This article will highlight the Best Crypto Staking Platforms to help investors earn passive income by securely locking away their digital assets.

Staking becomes simple, rewarding, and accessible to all users. Starting from dependable networks, to decentralized services, we’re going to look at the best options available that offer high returns along with flexibility and robust security.

What is Crypto Staking Platforms?

Crypto staking platforms are services that allow users to lock or “stake” their crypto to earn rewards while aiding a blockchain’s transactional validation and governance processes.

These platforms take away most of the technicalities and setup processes while also providing numerous coins or staking pools a user can select.

Participants earn additional tokens that result in pseudo passive income whilst securing proof of stake (PoS) blockchains.

Examples of staking platforms are centralized polices like Binance or Coinbase and decentralized protocols like Lido and Rocket Pool. Each has different reward rates, risks, and control to cater to all levels of crypto participants.

Key Point & Best Crypto Staking Platforms

| Platform | Type | Supported Assets | Estimated APY Range | Key Features | Minimum Deposit | Security/Regulation | Best For |

|---|---|---|---|---|---|---|---|

| Binance Earn | Flexible & Locked Savings, Staking | 350+ Cryptos | 0.5% – 25% | Offers flexible and locked options, Auto-invest feature, Dual investment | Very low (varies by asset) | Licensed globally, SAFU fund protection | Users seeking versatile earning options |

| OKX Earn | Staking, DeFi, Savings | 200+ Assets | 1% – 20% | Combines DeFi and CEX yields, simple UI, flexible durations | Low | Regulated, multi-layer security | DeFi + CeFi hybrid yield seekers |

| Kraken Staking | On-chain & Off-chain Staking | 15+ Coins | 1% – 25% | Simple staking interface, on-chain rewards, auto-compounding | $1 equivalent | US regulated exchange | Beginners and institutional stakers |

| Lido Finance | Liquid Staking Protocol | ETH, SOL, MATIC, etc. | 3% – 5% | Receive stETH tokens, DeFi integrations, decentralized validator set | No fixed minimum | Smart contract audits, DAO governance | ETH and DeFi yield enthusiasts |

| Coinbase Staking | Exchange Staking | ETH, ADA, SOL, etc. | 2% – 6% | Custodial staking, transparent rewards, institutional grade security | Small ($1–$10) | Fully regulated in US | Retail investors preferring safety |

| Rocket Pool | Decentralized ETH Staking | ETH only | 3% – 5% | Liquid staking via rETH, decentralized node network, permissionless | 0.01 ETH (for rETH) | Non-custodial, audited | ETH holders wanting decentralization |

| StakeWise | Liquid ETH Staking | ETH | 3% – 5% | Split reward/token model (sETH2/rETH2), DAO governance | No strict minimum | Audited smart contracts | Advanced ETH stakers and DAOs |

| Ankr Staking | Multi-chain Liquid Staking | ETH, BNB, AVAX, etc. | 3% – 8% | Supports multiple chains, issues liquid tokens (aTokens), API support | Minimal | Non-custodial, audited | Multi-chain developers & yield seekers |

| YouHodler | CeFi Earn Products | BTC, ETH, Stablecoins | 4% – 15% | Dual yield programs, compounding interest, crypto-collateral loans | $100 | Swiss-based, EU compliance | Passive income seekers with stablecoins |

| Nexo Earn | Interest & Staking | 40+ Assets | 4% – 16% | Daily payouts, NEXO token boosts yield, insured custody | $10 | Licensed in EU, insured assets | Users preferring flexible, insured yields |

1. Binance Earn

Binance Earn is one of the best Crypto staking platforms due to their diverse set of earning options that include flexible savings, locked staking, DeFi staking, and Dual Investment products, all within the same, secure ecosystem.

This diversity of products is such that users can select earning opportunities and choose to work on stable, low-risk return passive earnings, or on higher-yield opportunities. To further simplify the earnings process, one of the unique features is the ‘Auto-Invest’ tool that instantly reinvests earned rewards to increase earnings exponentially.

