This article discusses some cross-chain deflationary tokens to watch that combine scarcity with cross-chain capabilities.

These tokens not only eliminate supply with deflationary mechanisms, including burns and limited supply, but also work across several blockchains, providing even more utility.

From well-known leaders such as Bitcoin and Ethereum to new projects like SafeMoon and Flockerz, these tokens are pioneering the future of multi-chain crypto investing.

Key Points & Cross-Chain Deflationary Tokens To Watch

| Token | Key Points |

|---|---|

| Chainlink (LINK) | Decentralized oracle network; facilitates smart contract connectivity; deflationary mechanisms via token burns for network fees. |

| SafeMoon (SAFEMOON) | Known for automatic liquidity generation and static rewards; built-in token burn reduces supply over time. |

| Bitcoin (BTC) | Original cryptocurrency; limited supply of 21 million; halving events reduce miner rewards, creating deflationary pressure. |

| Flockerz (FLOCK) | Cross-chain NFT and DeFi token; deflationary through token burns and staking rewards; growing community-focused ecosystem. |

| Polygon (MATIC) | Ethereum layer-2 scaling solution; supports cross-chain transfers; deflationary via token burns for transaction fees. |

| Ethereum (ETH) | Smart contract leader; post-merge, EIP-1559 burns a portion of transaction fees, reducing supply over time. |

| Binance Coin (BNB) | Binance ecosystem token; periodic burns reduce total supply; used for trading fee discounts and DeFi activities. |

| Stellar (XLM) | Focuses on cross-border payments; deflationary through periodic supply reductions and network inflation control. |

| Cardano (ADA) | Proof-of-stake blockchain; deflationary via staking rewards and network governance mechanisms controlling issuance. |

| Tezos (XTZ) | Self-amending blockchain; staking (baking) rewards and on-chain governance can create a controlled deflationary effect. |

10 Cross-Chain Deflationary Tokens To Watch

1. Chainlink (LINK)

Chainlink connects smart contracts with real-world data through a decentralized oracle network, crossing blockchains and external information safely.

LINK incorporates elements of deflation through network token use where oracle service fees can be burned, reducing supply over time.

As a cross-chain enabler, interoperability is a critical feature of LINK for DeFi and other decentralized applications.

Strong utility arises from wide adoption and network effects. LINK’s ongoing integrations with diverse blockchains and protocols underscore its importance as a leading cross-chain deflationary token and a source of interest for developers and investors.

| Feature | Description |

|---|---|

| Purpose | Decentralized oracle network connecting smart contracts to real-world data. |

| Cross-Chain Capability | Supports multiple blockchain integrations, enabling interoperability for DeFi and NFT platforms. |

| Deflationary Mechanism | Fees for oracle services can be burned, reducing total token supply over time. |

| Use Cases | Smart contracts, DeFi, cross-chain data feeds. |

| Market Position | Widely adopted oracle solution; strong developer and enterprise network. |

2. SafeMoon (SAFEMOON)

SafeMoon is a community-driven token with a deflationary strategy as an incentive mechanism focused on grabbing attention.

There is a fee for every transaction and part of it will be sent to current holders and part will be sent to a wallet to be burned and removed from circulation forever.

SafeMoon also defends market conditions with auto-liquidity. The token is popular because of innovative social media marketing and a value proposition in tokenomics for holders.

There has been development on cross-chain to support diverse ecosystems and provide practicality. The deflationary hold incentive capture blocks and focusses on emerging community tokens.

| Feature | Description |

|---|---|

| Purpose | Community-driven token focused on holding incentives. |

| Cross-Chain Capability | Expanding support for multiple blockchain ecosystems. |

| Deflationary Mechanism | Transaction fees redistributed to holders; part of tokens burned automatically. |

| Use Cases | DeFi, staking, speculative investment. |

| Market Position | Popular for community engagement and tokenomics-based rewards. |

3. Bitcoin (BTC)

Bitcoin is the first cryptocurrency and serves as the benchmark against which all other digital assets are measured.

This is due to the programmed deflationary circulation of the currency and the maximum supply of 21 million coins.

Furthermore, the deflationary nature of Bitcoin is enhanced by block reward halving which takes place approximately every four years, slowing the release of new coins to the market.

Bitcoin is not inherently cross-chain, but the introduction of wrapped BTC and other interoperability protocols increasingly incorporate it into multi-chain ecosystems.

Its decentralized network is the most extensive and provides unconditional security, confidence, and global acceptance. Each attribute contributes to Bitcoin being the most invaluable cryptocurrency to any portfolio.

| Feature | Description |

|---|---|

| Purpose | First and most recognized cryptocurrency; digital gold. |

| Cross-Chain Capability | Interoperable via wrapped BTC and cross-chain bridges. |

| Deflationary Mechanism | Hard cap of 21 million coins; halving events reduce issuance rate. |

| Use Cases | Store of value, medium of exchange, collateral in DeFi. |

| Market Position | Largest market cap; mainstream adoption. |

4. Flockerz (FLOCK)

Flockerz is FLOCK is a budding cross-chain token that combines elements of NFTs and DeFi. It introduces deflationary policies by burning tokens while also offering staking rewards on FLOCK, thus lowering circulating supply and incentivizing long-term holding.

