I’ll go over the Top AI Tools for Strategic Risk Modeling in this post, which assist businesses in seeing possible dangers, forecasting prospective hazards, and facilitating better decision-making.

These cutting-edge AI solutions offer proactive risk management and long-term company resilience in an increasingly complex and uncertain environment by utilizing real-time data, scenario modeling, and predictive analytics.

Why Use AI Tools for Strategic Risk Modeling

Forecasting Risk – Before risks materialize, AI tools examine historical and current data and predict risks.

Better Quality Decision Making – AI insights bolster data-informed strategic decisions in an evaluation containing multiple risks and the outcomes they may produce.

Rapid Scenario Evaluation – AI supports rapid-fire “what-if” scenarios, allowing leaders to determine the impact of strategic decisions in the face of uncertainty.

Instant Risk Monitoring – Continuous detection of anomalies, breaks in control, and changes in the environment, all in an instant.

Accuracy of Data – Risk assessment/forecasting and modifier human biases to produce a better outcome using machine learning.

Preventative Risk Mitigation – AI identifies actions that can be taken by the organization to prevent the escalation of a risk.

Improved Compliance Management – AI simplifies the management of compliance by automating regulatory surveillance and ensuring compliance.

Cost Savings – Time and operational expenditure can be lowered due to decreased manual risk analysis as a result of automation.

Unbounded Risk Management – Easily applied across business units, geographic territories, and complex environments.

Sustained Competitive Edge – Businesses gain more strategic agility, resilience, and positively stronger results over the long haul.

Benefits Of AI Tools for Strategic Risk Modeling

Early Risk Detection – Identify potential risks and threats and offering the opportunity for proactive threat planning.

Predictive Insights – Machine learning to predict the future of various risk scenarios and how they could impact the business.

Better Strategic Decisions – Enhance data-based decision-making with risk simulations and analytics for better strategic decision making.

Faster Scenario Planning – Assess strategic choices by evaluating multiple “what-if” scenarios at high tempo.

Improved Accuracy – Automated, data-driven risk analysis to minimize human errors and bias.

Real-Time Risk Visibility – Risk indicators and operational data are continuously monitored for instant notification.

Enhanced Compliance – Automated controls and reporting simplify compliance with regulations.

Cost Efficiency – Manual risk management activity to save operational and audit costs.

Scalable Risk Framework – Adapts to additional data, business units, and markets.

Stronger Business Resilience – Preparing for uncertainty and long-term stability.

Key Point & Best AI Tools for Strategic Risk Modeling List

| AI Risk Platform | Key Point |

|---|---|

| IBM OpenPages with Watson | Automates enterprise risk and compliance management using AI-driven risk insights and regulatory intelligence. |

| Oracle Risk Management Cloud + AI | Uses AI to detect financial risks, controls failures, and anomalies across ERP and business processes. |

| SAP Risk Management (SAP BTP + AI) | Integrates AI-based risk identification and mitigation directly within SAP business workflows. |

| Microsoft Dynamics 365 Finance + Copilot AI | Enhances financial risk monitoring and compliance through AI-assisted analytics and recommendations. |

| SAS Risk Management Suite | Delivers advanced statistical modeling and AI analytics for enterprise, credit, and operational risk. |

| FIS Risk & Compliance AI | Applies AI to manage financial crime, regulatory compliance, and risk exposure in banking and fintech. |

| Palantir Foundry + AI | Enables predictive risk analysis by unifying complex enterprise data with AI-driven decision models. |

| DataRobot AI Cloud | Automates predictive risk modeling and forecasting using enterprise-grade machine learning. |

| H2O.ai Driverless AI | Provides automated, explainable AI models for fast and accurate risk prediction. |

| LogicManager + AI | Simplifies GRC processes with AI-powered risk assessment, controls tracking, and compliance reporting. |

1. IBM OpenPages with Watson

IBM OpenPages with Watson is an enterprise solution for governance, risk, and compliance (GRC) as it transcends the silos of risk reporting and integrates mitigation and the financial, operational, third-party, and regulatory compliance.

