This article will cover the Top NFT Fractional Ownership Platforms that are changing the way people invest in digital assets.

These platforms let several investors own portions of expensive NFTs. They split highly valued NFTs into tradable fractions.

By shared ownership, liquidity, and lowering the entry cost, they are making NFTs accessible to a bigger audience and creating immense potential in the digital collectibles markets.

Key Points & Top NFT fractional Ownership Platforms

| Platform | Key Points |

|---|---|

| Unique.li | Allows fractional investment in high-value NFTs; user-friendly interface. |

| LIQNFT | Offers NFT lending and fractionalization; unlocks capital from NFTs. |

| NFTfy | Decentralized platform for fractional NFT ownership and trading. |

| Fractional.art | Specializes in fractionalizing blue-chip NFTs; includes buyout mechanisms. |

| Rarible | Creator-centric marketplace; supports fractional ownership via governance token RARI. |

| OpenSea | Largest NFT marketplace; supports fractional ownership across multiple chains. |

| NIFTEX | Enables fractional ownership and liquidity pools for NFT indices. |

| DAOfi | Focuses on decentralized trading of fractional NFTs; supports governance. |

| RealT | Real estate NFT platform; allows fractional ownership of property assets. |

| Otis | Combines NFTs with traditional assets; fractional ownership of collectibles. |

10 Top NFT fractional Ownership Platforms

1. Unique.li

Unique.li is a decentralized platform allowing users to split their NFTs into tradable ERC-20 tokens. The platform aligns fractional token distribution with smart contracts to lock NFTs, each user able to diversify asset ownership.

This is aimed at widening the market for fractional NFTs and making them economically accessible to more users. Value appreciation is not restricted to whole asset buyers; fraction buyers, sellers, and traders also participate.

The platform enables the NFT holder to unlock liquidity, while the purchaser can participate in the fractional ownership scheme.

Features Unique.li

NFT Fractionalization – NFTs get locked in smart contracts and are issued ERC-20 tokens as fractions.

Democratized Access – Investors can collaborate and attain ownership of expensive NFTs without complete cost.

Trading Flexibility – Fraction tokens are eligible for trading in secondary markets.

Decentralized Governance – NFT fraction holders vote on governance choices of the NFT.

2. LIQNFT

LIQNFT is a platform to improve liquidity in the NFT market through fractional ownership and immediate liquidity pools.

Users can stake their NFTs into smart contracts which are split into fractions and subsequently traded as fungible tokens.

NFT fractions can be bought, sold, and traded, proving liquidity to what were previously inflexible digital assets.

The platform’s goal is to turn NFTs into more liquid financial instruments, facilitating the entry and exit of a range of positions in high-value digital assets.

Features LIQNFT

Instant Liquidity – NFT fractions are readily available for purchase or sale through existing liquidity pools.

Smart Contract Staking – NFTs are locked in smart contracts for the distribution of fractions.

Enhanced Market Liquidity – Invest in NFTs and enjoy easy mechanisms for entering and leaving the market.

Decentralized Ownership – High-value NFTs can be collectively owned by multiple individuals.

3. NFTfy

NFTfy is designed to enable NFT owners to create liquidity pools and fractionalize their assets using the Balancer protocol.

After an NFT is staked in a smart contract, the owner is issued one million NFT fractions, which they are free to trade or sell.

This approach creates liquidity for NFT owners and permits fractional ownership, thus enabling several purchasers to possess a portion of expensive NFTs.

NFTfy seeks to democratize the accessibility and liquidity of NFT investments for a broader audience.

Features NFTfy

Fractional NFT Issuance – NFTs are divided into portions for multiple individual investors.

Balancer Protocol Integration – NFT fractions are routed through liquidity pools for sale and purchase.

Accessible Investment – High-value NFTs can be easily financed.

Liquidity Provision – NFT fractions can be sold, purchased, or traded without restrictions.

4. Fractional.art

Fractional.art is classified as a protocol for decentralized governance through the fractionalization of NFTs.

By dividing NFTs into smaller portions that can be owned and traded, NFTs can be owned and governed collectively.

