This article conducts a comparative analysis of the most effective cryptocurrency debit cards suited for global consumption, analyzing their operational features, derived benefits, and distinguishing benefits that define their relative competitiveness.

The instruments facilitate the conversion and expenditure of digital assets—such as Bitcoin and Ethereum—at any merchant outlet displaying Visa or MasterCard acceptance

while concomitantly administering incentives including cashback, tiered rewards, and borderless usability for frequent travelers, cryptocurrency investors, and the general retail digital-currency community.

How We Choose The Best Crypto Debit Cards for Global Use

Geographic Reach – Cards exhibiting extensive international merchant support and acceptance across diverse regions receive priority.

Asset Coverage – Eligibility encompasses cards accommodating major cryptocurrencies, including Bitcoin (BTC), Ethereum (ETH), Tether (USDT), Binance Coin (BNB), and a significant number of alternative tokens.

Transaction Costs – Assessment incorporated one-time card issuance fees, recurring subscription charges, domestic and international ATM withdrawal tariffs, and foreign exchange spreads.

Incentives and Rewards – Higher rankings were accorded to products delivering substantial cash-back percentages, subscription waivers (e.g., for Netflix and Spotify), or crypto-based incentives.

Operational Simplicity – Preference was granted to cards demonstrating seamless mobile application support, immediate conversion from crypto to fiat, and compatibility with standard payment interfaces such as Apple Pay and Google Pay.

Regulatory Compliance and Security – Cards issued by licensed financial institutions and featuring technical safeguards such as two-factor authentication, card-lock capabilities, and adequate insurance coverage were favored.

User-Centric Evaluation – Insights were synthesized from aggregated consumer feedback, responsiveness of support infrastructures, and overall navigational ease.

Distinctive Functionality – Additional consideration was accorded for unique characteristics, including collateralized lending, decentralized finance (DeFi) interoperability, and support for multiple fiat currencies.

Key Points & Best Crypto Debit Cards For Global Use List

| Crypto Debit Card | Key Points |

|---|---|

| KAST Card | KAST is accepted at over 150 million merchants and ATMs in more than 160 countries |

| Crypto.com Visa Card | Up to 5% cashback in CRO, free Spotify/Netflix perks, multiple card tiers, supports 100+ countries. |

| Binance Visa Card | Up to 8% cashback in BNB, zero annual fees, supports 60M+ merchants globally, instant crypto-to-fiat conversion. |

| Coinbase Card | Available in US & EU, up to 4% crypto rewards, supports multiple cryptos, integrated with Coinbase wallet. |

| Wirex Visa Card | Supports 150+ currencies, up to 8% cashback in WXT, multi-currency accounts, available in 40+ countries. |

| BitPay Card | US-only, supports BTC, ETH, USDC & more, Google/Apple Pay compatible, instant crypto to USD conversion. |

| Nexo Card | No monthly/FX fees, uses crypto as collateral, up to 2% cashback, available in 30+ countries. |

| Revolut Card (Crypto Feature) | Fiat-first card with crypto trading option, supports 30+ cryptos, available in 200+ countries. |

| BlockCard (by Unbanked) | US-focused, supports 12+ cryptos, unlimited deposits, up to 6% rewards. |

| Paycent Card | Supports multiple fiat & cryptos, works in 200+ countries, mobile app for instant conversion. |

| Monolith Visa Card | Ethereum-based, supports DAI/ETH spending, DeFi wallet integration, only available in EU/UK. |

11 Best Crypto Debit Cards For Global Use

1.KAST Card

KAST card serves as a modern bridge between cryptocurrency and everyday spending, enabling seamless payments by linking a single USD and stablecoin balance directly to the global Visa network.

Spending crypto often involves manual conversions and unreliable checkout flows, creating friction at the point of payment. The KAST card simplifies this by letting users fund a single account with USD, crypto, or stablecoins such as USDC and USDT, which can then be used seamlessly for everyday purchases.

KAST is accepted at over 150 million merchants and ATMs in more than 160 countries, providing extensive international coverage for travel and cross-border spending. The platform supports USD payouts to bank accounts through ACH, Fedwire, and SWIFT, making it ideal for users who move between crypto, stablecoins, and traditional finance. Physical KAST Visa cards are issued free of charge, though ATM withdrawals and foreign currency transactions are subject to published limits and fees.

