In this article, I will cover how to Farm Stablecoins Across Different Chains and extend the limits of DeFi to a multichain architecture. Cross-chain stablecoin farming empowers investors to optimize yield farming, mitigate farming risks, and engage in multichain farming simultaneously.

With careful and coordinated asset allocation on different DeFi platforms and cross-chain platforms, users can achieve stable returns while avoiding excessive market risk, thus empowering stablecoins as a cashflow-generating financial instrument in DeFi.

Understanding Stablecoin Farming

Stablecoin farming is a method of earning passive income in DeFi by lending, staking, and providing liquidity through stablecoins – a cryptocurrency that has a pegged or fixed price to an asset (i.e. the US dollar).

Unlike other cryptocurrencies, stablecoins do not fluctuate in value, which reduces the risk. Farmers deposit stablecoins in a decentralized platform or protocol, which lends or uses the stablecoins in liquidity pools.

In return, the users gain rewards in the form of interest, more tokens, or fees from trades. Stablecoin farming provides liquidity to the crypto market while providing steady earnings to the investors with less risk to price changes associated with other crypto assets.

How to Farm Stablecoins Across Different Chains

Example: Farming USDC across Binance and the Ethereum Smart Chain (BSC).

Step 1: Choose Your Stablecoin

- Choose the stablecoin USDC given its availability and support on several chains.

Step 2: Acquire USDC

- Purchase USDC on a reputable exchange such as Coinbase, Binance, and Kraken.

Step 3: Select Chains for Farming

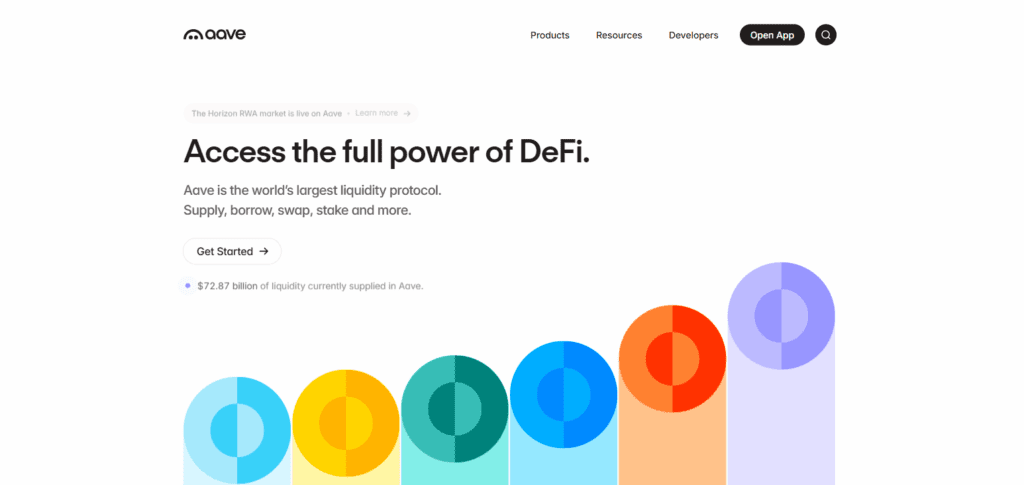

- Used Ethereum for Aave lending and BSC for the PancakeSwap liquidity pools.

