This article outlines the Best Crypto Security Practices, protecting your digital assets from cyber threats. As the value of your cryptocurrency increases, your cybersecurity needs appropriate attention.

Using a hardware wallet, creating a complex password, enabling two-factor password authentication, and avoiding phishing scams keep your cryptocurrency investment secured and within your control.

Key Points & Best Crypto Security Practices Detailed

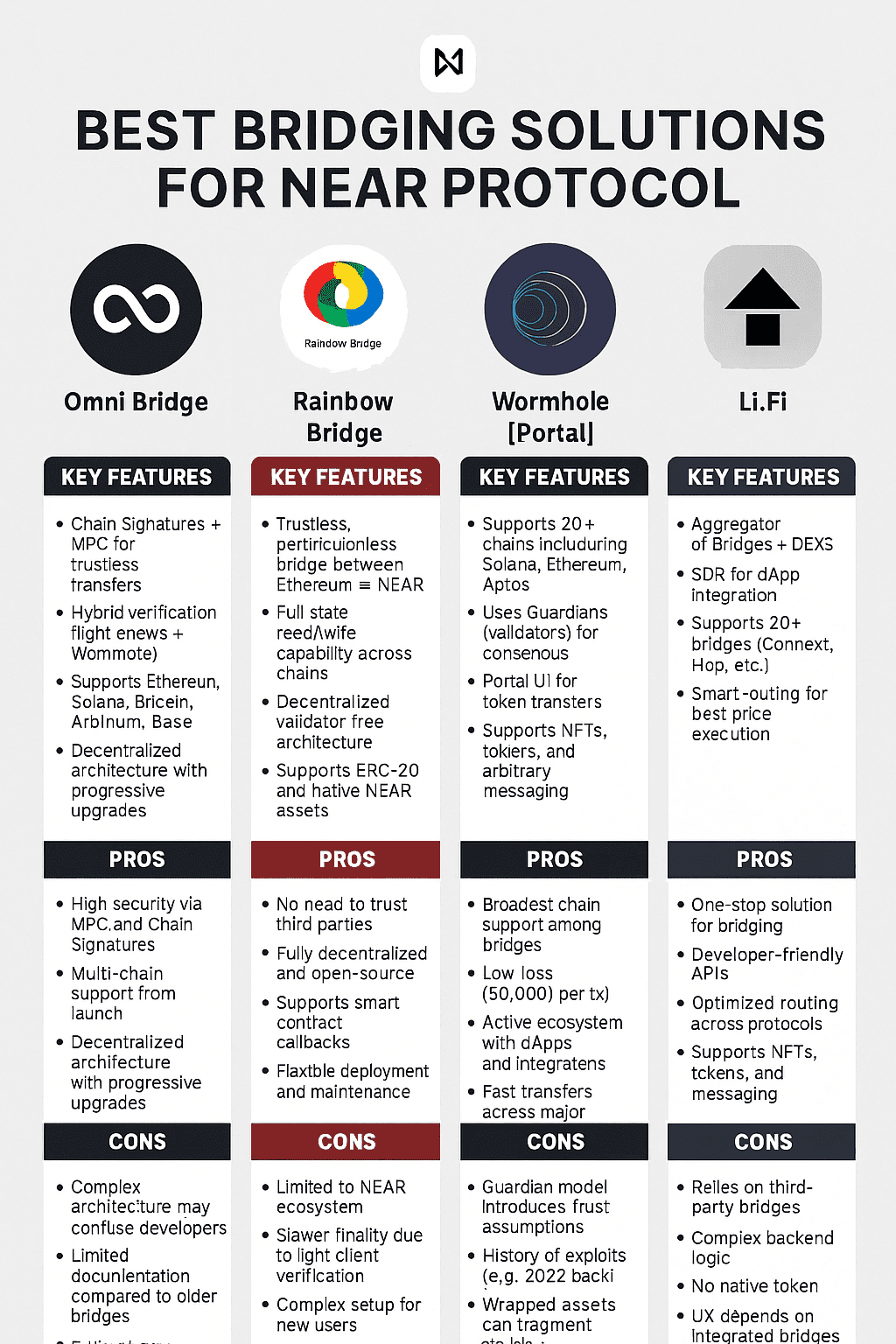

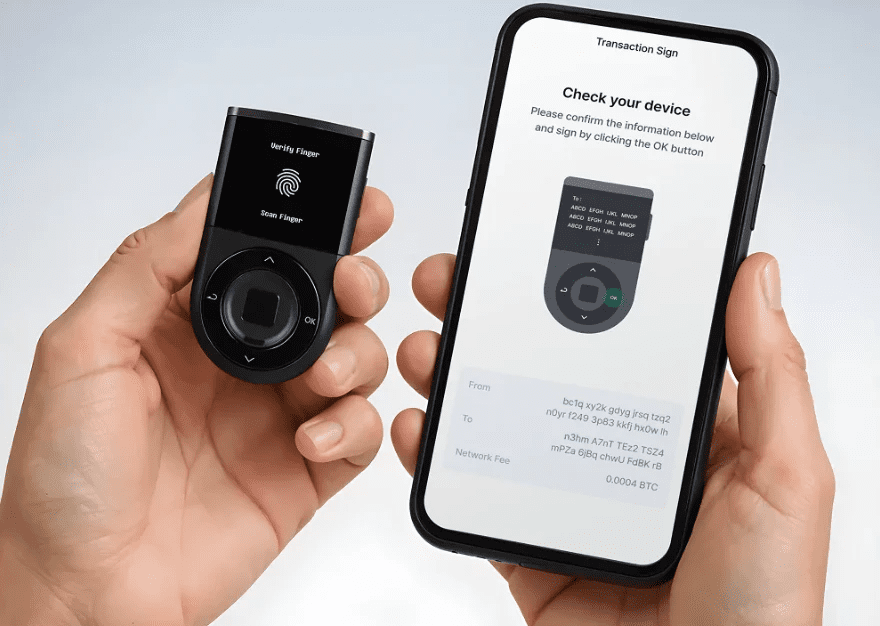

1. Use Hardware Wallets for Storage

By providing offline storage for crypto assets, hardware wallets such as Ledger and Trezor are practically immune to hacking.

These wallets are not like software wallets that are connected to the internet, as the private keys are stored safely offline.

The wallets require users to authorize each transaction, which protects the assets from malware and phishing attacks. These assets are also safe if the computer or other mobile devices are compromised.

Keeping the hardware wallets safe, regularly updating the software, and strong passwords will provide the best crypto protection. Hardware wallets are the safest crypto protection.

| Key Aspect | Details |

|---|---|

| What it is | A physical device that stores cryptocurrency offline, away from internet access. |

| Security Benefits | Protects private keys from malware, phishing attacks, and hacking attempts. |

| Examples | Ledger Nano X, Trezor Model T. |

| Best Practices | Confirm transactions physically on the device, use strong PIN codes, keep firmware updated. |

| Ideal For | Long-term storage or large amounts of crypto holdings. |

2. Enable Two-Factor Authentication (2FA)

