In 2026, blockchain interoperability is extremely important for enabling different systems to communicate. While Best LayerZero alternatives for interoperability is dominant, up-and-coming competitors are faster, more secure, and more useful for multi-chain transactions.

Whether for DeFi, NFTs, or enterprise blockchain, the right jumps for developed and seamless transfers and execution of smart contracts and scale. This article reviews the best of these LayerZero competitors that will enable fully developed multi-chain applications.

Key Factors to Consider in Best LayerZero alternatives for interoperability

Cross-Chain Compatibility

LayerZero needs to function across different blockchains, allowing your users to move tokens, interact with smart contracts, and transfer data across both EVM and non-EVM networks easily.

Security and Reliability

Security must be a priority to avoid losing funds, missing messages, or getting hacked. Look for cross-chain verifiable transactions, automated defenses, and risk-proven bridges.

Speed and Scalability

LayerZero needs to provide near instant transactions with low latency, or it will quickly be outperformed by other solutions. This is even more critical for DeFi and gaming applications.

Developer Tools and Ecosystem

In order to cut down integration time and onboarding friction, increased documentation, support, and more robust SDKs, APIs, and other tools need to be made available.

Cost Effeciency

For DeFi, NFTs, and Layer 2s, low gas fees, operational costs, and bridge costs become important in order to support sustainable cross-chain activity. This is crucial for microtransactions.

User-Friendliness and Accessibility

In order for LayerZero to be widely used by the market, it needs to have an intuitive UI, easy wallet integration, simple onboarding, and secure self-custodial asset transfers.

Management and Assistance of the Community

The involvement of the community and the distributed management of the community provide upgrades for the protocols and give suggestions for security and long-term care so that the interoperability solutions will continue to be useful and changing.

10 Best LayerZero Alternatives for Interoperability (2025)

| Alternative | Key Features & Strengths | Best Use Cases |

|---|---|---|

| Axelar | General message passing, Cosmos + EVM support, secure swaps | DeFi protocols, Layer‑2 scaling |

| Wormhole Portal | Token & NFT transfers, GameFi support, multi‑ecosystem reach | Gaming, collectibles, cross‑chain dApps |

| Synapse Protocol | Cross‑chain communication, liquidity pools, stablecoin swaps | DeFi liquidity, stablecoin interoperability |

| Hop Protocol | Layer‑2 to Layer‑2 bridging, instant liquidity, low fees | Ethereum rollups (Arbitrum, Optimism, zkSync) |

| Celer cBridge | zkBridge, cross‑chain liquidity, multi‑chain dApp support | DeFi & gaming dApps |

| Connext | Trust‑minimized bridging, modular architecture, fast liquidity transfers | Rollups, modular DeFi protocols |

| Chainlink CCIP | Oracle‑powered cross‑chain messaging, enterprise‑grade security | Enterprise integrations, DeFi messaging |

| LI.FI | Bridge aggregator, cross‑chain swaps, SDK for developers | Wallets, DEX aggregators, developer tooling |

| THORChain | Decentralized cross‑chain AMM, native asset swaps | Traders, liquidity pools, decentralized swaps |

| Symbiosis Finance | Cross‑chain liquidity aggregation, single‑click swaps across multiple chains | Retail DeFi users, multi‑chain liquidity access |