It is one of the safest platforms, offering user-friendly earning options thanks to strong security structures, the SAFU insurance fund, and global recognition of Binance. This makes it reliable for passive cryptocurrency earnings for all users.

Binance Earn

Pricing: fees depend on the product; fees vary on some ETH staking Binance historically used to take ~10% on some ETH staking) and APYs vary on the asset and product (flexible vs locked).

Features

- Flexible and locked (Simple Earn / Advanced Earn) products with minute and daily reward distribution.

- Diverse asset offerings (multiple tokens + stablecoins).

- Auto-subscription, convert-to-earn features, and integrated marketplace.

Pros

- Large assortment of products and assets.

- User-friendly interface and plenty of product offerings.

- Rapid on-ramp and high liquidity for withdrawals and trades.

Cons

- You are a centralized custodian means you don’t control your private keys.

- There are fees and commissions which are inconsistent, and then hidden per product.

- There are regulatory issues which may result in some jurisdictions not being able to stake.

2. OKX Earn

OKX Earn is one of the finest platforms for crypto staking mainly attributed to the integration of CeFi and DeFi crypto earning opportunities within a unified interface. From the OKX app, users may stake, lend, and engage in decentralized liquidity pools.

With flexible and fixed-term options, as well as a broad spectrum of tradable assets, OKX Earn allows users to customize their staking, lending, and liquidity providing experience.

OKX Earn gains competitive market advantage from the “Smart Portfolio” feature, which invests and reallocates users’ funds through different high-interest earning options. OKX Earn is enhanced by its robust security, transparency, and cross-chain accessibility.

OKX Earn

Price: Okay lists flexible, locked, and on-chain (DeFi integrations) products on the Earn pages. Each product and asset has an APR. As demand changes so does the price. There is no single fixed “price” and products come with different APRs.

Features

- Flexible Earn, Locked and On-chain Earn (DeFi integrations).

- Real-time APR display and some DeFi bonus rewards.

- Certain products have manual and automatic compounding options.

Pros

- Access to DeFi on-chain and CeFi conveniently.

- Competitive rates on some assets.

- Each product has an APR so there is no need to guess.

Cons

- Risk with smart contracts.

- APRs on different products are not consistent.

- Centralized custody.

- Products go in and out of availability. (OKX)

3. Kraken Staking

Kraken Staking has a reputation as one of the best crypto staking platforms as a result of regulatory compliance, reliability, and ease of use. It provides users with the option of earning rewards from assets such as ETH, ADA, DOT, and others without complicated arrangements thanks to on-chain and off-chain staking.

Kraken’s capacity for instantaneous reward allocation is a standout characteristic. A user can begin earning rewards the moment they stake an asset, alleviating the frustration of a lengthy earning period.

Predator Staking provides first-rate security and institutional quality components. Due to the intuitive design, frequent distribution, and accepted status within the international markets, Kraken is regarded as a self-contained and streamlined staking platform for all investors.

Kraken Staking

Price: Staking rewards are advertised (up to advertised protocol yields) and a commission is applied (example: ~30% commission on staking rewards per Kraken support historically). US staking has been paused historically.

Features

- Flexible, auto stake from spot balance and simple UI for beginners.

- Weekly reward distribution.

- Depending on the region there is a selection of PoS assets (ETH, ADA, DOT, SOL etc.) for staking.

Pros

- Users have no need to run validators to stake.

- Week-by-week payments and uncomplicated screens for staking.

- Well-established and trustworthy exchange (cross-border non-US offerings continue through subsidiaries).

Cons

- In comparison to the pure non-custodial alternatives, rewards commissions are expensive.

- History of regulatory activity causing product restrictions (e.g., US).

- Centralized custody and counterparty risk.