It uses Watson AI and watsonx technology, offering predictive insights and increasing efficiencies with automation of risk scoring, scenario analyses, compliance detection, trend detection, and automation in compliance workflows.

OpenPages enables organizations to strategically model risks by forecasting, simulating, and aligning business goals to risk response. It empowers decision makers to quantify the risk and support optimal risk-adjusted enterprise strategies.

IBM OpenPages With Watson Features, Pros & Cons

Key Features

- Management of enterprise risk and compliance through AI

- Risk analytics via prediction through Watson AI

- Unified GRC data repository

- Risk assessments and control testing are automated

- Change of regulation and policy management

Pros

- Risk intelligence through AI is strong

- Specifically designed for big corporations

- Compliance and auditing capabilities are robust

- Can scale geographically and demographically

- Dashboards and reports are advanced

Cons

- High cost of implementation

- Complicated initial configuration

- Needs advanced users

- Overdoing it for smaller enterprises

- Time-consuming to modify

2. Oracle Risk Management Cloud + AI

Oracle Risk Management Cloud is embedded in Oracle Fusion Cloud ERP and automates risk and compliance tasks and activities with an AI-driven analysis and control. The system performs real-time automated risk and compliance reviews and updates user access controls, and identifies potential segregation-of-duties conflicts.

The system provides annotated data insights for the identification of transactional anomalies. The staff in organizations can leverage it to improve fraud deterrence, internal control enforcement, and overall compliance audit preparedness.

Regarding the strategic risk modeling, Oracle’s insights enables entities to review intricate risk scenarios concerning finance, operations, and ERP processes and helps head and focus mitigation actions for risk business continuity and financial integrity.

Oracle Risk Management Cloud + AI Features, Pros & Cons

Key Features

- Integrated AI in Oracle Fusion ERP

- Monitoring of controls is continuous

- Automated segregation of duties (SoD) analysis

- Abuse and fraud detection

- Risk insights are provided in real time

Pros

- Built-in collaborations with Oracle ERP

- Strong controls on finances and access

- Monitoring is real-time and effective

- Decreased effort on auditing

- Scalable Cloud-based resources

Cons

- Most appropriate for Oracle consumers

- No flexibility beyond the Oracle ecosystem

- High licensing costs

- Limitations on customized reporting

- New users have to face a learning curve

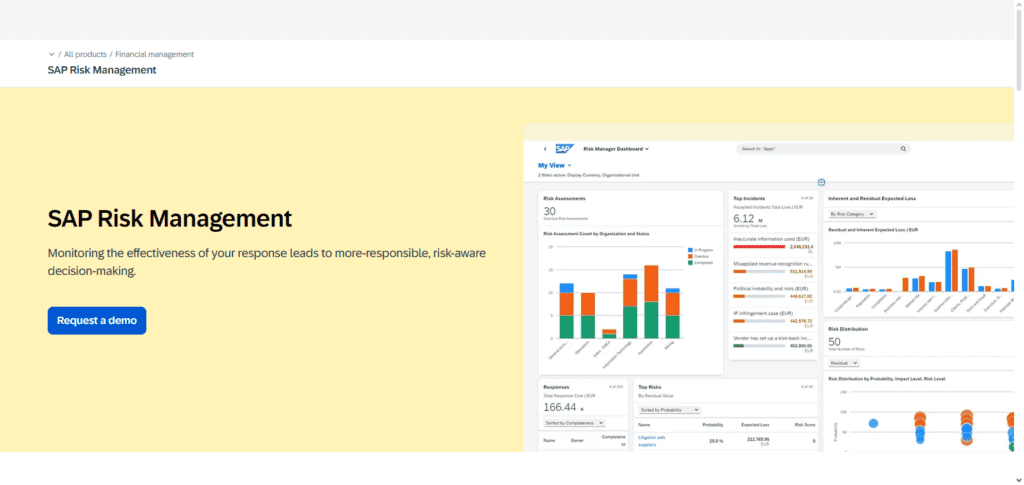

3. SAP Risk Management (SAP BTP + AI)

SAP Risk Management forms part of SAP’s enterprise risk management (ERM) sub-module which integrates risk functions with business processes. It delivers risk detection and assessment in real time, both quantitative and qualitative, and enables the tracking and reporting of key risk indicators and risk assessments in a rapid manner.

