Tracking new projects and market momentum in decentralized finance can quickly become overwhelming due to its ever-changing nature. How to Create a DeFi Watchlist enables you to structure and track tokens of interest, monitor price changes, and capitalize on new opportunities, all without any hassles.

Whether you’re new to DeFi or an experienced investor, creating a watchlist can help you make informed decisions and mitigate unnecessary risks in this complex and volatile ecosystem.

What is DeFi Watchlist?

A DeFi watchlist is a unique feature that helps users tailor their own lists and monitor their preferred decentralized finance (DeFi) projects all in one place. Unlike a general crypto portfolio tracker, a DeFi watchlist is only focused on DeFi tokens and platforms and even provides token price, market cap, liquidity, trading volume, staking, governance, and other important DeFi information at a glance.

By using a DeFi watchlist, users can identify emerging markets, receive up-to-date information on price fluctuations to optimize their portfolio, and avoid unnecessary costs associated with poorly managed crypto. This is pivotal in the DeFi space, where numerous projects are being developed along with multiple changes within existing projects.

How to Create a DeFi Watchlist

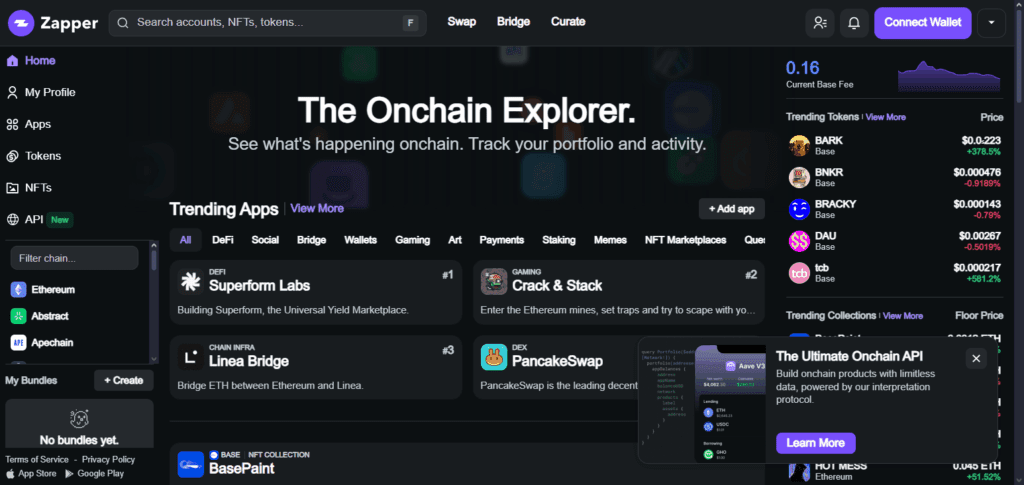

Example: Creating a DeFi Watchlist Using Zapper

Step 1: Sign Up or Connect Wallet

- Go to Zapper.fi and link your preferred crypto wallet (MetaMask, Wallet Connect, Ledger).

- Zapper does not require an account if you are using a wallet, since Zapper automatically retrieves your assets.

Step 2: Explore DeFi Projects

- Click on “Explore” to see new and trending DeFi opportunities.

- You may search by type (lending, yield farming, staking, or NFT-based DeFi).

Step 3: Select Tokens to Track

- Identify the tokens or projects you wish to track.

- You can easily watch them by clicking on the “+” or “Add to Watchlist” option.

Step 4: Add Key Metrics

- Add relevant and necessary information, such as the metric’s price, market cap, 1-week and 1-year staking APY, and 1-week liquidity.

- Potential earnings and risk analytics are available on Zapper as well.

Step 5: Set Alerts

- Set price notifications and alerts for significant token movements.

- Alerts allow you to jump on opportunities.

Step 6: Organize Your Watchlist

- Organize tokens by category, risk, and importance of the investment.

- Continuously curate your watchlist by adding new projects and deleting projects with low relevance.

Step 7: Keep Track and Make Changes

- Review your watchlist and analyze performance on a daily or weekly basis.

- Modify your portfolio based on project developments, staking rewards, and trends.

