This article outlines how to run bridging aggregator liquidity mining campaigns with an emphasis on step-by-step strategies for enhancing cross-chain liquidity, reaching out to potential users, and optimizing token incentives for cross-chain liquidity mining.

It covers campaign design, reward structure design, technical implementation, community engagement, and performance tracking to efficiently and successfully monitor and secure liquidity mining activities on many blockchains.

What is a Bridging Aggregator?

A bridging aggregator works under the DeFi umbrella. It allows connection between multiple blockchains in a network, and enables users to move assets between them.

For the fastest, cheapest, and most efficient transactions, they do not depend on a single bridge. They obtain their liquidity from several sources.

The reduction of costs and the improvement of user experience encourages the use of decentralized finance

Greater capital efficiency, and provides unfocused liquidity access from different ecosystems to projects. All of this fragmentation lessens the accessibility of DeFi.

How To Run Bridging Aggregator Liquidity Mining Campaigns

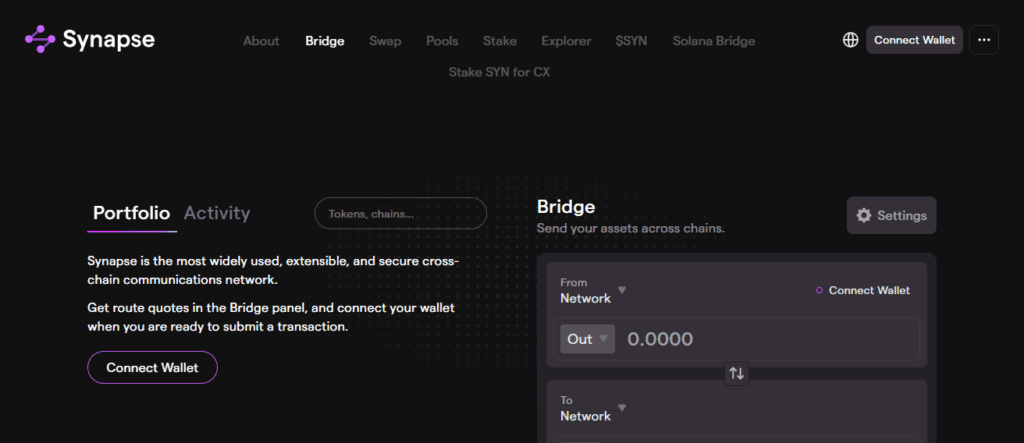

Example: Running a Liquidity Mining Campaign on Synapse Protocol

Set Campaign Goals

- Aim to grow the total value locked (TVL) on Synapse pools.

- Target users to bridge assets over Ethereum, BSC, and Polygon.

- Increase the adoption and engagement of the tokens.

Define Target Users

- Target cross-chain DeFi users currently active on Ethereum, BSC, and Polygon.

- Target liquidity providers (LPs) that would be interested in staking assets in Synapse pools.

Design Reward Structure

- Determine how many tokens will be set aside in total (for example, 500,000 SYN tokens).

- Use proportional rewards: LPs will be compensated based on the amount and duration of liquidity that they provided.

- Create bonus tiers for those who bridge between certain chains or provide liquidity to lower utilized pools.

Technical Setup

- Create a smart contract that will capture the LP’s contributions and issue SYN rewards to them.

- Setup Synapse’s bridging API to get real time bridging data across the chains.

- Make sure to perform a proper audit to capture any potential vulnerabilities.

Launch Marketing Campaign

- Communicate the news through social platforms and DeFi communities as well as Telegram and Discord.

- Explain the steps on how users are meant to participate.

- Hold AMAs and provide users with tutorials and walkthroughs to guide them.

Monitoring Feedback

- Monitor TVL size, active users, and bridging volume.

- Change reward multipliers/bonus tiers and add bonus tiers to encourage user participation.

- Deliver rewards within the promised time to keep users’ trust.

Feedback and Adjust

- Analyze campaign performance, including TVL, bridging, and retention.

- Collect participant feedback relevant to the campaign.

- Strategize the next liquidity mining cycle with prudence.

Why It Matters for Bridging Aggregators

Considering its importance for liquidity in bridging optimizers, cross chain liquidity mining helps make transfer of assets more efficient.

With more liquidity, cross chain asset transfer becomes more reliable, faster, and cheaper. Platforms with higher liquidity and lower slippage attract more users and enhance their market reputation.