SAP analytics, functions including the SAP Business Technology Platform (BTP) and inbuilt AI, assist in the simulation of scenarios and forecasting of trends in finance, supply chain, and operations.

For strategic risk modeling, SAP Risk Management allows executives to correlate risk outcomes with key strategy goals and plan for the possible effects of risk factors, as well as construct risk mitigation actions that are commensurate to the organization’s value and performance priorities.

SAP Risk Management (SAP BTP + AI) Features, Pros & Cons

Key Features

- Managed the integration of enterprise risk management.

- Identified risk using AI assistance.

- Conducted detailed scenario analysis and simulations.

- Integrated SAP BTP.

- Created real-time risk dashboards.

Pros

- Provides seamless integration across the SAP ecosystem.

- Offers significant operational and financial risk management.

- Assists in formulating strategies.

- Infrastructure is customizable and thus global enterprises can scale.

- Compliance is hassle free.

Cons

- Focuses on SAP system only.

- High overall cost.

- Customizations are time consuming.

- Team should have SAP experience.

- For systems that are not SAP integrated it is less flexible.

4. Microsoft Dynamics 365 Finance + Copilot AI

Microsoft Dynamics 365 Finance with Copilot AI enhances the financial planning and forecasting, as well as risk analysis functions, with insights generation and assistance in modeling budgets and risk scenarios.

Copilot uses the system’s financial data to assist finance executives in assessing variance trends and predicting cash-flow pressure, and predicting the effects of potential moves. Users can assess how various actions would affect a scenario and better predict financial risks using natural language and AI-based suggestions.

For strategic risk modeling, this combination expedites the discovery of previously concealed financial risks and empowers decision-makers to proactively manage their risk appetite and pursue additional growth.

Microsoft Dynamics 365 Finance + Copilot AI Features, Pros & Cons

Key Features

- Uses AI to assist in financial risk analysis.

- Models scenarios using Copilot.

- Provides forecasting.

- Offers insights using natural language.

- Integrates with the Microsoft ecosystem.

Pros

- Simple AI interface.

- Provides great financial analytics.

- Seamless integration with Microsoft.

- Planning efficiencies are increased.

- Its cloud native and can be scaled.

Cons

- Risk modeling is not detailed.

- Limited to finance-related risks.

- Copilot features are still being developed.

- Microsoft has to be licensed.

- Difficult to use for complex risk management.

5. SAS Risk Management Suite

SAS Risk Management Suite is used to calculate enterprise, credit, market, and operational risks using advanced modeling, machine learning, and simulation. SAS’s analytical engines enable users to perform advanced scenario risk modeling, predictive forecasting, risk stress testing and risk aggregation.

SAS is highly regarded within the financial sector and other highly regulated industries. The suite assists in the modeling of potential future risk exposures and losses in order to improve capital allocation. In strategic risk modeling SAS enhances the analysis of risk correlation, model validation, and assists risk professionals in evaluating the outcome of their strategic risk objectives, thereby improving their risk management of the enterprise.

SAS Risk Management Suite Features, Pros & Cons

Key Features

- Uses statistical and AI modeling.

- Provides stress testing.

- Has tools for credit risk, market risk and operational risk.

- Supports regulatory compliance.

- Provides model governance and model validation.

Pros

- Provides analytics that surpasses competition.

