As blockchain ecosystems continue to expand, finding reliable cross-chain solutions becomes essential. The Best Synapse Protocol Alternatives for Bridging offers users a faster, cheaper, and more secure way to move assets across a network.

No matter if you need deep liquidity, multi-chain support, or advanced inter-operability features, a number of top-tier protocols provide strong options. These alternatives allow traders, developers, and DeFi users to enjoy a more seamless cross-chain experience without having to rely soley on Synapse.

How To Choose the Best Synapse Protocol Alternatives For Bridging?

Supported Blockchains & Tokens

Choose a bridge that falls within your preferred blockchain networks and the crypto assets in your portfolio. This is crucial for smoother and easy moving of your tokens.

Comparing Speed and Fees

The overall ease of use of a bridge is dictated by how fast your transactions are completed and the fees that you will need to pay for every transfer.

Evaluate Security and Audits

Peace of mind in the level of security the blockchain bridge will provide can result in being able to lower the level of exploits. Evaluate validation distributed networks.

Select the Type of Bridging You Need

Different blockchain bridging systems are optimized for different functions, including simple asset transfers, swaps of assets across different blockchains, and seamless flexible cross-blockchain interfaces.

Assess Depth of Liquidity

The quality of blockchain bridging systems is determined by smooth transfer of assets and quick execution without loss to the network. Assess liquidity to avoid frustrating systems.

Assess User Experience

For this step choose a bridge. Assess whether it has a smooth and straightforward interface, uncomplicated navigation, and has clear transaction tracking. Ease and reliability are derived from a better user experience and interface.

Analyze System Integrations

For this step look for bridges that are partnered and integrated with big name players in the DeFi ecosystem, wallets, and dApps. Numerous partnerships are a signal a bridge will be well supported.

Look Into User Trust & History

Choose bridges that are reputed to have a trustworthy user base, active builders, and have maintained a good track record in security. Steer clear from projects that have unresolved security issues and outdated projects.

10 Best Synapse Protocol Alternatives

| Protocol | Key Strength |

|---|---|

| Symbiosis Finance | Broad support + efficient routing |

| Stargate Finance | Instant finality + unified liquidity |

| Across Protocol | Optimistic relayer model |

| Hop Protocol | AMM liquidity for fast moves |

| Celer cBridge | High performance + low fees |

| Axelar Network | General Message Passing (GMP) |

| Orbiter Finance | Fast & gas-efficient |

| Router Protocol | Integrates many ecosystems (incl. Solana) |

| deBridge | Supports messaging + assets |

| Allbridge | Easy UI + wide chain list |

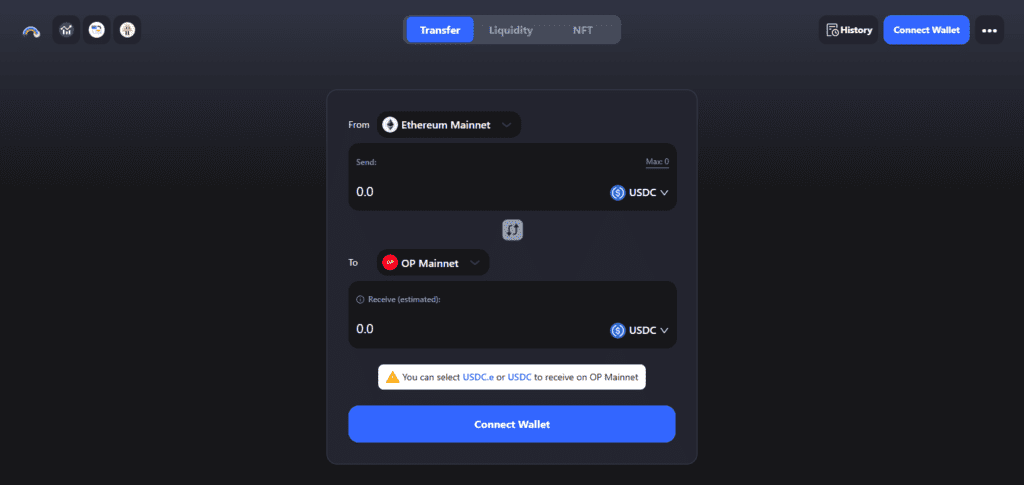

1. Symbiosis Finance

Symbiosis Finance is a multi-chain liquidity protocol for seamless token swaps and bridging across over 30 blockchains, is a cross-chain aggregator for the fastest and most inexpensive transfer routes, in the middle of each workflow, and is one of the Best Synapse Protocol Alternatives for Bridging. It offers integrated liquidity pools and stable executions.

