In this article, I’ll address Peer-To-Peer Bridging Aggregators to Avoid Centralized KYC. Users can securely and privately transfer assets across different blockchains while avoiding centralized intermediaries.

They utilize smart contracts and decentralized liquidity for non-custodial and cross-chain swaps, keeping them fast and reasonably priced. This enables users to control their assets and cross blockades without KYC.

Key Points & Peer-To-Peer Bridging Aggregator To Avoid Centralized KYC

| Aggregator | Key Features |

|---|---|

| Rango Exchange | Multi-chain support, integrates with major wallets, fast routing |

| Jumper Exchange | Aggregates multiple bridges, user-friendly interface, privacy-focused |

| Chainspot | Decentralized routing, supports EVM and non-EVM chains |

| Bungee Exchange | Powered by Socket protocol, efficient gas usage, no KYC |

| LI.FI Protocol | Smart routing across bridges and DEXs, developer-friendly |

| Across Protocol | Optimized for speed and low fees, Ethereum-centric bridging |

| Hop Protocol | Layer-2 focused, fast transfers between Ethereum rollups |

| Synapse Protocol | Supports multiple chains, liquidity pools for seamless swaps |

| Celer cBridge | High-performance bridging, wide chain support, no KYC |

| GhostSwap | Privacy-first, multi-chain token swaps, no identity verification |

10 Peer-To-Peer Bridging Aggregator To Avoid Centralized KYC

1. Rango Exchange

Rango Exchange is a cross-chain bridge aggregator and eliminates centralized KYC through its unique, fully decentralized approach to cross-chain and cross-asset swapping.

Rango utilizes smart contracts and liquidity providers to delay or eliminate KYC completions. Rango proudly claims no swaps will ever require KYC as long as they use customer wallets.

KYC is required at off-ramps, and customer wallets are a means of defaulting, fully KYC exempt wallets.

KYC exempt wallets will allow customers to access Rango and charge fees at rates not required to allow onboarding at centralized portals. Rango optimally routes swaps to reduce expenses and improve efficiency.

Features Rango Exchange

Decentralized Cross-Chain Swaps – Supports asset transfers across multiple blockchains without intermediaries.

Non-Custodial Transactions – Users retain full control of funds, eliminating centralized risk.

KYC-Free Access – No personal information is required for using the platform.

Liquidity Aggregation – Routes transactions through multiple decentralized liquidity sources for better rates.

Smart Contract Execution – Automated and secure transfers handled via audited contracts for transparency and safety.

2. Jumper Exchange

A cross-chain liquidity aggregator called Jumper Exchange aims to provide secure and non-custodial bridging services.

Jumper circumvents KYC safety nets and allows P2P swaps directly between wallets. Jumper combines multiple liquidity access points with blockchain bridges to tailor seamless and rapid transitions.

With no central confirmation needed, smart contracts provide safety verification and execute bridging and fund transit. Users can defy anonymity and access various DeFi ecosystems.

Jumper promotes decentralized execution and routing to avoid regulatory chains of custody linked to identity verification. Users are empowered with seamless and effortless cross-chain asset transfers.

Features Jumper Exchange

Peer-to-Peer Swaps – Allows direct wallet-to-wallet asset transfers.

Multi-Bridge Integration – Aggregates liquidity from various bridges to optimize transfers.

Privacy-Focused – Bypasses centralized KYC processes for enhanced anonymity.

Cost-Efficient Routing – Optimizes transaction paths to reduce fees and slippage.

Non-Custodial – Users maintain ownership of funds at all stages.

3. Chainspot

By combining multiple bridges, Chainspot allows asset transfers without central KYC to be done through a decentralized cross-chain routing protocol.

Users can directly and privately shift tokens across various blockchains from their wallets devoid of supervision using automated routing algorithms.

Fees and speeds get optimized for every transaction through a self-directed system that chooses the best route.

Funds are exclusively controlled by the users at every stage through to the completion of the transaction using their self-directed system.

For privacy-focused traders and DeFi users, Chainspot provides a rapid, inexpensive, and unrestricted KYC bridging between numerous blockchain ecosystems.

Features Chainspot

Decentralized Routing Protocol – Determines the optimum path to take for cross chain transactions.

