In this article, I will discuss the Best Crypto Liquidity Pools, exploring top platforms where users can trade, lend, and earn rewards.

Uniswap and Curve to PancakeSwap and Aave, these pools offer diverse opportunities for maximizing returns and providing liquidity.

Whether you are a beginner or an experienced DeFi user, understanding these pools is essential for smart crypto investing.

Key points & Best Crypto Liquidity Pools List

| Liquidity Pool | Key Points |

|---|---|

| Uniswap (UNI) | Largest decentralized exchange (DEX), supports ERC-20 tokens, uses automated market maker (AMM) model, low slippage for major pairs, strong community governance. |

| Curve Finance (CRV) | Specialized in stablecoin swaps, low fees and minimal slippage, efficient for pegged assets, CRV token rewards, widely used in DeFi yield strategies. |

| Balancer (BAL) | Flexible liquidity pools with multiple tokens, customizable weight distribution, supports portfolio rebalancing, BAL rewards, integration with DeFi protocols. |

| PancakeSwap (CAKE) | Leading DEX on Binance Smart Chain (BSC), lower gas fees than Ethereum, supports yield farming and staking, lottery and NFT integration, CAKE token rewards. |

| SushiSwap (SUSHI) | Fork of Uniswap with added features, multi-chain support, staking via SushiBar, yield farming incentives, community-driven governance. |

| Aave (AAVE) | Lending and borrowing protocol with liquidity pools, supports flash loans, depositors earn interest, highly secure, widely integrated in DeFi ecosystem. |

| Compound (COMP) | Algorithmic money market protocol, supports lending/borrowing, users earn COMP governance tokens, highly secure smart contracts, strong institutional adoption. |

| Yearn Finance (YFI) | Aggregates multiple liquidity pools for optimized yield farming, auto-compounds rewards, supports multiple strategies, community-governed, YFI as governance token. |

| 1inch Liquidity Protocol | Aggregates liquidity across multiple DEXs, reduces slippage, provides best swap rates, advanced routing technology, strong DeFi integrations. |

| Bancor (BNT) | First AMM protocol, supports impermanent loss protection, single-sided liquidity provision, deep liquidity for major tokens, BNT token incentives. |

10 Best Crypto Liquidity Pools

1.Uniswap (UNI)

Uniswap ranks among Ethereum’s premier decentralized exchanges, leveraging the automated market maker (AMM) architecture. By facilitating direct token swaps from user wallets, it eliminates the need for custodial intermediaries.

Liquidity providers deposit token pairs into pools, accruing transaction fees proportionate to their participation. V3’s concentrated liquidity model maximizes capital efficiency by allowing providers to range liquidity across specified price bands, thereby lowering slippage for traders.

Its broad integration across the DeFi ecosystem, coupled with continuous upgrades, ensures sustained market dominance. Governed by the UNI token, Uniswap not only maintains deep liquidity but also drives ongoing governance and ecosystem innovation.

| Pros | Cons |

|---|---|

| Largest DEX with deep liquidity | High gas fees on Ethereum |

| Supports thousands of ERC-20 tokens | Impermanent loss risk for LPs |

| Efficient AMM model with V3 upgrade | Complex for beginners |

| Strong community governance via UNI token | Limited to Ethereum mainnet (though L2 expanding) |

| Widely integrated across DeFi platforms | Competition from newer DEXs |

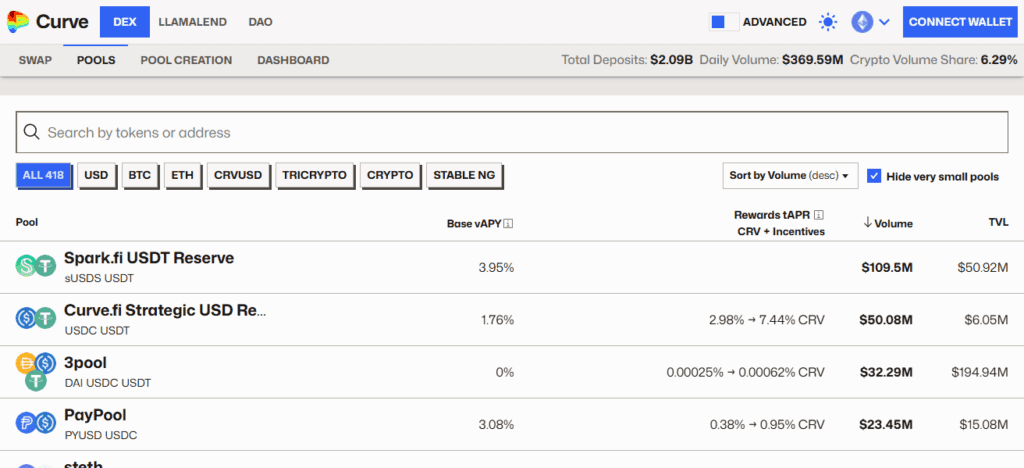

2.Curve Finance (CRV)

Curve Finance operates as a decentralized exchange protocol purpose-built for swapping stablecoins and pegged assets at minimal cost and slippage. By narrowing its design to stable-token trades, the protocol avoids the inflated slippage common in generalized DEXs.

