In this article, I will discuss the Best Crypto Tools for Automated Trading. Automated trading platforms facilitate traders’ abilities to execute strategies at any time without the influence of emotions.

3Commas, Cryptohopper, Coinrule, and WunderTrading provide bots and backtesting along with support for multiple exchanges, making these platforms fit for novice and proficient traders aiming for streamlined risk management and more rational trading in highly unpredictable crypto markets.

What is Crypto Tools for Automated Trading?

Automated trading crypto tools are specific software platforms or applications that perform cryptocurrency transactions automatically based on predetermined regulations, guidelines, or market signals.

These tools allow traders to save time and take advantage of market opportunities that they would otherwise miss because they do not have to be on constant manual monitoring. These applications include systems such as algorithm trading, management of trading portfolios, signaling instruments, and exchange connectivity.

Trade automation permits novice and expert traders to control and respond to changes in the market, streamlining the trading process and making it less unreliable on gut feelings.

Traders are able to optimize the returns on their investments while reducing the chances and magnitude of losses. Automated trading streamlines the trading process and minimizes the reliance on instinct.

How to Use Bots Crypto Tools for Automated Trading

Choose the Right Platform

- Research tools like 3Commas, Cryptohopper, Coinrule, WunderTrading, or TradeSanta.

- Consider features, supported exchanges, fees, and ease of use.

Create an Account & Secure It

- Sign up on your chosen platform.

- Enable 2FA (Two-Factor Authentication) for extra security.

Connect Your Exchange via API

- Generate API keys from your crypto exchange (Binance, KuCoin, Kraken, etc.).

- Grant only trading permissions (avoid withdrawal permissions for safety).

Select Your Trading Strategy

- Common strategies:

- Grid trading: Buy low, sell high within a price range.

- DCA (Dollar-Cost Averaging): Buy fixed amounts periodically.

- Trend-following: Follow indicators like Moving Averages, RSI, MACD.

- Arbitrage: Exploit price differences across exchanges.

- Beginners can start with pre-set or template strategies.

Set Parameters & Risk Management

- Define trade size, stop-loss, take-profit, and other limits.

- Avoid investing your entire capital; start small.

Backtest or Paper Trade

- Simulate your strategy on historical data or in demo mode.Review and modify parameters according to current performance metrics prior to going live.

Enable the Bot for Live Trading

- Engage the bot on the selected exchange.

- Safeguard performance especially during periods of high volatility/market fluctuations.

Improvements and Optimization

- Account for market fluctuations and prior performance to adjust strategies.

- Implement differing strategies on several bots to manage risk.

Key Point & Best Crypto Tools for Automated Trading List

| Crypto Tool | Key Features / Points |

|---|---|

| 3Commas | Smart trading terminals, automated bots, trailing stop loss, multi-exchange support |

| WunderTrading | Copy trading, automated strategies, real-time signals, portfolio tracking |

| Coinrule | No-code bot creation, pre-built templates, customizable trading strategies |

| Bitsgap | Arbitrage opportunities, grid and demo bots, unified exchange interface |

| CryptoHopper | Cloud-based bot, technical indicators, strategy designer, marketplace for templates |

| TradeSanta | Long and short bots, grid and DCA bots, easy-to-use interface, multi-exchange integration |

| Shrimpy | Portfolio rebalancing, social trading, performance analytics, multi-exchange support |

| Zignaly | Signal-based trading, copy trading, profit-sharing bots, API exchange connectivity |

| Kryll.io | Visual strategy builder, backtesting, marketplace for trading strategies |

| Autoview | Browser extension bot, integrates with TradingView signals, automated execution via scripts |