KYC-Free Usage – Transfers Rango Exchange without proving their identity.

Smart Contract Security – Automated smart contracts ensure trustless execution.

Multi-Chain Support – Provides bridging across several ecosystems of blockchains.

Optimized Fees & Speed – Employs aggregator logic to reduce costs and delays.

4. Bungee Exchange

Bungee Exchange specializes in cross-chain bridges and aims to make cross-chain transactions as uncomplicated as possible without compromising privacy.

It links several decentralized protocols to permit users to exchange and transfer assets in and out of blockchains without identity verification.

Bungee Exchange uses smart contracts to route assets and ensure that liquidity is available and fairly priced in the integrated partners.

Meanwhile, users of Bungee Exchange can simply keep all of their assets without worrying about centralized risks.

Bungee Exchange minimizes transfer route distance, and therefore, transaction fees, to optimize the movement of assets.

By facilitating direct peer-to-peer exchanges, Bungee Exchange provides a fully alternating decentralized and privacy-respecting option for cross-chain asset transfers without identity verification.

Features Bungee Exchange

Non-Custodial Cross-Chain Swaps – Users own their assets.

Decentralized Aggregator – Accesses multiple bridges and sources of liquidity.

KYC-Free Transactions – No centralized identity verification is required.

Optimized Transaction Paths – Fees and processing time are minimized.

Secure Smart Contracts – Transfers are executed safely and in a transparent manner.

5. LI.FI Protocol

LI.FI Protocol is a bridging aggregator custom made for non-custodial KYC-free crossing multiple chains.

It optimizes cross-chain swaps by uniting the liquidity and routing systems of multiple decentralized bridges.

While LI.FI uses smart contracts for automated and secure execution of cross-chain swaps, the users control their assets.

It relieves users of the complex decentralized networks crossing multiple bridges, and eliminates the need for central intermediaries.

It is modular for integration with various DeFi ecosystems allowing private, efficient, and fast token routing.

LI.FI appeals mostly to users who want to cross multiple chains with a high level of decentralization, privacy and simplicity.

Features LI.FI Protocol

Multi-Chain Bridge Aggregator – Enables transfers across multiple blockchains.

Non-Custodial – Users have complete control of their assets.

KYC-Free Access – Privacy is maintained while accessing different networks.

Dynamic Routing – Determines the fastest and most economical routes.

DeFi Integration Friendly – Integration with other decentralized apps is a breeze.

6. Across Protocol

Across Protocol is a decentralized bridge aggregator with no centralized KYC processes. It combines different bridging services to deliver the best possible options for cross-chain swaps.

It guarantees low prices and quick processing times. Transactions are handled by smart contracts and users retain full access and control of their funds.

Across Protocol tries to avoid all custodial mixers for privacy and KYC concerns. Across Protocol is perfect for users who want fast and easy access to multiple blockchains and care about privacy.

Its aggregation system improves the user experience by guaranteeing the availability of the system’s liquidity.

Features Across Protocol

Decentralized Cross-Chain Bridge – No centralized control for asset transfers.

KYC-Free Transactions – No personal data is needed.

Liquidity Aggregation – Improved efficiency by routing through multiple sources.

Smart Contract Security – Execution is trustless and guaranteed.

Low Fees & Fast Transfers – Routing is optimized for speed and cost.

