for rewards and discounts on features in Trust Wallet.

Governance Role – Users can suggest wallet features and vote on updates to the system.

Community Rewards – Increases seamless adoption utilizing loyalty rewards.

Staking – Users can earn interest by holding TWT tokens to stake on liquidity pools.

8. EPS (Ellipsis)

EPS is the minted token for Ellipsis, a decentralized exchange on the Binance Smart Chain that specializes in swapping stablecoins. The platform enables users to trade stablecoins such as USDT, BUSD, and USDC with minimal slippage and low fees.

EPS holders can join liquidity pools which allow them to earn passive income via liquidity provision staking. The token also comes with governance rights that enables the holder to vote on protocol changes.

Ellipsis is a fork of Curve Finance and has brought efficient trading of stablecoins to BSC, providing liquidity and maintaining DeFi users’ stablecoin liquidity. EPS is reliable and cost-effective for swaps which makes it a great basis for stablecoin DeFi.

Features EPS (Ellipsis)

Stablecoin Swaps – Easiest and cheapest way to swap stablecoins and export USD.

Liquidity Incentives – These are rewards provided to liquidity providers in the form of EPS tokens.

Staking Option – Offers the capability to earn passive income to users through staking.

Governance – Holds the community responsible for taking part in the upgrades of the protocol.

9. BURGER (BurgerSwap)

BURGER acts as the governance and utility token of BurgerSwap — a decentralized exchange on the Binance Smart Chain.

Users can swap and offer liquidity using the token for governance and voting. Users can earn BURGER ecosystem rewards through participation and liquidity providing.

BurgerSwap also allows bridging of Ethereum and other cross-chain assets. ETH DEXs are hard to use and transactions tend to take a long time.

BURGER increases exchange participation and the utility of DeFi on the Binance Smart Chain. Increased participation and community focus development ensures utility of BSC DeFi.

Features BURGER (BurgerSwap)

Governance Token – Proposes and votes on changes to the ecosystem from BURGER holders.

Cross-Chain Support – Permits the swapping of Ethereum and other tokens on the network.

DEX Incentives – Offers rewards on the liquidity to the providers and traders.

User Friendly Trading – Offers quick and inexpensive trading on the Binance Smart Chain.

10. BELT (Belt Finance)

BELT has been set aside as the governance and utility token for Belt Finance, an inverted yield optimization protocol on the Binance Smart Chain (BSC).

The platform assists liquidity providers by deploying automated yield optimization strategies over numerous stables and assets, thus maximizing returns.

Owners of the token have a say in the governance and protocol parameter changes through the voting system.

The token is used as liquidity mining rewards and staked tokens as well. The defining feature of the Belt Finance is the diverse risk-reward approach and automated portfolio management.

It is convenient for Belt to simplify yield farming and facilitate stable income opportunities, which is why it is a preferred option for Belt investors.

Features BELT (Belt Finance)

Yield Optimization – Executes various strategies to achieve farming for consistent returns.

Liquidity Incentives – Liquidity providers are given BELT rewards.

Governance Role – The platform policies and risk controls that a Token holder decides to exercise are up to him.

Stablecoin Pools – Enhanced strategies are employed to support various stable assets.

How We Choose Top Binance Smart Chain Tokens

Market Capitalization & Liquidity – High market cap and liquidity are sign of trust and stability and thus, tokens are given priority.

Utility & Use Cases – BSC functions like DEX trading, yield farming, governance, and lending are essential, and thus, tokens enabling them are given priority.

Ecosystem Adoption – The BSC ecosystem recognizes tokens that are integrated with numerous DeFi applications, wallets, and dApps.

Community & Governance – The presence of decentralized governance and active communities around a token boosts its credibility and growth prospects.

Security & Audits – The tokens selected are from transparent and audited projects to reduce risks of scam and exploits.

Innovation & Features – Tokens with unique features like leveraged yield farming, NFT integration, and stablecoin swaps are given priority.

Sustainability of Tokenomics – Tokens with balanced supply mechanisms, staking rewards, and deflationary models are considered reliable.

Conclsuion

To wrap it up, the foremost Binance Smart Chain tokens are instrumental in supporting DeFi, DEXs, NFTs, and yield farming in the BSC ecosystem.

Each token contains distinct functionalities regarding governance, staking, and trading. Collectively

They foster the advancement and implementation together with the financial prospects, placing BSC as one of the popular blockchain networks today.

FAQ

They are cryptocurrencies built on the Binance Smart Chain, used for DeFi, staking, governance, and trading.

BNB (Binance Coin) is the most widely used token on Binance Smart Chain.

Yes, many tokens like CAKE, BAKE, and ALPACA offer staking rewards.

Tokens from audited and trusted projects are generally safe, but always research before investing.

CAKE is the utility and governance token of PancakeSwap DEX, used for farming, staking, and voting.