In this article, I will examine the top aggregators with bridging functionality that also allow instant swaps. These services automate the transfer of tokens between disparate blockchains, with near real-time transfers and minimal fees.

They aggregate liquidity from diverse sources to yield the top swap rate and near instant execution. These aggregators streamline cross-chain transactions for tokens, NFTs, and even Layer 2s.

What is a Bridging Aggregator?

A bridging aggregator serves as an intermediary that integrates several blockchain bridges and decentralized exchanges (DEXs), thus simplifying the complexity of cross-chain transactions. It facilitates low-cost and high-speed blockchain token transfers by determining the most effective swap paths.

It improves liquidity from multiple platforms and aggregates them to decrease slippage and ensure low prices. These bridging platforms are compatible with several chains, Layer 2 networks, and widely traded tokens.

Thus simplifying accessibility for traders, developers, and DeFi clientele. These bridging aggregators now offer NFT transfers, yield opportunities, and developer tools. Thus, they are pivotal for secure and seamless management of multi-chain assets.

How To Choose a Top Bridging Aggregator With Instant Swaps

Supported Chains and Assets

Confirm if the aggregator offers services on the blockchains and tokens you want to transfer. An aggregator should be usable on a multitude of EVM chains, Layer 2 networks, and widely used assets to facilitate near-seamless cross-chain swaps.

Transaction Speed

Execution speed is essential, particularly for instant Layer 2 to Layer 2 and Layer 1 to Layer 2 swaps. Slow transfer speeds can be detrimental to trading and arbitrage opportunities, making instant swaps paramount.

Fees and Costs

Benchmark gas fees against bridging and platform fees. The best aggregators are able to route quickly without sacrificing cost efficiency.

Liquidity and Slippage

Minimal slippage is only possible with high liquidity during the swaps. Smoother transactions with reduced rates are possible with aggregators that draw liquidity from a number of DEXs and bridges.

Security and Reputation

Examine security audits, critiques, and telltale records of the protocol. The best aggregators are able to mitigate exposure to hacks, failed swaps, and loss of funds.

UInterface & Experience

Basic sophisticated user interfaces that are simple to navigate is useful for new entrants. The more adept traders can benefit from advanced user functionalities. A number of these platforms are able to provide bypass and routing options for instant swaps for ease of navigation.

Developer Support & Integrations

SDKs, APIs, and Smart Contract Integrations options are available for dApp developers. Integrated cross-chain functionality is available through developer-friendly aggregators.

Key Points

| Bridging Aggregator | Key Points |

|---|---|

| LI.FI | Multi-chain bridge & DEX aggregator, supports 20+ bridges, 200+ DEXs, and wallets like MetaMask; strong focus on liquidity sourcing. |

| Socket (Bungee) | Popular bridging & swapping aggregator; prioritizes speed, low cost, and best route execution; developer-friendly APIs. |

| Rango Exchange | Multi-chain DEX & bridge aggregator; supports cross-chain swaps across EVM & non-EVM chains; simple interface for users. |

| XY Finance | Provides cross-chain swaps, NFT transfers, and yield features; supports 20+ chains with fast routing. |

| Squid Router | Powered by Axelar; enables seamless cross-chain token & contract calls; developer-first infrastructure. |

| Rubicon | Decentralized order book protocol with cross-chain liquidity aggregation; focuses on efficient trading execution. |

| Owlto Finance | Layer 2-focused bridge for Ethereum scaling; supports fast, cheap transfers between L2 ecosystems. |

| Orbiter Finance | Specializes in L2-to-L2 bridging; ultra-low fees and fast settlement; popular among Ethereum rollup users. |

| Hop Protocol | Well-known rollup-to-rollup bridge; fast withdrawals from L2 to Ethereum; security-first design. |

| ChainHop | Multi-chain liquidity aggregator; supports direct cross-chain swaps without wrapped tokens. |

10 Top Bridging Aggregators With Instant Swaps

1.LI.FI

LI.FI has bridged over 20 liquidity providers and exchanges over 200 DEXs, which makes their cross-chain swaps seamless and instantaneous. More than 20 bridges DEXs and over 200 LI.FI systems with every DEX LI.FI seamlessly supports multi-chain bridging.

LI.FI provides instant transactions and supports instant transactions via MetaMask. LI.FI provides support access via APIs and SDKs for those ill cross-chain applications.