4. Lido Finance

Lido Finance has earned its place among top crypto staking platforms because it pioneered liquid staking, where customers can stake ETH, SOL, MATIC, and other assets and still keep them liquid by using derivatives like stETH.

Customers can even continue to trade or use their staked assets in DeFi and still earn rewards at the same time. Additional security is provided by Lido’s decentralized validator network which mitigates the risks of centralization.

The Lido DAO governs the network, which facilitates transparency in governance. This, together with Lido’s non-custodial approach and its integration with all major DeFi protocols, is what makes Lido Finance attractive to customers looking for yield and long-term investment.

Lido Finance

Features

- Liquid staking token (stETH) that accrues rewards via rebasing.

- Decentralized node operator set and DAO governance.

- No minimum ETH required; instant liquidity via stETH (tradeable).

Pros

- Non-custodial, permissioned decentralised model with immediate liquidity.

- Easy access to ETH staking rewards without running a validator.

- Large TVL provides deep market liquidity for stETH.

Cons

- Smart-contract and protocol risk (DeFi risks).

- stETH vs ETH peg can diverge in stressed markets (market risk).* Fee on the protocol affects gross rewards, so you may earn less compared to running your own validator.

5. Coinbase Staking

Coinbase Staking has an excellent reputation when it comes to staking platforms because of the balance it maintains between simplicity and trust on the regulatory safe and secure stakes for both retail and institutional investors.

They provide the ability to stake ETH, ADA, SOL, ATOM and more on the wallet and use it for staking without the need of any complex systems and infrastructure.

An amazing attribute of Coinbase Staking is the full and unambiguous reward documentation which shows all users the returns for any reward earned, universally proving the confidence of low-risk staking.

No need for users to manage or secure their stake, Coinbase Staking takes care of their validator operations on the system and performs insured custody and top-tier security. Since the interface is automatic, it unambiguously and efficiently posits rewards in an easy to use system thus proving their staking is reliable and safe.

Coinbase Staking

Costs: You can stake without incurring deposit or withdrawal fees; however, Coinbase does take a cut on the staking rewards, which averages 35% on several assets, and you can get discounts when you are a Coinbase One member. The annual percentage yield (APY) available on the interface is net of Coinbase’s staking commission.

Features

- Retail users can stake on major proof-of-stake (PoS) assets without complexity.

- No validator setup needed, and the in-app rewards are available.

- Depending on the asset and region, some assets allow instant unstake and reclamation features.

Pros

- Integrated and easy to use for beginners in the Coinbase ecosystem.

- You can rely on custody controls as well as the fiat custodial balance insurance.

- Active controls and clear communication around commissions and promotion.

Cons

- The commission you’ll pay can be substantially higher when compared to non-custodial staking systems.

- You will not have control over the staking keys.

- You may be subject to service restrictions due to jurisdiction and regulation.

6. Rocket Pool

Rocket Pool ranks among the top platforms for staking cryptocurrency because it provides users with a completely decentralized network for ETH staking. Users get full control and full transparency.

Unlike centralized exchanges, Rocket Pool lets anyone stake ETH and get rETH, a liquid staking token, which continuously captures rewards as they’re earned. Rocket Pool’s unique advantage is its dual participation model, allowing users to both run their own validator node with as little as 8 ETH and stake any smaller amount through the pool.

This unique model encourages decentralization and access. Coupled with audited smart contracts, community governance provides secure, trustless staking with confidence for ETH users.

Rocket Pool

Costs: When you hold rETH, you pay a node operator fee which is around 14% of the rewards generated and this is deducted from the rewards. You’ll get rETH in return (liquid token). The effective APY for you is equal to the stake yield minus the operator fee.

Features

- Provides liquid staking token (rETH) and offers decentralized and permissionless node operator capabilities.

- Small stakers can also join in without having to own 32 ETH.

- Hybrid model: run a node (operators) or stake with node operators (users).

Pros

- Lower trust assumptions than centralized exchanges; non-custodial.

- Liquid rETH token enables DeFi composability.

