This article examines the Best Crypto DeFi Platforms which are decentralised finance platforms that are changing the world of finance as we know it. These platforms allow users to trade, lend, borrow, and earn yields all without intermediaries.

DeFi platforms utilize blockchain technology and smart contracts. From the leading DEXs, like Uniswap, to the yield aggregators, like the Yearn Finance, DeFi platforms provide innovative solutions to investors that seek to earn high returns, have absolute access and autonomy, and transparency with their assets.

What is a DeFi Platform?

DeFi platforms, also known as DeFi crypto platforms, are applications built on a blockchain technology layer and designed as a robust alternative financial service without relying on core financial intermediaries (banks and institutions).

Such platforms provid decentralised networks (mostly as smart contracts). Automated execution and enforcement of transaction contracts adds a layer of efficiency to financial transactions.

Engagements on defi investment through lending, borrowing and trading allow one to manage resources on best DeFi platforms in a robust and transparent way.

How to Maximize Yield Farming?

Choose Trusted Protocols

Use platforms with solid audits and high liquidity like Aave, Curve, or Uniswap. If you’re willing to accept higher risk, only then consider unaudited or new protocols. Sustainable yield farming prioritizes safety and longevity over high flashy APYs.

Pick the Right Assets

Stablecoins (USDC, DAI) guarantee constant returns, while blue-chip tokens (ETH, BTC) are great for long-term appreciation. While LP tokens yield more, they come with risks like impermanent loss. So, ensure to balance your portfolio.

Use Yield Aggregators

Platforms like Beefy Finance, Yearn, or AutoFarm automate compounding and strategy optimizations. These yield aggregators reduce manual work, optimize gas fees, and rebalance your positions for enhanced returns.

Leverage Smart Vaults

Vaults are designed to pool funds and deploy them across various protocols. Some vaults use leverage to amplify yields which exposes you to liquidation risks. Opt for vaults with well-defined, transparent strategies that are backed by the community.

Automate with Bots

Gelato Network or Chainlink Automation are great tools for automating harvests, reinvestments, or rebalancing. They ensure to execute tasks on time which is crucial especially in fast moving markets to seize every opportunity.

Watch for Performance & Risks

Use Zapper, DeBank, or DefiLlama to examine the protocol’s health, TVL, and APY. Always be wary of smart contract risks, changes in governance, and keep an eye out for warning signs of a rug pull.

Layer Your Risk by Diversification

Hold assets within Ethereum, BNB Chain, Polygon, and Arbitrum, as well as use cross-chain bridges to mitigate single-chain risk with access opportunities like Stargate Finance.

Reinvest & Compound Rewards

Achieve yield growth through manual reinvestment, or by the use of auto-compounding vaults. Interval compounding during a season of growth will significantly boost your return and maintain farming efficiency.

Keep Tabs on Opportunities

Engage with others in the DeFi ecosystem through newsletters, Twitter, and Discord. These channels can funnel the uninitiated toward new high-yield protocols, which can be rewarding, but require keen risk analysis before participation.

Key Points

| Platform | Key Point / Feature |

|---|---|

| Uniswap | Leading DEX using AMM; enables decentralized token swaps without order books. |

| Aave | Lending and borrowing platform; offers flash loans and interest rate options. |

| MakerDAO | Creator of DAI stablecoin; enables collateralized lending and decentralized governance. |

| Compound | Algorithmic money market protocol; automatically adjusts interest rates based on supply/demand. |

| SushiSwap | DEX and DeFi ecosystem; supports yield farming, staking, and token swaps. |

| Curve Finance | Specialized in stablecoin and pegged-asset swaps; optimized for low slippage. |

| Balancer | Automated portfolio manager and liquidity protocol; supports multi-token pools. |

| Yearn Finance | Yield aggregator; optimizes returns by moving funds across DeFi protocols. |

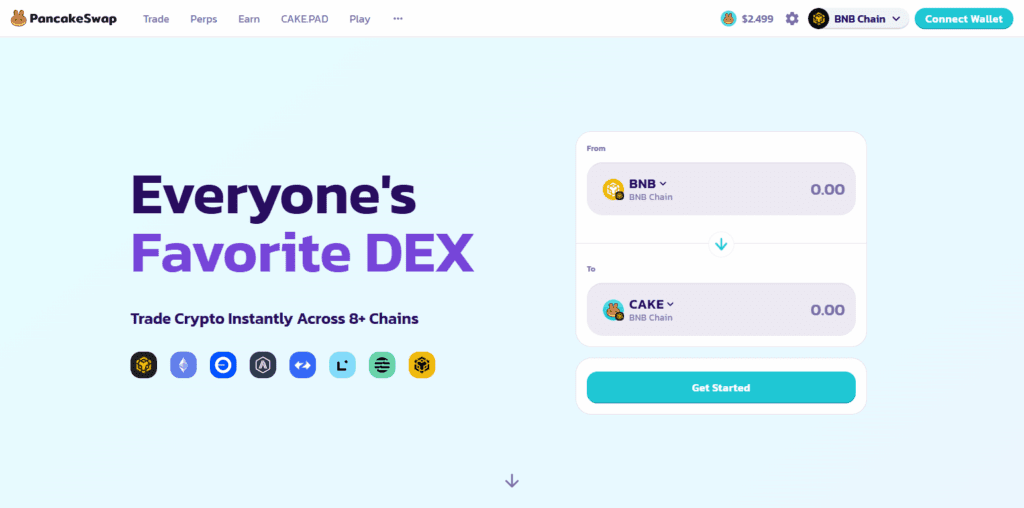

| PancakeSwap | Major DEX on BNB Chain; offers token swaps, staking, and lottery features. |

| Synthetix | Platform for synthetic assets; allows trading of derivatives like fiat, commodities, and crypto. |

1. Uniswap

Uniswap is among the best crypto DeFi platforms for decentralized trading. It functions as an automated market maker (AMM), enabling users to swap ERC-20 tokens directly from their wallets without an order book.

