Best Crypto Tools makes investing and managing digital assets safe and smart. With cutting-edge tools, investors have access to real-time market updates, state-of-the-art security features, and automated tax reporting systems.

These features also help investors stay informed. Monitoring performance and gaining access to advanced tools track risk, measure growth, and help in growth strategy refinement. Anyone can gain confidence in adjusting to changes in the crypto marketplace.

What is Crypto Tools?

Crypto tools encompass applications, platforms, and services that assist individuals in the effective management, analysis, trading, storage, and security of cryptocurrencies.

These tools consist of crypto wallets for asset storage, portfolio trackers for performance assessment, exchanges for asset transactions, analytics platforms for market analyses, tax compliance calculators, and security measures like hardware wallets and multi-factor authentication.

With automation, instantaneous information access, and enhanced security features, crypto tools simplify the process of investing in and managing digital assets and assist users in making informed decisions.

How to Track Portfolio Performance?

Select a Tracker for Your Portfolio

Identify a portfolio tracker such as CoinStats, CoinGecko, Delta, or Kubera that will allow you to view all your wallets, exchanges and assets in one place.

Configure Wallets and Exchanges

You can reduce manual entry mistakes with automatic balance updates by integrating your wallets and trading accounts through API and public keys.

Add Remaining Manual Transactions

You must include coins and assets bought in person, moved, or saved in a hardware wallet as these will impact your profit or loss calculations.

Activate Live Market Updates

Enable live price updates and define price alerts to help you assess the performance of your assets based on real-time price movements.

Analyze ROI and Profit and Loss

Examine the unrealized gains and realized profit indicators as well as the net worth trends to determine the actual portfolio growth and the associated risk.

Assess Asset Class Over Diversification

Identify possible concentration that can lead to overexposure to reduce risk and keep a steady investment strategy.

Analyze Past Performance and Usage of Charts

Determine the entry points and prevailing market conditions to derive successful strategies and identify long-term portfolio enhancements.

Set Alerts and Regular Check-ins

Also helps in detecting risks that need your attention. Helps you stay within your goal. Helps you review the holdings you have. You invest for some time and review the accumulated. Adjust your holdings accordingly as the end of each review period.

Key Points Table — Best Crypto Tools

| Tool | Key Point | Best For | Price |

|---|---|---|---|

| CoinMarketCap | Real-time crypto prices, market caps & rankings for thousands of assets | Market data tracking | Free |

| TradingView | Advanced charting, indicators, alerts & social trading ideas | Technical analysis | Free / Paid |

| CoinGecko | Token data, fundamentals, NFT stats & categories | Crypto research & tracking | Free |

| CoinStats | Multi-wallet/exchange syncing, portfolio ROI & reports | Portfolio management | Free / Paid |

| CertiK | Smart contract auditing & security score for crypto projects | Security research | Free / Paid |

| Chainalysis | Blockchain investigation, fraud detection & compliance tools | Institutional compliance | Paid |

| Etherscan | Ethereum transaction explorer, gas analytics & smart contract lookup | Blockchain transparency | Free |

| CryptoTaxCalculator | Automated tax reports for gains, DeFi, staking, NFTs | Tax compliance | Paid |

| Koinly | Global crypto tax reporting, exchange syncing, PnL tracking | Retail & institutional tax filing | Free / Paid |