This also incentivizes users to participate in liquidity mining for extended periods of time. For projects, increased liquidity means utility of their tokens increases

Driving adoption along more chains, generating more network effects, and amplifying growth in the DeFi space and cross chain interoperability.

Planning a Bridging Aggregator Liquidity Mining Campaign

Setting Goals: Identify campaign goals like increasing cross-chain liquidity, user onboarding, and engagement at various levels on the platform.

KPIs: TVL, user acquisition, retention: Evaluate the campaign on dimensions like TVL, user growth, and user return rate to assess its liquidity impact.

Reward Strategy (token emissions, bonus tiers): Develop a reward structure centered on tokens and bonus tiers to entice users to provide liquidity.

Target Audience Identification: Identify users most likely to engage, especially cross-chain DeFi users and liquidity providers, to focus your campaign.

Identifying Chains and Communities: Engage with blockchains and ecosystems where liquidity is underutilized but user interest is likely to be strong.

Prioritizing High-Value Liquidity Providers: Encourage users providing larger cliques with additional rewards to create a meaningful impact on TVL.

Designing the Campaign Mechanics

- Liquidity Tracking and Eligibility

- Which bridges and pools are eligible

- Metrics for calculating rewards

- Reward Distribution Models

- Fixed vs proportional rewards

- Time-weighted incentives

- Gamification and Retention

- Tiered rewards

- Staking multipliers or leaderboard competitions

Technical Setup

Smart Contract Deployment: Deploy strong smart contracts for secure reward distribution and reward automated management of inflation and liquidity stakes.

Reward Contracts and Staking Mechanisms: Create self-staking systems for pools and contracts that reward liquidity and determine stake time for each pool.

Integration with Bridging Aggregator Platforms: Use APIs to automate data exchange and smart contracts to track liquidity and dynamically adjust rewards during bridging.

API or Smart Contract Integration: Implement constant data exchange and user activity monitoring to automate reward management and prevent fraud.

Security Considerations: Implement security audits, exploit tests and emergency withdraw functions to prevent token hacks and loss during bridging.

Marketing and User Acquisition

Community Engagement

Build trust and encourage participation by communicating with users through social media, Telegram, and Discord.

AMAs, Social Media Campaigns

Educate users and stimulate interest in the campaign by conducting AMAs and executing social media marketing activities.

Partnering with Other Chains or Communities

Engaging with other blockchain networks allows tapping into new users and expanding cross-chain liquidity use.

Educational Content

Effective participation in liquidity mining as a user should be emphasized through step-by-step tutorials and guides.

Referral and Incentive Programs

Reward users for onboarding new customers and increasing liquidity to the platform.

Monitoring and Optimization

Tracking Campaign Performance: Constantly evaluate campaign effectiveness by assessing metrics such as total value locked, active users, and bridging volume.

Adjusting Rewards and Incentives: Change reward models proactively for engagement, optimize unsustainable surplus and unsustainable deficit ranges, and keep token systems in equilibrium.

Responding to Low Participation: Determine which pools or chains are attracting fewer liquidity providers and shift your incentives or marketing strategies accordingly.

Avoiding Over-Inflation of Tokens: Control the outflow of tokens to preserve worth and prevent the ecosystem from unsustainable long-term value erosion.

Post-Campaign Analysis: Determine the order of operations by documenting successful campaign elements and outlining remaining challenges for future work.

Planning for Next Campaigns: Refine targeting, reward mechanisms, and campaign design with insights from previous initiatives to maximize desired outcomes.

Risks and Challenges

User Education and Impermanent Loss: Users risk losing funds and understanding errors which participation education will solve.

Complexity of Liquidity Across Multiple Chains: Operational and technical difficulties multiply with liquidity management across chains.

Engagement Potential and Gas Fees: Users will disengage if there are high costs or little interest.

Conclusion

To wrap things up, it is clear that a successful bridging aggregator liquidity mining campaign requires thorough planning, defined objectives, and specific incentives.

A well thought out integration of the technical elements combined with marketing and ongoing assessment facilitates active involvement and increases cross-chain liquidity.

Expected outcomes can be achieved by risk mitigation, user education, and proper engagement analysis.

This approach enhances token value and earns lasting trust from the community, setting the foundation of future campaigns and the sustainable growth of the DeFi ecosystem.

FAQ

A platform connecting multiple blockchains for seamless cross-chain asset transfers.

Users provide liquidity to earn rewards, usually in platform tokens.

To increase cross-chain liquidity, attract users, and boost token adoption.

Define KPIs like TVL, user growth, and retention.

Rewards can be proportional, fixed, or tiered based on contributions.