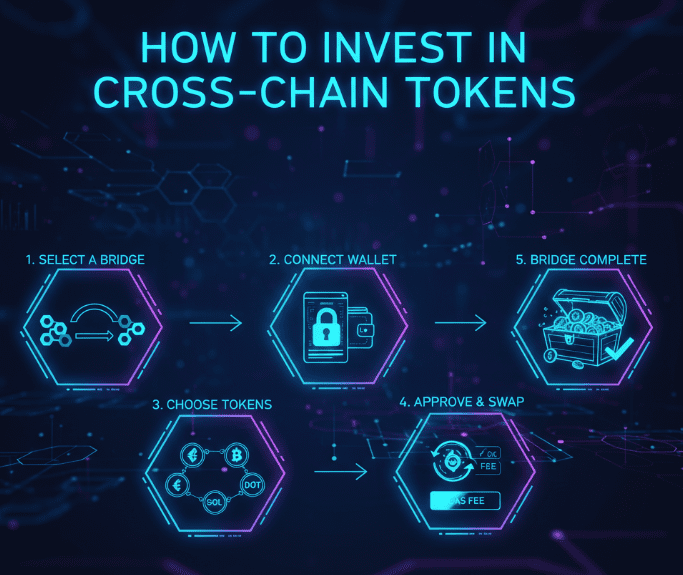

I will cover the topic of how to invest in cross-chain tokens, a growing trend in cryptocurrency. With cross-chain tokens, investors are able to use and trade assets across several blockchain networks.

This provides investors with more access to DeFi networks as well as greater flexibility and liquidity. The strategies, tips, and critical steps outlined in my guide below will help beginners invest safely and efficiently.

Understanding Cross-Chain Tokens

Cross-Chain Tokens are unique types of digital assets that are designed to work seamlessly across various blockchain networks. Unlike other tokens which work on a blockchain in isolation, cross-chain tokens can be traded, transferred, and utilized on multiple blockchain platforms without the need of a intermediary.

This ease of movement facilitates interaction with multiple decentralized finance (DeFi) applications, liquidity, and markets spread across various blockchains. Well-known examples of cross-chain tokens include wrapped tokens and other multi-chain native coins.

Wrapped tokens and other minted tokens retain their value, regardless of the network they are operate on.

Cross-chain tokens empowers ease of movement between blockchain networks, and in increase their value by adding more liquidity and flexibility to the ecosystem. Token are especially appealing to investors interested in diversified exposure.

How to Invest in Cross-Chain Tokens

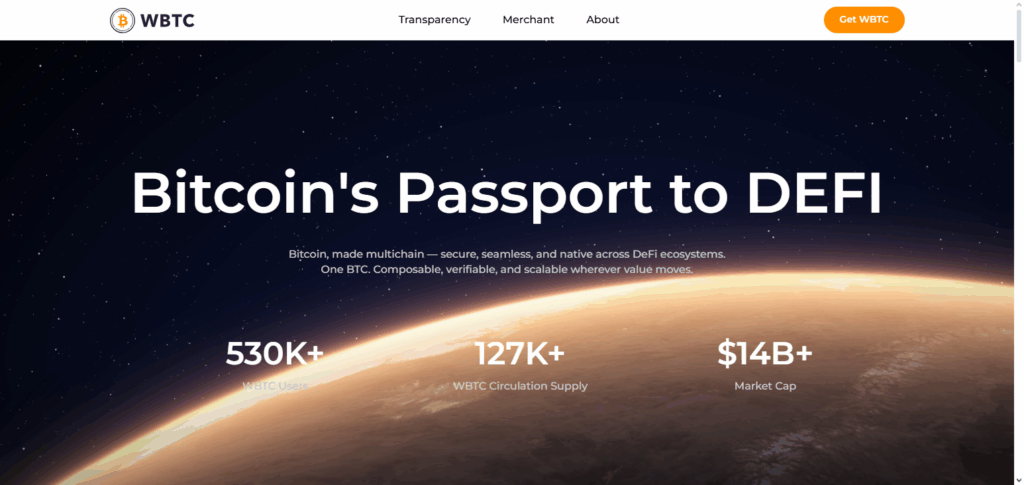

You will find below a guided example on how to invest in a cross-chain token. We will be using Wrapped Bitcoin (WBTC) for this example.

Step 1: Research the Token

- Understand what WBTC is: a tokenized version of Bitcoin on the Ethereum blockchain.

- Examine the project’s legitimacy, market cap, and community engagement.

- Review details on available cross-chain compatibility and supported networks.

Step 2: Select a Wallet That is Cross-Chain Compatible.

- Use cross-chain compatible wallets such as MetaMask, Trust Wallet, and Atomic Wallet.

- Confirm the wallet’s compatibility with WBTC’s operational chains, including Ethereum and Binance Smart Chain (BSC).

- Protect your wallet by creating a complex password and saving your backup seed phrase.

Step 3: Purchase the Token from a Trusted Exchange.

- On a centralized exchange, such as Binance and Kraken, and on a decentralized exchange (DEX), such as Uniswap, WBTC tokens can also be purchased.

- Fund your account with Bitcoin (BTC), Ethereum (ETH), or stablecoins to acquire WBTC.

Step 4: Transfer the Token to Another Chain (Optional).

- Use Multichain or AnySwap cross-chain bridges to transfer WBTC to Binance Smart Chain (BSC).