The platform accommodates both EVM and non-EVM networks which adds to its versatility. Non-custodial architecture guarantees security, while cross-chain swaps, stable routing, and real-time bridge monitoring enabled Symbiosis’s popularity among bridging users.

Symbiosis Finance Pros & Cons

Pros

- Integration with more than 30 EVM and non EVM chains.

- Cross-chain swaps available.

- Reasonable fees due to efficient route trimming.

Cons

- Some chains have a lower depth of liquidity.

- National non EVM is still increasing.

- Increased transfer times if congestion is an issue.

2. Stargate Finance

Built on LayerZero, Stargate Finance offers bridging with instant finality, seamless native asset cross-chain transfer, and unified liquidity pools. Users can traverse EVM blockchains with low slippage and security provided by omnichain messaging.

In the middle of its functionality, it demonstrates why it is one of the Best Synapse Protocol Alternatives for Bridging, especially for users needing high liquidity and quick settlement.

Stargate is one of the first services to offer support to stablecoins and has highly optimized integrations with major services in the DeFi sector.

Its routing is simple and does not utilize wrapped assets, enhancing security and ease of bridging. For cross-chain traders and DeFi users, Stargate is still one of the best options.

Stargate Finance Pros & Cons

Pros

- Bridging of native assets unified in a liquidity pool.

- Instant finality with very low slippage.

- Omnichain architecture supported by LayerZero.

Cons

- Chain limitations based on LayerZero endpoint supported chains.

- Bridging of stablecoins is the main focus.

- Omnichain messaging brings more complex features.

3. Across Protocol

Across Protocol is an intent-based bridge focused on providing quick and cost-effective transactions through the use of their unique optimistic relayer model. With this model, settlements are quick and fee costs are significantly lowered on major networks like Ethereum Layer 2.

In the centre of its design philosophy, Across is one of the best Synapse Protocol Alternatives For Bridging. Across has reliable transfer transactions that are backed by optimistic verification offered by UMA.

There is minimal risk and slippage, while providing relayers with liquidity. Across is one of the best options users have to benefit from smooth functionality and rapid low-cost cross-chain transactions with their broad integrations with numerous rollups focused on efficient cross-chain movement.

Across Protocol Pros & Cons

Pros

- Very quick bridging with a relayer based on intent.

- Lower fees by using optimistic verification with UMA.

- Stronger models of security by decreased slippage.

Cons

- Primarily supports Ethereum L1 and L2 ecosystems.

- Demand based shifts can influence relayer incentives.

- Limited non EVM support.

4. Hop Protocol

Hop Protocol is focused on bridging assets on the Ethereum Layer 2 networks, Optimism, Arbitrum, and Polygon by utilizing AMM-based liquidity pools. Because of this, users can experience rapid transactions and lower fees on popular ERC-20 tokens.

It is evident in the blockchain sector that Hop is among the best Synapse Protocol Alternatives For Bridging, especially for users who are quite active with the L2 ecosystems.

Hop has set restrictions with L2 rollups and fine-tunes the use of speedy transfers with hTokens, and liquidity providers. They are sought after and highly preferred for users who periodically and frequently bridge with reliable, steady, and safe execution between Ethereum scaling solutions.

Hop Protocol Pros & Cons

Pros

- Very good Ethereum L2-to-L2 transfer efficiency.

- Speed and low fees due to the use of hTokens.

- Support from the community is strong and has been established over the years.

Cons

- Focused on scaling networks for Ethereum.

- The token and chain’s liquidity is at times limited.

- The service is not good for bridging across different ecosystems (for example, Cosmos).

5. Celer cBridge

The Celer cBridge platform offers exceptional multi-chain bridging and caters to 40 + blockchains, with both EVM and Non-EVM ecosystems. It leverages the Celer State Guardian Network (SGN) for low latency and safe instant cross-chain transfers.

Celer stands out among the best Synapse Protocol alternatives for bridging as it offers diverse and efficient transfer capabilities across multiple blockchains. In addition, the platform extends support for cross-chain messaging, DeFi liquidity, and other operational integrations.