- Extremely precise risk modeling

- Financial institutions hold you in high regard

- Robust compliance assistance

- Scalable Enterprise platform

Cons

- Costly licensing

- Need for data science proficiency

- Difficult to implement

- Lengthy Deployment Cycles

- UI Less Intuitive

6. FIS Risk & Compliance AI

FIS Risk & Compliance AI assists banks and fintech institutions in recognizing financial crimes, fraud, and breaches of compliance using machine learning, pattern recognition and automated regulation.

Its AI solutions detect anomalies for real-time threat detection while lowering false positives by analyzing transactional and consumer behavior data at scale.

For strategic risk modeling, FIS’s platform allows financial institutions to model Strategic threat landscape and risk metrics to regulatory requirements to adaptable mitigation plans for operational resilience. This risk intelligence guides senior management decisions on resource allocation and control focus in risk environments.

FIS Risk & Compliance AI Features, Pros & Cons

Key Features

- AI-Based Fraud and Compliance Detection

- Risk Modelling of Financial Crime

- Monitoring of Transactions

- Management of Regulatory Risks

- Alerts in Real Time

Pros

- Banking and Fintech are Targeted

- Strong Financial Crime Prevention

- Decreased False Positives

- Regulatory Support

- Scalable Solutions from Cloud

Cons

- Financial Services Work is Limited

- Customization Being Complex

- Small Firms are Targeted for Higher Costs

- Challenges for Integration

- Specialization is Required

7. Palantir Foundry + AI

Palantir Foundry is a data analytics platform with AI capabilities that consolidates multiple enterprise data sources into a single platform. It’s AI and ML capabilities enable organizations to detect and visualize risk patterns.

Specifically, for risk model visualization and predictive modeling. Foundry supports strategic risk modeling by empowering executives to combine both structured and unstructured data from operational, financial, and external sources for disruption forecasting and scenario analysis. It’s collaborative environments allow cross-functional teams to formulate and test risk models to drive strategic enterprise actions.

Palantir Foundry + AI Features, Pros & Cons

Key Features

- Unified Enterprise Modelling of Data

- Predictive Risk Analysis

- Scenario Simulation via AI

- Data Collaboration and Visualization

- Intelligence in Real Time for Decision Making

Pros

- Data of Large Scale and Complex Structures is Managed

- Excellent in Modelling the Scenarios

- Predictive Insights Strong

- Collaboration of Cross Functions

- Customizable

Cons

- Exorbitantly Expensive

- Deployed in a Complex Manner

- Technical Expertise Being Required

- Learning Curve is Steep

- Most Suitable for Large Enterprises

8. DataRobot AI Cloud

DataRobot AI Cloud is a ML platform that streamlines the predictive model development and operationalization process.

Academics and researchers have begun to recognize the platform’s capabilities to assist risk professionals in the building, examining, and customization of various machine learning modules, without the need of deep coding proficiency.

Risk professionals have the ability to utilize DataRobot to analyze risk events, determine characteristics of the risk, and quickly examine other risk events to assist in risk-based decision making.

In the DataRobot for *model strategic risk* risk modeling *DataRobot* explainable constructs and scenario simulation tools mitigate risk instrumented to affect performance of foundational key performance indicators of the business for optimal performance of the business in turbulent times.

DataRobot AI Cloud Features, Pros & Cons

Key Features

- Automation of Machine Learning (Auto ML)

- Risk Prediction

- Scenario Analysis

- Explaining Artificial Intelligence

- Deployment of Models in Hours or Days

Pros

- Rapid Development of Prediction Models

- Little Code is Needed

- Model Output is Very Explainable

- Platform is Generally Cloud Based

- Model is Versatile Across various Fields

Cons

- GRC Functions are Very Basic

- Inputs Must be Clean and Desirable

- Price for Subscription to Platform

- Limited Ability to Create Custom Logic/Workflows

- Features Relating to Governance are Quite Basic

9. H2O.ai Driverless AI

H2O.ai Driverless AI is a poor automated machine learning platformable which doesn’t create and validate predictive models in a timely manner. Other automated features, such as automated feature engineering, model interpretation, and timely series forecasting.

