This article illustrates Limited Token Supply category cryptocurrencies and associated digital assets that appreciate in value due to scarcity.

Scarcity creates demand and therefore researching coins with limited supply can help in identifying long term opportunities.

The best low supply cryptocurrency list essentially captures opportunities that are worth following or tracking.

How To Choose Best low Supply Cryptocurrency

Maximum Supply – Most often, value is associated with scarcity. Hence, look for capped or low supply cryptocurrencies.

Utility & Use Case – The token should serve a real world function such as payments, DeFi, governance or asset, etc.

Founder & Team Reputation – The stronger, transparent, and reputable the team is, the more trust they garner for the expected long-term success.

Year of Launch & Track Record – Stability of older projects is a safety net that newer, unproven projects lack.

Performance on the Market – Volatility and price trends should be researched before investing.

Community Engagement & Adoption – The more easily a token is adopted, the more sustained value it holds.

Liquidity & Exchange Listings – Higher liquidity and easier trading are attributed to tokens listed on reputable exchanges.

Tokenomics – Focus on the long-term demand created by distribution and burning mechanisms, governance, or staking rewards.

Key Points & Details

| Cryptocurrency | Key Point |

|---|---|

| COINON | Low total supply; focuses on secure transactions. |

| SPOTON | Limited supply token; designed for fast peer-to-peer payments. |

| DIGG | Algorithmic Bitcoin-pegged token; scarce supply enhances value potential. |

| PLTRON | Low circulating supply; aims for decentralized app ecosystem. |

| MAON | Rare supply token; focuses on staking and yield generation. |

| GLDX | Digital gold token; limited supply mimics gold scarcity. |

| HOODON | Low supply cryptocurrency; supports community-driven projects. |

| EBTC | Bitcoin-based token with reduced supply; used for DeFi protocols. |

| LBTC | Low supply version of Bitcoin; emphasizes privacy features. |

| TBC | Limited supply coin; targets cross-border payments and adoption. |

9 Best Low Supply Cryptocurrency List

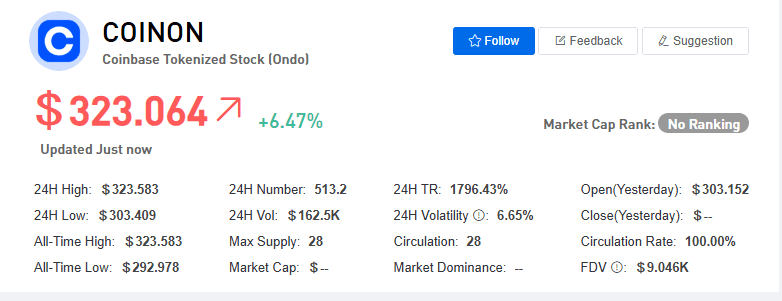

1. COINON

COINON is a tokenized representation of Coinbase’s equities – enabling users to track the performance of Coinbase’s market and investment activities using blockchain technology.

This token is used on the Ondo platform, which allows for the 24/5 trading of tokenized U.S. stocks and ETFs.

The diminishing circulation of COINON tokens is made more appealing due to its limited availability emphasizing its longevity.

At its focused price of approximately $319.24, COINON provides an opportunity for people living outside the US to invest in Coinbase easily and quickly without having a broker account

| Feature | Details |

|---|---|

| Type | Tokenized Coinbase Stock (Ondo) |

| Supply | Limited token issuance |

| Focus | Exposure to Coinbase performance |

| Trading | 24/5 trading availability |

| Advantage | Lets global investors access U.S. stock-like exposure |

2. SPOTON

SPOTON is the tokenized stock of Spotify, giving its holders the financial exposure as if owning the actual stock. SPOTON is also on the

Ondo platform, enabling the world to access Spotify’s market performance and allowing the minting and redemption of tokenized stocks 24/5.

The more SPOTON tokens become more readily available, the more valuable they can become due to SPOTON’s value trading of $164.49.

SPOTON is an alternative investment tool to people who are attracted to the financial performance of Spotify.

| Feature | Details |

|---|---|

| Type | Tokenized Spotify Stock (Ondo) |

| Supply | Restricted token supply |

| Focus | Mirrors Spotify’s market performance |

| Trading | Minting & redemption 24/5 |

| Advantage | Accessible globally without traditional brokerage |

3. DIGG

This is an algorithmic stablecoin pegged to Bitcoin, designed to maintain a 1:1 ratio with the latter.Its supply is adjusted dynamically (using rebasing mechanisms) to keep its price in proximity to Bitcoin’s price.

The scarcity caused by the limited supply of DIGG tokens together with its unique rebasing mechanism can create significant demand.

Currently priced at approximately \$591.89, DIGG provides an innovative solution for price exposure to Bitcoin without direct ownership.

| Feature | Details |

|---|---|

| Type | Algorithmic Bitcoin-pegged token |

| Supply | Elastic supply via rebasing |

| Focus | Pegged 1:1 to Bitcoin |

| Mechanism | Automatic supply adjustment |

| Advantage | Exposure to BTC without direct holding |

4. PLTRON

PLTRON enables users to access blockchain technology to gain exposure to the stock of Palantir Technologies (and its market performance) through a tokenized stock version.

Operating on the Ondo platform, PLTRON provides for the 24/5 trading of tokenized U.S. stocks and ETFs.

The supply of PLTRON tokens is lower (substantially limited) than other tokens and, thus, can experience substantial demand over time.

