Multi-Chain DeFi Dashboards To Track Yields and explain how these platforms assist investors in tracking and maximizing their DeFi investments across a variety of blockchains.

These dashboards provide investors with real-time information and actionable tools on APYs, total value locked (TVL), and liquidity, as well as insights into staking positions to simplify yield farming.

Portfolio management and overall DeFi investments in terms of efficiency, clarity, and profitability.

Key Points & Multi-Chain Defi Dashboards To Track Yields

| Dashboard | Key Features |

|---|---|

| DefiLlama | Tracks TVL, yields, fees across chains; yield aggregator; no wallet connection needed |

| Dune Analytics | Custom SQL-based dashboards; community-driven insights; multi-chain data support |

| DeBank | Real-time wallet tracking; supports 50+ chains; yield and lending analytics |

| Beefy Finance | Yield optimizer with auto-compounding vaults; supports 20+ chains |

| Zapper | Portfolio tracker; yield farming and staking tools; supports major EVM chains |

| Revert Finance | LP analytics for Uniswap, Balancer, Curve; historical yield data |

| Instadapp | Smart wallet automation; integrates lending, staking, and yield farming |

| AssetDash | Tracks crypto, stocks, NFTs in one dashboard; supports wallet and exchange sync |

| Nansen | On-chain analytics with wallet labeling; yield tracking and smart money flows |

9 Multi-Chain Defi Dashboards To Track Yields

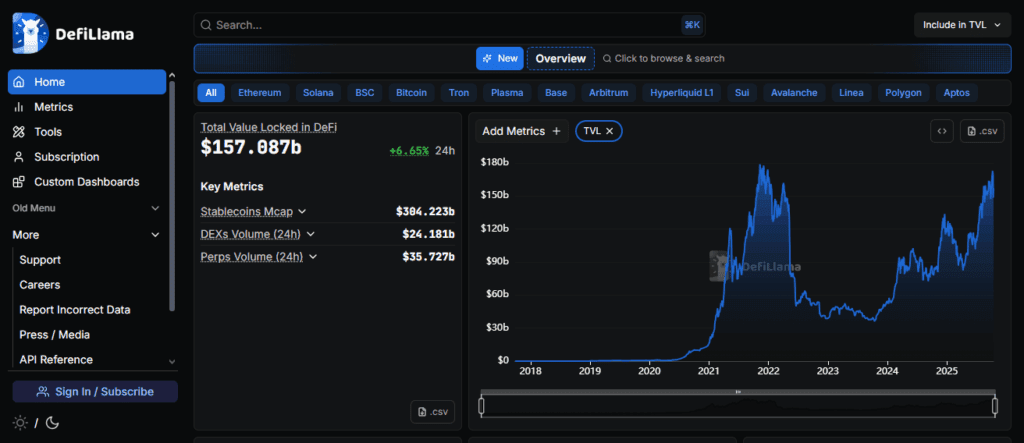

1. DeFiLlama

DeFiLlama is a prominent multi-chain DeFi analytics platform that tracks DeFi total value locked (TVL) and yield data.

It collects data across multiple blockchains, including Ethereum, Solana, and Avalanche, among others. It tracks hundreds of DeFi projects.

Users may observe growth trends in DeFi, assess the underlying assets in DeFi liquidity pools, and study the performance of single projects.

As an open-source project, the DeFiLlama platform is continually updated through community contributions and designed with transparency in mind.

It is a critical source for yield farmers, DeFi investors, and researchers seeking accurate, up-to-date DeFi yield data and visualizations.

Features DeFiLlama

- TVL & Yield Tracking: Achieves the aggregation of total value locked and yield across hundreds of protocols.

- Multi-Chain: Ethereum, Solana, Avalanche, and the majority of chains are included.

- Transparency: Open source means the community can and does contribute.

- Analytics & Visualizations: Analytics and visualizations of depths of cross-chain and liquidity pools, protocols and performance, and other trends are offered.

