In the contemporary multi-chain crypto ecosystem, shifting funds between blockchains can become tricky and expensive. The best crypto bridges offer fast, secure, and simple cross-chain swaps, allowing users to access DeFi, NFT marketplaces, and liquidity pools across various networks.

For crypto users, moving funds across networks becomes seamless, cost-effective, and aids participation in the fully interoperable blockchain ecosystem through cross-border access on trusted services, deBridge, Rhino.fi, and Synapse Protocol.

What is Crypto Bridges?

A crypto bridge connects various blockchain ecosystems and lets users exchange and move tokens, NFTs, and other digital assets across chains. These bridges foster cooperation across isolated blockchains.

Users can use assets on multiple blockchains, access DeFi platforms, and execute trades. As assets locked on one chain are transferred and equivalent tokens are minted on the other chain, crypto bridges provide solutions to the challenges presented by multi-chain ecosystems.

In a crypto ecosystem, these platforms provide fast and efficient cross-chain crypto transactions.

What Factor Considered Choosing Best Crypto Bridges for Cross-Chain?

For the best crypto bridge for cross-chain transfers, it is important to remember the following:

Supported Chains: Every bridge has the blockchains it can transfer assets between. Some bridges work with only a few blockchains, while others work with 20+ chains.

Bridging Fees: Transaction fees include a bridge fee and a network gas fee. The smaller the fees, the econonomic small transfers become.

Transaction Speed: For trades and arbitrage, fast finality is important. Some bridges settle in seconds, while others can take minutes, and even longer.

Security: Effective security assess protocols/bridges. Because bridges are often hacked, proven track records for security audits protocols are important.

Liquidity: Adequate transfers are processed smoother and with less slippage. Bridges with higher liquidity lessen slippage, failed, and delayed transfers.

User Experience: Overall usability improves with a simple, intuitive software design, and supportive customer care.

Decentralization & Trust: Of fully decentralized bridges, there is less reliance on intermediaries. Some decentralized bridges work with custodians.

Asset Compatibility: Not all bridges work with every asset. Make sure the bridge works with the token, NFT, or wrapped asset you are trying to move.

Monthly Volume & Reputation: When bridges have high transaction volume, this usually translates to reliability, and trust within the crypto community.

Extra Features: Additional crypto-bridging capabilities like yields, swaps, and instantaneous token conversions are also valuable.

By selecting the right bridge, your cross-chain transfers can be efficient, safe, and economical, reducing risk and allowing hassle-free movement across blockchains.

Key Point

| Crypto Bridge | Bridging Fees | Supported Chains (Examples) |

|---|---|---|

| deBridge | ~0.1% – 0.3% | Ethereum, BSC, Polygon, Avalanche, Fantom |

| Rhino.fi | ~0.2% – 0.5% | Ethereum, Arbitrum, Optimism, Polygon |

| Across Protocol | ~0.1% – 0.25% | Ethereum, Arbitrum, Optimism |

| Rango Exchange | ~0.15% – 0.3% | Ethereum, BSC, Polygon, Avalanche, Solana |

| Orbiter Finance | ~0.05% – 0.2% | Ethereum, Arbitrum, Optimism, Polygon |

| Skip Protocol | ~0.1% – 0.3% | Ethereum, BSC, Polygon, Avalanche, Fantom |

| Portal Bridge | ~0.1% – 0.25% | Ethereum, Solana, Polygon, BSC, Avalanche |

| Symbiosis Finance | ~0.1% – 0.35% | Ethereum, BSC, Polygon, Fantom, Avalanche |

| Synapse Protocol | ~0.1% – 0.3% | Ethereum, BSC, Polygon, Avalanche, Fantom, Optimism |

1. deBridge

deBridge is excellent because it guarantees secure, non-custodial cross-chain transfers. It is compatible with most EVM and non-EVM chains. These include Ethereum, Arbitrum, Avalanche, BNB Chain, Polygon, Optimism, and even Solana.

The deBridge protocol guarantees security and decentralization thanks to its unique delegated staking and validator consensus model. Everyone is charged a ‘bridge fee’ depending on the chain.

For instance, on Ethereum it is 0.001 ETH and on Polygon it is 0.5 MATIC. Because most transactions are confirmed in a few minutes, the $9.96 billion in total volume deBridge has processed, crowns it as a leader in interoperability.

deBridge Key features

- Decentralized validator network architecture (zero TVL: Total Value Locked).

- Cross-chain messaging and native asset transfers available.

- Instant execution (approximately 2 seconds) transfer sending without slippage.

Benefits

- Superlative reliability and speed (exceeding 9 billion volume, no exploits).