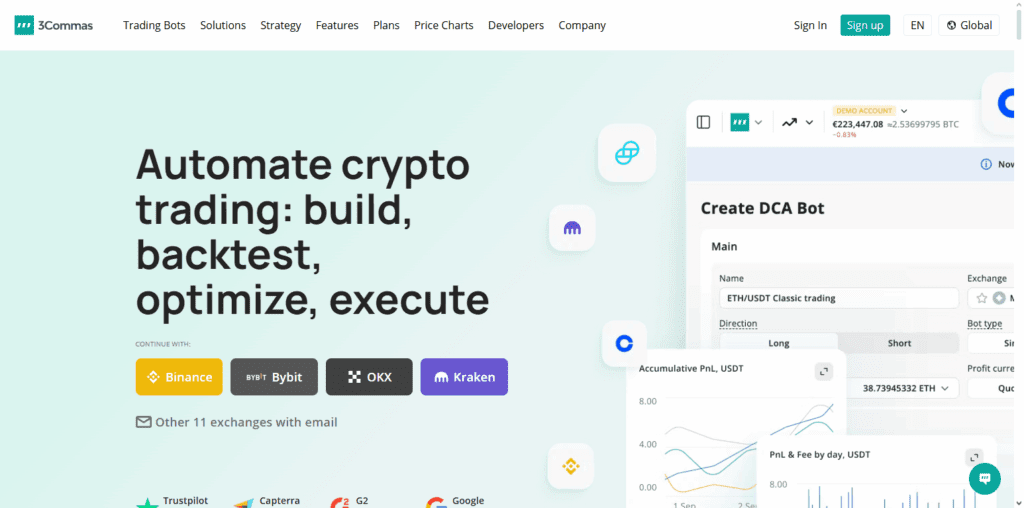

1. 3Commas

3Commas has become one of the best automation trading crypto tools because of the holistic and intuitive platform it has built for novice and advanced users alike.

What makes this trading platform automation tools unique is the use of advanced trading bots that intelligently manage trailing stop losses, take profit, smart order routing, and cross-exchange order execution for up to 5 exchanges at the same time! Strategies can be built from scratch or leveraged from the system’s built-in strategies giving users the freedom and automation required for efficient execution.

Detailed analytics and the ability to manage portfolios while trading from a cloud-based platform allows custom strategies to be cloud-based 24/7. The ability to automate risk adjusted profit taking strategies across multiple exchanges is what makes 3Commas powerful. The tools give a user the best possible automation to perform smart and consistent trading.

3Commas

Key Features:

- Multiple exchange support (14+).

- SmartTrades: Take profit & stop loss, trailing up & down.

- Grid bots, DCA bots, and backtesting are also available.

Pros:

- Excellent feature set for novice and experienced traders.

- Strong exchange support and automation functionality.

- Available demo/trial to try for free beforehand.

Cons:

- Within alternatives, it’s on the expensive end.

- Advanced features will require some learning.

- Free tier is demo-only; live trading will require a paid tier.

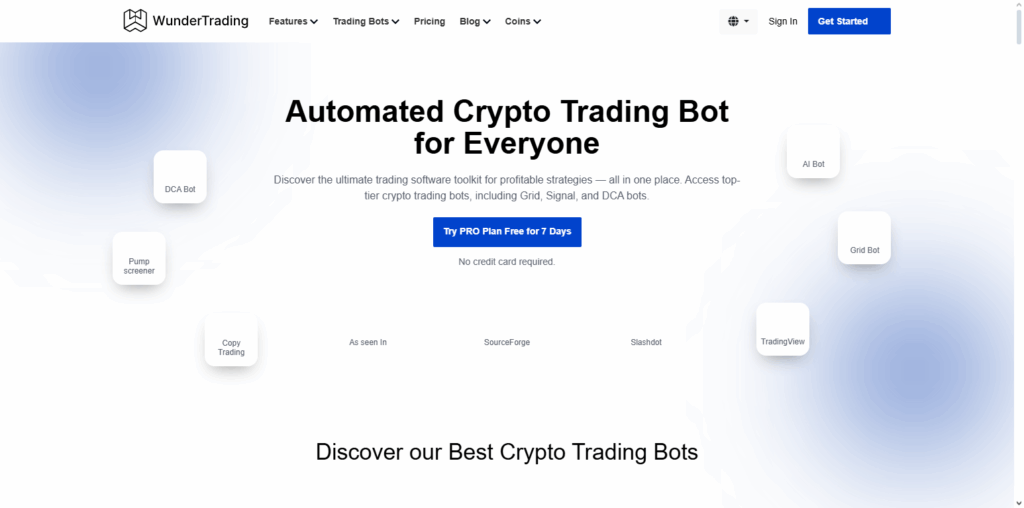

2. WunderTrading

WunderTrading is a leading automation trading platform in the cryptocurrency ecosystem because it combines copy trading and automation seamlessly.

