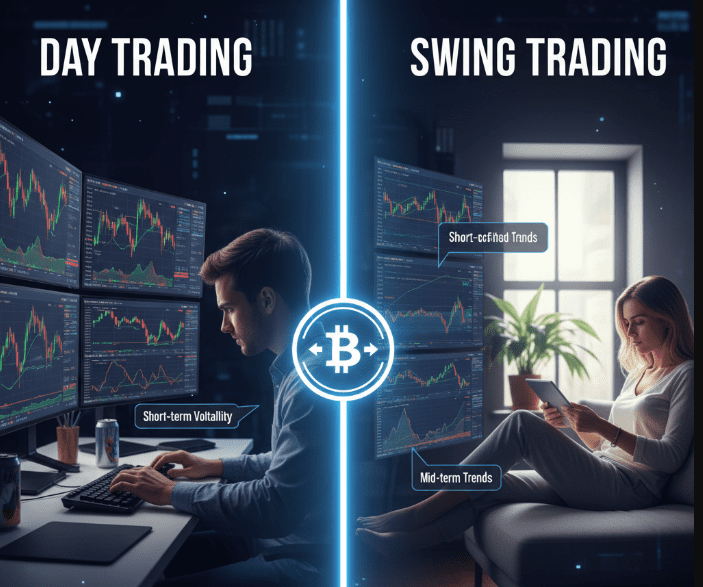

In this article, I will compare Day Trading vs. Swing Trading Cryptos, focusing on the fundamental differences, strategies, and advantages of each. Each of these methods is designed to accommodate a trader’s available time, risk appetite, and trading objectives.

Active traders can benefit from understanding both techniques as tools for success, whether they are seeking quick trades that can be closed within a day or larger trends that they may hold onto for an extended period.

What is Day Trading?

Day trading is a kinetic approach to trading as assets are traded in a single trading session within hours or even minutes of purchase.

An example of assets a trader can purchase is cryptocurrency. Unlike long-term investment, a trader in such a scenario does not keep a position overnight as they seek volatility throughout the trading day. Each trading day, a trader will conduct day trading analysis.

This will help them identify a trading approach to currency charts, trading, and currency patterns. Although day trading puts a trader in a position of highly reduced risk, the profits are extremely rewarding.

This approach to trading also lies in day trading discipline as with that, the profits can be maximised. Nevertheless, tools such as stop-loss will be in a trader’s roadmap and are indispensable.

What is Swing Trading?

Swing trading is the medium-term trading strategy where a trader uses cryptocurrencies for a couple of days to a weeks in a bid to capitalize on the price “swings” or price movements.

Unlike day trading, swing traders do not focus on the minute movements in the market, but rather on the larger market shifts.

Swing trading is a balanced approach and spends the majority of the trading day analyzing different assets, using market fundamentals on occasion.

Compared to day trading, swing trading offers greater flexibility and requires less active screen time, making it more suited for part-time traders.

Nevertheless, it still poses a high level of uncertainty. It requires the trader to deploy proper risk management strategies, such as the use of stop losses, to safeguard their trading capital.

Key Differences Between Day Trading and Swing Trading

| Feature | Day Trading | Swing Trading |

|---|---|---|

| Timeframe | Trades opened and closed within the same day | Trades held for several days to weeks |

| Trading Frequency | High – multiple trades per day | Moderate – fewer trades over longer periods |

| Risk Level | High due to short-term volatility | Moderate – less affected by intraday swings |

| Profit Potential | Smaller per trade, but frequent | Larger per trade, but less frequent |

| Time Commitment | Requires constant monitoring | Can be managed part-time |

| Tools Needed | Advanced charting, real-time data, fast execution | Technical analysis, trend indicators, occasional fundamentals |

| Emotional Stress | High – quick decisions under pressure | Moderate – more time to plan trades |

Factors to Consider Before Choosing a Strategy

Experience Level

Day trading is suited for highly skilled traders, while swing trading is appropriate for novices because it requires less intense monitoring.

Risk Tolerance

Although day trading is associated with elevated short-term risk, swing trading poses less volatile risk.

Time Availability

Day trading is appropriate for those willing to devote all their time to it while swing trading is suited for people with time constraints.

Capital Requirements

Day trading is capital-intensive as it entails multiple trades, while swing trading is less costly to initiate.

Market Volatility

Swing traders benefit from large trending movements, while day traders excel in fiercely volatile markets.

Trading Tools & Skills

Day trading requires the split-second execution of orders, along with advanced tools, whereas swing trading relies predominantly on trend analysis and patience.

Tips for Successful Crypto Trading

Use Technical and Fundamental Analysis: You need to make your own inferences based on charts, indicators, and any market news that holds value.

Set Stop-Loss and Take-Profit Levels: Your money will be protected, and a profit will be automatically recorded.

Manage Risk: Never invest more money than you and your account are comfortable losing.

Stay Updated: Follow anything crypto like news, trends, regulations, and markets.

Maintain Discipline: Follow your own trading plan and avoid making decisions when you are emotional.

Start Small: Under no circumstances should you start with higher trades, otherwise you will lose money that you could have used to gain some experience.

Pros & Cons

Pros & Cons of Day Trading

Pros:

- Able to make a profit from multiple trades

- Changes in the market can be made quickly

- Able to take advantage of intraday volatility

Cons:

- Creates a high-stress level which can be difficult to manage

- Market supervision is required for an indefinite period

- Frequent trades make the transaction fee much higher

Pros & Cons of Swing Trading

Pros:

- Day trading takes much less time

- Larger price changes can be captured

- Less emotional discharge and transaction costs

Cons:

- Trades can be susceptible to market risks which happen overnight or during the weekend

- Making a profit is much slower than day trading

- Must be patient and have strong analysis to make accurate forecasts uniformly

Conclusion

A person’s experience, ability to take risks, available time and commitment are key factors when considering cryptocurrency day trading or swing trading.

Day trading offers numerous opportunities to generate profits. However, it is time-consuming, requires instant decisions, and carries a higher risk.

A person can spend fewer hours detecting the market’s direction on swing trading, which allows for capturing larger market movements over several days or weeks. Swing trading is less emotionally taxing, which is another plus.

Both methods have their merits, and it is crucial to analyze your objectives, capabilities, and style of trading. Both techniques can lead to success, provided that efficient planning, discipline, and risk management are employed.

FAQ

Beginners may find swing trading easier, as day trading requires fast decision-making, advanced tools, and constant monitoring.

Swing trading is generally less stressful, as it involves fewer trades and less screen time compared to day trading.

Yes. Day trading requires real-time charts and fast execution platforms, while swing trading relies on technical analysis and trend indicators.

Profitability depends on skill, experience, and market conditions. Day trading can yield frequent small gains, while swing trading targets larger movements over time.