This article will cover the Best Strategies For Growth In Crypto Tokenomics focusing on how deflationary strategies, staking, governance, and even cross-chain compatibility token burns help create sustainable ecosystems.

These strategies foster adoption and also create long-term value which are necessary for any project to succeed in the growing competition in the crypto space.

Key Point & Best Crypto Tokenomics Strategies for Growth List

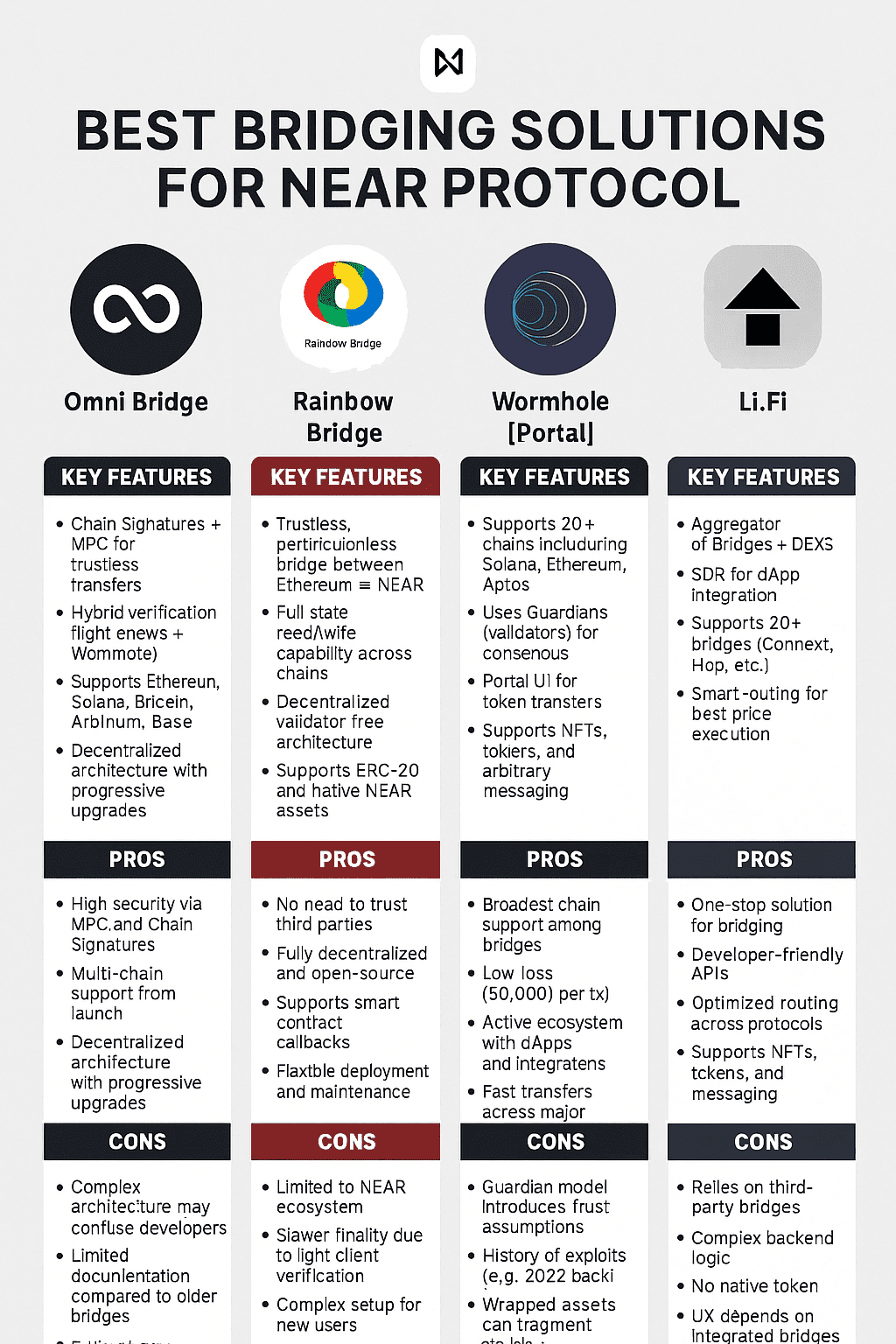

| Feature | Purpose | Key Point |

|---|---|---|

| Deflationary Token Burns | Reduce circulating supply | Permanently destroys tokens to increase scarcity and long-term value. |

