This post will look at two major trading platforms, Coinbase vs Robinhood. I will analyze which of the platforms best fits your investing style based on the various attributes of each, including features, costs, safety, and ease of use.

I will also highlight the differences and similarities between the platforms to help both novice and seasoned traders, whether your focus is on crypto, stocks, or a combination of the two.

Overview

Cryptocurrency and stock trading are rapidly growing, and selecting the most suitable platform is very important. In the current market, Coinbase and Robinhood are some of the most popular options.

Every trading platform accommodates different types of traders and investors. In this article, we will provide an overview of the differences, cover the fees, features, security, and usability to assist you in making a decision.

What Is Coinbase?

Coinbase was established in 2012 and has become one of the oldest and most reliable cryptocurrency exchanges in the sector.

With its simple and easy-to-use platform, it appeals to novice and professional traders alike. Users can trade a variety of cryptocurrency digital assets, including Bitcoin, Ethereum, and newer altcoins.

Coinbase promotes and prioritizes the safety of its customers by adopting specialized security protocols such as two-factor authentication and cold storage of digital assets.

Users mainly looking for focused and uncomplicated cryptocurrency trading will find Coinbase’s specialized services most gratifying.

Coinbase’s global outreach and regulatory compliance designs on offering digital assets place them still as a top providing company.

Key Features of Coinbase

- Covers more than 200 cryptocurrencies.

- Offers Coinbase Pro for higher-level traders and provides lower fees.

- Effective security implementations such as 2-step verification and cold storage.

- Educational tools and crypto learning rewards.

- Mobile app adds convenience for trading anytime and anywhere.

Pros And Cons

Pros of Coinbase

- Beginner-friendly interface.

- Wide range of supported cryptocurrencies.

- High-security standards.

- Staking options for earning rewards.

Cons of Coinbase

- Higher fees compared to some other exchanges.

- Limited stock and other investment options.

What is Robinhood?

Founded in 2013, Robinhood changed the way people invest by offering commission-free trading on stocks, ETFs, and options.

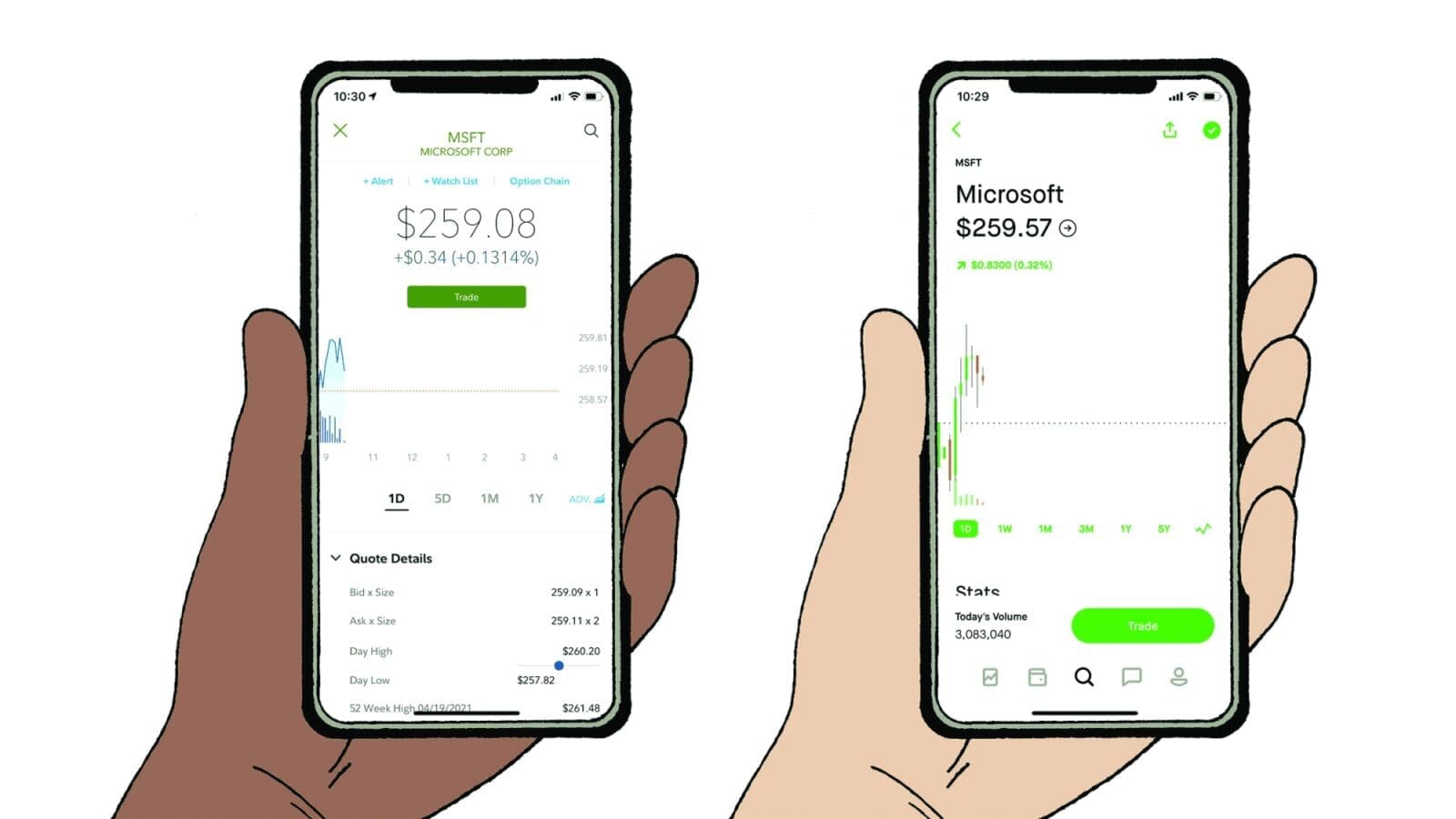

The mobile app was designed to be user-friendly, which appealed to millennials and casual, less-experienced investors looking for affordable financial resources.

