Why Binance is banned in Canada and what led to its exit from the market. Binance could not adhere to some of the compliance and regulatory requirements given to them in the region, and this in the end led to traders from Canada looking to alternative trading platforms.

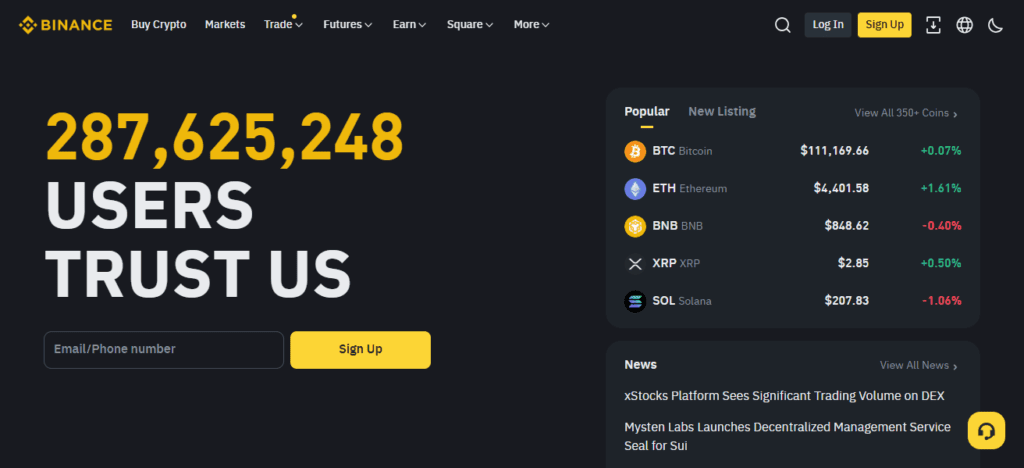

What is Binance?

Binance is the biggest cryptocurrency exchange in the world in terms of trading volume. It was founded in 2017 by Changpeng Zhao (CZ). It was originally based in China, but the company had to relocate after encountering regulatory problems.

The exchange permits users to deal in hundreds of cryptocurrencies, which include Bitcoin and Ethereum, as well as a multitude of altcoins. It provides users with features like spot trading and futures, as well as staking, savings, and a myriad of DeFi services.

They are recognized for their low trading fees, diverse selection of cryptocurrencies, and sophisticated trading instruments.

They also have their own blockchain called the BNB Chain, and a native token called BNB which grants users trading fee discounts and serves other purposes within Binance’s ecosystem. Currently, Binance boasts millions of users all over the globe.

Why is Binance Banned In Canada?

Incomplete Licensing

Binance did not get approval or registration from Canadian authorities, a necessary step in legally operating in Canada as a crypto exchange.

Inadequate Responses to Regulatory Concerns

Regulatory bodies, including the Ontario Securities Commission, legally directed Binance to cease operations in Canada.

Non-Compliance with Anti-Money Laundering and KYC Rules

Binance inconsistently performed Canada’s regulatory KYC and anti-money laundering statutes.

Canadian Investors’ Risks

Canadian investors were using a platform that lacked the necessary regulatory oversight, posing a risk.

International Regulatory Restrictions

Other nations have also restricted Binance as a result of global regulatory oversight.

Services Cut

Binance’s regulatory oversight forced it to cut or suspend its services to Canadian users, effectively shutting down the platform.

Implications of the Ban for Canadian Users

Users in Canada face consequences triggered by the ban on Binance. First, most Canadians can no longer use the advanced features Binance offers, such as spot trading, futures, and staking. Users also face account restrictions which might include limited or fully blocked access to deposits, withdrawals, and trading specific cryptocurrencies.

Unregulated trading constitutes an increased risk of loss as protection of funds traded remains outside Canadian jurisdiction, other than account restrictions.

Users seeking alternative fully compliant exchanges in Canada might face higher fees and limited options in cryptocurrencies, as the ban forces users to look for compliant exchanges. Users also face legal risk interacting with non-compliant exchanges which can increase the risk of regulatory scrutiny.

As such, the ban highlights the increased risk and loss of protection associated with unregulated platforms which can lead to an increase in accounts being used without the owner’s full knowledge.

Binance’s Response to the Ban

To address the ban in Canada, Binance has said they remain committed to respecting local regulations and working with the Canadian government to fix the situation.

The exchange is reportedly working on meeting local regulations that, among other things, include enhancements to KYC and AML frameworks.

Binance has reiterated its desire to provide users with a secure and positive trading experience while meeting the changing legal regulations.

The exchange specifically asked Canadian users to obey government instructions; and in response to government instructions, Binance limited and changed the services offered in that market.

The response to Canadian regulations shows Binance’s intent to remain compliant and operate in as many markets as possible.