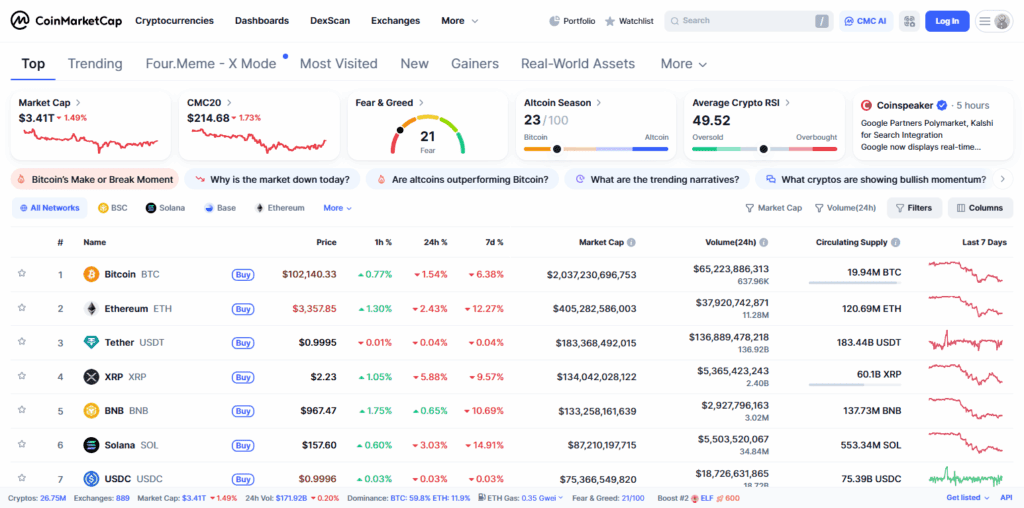

1. CoinMarketCap

CoinMarketCap is one of the most widely used platforms for tracking cryptocurrency prices, market caps, volume, charts, and rankings across thousands of digital assets. It provides key metrics like circulating supply, dominance, and historical data to help investors understand market trends.

As part of the Best Crypto Tools, CoinMarketCap offers portfolio tracking, watchlists, educational resources, and exchange listings to support informed decisions. Users can also explore new and trending tokens, ICO calendars, and community insights.

With accurate real-time data and global coverage, CoinMarketCap remains a trusted starting point for beginners and professionals researching the crypto market.

CoinMarketCap Key Features

- Real-time crypto pricing and market cap tracking

- Historical charts and trading volume data

- Watchlists and portfolio tracking

- Rankings for exchanges, trending coins, and new listings

Pros

- Free and widely trusted data source

- Supports thousands of cryptocurrencies

- Easy-to-use interface for beginners

- Detailed market overview and metrics

Cons

- Occasional price update delays on lesser-known tokens

- Heavy ads on free version

- Limited advanced analytics

- Portfolio tools not as detailed as competitors

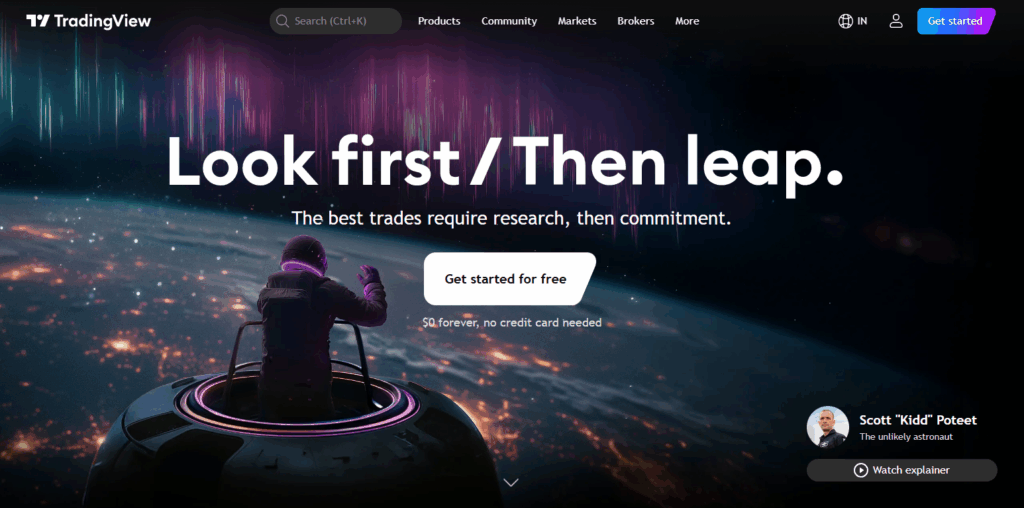

2. TradingView

TradingView is one of the largest charting platforms popular with traders across the crypto, stocks, forex, and all other financial markets. It specializes in advanced indicators, custom charting, alerts, and provides a plethora of trading ideas from the community.

Ranked among the Best Crypto Tools, users can conduct precision strategy visualization and technical analysis and link trading account and exchanges for effortless trades. It uses Pine Editor for scripting, providing self automated trading and the ability to create custom indicators.

