Finding the best crypto portfolio rebalancing tools can be pretty challenging, given the market’s rapid fluctuations. That’s where crypto portfolio rebalancing tools come in, providing automated strategies for maintaining balance, reducing risk, and optimizing returns.

Whether simple, mobile applications or full-fledged, multi-exchange solutions, these tools span the entire risk and complexity spectrum, offering flexibility, security, and intelligent analytics.

From self-directed strategies with minimal fee structures to high-touch, hyper-automated solutions, the best tools ensure compliance with discipline, maintaining alignment with long-term portfolio objectives.

What is Rebalancing?

Rebalancing is frequently used to adjust the risk level of the portfolio so that there is no over- or under-exposure to certain assets to maximize profit. This is considered a portfolio optimization technique.

Over a specific time period, the assets in a portfolio will position themselves positively or negatively to one another; thus, the portfolio has to be optimized to mitigate risk.

Benefits of Crypto Portfolio Rebalancing

Below is a comprehensive take on the benefits of crypto portfolio rebalancing.

Risk Management. Your portfolio loses balance because of a single crypto. Constant rebalancing avoids over-concentration on a crypto, reducing the chances of a significant loss from a very volatile single crypto asset.

Profit Optimization. Profit is not reward maximization; it is the result of frequent selling of high fliers while picking underperformers during the price swings.

Upholds Investment Strategy. Asset allocation and investment goals are met based on the rebalancing strategy. It is tough not to make emotional or impulsive decisions.

Reduces Volatility. Long term portfolio growth is much smoother due to the blending a balanced combination of high risk and stable assets.

Boosts Discipline. Procrastination and absence of discipline are the result of panic selling, which regular rebalancing avoids, particularly during difficult market conditions.

Automated Rebalancing. Consistent digital portfolio management is achieved through crypto rebalancing tools, which automate various processes, thereby saving time.

Dynamic Trading Strategy. Comprised of buying low and selling high, rebalancing is a process that corrects market imbalances and vice versa.

Key Point

| Platform | Supported Exchanges | Mobile App | Free/Paid Plan |

|---|---|---|---|

| 3Commas | Binance, Coinbase, Kraken, etc. | Yes | Free & Paid |

| Quadency | Binance, KuCoin, Bittrex, etc. | No | Free & Paid |

| Binance | Native Binance only | Yes | Free |

| Pionex | Native Pionex | Yes | Free |

| Coinrule | Binance, Kraken, Bitstamp, etc. | No | Paid |

| Holderlab | Multiple (via API) | Yes | Free & Paid |

| CoinStats | Binance, Coinbase, Kraken, etc. | Yes | Free & Paid |

| SwissBorg | Binance, Coinbase, etc. | Yes | Free & Paid |

| Shrimpy | Multiple exchanges | Yes | Paid |

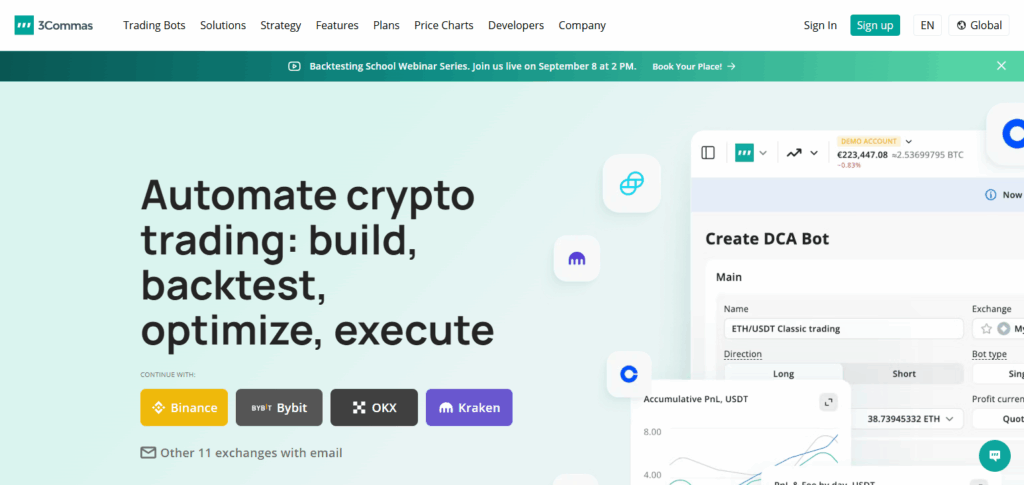

1. 3Commas

3Commas Like other trading platforms, 3Commas is a crypto trading platform that also does portfolio rebalancing, automated trading bots, and analytics. 3Commas is known for smart trading and supports 20 exchanges like Binance and Coinbase.

They offer a free plan, with tiered paid plans priced between $29 and $99/month. There are flexible rebalancing strategies and support for hundreds of coins.