Flockerz emphasizes community and ecosystem development, embedding NFTs and gamified elements into ecosystem components.

It’s also one of the first projects in deflationary tokenomics to build innovative cross-chain integrated NFTs and DeFi gamified ecosystems.

Despite being in the early phases of development, Flockerz is a viable option for early stage investors in multi-chain ecosystems.

| Feature | Description |

|---|---|

| Purpose | NFT and DeFi ecosystem token with gamification features. |

| Cross-Chain Capability | Supports cross-chain transfers to enhance liquidity. |

| Deflationary Mechanism | Token burns on transactions; staking rewards reduce circulating supply. |

| Use Cases | NFT platforms, DeFi, staking, gaming ecosystems. |

| Market Position | Emerging community-focused project with growth potential. |

5. Polygon (MATIC)

Polygon is an Ethereum layer-2 scaling solution that increases transaction speeds and minimizes costs.

MATIC tokens are the means of transactions and staking on the network, and a portion of the fees are burned in a deflationary mechanism, reducing the supply.

With cross-chain bridged, Polygon facilitates the seamless transfer of assets and applications between various blockchain networks.

This increases interoperability. Polygon ecosystems consist of DeFi, NFTs, and enterprise solutions, thus providing versatility for developers and investors.

MATIC is a deflationary token that offers interoperability within blockchains, and is thus widely adopted, providing real-world use and growth potential within an expanding blockchain ecosystem.

| Feature | Description |

|---|---|

| Purpose | Layer-2 scaling solution for Ethereum. |

| Cross-Chain Capability | Bridges enable interoperability with Ethereum and other blockchains. |

| Deflationary Mechanism | Portion of transaction fees burned, reducing circulating supply. |

| Use Cases | DeFi, NFTs, enterprise blockchain solutions. |

| Market Position | Widely adopted as Ethereum scaling solution; growing ecosystem. |

6. Ethereum (ETH)

Ethereum is the leading smart contract platform and has built, and is building, a new world of decentralized applications, DeFi, and NFTs.

Being deflationary, after the implementation of EIP-1559, Ethereum burns a fraction of the transaction fees, making supply reduced over time.

Ethereum also cross-border bridges and Layer-2 solutions like Polygon help in cross-network layer interoperability.

Ethereum remains the dominant and only transaction fee medium and is also staked in Ethereum 2.0 and used in decentralized application (dApp) pods.

The combination of the asset’s cross-border capabilities, deflationary issuance, and ecosystem growth certainly indicates Ethereum is a top asset for investors looking to participate in the second secondary growth layer of blockchain.

| Feature | Description |

|---|---|

| Purpose | Leading smart contract and dApp platform. |

| Cross-Chain Capability | Supports bridges and Layer-2 solutions like Polygon for cross-chain interoperability. |

| Deflationary Mechanism | EIP-1559 burns a portion of transaction fees; supply gradually decreases. |

| Use Cases | DeFi, NFTs, enterprise dApps, staking. |

| Market Position | Second-largest cryptocurrency by market cap; essential for blockchain ecosystem. |

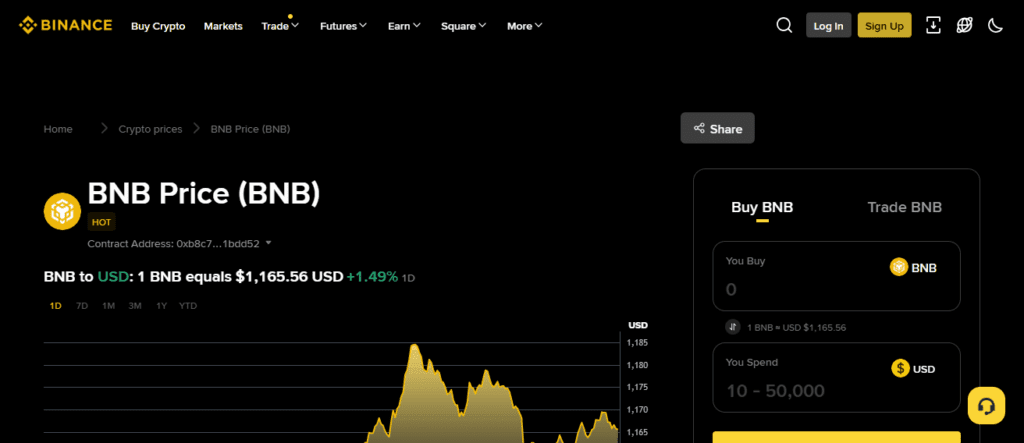

7. Binance Coin (BNB)

Binance Coin (BNB) is used primarily for Binance ecosystem trading fee discounts but is also used for staking and various DeFi applications.

