This article outlines Best Crypto Arbitrage Tools to capture price differences on various exchanges. Advanced platforms automate the buy low/sell high strategies, providing faster execution and minimizing risk.

From newcomers to seasoned professionals, crypto arbitrage is easier, more intelligent and profitable with the tools available as the market continues to evolve. Tools like CryptoHopper, 3Commas, and Bitsgap help to automate and optimize the arbitrage trading process.

What Is Crypto Arbitrage?

Crypto arbitrage refers to the process of profiting from differences in the markets and exchanges of the same coins. Since differences in liquidity, speed of transactions, and demand slightly impact cryptocurrency prices, such discrepancies open profit-making prospects.

A trader could, for instance, acquire a cryptocurrency on one exchange and sell it on a different one at a profit. Traders can use software programmed for the process or carry it out themselves.

Although this strategy can fetch profits, it is vital to consider and mitigate transfer volatility, differences in costs and, to a lesser extent, omission delays.

How to Profit From Price Differences?

Being able to capitalize on potential price differentials in crypto will involve determining, confirming, and carrying out trades in a sequence that beats the market to closing the gaps. This entails a need for automation, speed, and risk management. This is how it is best done in the market:

Step-by-Step Process to Profit from Crypto Price Differences

Finding Price Differentials

Tools such as Bitsgap, ArbitrageScanner.io, or ArbiTool can help find price differentials on various crypto exchanges.

Identifying spatial arbitrage (same asset, different exchanges), triangular arbitrage (within one exchange), or statistical arbitrage (mean reversion patterns) can provide good opportunities.

Example: BTC is $66,000 on Binance and $66,300 on Kraken — a $300 spread.

Check for Fees and Liquidity

Check if both exchanges have enough liquidity to cover your trade. You don’t want to have your trade executed with slippage.

Estimate trading, withdrawal, and network transfer fees. Cost simulations can be done on 3Commas and CryptoHopper to assist in determining the net profit.

A $300 spread might shrink to $50 after fees — still profitable if executed quickly.

Use Cross-Exchange Bots or Transfer Funds

You can also do real time arbitrage trades if you pre-fund both exchanges. Automated real time arbitrage trades can be worked with bots on HaasOnline, WunderTrading, or Pionex. These bots will trade simultaneously on different exchanges using API’s for automation.- In fast-moving markets, the ability to reduce latency and human errors is essential.

Buy and Sell at the Same Time

Acquire the asset on the lower-priced exchange and sell it on the higher-priced exchange.

Automatically do this using smart order routing or one-click arbitrage features in Bitsgap or Kryll.io.

To lock in the spread, ensure both trades have been completed.

Rebalance and Keep Going

After profit is made, in order to seek another opportunity, restock your funds on the respective exchanges.

Use Coinrule or 3Commas to restock and automate new spread monitoring. Track your performance and volatility, fees, and execution speed to improve your strategy.

Key Point

| Tool | Key features & notes |

|---|---|

| Bitsgap | Supports 25+ exchanges, has a built‑in arbitrage scanner, demo mode, portfolio management. |

| CryptoHopper | Cloud‑based bot infrastructure, supports cross‑exchange arbitrage, social/copy trading. |

| Coinrule | No‑code rule builder, supports custom arbitrage strategies across exchanges. |

| HaasOnline (HaasBot) | Advanced scripting support, many exchanges, built for more technical users. |

| Kryll.io | Visual drag‑and‑drop bot builder, supports arbitrage strategies, marketplace for strategies. |

| 3Commas | Smart bots, supports arbitrage scanning and multi‑exchange trading. |

| ArbiTool | A dedicated arbitrage scanner focusing on real‑time price differences across exchanges. |

| ArbitrageScanner.io | Focuses on CEX & DEX price spread alerts, supports spot & futures arbitrage. |

| WunderTrading | Automation + spread/arbitrage features, supports multiple exchanges and copy‑trading. |

| Pionex | Exchange + built‑in arbitrage bots (spot/futures), simpler for beginners. |

1. Bitsgap

Bitsgap is a powerful crypto arbitrage platform offering automated bots, smart order routing, and access to 15+ exchanges. It scans price differences across markets and executes trades instantly using API keys.