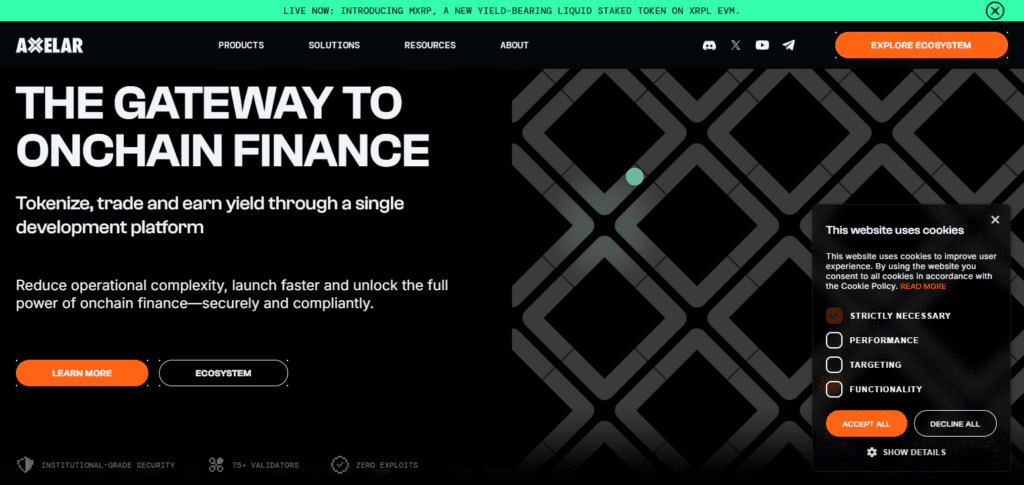

1. Axelar

Token transfers, smart contract executions, and liquidity routing are some of the functionalities that Axelar offers. It focuses on creating a decentralized infrastructure for cross-chain interoperability and has also built secured cross-chain communication for Cosmos and Ethereum.

Developers, along with creating scalable Layer 2 and DeFi solutions, can also build decentralized applications that tokens and contracts fully communicate and route with.

Developers also sustain their interoperability components with Axelar which is nationally ranked among the Best LayerZero Alternatives for Interoperability.

Axelar Key Features

- A decentralized network of validators securing cross-chain message transfers

- Interoperability of smart contracts via General Message Passing (GMP)

- Native token transfers and communication between decentralized applications (dApps)

Pros

- Top security as obtained from Proof-of-Stake validation.

- Outstanding developer tooling and Software Development Kits (SDKs).

- A large number of key EVM and non-EVM chains are supported.

Cons

- Slightly higher fees than bridges with only liquidity.

- Messaging delays are a function of the validators’ consensus.

2. Wormhole Portal

Wormhole is a cross-chain messaging protocol that allows for the transfer of tokens and NFTs. It is programmed to support multiple ecosystems including Ethereum, Solana, and BNB Chain.

Its seamless functionality encourages assists movement and allows for inter-chain communication. Wormhole is a guardian that secures cross-chain transfers which promotes the concept of decentralization.

Amidst everything, Wormhole Portal has one of the Best LayerZero alternatives for interoperability especially for multi‑ecosystem projects with NFT capabilities which is why they are popular among developers for gaming and collectible platforms.

Wormhole Portal Key Features

- A cross-chain messaging system based on Guardians.

- Enables bridging of assets and sending arbitrary messages.

- Extensive ecosystem (DeFi, NFTs, governance) integrations.

Pros

- Extensive support for various chains (Solana, Ethereum, Ethereum Layer 2s, and others).

- Widely used in the ecosystem as a battle-tested solution with high total value locked.

- Provides cross-chain messaging with low lag.

Cons

- Inherent reliance on a guardian set (less than fully trustless).

- Previous exploits in the system have led to a loss of user confidence.

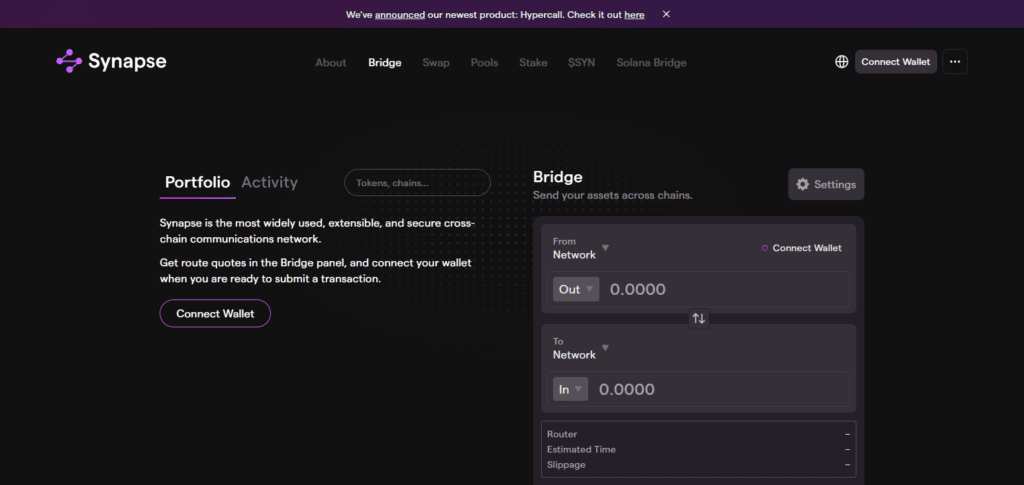

3. Synapse Protocol

Synapse Protocol is a specialist of the cross‑chain liquidity pools and stablecoin swaps. It allows for extremely quick and safe interoperability with stablecoin liquidity between the most prominent blockchains.