Key Elements to Include in Your DeFi Watchlist

Project Name and Token Symbol — All DeFi projects and their applicable tokens must be identified with ease.

Current Price — Token prices must be monitored in real-time alongside market changes.

Market Capitalization — The value and size of the project in the market must be understood.

Trading Volume — Observe the liquidity of the token and how actively it is traded.

Platform/Blockchain Network — Identify which blockchain the DeFi project operates on (e.g. Ethereum and Binance Smart Chain).

Staking and Yield Opportunities — Potential earnings from token staking and farming must be tracked.

Governance Details — Voting rights or governance the token works must be observed.

Risk Indicators — Volatility, project health, and security audits include the potential risks of the project.

News and Updates — Stay informed with project announcements, partnerships, and upgrades.

Price Alerts and Notifications — Alerts must be set for price changes and important milestones in order for action to be taken.

Tools and Platforms for Creating a DeFi Watchlist

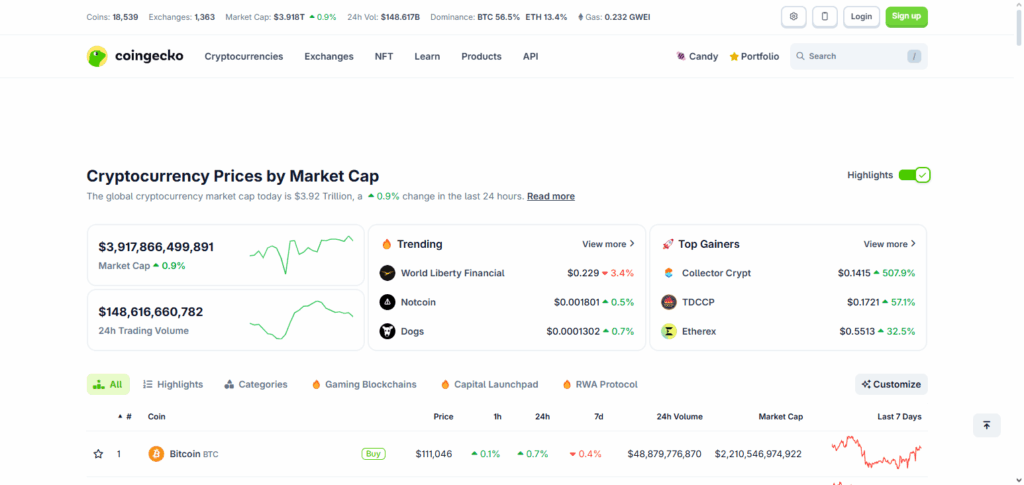

CoinGecko

Recognized as one of the best pages on the internet for creating a DeFi watchlist, CoinGecko offers users access to comprehensive, real-time data on tokens and DeFi projects on hundreds of different blockchains.

With its tool, users can monitor price, market cap, trading volume, and liquidity all in one place. Users can track digital tokens, organize them, set alerts, and monitor their performance using the portfolio feature. Investors and traders can also leverage the DeFi rankings, precise analytics, and news to manage their investments and stay informed about the market.

DeFi Pulse

DeFi Pulse is crucial when formulating a DeFi watchlist, given that it narrows down its research to a single industry, providing detailed insights on its performance and health. They also track Total Value Locked (TVL), lending rates, and liquidity on various protocols, making it easy to measure the strength of a given project.

Users can see trending tokens, track available staking, and project metrics in a single view. DeFi Pulse’s intuitive design, paired with its robust data analytics, makes it an unparalleled asset in the efficient tracking and management of a DeFi watchlist.