In the middle of its robust feature set, Bitsgap includes demo trading, portfolio tracking, and grid bots for passive income. Its arbitrage bot supports triangular and spatial strategies, ensuring low slippage and high speed.

The platform also provides historical performance analytics and customizable trading signals. With a clean UI and strong security protocols, Bitsgap is ideal for traders seeking consistent arbitrage profits across centralized exchanges.

Bitsgap Key Features

- Real-time Arbitrage Scanning 25+ Major Exchanges.

- Automated trading bots with customizable strategies.

- Unified interface and portfolio tracking across exchanges.

- Strategy testing in a demo trading mode.

Pros

- The platform is simple for beginners.

- Real-time data assures guarantees.

- Secure API integration without custody of the funds.

- Grid trading and futures trading is available.

Cons

- Subscription plans are not economical for junior traders.

- A mobile application is not available.

- A strong and reliable internet connection is needed.

- Manual trading has very limited adjustments.

2. CryptoHopper

CryptoHopper is a crypto trading bot based in the cloud and works on multiple platforms. It offers spread detection, trailing stop-loss options, and integration with Marketplace strategies.

Halfway into the features, CryptoHopper allows users to implement live arbitrage strategies using real-time price gaps and control over latency. It allows triangular arbitrage and offers backtesting to sharpen the strategies.

One can easily adjust and oversee the bot using a well-designed dashboard. Automated signal integration from TradingView is an added advantage.

With support over 100 coins and more than 10 exchanges, it is the most preferred to traders needing flexible and scalable arbitrage options.

CryptoHopper Key Features:

- Offers cloud trading services, so there is no need to download software.

- Provides a built-in strategy designer and a strategy marketplace.

- Allows arbitrage trading between multiple exchanges.

- Provides AI strategy customization where users can mirror trades of any strategy.

Pros:

- Supplies a seamless interface for beginners while integrating advanced options.

- Automated cloud trading operations ensure trading is done without any breaks.

- Provides a robust community for strategies and an integrated marketplace.

- Allows trading on the spot as well as arbitrage trading.

Cons:

- Complex strategy setup can be a little challenging for new traders.

- A monthly subscription can be costly for novice traders.

- Compared to rivals, there is a reduced quantity of supported exchanges.

- Some advanced functionalities are only accessible under the more costly subscription plans.

3. Coinrule

Coinrule is a platform for automating trading in cryptocurrency based on user-defined rules and strategies, and it offers a no-code solution. It is possible to implement arbitrage through the use conditional logic on multiple crypto exchanges and an automation system.

In the middle of its offering, Coinrule provides templates for arbitrage setups, including price spread triggers and volume filters. Users can exploit pricing gaps in real-time with custom deployed “if this, then that” logic.

Integration with major exchanges including 3 of the top 5 exchanges (Binance, Kraken, and Coinbase) enables valuable arbitrage opportunities.

It backs its offering with educational materials including backtesting and a demo mode. As a no-code solution, Coinrule offers a valuable user experience in arbitrage trading.

Coinrule Key Features

- A no-code strategy builder that facilitates the creation of automated trading rules.

- Supports over 10 leading exchanges in the crypto market.

- For those who are just starting, there are pre-built templates available.

- Alerts and market monitoring are provided in real time.

Pros:

- This is perfect for people who do not know programming.

- Rules can be created and deployed almost instantly.

- Very secure; API keys are encrypted.

- Good educational material and tutorials are available.

Cons:

- Features included in the free plan are quite limited.

- Advanced tools for arbitrage are missing.

- Outdated backtesting data.

- There is no native mobile application to manage things live.

4. HaasOnline

HaasOnline is a professional-grade crypto bot platform that specializes in sophisticated arbitrage trading and trading algorithm execution. It provides tools that allow latency optimization, scripting, and exchange integration via API.

Along with the rest of its robust toolset, HaasOnline provides arbitrage bots that analyze various markets for price inequitability and close the gaps in arbitrage opportunities via automated execution.

The trade execution can be customized with the use of the proprietary HaasScript, and then the trade can be tested with historical data.

It’s capable of handling triangular, spatial, and inter-exchange arbitrage and provides extensive dashboard analytics, trade visualizations, and tools for risk management. HaasOnline is more suited for advanced users looking for precise execution and performance of arbitrage trading.

