This is about the Best Coinbase Alternatives for traders and investors who want more choices, more affordable pricing, and more cryptocurrencies. Coinbase is widely accepted as a beginner’s gateway, but a great many people want more sophisticated trading instruments.

Others seek improved security and worldwide availability. Looking for these alternatives is about finding exchanges that more closely match your trading preferences, your privacy concerns, and the cryptocurrency objectives you wish to pursue.

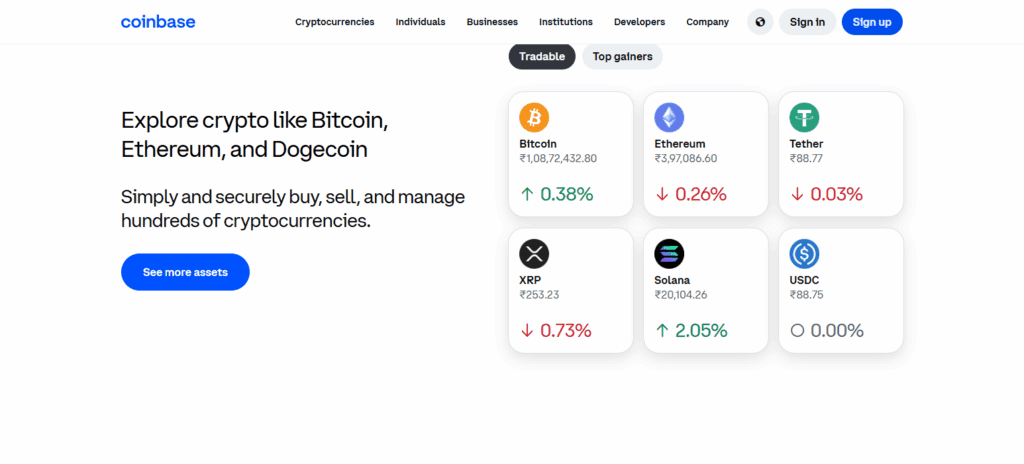

What Is Coinbase?

Since its establishment in 2012, Coinbase has been one of the leading cryptocurrency exchanges in the United States. It has been very accessible for people who want to buy, sell, and store digital assets such as Ethereum and Bitcoin.

Coinbase also facilitates the storing of other digital assets. For beginners, Coinbase provides a simple, friendly, and secure interface. Coinbase takes compliance with the law very seriously as very few exchanges do.

For crypto market beginners, that makes Coinbase a great choice. That said, many traders find Coinbase limited in terms of the more advanced trading features that other exchanges provide at lower costs and with greater flexibility.

Why Look for a Coinbase Alternative?

Lower Fees. Many alternatives to Coinbase offer more competitive trading and withdrawal fees, improving their value to regular traders and investors with high trading volumes.

More Crypto Options. Compared to Coinbase’s more limited offerings, alternatives tend to provide an even greater range of cryptocurrencies and tokens.

Global Accessibility. Certain exchanges are available in areas where Coinbase has restrictions or limited access.

Advanced Trading Tools. Futures, margin trading, and advanced charting (which are not available on Coinbase) are offered by Binance and Kraken.

Better Customer Support. Certain alternatives to Coinbase are said to provide quicker and more reactive customer support.

Privacy & Anonymity. Certain alternatives provide options with little KYC and trading more focused on privacy.

Staking & Rewards. Other exchanges provide more aggressive savings plans, staking rewards, and more advanced crypto rewards.

Enhanced Security. Unlike others, some provide advanced protections like proof-of-reserves, multi-layer defenses, and even decentralized custody.