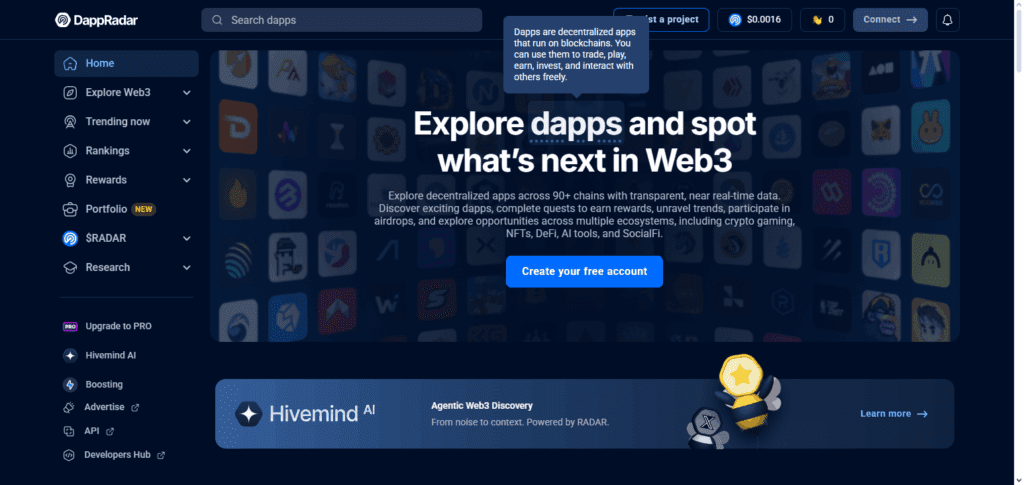

DappRadar

DappRadar is ideal for building a DeFi watchlist since it tracks decentralized applications (dApps) on multiple blockchains, providing a comprehensive view of the DeFi landscape. Users can keep track of each project’s token value, active users, liquidity, and transaction volume.

Its ability to classify dApps based on popularity and engagement is perhaps the most useful for investors trying to discover new dApps. DappRadar is a one-stop dashboard for users to analyze and streamline wallet-managed tracking of their favorite DeFi projects.

Tips for an Effective DeFi Watchlist

Look for Promising Projects First – Look for DeFi Tokens with active development, strong fundamentals, and an established team.

Avoid the Information Overload – Set a token limit to manage the data and avoid feeling overwhelmed.

Obtain Essential Data – Track the price, market capitalization, liquidity, staking rewards, and governance to aid in precision decision-making.

Configure Alerts – Price and update alerts help gain an edge with swift reactions.

Keep Your Watchlist Current – Fresh active projects must be included, while stale or lackluster performing projects must be removed.

Categorize By Type or Risk – Classify tokens based on the blockchain, type of project, or risk.

Utilize Authorized Interfaces – Precise and prompt information is available from CoinGecko, Zapper, or DappRadar.

Common Mistakes to Avoid

Tracking an Excessive Number of Tokens – Setting your watchlist to an excessive limit may hinder its practical monitoring.

Ignoring the Fundamentals of the Project – Price shifts are analysed and the worth of the project and its utility are overlooked.

Ignoring the Assessment of the Project – Not contemplating the liquidity, volatility, and the security risks of the project.

Failing to Make Periodic Updates – Updates provides an opportunity to either lose an opportunity altogether or make a suboptimal choice.

Avoidance of Superficial Reliance of the Alerts – Reviewing the projects in question is one of the processes that is overlooked quite frequently.

Avoiding Lack of Project Diversification – Focusing on one category of DeFi project will cause the exposure to risk to be more heightened.

Avoiding Lack of Reliable Platforms for Data Collection – Investment may be lost as a direct result of poor data and its misinformation.

Conclusion

Constructing a DeFi watchlist is, along with perhaps the most critical task for any investor or crypto enthusiast seeking to get a strategy in the swiftly evolving world of decentralized finance. Through diligent selection of projects and the careful monitoring of necessary metrics such as price, liquidity, and staking, it is possible to efficiently keep track of your target tokens using reliable sites as CoinGecko, DeFi Pulse, and DappRadar.

Regular updates and alerts along with proper organized categorizing help a decision to be made with the utmost information possible minimizing the decision. With these in mind, a DeFi watchlist will help you not only capture any potential opportunities but also help you manage your portfolio efficiently in case of any shift in the crypto landscape.

FAQ

It helps investors monitor top DeFi projects, make informed decisions, react quickly to market changes, and manage portfolios efficiently.

Popular platforms include CoinGecko, DeFi Pulse, DappRadar, Zapper, Zerion, and Delta.

Track price, market cap, trading volume, liquidity, staking rewards, governance updates, and risk indicators.