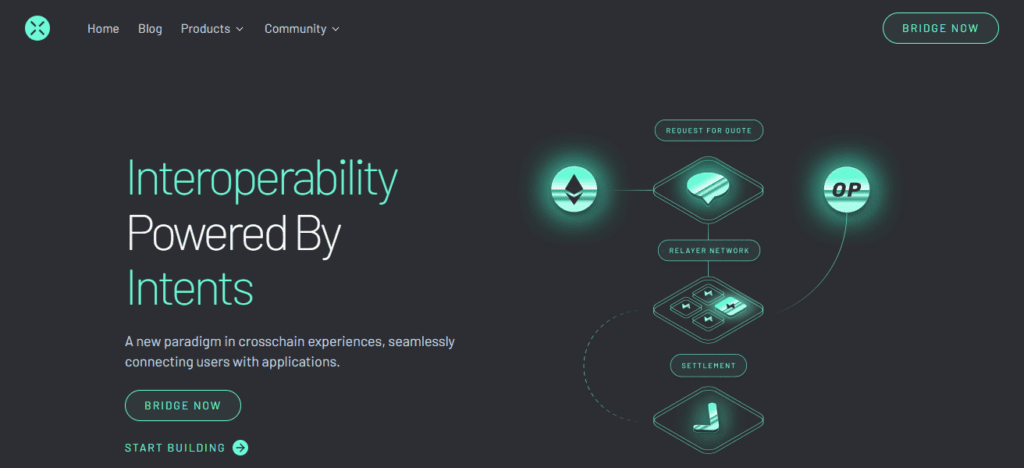

7. Hop Protocol

Hop Protocol is a layer-2 bridging solution to seamlessly and efficiently cross chains without centralized KYC.

Its primary focus is on the Ethereum Layer-2 ecosystems and the surrounding chains. Hop utilizes automated liquidity pools and smart contracts to deliver fast transfers, and users retain full control of their tokens.

Hop uses KYC-free P2P transfers to enable users to move assets directly from their wallets, and is perfect for active participants of the decentralized economy

who are looking for a KYC-free, low-cost, cross-border transfer system with minimum intermediaries.

Features Hop Protocol

Layer-2 & Multi-Chain Support – Focused on fast transfers within Ethereum L2s and beyond to other chains.

KYC-Free Swaps – User anonymity is maintained.

Non-Custodial – Users maintain complete control over their assets.

Liquidity Pool-Based Transfers – These transfers minimizes slippage and transaction time.

Cost Effective – Consolidates liquidity to reduce transaction fees.

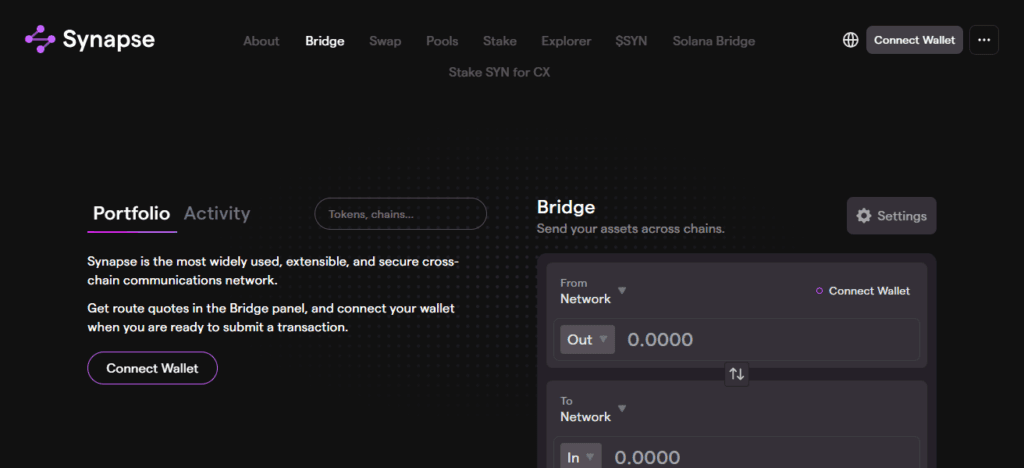

8. Synapse Protocol

Synapse Protocol is a cross-chain bridge and liquidity aggregator that enables KYC-free transfers across several blockchains at a time.

It uses smart contracts and liquidity pools to swap assets while allowing users to take custody of funds.

Synapse aggregates routes across different blockchain bridges to swap assets in a gas-efficient manner and at greater speeds to ease cross-chain transactions.

By not using centralized services, Synapse protects user privacy and custodial risks. Its non-custodial architecture is built to safely and seamlessly permit users to participate in a multi-chain DeFi ecosystem.

Users wanting to decentralized peer-to-peer bridging Synapse Protocol will bridge targeted assets to be used on DeFi services without the hassle of revealing personal information.

Features Synapse Protocol

Decentralized Cross-Chain Transfers – Assists various blockchain networks.

KYC-Free Access – Operates privately.

Liquidity Routing – Diversely sources liquidity to complete a transaction.

Security via Smart Contracts – Trustless execution offers guaranteed security.