| Staking and Yield Incentives | Reward long-term holders | Provides passive income through staking rewards or yield farming. |

| Controlled Token Supply & Vesting Schedules | Ensure sustainable distribution | Prevents sudden dumps and stabilizes token release over time. |

| Governance and DAO Participation | Enable decentralized decision-making | Token holders vote on upgrades, proposals, and ecosystem changes. |

| Utility-Driven Token Use Cases | Drive real-world adoption | Tokens used for payments, access to services, or unlocking features. |

1. Deflationary Tokens Burns

Deflationary token burns are a critical mechanism in which a subset of tokens are permanently removed from circulation to increase scarcity, thus aiding in appreciation of price over a long term.

A token burn mitigates supply inflation while signaling a strong intention from the developers to defend the value of the tokens.

Within the scope of Best Crypto Tokenomics Strategies, token burns are integral to fostering a balanced ecosystem that rewards early community members while ensuring the community-wide incentives are taken care of.

They work best in cases of high initial supply, easing genuine circulation and aiding in scarcer ecosystems that increase the desirability of the token to investors as well as users.

Deflationary Token Burns Features:

- Tokens can be destroyed permanently through burning.

- An automatic burn can be done through transaction fees, or can be triggered manually when the need arises.

- Permanently reduces the total circulating supply over a sustained period.

- Deflationary tokens like gold can be equivalent to and creates scarcity.

Pros:

- A policy of appreciation in prices for a sustained period of time, is positively aligned.

- Affirmative evidence on the dev of long-term burn policies and their impact is reassuring.

- Number of long-term holders will certainly go up, considering the demand for them

- Avatar inflation token supply will be positively impacted.

Cons:

- Overabundant supply can be burn and illiquid.

- Less prominent benefits for short-term investors.

- Period of burn events can have speculative bull runs.

- Market demand is more of a priority than the token.

2. Staking and Yield Incentives

Passive income options are available to the token holders by staking and yield incentives which unlock assets to secure consensus and liquid. This strengthens the blockchain network and these users are rewarded for the extra tokens.

As part of the Best Crypto Tokenomics Strategies, staking establishes a self-contained cycle that facilitates long-term holding by investors. This way, sell pressure is reduced.

Yield farming programs extend this by rewarding liquidity providers across decentralized finance (DeFi) platforms.

These mechanisms together boost network stability and user engagement, all while token holders remain active and productive. Loyal investors are also well taken care of.

Staking and Yield Incentives Features

- Tokens can be uploaded to the network to provide security for public and private blockchains or to liquidity pools.

- A portion of the total supply is staked and on a preset schedule, the staker is paid rewards.

- A portion of the total supply is staked and is paid a reward on a predetermined schedule.

- Added security and involvement of participants in the blockchain is enhanced.

Pros:

- Token policies that reduce instant selling becomes more favorable.

- Earning by just holding the token is possible.

- Improvement in the total network is certain.

- Coalition of the community is favorable along with the expansion of the project.

Cons:

- For staked tokens, liquidity is less available.

- As dilution happens over time, lost rewards become more commonplace.

- Attracts Yield Chasers, Users Chasers Who Will Omit when Yield Rates Dropped.

- Concentrated Tokens in Validator Nodes, OR: Validator Tokens can and/or in and/or Pools of Tokens.