BNB is deflationary; Binance periodically burns (destroys) a certain number of BNB tokens to reduce the total supply and decrease availability.

BNB has moved far beyond Binance Chain and its primary function to support cross-chain activities and interactions with decentralized applications using the Binance Smart Chain (BSC).

BNB’s deflationary tokenomics and extensive utility BSC has increased the number of applications and activities with Binance.

BNB is actively DeFi integrated, ensuring its anticipated cross-chain utility and deflationary BNB remains, and is, top of the Binance ecosystem.

| Feature | Description |

|---|---|

| Purpose | Utility token for Binance ecosystem, including BSC. |

| Cross-Chain Capability | Binance Smart Chain enables cross-chain transactions. |

| Deflationary Mechanism | Quarterly token burns reduce total supply. |

| Use Cases | Trading fee discounts, staking, DeFi, NFT platforms. |

| Market Position | One of the largest exchange tokens; high liquidity and adoption. |

8. Stellar (XLM)

Stellar is based on enabling fast, low-cost, and cross-border payments and is perfect for deflationary payment systems.

XLM also displays deflationary qualities as the Stellar Development Foundation periodically adjusts the supply and for extreme inflation control to stabilize value.

The network also has the ability to exchange and interoperate within and across fiat, crypto, and other blockchains, making it a cross-chain asset for real payment use cases.

Stellar has also gained traction within the finance and remittance industries for close ecosystems as the protocol focuses on efficiency, scale, and inclusive design.

The control of the inflationary limit, and the cross-chain use of real payments, XLM can improve on traditional blockchain systems for trading making it a top candidate for investors.

| Feature | Description |

|---|---|

| Purpose | Blockchain for fast, low-cost cross-border payments. |

| Cross-Chain Capability | Supports interoperability between cryptocurrencies and fiat. |

| Deflationary Mechanism | Periodic supply reductions to maintain stability. |

| Use Cases | Payments, remittances, tokenized assets. |

| Market Position | Recognized for payment-focused blockchain solutions; financial partnerships. |

9. Cardano (ADA)

Cardano is a proof-of-stake blockchain built with a focus on security, scalability, and sustainability. Deflationary mechanics with predictable supply inflation and on-chain governance control supply growth.

Cardano enables cross-chain expansion by supporting bridges and sidechains. Cardano is a pioneer for smart contracts, decentralized applications, and NFT projects.

Cardano has a strong focus on research, built a sustainable governance model, and uses a deflationary energy consensus.

Due to its cross-chain capabilities, sustainability, and research focus, Cardano is an attractive long-term investment.

| Feature | Description |

|---|---|

| Purpose | Proof-of-stake blockchain with focus on security and sustainability. |

| Cross-Chain Capability | Bridges and sidechains allow interoperability with other chains. |

| Deflationary Mechanism | Controlled issuance through staking rewards; governance regulates supply. |

| Use Cases | Smart contracts, dApps, NFTs, DeFi. |

| Market Position | Research-driven development; strong long-term adoption potential. |

10. Tezos (XTZ)

Tezos is a self-amending blockchain with built on-chain governance and smart contracts. The deflationary part is governed by staking (baking) rewards and other network mechanisms governing supply control.

Tezos cross-chain expansion is achieved with interoperability solutions. The self-amendment protocol is a more valuable network improvement mechanism, and it limits hard forks which improves network resiliency and stability.

Tezos has use cases in DeFi, NFTs, and enterprise blockchain. With self-amendment and strong governance, Tezos has evolved into a more valuable ecosystem.

| Feature | Description |

|---|---|

| Purpose | Self-amending blockchain with on-chain governance. |

| Cross-Chain Capability | Supports interoperability for DeFi and dApps across chains. |

| Deflationary Mechanism | Controlled token issuance and staking rewards reduce circulating supply. |

| Use Cases | Smart contracts, NFTs, DeFi, enterprise solutions. |

| Market Position | Innovative governance and upgrade mechanism; sustainable ecosystem. |

Conclsuion

In conclusion, Cross-chain deflationary tokens, by Scenery, combine scarcity with interconnectivity, which is redefining the crypto market.

While established tokens, Bitcoin, Ethereum, and Chainlink, provide reliability, new projects such as Flockerz and SafeMoon bring innovation with community-centered, deflationary models.

These assets can offer potential long-term capital appreciation along with cross-chain utility which makes them ideal for crypto investors focusing on versatility and long-term sustainability.

FAQ

Tokens that can operate across multiple blockchains while reducing supply over time through burns or limited issuance.

They combine scarcity with interoperability, increasing long-term value and utility.

Bitcoin (BTC), Ethereum (ETH), Chainlink (LINK), Polygon (MATIC), SafeMoon (SAFEMOON), Binance Coin (BNB), Stellar (XLM), Cardano (ADA), Tezos (XTZ), Flockerz (FLOCK).

Through token burns, reduced issuance, or transaction fees that remove tokens from circulation.

Yes, most are integral to DeFi, NFTs, and staking platforms.