Key Point

| Exchange | Key Features | Notable Advantage |

|---|---|---|

| Kraken | Founded in 2011, supports 200+ coins, strong security & staking | Highly trusted with advanced trading tools |

| Binance | Largest exchange by volume, low fees, wide asset selection | Best for global crypto traders |

| Gemini | US-regulated, secure storage, intuitive app | Ideal for beginners & institutions |

| Bitstamp | Founded in 2011, transparent fees, fiat gateways | One of the oldest regulated exchanges |

| Bitfinex | Deep liquidity, margin & derivatives trading | Best for professional traders |

| OKX | Supports spot, futures & DeFi services | Feature-rich with global accessibility |

| Bybit | Derivatives-focused, copy trading, bonuses | Excellent for margin & futures trading |

| Crypto.com | Offers Visa card, staking, and mobile app | Best for crypto payments & rewards |

| eToro | Social trading, stocks + crypto in one platform | Great for beginners & copy trading |

| Robinhood | Commission-free trading, user-friendly app | Perfect for quick retail investing |

1. Robinhood

In the United States, Robinhood was introduced and incorporated the trading of cryptocurrencies in 2018. Besides offering transfers and deposits, Robinhood functions cryptocurrencies bank withdrawals a few select coins.

Robinhood offers a simplistic mobile interface for trading stocks, ETFs, options and cryptocurrencies.

Support for Robinhood is available through chat and email, but is limited in understand and effectiveness, Since Robinhood is available in the United States, it is suited best for those beginners trying to find zero-fee trading.

Robinhood Key Details

- Launched: 2013, USA

- Regions: US only

- Deposit/Withdraw: Bank transfer

- Services: Stocks, ETFs, options, crypto

- Support: Chat, email

Pros:

- Zero-fee trading

- Simple and intuitive mobile app

- Great for beginners and stock-crypto crossover

Cons:

- Limited crypto withdrawals

- Few supported coins

- No advanced trading features or tools

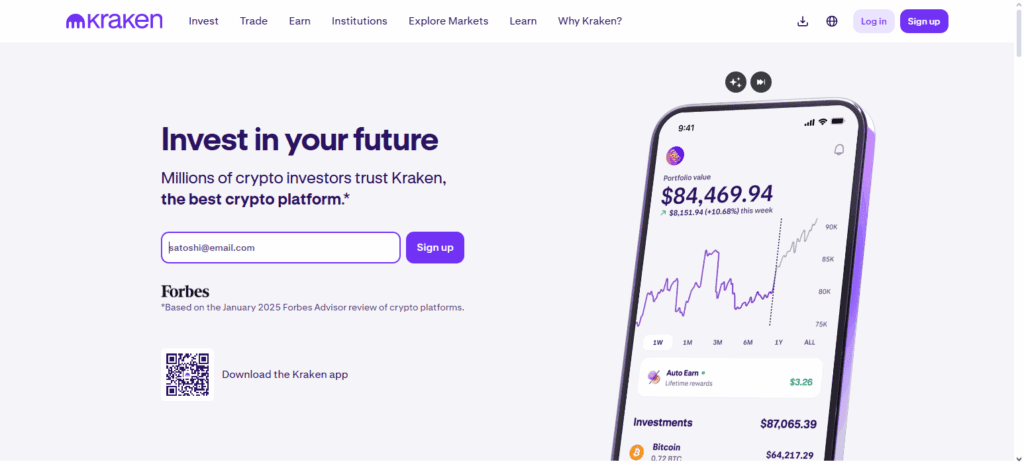

2. Kraken

Established in the United States in 2011, Kraken is recognized for its top-notch security features and operational transparency. Available in most part of the globe, except for a few restricted territories, Kraken accepts bank wires, SWIFT, SEPA, and crypto transfers.

Kraken offers spot trading, futures, margin trading, staking, and advanced charting tools. For customer support, the company offers live chat and ticketing.

They are also recognized to respond in a timely manner. Compared to Coinbase, Kraken is a better option because of the lower fees and high level trading tools, better professional trading customizations and trading support.

Kraken Key Details

- Launched: 2011, USA

- Regions: Global (except sanctioned countries)

- Deposit/Withdraw: Bank wire, SWIFT, SEPA, crypto

- Services: Spot, futures, margin trading, staking

- Support: Live chat, ticket system

Pros:

- Excellent security and regulatory compliance

- Low trading fees for pro users

- Wide range of fiat and crypto pairs

Cons:

- Interface can be complex for beginners

- Limited mobile app features compared to competitors

- Some fiat methods are slow or region-restricted

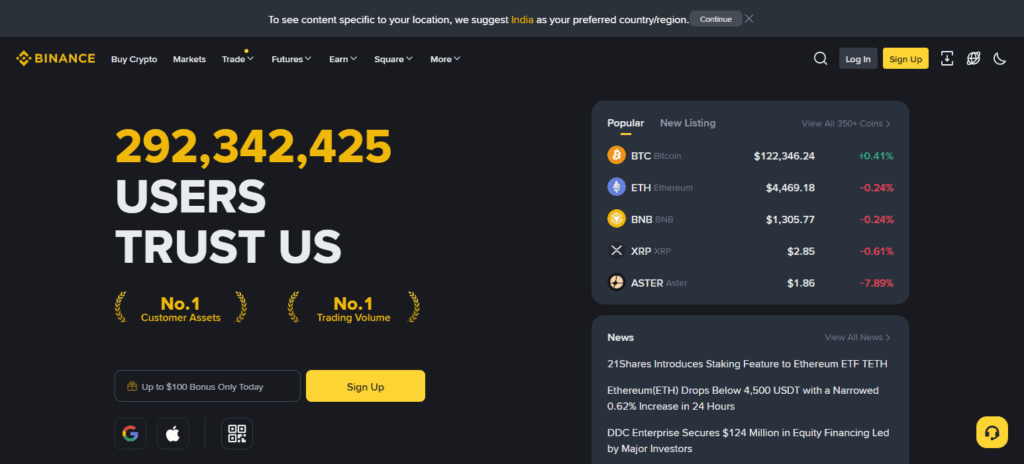

3. Binance

Binance was launched in 2017 in China and is now headquartered in Dubai. It is the world’s largest crypto exchange. Binance is also recognized for the largest volume by exchange.

They accept bank transfers, P2P, debit/credit cards, and crypto deposits/withdrawals and now operates in over 180 countries but is limited access in the US and some Europe regions.

They have a vast number of features which includes spot, futures, margin trading, staking, launchpad, NFT marketplace, and more. Customer support is available in more than one language and can be reached through live chat.

Binance also offers some of the most competitive rates (0.1%), vast selection of tokens, and extensive services among crypto exchanges, which is why they are a great alternative to Coinbase.—

Binance Key Details:

- Launched: 2017, China (HQ in Dubai)

- Regions: 180+ countries (restricted in US, UK)

- Deposit/Withdraw: Bank transfer, P2P, cards, crypto

- Services: Spot, futures, staking, NFTs, launchpad

- Support: Live chat, multilingual help center

Pros:

- Lowest fees in the industry

- Massive coin selection and liquidity

- Advanced trading tools and ecosystem

Cons:

- Regulatory scrutiny in multiple countries

- Overwhelming for new users

- Limited support for fiat in some regions

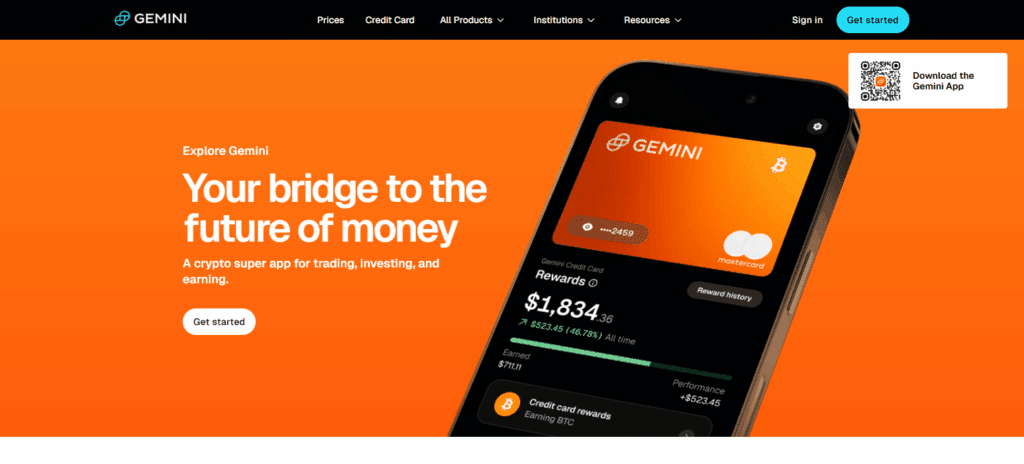

4. Gemini

Founded in 2014 in the USA by the Winklevoss twins, Gemini is a compliance-focused exchange. It supports ACH, wire transfers, debit cards, and crypto deposits/withdrawals, and is available in North America, Europe, and parts of Asia.