Two-factor authentication provides added protection to your crypto accounts using a password and a temporarily generated code from Google Authenticator or Authy.

This complex password paired with a code transaction greatly cuts the chance of criminals getting control of your accounts.

Don’t use SMS-based 2FA, as criminals generally use SIM swapping attacks. Use authenticator apps or hardware security keys instead.

Once a month login to your account and update your 2FA method. Once 2FA protection is active, the chance of theft on the accounts linked to the wallets and crypto services is greatly reduced since attackers can’t access your account.

| Key Aspect | Details |

|---|---|

| What it is | An extra layer of security requiring two forms of verification. |

| Security Benefits | Prevents unauthorized access even if a password is compromised. |

| Types | Authenticator apps (Google Authenticator, Authy), hardware security keys (YubiKey). |

| Avoid | SMS-based 2FA due to SIM swap vulnerabilities. |

| Best Practices | Enable on all exchange accounts, wallets, and email linked to crypto. |

3. Use Strong and Unique Passwords

Despite a greater focus on the security of crypto wallets and other services, weak or compromised passwords are still a weak point and encourage unauthorized access.

Therefore passwords must be strong, that is, long and complex, having a combination of lowercase, uppercase letters, along with numbers and special characters.

It is also important that the password be unique from other accounts to reduce risk of a data breach. Using a unique password for each crypto account with the aid of a password manager makes the process easier.