Due to their low fees, high reliability, and vast network support, celer cBridge is one of the best among users looking for broad multi-chain connectivity.

Celer cBridge Pros & Cons

Pros

- Over 40 blockchains are supported with great reliability.

- Uses the State Guardian Network for quick transfers.

- Low latency makes the system great for moving across chains frequently.

Cons

- Trust in the SGN validator model is necessary.

- The interface is complicated for beginners.

- Sometimes, during times of high traffic, there are liquidity issues.

6. Axelar Network

Combining the network of decentralized validators with General Message Passing (GMP), Axelar Network provides secure and instant cross-chain communication and token transfers. From users, this platform guarantees smooth bridging across multiple ecosystems, including Cosmos, Ethereum, and Avalanche. Developers also gain the ability to create genuinely cross-chain applications.

As the midpoint of its advanced interoperability initiatives, Axelar, integrated with Synapse, is undoubtedly one of the Best Synapse Protocol Alternatives for Bridging while specializing in programmable cross-chain interaction.

It completely removes dependence on wrapped assets and guarantees full-cycle security. Axelar’s modular architecture and wide-ranging integrations make it one of the most comprehensive bridging mechanisms in the industry.

Axelar Network Pros & Cons

Pros

- For great security, the validator network is completely decentralized.

- Not only is there token bridging, there is also cross-chain messaging (GMP).

- Able to connect major non-EVM ecosystems (Cosmos) and EVM.

Cons

- Compared to simple token bridges, it’s more technical.

- In some situations, there are transfers of wrapped assets.

- There is slightly more time to reach finality when compared to liquidity-pool bridges.

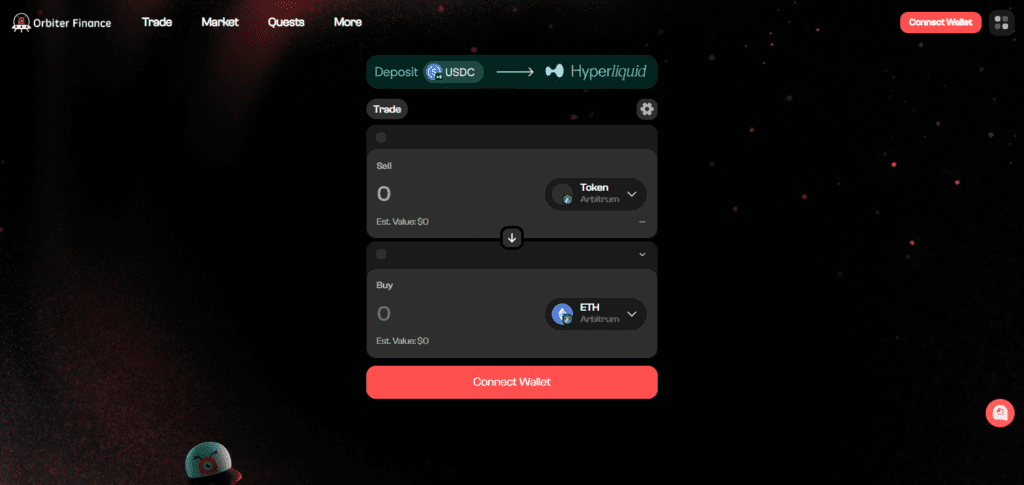

7. Orbiter Finance

Orbiter Finance achieves fast and inexpensive transactions with a mediated Maker-Receiver mechanism for Ethereum Layer 2s. It also does not lock assets in a liquidity pool and is able to migrate ETH and stablecoins quickly.

Orbiter’s determination and specialization with L2s make it one of the Best Synapse Protocol Alternatives for Bridging with a rollup focus. It benefits users most with Arbirtum, zkSync, Base, and Optimism for high-paced trading due to its instant settlement and simplicity. Its wide adoption and minimal costs make her a favorite for L2 bridging.

Orbiter Finance Pros & Cons

Pros

- Gas-efficient and very quick when it comes to L2 bridging.

- There are no liquidity pools in the system, rather, it uses the Maker/Receiver model.

- Great for moving stablecoins and ETH between rollups.

Cons

- There is limited support outside of Ethereum L2 networks.

- Transfers are dependent on Maker availability.

- Not good for bridging across chains or for complex bridging.