LI.FI is rooted in highly advanced routing technology, which is optimized for the most efficient and economical cross-blockchain swaps. With broad ecosystem support LI.FI’s advanced routing technology provides users and developers with broad support for instant swaps.

| Feature | Explanation |

|---|---|

| Type | Multi-chain bridge & DEX aggregator |

| Chains Supported | 20+ blockchains, 200+ DEXs integrated |

| Key Advantage | Finds cheapest and fastest routes for instant swaps |

| Developer Tools | SDKs & APIs for dApp integration |

| Wallet Support | Works with MetaMask and major wallets |

| Use Case | Best for users and developers needing efficient cross-chain swaps |

2. Socket (Bungee)

Socket, dubbed Bungee in its user interface, is the top provider offering cross-chain bridging—along with instant token swaps—and guarantees the lowest costs. Bungee uses proprietary technology to get the users the lowest cost, fastest, and most dependable routes available.

By pooling together the liquidity of multiple bridges and swap protocols, Bungee smoothens the execution process for both retail and institutional traders. Bungee’s developer-friendly APIs allow dApps to incorporate cross-chain transactions within their services easily.

Socket is a cross-chain bridging platform that is compatible with many different blockchains and Layer 2 networks. It also has an emphasis on ease of use and process optimization, which makes Bungee a preferred tool for instant cross-chain transactions.

| Feature | Explanation |

|---|---|

| Type | Cross-chain bridge & liquidity aggregator |

| Chains Supported | EVM + L2 networks widely supported |

| Key Advantage | Prioritizes low-cost, fast, and reliable swaps |

| Developer Tools | Powerful APIs for cross-chain integration |

| Interface | Bungee dApp for simple swaps |

| Use Case | Retail traders & developers seeking instant routes |

3. Rango Exchange

Rango Exchange, an innovative multi-chain swap aggregator, seeks to enhance software usability across blockchains. EVM-compatible and other non-EVM chains can enable users to cross-chain swap and bypass intricate bridge configurations instantly.

To achieve optimal exchange rates, Rango pools liquidity from many DEXs, bridges, and swap protocol liquidity providers. It facilitates cross-chain swaps of native coins, wrapped tokens, and cross-chain stablecoins.

Rango Exchange is simple enough for novices while offering sufficient complexity for seasoned traders. Rango Exchange’s extensive architecture interoperability and exchange proxy have made it one of the most effective instant cross-chain swap platforms in the world.

| Feature | Explanation |

|---|---|

| Type | Multi-chain DEX & bridge aggregator |

| Chains Supported | EVM & non-EVM blockchains |

| Key Advantage | Unified swaps across chains in one step |

| Interface | Beginner-friendly, advanced options for traders |

| Liquidity Source | Aggregates DEXs + Bridges |

| Use Case | Users wanting easy instant swaps across different ecosystems |

4. XY Finance

XY Finance offers extensive cross-chain liquidity aggregation services to tokens, NFTs, and even GameFi assets. With more than 20 blockchains supported, rapid and economical instant swaps are available.

Its routing algorithm secures the optimal pricing over several bridges and DEXes. XY Finance’s broader asset coverage is beyond tokens to NFTs and gaming tokens.

XY Finance’s cross-chain swaps are instant and powerful, multi-chain, beginner NFTs and yield features integrated into the platform. XY Finance is notable for its simplicity and powerful tools for developers.

| Feature | Explanation |

|---|---|

| Type | Cross-chain liquidity aggregator |

| Chains Supported | 20+ chains for tokens, NFTs, GameFi |

| Key Advantage | Transfers beyond tokens (NFTs, GameFi assets) |

| Routing | Best swap paths with instant execution |

| Extra Feature | Yield & DeFi integration |

| Use Case | Traders needing tokens + NFT cross-chain swaps |

5. Squid Router

Squid Router isa cross-chain liquidity protocol built on Axelar’s infrastructure that enables instant swaps and cross-chain contract calls. Unlike most bridges, Squid Router allows users and developers to interact with dApps spanning multiple chains freely.

Squid consolidates liquidity to enhance the speed of transaction execution and efficiently routes swaps. Its developer-first construct offers extensive APIs and SDKs, ensuring optimal execution of on-chain transactions, and covers a large spectrum of assets.

Squid Router is a proven, reliable platform for instant swaps and cross-chain dApp interactions using Axelar’s seamless security and interoperability.

| Feature | Explanation |

|---|---|

| Type | Cross-chain liquidity + smart contract router |

| Chains Supported | Built on Axelar network |

| Key Advantage | Enables contract calls across chains |

| Developer Tools | SDKs + APIs for dApps |

| Security | Backed by Axelar’s interoperability layer |

| Use Case | Developers & protocols needing cross-chain functionality |

6. Rubicon

Rubicon is an innovative cross-chain decentralized order book protocol that enables fast and efficient swaps by aggregating liquidity across chains.