For intraday or long-term analysis, TradingView gives the essential aids for assessing trends, determining entry and exit points, and keeping pace in fast-moving markets.

TradingView Key Features

- Advanced charting with 100+ indicators

- Custom scripts via Pine Editor

- Price and strategy alerts

- Social trading and shared analysis

Pros

- Best-in-class technical analysis tools

- Multi-market support (crypto, stocks, forex)

- Cloud-based charts available anywhere

- Strong trader community insights

Cons

- Full feature set requires paid plans

- Complex interface for beginners

- Limited direct crypto trading integration

- Learning curve for custom scripts

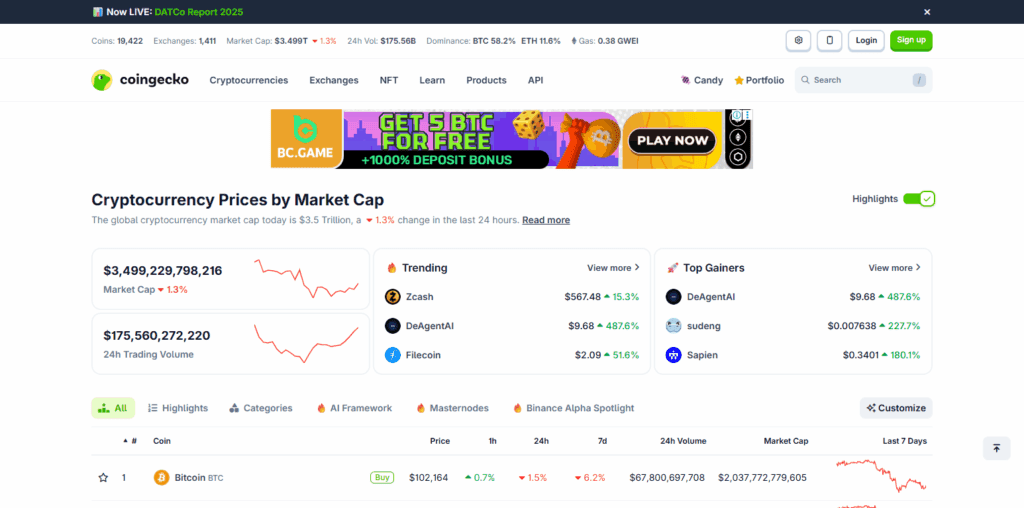

3. CoinGecko

CoinGecko is one of the most complete crypto data aggregators. It provides real-time pricing, market metrics, crypto fundamentals, trading pairs, and NFT data. What is remarkable is its analysis of the often neglected areas of crypto, tokenomics, and community and developer engagement.

As one of the Best Crypto Tools, CoinGecko specializes in research, crypto portfolio tracking, alerts, and the ability to navigate other important categories like DeFi, GameFi, and AI coins. Investors can assess liquidity, historical data, performance, and project rankings.

With data in multiple languages, CoinGecko is one the most reliable platforms for researching coins and analyzing market movements, not just price charts.

CoinGecko Key Features

- Market prices, fundamentals, developer data.