- Make sure to follow the WBTC instructions for the safe transfer of coins between chains.

Step 5: Store or invest in DeFi

- Store the token in your wallet for holding or

- Stake, lend, or deploy in yield farming and liquidity pools to earn passive income on the target blockchain.

Step 6: Monitor and Manage Your Investment

- Track the token price, liquidity, and project progress.

- Hedge with other cross-chain tokens to lower your risk.

Why Invest in Cross-Chain Tokens

Diversification Across Multiple Blockchains

Cross-chain tokens permit ownership of digital assets on several networks unlike focusing on one blockchain.

Access to More DeFi Opportunities

They facilitate engagement with DeFi platforms across various ecosystems, including staking, lending, and yield farming.

Enhanced Liquidity

Cross-chain tokens increase access to different markets and trading opportunities through their ability to move freely between chains.

Reduced Transaction Bottlenecks

Cross-chain tokens can be used to relieve congestion, high fees, and bottlenecks on a single blockchain.

Potential for Higher Returns

More chains mean more emerging projects and better earning potential, so by using more chains, investors can access improved liquidity.

Interoperability Between Platforms

Cross-chain tokens can be applied in more than one wallet, exchange, or dApp, and so offer better usability and flexibility.

Are cross-chain tokens safe?

Cross-chain tokens may be less risky than other options available, as long as the correct measures are put in place, but still, they remain dangerous.

It is susceptible to breaches, as cross-chain systems operate using smart contracts and bridges. It could lead to a monetary loss.

As an additional concern, usability could be impacted by transaction costs or a backlog of transactions. Investors must implement safe measures for well-audited projects, safe wallets, and cross-chain bridges with a reputation.

Moreover, the thorough study of every token’s development team and ecosystem, coupled with diversification, minimizes risks considerably with cross-chain investments.

Tips for Successful Cross-Chain Investing

Do Thorough Research

Analyze and understand the token and it’s project, including the team behind it, the roadmap, and relevant market factors.

Use Reliable Wallets and Platforms

Make sure you select wallet and exchange/bridge providers that are widely regarded, such as MetaMask, Trust Wallet, and other cross-chain interoperable wallets.

Diversify Your Investments

Reduce risk and maximize opportunities by investing across multiple cross-chain tokens.

Monitor Network Fees and Liquidity

Keep losses to a minimum by understanding the different chains and their associated transaction fees.

Stay Updated with Project Developments

Keep track of project news and official announcements to stay ahead of the game.

Use Portfolio Trackers

Manage your assets seamlessly with advanced trackers like Zapper and Debank that provide convenience to users with cross-chain and multi-chain assets.

Manage Risks

Over-leveraging can be a key mistake while investing in Cross-chain. These investments can be volatile, so only spend what you’re willing to risk.

Risks and How to Manage Them

Smart Contracts Exposure

- Risk: Smart contracts can be hacked to steal cross-chain tokens.

- Management: Avoid audited projects, Omni-chain, and work only with well-known firms. Avoid engaging with newly launched tokens and those that have not been audited.

Price Volatility

- Risk: The cross-chain token is likely to experience very large swings in price due to the volatility in the crypto market.

- Management: Do not buy in more than you are willing to risk and diversify your portfolio.

Congestion and Costly Fees

- Risk: During periods of negative net congestion, the cost of transferring tokens across cross chains can be restrictive and can also take longer.

- Management: Avoid these periods and time your transactions for low-cross-chain congestion.

Cross-chain Bridge

- Risk: Bridges to cross chains are highly susceptible to hacks or as targets of faults with regards to losing your crypto.

- Management: Always start with major bridges which have a previous record of good security. Make sure to test the bridges with small amounts before large transfers.

Regulatory Exposure

- Risk: These types of cross-chain tokens have a great deal of ambiguity surround them.

- Management: Ensure you are aware of local regulations and opt for more legal compliance if your area’s regulations are stricter.

Pros & Cons

| Pros | Cons |

|---|---|

| Diversification across multiple blockchains | High price volatility |

| Access to more DeFi opportunities | Smart contract vulnerabilities |

| Enhanced liquidity and trading options | Risks with cross-chain bridges |

| Reduced transaction bottlenecks | Network congestion and high fees |

| Potential for higher returns | Regulatory uncertainties in some regions |

| Interoperability between wallets, exchanges, and dApps | Requires technical knowledge for safe management |

Conclusion

Investing in cross-chain tokens allows for diversification in crypto portfolios, access to more DeFi elds, plus wider liquidity and interoperability.

Although engaging in this activity can be risky and requires higher attention, proper wallets and bridges can be used to minimize the risks. Investors, ranging from beginners to experienced, need to conduct thorough research that is flexible enough to cope with market changes to succeed with cross-chain investing.

Once the strategy is set correctly and the guidelines for investing are followed, cross-chain tokens become a valuable asset for an investor’s portfolio, given the rapid advancement in the crypto world.

FAQ

You can buy them on reputable exchanges (centralized or decentralized) using fiat, BTC, ETH, or stablecoins. Ensure your wallet supports the token’s networks.

A cross-chain bridge is a tool that allows tokens to move between different blockchains, enabling interoperability and access to multiple platforms.

While many projects are secure, risks include smart contract vulnerabilities, bridge exploits, and network congestion. Always use audited projects and reliable platforms.

Diversify your portfolio, use reputable wallets and exchanges, monitor network fees, and stay updated on project news and regulations.