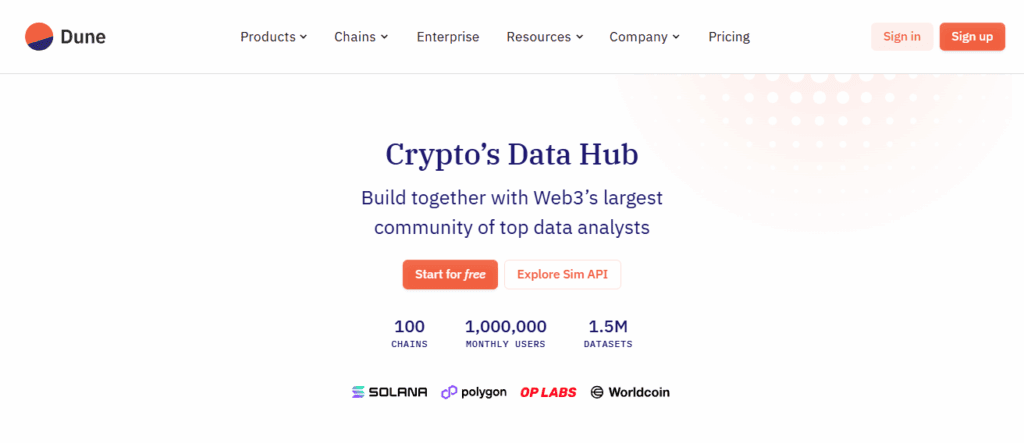

2. Dune Analytics

Dune Analytics lets you customize your analytics dashboards to visualize your blockchain data, without requiring advanced coding skills.

It supports multiple chains, including Ethereum and Arbitrum, and provides analytics on protocol yields, token flow analysis, and liquidity movement.

It excels at user-customizable SQL analytics queries, enabling users to implement bespoke DeFi monitoring aligned with their user-defined strategies.

Dune allows traders, analysts, and developers to view and analyze time-series data on analytics yields, performance history, and real-time interactions with tokens.

For the DeFi open-source community, it enables sharing analytics dashboards with community members to promote open collaboration.

Features Dune Analytics

- Custom Dashboards: Each individual can tailor a dashboard to their unique analytics needs.

- Multi-Chain: Ethereum and Arbitrum and other chains provide analytics of a wider scope.

- SQL Queries: SQL can be used to prepare custom analytics, which is a step up in monitoring.

- Community Collaboration: Public dashboards are a means of tracking and collaborating.

3. DeBank

DeBank serves as a multi-chain DeFi wallet and an analytics dashboard for yield tracking, portfolio management, and analysis of decentralized investments.

DeBank works with Ethereum, Binance Smart Chain, and Polygon, enabling users to track all assets, yield farming, and cross-protocol lending activities.

DeBank’s dashboard displays APYs, farming positions, and token exposure to help users understand complex DeFi data.

Other features include risk assessment and analyzing potential new investments. DeBank analytics provide a complete view for users on wallet DeFi and helps maximize profit on the DeFi strategy by optimizing wallet strategies on the underperforming assets.

Features DeBank

- Portfolio Tracking: Assets and their associated ranges pertaining to lending, staking, and yield farming are monitored.

- Multi-Chain Coverage: Ethereum, BSC, Polygon, and other networks are included.

- Investment Insights: Visual representation of APYs, token exposure monitoring, and risk assessment are provided.

- Opportunity Discovery: New and innovative DeFi projects can be investigated.

4. Beefy Finance

Beefy Finance is yield optimizer that automatically compounds users’ returns across a number of different DeFi chains.

While it is primarily a vault-based yield-farming platform, it also serves as a dashboard for aggregating yield information across PancakeSwap, SushiSwap, and Curve, among other protocols.

In a unified interface, users are able to track projected APYs, historical returns, and vault performance. Beefy optimizes yields with minimal manual input by automating strategic yield compounding.

Users can track and manage multiple cross-chain assets across the BSC, Fantom, Avalanche, and other networks.

Beefy Finance allows users to save time and refine their DeFi strategies and most importantly, it empowers them to make educated profit optimization decisions.

Features Beefy Finance

- Yield Optimization: Vaults are used to syndicate yield earning, streamlining the optimization process.

- Cross-Chain Support: BSC, Fantom, and Avalanche, along with other chains.

- Vault Analytics: Forecasts APYs, assesses historical performance, and analyzes historical performance.

- Automation: Minimizing human intervention by carrying out compounding tactics in an effective manner.

5. Zapper

Zapper creates a unified DeFi dashboard across multiple domains, providing a comprehensive overview of your investments, yield capture, and profit management on Ethereum, Polygon, and Binance Smart Chain.

For a seamless experience, Zapper offers a direct view of your DeFi positions on a consolidated dashboard, summarizing your liquidity pools, staking positions, and vaults.