Alternatives for Canadian Crypto Traders

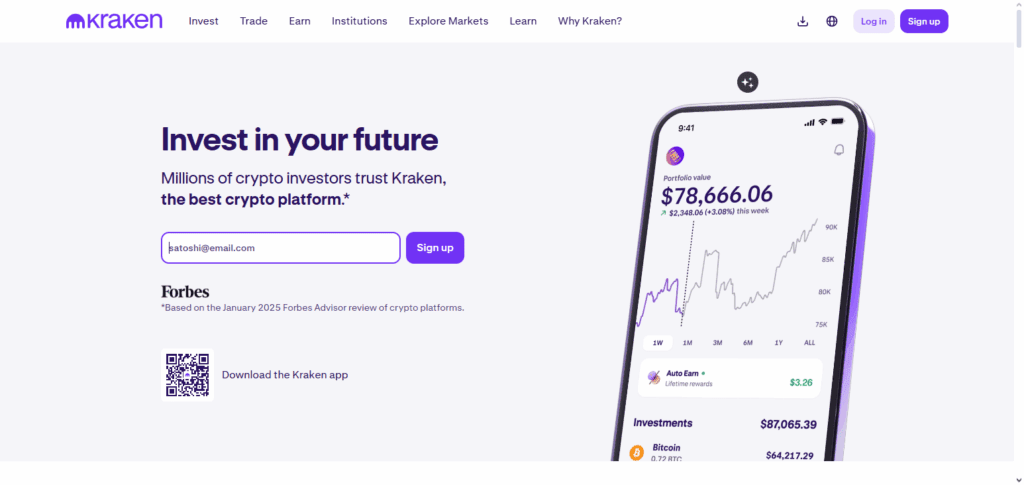

1. Kraken

“Kraken is a fully regulated exchange in Canada which as a result provides strong compliance and security features. Kraken provides spot trading, staking and futures trading and offers transparent fee structure.

Kraken is fully dependable as Canadian traders get to use Interac e-Transfers and wire transfers to fund their accounts.

Their responsive customer support, along with their reputation for safety, makes Kraken an ideal alternative for Canadians in need of Binance-like services and strict compliance for Canada.”

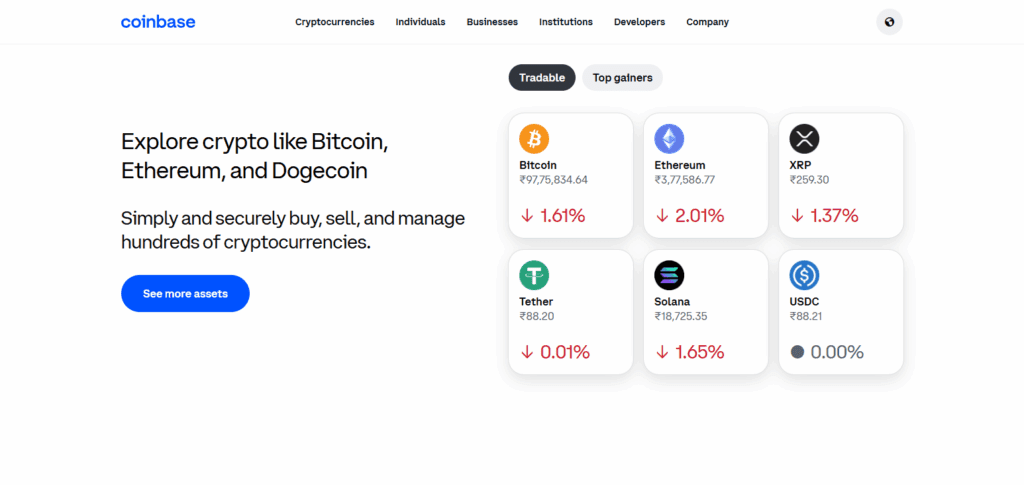

2. Coinbase

“Coinbase is considered to be one of the most convenient and the best crypto exchange in Canada. It accommodates customers of all experience levels as Coinbase boasts a simple to use interface.

Canadians have seamless access as the exchange offers over 200 cryptocurrencies and accepts CAD via Interac e-Transfers and debit cards.

Coinbase is regulated and compliant with Canadian law, however the exchange is fee heavy with trading costs around 0.5% plus a spread. Security measures, along with ease of access, makes Coinbase a great Binance alternative for Canadian investors.”

3. Bitbuy

Bitbuy is a Canadian exchange, and one of the safest options after the Binance ban, since it is fully compliant with Canadian security regulations. It offers Spot Trading, Express Trade and Pro Trade for various levels of users.

Competitive compared to other exchanges, the maker and taker fees ranging from 0.1%-0.2%. Users can fund their accounts with Interac e-Transfers, bank wires and crypto deposits.

Bitbuy is a Canadian exchange and registered with FINTRAC providing a widely available solution to Canadian traders with 24/7 support.

4. Crypto.com

In Canada, Crypto.com is one of the go to exchanges. Users can do spot trading, staking, and use Crypto.com Visa Cards, and access various DeFi services. It is easy to use and supports CAD deposits via e-Transfers and wire transfers.

The fees are very low, with maker-taker rates starting at just 0.075%. Crypto.com is safe and operates legally in Canada, as it follows Canadian securities regulations.

With the known mobile app and the Crypto.com ecosystem, it is a strong Binance alternative for Canadians wishing to add trading and lifestyle crypto services in a regulated environment.—

5. Newton

As one of the most affordable options within the Canadian cryptocurrency exchange market, Newton does not charge trading commissions, although there are spread charges.

Unlike most competitors, Newton accepts CAD deposits and withdraws through Interac e-Transfer, which is a bonus for cryptocurrency investors.

FINTRAC compliant Canadian investors will appreciate the 70+ cryptocurrencies and mobile-optimized design. Similar to Binance, many Canadian traders appreciate the effortless trading and regulatory clarity.

Conclsuion

To conclude, Why is Binance Banned In Canada because it did not comply with the stringent border regulatory rules on derivatives, investor protection, and registration.

Although it was the top crypto exchange in the country before, it’s exit showcases Canada’s resolve towards investor protection. For traders, focus now shifts to regulatory compliant alternatives in line with the Canadian changing crypto legislation.

FAQ

Binance officially announced its exit in May 2023.

New rules restricted stablecoins, required preregistration, and imposed stricter compliance for derivatives and investor protection.

Users were asked to close positions by September 30, 2023, and accounts were shifted to withdrawal-only mode.