Crucial assets such as USDT, USDC, DAI, and wrapped tokens—including stETH—can therefore be exchanged at impressively low fees.

Through a specialized automated market maker (AMM) architecture, liquidity providers experience impermanent loss that is substantially mitigated when assets retain their pegs.

Market participants who deposit funds receive transaction fees in addition to CRV governance tokens, with effective yields often accentuated by well-structured yield farming campaigns. Because of these features

Curve’s protocol has evolved into a foundational layer of the decentralized finance (DeFi) space, serving as a liquidity hub for yield-optimisation strategies and aggregators.

Its longitudinal growth stems from acute attention to stable-coin capital efficiency and horizontal crosstalk with the wider DeFi ecosystem, fostering an increasingly interoperative market infrastructure.

| Pros | Cons |

|---|---|

| Best for stablecoin and pegged asset swaps | Limited to stable/pegged assets |

| Very low slippage and trading fees | Interface can be difficult for new users |

| Deep liquidity pools with high efficiency | Yield farming strategies can be complex |

| Rewards with CRV tokens | Governance token highly inflationary |

| Core part of DeFi yield optimization | High reliance on Ethereum ecosystem |

3.Balancer (BAL)

Balancer distinguishes itself as an advanced decentralized liquidity framework characterized by fully customizable pools that accommodate multiple assets and non-fixed weight settings.

In contrast to Uniswap’s rigid equal-weight pools, Balancer permits composable liquidity configurations of up to eight tokens, each assigned an adjustable share.

This capability empowers users to construct automated, tokenized index vehicles that self-rebalance as market prices shift. Providers receive both transaction fees and governance emission rewards, while traders enjoy shallow slippage and orderly depth across heterogeneous securities.

Balancer’s architecture is deeply embedded within the DeFi ecosystem, delivering recurring yield as well as systematic portfolio oversight. The protocol’s intelligent trade-routing algorithms disseminate orders among heterogeneous pools, optimizing execution across diverse paths.

This interoperability and metabolic efficiency render Balancer an essential tool for institutions and emergent developers alike.

| Pros | Cons |

|---|---|

| Customizable pools with multiple tokens | Less liquidity compared to Uniswap |

| Flexible weight distribution (not just 50/50) | More complex setup for LPs |

| Functions like a decentralized index fund | Higher gas costs on Ethereum |

| BAL token rewards for LPs | Limited mainstream adoption |

| Strong DeFi integrations and routing | Advanced features may confuse beginners |

4.PancakeSwap (CAKE)

PancakeSwap remains the most prominent decentralized exchange operating on the Binance Smart Chain (BSC), characterized by rapid trade confirmations and fees that remain a fraction of those charged by Ethereum-hosted platforms.

Employing the automated market maker (AMM) architecture, the platform not only facilitates token swaps but also offers extensive yield farming capabilities. Liquidity providers receive a dual reward: a percentage of swap fees and periodic distributions of CAKE tokens.

Users are afforded the further opportunity to stake accumulated CAKE within the Syrup Pools, generating a reliable stream of passive returns. Against the backdrop of primary trading functions, PancakeSwap has broadened its offering to encompass lottery draws, native NFT support, and a variety of gamified decentralized finance (DeFi) mechanisms.

User uptake has been fostered by an intuitive interface, highly economical settlement costs, and resilient liquidity depth. These attributes are particularly well aligned to retail participants seeking economical access to decentralized finance, insulated from the substantial gas fees that typify Ethereum transactions.

| Pros | Cons |

|---|---|

| Customizable pools with multiple tokens | Less liquidity compared to Uniswap |

| Flexible weight distribution (not just 50/50) | More complex setup for LPs |

| Functions like a decentralized index fund | Higher gas costs on Ethereum |

| BAL token rewards for LPs | Limited mainstream adoption |

| Strong DeFi integrations and routing | Advanced features may confuse beginners |

5.SushiSwap (SUSHI)

Originally a Uniswap clone, SushiSwap has matured into a comprehensive, multi-chain environment for liquidity provision and trading. Its compatibility spans Ethereum, Binance Smart Chain, Polygon, and additional layer-one and layer-two networks, granting users near-universal entry.