Its unique ability to let users emulate a live professional trader’s strategy and copy trades in real-time while retaining full control over your capital is a top-tier feature. The platform’s versatility is further enhanced through custom automated trading bots, real-time signals, and cross-exchange portfolio management.

Thanks to its user-friendly interface and cloud technology, the platform guarantees uninterrupted trade execution 24/7. By uniting social trading with automation and in-depth analytics, WunderTrading provides a unique offering to both new and seasoned crypto traders.

WunderTrading

Key Features:

- Automate any TradingView script into a bot.

- Spot & futures grid bots, DCA, copy trading & signals.

Pros:

- Lower entry price compared to some competitors.

- Strong integration with TradingView for strategy automation.

- Good for both beginner and more advanced automation.

Cons:

- Some of the advanced features locked behind higher tiers.

- Might still require familiarity with TradingView and scripting for full benefit.

- Interface and depth may be more complex for total beginners. Bonuses may be the best for advanced users.

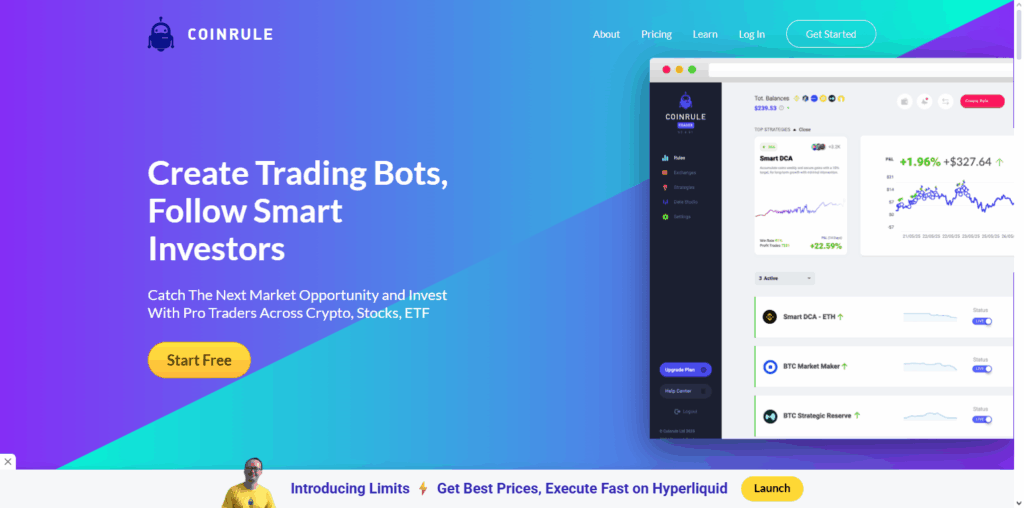

3. Coinrule

Coinrule stands at the forefront of automated trading technology. The goal is simplification of automated trading strategies while making no compromise on their sophistication, all without requiring any coding skills.

The point of distinction is the “no-code” feature, which enables users to design their own trading bots with basic if-this-then-that instructions, as well as with available templates that tackle different trading scenarios. With its real-time execution, automated trading strategies are deployed simultaneously across multiple platforms.

There are also real-time assessment tools to monitor performance. In combination with automation, strategic simplification, and flexibility, Coinrule is designed to help users of all experience levels to navigate trading effectively and reliably in a dynamic crypto environment.

Coinrule

Key Features:

- Template strategies, rule‑based automation (no coding).

- Supports multiple exchanges, leverage trading, demo rules.

- Backtesting, advanced indicators, social copy‑trading.

Pros:

- Very beginner‑friendly with visual rule builder, no code required.

- Free plan allows you to test without cost. Bonuses may be the best for advanced users.

- Mid-tier levels are reasonable and fairly priced.

Cons:

- Free plan is quite limited (small volume and very few rules).

- Higher tiers (US$749) are too much for casual traders.

- Some advanced features (leverage and many rules) only come with top tier.

4. Bitsgap

Bitsgap is an integrated tool for automated trading in cryptocurrency. It is unique due to the integration of bot trading automation, bot portfolio management, and the ability to exploit price arbitrage opportunities.

Its primary unique selling proposition is the combination of grid and DCA bots that trade autonomously, allowing users to exploit market volatility while insulating themselves from market losses. For users that arbitrage between price-exchange pairs, the tool provides support for price discrepancies on several exchanges.