Rationalized Gas & Processing – Smart contracts enhance gas optimization and transaction processing

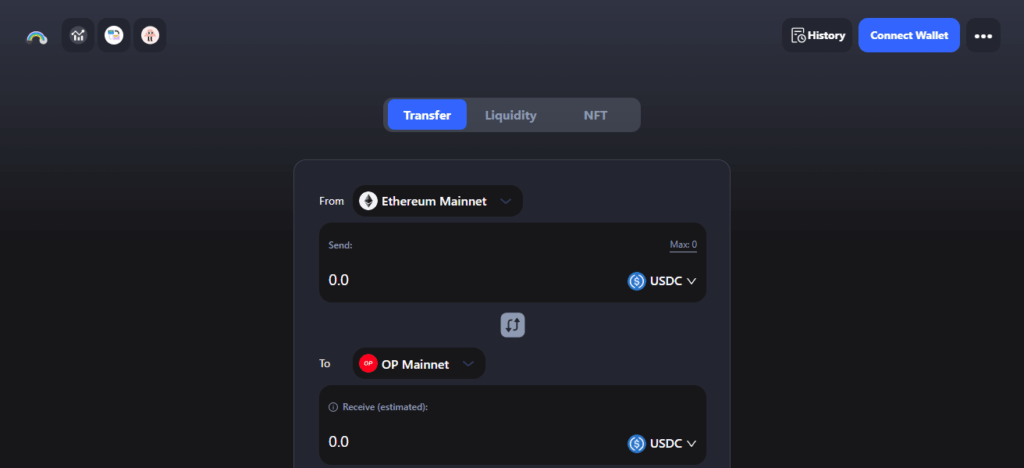

9. Celer cBridge

Celer cBridge is a decentralized cross-chain bridging protocol that lets users transfer assets without personal information being recorded.

It sources liquidity from multiple places to execute fast and low-cost token swaps on the supported networks.

Funds under the user’s control, remain safe and non-custodial while smart contracts execute the transfer and closing of the swap.

The cBridge system’s peer-to-peer construction lowers the need for KYC-ensuring third parties in the transfer channels.

DeFi users will appreciate the multi-token and batch transfer systems. Celer cBridge for cross-chain transfer operations is notable for fast and efficient services while being KYC-free.

Features Celer cBridge

Non-Custodial Transfers – Users manage their funds entirely.

KYC-Free Cross-Chain Swaps – User KYC is not required.

Liquidity Aggregation – Better rates from various sources.

Multi-Token Support – There is extensive asset support.

Execution is Fast & Secure – Trustless transfers are protected by smart contracts.

10. GhostSwap

GhostSwap prioritizes confidentiality for decentralized bridging and swapping. Users can transfer assets across GhostSwap’s supported chains without completing a KYC.

GhostSwap balances pricing and slippage through several liquidity providers. Smart contracts are designed to allow users full control of funds.

GhostSwap boosts the privacy and security of transfers by eliminating custodial delays. Users looking for privacy, low fees, and reliable cross-chain swaps choose GhostSwap for their DeFi activities.

Its automated liquidity routing moving through multiple decentralized networks is what sets GhostSwap apart from its competitors.

Features GhostSwap

Decentralized Swapping – Cross-chain transfers are accessible via peer-to-peer.

Complete KYC-Free Privacy – There is no identity verification.

Liquidity Routing – Sources are aggregated to determine the best rates for swaps.

Non-Custodial Control – Users control their assets at all times.

Secure Smart Contracts – Ensures safe, trustless transactions.

Conclsuion

To summarize, Peer-To-Peer Bridging Aggregators provide an affordable, decentralized, and private method to transfer assets across blockchains without going through centralized KYC processes.

They guarantee privacy, cost efficiency, and user control through the use of smart contracts and aggregated liquidity.

Such platforms give users the tools needed to access various networks in a streamlined, secure, and anonymous fashion. It’s easy to see the necessity of these platforms in current decentralized finance.

FAQ

It’s a platform that allows users to transfer assets across blockchains directly, without intermediaries.

By using decentralized smart contracts, users can swap tokens without submitting personal information.

Yes, funds remain in your wallet until the transaction is completed, ensuring non-custodial security.

Most aggregators support multiple networks like Ethereum, BSC, Polygon, and Layer-2 chains.

Yes, aggregator protocols optimize routes to reduce time and transaction costs.