They have 2-factor access and enforce key api protection. Users can download the 3Commas app for iOS and Android, enabling easy portfolio rebalancing on the move. Minimum investment is based on the amount of the exchange balance.

Benefits of 3Commas

- Automated portfolio rebalancing with clever trading strategies.

- Support for 20+ major exchanges, including Binance and Coinbase.

- Mobile apps allow rebalancing on the go at any time.

- Free and tiered pricing plans for varying levels of traders.

Pros

- Supports 20+ major exchanges.

- Advanced bots and innovative trading features.

- Mobile apps for portfolio control.

- Free and paid plans available.

Cons

- Paid plans of 29 and 99 can be expensive for some.

- Beginners would face the obstacle of the learning curve.

- Glitches are sometimes reported on the platform.

2. Quadency

Quadency is a versatile crypto trading and portfolio management tool. Quadency integrates with many exchanges, including Binance, Bittrex, and KuCoin, permitting seamless cross-exchange asset management.

Quadency’s paid and free tiers start at \$49/month for advanced automation. Quadency’s portfolio management strategies enable customizable rebalancing with scheduled adjustments.

Quadency’s web and desktop interfaces support dozens of cryptocurrencies and ensure security via encrypted API connections.

Traders can also gain mobile access to Quadency’s advanced analytics dashboard to monitor portfolio performance and movements on the broader market. Minimum investment is flexible.

Benefits of Quadency

- Portfolio rebalancing across multiple exchanges, with automated and customizable rebalancing.

- Mobile accessibility to analytics and portfolio tracking.

- Manage your portfolio across multiple exchanges in a single, intuitive dashboard.

- Portfolio rebalancing for casual and professional users.

Pros:

- Asset management across exchanges.

- Scheduling and automation are adjustable.

- Free and paid plans are available.

- Performance can be monitored on analytics dashboard.

Cons:

- Paid plans starts from $49/month.

- Mobile offerings are not as robust as the web and desktop versions.

- Platform is newer and hence has lesser user base.

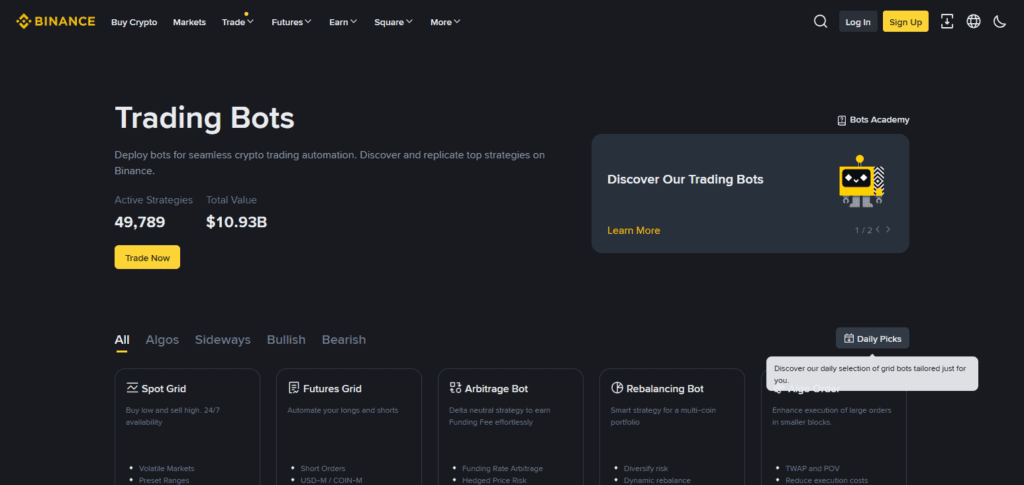

3. Binance

Binance is one of the largest global crypto exchanges and offers seamless portfolio rebalancing and investment automation. It also charges a highly competitive fee of 0.1% for trades and offers discounted fees to BNB holders.

Binance supports hundreds of coins and has diverse trading pairs, allowing traders extensive investment opportunities. Binance rebalancing via recurring buys and staking can be automated. Binance account security includes two-factor authentication, a withdrawal whitelist, and SAFU insurance funds.

The Binance mobile app offers complete portfolio management, with varying minimum coin investments. Binance is recommended for individuals seeking an integrated rebalancing account, enhanced security, and high liquidity.

Benefits of Binance

- Direct access to diverse trading pairs and hundreds of coins.

- Automated portfolio rebalancing via staking and recurring buys.

- Low trading fees and automated rebalancing.

- 2FA, SAFU insurance, and cold storage automated portfolio rebalancing.

- Access to the most liquid trading across multiple coins.

Pros:

- Very low fees (0.1% which is even lesser with BNB).

- High liquidity and wide coin support.

- Strong security measures (SAFU, whitelist, 2FA).

