In this article, I’ll guide you through how to manage crypto taxes across multiple chains. With traders using Ethereum, BNB Chain, Solana, and more, tax reporting can quickly get complicated.

We’ll explore practical strategies, tools, and common mistakes to avoid, helping you stay compliant while simplifying the entire multi-chain tax management process.

Understanding Crypto Tax Basics

Taxation of cryptocurrencies hinges on the classification assigned by taxing authorities, which typically categorize digital assets as either property or capital assets.

Consequently, taxable events consist of converting cryptocurrency into fiat currency, executing cross-chain token swaps, accruing rewards from staking or yield farming, and disposing of non-fungible tokens (NFTs).

Accuracy in recomputing the taxable consequence in each scenario necessitates the determination of cost basis, realization of gains, or recognition of income.

Related costs, such as gas fees incurred during the on-chain transactions, may also influence the final taxable amount and should not be disregarded.

Comprehending these fundamental principles affords cryptocurrency participants a framework for fulfilling compliance obligations and for mitigating the risk of materially inaccurate disclosures.

How To Managing Crypto Taxes Across Multiple Chains

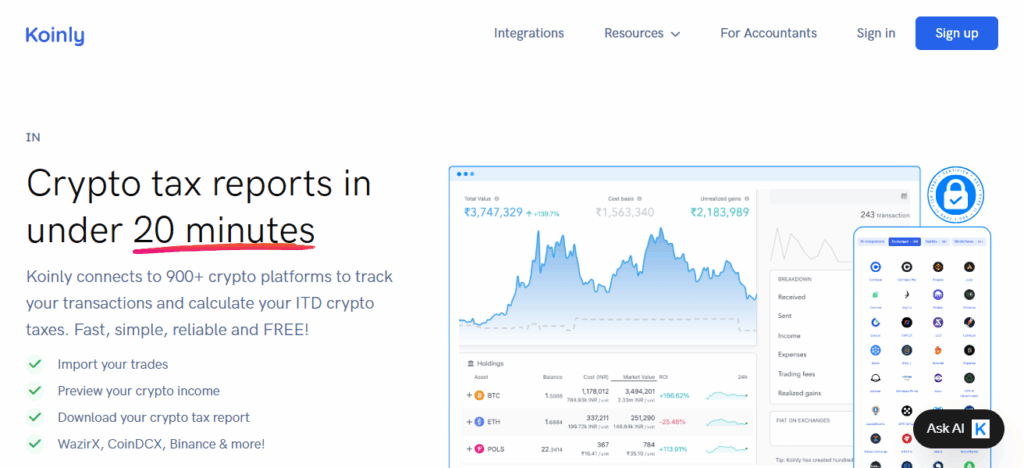

Example: Managing Multi-Chain Crypto Taxes with Koinly

Create an Account – Register on Koinly. Select your residency to guarantee home-country tax regulations drive the computations.

Add Wallets & Exchanges – Link all relevant wallets (Ethereum, BNB Chain, Solana, Polygon, etc.) using public keys or, where supported, API keys.

Import Transactions – Koinly systematically retrieves on-chain events—swaps, cross-chain bridges, staking rewards, NFT trades, and gas costs—saving manual entry.

Review Data – Scrutinize for omitted or duplicated records, paying extra attention to transactions involving bridges, which are known to exhibit importing inconsistencies.

Auto Cost-Basis Calculation – The platform pairs acquisitions and dispositions, includes attributable gas, and computes realised or realised gains for each event.

Tax Report Generation – Generate downloadable tax documentation tailored to your jurisdiction (e.g., IRS Form 8949, HMRC Capital Gains, ATO, etc.) within minutes.

Stay Organized – Leverage Koinly’s portfolio overview to track assets across all connected blockchains and to proactively align your records with impending fiscal cut-off dates.

Challenges of Multi-Chain Taxation

Fragmented wallets and assets across multiple networks introduce severe record-keeping challenges. Manually reconciling multiple Ethereum, Binance Smart Chain, and Solana wallets hinders the preparation of accurate tax filings and significantly amplifies the risk of omissions.

Gas fees, which vary across chains, must be meticulously recorded. These incidental charges directly affect the cost basis, thus altering taxable gains or losses for each individual trade or transfer, yet they easily go overlooked if process standardization is absent.

