I will discuss the How to Handle Crypto Taxes Globally marks a pivotal deadline, as regulatory scrutiny intensifies across jurisdictions.

Activities such as trading, liquidity provisioning, low-cost swaps, NFT minting, and international transfers now attract varied tax treatments, and the breadth of digital-asset tax regimes is growing.

Investors who decipher compliance pathways, assess the scope and application of is-deemed dividend-style international taxation, and enlist specialist CPAs for precedent-sensitive and nautical asset taxation, will streamline self-assessment documentation and fortify their worldwide compliance posture.

About Crypto Taxes

Crypto taxes encompass the frameworks of taxation governing the varied transactions involving cryptocurrency—from acquisition, disposition, and exchange to staking and mining of digital assets.

The prevailing international norm is to classify cryptocurrencies as property or capital assets, consequently subjecting realized gains to capital gains tax and income derived from mining or staking activities to income tax.

Jurisdictions differ substantially; certain states impose rigorous disclosure obligations, while others adopt a more permissive stance. Investors and holders of digital assets, therefore, bear the exigent duty of systematically logging all transactions, identifying and documenting every taxable event, and adhering to the prevailing tax statutes of their respective jurisdictions.

How to Handle Crypto Taxes Globally

Example: Handling Global Crypto Taxation – John’s Methodology

Aggregate All Transaction Data

- John retrieves CSVs from exchanges, hot/cold wallets, and DeFi interfaces, compiling trade, yield, and NFT-sale information.

Identify Tax Residency and Jurisdiction Scope

- He annotates all residency shifts to ascertain which periods and transactions are subject to the respective national rules.

Tax Classification of Transactions

- Comprehensive trade events incur capital gains tax.

- All yield, airdrops, and mine rewards are treated as ordinary income.

- Internal transfers between personal wallets are regarded as non-tax events.

Determine Cost Basis and Realization of Gains

- For each taxable exit, John computes the effective cost basis and the resulting profit or loss in the local currency.

Monitor Taxable Income Events

- Staking, mining, or airdrop receipts are recorded at prevailing market values upon receipt, treated as ordinary income.

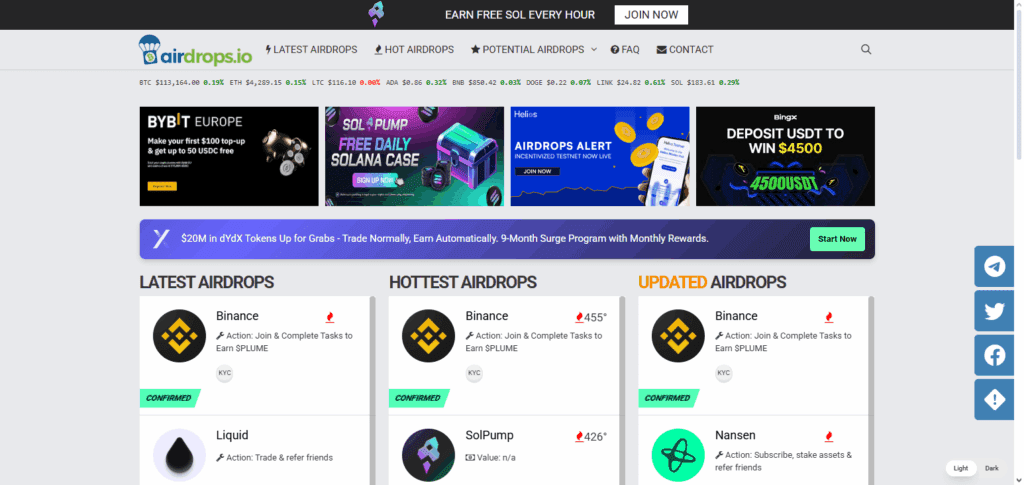

Leverage Dedicated Tax Software

- He uploads the entire dataset to a cryptocurrency tax application, which auto-generates jurisdiction-compliant tax summaries.

Engage an International Crypto Tax CPA

- A tax advisor specializes in multi-jurisdiction crypto taxation audits the summaries, clarifies residency implications, and identifies applicable double taxation agreements.

Timely Submission of Tax Returns

- John files respective jurisdiction returns, documents, and payments or credits before statutory deadlines.

Preserve Supporting Documentation

- He retains all CSV extracts, blockchain proofs, residency certificates, and advisory correspondence in a systematic repository for future audit support.

Key Challenges in Global Crypto Taxation

Disparate National Classifications

Each jurisdiction applies its own conceptual framework to cryptocurrency—classifying it variously as property, foreign exchange, or commodity—resulting in inconsistencies that complicate compliance for cross-border participants. Absent harmonized definitions, investors face the paradox of adhering simultaneously to multiple, sometimes conflicting, legal obligations whenever a token crosses a national boundary.