It is possible to implement general messaging where developers can build dApps which interoperates among different ecosystems. Synapse’s liquidity network provides for efficient routing where slippage and costs are reduced for the users.

Among its many features, Synapse Protocol is one of the Best LayerZero alternatives for interoperability especially for DeFi projects with stablecoin transfers and liquidity aggregation on a number of chains to improve user experience on decentralized finance applications.

Synapse Protocol Key Features

- Bridges tokens based on available liquidity.

- Utilizes native liquidity pools for cross-chain swaps.

- Provides cross-chain message transfers on a basic level.

Pros

- Fast and very low fee transfers.

- Better designed interface for user experience.

- Supports a large number of EVM chains.

Cons

- Compared to LayerZero, generalized messaging is quite limited.

- During times of high volatility, there are liquidity risks.

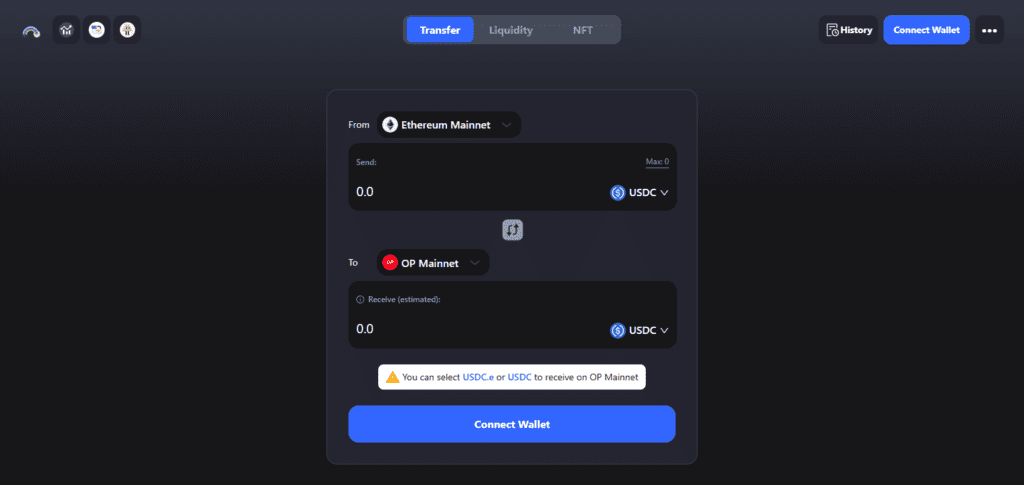

4. Hop Protocol

Hop Protocol concentrates on bridging Ethereum Layer‑2 rollups such as Arbitrum, Optimism, and zkSync. It allows for instant liquidity transfers to and from rollups at low fees which is useful for scaling Ethereum applications. Hop has a structured AMM to ensure efficient swaps among rollups to fast settlement.

Many users consider Hop Protocol one of the best for its LayerZero competitors including Celer, Connext, Chainlink as well as others that focus on Layer 2 with Cost-efficient bridging solutions that allow dApp developers to maintain their ability to build quickly without degrading decentralization.

Hop Protocol Key Features

- Bridging solution designed with rollups in mind.

- Fast exits with bonded liquidity from liquidity providers.

- Optimized for Ethereum L2 ecosystems

Pros

- Instantaneous transfers between rollups

- Excellent experience for users on L2

- Lessened withdrawal wait times

Cons

- Limited L1 and non-EVM availability

- Depends on liquidity

5. Celer CBridge

covering 40+ blockchains including Ethereum, BNB Chain, and Polygon. Celer cBridge is a cross-chain liquidity protocol that integrates zkBridge technology allowing for secure and efficient interoperability, as well as stream dApp communications and token transfers.

It’s also gaming and DeFi enabled, making it versatile. Some of celer cbridge’s celer features has got it to rank one of the Best LayerZero competitors for interoperability; with a secure and scalable cross-chain liquidity & dApp integration routing.