It consolidates the user’s active exchange accounts, live market statistics, and backtracking statistical models in one interface to facilitate user-placed trading strategies. For integrated automation, Bitsgap is an excellent platform for optimized trading in cryptocurrency.

Bitsgap

Key Features:

- All-in-one platform includes a trading terminal, portfolio tracking, smart orders, and bots (DCA, GRID, COMBO).

- Connects to 15+ exchanges.

Pros:

- Good combination of automation and manual tools (terminal and bots),

- Reasonably priced.

- Multiple bot types and smart orders.

Cons:

- Advanced features may be locked behind higher-tier plans or add-ons.

- Some absolute beginners may find the interface a bit complex.

- There are inconsistencies in pricing and features across the different plans.

5. CryptoHopper

CryptoHopper stands out as a top choice for automated trading tools. Not only does it offer cloud-based services but it is also customizable. One of the features that set it apart from the competition is the capability of advanced trading bot creation through the use of technical indicators and customizable strategy designers as well as a huge selection of pre-designed templates from the marketplace.

While most of the features are designed to enhance the bot’s performance, traders also appreciate the ability to have trades automated across numerous exchanges in a 24/7 fashion without the risk of downtime.

Performance optimization is achieved through the use of advanced AI trading signals along with trailing stop-loss and other take-profit algorithms. Along with multitude of strategies that can be used the automation and customizable tools on the platform make CryptoHopper a powerful tool for traders.

CryptoHopper

Key Features:

- Bots may be traded 24/7 with cloud trading, and users can trade strategies and signals.

- Copy bot trading, exchange integration, and accessible strategy templates.

Pros:

- Well-established and mature platform with more available strategies.

- Advanced users along with users requesting signal/marketplace services.

- Multiple options

Cons:

- Free tier underwhelming.

- Higher pricing for advanced users.

- Advanced offerings may be too much for casual users.

6. TradeSanta

TradeSanta stands out for its simplicity and efficiency as an automated trading crypto tool for both novice and veteran traders. One of its best features is the system of grid and DCA bots which automatically execute buy and sell orders optimally during price fluctuations.

With TradeSanta, you can configure multiple exchange accounts and execute trades from any of the accounts through a single dashboard. The platform also includes predefined automation modules, continuous performance tracking, and real-time trading through the cloud.

With simple automation, TradeSanta provides effective management of trading risk and guarantees the performance of automated trades across multiple exchange accounts, saving traders time and minimizing emotional trading.

TradeSanta

Key Features:

- Long and short strategy bots available along with smart trading and unlimited pairs to trade in paid plans.

- Other than exchange trading fees, all plans have fixed prices and no commissions.

Pros:

- Well-defined pricing.

- Reasonable entry cost.

- Unlimited pairs to trade in paid plans.

Cons:

- Basic plan still lacks in number of bots offered.

- There is a very limited free trial offered.

- Higher tiers have advanced features such as custom signals and unlimited bots.

7. Shrimpy

Shrimpy specializes in automated crypto trading and is reputed for its emphasis on portfolio management and automation for long-term investments. One of its distinguishing features is automated portfolio rebalancing.

It rebalances based on individual user instructions to optimize diversification and varying levels of risk. Shrimpy supports social trading functionality, where Shrimpy users can follow and copy the movements of professional traders.

It also consolidates account management across different exchanges. It offers analytics, performance tools, backtesting, and full automation to assist traders in reducing manual work while maximizing returns. The combination of rebalancing, social trading, and support for various exchanges positions Shrimpy as a dependable platform for methodical crypto trading.

Shrimpy

Features

- Offers portfolio rebalancing, DCA (dollar‑cost averaging), and portfolio stop loss.

- Provides unlimited spot trades. (You trade on your exchange, Shrimpy connects).

Pros:

- Useful for portfolio management and for passive investors rather than purely active trading.

- Provides affordable entry level.

- Paid plans offer strong support for multiple exchanges & portfolios.

Cons:

- Not much emphasis on active bot trading (DCA/rebalancing rather than frequent trade bots).

- Higher tiers can get expensive (~US$299).

- Certain features are restricted on the lower-tier plans as per feedback received.

8. Zignaly

Zignaly is a top automated crypto trading application. It is popular for customized automated trading, copy trading, and signal-based automated trading for clients. It offers signal automation without complex trading automation technology.