| PROS | CONS |

| Earn up to 8% rewards, up to 13% in select seasons | Some premium cards have high annual fees |

| Multiple card tiers to suit different user needs and styles | FX fees on non-USD transactions |

| Use globally in 160+ countries wherever Visa is accepted | ATM fees and withdrawal limits may apply |

| Supports both fiat & crypto | Rewards vary by tier and season |

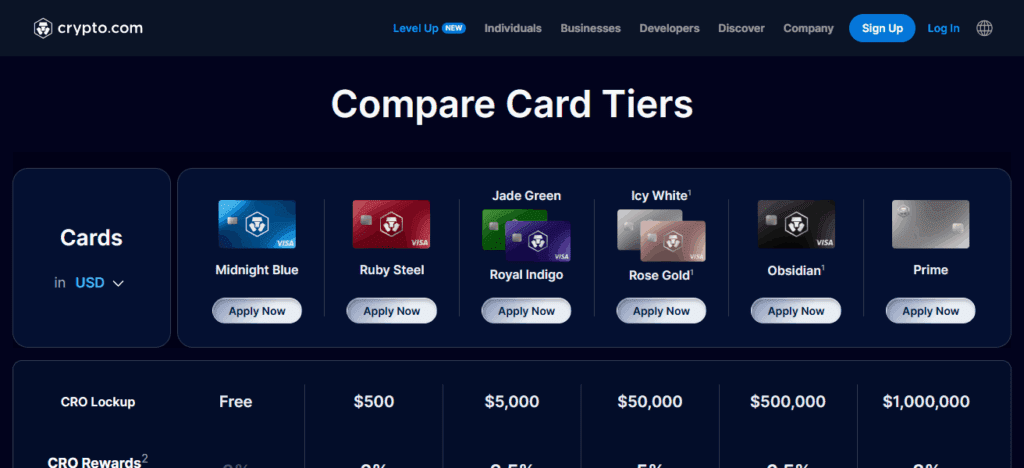

2.Crypto.com Visa Card

Regarded as a leading crypto debit solution, the Crypto.com Visa Card rewards holders with up to 5% cashback in CRO tokens. Tiers vary: longer staking periods unlock premium perks—complimentary Spotify, Netflix subscriptions, and complimentary access to affiliated airport lounges.

Accepted in over 100 jurisdictions, the card performs instant crypto-to-fiat conversion, ensuring frictionless transactions. It incurs no annual fee while remaining tightly integrated into the user-friendly Crypto.com app, making it an attractive, no-frills choice for internationally mobile crypto holders.

| Pros | Cons |

|---|---|

| Up to 5% cashback in CRO tokens | Cashback requires CRO staking |

| Free Spotify, Netflix, and lounge perks | Rewards decrease if CRO is unstaked |

| Supports 100+ countries | CRO token volatility affects rewards value |

| No annual fees | High staking requirements for premium tiers |

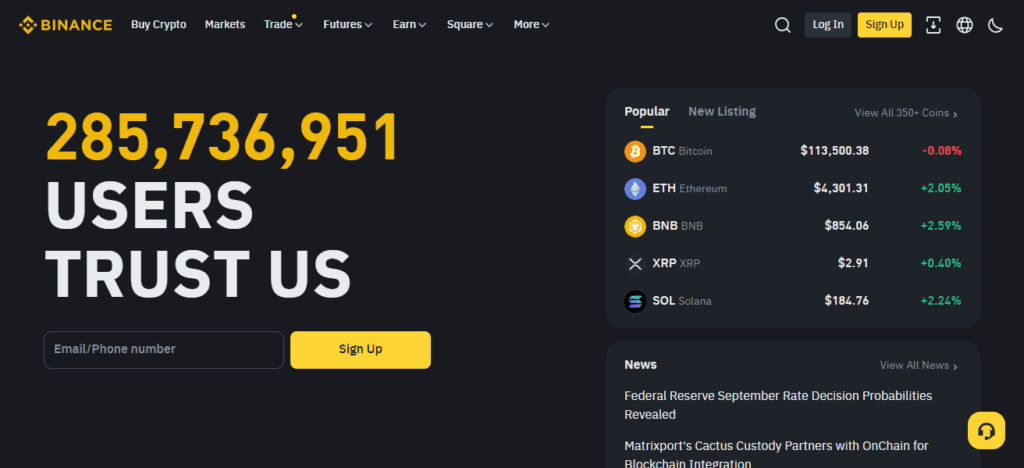

3.Binance Visa Card

The Binance Visa Card equips holders to spend diverse cryptocurrencies wherever Visa is accepted, conducting real-time conversion to local fiat. Users earn up to 8% cashback in BNB, adjustable based on staking commitments.

No annual or transaction fees substantially boost its cost-effectiveness. Supported by millions of merchants, the card synchronizes effortlessly with the Binance ecosystem.