3. Controlled Token Supply & Vesting Schedules

Vesting schedules and controlled token supply are meant to limit inflation as well as mitigate the risks associated with sudden token drops that can harm the market. Many projects implement a gradual release of allocation for the team or investors that have been locked away.

This promotes fairness and sustainability over the long term. As part of Best Crypto Tokenomics Strategies, having vesting periods fosters crypto tokenomics strategies to receive tokenomics inflation with trust and shows the founders are open to scrutiny.

Controlled supply means that long term tokens holders are protected from the devaluation. Also those holders are protected from tokens being dumped in the market.

Developers, investors, and community alignment is crucial. It is the only way to have vesting schedules that sustain price stability, endorse projects responsibly, and lower speculation driven volatility. All this aids the crypto ecosystem.

Controlled Token Supply & Vesting Schedules Features

- Tokens are released with specific time periods.

- Teams, investors, & communities unlock in phases.

- Sudden shocks in market supply are avoided.

- Ensures equity in the allocation of tokens.

Pros:

- Trusts investors with disclosure.

- Increases token value by reducing the chances of a market dump.

- Provides long-term dedication from the teams.

- Helps in the advancement of the project.

Cons:

- Investors can feel held captive to the token.

- Controlled timeframes are rigid and constrain the project.

- Price can still be affected by large trigger events.

- Loss of trust from the community can occur when failure of control and planning happens.

4. Governance and DAO Participation

Token holders can impact the direction of a project by voting on protocol enhancements, fee arrangements, and ecosystem extensions. This breaks up central power and encourages community stewardship.

In Best Crypto Tokenomics Strategies, people wield governance tokens for power, and no one individual can control the project. Moreover, strong DAO participation builds trust and retention as supporters feel appreciated.

On the other hand, blockchain voting combined with open community proposals can align the project’s growth with the community’s interests.

To summarize, governance-driven tokenomics enhances accountability and adoption. It also ensures that controlling innovation remains with the community and that holding a token is no longer a meaningless speculative or passive activity.

DAO With a Governance LayerFeatures:

- Users can propose changes to the protocol and vote.

- Disciplined self-governance.

- All proposals are public and available on-chain.

- Governance and utility tokens are one and the same.

Pros:

- Users have the power to take action.

- Trust is built through openness.

- Eliminates the possibility of a single authority.

- Gains attraction from users who want to take part in the development.

Cons:

- Absentee ballots can be detrimental.

- People with large holdings can sway the results.

- Complicated governance can be easily broken by newcomers.

- Proposals can slow down important changes.

5. Use Cases of Utility-Driven Tokens

Use cases of utility-driven tokens go beyond speculation by integrating tokens within real-life and ecosystem specific activities. These tokens can facilitate payments, paying transaction fees, and accessing premium services, along with feature unlocking within decentralized applications.

Having strong utility creates consistent demand regardless of trading, thereby providing tokens adequate value retention. This also promotes user participation within the ecosystem, strengthening the economy.

Utility-rich projects are less volatile, as tokens are not value speculative. Sustainability and user-driven growth is also easier to achieve with such economic models.

Token Utility Features:

- Payments are settled in tokens.

- Token holders are granted premium services.

- Token holders can pay transaction fees.

- Token holders gain additional benefits.

Pros:

- Token real demand is validated.

- Sustained use of the ecosystem is incentivized.

- Speculation is not the only focus.

- Developers and enterprises are drawn in.

Cons:

- Limited adoption is a risk.

- Ecosystem expansion is a must.

- User apprehension is caused by overly complex models.

- Token value is weakened by competing uses.

6. Liquidity Mining Programs

Under liquidity mining programs, users who contributed tokens to liquidity pools within decentralized exchanges and enhanced trading depth while reducing slippage are rewarded. This also strengthens market efficiency and creates passive income streams.

Under the Best Crypto Tokenomics Strategies liquidity mining fulfills the strongest community incentive to sustain tokens being usable and accessible. This leads to liquidity mining programs that provide additional governance tokens along with loyalty rewards.