Celer cBridge Key Features

- Token transfers on different blockchains driven by liquidity

- State Guardian Network (SGN) ensures safety

- Supports message transfer with Celer Instant Messages

Pros

- Affordable and quick transaction processing

- Great coverage for EVM-compatible blockchains

- Built for high-traffic corporate use

Cons

- Less flexible messaging compared to LayerZero

- Some security risk from off-chain validation

6. Connext

Connext has designed a modular architecture that isolates trust-minimized bridging with active decentralization, focusing on Ethereum rollups and sidechains for rapid liquidity transfers.

It’s their focus on security that removes all centralized intermediaries that allows for Connext to support all modular DeFi protocols making it highly flexible for developers.

For these reasons and others, Connext gets ranked as one of the Best LayerZero competitors for interoperability focusing on bridging safe, modular, and scalable across Ethereum Layer 2.

Connext Key Features

- Modular design for cross-chain messaging (xCalls)

- Router-based liquidity model

- A focus on minimizing trust

Pros

- High commitment to decentralization

- Excellent for multi-chain dApps

- No need for wrapped assets

Cons

- Other providers cover more chains

- Greater difficulty for beginner integrations

7. Chainlink CCIP

Chainlink’s governance CCIP is widely recognized for offering secure cross-chain interoperability via the oracle network, which facilitates the swift and safe coss-chain message and token transfers.

Enterprise-grade applications require reliability and scalability, which CCIP has through integration with DeFi protocols and advanced use cases such as cross-chain lending and derivatives.

Mid-features, Chainwalk CCIP is among the Best LayerZero alternatives for Interoperability with enterprise-grade security and user-friendly applications for building advanced cross-chain applications.

Chainlink CCIP Key Features

- Decentralized Oracle Network (DON) security

- Messages and tokens transfer across chains

- Built-in risk management and rate limits

Pros

- Top-notch security for enterprises

- Excellent reputation with Chainlink

- Great for high-value and institutional use

Cons

- Premium pricing compared to lightweight bridges

- Growing their list of supported blockchains

8. LI.FI

LI.FI is a bridge aggregator, blending several interoperability protocols into one easily digest SDK for developers. It engages in cross-chain swaps, route liquidity, and integrates wallets, making it a robust tool for dApp developers. LI.FI enhances user experience through one-click cross-chain transactions.

Close to the top of the list is LI.FI for Best LayerZero alternatives for Interoperability, allowing developers a seamless interface for access to multiple bridges, liquidity sources, and end-users.

LI.FI Key Features

- Part of the cross-chain aggregation liquidity protocol.

- Involves the execution of transactions on various bridges and DEXs.

- Prioritizes API for developers.

Pros

- Executes transactions in the best manner across multiple chains.

- Handles the complexity of multiple bridges and DEXs.

- Well suited for wallets and aggregators.

Cons

- Doesn’t have.

- Integrated protocols determine the security.

9. THORChain

THORChain is a cross-chain AMM which is decentralized and allows for the swapping of native assets without needing wrapped tokens. It is compatible with Bitcoin, Ethereum, and other major trading chains while offering compatible trading liquidity pools.

What makes THORChain special is the decentralized custody and trustless swaps, a rare interoperability feature.

At this point in time, THORChain is amongst the top players in the industry when it comes to LayerZero alternatives and interoperability as traders are able to utilize decentralized and native asset swaps across various ecosystems, with no use of CEXs.

THORChain Key Features

- Cross-chain self-custodial asset swaps with no wrapping

- RUNE collateralizes liquidity pools

- AMM for cross-chain swaps with full decentralization

Pros

- No wrapped or custodial assets.

- Increased decentralization.

- Strong support for non-EVM and Bitcoin.

Cons

- Smart contract messaging is limited.

- Tokenomics can be complicated.

