This article describes the process of hedging Bridging Aggregator Tokens (BATs) with the use of derivatives.

Hedging is needed for safeguarding your cross-chain assets from risks associated with price fluctuations and the market.

With the aid of futures, options, and perpetual swaps, holders of BATs will be able to manage their exposure, minimize likely risks of loss, and keep their portfolios from destabilizing while still enjoying the decentralized finance opportunities available on various blockchains.

What Is Bridging Aggregator Tokens?

Bridging Aggregator Tokens (BATs) are crypto tokens that consolidate assets across multiple blockchains into a single, tradable token.

When performing a transaction, they simplify access to DeFi opportunities across blockchains, enhancing liquidity.

BATs represent a suite of assets from multiple chains, potentially sparing holders the hassle of managing dozens of tokens, while liquidity fragmentation becomes liquidity-decked chaos.

Liquid holders and tradable token systems also deploy BATs to value transfers as LINCS and XLINKs.

However BATs derive primary value from the volatility of their underlying assets, leaving holders to deal with liquidity fragmentation chaos.

How To Hedge Bridging Aggregator Tokens With Derivatives

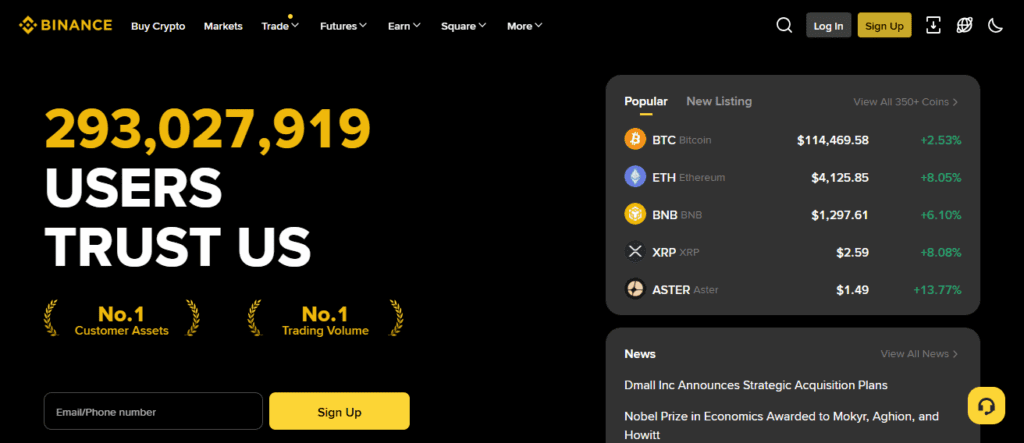

One Platform Example: Hedging BATs on Binance

Step 1: Identify Your Exposure

Let’s say you own 1,000 units of a BAT priced at $10, so your total exposure is $10,000. In this case, you’d want to guard against a price decrease over the next month.

Step 2: Choose a Derivative

For a hedge on Binance, you can choose futures contracts or options. In this case, we’ll use BTC-Pegged BAT Futures.

Step 3: Calculate Hedge Size

To completely hedge this exposure, you have to take a short futures position of $10,000. Even with leverage, risk management is best done using 1x leverage, meaning you will not take leverage so you can accurately assess your risk.

Step 4: Execute the Hedge

- Click on Futures trading tab.

- Select BAT/USDT Perpetual Futures.

- Open a short position of 1,000 BAT at the market price.

Step 5: Monitor and Adjust

- Monitor the BAT price.

- If the price drops, your short futures position gain will offset the losses on your BATs.

- If the price rises, the BATs will gain with the price and your futures position will drop but will still offset the gain to keep the position balanced.

Step 6: Closing the Hedge

- At the end of the risk period, close your futures position to realize the hedge.

- Consider the market environment to assess the remaining need for partial or continued hedging.

Hedging Strategies Using Derivatives

Futures Contracts

Shorting BATs futures to offset price declines:: A short position in BAT futures generates profits when BAT prices decline, offsetting losses in your spot holdings and lowering your overall portfolio risk.

Calculating contract size for effective hedging:: Calculate the number of futures contracts based on the total value of your BAT holdings to ensure the hedge sufficiently balances price movement in either direction.