The projects visibility and user adoption is enhanced by aligning the user and investor liquidity interests, which also sustains liquidity for new and existing projects within decentralized finance.

Liquidity Mining Programs Features

- Tokenized assets are deposited into designated liquidity pools.

- Native and partnership tokens are earned as rewards.

- Depth and efficiency of the exchange are enhanced.

- DeFi ecosystems are boosted.

Pros:

- Liquidity for trading is improved.

- Increased adoption.

- Contributors earn passive revenue.

- Growth of decentralized exchanges is supported.

Cons:

- Providers are exposed to illiquidity risk.

- High emissions create inflation.

- Short-term opportunistic liquidity users are highly transient.

- Users lack retention.

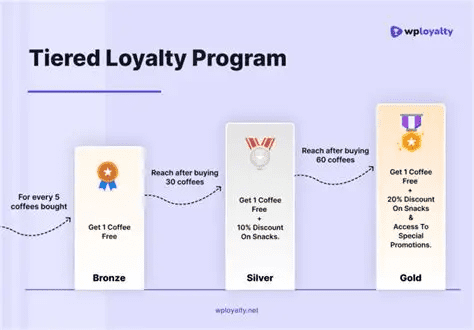

7. Tiered Reward Structures

Tiered reward structures give increasing incentives for users as size or length of token commitment deepens. This helps gain deeper engagement and loyalty from the users. As emphasized in Best Crypto Tokenomics Strategies, tiered systems seem to strike the sweet spot of rewarding casual users whilst incentivizing larger stakeholders.

For instance, premium benefits, governance powers, or higher yield may be available for longer staking terms or larger token contributions.

This model of gamified rewards inspires competition while curbing market sell pressure on tokens, thus promoting stability. Sustained ecosystem participation and user retention is managed by tiered reward systems which strikes a balance between scale and loyalty.

Tiered Reward Structures Features

- Duration or size of stake dictates the score.

- Premium benefits for upper higher tier users.

- Encourages deeper participation and loyalty.

- Engages users through gamified participation.

Pros:

- Keeps high value investors.

- Promotes possession for a longer duration.

- Increases interaction from users.

- Enhances the loyalty towards the project.

Cons:

- Less wealthy users might feel left out.

- Complicated reward structures puzzles the users.

- Might concentrate the rewards to the affluent users.

- Can foster disparity in the community.

8. Cross-Chain Compatibility

Cross-chain compatibility increases a token’s usability by enabling transfers and interactions across several blockchain networks without friction. This feature encourages the adoption of the token by eliminating the constraints of a single ecosystem.

As discussed in Best Crypto Tokenomics Strategies, interoperability allows tokens to access a wider range of users and value by connecting to various markets, DeFi platforms, and decentralized apps.

It also enhances liquidity fragmentation by increasing efficiency for users and developers. Cross-chain bridges, wrapped tokens, and multichain frameworks enable ecosystems to expand beyond their original chains, increasing the resilience, flexibility, and readiness of projects for the evolving crypto world.

Cross-Chain Compatibility Features:

- Assets can transfer over various blockchains.

- Through bridges, wrapped tokens, or cross-chain protocols.

- Increases participation in the ecosystem.

- Minimizes fragmentation in liquidity.

Pros:

- Enhances the utility and adoption of the token.

- Improves connection and interaction with other ecosystems.

- Gains more developers and users.

- Improves the efficiency of liquidity.

Cons:

- Bridges pose a significant risk in the security aspect.

- Adds a layer of technical difficulty to users.

- Assets that are wrapped might lose trust from hacks.

- Increases the cost of upkeep for developers.

9. Community Incentives and Airdrops

Community incentives and airdrops use free token distributions as bonuses for loyal users all while attracting new participants. These techniques are fundamental for more user engagement and quick adoption.