Currently offered at a price of \$164.86, PLTRON provides a novel solution for investors outside the U.S. to gain exposure to the market for Palantir stocks without the need for a traditional brokerage account.

| Feature | Details |

|---|---|

| Type | Tokenized Palantir Stock (Ondo) |

| Supply | Low supply, tokenized shares |

| Focus | Reflects Palantir’s performance |

| Trading | 24/5 availability |

| Advantage | Non-U.S. investors can access PLTR |

5. MAON

MAON provides holders of the token an economic exposure equivalent to owning shares of the underlying stock, thus, serving as a tokenized Mastercard stock.

Operated on the Ondo platform, holders of the token can mint and redeem the tokenized stock 24/5 and access MasterCard’s market performance from anywhere in the globe.

MAON tokens are scarce tradeable assets which might bring about a rise in value. Investing in MAON tokens is a proxy investment for those wishing to invest in MasterCard whose stocks trade for about $582.64.

| Feature | Details |

|---|---|

| Type | Tokenized Mastercard Stock (Ondo) |

| Supply | Limited issuance |

| Focus | Exposure to Mastercard’s value |

| Trading | 24/5 blockchain trading |

| Advantage | Alternative way to invest in Mastercard |

6. GLDX

GLDX serves for those who want to invest in cryptocurrency but need to have a less volatile investment as it offers a cryptocurrency that is pegged to the value of gold.

The gold pegged cryptocurrency value’s are under tightly controlled algorithms to avoid needless volatility.

This mechanism ensures that the priced of the gold are stable – the value of GLDX pegged to gold is stable.

Scarcity of GLDX and gold is scarce assets which enhances the value of the GLDX tokens over time. Investing in GLDX is also convenient as it priced under traditional gold securities.

| Feature | Details |

|---|---|

| Type | Digital Gold Token |

| Supply | Scarce, pegged to gold |

| Focus | Stable, value storage |

| Mechanism | Algorithmic control of supply |

| Advantage | Gold exposure via crypto |

7. HOODON

HOODON is a tokenized stock of Robinhood Markets incorporated with its shared economic exposure version.

It enables the holders of HOODON stock to engage with faucets of the stock on the Ondo platform which allows them to mint and redeem the tokenized stocks.

24/5 access is also offered to the stock which allows Robinhood holders to operate on an international level.

The price for one HOODON token is nominal and the higher price fulling the RobinHood ecosystem might bring a rise as the tokens are scarce.

| Feature | Details |

|---|---|

| Type | Tokenized Robinhood Stock (Ondo) |

| Supply | Limited token release |

| Focus | Tracks Robinhood’s market price |

| Trading | 24/5 tokenized stock market |

| Advantage | Easy Robinhood exposure for global investors |

8. EBTC

EBTC is a cryptocurrency token built on the Ethereum layer 2 platform, providing as an exposure to Bitcoin cross the price fluctuations.

With a capped supply of 21 million tokens, always in the cross of Bitcoin, EBTC serves as a scarce asset to the Ethereum blockchain ecosystem.

Currently, the circulating supply is approximated to be around 18.9 million, where the price of an EBTC token is approximated to \$0.46. The scarcity in the supply of EBTC tokens is expected to increase their value over period of time.

| Feature | Details |

|---|---|

| Type | Ethereum-based Bitcoin token |

| Supply | Fixed 21 million (like BTC) |

| Focus | BTC exposure on Ethereum |

| Circulating Supply | ~18.9 million |

| Advantage | DeFi compatibility with Bitcoin-like scarcity |

9. LBTC

LBTC is a tokenized counterpart of Litecoin, intended to extend the value and utility of Litecoin to the Bitcoin network.

It helps users to transact litecoin at faster and cheaper rates compared to the Bitcoin network. For the limited supply of LBTC tokens, there is a strong potential value increase.

At the price of 0.46, users are able to transact at Litecoin value in the Bitcoin.

| Feature | Details |

|---|---|

| Type | Bitcoin-compatible Litecoin token |

| Supply | Limited issue |

| Focus | Combines BTC’s network with Litecoin’s efficiency |

| Utility | Faster transactions, lower fees |

| Advantage | Dual exposure to BTC & LTC ecosystems |

10. TBC

TBC is on the quest to become a unique world currency. Unlike usual, the value is controlled by algorithms, which allows it to grow almost endlessly till it achieves a market cap of 1 trillion dollars.

More tokens will increase in availability, which may in turn cause the value to increase. Currently offered for 0.46 USD. It will interest many due to the unconventional method it is offered.

| Feature | Details |

|---|---|

| Type | Unique economic-model cryptocurrency |

| Supply | Controlled, aimed at growth |

| Focus | Global alternative currency |

| Mechanism | Continuous supply adjustment |

| Advantage | Seeks trillion-dollar ecosystem goal |

Conclusion

To summarize, The Best Low Supply Cryptocurrency List identifies tokens with values derived from scarcity, unique use cases, and innovative models ranging from tokenized stocks to gold-backed assets, and even alternatives to Bitcoin.

The tokens’ restricted supply improves demand potential while providing investors with varied exposure across finance, payments, and decentralized systems.

For investors willing to bet on long-term growth, these low-supply cryptos present compelling prospects in the digitizing economy.

FAQ

It refers to coins with a capped or limited circulating supply, increasing scarcity and value potential.

Ethereum doesn’t have a hard cap, but its burning mechanism makes it semi-deflationary, so it’s often included.

Chainlink (1B max) and Toncoin (~5B max) have among the lowest compared to others.

Scarcity can drive demand, as limited tokens often appreciate in value with adoption.

Yes, though it has unlimited supply, it’s often discussed due to its popularity and large cap.