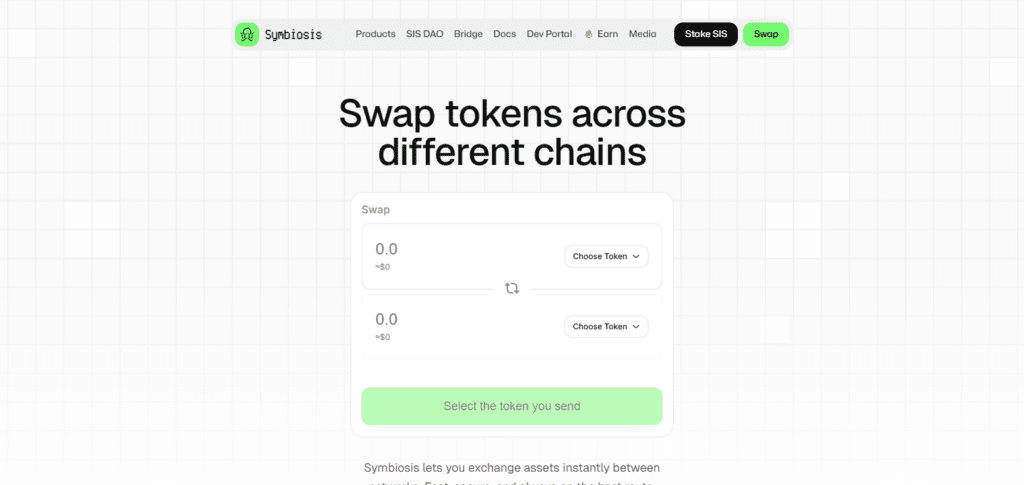

10. Symbiosis Finance

Symbiosis Finance is a cross-chain liquidity aggregator, allowing seamless and instant one-click swaps across multiple blockchains in one transaction.

Easy use access to liquidity in various ecosystems such as Ethereum, Polygon, and Binance Smart Chain is also provided to DeFi users.

With efficient routing and an interface that is easy to use, Symbiosis Finance is one of the best LayerZero alternatives when it comes to interoperability, giving users and developers easy access liquidity to various blockchains.

Symbiosis Finance Key Features

- AMM and liquidity protocol with cross-chain capabilities.

- Liquidity pools across chains and unified.

- Instant swaps on the supported chains.

Pros

- No multiple bridges to manage.

- User experience is hassle free.

- No need to manage multiple bridges.

Cons

- Smaller relative to the top competition.

- Varies depending on the supported chain.

How to Choose the Right Best LayerZero alternatives for interoperability

Check Cross-Chain Availability

- Identify the blockchains the protocol can link.

- Check for support of your target networks (EVM, non-EVM, L2s) for frictionless transfers of data and assets.

Check for Credibility and Security

- Look for protocols with audited smart contracts and secured bridges with decentralized and authoritative verification.

- Look for a history of vulnerabilities, exploits, and downtime from past usage.

Identify Speed and Scalability

- Look for the transaction latency and throughput.

- If you are working with high-frequency DeFi and NFT, focus on the solutions that can more efficiently operate at larger volumes.

Assess the Ecosystem and Available Resources for Developers

- Check for the documentation, APIs, and SDKs.

- An outstanding developer ecosystem can ease the integration and help in faster development of the applications.

Assess applications for Cost Effectiveness

- Analyze operational costs and bridge fees, as well as the costs of transactions.

- In case of microtransactions and frequent transfers, lower costs are crucial.

Assess the User Experience

- Examine end-user interfaces for ease of use and wallet compatibility.

- Lower cross-chain activity errors are achieved by better UX, and so is higher adoption.

Analyze Community and Governance

- Look for decentralized governance and effective community building.

- Because of increased community involvement, there are usually quicker updates, enhanced security methods, and sustainable practices in the long run.

Conclusion

It is already evident how important seamless cross-chain integration will be for 2026. Each protocol has a diverse set of features and capabilities. Some focus on speed and low fees; others on security and developer support.

Some even have enterprise-grade scalable architecture. Evaluating for cross-chain compatibility, security, cost efficiency, and ecosystem support will have to be a focus for many years to come.

This will be true for projects that focus on DeFi, NFTs, blockchain gaming, and enterprise blockchain. With the flexibility and efficiency of the evolving blockchain landscape, ensuring maximum seamless interoperability across a number of networks will be the goal.

FAQ

LayerZero is a cross-chain interoperability protocol that enables communication between different blockchains. Alternatives are needed to provide more options for speed, cost efficiency, security, and specific use cases.

Protocols like Celer cBridge and Hop Protocol are optimized for fast cross-chain transactions, particularly for DeFi and Layer 2 scaling solutions.

Yes, most top alternatives like Axelar Network and Chainlink CCIP use audited smart contracts, decentralized verification, and strong security mechanisms to ensure safe cross-chain transactions.

Wormhole, Synapse Protocol, and LayerSwap excel in fast and low-cost cross-chain NFT transfers and in-game asset interoperability.

Yes, solutions like Axelar Network and Polkadot Bridges provide enterprise-grade interoperability with strong security, auditability, and scalability suitable for business applications.