- Types of tokens and NFT analytics

- Alerts and tracker for Portfolios

- Insights on Community and Liquidity

Pros

- Comprehensive tokenomics and project research

- Includes NFT and fungible assets

- Facilitates easy comparison of identical tokens

- Most tools are free

Cons

- Small-cap coin data are delayed

- Limited tools for charting compared to competitors

- No high-end analytics for institutions

- Free plan has advertisements

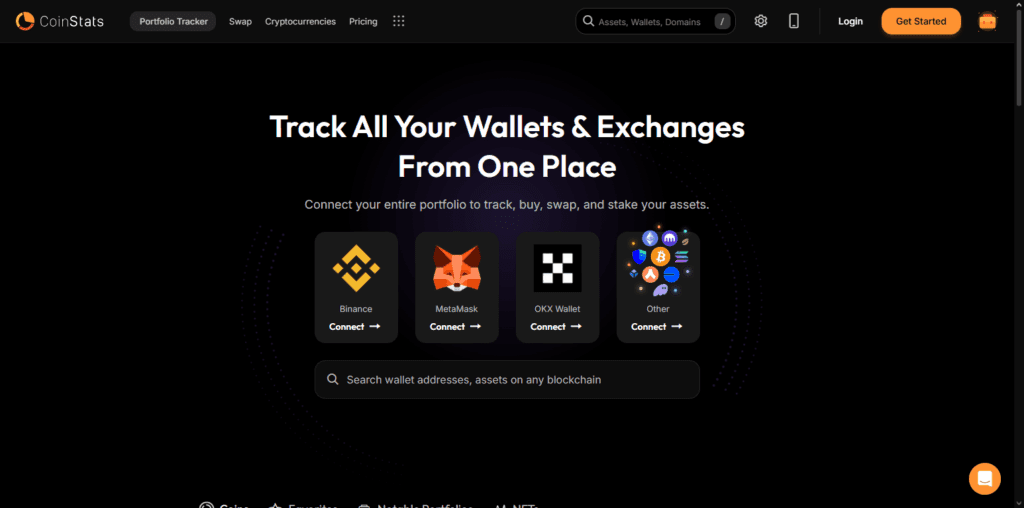

4. CoinStats

CoinStats is a sophisticated tool for managing crypto portfolios as it integrates with wallets, exchanges, and DeFi platforms to provide real-time net worth and asset performance tracking. Users are able to evaluate their profit, loss, asset allocation, and historical returns over a defined period.

Among the Best Crypto Tools, CoinStats also offers features for tax reporting and insights, market research, profit and loss alerts, staking, and secure cloud backups. It integrates centralized platforms, hardware wallets, and decentralized wallets as well as other hardware to streamline complex crypto holding.

For active traders or crypto retail investors, CoinStats understands your needs offering a comprehensive financial overview for improved trading strategy and organization in the crypto market.

CoinStats Key Features

- Syncing multiple wallets and exchanges

- Reports on profit/loss, ROI, and portfolios

- Insights on market trends and price alerts

- Tax calculations and help with staking

Pros

- Excellent tracking across multiple platforms

- Strong dashboard with detailed performance charts

- DeFi compatibility

- Good mobile experience

Cons

- Paid upgrades are needed for full benefits

- Syncing with exchanges has issues

- New users have to deal with learning curve

- Limited analytics compared to TradingView

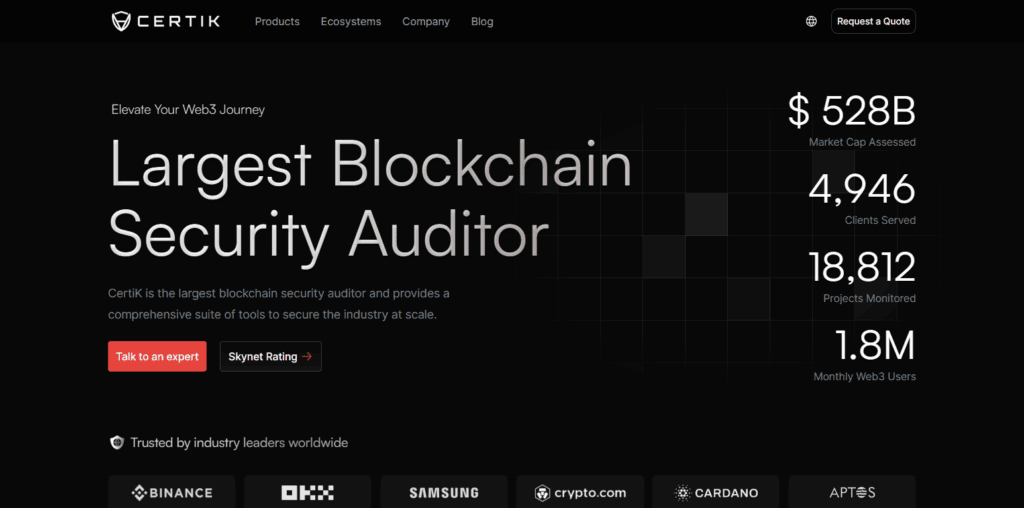

5. CertiK

CertiK is a frontrunner in blockchain security, undertaking smart contract audits, penetrating testing, risk assessment for crypto projects, and security certificate issuance. It caps threats that investors loss by pinpointing exploitable openings.