In addition to offering advanced transactional analytics, Zapper provides a full suite of liquidity management, staking, and token-swapping tools, turning complex DeFi tasks into simple, executable steps.

Zapper offers advanced analytic tools, and analytics and integration APY performance metrics comparable across your yield synthetizations simplifies management.

Zapper’s intuitive design and cross-chain performance make it suitable for all users, whether novice or expert, looking to balance multiple investments.

Features Zapper

- Portfolio Aggregation: Merging DeFi positions and consolidating under a single umbrella.

- Transaction Execution: Liq, stake, and token swap actions and transactions performed in one, unified DeFi interface.

- Yield Tracking: Monitors performance of your DeFi positions; indicates APYs and past performance as well as diversification of your holdings.

- Multi-Chain Support: Compatible with and provides support for Ethereum, Polygon, BSC and other blockchains.

6. Revert Finance

Revert Finance is a new DeFi dashboard that lets users track yield farming, staking, and lending across several blockchains.

Users get real-time information on yields, liquidity, and the risks they might be taking across different protocols.

Users get advanced analytics, but the platform strives to keep the interface and experience intuitive.

Users of Revert Finance can track changing DeFi markets across multiple blockchains and locate the most profitable farming opportunities.

Users can carry out investment strategies through the dashboard’s direct smart contract interface, so they never have to leave the platform. Actionable tools and data aggregation make Revert Finance a comprehensive yield-tracking solution.

Features Revert Finance

- Real-Time Monitoring: Monitors yield farming, lending and staking position movements.

- Analytics & Insights: Monitoring APYs, liquidity distribution of lending and borrowing, and risk.

- Smart Contract Interaction: Invest and manage your portfolio, all within a single DeFi ecosystem.

- Portfolio Optimization: Trends in cross-chain farming and profitable farming.

7. Instadapp

Instadapp enables users to manage their DeFi portfolios in a streamlined way. Users can use a multi-chain cash and position management dashboard to optimize their yield through lending and borrowing across chains and protocols like Aave, Compound, and MakerDAO.

Users of Instadapp can access more sophisticated Automated DeFi strategies and take control of their Interactions through Automated debt management, leverage and yield farming.

Instadapp eliminates user guesswork when monitoring APYs, dynamically focusing and restructuring their cash flows.

Deployed in the Instadapp app is uncompromising and flexible smart contracts, creating a safe environment to conduct integrated cross-leg DeFi cash management strategies,

While controlling risk and gas costs. Instadapp is a perfect solution for the individual user, and for professional users in the DeFi space looking for optimized strategies to cross different yield centers on different chains.

Features Instadapp

- Unified Dashboard: Aggregates positions within one unified interface. Zapper provides seamless DeFi access by integrating Aave, Compound, MakerDAO and more.

- Automated Strategies: Instadapp provides automated management of your farming, along with your leverage, and debt for farming.

- Multi-Chain Compatibility: Compatible with Polygon and Ethereum, Radar provides cross-chain access.

- Secure Execution: Instadapp ensures safe execution of complex DeFi transactions with multi-step actions through smart contracts.

8. AssetDash

AssetDash is a versatile blockchain asset portfolio and DeFi dashboard. It organizes and tracks cryptocurrencies, DeFi tokens, and staking positions across multiple chains.

It effectively analyzes asset distribution, historical performance, and yield metrics across Ethereum, Binance Smart Chain, and various other networks.

Users can maintain a clear view of APYs and evaluate liquidity pool performance, price movements, and other metrics. Quick change alerts on yield or any aspects of a protocol allow timely decision-making.

The comprehensive functionality of AssetDash enables sophisticated users to manage devises and evaluate DeFi portfolios to automate cross-chain risk assessment, while the straightforward design helps novices to get started.

Features AssetDash

- Portfolio Visualization: Monitors and displays allocation of assets in your portfolio along with its historical performance and yields.

- Multi-Chain Tracking: Compatible with Ethereum, BSC and other major blockchains for tracking of your assets.

- Alerts & Notifications: Alerts users on major yield fluctuations and critical metric changes on a protocol.

- User-Friendly Interface: Great for beginners while still having the features needed for advanced portfolio management.