Zignaly can be linked to different crypto exchange platforms and protects user transactions through an API. Trading is automated for 24 hours and 7 days a week. Zignaly provides clients automated trading while sharing profits through trading bots, strategy diversification, robust trading analytics, control risk features, and control of personal crypto assets.

Zignaly provides automation, social trading, and strategy flexibility, helping traders maximize earnings and minimize efforts or help during trading. This is critical due to the ever-changing nature of crypto trading.

Zignaly

Features:

- Social trading/copy trading sevice: you can follow pro traders and signals.

- DCA bots included along with other risk management tools.

Pros:

- Good for beginners as many basic features are free.

- Optional premium signals are priced affordably.

- It’s a simpler model if you prefer copy-trading than building full custom bots.

Cons:

- If you want fully automated custom strategies you will need to get the more expensive premium plans.

- Full-featured bots will have more control and negexity.

- Hidden costs (signal fees) can become considerable.

9. Kryll.io

Kryll is well-known as an automated trading tool which is most appreciated for its visual strategy builder which helps users develop intricate trading bots even if they do not know how to code. The ability to design, test, and implement strategies using a drag-and-drop system helps configure each step in a very flexible and intuitive way.

Making decisions is also a lot easier using Kryll’s backtesting tools as they help in assessing different strategies by comparing them to historical data. The platform is cloud based so it is accessible for automation on a 24/7 basis.

It supports several exchanges and even has a marketplace designed for buying and selling strategies that other users have created. The combination of visual strategy design, backtesting, and marketplace integration allows Kryll to help traders automate their trades in a reliable manner.

Kryll.io

Key Features:

- Drag and drop visual strategy builder (no code needed).

- Customers can backtest their strategies for free an unlimited amount of times.

- Major exchanges and TradingView integration.

Pros:

- Very flexible cost model, you only pay for what you use.

- Great for users who want to experiment or build their strategies.

- Unlimited backtesting is a strong advantage.

Cons:

- Possibly more difficult to estimate cost because it is a % of capital.

- May require more strategy building.

- Native token (KRL) use adds complexity (you may need to hold KRL for discounts).

10. Autoview

Autoview is a crypto tool developed primarily for automated trading. It differentiates itself through its deep integration with TradingView for executing trades based on real-time chart signals.

Autoview’s strongest capability is transforming TradingView alerts to automated orders on different exchanges within seconds, helping traders pursue technical analysis without having to do the trading manually. Autoview is a browser extension which provides a lightweight, dependable, and customizable approach to automation.

Users can set real-time automated performance tracking for complex strategies that include stop-loss, take-profit, and trailing orders. Autoview combines automated order execution with advanced trading charts to provide accuracy and efficiency which is crucial for traders who use technical signals.

Autoview

Key Features:

- Webhook and script-based automation, specifically integrates with TradingView alerts.

- Supports more than 18 exchanges and a variety of asset types.

Pros:

- Very low cost, especially for the paid version.

- Ideal for those who have experience with TradingView and need tailored alerts for their automated trading.

- Advanced users will find the flexibility and driven-scripts and alerts functionality to be a great asset.

Cons:

- Some bots offer more turnkey functionality because these will need more configuration on your part to create and customize your alerts and scripts.

- Free plans could be more restrictive than people expect.

- For complete novices, it does require a higher technical approach relative to the rest of the market.

Conclusion

Automated crypto trading tools have changed the way traders handle their portfolios because of their speed, accuracy, and non-stop, strategic execution. 3Commas, Cryptohopper, Coinrule, WunderTrading, and TradeSanta are known for their easy-to-navigate designs, various bot strategies, and excellent exchange integrations.

While some become frustrated with the absence of certainty as to profit, these systems lessen emotional trading, make backtesting easy, and let novices and seasoned traders carry out high-level strategies with ease.

Which system is best for you is determined by your trading technique, risk appetite, and the amount of automation you want. In the end, the tools make the management of highly volatile crypto with disciplined trading easy.

FAQ

Not always. Many platforms cater to non‑coders with templates and UI‑based rule builders (like Coinrule). But if you want truly custom strategies you may need scripting or more advanced logic.

Yes — many platforms offer backtesting and/or demo/paper‑trading environments so you can test without real monies.

No. Automation helps execution and removes emotion, but markets are uncertain and volatile. Past performance is not a guarantee of future results.