Cardholders may dispense Bitcoin, Ethereum, BNB, and select stablecoins, presenting a compelling solution for active traders seeking straightforward, real-time access to their crypto portfolios.

| Pros | Cons |

|---|---|

| Up to 8% cashback in BNB | Requires BNB staking for maximum rewards |

| No annual or transaction fees | Limited availability in some regions |

| Works at 60M+ merchants worldwide | Cashback only in BNB |

| Seamless Binance app integration | Regional restrictions due to regulations |

4.Coinbase Card

The Coinbase Card streamlines transactions by permitting direct expenditure from the Coinbase wallet. It accommodates a diverse range of cryptocurrencies and delivers a reward of up to 4% in digital assets, contingent upon the selected rewards tier.

Accepted throughout both the United States and the European Union, it caters particularly well to international travellers. Crypto is converted to fiat at the point of sale without delay, and the card interfaces seamlessly with both Google Pay and Apple Pay.

Backed by the compliance framework of a regulated exchange, the solution combines adaptability with trusted security, simplifying global purchases.

| Pros | Cons |

|---|---|

| Up to 4% crypto rewards | Limited availability (US & EU only) |

| Spend directly from Coinbase wallet | High staking not available for rewards |

| Supports multiple cryptos | Conversion fees can be costly |

| Compatible with Apple Pay/Google Pay | Rewards limited compared to competitors |

5.Wirex Visa Card

The Wirex Visa Card is distinguished by its extensive flexibility, handling over 150 currencies—both conventional and digital. Users benefit from up to 8% cashback in Wirex’s proprietary WXT token, appealing to users who transact frequently. Issuable in more than 40 jurisdictions, the card includes no-fee multi-currency wallets

facilitating effortless transfers between fiat and cryptocurrency. The system supports Wallet integrations with Apple Pay and Google Pay, thereby enhancing transactional speed.

Wirex is further recognised for an intuitive mobile application, a broad geographical footprint, and its attractive reward infrastructure, solidifying its status among crypto users.

| Pros | Cons |

|---|---|

| Supports 150+ fiat & cryptos | Limited availability (40+ countries) |

| Up to 8% cashback in WXT | Cashback only in Wirex’s token |

| Multi-currency accounts | Exchange rates may vary |

| Works with Apple/Google Pay | Limited DeFi features compared to rivals |

6.BitPay Card

The BitPay Card, issued in the United States, provides a protected mechanism for direct expenditure of Bitcoin, Ethereum, USDC, and a selection of other widely adopted digital currencies. Instant conversion to US dollars occurs at the point of transaction, and compatibility with both Apple Pay and Google Pay streamlines the user experience.

Asset governance occurs exclusively via the BitPay mobile application, which permits card suspension, transaction oversight, and other essential controls in real time.

The issuance of the card incurs no conversion costs, and users may optionally elect for direct deposit into a traditional bank account.

Reinforced by strong security measures and a proven operational track record, the BitPay Card has been consistently rated among the most dependable crypto expense instruments in the US market.

| Pros | Cons |

|---|---|

| Supports BTC, ETH, USDC & more | Available only in the US |

| Instant crypto-to-USD conversion | No cashback or rewards |

| Works with Apple Pay & Google Pay | ATM withdrawal fees apply |

| No conversion fees | Limited to fiat conversion only |

7.Nexo Card

The Nexo Card distinguishes itself by allowing expenditure of digital assets without outright liquidation; user holdings constitute collateral that underpins a credit line.

Presently accessible in over thirty jurisdictions, the card imposes no periodic maintenance fees, nor costs for foreign transacting, and rewards holders with cashback of up to 2 percent in either NEXO utility tokens or Bitcoin. Integration with Apple Pay and Google Pay facilitates borderless commerce.

This credit-line paradigm specifically advances the strategic objectives of long-term cryptocurrency custodians, enabling them to retain appreciated assets.

The card furthermore offers adaptive repayment structures, thereby harmonizing practical expenditure with ongoing asset preservation.

| Pros | Cons |

|---|---|

| Spend crypto without selling (collateral-based) | Only available in select 30+ countries |

| No FX or monthly fees | Cashback limited to 2% |

| Up to 2% cashback in BTC or NEXO | Rewards capped compared to other cards |

| Compatible with Apple/Google Pay | Requires Nexo account & credit line setup |

8.Revolut Card (Crypto Feature)

The Revolut Card qualifies as a hybrid digital asset product rather than a dedicated crypto debit card. Its crypto-related functionality is seamlessly embedded within a broader no-border banking ecosystem.

Offered in a footprint exceeding 200 countries, the card accepts a living menu of more than 30 cryptocurrencies in tandem with fiat denominations.