- Chain diversity— including Solana, Ethereum, and BNB.

- API and SDK provided.

Drawbacks

- Limited non- EVM (Ethereum Virtual Machine) chain support in comparison with aggregators.

- Advanced messaging use cases that are technical integrated are compulsory.

2. Rhino.fi

Rhino.fi is also among the best crypto bridges. Because it guarantees cross-chain transfers in less than a minute, it’s the best for stablecoin liquidity. It is compatible with 35+ chains, Ethereum, Arbitrum, Optimism, Base, Polygon, zkSync, and Starknet among them.

In most cases, transactions are completed in under 60 seconds. For every transaction, the fee is 0.12% and the total volume processed is over $5.5 billion. In total, over 6 million transactions has been processed. It is best suited for DeFi apps and serves as a fiat on/off ramp.

Rhino.fi Key features

- 35 plus cross-chain DeFi liquidity.

- Bridging speed is increased through StarkEx Layer 2 technology.

- Provides wallet integrations and fiat on/off ramps.

Benefits

- Transaction speed is superlative (approx. 60 seconds).

- Designed for DeFi flow integrations making it easy for customers.

- Yield strategies and flow management for stablecoins.

Drawbacks

- Swap fees (~0.12%) are higher than in some competition.

- For non-EVM chains, it provides limited support especially Solana and Cosmos.

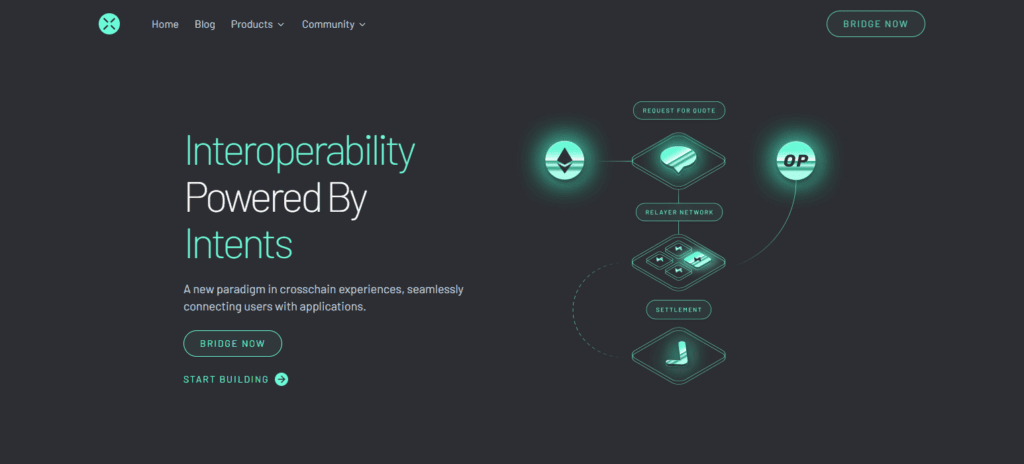

3. Across Protocol

Across Protocol is one of the best crypto bridges for Layer 2 ecosystems. It supports 20+ EVM chains, including Ethereum, Arbitrum, Optimism, Base, Blast, Polygon, zkSync, and Scroll. It uses UMA’s Optimistic Oracle and relayer competition to fulfill user intents quickly.

Bridging fees range from 0.06% to 0.12%, and transactions typically settle in under 1 minute. With monthly volumes exceeding $1 billion, Across is a top choice for fast, secure, and scalable bridging.

Across Protocol Key Features:

- Bridging using intent based UMA’s Optimistic Oracle.

- Fast fulfillment with Relayer competition.

- Layer 2 ecosystems focused.

Pros:

- Fast bridging under 1 minute.

- Low fees (0.06%–0.12%) and very scalable.

- Over $20B in volume demonstrating strong usage.

Cons:

- Mostly EVM focused. No support for Solana and Cosmos.

- No native token swaps. Only asset bridging.

4. Rango Exchange

Rango Exchange stands out as one of the best crypto bridges due to its aggregation of 75+ blockchains, including Bitcoin, Ethereum, Solana, Cosmos, Tron, and Ton. It integrates 130+ DEXs and 26+ bridges, offering smart routing and message passing.

Fees are minimal, often around 0.1%, and transactions complete in ~30 seconds. With over $4.3 billion in volume and a 95%+ success rate, Rango is ideal for users seeking broad chain support and fast execution.

Rango Exchange Key Features

- Over 130 DEXs and 26+ bridges aggregated.

- Bitcoin, Solana, Cosmos, and Tron plus 75+ chains supported.

- Cross-chain swaps and smart routing provided.