NFT owners can lock their assets into the platform, which issues fraction-representing ERC-20 tokens.

Users can buy and sell these tokens, allowing multiple users to invest in a digitized asset. Fractional.art also enables community governance through the NFTs governed as assets.

Features Fractional.art

ERC-20 Tokenization – Converts NFTs into token fractions that can be traded.

Community Governance – Holders of the tokens vote on various NFT Governance decisions.

Collective Ownership – Multiple digitals assets can be co-owned democratically co-owned.

Secondary Trading – The fractioned tokens can be traded on the platform.

5. Rarible

Rarible is an NFT marketplace which is decentralized. The users of Rarible NFT marketplace can create NFTs or buy and sell them.

Rarible mostly attends to their users requests to create and trade NFTs. Rarible also offers fractional ownership of NFTs.

NFTs can be listed for sale and buyers can buy shared ownership of NFTs in fractions. The community governance made Rarible more decentralized

Which made it cube more enthusiastic for NFT which also fostered the ecosystem of the NFTs. Governance made it possible for users to vote on upgrades and decisions made in the platform.

Features Rarible

NFT Marketplace – Create, buy, and sell NFTs on a single platform.

Fractional Ownership Support – Certain NFTs on the platform can be split and shared.

Decentralized Governance – Platform decisions and upgrades are influenced by NFT holders.

Wide NFT Selection – For fractional investment, a diverse range of digital assets are available.

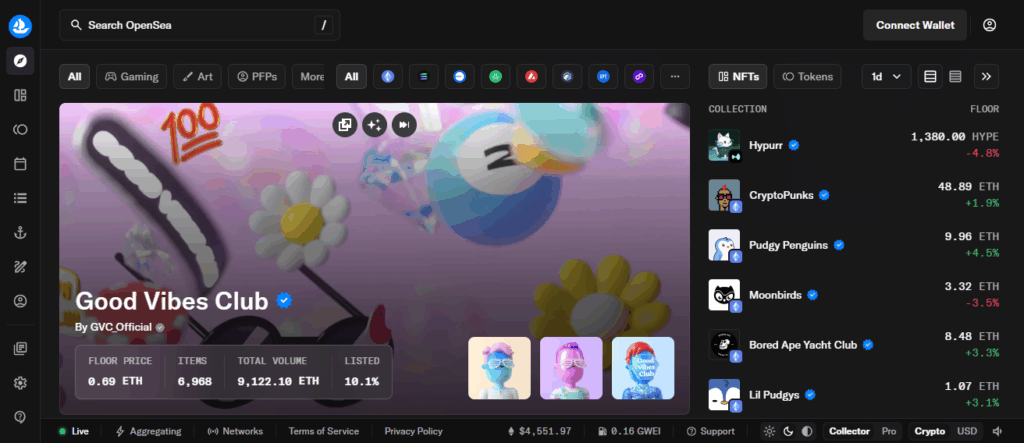

6. OpenSea

OpenSea is the largest NFT marketplace and offers the ability to find, purchase, and sell NFTs. OpenSea has primarily focused NFT trading but has begun to support fractional ownership of some assets.

Users can list their NFTs for sale, and buyers can purchase fractions of these assets, enabling shared ownership.

OpenSea is a considerable player in the space, and its large audience and asset collection support the marketplace through its massive collection of digital assets.

Features OpenSea

Largest NFT Marketplace – The selection of digital assets is vast and highly varied.

Fractional Ownership – High value NFTs on the platform can be fractioned and owned shared.

Liquidity Access – Provides fractional investors the ability to trade NFTs.

User-Friendly Platform – The buying and selling of NFT fragments is easily done by beginners.

7. NIFTEX

NIFTEX focuses on all facets in fractional NFTs, letting clients split ownership into small, tradeable chunks.

NIFTEX locks NFTs into a smart contract, then issues ERC-20 tokens that represent fractions of that asset.

These tokens can be purchased, sold, and traded, making it possible for multiple participants to own a piece of the NFT.

NIFTEX seeks to improve the NFT market’s liquidity and accessibility, allowing more investors to engage in expensive digital assets.