Instant crypto-to-fiat conversion permits proprietary or public blockchain balances to be transformed at the POS or online checkout without prior limit restrictions, thus optimizing purchasing power in real time.

Auxiliary features—structured budgeting, fractional equity purchasing, travel insurance variants, and aggregator support for both Apple Pay and Google Pay—produce an elegant single-wallet experience, especially for frequent cross-border travelers.

Travelers view the Revolut Card as an all-in-one financial toolkit that accommodates legacy banking and digital assets on a single platform.

| Pros | Cons |

|---|---|

| Available in 200+ countries | Not a pure crypto card |

| Supports 30+ cryptocurrencies | Conversion fees may apply |

| Hybrid banking + crypto solution | No dedicated crypto rewards |

| Budgeting & investment features | Limited DeFi and staking options |

9.BlockCard (by Unbanked)

BlockCard by Unbanked delivers a crypto debit solution oriented toward the U.S. market, accepting an array of 12+ cryptocurrencies, including Bitcoin, Ethereum, and a suite of algorithmic and fiat-pegged stablecoins.

It is differentiated by the combination of absence of deposit limits and reward incentives that tier as high as 6% of transaction volume.

The fee schedule is competitive by industry standards, with no monthly maintenance charge, and all spending is settled in real time through on-chain and off-chain conversion at the point of sale, providing market-derived exchange rates.

BlockCard also permits the optional linkage of direct deposit streams in USD, which constituents can allocate to on-chain wallets or retain in fiat.

An application with single-sign-on architecture manages both crypto balances and reward tiers, allowing for point-redemption mechanics, making the BlockCard a versatile instrument engineered for high-frequency expenditures by digital asset custodians seeking maximum liquidity and utility.

| Pros | Cons |

|---|---|

| Supports 12+ cryptocurrencies | US-focused, limited global reach |

| Up to 6% rewards | Rewards depend on token staking |

| Unlimited deposits | Fees higher than some competitors |

| Simple app integration | No major perks like travel benefits |

10.Paycent Card

The Paycent Card is a multi-currency prepaid crypto debit card that facilitates both fiat and digital asset expenditure in more than 200 jurisdictions. Instant on-the-fly conversion allows users to pay anywhere traditional card networks operate while holding diverse cryptocurrencies.

The Paycent application provides seamless interfaces for real-time fund transfers, asset conversion, and balance oversight. Coverage extends across major tokens such as Bitcoin, Ethereum, and Litecoin, making it especially valuable for cross-border travelers.

The card’s comparatively low transaction fees and competitive exchange spreads position it as a compelling choice for users needing a reliable, borderless payment solution.

| Pros | Cons |

|---|---|

| Available in 200+ countries | Higher fees in some regions |

| Supports both fiat & crypto | Limited rewards compared to others |

| Works with multiple major cryptos | Customer support not as strong |

| Strong mobile app features | May require KYC delays |

11.Monolith Visa Card

The Monolith Visa Card leverages Ethereum smart contracts to offer a non-custodial debit instrument exclusively to custodial Ethereum users. Funds in Ethereum and DAI can be spent on-the-spot via direct card issuance while users retain control via compatible wallets.

Its operational footprint is limited to the UK and EU, targeting crypto-native users eager to interact with off-chain commerce.

Minimal transactional fees and instantaneous asset tokenization to fiat ensure smooth day-to-day use. Monolith’s integration with the Ethereum ecosystem delivers the double advantage of decentralization and global Visa acceptance, making it unique in the current card landscape.

| Pros | Cons |

|---|---|

| Ethereum-based, supports ETH & DAI | Limited to UK & EU only |

| Non-custodial wallet integration | No cashback or rewards program |

| DeFi-friendly and decentralized | Fewer supported cryptos |

| Low fees for DeFi users | Not ideal for casual users |

Conclsuion

In summary, the most advantageous cryptocurrency debit cards for international application deliver adaptive spending, attractive rewards, and effortless conversion from crypto to domestic currency across a vast merchant network.

While the cards vary in their principal advantages—ranging from cashback incentives to extensive geographical acceptance, and from traditional rewards to decentralized finance onboarding—they generally align to facilitate regular transactions with digital assets.

Selecting the most effective option is contingent upon individual residence, preferred digital currencies, and specific reward strategies, thereby affirming their status as strategic instruments for routine asset liquidation and utilization.

FAQ

A crypto debit card lets you spend cryptocurrencies by instantly converting them into fiat at merchants worldwide.

Yes, but availability depends on the provider. Some are region-specific, while others work in 100+ countries.

Many cards provide cashback (up to 8%), paid in native tokens or Bitcoin.