Pros:

- Broadest chain support among all bridges.

- Fast execution (~30 seconds) and high success rate.

- No platform fees aside from partner DEX fees.

Cons:

- Complex routing may confuse new users.

- Execution security depends on trust in third-party bridges.

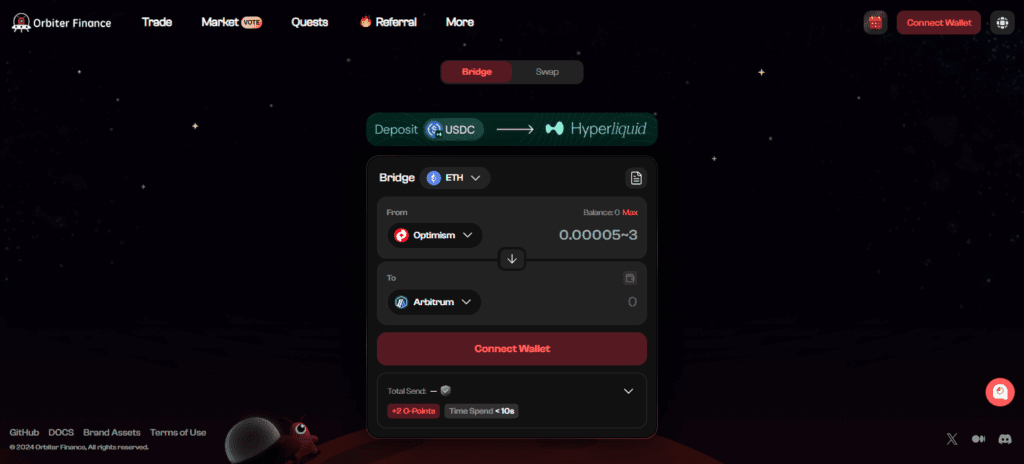

5. Orbiter Finance

Among Ethereum-native rollups, Orbiter Finance ranks among the best crypto bridges. It covers 19+ networks, which include Ethereum, Arbitrum, Optimism, zkSync, StarkNet, Polygon, and Base. With the maker-sender model, Orbiter facilitates near-instant transfers right to EOAs.

Fees vary from 0.03% to 0.30% with an additional gas withholding fee. Orbiter boasts a 20-second transaction settlement time and over $1.5 billion in volume, catering primarily to rollup-native users.

Orbiter Finance Key Features

- Maker-sender model for rollup-native bridging.

- Chains supported include 19+ zkSync, StarkNet, and Bitcoin L2s.

- Gamified NFT rewards for frequent users.

Pros:

- Near-instant transfers (~20 seconds).

- Low fees (0.03%–0.30%) and direct-to-wallet delivery.

- Optimized for rollups and Ethereum-native assets.

Cons:

- Limited support for non-EVM chains.

- Gas fees are unpredictable.

6. Skip Protocol

Skip Protocol is one of the best crypto bridges for Cosmos-native chains. It supports 50+ IBC chains, which include Cosmos Hub, Osmosis, and Ethereum. It utilizes IBC message passing to guarantee secure and decentralized transfers.

Fees range from 0.02% to 0.09%, and transactions are instant (~5 seconds). Skip is best for users in the Cosmos ecosystem needing fast and low-cost interoperability, with over $300 million in volume.

Skip Protocol Key Features

- Cosmos-native bridge using IBC message passing

- 50+ Cosmos chains and Ethereum support

- Instant (~ 5 sec) bridge transaction

Pros:

- Fastest execution bridge across all bridges

- Cheap bridge fees (0.02%–0.09%) and low risk IBC architecture

- Quality bridge for those residing in the Cosmos ecosystem

Cons:

- Not for those who want to bridge BTC or Solana

- Large swaps may face limited liquidity

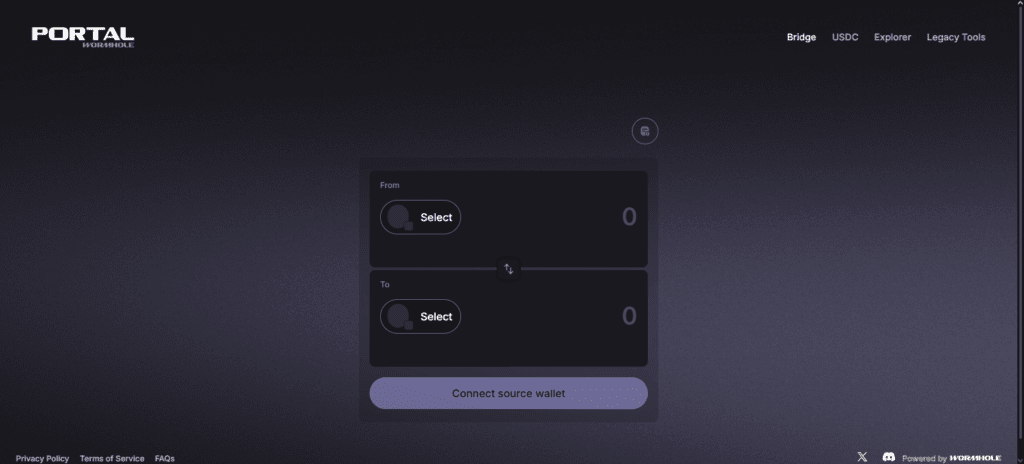

7. Portal Bridge (Wormhole)

Portal Bridge is wormhole-powered and is ranked among the best crypto bridges for non-EVM ecosystems. It services 30+ chains such as Solana, Aptos, Ethereum, Cosmos, and Sui. It uses guardian nodes and a mint-and-burn model for secure transfers.

Transaction Fees in the service are ~0.1% and quick with a ~1 minute settlement period. Portal has recorded over $2 billion in volume and is a great option for developers who are building for multiple ecosystems.

Portal Bridge (Wormhole) Key Features:

- Guardian-based mint-and-burn model

- 30+ chains including Solana and Aptos and over Ethereum and Cosmos

- Tokens and NFTs allowed for transfer

Pros:

- Strong support of non-EVM chains (Solana and Aptos Sui)

- NFTs and multi-asset bridging supported

- Safe due to decentralized guardian network

Cons:

- Guardian model exploits

- Slow bridging approx 1 min based on other bridges

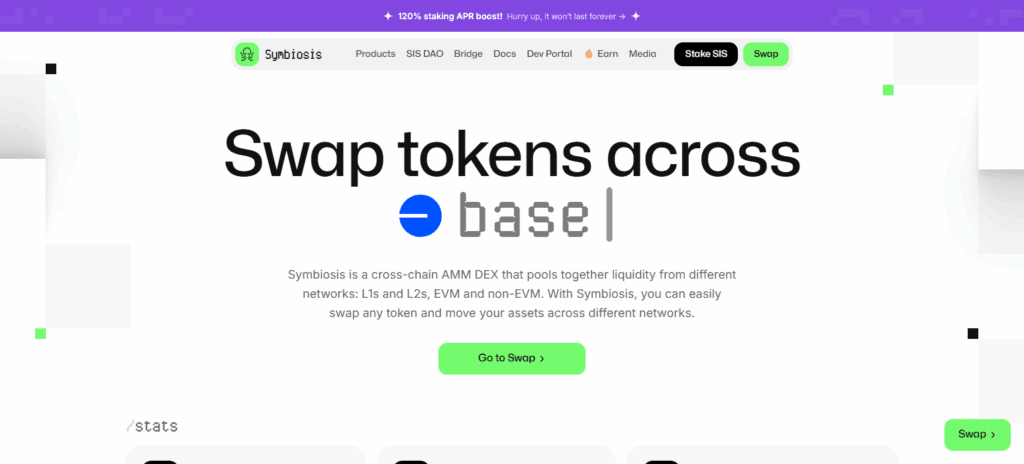

8. Symbiosis Finance

Symbiosis Finance is among the best crypto bridges for cross-chain liquidity aggregation. It has 45+ chains in its service, with Ethereum, BNB Chain, Polygon, Avalanche, and Bitcoin. It uses multi-party computation (MPC) in route creation, which allows for single-transaction swaps with no wrapped tokens.

The Transaction Fees are low and settled in under a minute due to optimized DEX-routing. Symbiosis has handled over $4 billion in volume and is a safe and adaptable option for clients who need cross-chain swaps.

Symbiosis Finance Key Features

- Exchange and execute single-click cross-chain swaps

- Supports 45+ chains including Bitcoin and Ethereum

- No wrapped tokens—native assets provided

Pros:

- Providing secure and private bridging

- Fast execution and low fees

- Broad scope of bridging 430+ poos

Cons:

- Overly complex design for beginners.

- Compared to Rhino.fi or Synapse, there are fewer DeFi integrations.