While Rubicon is not an automated market maker, it provides order book-based trading with instantaneous execution, thus enhancing control and transparency for users.

Its aggregation provides optimal pricing and deep liquidity, serving retail and institutional traders. Its capability for integration with cross-chain protocols also expands its functionality beyond single-chain ecosystems.

For its efficient trading design, Rubicon is considered a one-of-a-kind aggregator in the market, offering near-instant swaps and competitive pricing.

| Feature | Explanation |

|---|---|

| Type | Decentralized order book protocol |

| Chains Supported | Focus on Ethereum + cross-chain expansion |

| Key Advantage | Order book model for instant execution |

| Liquidity Source | Deep aggregated liquidity pools |

| Unique Feature | More control than AMM-based swaps |

| Use Case | Traders seeking transparent, order-book swaps |

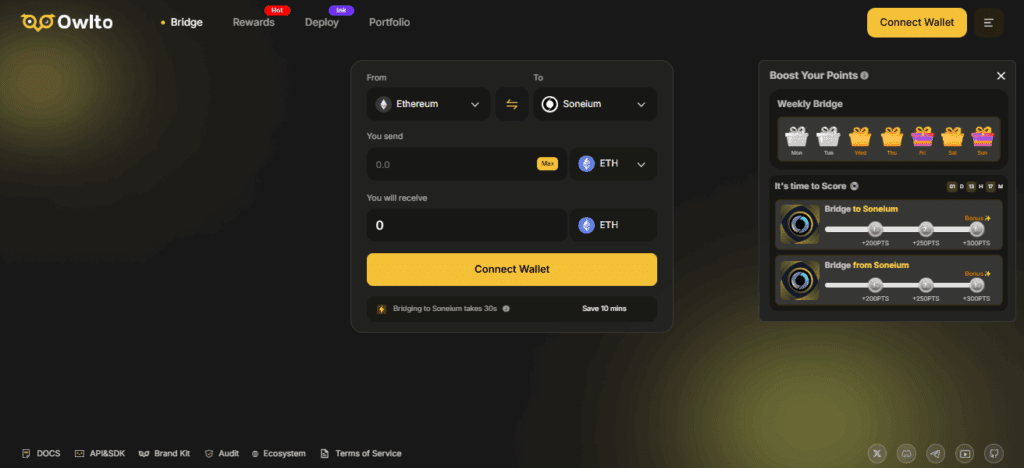

7. Owlto Finance

Owlto Finance is a cross-chain bridge that allows fast and inexpensive swaps within and between Ethereum scaling solutions with a focus on Layer 2 infrastructure.

Targeting ecosystems like Arbitrum, Optimism, and zkSync, it allows instantaneous transfers at a fraction of the gas fees charged by traditional bridges.

The platform is user-friendly and secure, also serving citizens of Ethereum’s scaling ecosystem. With a focus on Layer 2 swaps, Owlto Finance is rapidly becoming a preferred infrastructure provider for low-latency and low-cost bridge connections between rollups and sidechains.