- Incentivizes decentralization of validators.

Cons

- Protocol and smart-contract risk.

- Operator fee reduces gross yield versus solo validating.

- Slight complexity compared to centralized staking for absolute beginners. (rocketpool.net)

7. StakeWise

StakeWise stands out among crypto staking platforms due to its transparent and efficient liquid staking Ethereum solution. This platform distinguishes staking rewards and principal balance into two tokens, sETH2 and rETH2.

This inventive design enables users to reinvest or trade rewards for more flexible cash flow. StakeWise’s unique feature called “auto-compounding” boosts rewards and does so without requiring users to perform any manual calculations, saving time and effort.

StakeWise employs audited smart contracts and is governed by a decentralized DAO, ensuring a high level of security and community governance. Having a non-custodial design and flexible yield strategies, StakeWise is most suited to advanced Ethereum stakers.

StakeWise

Price: StakeWise charges a service fee on rewards (commonly ~10% of staking rewards); users receive liquid tokens (e.g., sETH2/osETH) representing stake. No deposit/withdrawal fees beyond network gas. (Stakewise Landing)

Features

- Liquid staking tokens (split reward + principal tokens in some workflows), vaults and a marketplace for staking offers.

- Non-custodial; users can trade or use liquid tokens in DeFi.

- Audited smart contracts and operator tooling for validators.

Pros

- Lower protocol fee than some other services; flexible liquid staking options.

- Non-custodial and DeFi-friendly tokens.

- Audit history and tooling for advanced users.

Cons

- Smart-contract risk and DeFi market risk when using liquid tokens.

- May be less familiar UI for complete beginners.

- The liquidity of certain liquid tokens across DEXs can differ.

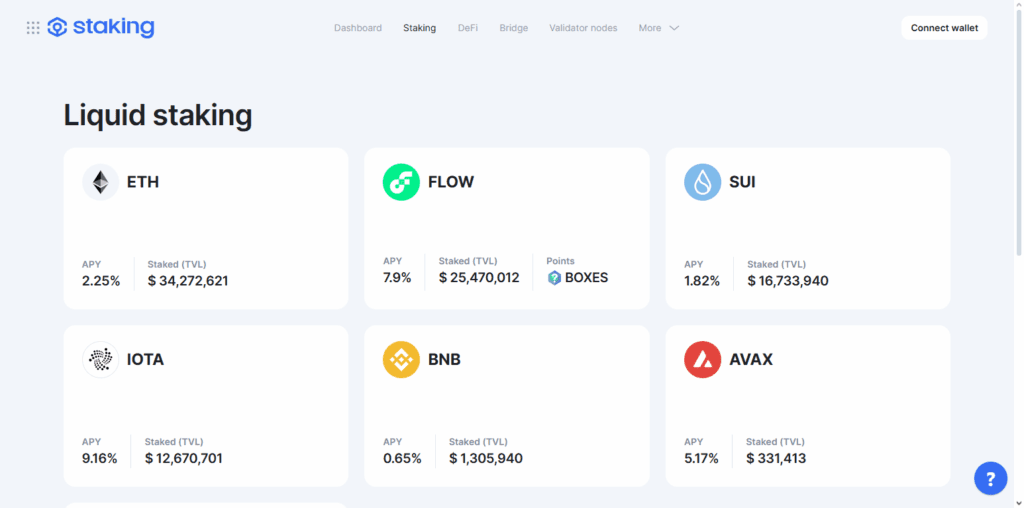

8. Ankr Staking

Ankr Staking is one of the best crypto staking platforms because it offers multi-chain liquid staking on major networks such as Ethereum, BNB Chain, Avalanche, and Polygon.

The staking of liquid aTokens is Ankr’s most innovative feature as it facilitates the earning of staking rewards and the use of aTokens in various DeFi protocols. In addition to liquid staking and wide network support, Ankr’s decentralized design contributes to the reliability of its node staking and mitigates single points of failure.