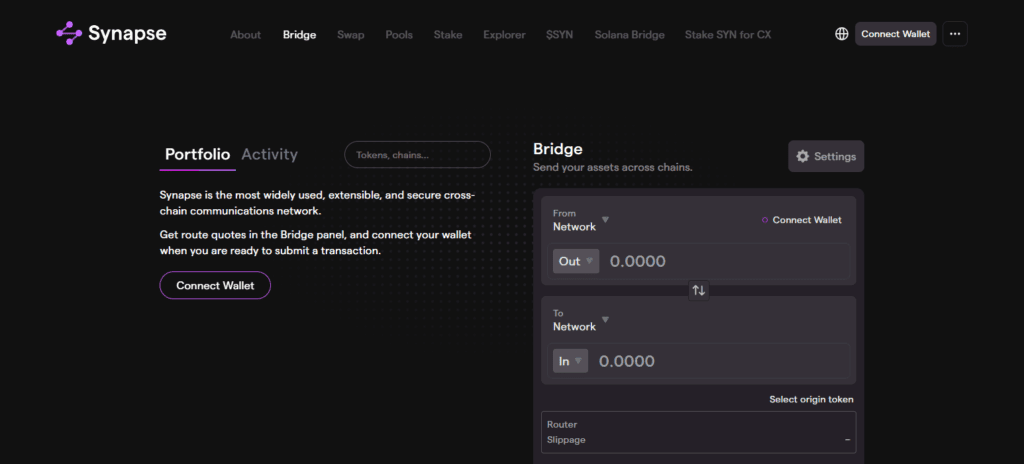

9. Synapse Protocol

Synapse Protocol stands out as one of the most effective crypto bridges for AMM-based bridging. It has a wide spanning support for 20+ networks, including Ethereum, BNB Chain, Avalanche, Polygon, Arbitrum and Fantom.

Synapse allows for the quick and effective transfer of assets via the use of optimistic verification and the stableswap algorithms. Estimated fees depend on slippage and liquidity, and cashing out takes 1–5 minutes. Synapse is compatible with 50+ assets and has processed several billion making it a darling for DeFi bridges.

Synapse Protocol Key Features

- Automated market maker (AMM)-based bridge with stableswap algorithms.

- Supports over 20 chains, including Ethereum, BNB, Arbitrum, and Fantom.

- Provides liquidity pools and token swaps.

Pros:

- Deep liquidity and DeFi integrations.

- More than 50 assets are supported, including SYN, USDC, and ETH.

- Variable fees for flexible bridging.

Cons:

- Compared to newer bridges, Synapse has a slower transaction speed (1-5 minutes).

- Optimistic verification could delay finality.

Are Crypto Bridges Safe?

The importance of crypto bridges in interoperability between blockchains cannot be overlooked. Their safety, however, relies on the specific design, security frameworks, and operational transparency of each protocol.

Most of the notable crypto bridges, like deBridge, Across Protocol, and Synapse, do make use of decentralized validators, optimistic verification, or multi-party computation, adding layers of security.

On the other hand, some crypto bridges also use centralized relayers and custodial models which are even riskier. Bridges have, in the past, answered to smart contract exploits and compromised validators, resulting in millions gone.

Nevertheless, more recent protocols implement much more valuable practices that include intent-based execution, zero- total value locked, and real-time auditing to drastically shrink available attack surfaces.

Crypto bridges have the potential to be secure, but all prospective users have to do due diligence on a given protocol’s security practices, audit trail, and peer reputation to safely transfer large amounts of value between chains.

Conclusion

To wrap things up, selecting the right crypto bridge for cross-chain transfers is essential for optimizing the efficiency, security, and affordability of the multi-chain crypto ecosystem.

Bridges like deBridge, Rhino.fi, Across Protocol, Rango Exchange, Orbiter Finance, Skip Protocol, Portal Bridge, Symbiosis Finance, and Synapse Protocol provide competitive advantages, such as extensive chain coverage, affordability, quick transfers, and robust security.

By paying attention to aspects such as the chains offered, costs, speed, liquidity, and the bridge’s general standing, users will do risk-sensitive cross-chain transfers to expand their DeFi and NFT holdings.

FAQ

A crypto bridge is a protocol that allows users to transfer tokens, NFTs, or other digital assets between different blockchain networks, enabling cross-chain interoperability.

Bridges allow access to DeFi platforms, NFT marketplaces, and other ecosystems on multiple chains without selling your assets. They simplify cross-chain transfers and expand crypto utility.

Some of the top options include deBridge, Rhino.fi, Across Protocol, Rango Exchange, Orbiter Finance, Skip Protocol, Portal Bridge, Symbiosis Finance, and Synapse Protocol. These bridges are known for fast transfers, low fees, and broad chain support.

Fees vary by bridge and blockchain but typically range from 0.05% to 0.35% per transaction. Some bridges also charge network gas fees depending on the chain.

While most bridges implement audits and security protocols, bridges are common targets for hacks. Choosing well-audited, reputable bridges with a strong track record minimizes risk.