Potential for Jurisdictional Overlap

Cross-border capital movements can lead to identical income or capital gain being subjected to taxation in two different jurisdictions. Absent a pertinent double taxation agreement, the taxpayer confronts both levies, compression of net returns, and sometimes protracted administrative disputes beyond the tax year of realization.

Intricate Transaction-Mapping Obligations

Governments are increasingly demanding granular reporting—documenting each swap, yield event, or non-fungible token acquisition. Given the speed and multiplicative scale of tokenized portfolios, maintaining a reconciled ledger that satisfies multiple tax audits demands automated, painstakingly precise systems, imposing disproportionate burdens on non-institutional investors.

Working with CPAs & Tax Professionals

Managing tax obligations associated with cryptocurrency on a global scale can be daunting when jurisdictions apply disparate regulations to trading, staking, non-fungible tokens (NFTs), and decentralized finance (DeFi) activities. Engaging certified public accountants (CPAs) and specialized tax advisors thus becomes a critical requirement.

International tax professionals possess in-depth knowledge of cross-border statutes, residency definitions, and double-tax conventions, equipping clients to maintain compliance while preserving tax efficiency.

A CPA clarifies intricate reporting protocols, oversees meticulous record maintenance, and can defend a taxpayer’s position during administrative reviews.

For investors with a portfolio spanning several nations, soliciting focused tax advice affords reassurance and enables customized compliance strategies for simultaneous filings in multiple domiciles, simplifying the lawful and efficient oversight of cryptocurrency liabilities.

Common Mistakes to Avoid in 2025

Ignoring Local Regulations: Investors frequently operate under the misguided assumption that a particular jurisdiction treats crypto transactions as untaxed. Regulations, however, evolve at an accelerating pace, and periodic oversight may introduce compliance gaps. Outdated assumptions expose holdings to severe penalties and the risk of a prolonged audit.

Not Reporting Crypto-to-Crypto Trades: The exchange of one digital asset for another triggers a capital gains or income recognition obligation in the majority of legal contexts. Investors often overlook the necessity of documenting these swaps, resulting in an understated gains figure. This oversight can accumulate, eventually leading to disproportionate penalties and intricate compliance complications.

Overlooking Staking, Airdrops, and NFT Income: Rewards earned through staking, unsolicited airdrops, and NFT transactions may each qualify as taxable income under established anti-avoidance rules. Investors frequently neglect to quantify these inflows, creating the possibility of understated income and subsequent audit challenges. Prompt and complete recognition of such income shields the taxpayer from disproportionate retroactive assessments.

Future of Global Crypto Taxation

Looking ahead to 2025 and later, the global landscape of cryptocurrency taxation is set to converge around broad uniformity and tightened enforcement mechanisms. Nation-states are accelerating collaborative initiatives, leveraging the OECD’s Crypto-Asset Reporting Framework (CARF) to align cross-border disclosure obligations and close prevailing gaps.

This effort will diminish jurisdictional arbitrage, enabling tax authorities to monitor international flows of digital assets with enhanced precision. Furthermore, the anticipated proliferation of central bank digital currencies (CBDCs) and the implementation of distributed-ledger-based tax reporting infrastructures will likely render compliance largely automatic and enhance the reliability of post-transaction reviews.

Though specific mandates may still exhibit regional discrepancies, the prevailing orientation of regulatory design remains oriented toward improved visibility, reinforced oversight, and the introduction of more harmonized tax-reporting obligations for both individual investors and enterprise participants in the crypto ecosystem.

Conclusion

Managing international cryptocurrency tax exposure in 2025 demands advance structuring, meticulous documentation, and an intimate knowledge of divergent legal frameworks.

As sovereign authorities classify digital assets variously as property, capital assets, or ordinary income, traders must capture and report every taxable event—including exchanges, rewards, NFT disposals, and decentralized finance yields.

Deploying dedicated tax software, engaging qualified CPA firms, and leveraging applicable double-tax treaties materially streamline compliance while optimizing potential tax savings. Given the continuous evolution of statutory guidance in multiple jurisdictions, timely surveillance of regulatory change is non-negotiable.

By implementing anticipatory governance frameworks and liaising regularly with tax counsel, crypto stakeholders can secure timely compliance, mitigate risk of penalties, and effectively administer regional exposure across a highly dynamic digital landscape.

FAQ

It depends. Some countries like Singapore don’t tax capital gains, but income from crypto activities may still be taxable. Always check local laws.

Use tax treaties between countries and consult a CPA. Proper documentation of residency change helps prevent being taxed twice on the same income.

Yes, in most countries. Swapping Bitcoin for Ethereum, for example, is treated as a disposal event and may trigger capital gains tax.