CertiK is a vital pillar in the Best Crypto Tools as it offers security ratings, threat monitoring in real-time, and audit trail of received certificates. Safety assurance brings Credence to payment systems, it is relied on by many pivotal DeFi as well as blockchain mpanies.

Empowering users to determine a project’s safety, on-chain analytics coupled with Skynet monitoring. CertiK is transparent minimizing ambiguity leading to the maximalization of risk in the environment crypto.

CertiK Key Features

- Audits of smart contracts with risk scores

- On-going monitoring within the chain

- Skynet

- Security leaderboard for verified projects.

Pros

- Builds trust in DeFi and blockchain initiatives

- High-profile protocols use the platform

- Security reports are transparent

- Prevents major rug pulls and exploits

Cons

- Reports are mainly aimed at institutions.

- No portfolio or trading tools

- Long wait for audits due to large queue

- Paid services can get pricey

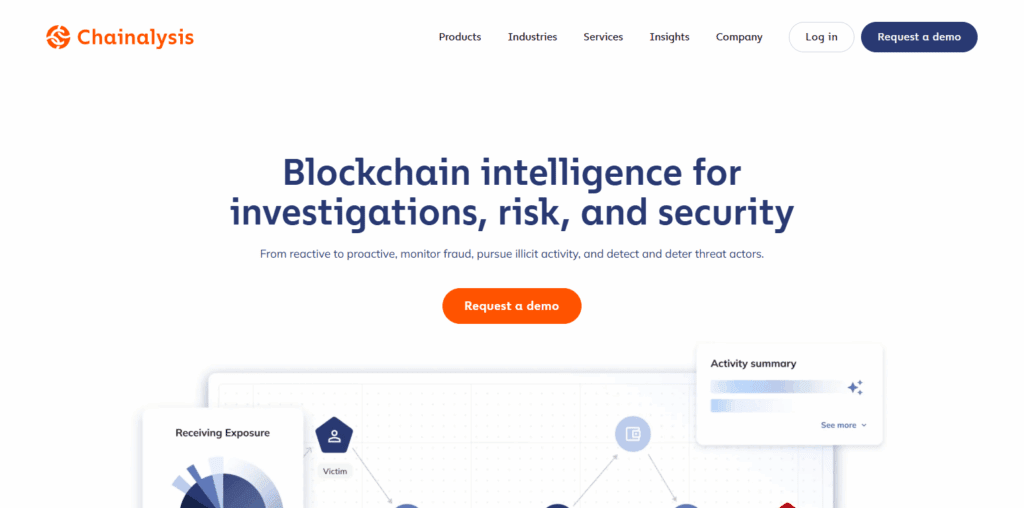

6. Chainalysis

Chainalysis is a leading blockchain analytics and compliance solution for governments, exchanges, and institutions to track illegal activity on crypto transactions. It surveys extensive blockchain data for fraud, hacking, and other criminal behaviors.

Chainalysis provides anti-money laundering, risk-scoring, investigative intelligence, and other reporting crypto compliance tools. It builds trust in crypto ecosystems by ensuring funding meets compliance to legalized crypto norms and restrictions within international borders.

Chainalysis has helped make the crypto industry safer, more transparent, and more accessible to legitimate users and institutions through high-profile investigations, financial security, and compliance to regulation.

Chainalysis Key Features

- Blockchain investigation and analytics

- Risk scoring and compliance to AML

- Detection of fraud and hacks

- Reporting tools of enterprise-grade

Pros

- Leading globally in compliance of crypto regulations

- Assists in tracking funds after theft

- Used extensively by governments, and exchanges

- Enhances safety in the crypto ecosystem

Cons

- No services to retail customers

- Very high pricing levels

- Privacy concerns among crypto users

- No retail investment features

7. Etherscan

Etherscan is the Ethereum blockchain explorer users trust most for verifying wallet transactions, smart contracts, gas fees, analytics on tokens, and activity on the network. It is crucial for monitoring transfers, transactions, and contract code.

Etherscan was the first Best Crypto Tool and facilitates most on- chain data access without intermediary reliance. Its data is invaluable to software developers for API access, contract automation, and blockchain interaction.