| Feature | Explanation |

|---|---|

| Type | Layer 2-focused bridge |

| Chains Supported | Optimism, Arbitrum, zkSync, etc. |

| Key Advantage | Ultra-fast, low-cost transfers between L2s |

| Interface | Easy-to-use swap dashboard |

| Specialization | Ethereum scaling solutions |

| Use Case | Users frequently bridging between L2 networks |

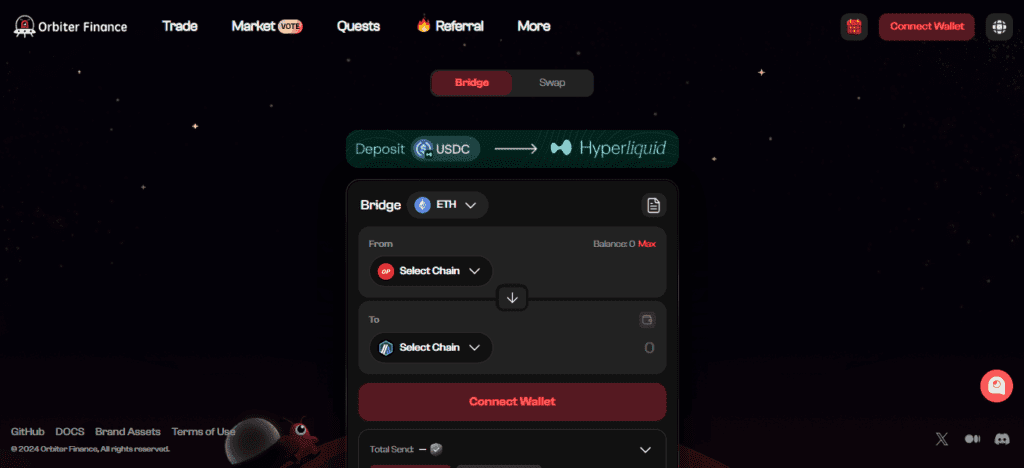

8. Orbiter Finance

The company Orbiter Finance works on instantaneous transfers from Layer 2 networks of Arbitrum, Optimism, zkSync, StarkNet, and the broader Ethereum framework. Traders and individuals specialized in decentralized finance readily employ Orbiter’s protocol because of its ultra-low fees and instantaneous settlement capabilities.

In contrast to other alternatives, Orbiter Finance bridges only rollups, which are types of layer 2 blockchains, ensuring uninterrupted Ethereum interchanges.

Community support is strong and, coupled with the efficient and economic transaction times, Orbiter is regarded as one of the foremost bridging services for instantaneous Layer 2 changes.

| Feature | Explanation |

|---|---|

| Type | L2-to-L2 bridging protocol |

| Chains Supported | Arbitrum, Optimism, StarkNet, zkSync |

| Key Advantage | Instant rollup-to-rollup transfers |

| Transaction Speed | High-speed settlement, low fees |

| Focus | Specializes only in L2 transfers |

| Use Case | Ethereum rollup users needing fast swaps |

9. Hop Protocol

Hop Protocol is a bridging protocol designed to facilitate transfers between Ethereum and its Layer 2 rollups almost instantaneously.

Users can exchange and withdraw stablecoins, ETH, and other tokens on supported networks through the ability to near-instantly withdraw, provided by the protocol’s unique liquidity pool mechanism, which solves slow L2-to-L1 withdrawal times.

Ethereum users can readily utilize Hop Protocol due to its open-source structure and solid security model. Traders who require quick transfers between rollups such as Optimism, Arbitrum, and Polygon place a lot of value on Hop Protocol’s ability to provide safe and instantaneous cross-chain swaps.

| Feature | Explanation |

|---|---|

| Type | Rollup-to-rollup bridge |

| Chains Supported | Ethereum, Polygon, Arbitrum, Optimism |

| Key Advantage | Near-instant withdrawals from L2s to L1 |

| Mechanism | Liquidity pool-based system |

| Security | Open-source & trusted by Ethereum community |

| Use Case | Traders needing secure swaps between L1 & L2s |

10.ChainHop

ChainHop offers a cross-chain multi-chain liquidity aggregator that enables swaps directly across blockchains without the excessive use of wrapped tokens. Its adaptive routing technology selects the fastest and cheapest paths across blockchains, allowing users to obtain swaps rapidly and at low costs.

Through the integration of multiple bridges and DEXs, users are no longer required to perform swaps from one blockchain to another manually; essential bridging and swaps are done seamlessly. This offers optimal bridging and swapping that is hassle-free.

ChainHop is geared toward offering multiple chains and assets, which enables users to transfer funds in a second. Because it offers direct swaps, it is an emerging aggregator for instant cross-chain transactions.

| Feature | Explanation |

|---|---|

| Type | Multi-chain liquidity aggregator |

| Chains Supported | Supports major EVM chains |

| Key Advantage | Direct cross-chain swaps without wrapped tokens |

| Routing | Best path algorithm for low cost |

| Interface | Smooth, beginner-friendly |

| Use Case | Users seeking direct and efficient instant swaps |

Conclsuion

In conclusion, aggregators of cross-chain swaps such as LI.FI, Bungee, Rango, XY Finance, and Hop Protocol have optimally solved liquidity issues while maintaining speed, low cost, and low slippage.

Top bridging aggregators with instant swaps maintain reliable liquidity at a low cost and provide seamless and quick cross-chain swaps. Users are trained to appreciate the ability of the selected aggregator to facilitate safe and rapid token, NFT, and asset cross-chain moves, thereby making cross-chain trading seamless and widely available.

FAQ

A bridging aggregator connects multiple bridges and DEXs to enable fast, low-cost cross-chain token swaps.

LI.FI, Socket (Bungee), Rango Exchange, XY Finance, Squid Router, Rubicon, Owlto Finance, Orbiter Finance, Hop Protocol, and ChainHop.

They use aggregated liquidity and optimized routing to execute cross-chain transfers quickly with minimal delays.