Gemini offers spot trading, staking, Gemini Earn, and a regulated stablecoin (GUSD). Its customer support includes email and help center, with a reputation for regulatory transparency. As a best Coinbase alternative, Gemini offers better institutional-grade custody and compliance.

Gemini Key Details

- Launched: 2014, USA

- Regions: North America, Europe, Asia

- Deposit/Withdraw: ACH, wire, debit card, crypto

- Services: Spot trading, staking, Gemini Earn

- Support: Email, help center

Pros:

- Solid regulatory framework and compliance

- Institutional-grade custody and security

- Clean, beginner-friendly interface

Cons:

- Higher fees than most competitors

- Limited coin selection

- Slower customer support response times

5. Bitstamp

Launched in 2011 in Luxembourg, Bitstamp is one of the oldest crypto exchanges. It supports SEPA, SWIFT, credit/debit cards, and crypto transfers, and is available in Europe, USA, and select Asian markets.

Bitstamp offers spot trading, staking, and API access, and is known for its regulatory adherence and reliability.

Customer support includes email and ticketing, with positive reviews. As a best Coinbase alternative, Bitstamp is ideal for European users seeking lower fees and trustworthiness.

Bitstamp Key Details

- Launched: 2011, Luxembourg

- Regions: Europe, USA, Asia

- Deposit/Withdraw: SEPA, SWIFT, cards, crypto

- Services: Spot trading, staking, APIs

- Support: Email, ticket system

Pros:

- Trusted legacy exchange with strong reputation

- Low fees for European users

- Simple and reliable platform

Cons:

- Limited advanced trading features

- Smaller coin selection

- No margin or derivatives trading

6. Bitfinex

Bitfinex was established in Hong Kong in 2012 and is designed for advanced traders. It allows for wire transfers and crypto deposits and withdrawals, and offers spot, margin, and derivatives trading, lending, and staking.

While available globally, it is restricted in the US. Bitfinex is recognized for its advanced trading tools and deep liquidity. Support is limited to ticketing and a knowledge base.

While this has drawn criticism during previous outages, we have it as the best alternative to Coinbase since Bitfinex has a much wider variety of trading options and lower fees aimed at professional traders.

Bitfinex Key Details

- Launched: 2012, Hong Kong

- Regions: Global (not US)

- Deposit/Withdraw: Bank wire, crypto

- Services: Spot, margin, derivatives, lending

- Support: Ticket system, knowledge base

Pros:

- Deep liquidity for large trades

- Advanced trading tools and order types

- Supports lending and borrowing

Cons:

- Not beginner-friendly

- History of past security breaches

- Limited fiat onboarding options

7. OKX

OKX was launched in 2017 in China, and is now based in Seychelles. It has become a global crypto powerhouse with bank transfers, P2P, and crypto deposits and withdrawals and is available in more than 100 countries. OKX provides spot, futures, options, and DeFi tools and has a noted mobile app and trading interfaces.

Customer support comes with live chat and a multilingual help center. OKX is widely regarded as the best alternative to Coinbase due to its superb capabilities in derivatives and DeFi integrations.

OKX Key Details

- Launched: 2017, China (HQ in Seychelles)

- Regions: 100+ countries

- Deposit/Withdraw: Bank, P2P, crypto

- Services: Spot, futures, staking, Web3 wallet

- Assistance: Live chat, multilingual help center

Pros:

- Strong DeFi and Web3 integration

- Competitive fees and fast execution

- Wide range of trading products

Cons:

- Complex interface for beginners

- Limited support for fiat

- Regulatory uncertainty in some regions

8. ByBit

ByBit was established in Singapore in 2018 and is known for quick execution and reasonable trading fees. As a platform, it is equipped for crypto deposits, P2P transactions, and fiat gateways through third parties.

It is accessible in most areas apart from the US. ByBit also includes spot trading, derivatives, copy trading, staking, and an NFT marketplace. It has live chat and tutorial support integration.