Capture a share of transaction fees and SUSHI token emissions, augmented by dynamic yield-farming campaigns. Central to its value proposition is the SushiBar staking module, allowing users to deposit SUSHI and mint xSUSHI, thereby acquiring a pro-rata claim on the platform’s accumulated protocol revenue.

Governance is uniformly devolved to the SUSHI token holder community, granting acheives decentralized oversight of both operational and economic parameters.

SushiSwap is distinguished by a slate of innovative product verticals and prolific ecosystem expansion, evolving from a simple front-end into a cohesive DeFi platform that underpins both liquidity generators and the broader trading economy.

| Pros | Cons |

|---|---|

| Low transaction fees on Binance Smart Chain | Security risks from BSC centralization |

| Fast and efficient AMM model | Impermanent loss for LPs |

| Yield farming and staking with CAKE | Lower liquidity compared to Uniswap |

| User-friendly interface with gamification | Heavy reliance on CAKE token incentives |

| Extra features: lottery, NFTs, predictions | Exposure to BSC rug pulls and scams |

6.Aave (AAVE)

Aave stands as a leading autonomous platform in the decentralized lending and borrowing landscape. Eschewing the conventional automated market maker (AMM) infrastructure, the protocol employs a liquidity-pool architecture

That allows participants to supply capital into collateralized lending markets. By depositing cryptocurrencies, liquidity providers receive passive yield while borrowers meet defined collateral ratios to access credit.

Aave introduces several distinctive functionalities, namely flash loans, the option of toggling between variable or stable interest rates, and the predominant model of over-collateralization. In exchange for the capital supplied, providers accrue interest and AAVE governance tokens, thereby aligning compensation with protocol stewardship.

Extensive security audits, across independent firms, alongside deep integration into the decentralized finance (DeFi) ecosystem, render the protocol exceptionally robust.

By operating across multiple blockchains and welcoming institutional liquidity, Aave consolidates its status as a primary pillar for users necessitating credit markets free from the impermanent liquidity risk of token exchanges.

| Pros | Cons |

|---|---|

| Highly trusted lending protocol | Over-collateralization required |

| Earn interest by supplying assets | Liquidation risk for borrowers |

| Features flash loans and rate options | Complex for new DeFi users |

| Governance through AAVE token | High gas costs on Ethereum mainnet |

| Widely integrated across DeFi platforms | Limited token support vs DEXs |

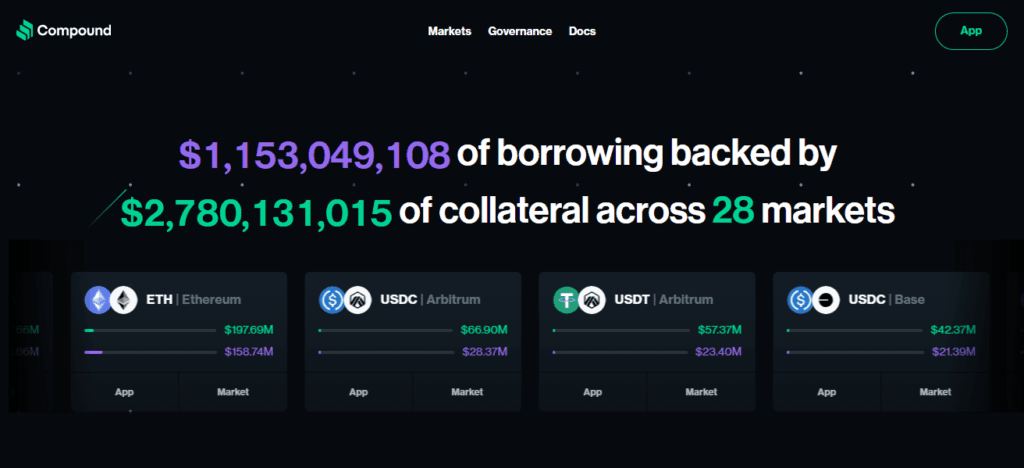

7.Compound (COMP)

Compound offers a pioneering protocol for decentralized money markets, enabling users to lend and borrow cryptocurrencies through automated liquidity pools. Asset suppliers earn interest rewarded in real time, while borrowers incur a dynamically determined interest rate indexed to liquidity availability.

Depositors are issued cTokens, whose increasing balances signal accrued interest and represent proof of deposit. Participation in protocol governance is moderated through the COMP token, which empowers holders to initiate and decide on protocol enhancements through on-chain voting.