Ankr serves not just End Users, but Software Developers too. It is developer-friendly as it provides API documentation and advanced analytics for staking and performance tracking. Flexible, secure, and scalable staking provided by Ankr enables non-custodial staking across a wide array of networks.

Ankr Staking

Price: the liquid staking token and network determine the APYs and fees; Ankr offers liquid staking tokens and has an ecosystem to compound and use them. The fees vary with the product.

Features

- Liquid staking tokens across several chains, DeFi integrated vaults, and DeFi staking.

- Possibility of lending/borrowing, and liquidity provision with staked representations.

- System audits and bug bounties to secure the protocol.

Pros

- Multi-chain and numerous integrations (flexibility in use cases).

- Yields can be compounded with vaults and liquidity strategies.

- Ecosystem and developer network are robust.

Cons

- Risks of smart contract failures and bridging for cross-chain features.

- The effective yields depend on how the liquid tokens are utilized (complex).

- You can have centralization tradeoffs with some custodied programs versus fully permissionless staking.

9. YouHodler

YouHodler has become one of the best earning and crypto stakinng platforms because it integrates traditional finance and digital assets which is why it has unique yield products.

Users can earn passive income and have funds that are easy and quick to access while earning interest on major cryptocurrencies, stablecoins, and even fiat. YouHodler has unique tools like Dual Yield and Multi HODL that allow users to earn interest while smartly multiplying potential market profit.

YouHodler’s location in Switzerland and EU regulations means YouHodler’s safety and assets will be protected. YouHodler is also targeted to Long Term Investors due to the high yield flexible security, robust, and flexible terms.

YouHodler

Price: Yields vary by asset; YouHodler advertises roughly ~12–18% p.a. on selected products promotions with tiered loyalty levels. Actual yield depends on the asset, lockup, and loyalty level.

Features

- “Savings” accounts, fixed and flexible offers, and loyalty tiers to amplify rates.

- Loans, exchange, multi-currency wallets, and income products are added as services.

- Loans or higher loyalty tiers can help unlock promos / higher rates.

Pros

- Personalized promos with higher yields on certain coins.

- Various product offerings within one app (savings, fixed, loans).

- Frequent promotions on loyalty boosts and higher loyalty tiers.

Cons

- Custodial models with higher yields sometimes have counterparty risks.

- Some higher rates are offered when large deposits or loan contracts are agreed upon.

- Historic variability related to offers (jurisdictional/regulatory)