- Full portfolio is managed on mobile app.

Cons:

- New investors would face a steep learning curve.

- Some countries are restricted for a number of reasons.

4. Pionex

Pionex is a crypto exchange with automated trading and integrated portfolio rebalancing tools, aimed at both amateur and professional users.

The exchange supports dozens of coins, provides its native trading bots, and charges minimal trading fees of around 0.05%, making rebalancing cost-effective.

Pionex utilizes 2FA along with cold storage reserves as a means of security. The company has web and mobile platforms, allowing users to start with very low minimum balances, depending on the asset.

Pionex’s rebalancing approach uses automation to reallocate and maintain target balances, making it optimal for hands-off investors.

Benefits of Pionex

- Automated portfolio rebalancing with in-built bots.

- Reduced mobile-centric trading.

- Robust two-factor authentication and cold storage securitized portfolio rebalancing.

- Automated portfolio rebalancing with over 0.05% completion.

Pros:

- Ultra low fees of 0.05%.

- Free built in trading bots.

- Cold stored with 2FA for security.

- Good for automation and very easy to use.

Cons:

- Only available on Pionex’s own exchange.

- Lesser number of coins available compared to Binance.

- No sandbox training available.

5. Coinrule

Coinrule is a no-code automated crypto trading platform that allows automated rebalancing on multiple exchange accounts like Binance, Kraken, and Bitstamp. Coinrule has several pricing tiers, starting from $29/month, with more advanced plans offering more complex automated trading strategies.

The platform supports hundreds of coins and uses rule-based rebalancing triggered by user-defined rebalancing parameters. Security is enhanced with user-defined API keys and 2FA.

Mobile app support is minimal, however, the web interface is full-featured. Fund minimums correspond with balances on the connected exchange. Coinrule appeals to traders who desire autonomous control over portfolio rebalancing without manual engagement.

Benefits of Coinrule

- Automated rebalancing based on pre-defined conditions.

- Integrates with major exchanges such as Binance and Kraken.

- Custom tailored approaches to trading as per user specifications.

- Protection via custom API keys with enforced 2FA.

- Ideal for traders wanting minimal interaction with active portfolio management.

Pros

- No advocacy required and simple to configure.

- Supports major exchanges such as Binance and Kraken.

- Strong security supported through API keys and 2FA.

- Supports a couple of hundreds of cryptocurrencies.

Cons

- Advanced strategies paywall.

- Web-based app with minimal mobile support.

6. CoinStats

Users can track and manage hundreds of coins across multiple exchanges, including Binance, Coinbase, and Kraken, with automatic rebalancing, advanced DeFi analytics, and portfolio management features available on CoinStats.

It offers free plans and Pro subscriptions at $14.99/month. Users can also automate and manually rebalance with scheduled parameters. API key 2FA and other mobile features are also available.

The minimum investment depends on the connected exchange. CoinStats is user-friendly for both casual and professional investors.

Benefits of CoinStats

- Portfolio management across different exchanges.

- Options for automatic and manual rebalancing.

- Advanced analytics tools integrated for DeFi systems.

- Free and Pro tiers for growth.

- Designed for casual and professional investors.

Pros

- Single portfolio tracker integrated with all exchanges.

- Supports DeFi and other crypto analytic tools.

- Options for rebalancing both automatic and manual.

- Has a free basic plan and a Pro plan.

Cons

- Tools on Pro plan ($14.99/month) are basic compared to competitors.

- Less sophisticated automation compared to 3Commas.

7. SwissBorg

SwissBorg presents a crypto wealth management platform, focused on mobile devices, that provides portfolio rebalancing, smart yield, and analytics. SwissBorg applies a rule-based approach and supports dozens of coins, automatically maintaining target allocations.

Most of the platform’s offerings are free, with premium memberships that come with advanced analytic features. Security has become a dominant concern and involves encrypted keys, two-factor authentication, and multi-signature wallets.

The mobile app is powerful, offering real-time portfolio and investment tracking capabilities. The low minimum investment requirements are very welcoming to new investors. SwissBorg is perfect for users looking for a mobile and rebalancing-centric platform with growth-driven features.

Benefits of SwissBorg

- Crypto wealth management platform with a mobile-first approach.

- Portfolio rebalancing via smart yield and rule-based investment.

- Designed with beginners in mind and has low entry points.

- Uses multi-signature wallets with 2FA for security.

- Offers investment analytics with real-time tracking.

Pros

- Mobile application is simple to use.

- Secure with multi-signature wallets and 2FA.

- Smart yield and rule-based rebalancing.

- Low deposits make it easy for beginners.

Cons

- Few supported exchanges.

- Additional payments are required to access more features.