Security is also improved with releases as the passwords must be complex. Strong unique passwords, especially on the high risk exchange, weakens the chance of a hacking and protects crypto transactions linked to your email.

| Key Aspect | Details |

|---|---|

| What it is | Complex passwords combining letters, numbers, and special characters. |

| Security Benefits | Reduces the risk of brute-force attacks and credential theft. |

| Best Practices | Avoid reusing passwords; use a reliable password manager. |

| Ideal For | All crypto-related accounts including exchanges, wallets, and email accounts. |

| Extra Tip | Change passwords regularly for enhanced security. |

4. Keep Software Updated

The importance of device security within the cryptocurrency space cannot be overstated. Regular system updates, whether for your operating system, crypto wallet, or exchange apps, strengthen your defenses against new malware or phishing schemes.

Unsurprisingly, outdated software leaves your system wide open to various cyber attacks. Automatic updates, when available, should definitely be turned on.

Also, routinely updating your antivirus software along with your firewalls will shield your crypto wallets and exchanges from potential attack.

By routinely updating your software, you cut down the odds of system exploits. Regular software updates, therefore, stand as a crucial practice for shielding your crypto assets from possible theft or compromise.

| Key Aspect | Details |

|---|---|

| What it is | Regular updates of operating systems, wallets, and exchange apps. |

| Security Benefits | Patches vulnerabilities that hackers could exploit. |

| Best Practices | Enable automatic updates, update antivirus/firewall software, and monitor firmware updates. |

| Risks of Neglect | Outdated software can lead to malware attacks and loss of funds. |

5. Avoiding Phishing Scams

One of the greatest threats in the world of cryptocurrency is phishing scams. Fraudsters try to trick you into giving out your login information or private keys by creating a phony website, email, or message that looks like a legitimate exchange or wallet.

You can protect yourself by checking spellings in URLs, being careful about links, and verifying the senders’ addresses.

Remember, you should never share private keys and seed phrases. Bookmarked sites helped you save time, but remember to save your sites and avoid the search engine.

Be on the lookout for fake support-scams or “giveaway” scams, which is a form of social engineering.

By being careful about phishing scams, you can prevent thieves from accessing your cryptocurrency accounts, which is a form of digital asset theft.

| Key Aspect | Details |

|---|---|

| What it is | Fraudulent attempts to steal credentials via fake websites, emails, or messages. |

| Security Benefits | Protects against unauthorized access to wallets and exchanges. |

| Best Practices | Verify URLs, avoid clicking suspicious links, never share private keys or seed phrases. |

| Common Scams | Fake giveaways, fake customer support emails, and malicious links. |

| Extra Tip | Bookmark official exchange websites to prevent visiting fake ones. |

6. Protect Your Private Keys and Seed Phrases

Private keys and seed phrases are the master keys to your cryptocurrency holdings. They can never be stored online, in screenshots, or in cloud storage.

Write them down and keep them in a secure, offline location, preferably in a fireproof safe. Don’t share them with anyone, even supposed support personnel.

Encrypted physical backups are even more secure. Once a private key or seed phrase is exposed, funds can be accessed in seconds, and there is nothing you can do to stop it.

Efficient management of such sensitive credentials ensures that your crypto stays safe and accessible.

| Key Aspect | Details |

|---|---|

| What it is | Sensitive credentials that grant access to your crypto holdings. |

| Security Benefits | Unauthorized access to private keys allows instant theft of funds. |

| Best Practices | Store offline in a secure location, use encrypted backups, never share with anyone. |

| Ideal Storage | Fireproof safe or encrypted hardware device. |

| Extra Tip | Avoid taking screenshots or storing them in the cloud. |

7. Use Reputable Exchanges and Wallets

Use exchanges and wallets with a reliable history and a strong reputation. Trusted services implement comprehensive security measures such as encryption, cold storage, and multi-signature wallets to safeguard funds.

Reading reviews and looking up regulatory compliance are essential steps, as well as avoiding services with a history of security breaches. Staying with well-known services can prevent cases of losing money from hacking and exit scams.