Features NIFTEX

High-Value NFT Fractionalization – Expensive NFTs can be split into smaller, tradable portions.

ERC-20 Fraction Tokens – Secure, tokenized fractional NFTs are provided.

Increased Market Liquidity – The fractions of NFTs can be freely traded.

Wider Investor Access – Different people get to co-own premium NFTs.

8. DAOfi

DAOfi is the first mover in fractionalization of NFTs. The first mover in fractionalization of NFTs is DAOfi. DAOfi provides the first mover advantage in fractionalization of NFTs.

DAOfi provides first mover advantage in fractionalization of NFTs. DAOfi is the first mover in fractionalization of NFTs. The first mover in fractionalization of NFTs is DAOfi.

DAOfi provides the first mover advantage in fractionalization of NFTs. DAOfi provides first mover advantage in fractionalizing NFTs. DAOfi is the first mover in the fractionalization of NFTs.

The first mover in the DAOfi provides first mover advantage in fractionalization of the NFTs. DAOfi provides the first mover advantage in NFT fractionalization.

DAOfi is the first mover in fractionalizing NFTs in the DAOfi provides the first mover in fractionalization of NFTs.

Features DAOfi

Fractional NFT Platform – Employs Fractional.art protocol for splitting NFTs into ERC-20 tokens.

Community Governance – NFT owners manage voting on the respective assignment of NFTs.

Shared Ownership – Multiple users to co-own premium NFTs.

Secondary Market Trading – Fractional tokens can be traded on the secondary market.

9. RealT

RealT provides the option to tokenize assets as NFTs which includes real estate properties, thereby permitting fractional possession of physical assets.

Each property gets its own unique NFT which can then be purchased as investments in fractional portions.

This system permits investments in real estate even when one has a smaller budget which pays access to the income streams and appreciation of the property.

RealT uses the blockchain technology to secure fractional ownership and clear transactions which helps in democratizing the real estate investments.

Features RealT

Real Estate NFTs – NFT fractions can be made for physical properties.

Fractional Ownership – Investors can purchase a small portion of a property.

Income Streams – Fractional owners receive a portion of the rental income.

Transparent Blockchain Transactions – Property ownership will be fully verifiable on the blockchain.

10. Otis

Otis lets users buy fractional shares of expensive art, collectibles, and NFTs. For each acquired asset, Otis divides ownership into shares, which investors buy.

This lets people invest in expensive items and appreciate and profit from them, even if they don’t own the entire asset.

Otis permits users to buy, sell or trade their fractional shares, providing liquidity and ease of access to the alternative investment market.

Features Otis

Alternative Asset Investments – Fractional shares in NFTs, art, and collectibles.

Fractional Trading – Investors can easily execute buy, sell, or trade orders.

High-Value Asset Access – Smaller investors can take positions on otherwise inaccessible high value assets.

Marketplace Liquidity – A place to trade fractional, or fully fractionalized shares.

Conclsuion

In the cocnlsuion Top NFT fractional ownership platforms like Unique.li, LIQNFT, NFTfy, and others are transforming digital asset investment by enabling shared ownership, liquidity, and accessible entry to high-value NFTs.

They combine smart contracts, ERC-20 tokenization, and community governance to democratize NFT investments, making it easier for multiple investors to co-own, trade, and benefit from the growing NFT ecosystem.

FAQ

In the cocnlsuion Top NFT fractional ownership platforms like Unique.li, LIQNFT, NFTfy, and others are transforming digital asset investment by enabling shared ownership, liquidity, and accessible entry to high-value NFTs.

They combine smart contracts, ERC-20 tokenization, and community governance to democratize NFT investments, making it easier for multiple investors to co-own, trade, and benefit from the growing NFT ecosystem.

FAQ

It allows multiple investors to own portions of a single NFT through tokenized fractions, making high-value assets more accessible.

NFTs are locked in smart contracts and divided into ERC-20 tokens, which can be traded or sold.

Anyone with a crypto wallet and sufficient funds for the NFT fractions can invest.

Yes, as ownership is recorded on the blockchain, but platform and smart contract risks remain.

Yes, most platforms allow secondary trading of fractional tokens.