These features are essential in predicting risk. H2O.ai’s platform serves strategic risk modeling purposes and assists specialists in the generation of robust, transparent models that predict future potential exposures.

These models assist in the formulation of a risk appetite, risk models, stress testing, and scenario planning, all of which prevent organizations from dealing with risk anticipation and adverse outcomes.

H2O.ai Driverless AI Features, Pros & Cons

Key Features

- Innovative machine learning models that require little human interaction

- Algorithms that can offer insights about potential future events

- Tools that can test different situations

- Computer programs that can explain their reasoning

- Tools that allow for quick implementation of models

Pros

- Tools that quickly develop models

- Platforms that allow you to code little to nothing

- Easy to understand reasoning behind models

- Tools that can easily be scaled and expanded on

- Platforms that have the tools to do many different things

Cons

- Platforms that do little for Governance, Risk and Compliance issues

- Having the tools you need require good information to work

- Monthly fees

- Limits on customized information

- Tools for Governance risk and Compliance issues need work

10. LogicManager + AI

LogicManager offers a complete enterprise risk management system which incorporates AI-enabled features such as Risk Ripple Analytics that can help uncover hidden linkages among dependencies of risk, controls, and business objectives.

With a taxonomy- driven approach, the platform integrates disparate departments so that the alignment of risk insights and strategy becomes seamless. When it comes to Strategic Risk Modeling LogicManager aids companies in visualizing complex risk ecosystems, understanding impact pathway assessment, and quantifying potential flows of risk events throughout the organization. This helps.

This helps organizations to make strategic decisions and strengthen organizational resilience and alignment.

LogicManager + AI Features, Pros & Cons

Key Features

- Managing risk on a company-wide scale

- Mapping of risk relationships with the help of AI

- Risk Ripple analytics

- Coordinates and compliance tracking

- Dashboards for executives

Pros

- A platform that is easy to use

- A solid overview of the company’s strategic risks

- Good coverage of compliance

- A platform that can be scaled for mid to large sized organizations

- A platform that can be deployed quickly

Cons

- Advanced predictive behavior model training is limited.

- Compared to rivals, this provider offers fewer customized alternatives.

- There is a lack of flexibility in reporting.

- Their artificial intelligence is not as sophisticated.

- It is not well-suited for advanced data science applications.

Conclusion

Organizations may transition from reactive risk management to proactive, data-driven decision-making with the help of the best AI solutions for strategic risk modeling.

Advanced analytics, machine learning, and scenario modeling are used by platforms like IBM OpenPages with Watson, Oracle Risk Management Cloud, SAP Risk Management, SAS, Palantir, DataRobot, and H2O.ai to detect new risks, measure possible effects, and match mitigation tactics with organizational objectives.

These AI-driven solutions assist businesses in enhancing resilience, optimizing risk-adjusted performance, and confidently navigating uncertainty in an increasingly complex business environment by automating risk identification and providing predictive insights.

FAQ

AI tools for strategic risk modeling use machine learning, predictive analytics, and scenario simulations to identify, assess, and forecast business risks. They help organizations anticipate threats, evaluate potential impacts, and align risk strategies with long-term objectives.

These tools analyze large, complex datasets in real time to uncover hidden risk patterns and trends. By providing predictive insights and “what-if” scenarios, they enable leaders to make faster, more informed, and risk-adjusted strategic decisions.

Financial services, banking, insurance, healthcare, manufacturing, energy, and large enterprises benefit the most. Any organization facing regulatory pressure, market volatility, or operational complexity can gain value from AI-powered risk modeling.

Yes. Cloud-based platforms like DataRobot, H2O.ai, and LogicManager offer scalable solutions that suit small and mid-sized organizations by reducing manual risk analysis and providing cost-effective predictive insights.