Step 4: Bridge USDC Between Chains

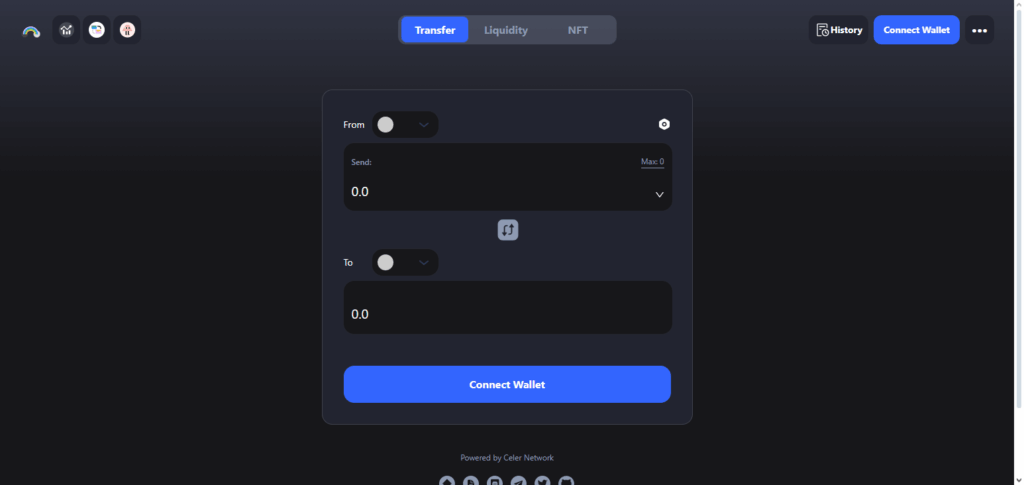

- Send USDC from Ethereum to BSC using a reputable bridge such as Celer cBridge or Multichain.

- Always confirm the gas fees before the transaction.

Step 5: Deposit USDC on Ethereum

- Deposit USDC on Aave to earn interest (APY 3–5 percent).

- Be vigilant to track your deposit and interest.

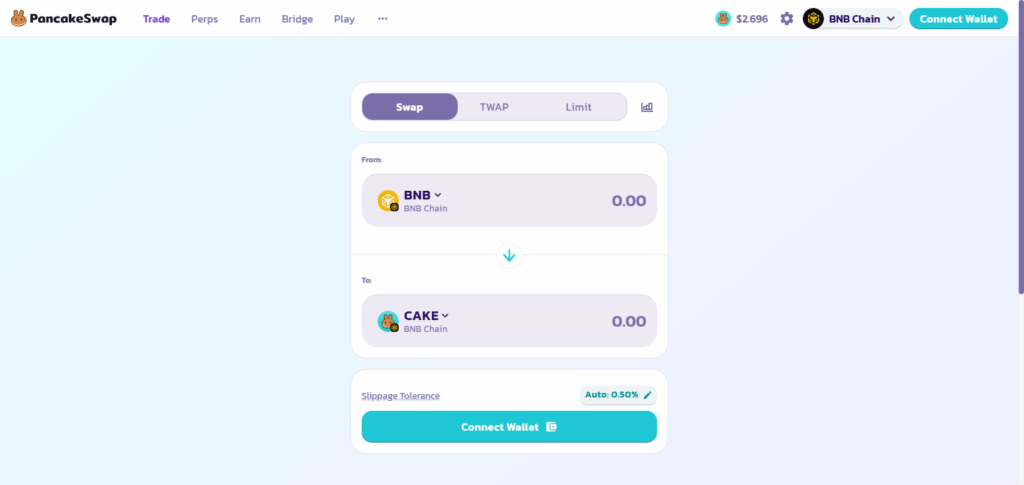

Step 6: Provide Liquidity on BSC

- On PancakeSwap, contribute USDC to a stablecoin pool (USDC/USDT) and earn CAKE as a liquidity provider.

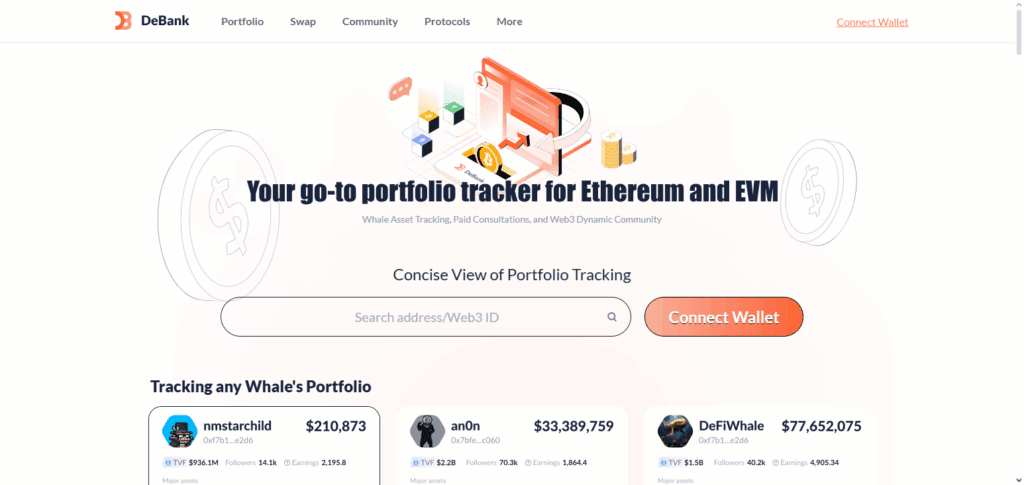

Step 7: Track Yields Across Chains

- Better use of DeFi monitoring platforms like Debank and Zerion to track the APY and rewards from the two chains.