HaasOnline (HaasBot) Key Features

- For advanced automation, there is advanced scripting called HaasScript.

- Multiple exchanges and trading pairs are supported.

- Backtesting, real-time arbitrage, and paper trading.

- Assessment of performance and risk is detailed.

Pros:

- Offers high degree of customization geared for professional traders.

- Self-hosted setup provides greater security.

- Backtesting is reliable and ensures sound strategies are created.

- Advanced arbitrage modules provided.

Cons:

- There are no pre-requisites.

- Licensing is costly compared to others in the market.

- There is no cloud version available.

- A steep learning curve is present, and the interface may disorient beginners.

5. Kryll.io

Kryll.io is a platform that provides a visual strategy builder for crypto trading, complete with modules for arbitrage trading and a marketplace for ready-to-use bots. Users can create arbitrage tactics by dragging and dropping logic blocks.

Kryll.io provides multi-exchange price scanning and conditional execution of trading orders for the automated arbitrage trading system. It facilitates trade via the platform with real-time monitoring, and users can analyze the performance with customizable metrics, including backtesting.

Users can also rent and sell strategies, thus enhancing the collaborative spirit of the platform. Kryll.io is an ideal choice for users looking for a no-coding approach to arbitrage bot development and execution, as it is compatible with all the major crypto exchanges.

Kryll.io Key Features

- Strategy builder with visual drag-and-drop functionality.

- Execution of trading bots on the cloud with 24/7 operation.

- A marketplace for exchanging strategies.

- Arbitrage that involves several exchange systems.

Pros:

- Intuitive visual functionality.

- No need for programming expertise.

- Gain profitable strategies built by the community.

- Clear and honest pricing.

Cons:

- Free access is constrained.

- Advanced features come with hefty fees.

- Strategies in the marketplace might have inconsistent quality.

- Advanced setups don’t have robust customer support.

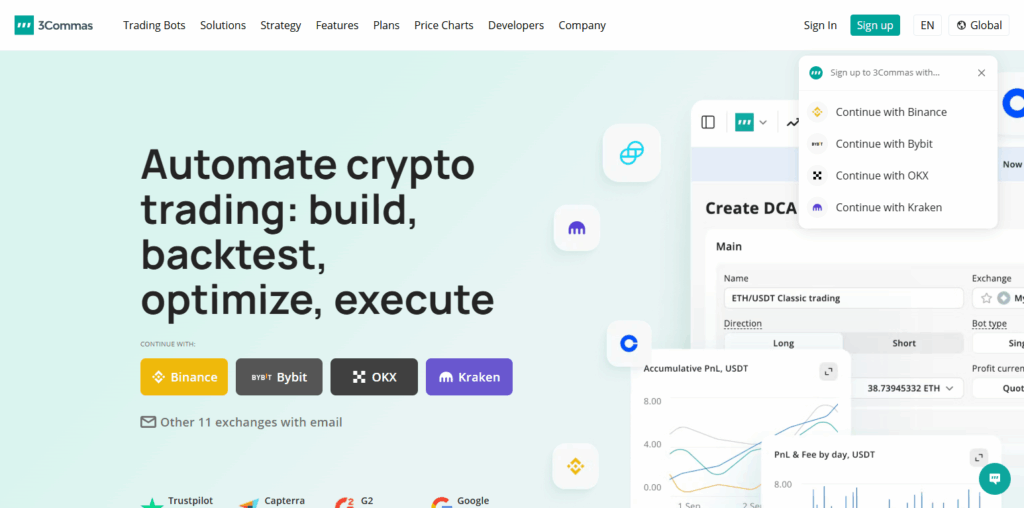

6. 3Commas

3Commas offers smart bots, portfolio tracking, and arbitrage tools as part of its many features. With spread-based arbitrage across multiple exchanges, users can devise their own strategies.

3Commas offers trailing orders, take-profit logic, and real-time price feeds for arbitrage execution. The system connects to over 15 exchanges and features a strategy marketplace.

Performance can be monitored through mobile and desktop dashboards. Community support and educational content are additional features.

3Commas is exceptionally built to enable arbitrage traders to use powerful automation and to remove as much manual arbitrage effort as possible.