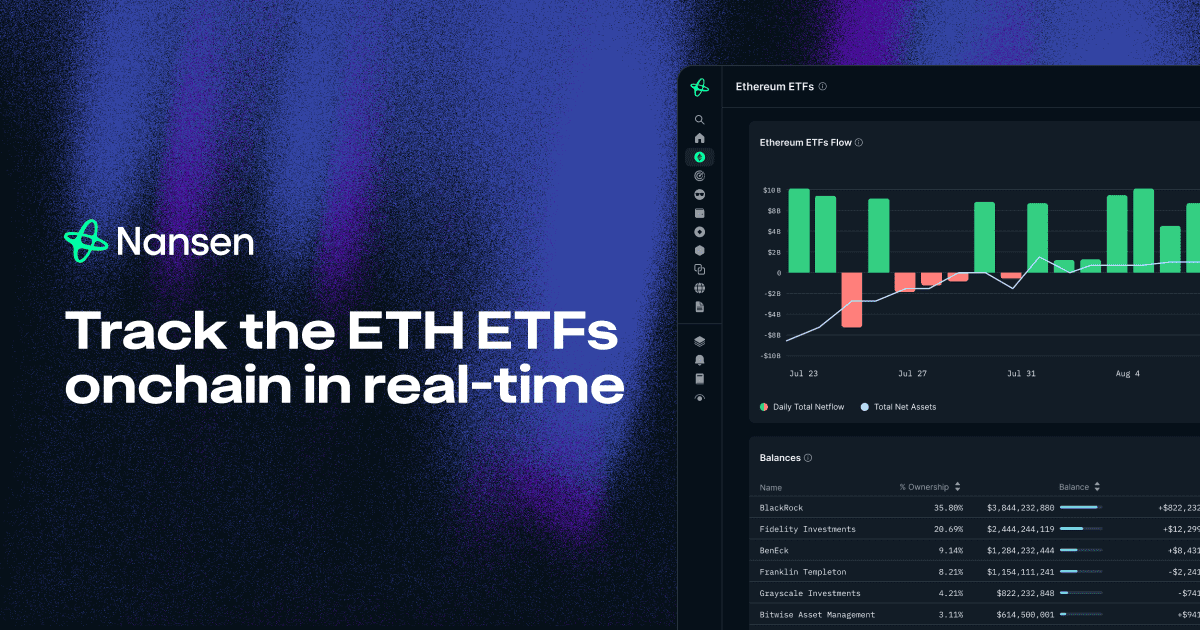

9. Nansen

Nansen has become one of the most sophisticated blockchain analytics solutions available today. It evaluates the activity of multiple DeFi protocols across several blockchains and provides comprehensive DeFi insights.

It assesses wallet activity, tracks token movements, and analyzes yield farming and liquidity harvesting on Ethereum, Polygon, and several other chains.

Nansen uses proprietary on-chain data tagged by the company to locate smart money, big wallets, and other speculative opportunities within the blockchain ecosystem.

It enables users to build custom dashboards to track, in real time, the yield, performance, and health of various protocols and financial portfolios.

Nansen provides tools to help assess opportunities, spot irrational market moves, and analyze the risks of blockchain investments.

Data accuracy, advanced metrics, and comprehensive analytics are beneficial for professional researchers and trading firms working across various DeFi layers.

Features Nansen

- Deep Analytics: Monitors movements in wallets, tokens, liquidity and more.

- Smart Money Insights: Spots whale accounts and potential new opportunities.

- Dashboard Customization: Tracks your yields, portfolio, and the health of protocols.

- Multi-Chain Support: Works across Ethereum, Polygon and more, for advanced professional traders.

Conclsuion

To sum up, Multi-chain DeFi dashboards have become invaluable resources for yield-focused investors, providing up-to-the-minute information spanning Ethereum, BSC, Polygon, and several other networks.

DefiLlama, Zapper, and Nansen enable investors to easily track their portfolios and leverage analytics, automation, and cross-chain visibility to optimize returns and streamline decision-making.

These tools enhance user confidence by providing consolidated views that incorporate positions, APYs, and risk, thereby making it possible for users to profit optimally and in a risk-calibrated manner.

FAQ

A platform that tracks DeFi assets, yields, and liquidity across multiple blockchain networks.

Ethereum, Binance Smart Chain, Polygon, Solana, Avalanche, Fantom, and more.

APYs, TVL, liquidity pools, staking positions, token exposure, and portfolio performance.

Some, like Zapper and Instadapp, allow staking, swaps, and adding liquidity directly.

Yes, many offer intuitive interfaces, though advanced dashboards provide deeper analytics.