8. Router Protocol

Router Protocol crosses interoperability and supports transmitting tokens, invoking contracts, and routing assets on both EVM and non EVM chains. Router Protocol is a cross-chain agnostic layer, acting as a base for various ecosystems.

As of this point in time, Router has solidified its rank in the Best Synapse Protocol Alternatives For Bridging category due to its offerings in cross-chain swaps with intelligent routing. Developers are able to create applications that bridge across multiple chains, while users get to seamlessly and securely bridge their coins.

Router is the most versatile and optimal for cross-border DeFi engagements due to its collaborations with several blockchains and its rapidly growing network.

Router Protocol Pros & Cons

Pros

- Great functioning across EVM and non-EVM chains.

- Offers and facilitates cross-chain swaps and smart routing.

- Great developer community for omni-chain apps.

Cons

- More complicated system than simple bridges.

- The routing system can have delays if availability is low.

- Some features can be complicated and require some dApp integration.

9. deBridge

Providing infrastructure that aims for maximum cross-chain security, deBridge has designed systems that are able to transfer both tokens and arbitrary data messages through the use of decentralized validators along faultless anti-slashing systems that protect bridge-related attacks.

At mid-point, design description shows that deBridge is among the Best Synapse Protocol Alternatives For Bridging as a consequence of its robust security frameworks with a variety of cross-chain functionalities. deBridge boasts the capacity to facilitate cross-chain swaps along with payload transfers through DeFi integrations.

The elaborate cross-chain logic that the developers of deBridge can exert through its Message conduit is what allows deBridge to be a one of a kind instrument for cross-chain applications for developers.

deBridge Pros & Cons

Pros

- Great security using decentralized validators and anti-slashing.

- Excellent support for token transfers and arbitrary data messaging.

- Great for DeFi protocols requiring cross-chain automation.

Cons

- Slightly increased fees than the regular simple bridges.

- Some competitors support more chains.

- The features in this system are designed for developers, so casual users may find them overwhelming.

10. Allbridge

Allbridge is a multi-chain bridging solution that is, among other things, applauded for its coverage of both EVM and Non-EVM blockchains such as Solana, Near and Aptos. Allbridge allows quick, straightforward, and virtually seamless transfers of assets with a simple user interface.

In the middle of its capabilities, Allbridge demonstrates its relevance as one of the best synapse protocol alternatives for bridging, providing wide network connectivity for different users.

Allbridge prioritizes user-friendliness while keeping decentralization intact. Its ability to integrate new ecosystems makes it invaluable to users looking for extensive cross-chain access and easy transfer of tokens.

Allbridge Pros & Cons

Pros

- Great connection between EVM and non-EVM ecosystems.

- Great user interface and experience for simple bridging.

- Includes new chains like Solana, Aptos, and Near.

Cons

- Past security issues affected some trust.

- Some less popular chains can have low availability.

- Some large institution transfers may not work record breaking large.

Conclusion

When it comes to choosing the best Synapse Protocol alternatives for bridging, it all comes down to your priorities, be it speed, cost efficiency, security, or multi-chain coverage. Stargate Finance, Across Protocol, and Hop Protocol all provide lightning-fast and reliable bridging within the Ethereum ecosystem.

Symbiosis Finance, Celer cBridge, Router Protocol, and Allbridge have the best network coverage for users on sveral different blockchains. For more refined cross-chain messaging and interoperability, Axelar Network and deBridge offer top tier advanced infrastructure.

Overall, each of these alternative protocols bring something different to the table which provides plenty of opportunities to offer the best seamless, safe, and adaptable movement of digital assets on the blockchain.

FAQ

Some of the best alternatives include Symbiosis Finance, Stargate Finance, Across Protocol, Hop Protocol, Celer cBridge, Axelar Network, Orbiter Finance, Router Protocol, deBridge, and Allbridge. These platforms offer fast, secure, and cost-efficient cross-chain bridging.

Across Protocol and Orbiter Finance are ideal for users wanting very fast, low-cost transfers, especially within Ethereum Layer 2 networks like Arbitrum, Optimism, and Base.

Celer cBridge, Symbiosis Finance, and Router Protocol support a wide range of EVM and non-EVM chains, making them excellent for users operating across diverse ecosystems.

Axelar Network and deBridge are considered highly secure due to their decentralized validator networks and strong anti-slashing security models.

Stargate Finance is one of the most reliable options for stablecoin bridging thanks to its unified liquidity and native asset transfers with minimal slippage.