Options Contracts

Buying puts to protect downside risk:: A put option entitles the holder to a predetermined price BAT sale, protecting the holder from a declining price while allowing the holder to keep BAT in wallet.

Writing covered calls for income while hedging:: Selling call options against BAT in your possession provides income while partially hedging your position, but the profit is capped if the price exceeds the option’s strike price.

Example scenarios with calculations:: Demonstrate the ways BAT positions are protected using options, and show price levels to determine the potential profit or loss to help traders with hedging.

Perpetual Swaps

How perpetual contracts differ from futures: Perpetual swaps do not have an expiry date like traditional futures, giving the trader an opportunity to trade them endlessly. They are designed to ensure that the contract price stays close to the spot market through the use of funding rates.

Using them for continuous hedging: Volatility of BAT can be hedged using perpetual swaps. The trader can adjust the position as needed, the perpetual swaps allow the trader to not worry about the position closing as the contracts do not have an expiry date.

Can hedging reduce profits as well as losses?

Hedging emphasizes risk management instead of profit maximization. For example, when hedging BAT investments, one can utilize futures, options, or perpetual swap contracts to shield their investments from losses attributable to price drops.

The protection, however, has drawbacks. Overly protective positions will limit one’s profits in scenarios where the price of the token increases substantially.

Gains will be diminished and may offset losses from derivative positions. Hedging reduces reward disproportionality and protects against the volatility of investments. Such strategies defend profits but do not seek to profit aggressively.

Risk Management and Considerations

Risks of over-hedging or under-hedging: Undue hedging or avoiding it altogether could result in avoidable losses or could leave your portfolio unprotected.

Platform-specific risks (liquidity, fees, funding rates): Derivative trading and hedging involve risks like low liquidity and fluctuating fees and funding rates that impact hedge effectiveness.

Tax implications of derivatives trading in different jurisdictions: Derivatives trading could attract different taxes in various places and require compliance and impact your net returns.

Importance of monitoring and adjusting hedges regularly: Sustained market volatility or illiquidity could make static hedges ineffective, which is why constant monitoring is needed.

Tools and Platforms for Hedging BATs

Jumper Exchange

Jumper Exchange focuses on aggregating liquidity across different chains, enabling BAT holders to swap tokens between chains conveniently.

By sourcing liquidity from various providers, Jumper Exchange decreases slippage, making transactions more effective.

For users dealing with cross-chain risk, Jumper Exchange is a game changer, as it allows movement of assets between chains with no manual multi-swap.

Users appreciate the intelligent trade-off between fees and trade size. Jumper Exchange is an aggregator of liquidity for BAT holders

Helping users mitigate exposure through agile liquidity movement and cross-chain risk hedging in DeFi. Overall, it’s a liquidity hedging solution.

Rubic Exchange

Rubic Exchange facilitates seamless multi-chain swaps by integrating more than 90 blockchains along with 220+ decentralized exchanges (DEXs).

This interconnected network enables BAT holders to perform transactions across chains and avoids issues with fragmented liquidity.

Automated routing and aggregation technologies pioneered by Rubic optimize transaction paths, and help decrease slippage and costs.

Rubic is excellent for traders who need to diversify their holdings across chains to mitigate risk, or BAT tokens that need quick passage across ecosystem borders.

Advanced cross-chain functionality and decentralized trading Rubic provides ensures traders seamless transfers and immediate liquidity for more complex strategies.

Conclusion

Finally, hedging bridging aggregator tokens with derivatives will help to manage cross-chain volatility and safeguard investments against precipitous price drops.

With futures, options, and perpetual swaps, traders can mitigate risks and retain exposure to possible rewards at the same time.

Appropriate hedging involves advanced calculations, meticulous monitoring, and optimal platform selection, all of which makes it an indispensable component of capital preservation within the decentralized finance ecosystem.

FAQ

Tokens that consolidate assets across multiple blockchains for easier cross-chain trading and liquidity.

To protect against price volatility, impermanent loss, and cross-chain risks.

Futures, options, and perpetual swaps.

Shorting BAT futures offsets losses if prices drop.

Buying puts protects downside; covered calls generate income while hedging.