It is a great option for users looking for speedy trading because it focuses on low-cost derivatives. ByBit is also considered the best Coinbase alternative for active traders and scalpers.

ByBit Key Details

- Established: 2018, Singapore

- Operational Regions: Global (excluding US)

- Deposit/Withdrawal Methods: Crypto, P2P, fiat through third-party

- Offered Services: Spot, derivatives, copy trading, NFTs

- Assistance: 24/7 live chat

Pros:

- High leverage and fast trading engine

- User-friendly interface for active traders

- Strong community and educational content

Cons:

- Direct fiat withdrawals are not allowed

- Limited regulatory oversight

- Some countries have restricted access

9. Crypto.com

Crypto.com launched in 2016 in Hong Kong and is now headquartered in Singapore. It facilitates bank transfers, credit/debit cards, and crypto deposits.

It is accessible in 90+ countries and supports spot trading, staking, lending, a DeFi wallet, and a Visa crypto card.

Its mobile-centric approach and live chat support enhance user experience. It is regarded as the best alternative to Coinbase primarily due to its exceptional card program and mobile offering.—

Crypto.com Key Details

- Established: 2016, Hong Kong and Singapore

- Operational Regions: 90+ countries

- Deposit/Withdrawal Methods: Bank, cards, crypto

- Offered Services: spot, staking, lending, Visa card

- Assistance: Live chat, help center

Pros:

- Great mobile app and user experience

- Crypto Visa card with cashback rewards

- Wide range of services including DeFi

Cons:

- Fees are complicated and difficult to understand

- Customer support varies in helpfulness

- In some regions, processing fiat is slow

10. eToro

eToro began its journey in 2007 in Israel and recently diversified its offerings by adding cryptocurrency trading in 2013. The platform accepts bank transfers, PayPal, credit and debit cards, and offers stocks, ETFs, cryptocurrencies, and copy trading.

Targeted to multi-asset investors, eToro has a presence in Europe, Australia, and a few countries in Asia. eToro has responsive customer support in the form of live chat and ticketing systems and has received positive testimonials.

Regarding social trading capabilities and the range of assets open to users, eToro is the best alternative to Coinbase.

eToro Key Details

- Established: 2007, Israel and Singapore

- Regions: Europe, Australia, Asia

- Deposit/Withdraw: Bank, PayPal, cards

- Services: Crypto, stocks, ETFs, copy trading

- Support: Live chat, ticketing

Pros:

- Multi-asset platform for diversified investing

- Social trading and copy portfolios

- Regulated in multiple jurisdictions

Cons:

- Limited crypto features (no withdrawals for some coins)

- Higher spreads than traditional exchanges

- Not ideal for advanced crypto traders

Conclusion

To summarize, deciding which Coinbase alternative is most appropriate is based on individual trading intentions, level of expertise, and geographical opportunities. Kraken, Binance, OKX, and Crypto.com, for example, boast reduced costs, expanded cryptocurrency selections, and sophisticated trading apparatuses suitable for novices and seasoned traders.

Mileage may vary for clients of Gemini and Bitstamp, though their appeal and reputation is based on solid regulatory frameworks. Conversely, Bybit and Bitfinex serve high-volume clients trading crypto and may use derivatives and leverage. Safely, affordably, and accessibly, these platforms enhance trading and asset management activities more than Coinbase.

FAQ

Coinbase is user-friendly but has high fees, limited trading tools, and regional restrictions. Alternatives like Kraken, Binance, Gemini, and ByBit offer lower costs, more coins, and advanced features for traders and investors.

Binance and ByBit are known for ultra-low trading fees (as low as 0.1%).

Binance also offers fee discounts with BNB token usage.

Kraken provides competitive fees for spot and futures trading.

Gemini and Crypto.com offer clean interfaces, educational tools, and regulated environments ideal for new users.

Robinhood is also beginner-friendly but has limited crypto withdrawal options.

Binance leads with 350+ coins, followed by OKX, ByBit, and Bitfinex. These platforms are ideal for users seeking altcoin exposure beyond Coinbase’s limited listings.

Kraken, Crypto.com, and ByBit provide 24/7 live chat, while Gemini and eToro offer responsive ticketing systems.

Coinbase support is often slower, making these alternatives more reliable during urgent issues.