Robinhood increased trading functionality and added no-fee trading on popular cryptocurrencies such as Bitcoin and Ethereum.

The platform’s simplicity, educational resources and real-time market data, all provided at no cost, makes Robinhood trading particularly appealing to novice investors.

Portfolios can be managed easily and effortlessly. In addition to the democratic nature of investing, Robinhood remains focused on customization and innovation making it an industry leader in retail trading.

Key Features of Robinhood

- No commission fees on trades: stocks, ETFs, options, and cryptocurrencies.

- Investors on a budget benefit from fractional shares.

- User friendly mobile app.

- Cash management: debit cards and interest on balance.

- Instant deposits available.

Pros and Cons Robinhood

Pros of Robinhood

- Commission-free trading.

- Supports both stocks and cryptocurrencies.

- User-friendly for beginners.

- No minimum deposit requirements.

Cons of Robinhood

- Limited range of cryptocurrencies compared to Coinbase.

- Customer support can be slow.

- Past controversies regarding trading restrictions.

Coinbase vs Robinhood: Comparison Table

| Feature | Coinbase | Robinhood |

|---|---|---|

| Year Founded | 2012 | 2013 |

| Primary Focus | Cryptocurrency trading | Stocks, ETFs, Options, Crypto |

| Number of Cryptos | 200+ | 100+ |

| Fees | Higher fees (1.49%-3.99%) | $0 commission (some fees may apply) |

| User Interface | Beginner-friendly, Coinbase Pro for advanced | Simple and intuitive |

| Security | High (cold storage, 2FA) | Moderate (2FA, limited insurance) |

| Mobile App | iOS & Android | iOS & Android |

| Educational Resources | Yes | Limited |

| Account Minimum | $0 | $0 |

| Staking Options | Yes | No |

Fees and Pricing

Comparing Coinbase to Robinhood brings to mind differences in fees. Coinbase charges between 1.49% to 3.99% on standard crypto transactions.

In contrast, Robinhood does not charge commissions on stocks, ETFs, or crypto. However, Robinhood should be carefully evaluated for hidden fees, as they use spread pricing on crypto trades.

For active traders, Coinbase Pro offers the most economical drivers due to the competitive low fees starting at 0.50% on trades, which is beneficial for high-volume trading.

Robinhood’s fee-free model certainly appeals to casual investors who are just starting out or making smaller trades, but these casual investors would be disappointed due to the hidden fees.

Security

Considering the nature of any trading platform, its security features are essential. Coinbase has a good reputation with its security features, having 2FA, being insured, and keeping the majority of their assets in cold offline storage.

To a lesser extent, Robinhood has 2FA and SIPC insurance on cash and securities, although the platform has attracted criticism for past breaches of security and service outages.

Security-wise, Robinhood is adequate for casual stock and crypto investors, whereas Coinbase’s security features make it a safer choice for crypto-heavy traders.

Usability

While both systems are designed for easy use, there are different target users. Coinbase has its professional clients mainly for its Coinbase Pro with advanced trading features.

On the other hand, Robinhood has aimed its platform at simplicity and accessibility, which is best suited for beginners. To this end, Robinhood has designed a streamlined mobile app that gamifies the trading of stocks and crypto.

Investment Options

Focusing on the crypto market, Coinbase has over 200 coins available for trading, along with the ability to stake and earn crypto rewards.

On the other hand, Robinhood has a more varied set of trading instruments including stocks, cryptocurrencies, ETFs, options and, a more limited crypto selection. If you want a one-stop platform for all your investments, you’ll find Robinhood has an advantage.

Conclsuion

Your investment objectives will determine the right platform between Coinbase and Robinhood. Coinbase is ideal if you want to focus on cryptocurrencies and care most about security.

On the other hand, if you are looking for a zero-commission platform to trade stocks, in addition to crypto, Robinhood fits your requirements best.

Coinbase and Robinhood are both mobile-optimized, designed for beginners, and built to serve different kinds of investors. Identifying your most important trading attributes will help you narrow down your options.

FAQ

Coinbase is better due to its wider range of cryptocurrencies and advanced trading features.

Robinhood is ideal because it offers commission-free trading of stocks, ETFs, and options.

Coinbase charges 1.49%-3.99% for standard trades, while Robinhood offers commission-free trading with some hidden spreads on crypto.

Coinbase has stronger security measures, including cold storage and insurance coverage, making it safer for crypto assets.

Yes, both Coinbase and Robinhood have mobile apps for iOS and Android, with easy-to-use interfaces.