3Commas

Key Features:

- Trading bots for smart trading with DCA and arbitrage.

- Management of multi-exchange portfolios.

- Tools for copy trading and social analytics.

- Synchronization of mobile and web app.

Pros:

- Integration with over 20 exchanges.

- Useful for both beginners and advanced users.

- Trading bots help in making automated decisions.

- Performance tracking is detailed and extensive.

Cons:

- Limited automation on the free plan.

- API limits for high-volume traders.

- Overloaded interfaces might cause lag.

- Arbitrage execution requires using external exchanges.

7. ArbiTool

For tracking price disparities across 40+ exchanges and 1000+ coins, ArbiTool offers real-time alerts and spread analysis. Part of its primary functions, ArbiTool, offers a dashboard displaying profitable arbitrage paths incorporating volume, fees, and coin pair filters.

The system facilitates manual as well as semi-automated trading, and is valuable for detecting spatial arbitrage opportunities between exchanges that are highly liquid.

ArbiTool is web based and does not require advanced bot features, which makes it quick and easy for arbitrage traders of any experience level to use.

ArbiTool Key Features

- Real-time arbitrage scanning across major exchanges.

- Displays profit percentage, trade routes, and fees.

- Web-based platform with instant notifications.

- Customizable filters for coin selection.

Pros:

- Accurate live data tracking.

- Supports many exchange integrations.

- Simple and intuitive user interface.

- Ideal for quick, short-term arbitrage trades.

Cons:

- No automation—manual trade execution required.

- Subscription-based access.

- No mobile application.

- Limited to spot arbitrage only.

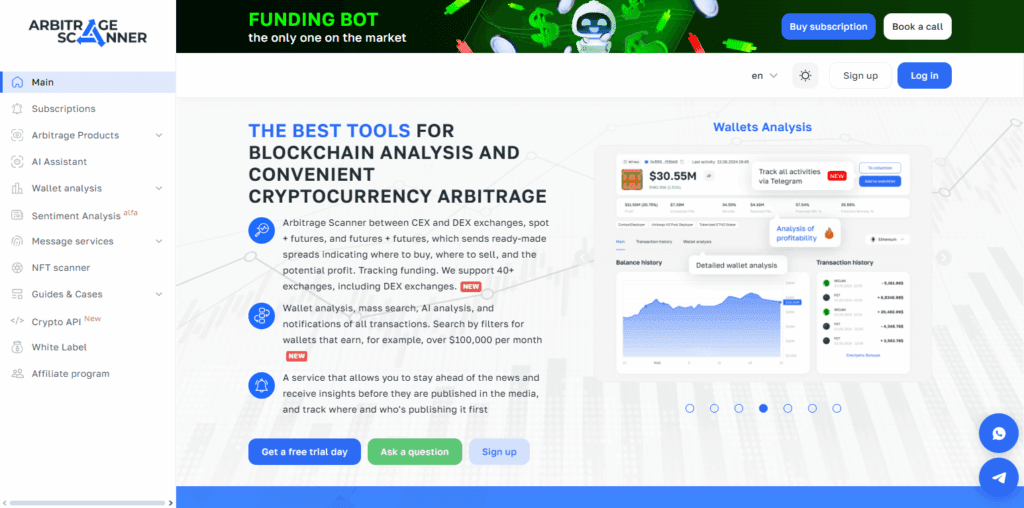

8. ArbitrageScanner.io

ArbitrageScanner.io features a real-time order book arbitrage monitoring tool, which supports all types of exchange systems, centralized, decentralized, and hybrid. It also analyzes and tracks relevant parameters needed for arbitrage opportunity evaluation like spread, cost of execution, liquidity, and transaction cost.

Midrange in its features, ArbitrageScanner.io offers arbitrage history, exchange filters, and alerts of user-defined parameters. The platform offers supports for triangular and spatial arbitrage, wallet and API for the execution, as well as mobile notifications and browser extensions for quick access.

With its support for more than 50 exchanges and 500+ coins, ArbitrageScanner.io is a safe choice for arbitrage traders, especially those who prefer fast and automated execution.

ArbitrageScanner.io Key Features

- Monitors both centralized and decentralized exchanges.

- Detects spot and futures arbitrage opportunities.