Transaction type designation is pivotal, because the tax treatment of activities such as bridging versus swapping can differ significantly across jurisdictions. Errors in categorization may expose taxpayers to penalties or to the prospect of costly tax audit.

Aggregation tools can lead to either double-counting or missing records. Importing the same wallet seed phrase into tax software multiple times creates duplicates, while wallets that remain unconnected to the software risk leaving capital gains or losses unreported.

Manual data entry is often unavoidable, particularly for networks that do not provide robust explorers or consistent export features. Importing records line-by-line consumes excessive preparation time and raises the likelihood of transcription errors that could alter tax outcomes.

Strategies to Manage Multi-Chain Taxes

Consolidate Data Early

Establish a single, up-to-date ledger cataloging all wallet addresses, organized by blockchain. This central source minimizes fragmentation risk. Utilize blockchain explorers to extract comprehensive transaction details, allowing for aggregation before ledger ingestion.

Use Crypto Tax Software

Evaluate platforms such as Koinly, CoinTracking, Accointing, TokenTax, and ZenLedger. Verify each tool’s handling of multi-chain data through APIs, CSV imports, or wallet synchronization. The principal advantages include automated cost-basis determination, efficient tax-loss harvesting, and consolidated portfolio oversight.

Manual Tracking & Spreadsheets

Resort to manual methods only for chains, tokens, or DeFi services beyond standard software coverage. Apply established best practices, such as uniform date formats, consistent naming conventions, and separated capital and income sections, to limit human error.

Set Up Regular Reporting

Establish a disciplined periodic reconciliation cycle—monthly or quarterly—to forestall compressed year-end workloads. Utilize automation to schedule recurring data pulls from wallets and exchanges, ensuring consistent inventory and transaction updates.

Work with Tax Professionals

Engagement with an experienced tax advisor is imperative for accounts with elevated transaction volumes or complex DeFi exposure. Prioritize professionals who demonstrate fluency in multi-chain protocols, staking mechanics, and liquidity provisioning.

Common Mistakes To Avoid

Underestimating small receipts (airdrop dust, micro swaps)—Neglected minuscule gains can cumulatively incur taxes; omission may lead to unintended underreporting.

Disregarding gas fees in cost basis adjustments—Transaction fees alter profit measurement; excluding them distorts cost basis and results in inaccurate taxable income.

Misclassifying bridge transfers, leading to duplicate reporting—Bridges log receiving and sending legs. Recording each leg as separate trades duplicates gains and elevates tax.

Consolidating personal and enterprise wallets—Blended wallets obscure transaction motives, complicating reconciliation and elevating audit exposure on erroneously claimed expenses.

Future of Multi-Chain Tax Compliance

Expanding cross-chain data support within tax software – Leading platforms are integrating multiple protocols, allowing streamlined identification and reporting of transactions on Ethereum, Solana, and beyond.

AI’s forthcoming function in multi-chain transaction reconciliation – Intelligent systems are poised to auto-classify entries, spot duplicates, and resolve cross-chain discrepancies, lowering compliance burdens.

Anticipated tightening of global reporting mandates – Authorities, including the U.S. IRS and European MiCA, are enforcing stricter disclosure, compelling traders to maintain cohesive, auditable records.

Conclusion

In summary, effective management of cryptocurrency taxation across heterogeneous blockchains demands continual oversight, meticulous cost-basis determination, and the employment of robust software solutions.

As decentralized finance, non-fungible tokens, and multi-chain transactions proliferate, the imperative of systematic record-keeping becomes even more pronounced.

Employing purpose-built tax software, routinely reconciling transaction logs, and obtaining expert advisory not only secures regulatory compliance and curtails miscalculations, but also positions investors advantageously ahead of anticipated tightening of international tax enforcement.

FAQ

Yes. Swaps, staking rewards, and sales are usually taxable. Bridges may or may not be, depending on your jurisdiction.

Use crypto tax software to sync wallets, track transactions, and generate reports. Regular reconciliations reduce year-end stress.

In most regions, gas fees can be included in cost basis or deducted as expenses when calculating taxable gains/losses.