Step 8: Harvest and Reinvest

- If you have some liquidity on BSC, reclaim rewards on both chains and some rewards on Ethereum.

- Use rewards to either reinvest to enhance earnings or change chains to optimize yields.

Step 9: Analyze Risk Factors

- Don’t overinvest in one network.

- Consider the risks of smart contracts and bridges.

Benefits of Cross-Chain Stablecoin Farming

Diversification of Assets

stablecoins, are less prone to the risk of issues on a specific network.

Access to Higher Yields

Different chains have different APYs, and farmers can choose the chains that provide the highest APY to maximize returns.

Fewer Congested Networks and Gas Fees

Gas fees are much cheaper on less congested networks and farming on several chains.

Exposure to Various DeFi Ecosystems

More diverse DeFi protocols can provide staking and liquidity provision.

Increased Flexibility and Liquidity

Cross-chain farming enables the rapid movement of assets.

Risk Mitigation

Holding assets on various chains and platforms can help minimize impact on hacks or other failures.

Tips for Maximizing Profits Safely

Use Many Chains and Platforms: Place coins on different crypto ledgers and DeFi protocols.

Maintain a High Cash Flow: Comes with investing more than high amounts of coins.

Mainstream Platforms Only: Use DeFi protocols that are well known.

Use Peppered Zone for High Gas Fees: Regularly maintain profits for gas fees.

Bridges of High Reliability Only: Only transfer via secure cross-chain.

Ensure Staying Relevant: DeFi strategies.

Intelligent Re-investment: Spend rewards on assets that are high return.

Common Mistakes to Avoid

Ignoring Gas and Transaction Fees

Fees are a notorious “profit killer.” Selling poorly positioned stablecoins to cover fees will yield a horrible loss.

Using Unverified Bridges

Risk of funds loss via insecure or fraudulent cross-chain bridges is too great.

Chasing Extremely High Yields

Yields claiming to be “extremely high” are often riskier.

Ignoring the Chain

Sudden loss of assets from sudden failure of a chain or unforecasted issues is always a threat.

Overconcentration

complete focus onto one chain or platform.

Keeping Risk Assessment

Protocols and integrations are a metric to watch.

Position Monitoring

Yields streamline from active management.

Not Paying Attention

Loss of stablecoin from sudden market stress.

Pros & Cons

| Pros | Cons |

|---|---|

| Diversifies assets across multiple blockchains, reducing risk. | Higher complexity in managing multiple chains and protocols. |

| Access to higher yields by comparing APYs on different platforms. | Gas and transaction fees can reduce net profits. |

| Exposure to various DeFi ecosystems and opportunities. | Cross-chain bridges carry potential security risks. |

| Reduces dependency on a single blockchain network. | Requires active monitoring to optimize returns. |

| Enables compounding rewards through reinvestment. | Risk of impermanent loss or stablecoin depegging in some pools. |

Conclusion

DeFi yield farming with stablecoins on different chains offers high yields with reduced risk. Farming stablecoins across multiple blockchains and using trusted protocols while monitoring fees and rewards Allows for maximized profits with reduced risk.

Cross-chain farming provides greater APY than yield farming on a single chain along with a greater variety of DeFi protocols while improving liquidity. It requires sophisticated planning, consistent monitoring, and risk control to steer clear from common issues of bridge exploits and overconcentration.

Considered stablecoin farming across chains can provide consistent and low-volatilty returns with less risk and computational effort.

FAQ

Use trusted cross-chain bridges like Multichain or Celer cBridge, ensuring you account for gas fees and security.

It’s the practice of earning yield by staking, lending, or providing liquidity with stablecoins on multiple blockchain networks simultaneously.

Diversify across chains and platforms, monitor yields, start small, and reinvest rewards strategically.

Basic understanding of wallets, DeFi platforms, and cross-chain transfers is recommended, but beginners can start with smaller amounts to learn safely.