- Real-time notifications via Telegram and email.

- API-based data fetching with high accuracy.

Pros:

- Fast and accurate arbitrage tracking.

- Supports DEX and CEX integration.

- Simple dashboard with advanced analytics.

- Continuous updates and community support.

Cons:

- No auto-trading—manual execution needed.

- Premium plans are pricey.

- Steep learning curve for new users.

- Limited customization for strategy automation.

9. WunderTrading

WunderTrading is an automation platform for crypto trading which offers arbitrage bots, copy trading, and smart order routing features. It also offers a streamlined user experience and low friction for traders looking to automate their arbitrage strategies as well as access to multiple exchanges.

Positioned in the middle of its features, WunderTrading offers spread detection and latency optimization tools for arbitrage execution. The platform also supports automation for arbitrage trading using execution triggers from TradingView.

Users can manager their portfolio, setup and modify stop-loss, take-profit, and other order parameters, and monitor their performance live, all in the same workspace. With its automation features and strategy diversification, WunderTrading is appropriate for both advanced and novice traders.—

WunderTrading Key Features

- Smart trading terminal with copy-trading features.

- Supports arbitrage, grid, and futures bots.

- Cloud-based with portfolio management tools.

- Integration with TradingView signals.

Pros:

- Easy to use for beginners.

- Supports automated arbitrage via API.

- Copy-trading helps users follow experts.

- Real-time execution ensures minimal slippage.

Cons:

- Complex setup for advanced bots.

- Limited free plan options.

- Requires API permissions for trading.

- Strategy marketplace still expanding.

10. Pionex

Pionex is a cryptocurrency exchange and has integrated trading bots including a triangular arbitrage bot. It has zero trading fees, and supporting bots work with major coins and pairs.

As a part of its bot offerings, Pionex has arbitrage tools that examine price variations and automatically execute trades. The bots can be accessed and controlled through a mobile device, and there are over 16 different bots available.

Community education materials are offered in addition to Pionex manuals. Due to its low fees and built in automation, Pionex is a great choice for traders who want to perform arbitrage in a safe and regulated environment with minimal automation effort. Pionex is fully compliant with US regulations.

Pionex Key Features

- Has integrated arbitrage and grid trading bots.

- Low trading fees at the integrated exchange.

- Mobile application available for easy management.

- Automated portfolio control and rebalancing.

Pros

- Easiest to use for beginners.

- Automated bots at no extra charge (more than 16).

- Competitive trading fees (0.05%).

- Fully regulated and 24/7 accessible.

Cons

- Services restricted to the Pionex exchange.

- Advanced users will find little room for customization.

- No marketplace to share strategies.

- High network congestion means larger withdrawal delays.

Trading Bots in Crypto and Its Benefits

Crypto arbitrage trading bots offer considerable benefits to novice and seasoned traders alike:

Lower Risk, Higher Profits: Bots execute systematic trading strategies that capture arbitrage profits and lower risk by reducing the chances of human error when trading.

Profits All the Time: Bots operate with little supervision and continuously search for arbitrage opportunities, ensuring profits are generated while the trader is asleep.

Reduced Emotional Bias: Trading is often accompanied by emotions, which can hinder the execution of profitable trades; the bots ensure that trades are performed as planned.

Multiple Market Reach: Bots link to and operate multiple crypto exchanges simultaneously allowing the trader to seize multiple arbitrage opportunities across disparate markets.

Sophisticated Tools: Most bots have additional features that help traders manage their strategies, predict results, and protect their capital. These include backtesting, AI, and risk management analytics.

Conclusion

For traders who wish to profit from inefficiencies in the market with little risk, crypto arbitrage trading is the answer. Having the right arbitrage tool is vital since it automates trading, analyzes market spreads, and executes trades much faster than any human.

Automated and semi-automated trading platforms like AutoShark and ProfitTrailer offer simple intuitive designs while crypto arbitrage scanners like Arbitrage Scanner and ArbiTool.ai offer detailed analysis and deep insight into the cryptocurrency market providing precision for trades.

In the end it comes down to your trading experience, strategies, and the exchanges you wish to trade between. With appropriate risk management, trade responsibilities, and the right trading bots, crypto arbitrage trading can provide profitability and consistency to any trading portfolio.