Etherscan enhancement of Ethereum blockchain exposes accountability and improved ease of navigation for users at all experience levels and Ethereum activists.

Etherscan Key Features

- Tracker for Ethereum transactions and wallets

- Monitor and chart gas fees

- Verification and execution of smart contracts

- Token/STO metadata and analytics

Pros

- Completely free to use

- Essential for on-chain transparency

- Developer-friendly tools and APIs

- No account needed

Cons

- Only Ethereum and ERC assets

- Complex for a beginner

- No investment or trading features

- Limited visual analytics

8. CryptoTaxCalculator

This is a tool that automates tax calculations for cryptocurrency activities, including trading, staking, mining, NFTs, and DeFi activities. To find out the profit/loss summaries and taxable events, it connects with numerous exchanges and wallets.

Ranked among the Best Crypto Tools, CryptoTaxCalculator generates and supports ready-to-file reports for global tax jurisdictions, and ensures compliance with tax regulations, thereby reducing manual work.

It also eliminates errors on spreadsheets and provides explanations for the most difficult crypto tax regulations. Traders and investors appreciate its detailed breakdowns for compliance and a better understanding of their financial obligations with crypto.

CryptoTaxCalculator Key Features

- Automated crypto tax calculations

- Support for DeFi, NFT and staking income

- Integration with top exchanges

- Compliance formats specific to each country

Pros

- Saves time and reduces tax errors.

- Best suited for advanced DeFi investors.

- Events subject to tax are simplified.

- Help from professional auditors.

Cons

- Losing the ability to generate complete reports with a paid plan.

- Might be confusing for a new user.

- Expanding the number of countries marks a new point.

- Manual adjustments may be required.

9. Koinly

Koinly is one of the most used crypto tax software that connects with wallets, blockchains, and exchanges, tracks transactions, and automatically generates tax reports. It calculates capital gains, income, cost basis, and portfolio performance with ease.

Ranked among the Best Crypto Tools, Koinly supports global tax formats, making it useful for both individuals and businesses. It also offers tax optimization, detailed audit reports, and real-time portfolio monitoring.

With user-friendly dashboards and strong automation, Koinly simplifies tax filing and ensures compliance with crypto regulations across multiple countries.

Koinly Key Features

- Income and capital gains tracking.

- Exchange and wallet sync.

- Monitor your portfolio in real-time.

- Tax-related tools.

Pros

- Covers the most global tax jurisdictions.

- Easy to understand with a beginner-friendly UI.

- Thorough with Deatils on the PnL.

- Basic tracking has a free plan.

Cons

- Paid plan required for complete reports.

- Delay in syncing with the blockchain.

- Advanced features are limited within the free plan.

- Manual PnL reconciliation may be required.

Conclusion

For effective investing, performing good portfolio management, and ensuring total safety in the digital asset market which is growing rapidly, choosing the appropriate crypto tools is invaluable. Certain tools like CoinMarketCap, CoinGecko, and TradingView are important for market analysis, and CoinStats for performance tracking.

For market safety and transparency, CertiK and Chainalysis are your guardians, and Etherscan, verified blockchain elements. Koinly and CryptoTaxCalculator, on the contrary, are tax tools for navigating complex regulations for crypto transactions.

Combining most tools as per your requirements will allow you to trade freely and safely, and crypto tools are designed for supporting your decision making for the crypto economy to be successful in the long term.

FAQ

Best Crypto Tools are used to track market prices, manage portfolios, perform technical analysis, enhance security, verify transactions, and generate tax reports for cryptocurrencies.

Many crypto tools like CoinMarketCap, CoinGecko, and Etherscan are free. However, advanced features in tools like TradingView, CoinStats, and tax software may require paid plans.

CoinMarketCap and CoinGecko are the best starting points because they provide easy-to-understand price data, rankings, and portfolio options without complexity.

CertiK and Chainalysis are top security-focused tools that analyze smart contracts, detect fraud, and rate project risks to keep investors safe.

CoinStats is one of the best portfolio trackers. It syncs wallets and exchanges to track net worth, asset allocation, and real-time profit/loss.