Under Best Crypto Tokenomics Strategies, airdrops can bootstrap communities by rewarding early supporters or by incentivizing certain actions like governance voting and liquidity provision. Incentives also encourage organic promotion.

These programs help users and as a bonus give them plenty of trust while decentralizing token allocation. This results in a more active and inclusive ecosystem where active participants are appreciated and invested in long-term success of the project.

Community Incentives and Airdrops Features

- No-cost tokens offered to users.

- Rewards are tied to allegiance or particular activities.

- Encourages use and public awareness.

- Distributes token ownership.

Pros:

- Builds reputation and trust with the community.

- Rapidly increases the project’s visibility.

- Rewards project’s early supporters.

- Gains more users in governance or utility.

Cons

- Airdropped tokens can be in a dump to other users.

- Can lead to a hype that is poorly controlled.

- Exploited by bots for the distributions.

- Can be costly for projects that are low on budget.

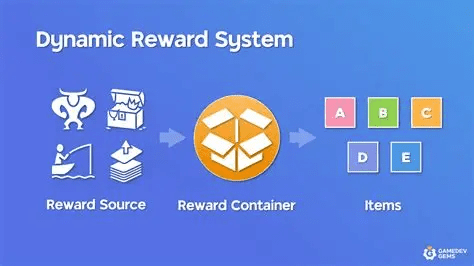

10. Dynamic Fee and Reward Mechanisms

Dynamic fee and reward mechanisms operate and monitor trading activity, network conditions, or demand to determine the economics of a token. For example, in a low activity period, the transaction fee can drop, and in a congestion period, the fee can rise to balance usage.

Under Best Crypto Tokenomics Strategies, such mechanisms help in the maintenance of sustainable growth while rewarding engagement in long-term positive behavior and discouraging negative behaviors like harmful over-speculation. Also, more flexible models will optimize incentives, making them user-friendly and adaptive.—

Changes to Fee Structures and Dynamic Rewards Systems

Features:

- Fee increments depend on the demand of the network.

- Rewards allocate based on the active engagement of users.

- Ensures ecosystem activities are balanced and equitable.

- Provides control on the volatility of the market with elastic mechanisms.

Pros:

- Operates with the network’s optimum efficiency proportionate to the volume of users.

- Usage stimulation funding allows the reward system to impact engagement.

- Supply and demand balance is easily achieved.

- Value is sustained over long periods of time.

Cons

- Discomfort from users due to sudden changes in fee structure.

- Additional difficulty in comprehension.

- If deployed inappropriately can be a hindrance to market adoption.

- Persistent adjustment spends a great deal of time.

Conclusion

In the crypto world we live in today, tokenomics strategies are essential for long-lasting development, community trust, and long-term utilization of the platform.

Each of the mechanisms plays a key part in value and stability, whether it be deflationary burns that increase scarcity, staking and yield incentives that profit holders, or governance frameworks that empower communities.

Further adaptability is ensured by cross-chain compatibility and ever-evolving reward systems, whereas community-driven and utility-driven engagement frameworks fuel participation.

All systems have pros and cons, but when filtered through a pragmatic lens, these strategies outline the Best Crypto Tokenomics Strategies which advocate balanced development, sturdiness, and inclusivity in decentralized economies.

FAQ

Tokenomics strategies define how a cryptocurrency’s supply, distribution, and incentives are structured to create sustainable value, encourage adoption, and reward participation.

No single approach works best in isolation. The strongest projects combine multiple strategies like deflationary burns, staking rewards, and governance to balance scarcity, growth, and community trust.

Burns can increase scarcity and long-term value, but without strong utility and demand, they may have little impact beyond short-term speculation.

While staking provides passive income, risks include locked liquidity, fluctuating rewards, validator centralization, and potential smart contract vulnerabilities.

Cross-chain compatibility ensures tokens can move across different blockchains, increasing adoption, reducing liquidity fragmentation, and making ecosystems more resilient.