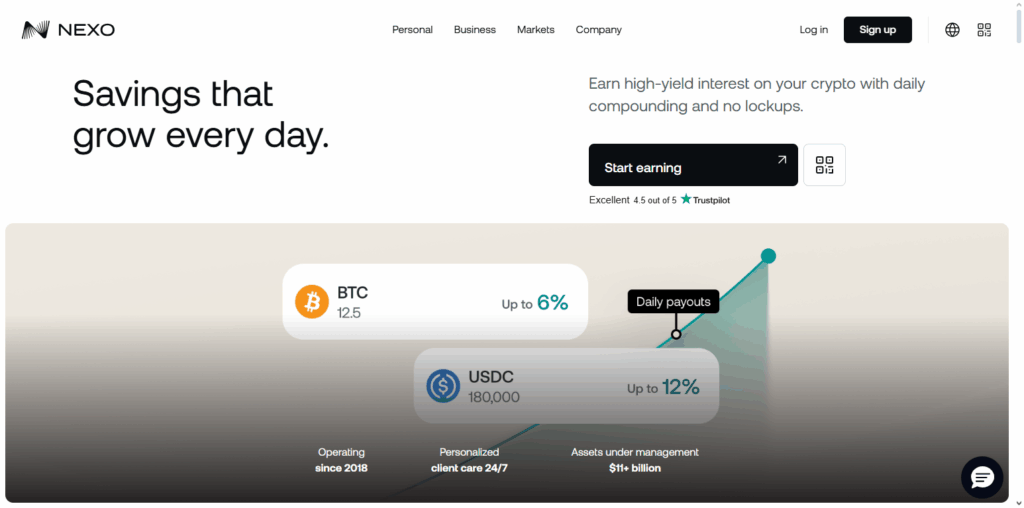

10. Nexo Earn

Nexo Earn stands out as a top crypto staking and earning platform for several reasons: daily interest payouts, flexible terms, and guarantees strong asset protection, all in a single platform. Offering interest earning accounts and staking accounts, Nexo Earn provides earnings up to 16% on over 40 cryptoassets, including stablecoins.

What really helps Nexo Earn stand out and provides lasting customer loyalty is its unique Nexo Token loyalty tiers and associated benefits.

And unlike most neobanks, Nexo is completely regulated in Europe and offers the peace of mind of insurance, audited custody as well as instant withdrawal. That, along with full operational transparency, ensures that passive income is reliable, sustainable, and available 24/7 to investors from anywhere in the world.

Nexo Earn

Features

- Flexible and fixed savings accounts, loyalty program with higher rates dependent on NEXO holdings, and payment in NEXO for extra bonus.

- Additional features: card, credit lines, and exchanges.

- Daily payouts for flexible accounts are compoundable.

Pros

- Good rates with daily compounding offered for many assets.

- Active users within the loyalty program can significantly enhance their rates.

- Good product interlinkage (lend, borrow, card) and intuitive UI.

Cons

- Tenant credit/custodial risk — some of the funds are deployed in loan/credit activities.

- Past U.S. regulatory restrictions and settlement history (SEC).

- Earning some of the highest yields requires locking in your NEXO token payout or fulfilling loyalty tier requirements.

How to Start Crypto Staking Platforms

Research and Choose a Platform

- Determine what your goals are, what assets the platform supports, and evaluate its security. Platforms like Binance Earn, Lido Finance and Coinbase staking are solid options.

Create an Account

- Register for your selected platform and, if necessary, go through the KYC process.

Deposit or Buy Crypto

- Either you can deposit crypto or you can purchase it through the platform to add funds to your crypto wallet.

Select a Staking Option

- Decide which coin you want to stake and the staking option i.e. flexible, locked, or liquid.

Review Terms and APY

- After reviewing, make sure you understand the reward rates, lock-in periods, exit conditions, and withdrawal restrictions before proceeding.

Start Staking

- Execute the staking action, and your crypto will either be locked or sent to validators for delegating.

Monitor Rewards

- Manage your staking and reward tracking through the crypto dashboard or the mobile app provided by the platform.

Reinvest or Withdraw Earnings

- Choose to either withdraw your rewards for cash flow or reinvest them for compounding.

Stay Updated

- Read platform notifications and track any staking-related blockchain changes to get the most out of your stakes.

Conclusion

To sum up, top cryptocurrency staking platforms come with all the facets that allow investors to earn passive income on their cryptocurrency: They perfect the trifecta of secure, user-friendly, and profitable. For each investor, there’s a staking method.

For those seeking centralization, regulation, and ease, there’s Binance Earn, Coinbase Staking, and Nexo Earn. For those wanting decentralization, control, and clear-cut staking with no ‘hidden’ fees, there are Lido Finance, Rocket Pool, and Ankr Staking.

The most important thing when it comes to staking is finding the right platform for your risk appetite, target return, and desired level of dominance. By staking prudently, investors are able to amplify their holdings and aid blockchain networks in sustaining continuous operations.

FAQ

No. Centralized platforms like Binance Earn or Coinbase make staking beginner-friendly, while decentralized options like Lido or Rocket Pool offer more control for advanced users.

Rewards depend on factors like the staked amount, lock duration, network inflation rate, and validator performance.

Yes, in most countries staking rewards are considered taxable income. It’s recommended to check local tax regulations or consult a tax advisor.