Renowned for its rigorous security audits and operational resilience, Compound consistently attracts both retail and institutional participants in the DeFi ecosystem. The underlying algorithmic interest mechanism balances capital supply and borrower demand, ensuring transparent price discovery, rendering Compound a core infrastructural layer for decentralized finance.

| Pros | Cons |

|---|---|

| Pioneering money market protocol | Over-collateralization required |

| Simple interface for lending/borrowing | Limited token support |

| Earn COMP tokens as incentives | Governance power concentrated in few holders |

| Strong institutional adoption | High Ethereum gas costs |

| Secure and widely audited | Impermanent loss not eliminated |

8.Yearn Finance (YFI)

Yearn Finance is a protocol designed to maximize yield by automatically reallocating deposited assets across a variety of liquidity pools. Rather than manually identifying the highest yield opportunities, users deposit their tokens into Yearn Vaults, which employ algorithmic strategies to steer capital toward the most lucrative pools at any given moment.

The accrued yield is subsequently auto-compounded, thereby enhancing efficiency and allowing users to earn passive income with minimal oversight. The protocol is governed by the YFI token, granting holders the authority to propose and vote on material protocol alterations and strategic priorities.

Renowned for a talented developer team and its suite of automated strategies, Yearn has emerged as a foundational toolkit within the DeFi ecosystem. It lowers the entry barrier for less experienced participants while concurrently catering to seasoned liquidity providers who seek high-precision, optimized yield strategies.

| Pros | Cons |

|---|---|

| Automates yield farming strategies | Fees can reduce profits |

| Saves time for DeFi investors | Risk if smart contracts are exploited |

| Community-driven with YFI governance | YFI token is very expensive/volatile |

| Auto-compounding rewards for efficiency | Complexity may confuse beginners |

| Strong developer ecosystem | Dependent on other protocols’ performance |

9.1inch Liquidity Protocol

1inch operates as a decentralized exchange (DEX) aggregator that reconciles disparate liquidity sources to deliver the most favorable price execution along with the least possible slippage for clients. Rather than deploying a proprietary liquidity vault, the platform dynamically interfaces with existing reservoirs on protocols such as Uniswap, Curve, and Balancer.

A proprietary order-routing algorithm deconstructs trades, distributing components across multiple liquidity venues to achieve optimal pricing and depth. The underlying governance and rewards architecture is maintained by the 1INCH utility token, which participants stake and distribute to align incentives across the ecosystem.

Liquidity providers receive yield incentives, accrued through swap-fee and reward pools, for seed capital directed into 1inch-operated vaults. The architecture supports multiple layer-one and layer-two chains, employs algorithmic gas management, and features composable interfaces with leading DeFi primitives, making 1inch the preferred venue for cost-aware traders and yield-focused liquidity providers.

| Pros | Cons |

|---|---|

| Aggregates liquidity across many DEXs | Higher complexity in routing |

| Best swap rates with reduced slippage | No direct native liquidity (depends on others) |

| Multi-chain support (Ethereum, BSC, Polygon, etc.) | Gas fees can still be high on Ethereum |

| Advanced routing technology | Steeper learning curve for beginners |

| Governance with 1INCH token | Competition from other aggregators |

10.Bancor (BNT)

Bancor pioneered the automatic market maker (AMM) concept, establishing the blueprint for decentralized liquidity without order books. Its architecture delivers single-sided liquidity, allowing users to deposit a single token rather than traditional pairs, thus lowering the deposit barrier.

The protocol further mitigates one of DeFi’s major risks through built-in impermanent loss protection and subsequently rewards liquidity providers with trading fees and BNT incentives.

Token custodians perceive tangible value, as ample persistent liquidity and an aggregate of 40+ trading pairs serve to deepen price execution for incoming swaps. Bancor’s commitment to user safety differentiates it and undeniably constitutes an enduring template in the evolving space of decentralized exchanges.

| Pros | Cons |

|---|---|

| First AMM protocol, proven history | Lower liquidity vs Uniswap/Curve |

| Impermanent loss protection | More complex mechanics for LPs |

| Single-sided liquidity provision allowed | Relatively high fees compared to Curve |

| BNT token incentives for providers | Dependence on BNT token performance |

| Deep liquidity in supported tokens | Limited token selection compared to others |

Conclsuion

In sum, the most effective liquidity pools within the cryptocurrency ecosystem present varied avenues for both traders and investors, ranging from Curve’s stablecoin-centric optimization to PancakeSwap’s minimal fee architecture and Aave’s lending functionalities.

Every pool is tailored to fulfil distinct requirements, including yield farming, token interchange, or borrowing. The selection of the appropriate platform is thus contingent upon the user’s objectives—whether the priority is executing swaps, accruing passive returns, or managing exposure within decentralized finance.

FAQ

A crypto liquidity pool is a collection of funds locked in a smart contract, enabling decentralized trading, lending, and yield farming.

By providing tokens to a pool, you earn trading fees, rewards, or interest depending on the protocol.

Yes, risks include impermanent loss, smart contract vulnerabilities, and market volatility.