8. Shrimpy

Shrimpy is a crypto portfolio automation tool that focuses on rebalancing and social trading. Shrimpy has access to many exchanges, including Binance, Coinbase, Kraken, and Bitstamp, which enables access to hundreds of coins.

Pricing is subscription-based, starting with the individual plan at $19/month and higher tiers for advanced features. Shrimpy incorporates automated rebalancing strategies such as periodic and threshold-based rebalancing.

Encrypted API keys and two-factor authentication enhance Shrimpy’s powerful security. Available in both mobile and web apps, Shrimpy allows users to monitor and manage their portfolios.

The investment minimum is set by the exchanges that are connected. Shrimpy is ideal for investors who want portfolio automation and expect long-term growth.

Benefits of Shrimpy

- Focused on portfolio automation and rebalancing.

- Supports exchanges like Binance and Coinbase.

- Offers periodic and strategy-based trading.

- Includes social trading where users can trade and share strategies.

- Supports web and mobile devices.

Pros:

- Multi-exchange capabilities (Binance, Coinbase, Kraken).

- Automated periodic & threshold rebalancing strategies.

- Includes social trading features.

- Accessible on the web and mobile version.

Cons

- Most useful features are gated on more expensive plans.

- Social trading features might not appeal to every user.

How Can You Use Tools To Rebalance?

You can utilize a rebalancer tool to assist you in keeping a portfolio that suits your risk appetite. Allotment tools for rebalancing a portfolio help an investor maintain a portfolio that matches his or her risk tolerance.

These tools facilitate the migration of transfers and the reallocation of assets across different accounts to achieve the desired target allocation for the portfolio structure on an account. Some can even perform these tasks to completion automatically.

More information can be found at napbots.com, which is where you can learn about an automated rebalancer tool. The crypto tools concerning rebalancing are tailored for an individual whose main aim is to reduce the exposure to volatility surrounding cryptocurrency.

Even so, these are unlikely to be helpful to individuals whose trading strategy involves frequent daily transactions.

Mistakes to Avoid When Rebalancing

Error rebalancing can fail to maintain the preset goals and objectives of the portfolio. Most of these mistakes can be mitigated through proper planning.

Investing in Low-Performing Assets

Investors often focus too heavily on underperforming assets. Of course, wanting to cut losses is very nice, but it can ignore perilous, unbalanced portfolio and quite overweight c.

Proper rebalancing requires considering both the gains and losses and re-evaluating to ensure an appropriate level of diversification around objectives. The Portfolio.

Lack of Experience and Radical Changes

Typically, novice investors find the rebalancing exercise to be somewhat daunting and intimidating. They thus respond and deal with these rebalancing matters with young and radical notions.

Extreme changes done to a portfolio often lead to severe, unanticipated effects that increase instability and volatility.

For this reason, novices need to address this matter, emphasizing the stepwise approach and understanding the effect each step ETF has on the portfolio before step changes are made.

Neglecting Taxes

Tax triggered in the rebalancing of a portfolio CFDs is not only restricted to the allocation. For instance, the realisation of some assets at a gain brings about the capital gains that need to be settled and rationalised.

The gains might be taxable, mainly based on the fact that the proposal is regarded as property to the IRS. Ensuring these expenses are present at the time is necessary to avoid surprises during payments at the end of the fiscal year.

Conclusion

The crypto portfolio rebalancing tool that you choose will depend on your level of experience in trading, your budget, and finally, your expectations. For example, if you are a frequent trader, you can use platforms such as Binance and Pionex due to their low fees and built-in automation.

Pionex, 3Commas, and Shrimpy, on the other hand, seem to be centered more around professional traders due to their advanced strategies, access to multiple exchanges, and social trading.

If you are an everyday investor with budget constraints, consider using Holderlab and CoinStats. Also, if you use your mobile phone often, you can use SwissBorg, which, in addition, offers safe yet straightforward wealth management.

Quadency and Coinrule offer versatile automation tools, ideal for traders who want to customize their strategy. In the end, the optimal rebalancing tool is the one that provides a balance between automation, security, and usability for your specific investment strategy.

FAQ

Portfolio rebalancing is the process of adjusting your cryptocurrency holdings to maintain a target allocation. It helps manage risk, ensures diversification, and keeps your portfolio aligned with your investment goals.

Rebalancing tools automate the process, saving time and reducing emotional decision-making. They provide precision, customizable strategies, and often integrate with multiple exchanges for seamless adjustments.

Platforms like SwissBorg and CoinStats are beginner-friendly due to their simple interfaces, mobile-first designs, and low minimum investment requirements.

3Commas, Shrimpy, and Coinrule offer advanced features like customizable bots, rule-based automation, and multi-exchange support—ideal for experienced traders.

Most reputable platforms use API keys, two-factor authentication (2FA), and encrypted connections. However, it’s crucial only to connect exchanges you trust and never share withdrawal-enabled API keys.