Slightly diversifying the wallets you use can be a protective measure as well. When you use services from authenticated providers, you can be sure that the money you are investing in crypto is protected and that the money is managed under professional security standards.

| Key Aspect | Details |

|---|---|

| What it is | Platforms with strong security measures, licensing, and positive reputation. |

| Security Benefits | Lower risk of hacks, scams, and regulatory issues. |

| Best Practices | Check reviews, regulatory compliance, and history of security breaches. |

| Examples | Binance, Coinbase, Kraken (well-known trusted platforms). |

| Extra Tip | Diversify funds across multiple trustworthy platforms for added safety. |

8. Enable Multi-Signature Transactions

Multisignature wallets need several private keys to approve a transaction. For instance, in a 2-of-3 arrangement, two of the three keys must be presented to authorize a withdrawal.

This setup blocks illegal withdrawals from a drained key since the key user must authorize the transaction. Their security features make multisig wallets optimal for businesses, large joint accounts, and large crypto holders.

When coupled with the use a secured hardware wallets, the security is much greater. By centralizing control of transactions through several keys, the holder defends the crypto assets from hacks, loss, and unauthorized transactions.

Fund withdrawal is impossible when the lone key is activated, upholding the principle of crypto security.

| Key Aspect | Details |

|---|---|

| What it is | Wallets requiring multiple keys to authorize a transaction. |

| Security Benefits | Prevents theft if one key is compromised. |

| Use Case | 2-of-3 or 3-of-5 multisig setups for individuals, businesses, or joint accounts. |

| Best Practices | Combine with hardware wallets and secure storage. |

| Extra Tip | Reduces risk of accidental or malicious transactions. |

9. Look Out For Your Accounts and Transactions on a Regular Basis

By regularly checking your accounts, you are able to spot unauthorized activities early. Look for balances and transaction history, and note any login activities on your wallets and your crypto exchanges.

Notifications for withdrawals and other account alterations allow you to respond to any unlawful activities right away. Frequent checks so that you can quickly freeze accounts, call support, or identify phishing or log-on attempts.

Monitoring accounts helps you quickly identify phishing attempts or abnormal log-ins. Monitoring your crypto accounts helps you quickly identify phishing attempts or abnormal log-ins.

Monitoring helps mitigate possible losses while assisting you to meet best practices for security, and helps you remain confident that your digital assets are safe and secure.

| Key Aspect | Details |

|---|---|

| What it is | Regular monitoring of balances, transactions, and account activity. |

| Security Benefits | Early detection of suspicious activity allows prompt action. |

| Best Practices | Set up alerts for withdrawals, unusual logins, or login attempts. |

| Extra Tip | Review transaction history periodically to ensure everything is correct. |

10. Backup Your Wallets and Any Other Relevant Data Safely

You can regularly and securely backup your wallets to recover funds even if your device was stolen or damaged.

Offline, you can keep your backup encrypted on a USB, as a document, or a hardware device, then keep it locked in a safe location.

Online, you are more likely to experience hacking incursions, ransomware attacks, and other cyber threats.

To be certain that you can recover your device, regularly test your backup to streamline your recovery steps.

Backing up data and wallets gives you the confidence that your funds are accessible even in the most unfavorable situations.

| Key Aspect | Details |

|---|---|

| What it is | Keeping secure copies of wallets, private keys, and important crypto data. |

| Security Benefits | Ensures access to funds in case of device loss, theft, or damage. |

| Best Practices | Store backups offline on encrypted drives or paper, test recovery procedures periodically. |

| Risks of Neglect | Loss of wallets without backups can result in permanent loss of funds. |

| Extra Tip | Avoid storing backups online or on cloud platforms to reduce exposure. |

Conclusion

To conclude, without a doubt, best practices for crypto security is fundamental to protect your assets. Using hardware wallets and strong, 2FA secured, reputable platforms and, secure backups

while using phishing and account monitoring will significantly help to protect against theft/loss. These strategies, without a doubt, will maintain long-term control and safety for your crypto portfolio.

FAQ

Using hardware wallets keeps your private keys offline, protecting them from hacks and malware.

Two-Factor Authentication adds an extra login step, preventing unauthorized access even if passwords are stolen.

No, always use strong and unique passwords for each account to reduce hacking risks.

Regularly update wallets, apps, and devices to patch security vulnerabilities.

Verify URLs, avoid suspicious links, and never share private keys or seed phrases.