Liquidity providers earn swap fees by depositing their assets into liquidity pools. Uniswap’s protocol guarantees uninterrupted liquidity and provides low-cost and transparent services. Its use case and accessibility make it a pillar of Ethereum DeFi.

Uniswap has also added governance features through the UNI token, allowing users to vote on proposed protocol changes, adding even more DeFi value to the platform.

Uniswap Key Features:

- AMM-based decentralized exchange

- ERC-20 token swaps

- Liquidity provision with pools

- UNI governance token for protocol decisions

Pros:

- Easy and fast token swaps

- Deep liquidity across assets

- Community-driven governance

- Broad adoption and integration

Cons:

- High Ethereum gas fees

- Impermanent loss for liquidity providers

- Limited cross-chain support

- Vulnerable to front-running attacks

2. Aave

Aave specializes in decentralized borrowing and lending, building its reputation in the industry as the best crypto DeFi platform. It helps users earn interest by allowing them to deposit crypto and provides options for them to borrow crypto against collateral.

Aave also helps users with flash loans, which are uncollateralized loans for rapid borrowing and lending. They also offer customizable and fixed interest rate offers. They offer smart contract audits for loans that collateralize.

AAVE tokens are designed as governance tokens to vote on the protocol changes. Aave supports customer cross chains, and multiple assets, and serves both retail and institutional clients to decentralized financial services. This strategic positioning helps Aave to stand the test of time in the DeFi lending industry.

Aave Key Features:

- Decentralized lending and borrowing

- Flash loans functionality

- Flexible interest rate options

- AAVE governance token for voting

Pros:

- Instant liquidity via flash loans

- Multi-asset support for lending/borrowing

- Secure and audited smart contracts

- Active community governance

Cons:

- Complex for beginners

- High Ethereum gas fees

- Potential smart contract vulnerabilities

- Liquidation risks in volatile markets

3. MakerDAO

MakerDAO is a foundational crypto DeFi platform that offers the DAI stablecoin and a borrow feature on its platform. It serves as a decentralized, soft-pegged stablecoin on Ethereum. With the ability to mint DAI, users can extract ETH borrowed against a Maker Vault, thereby facilitating decentralized borrowing.

MKR is MakerDAO’s governance token that facilitates voting for its token holders on risk parameters and upgrades to the borrowing system.

Smart contracts and liquidation procedures in the protocol help keep the DAI stablecoin’s peg. One of the most best and trusted DeFi crypto lending platforms in the market, MakerDAO also supports multiple stablecoins and offers risk-managed borrowing.

MakerDAO Key Features:

- Maker of the DAI stablecoin.

- Issuance of loans from collaterals.

- Voting using MKR token.

- There is an autonomous decentralized governance.

Pros:

- There is a stable DAI and a decentralized stablecoin.

- There is a transparent governance of the system.

- There are risk management in features collateral.

- Community Support is Solid

Cons:

- Risk of collateral liquidation

- Yearly governance votes and slow decisions

- Exposure to ETH price volatility

- New users may find it complex

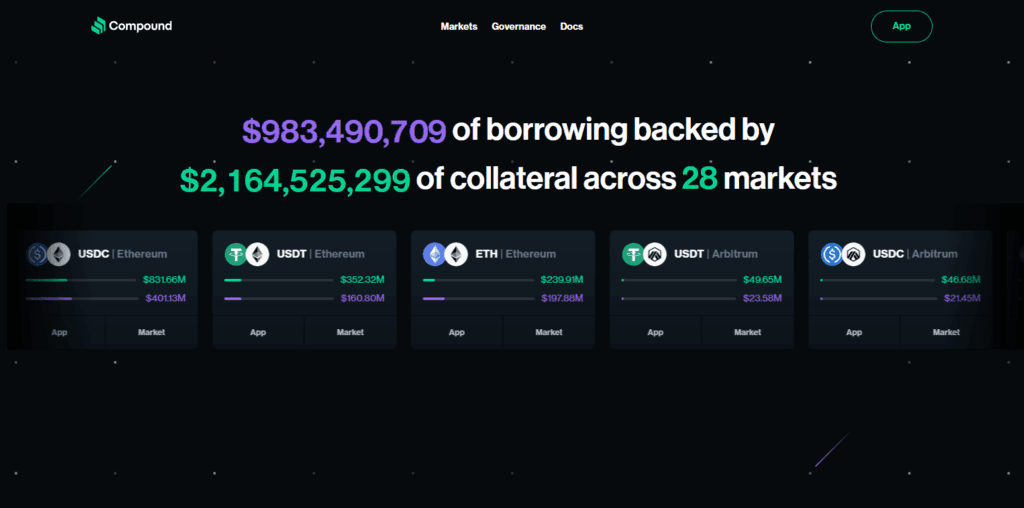

4. Compound

Compound is one of the best platforms for lending and borrowing in the crypto DeFi ecosystem. Interest rates are managed and adjusted by smart contracts based on supply and demand. Users can lend assets and earn interest and borrow assets, all in a seamless transaction.

Holders of the governance token, COMP, can vote on upgrades and new assets defining the ecosystem. Compound is built around user security, from interest calculation transparency to regular external audits.

This security has inspired many of the derivative and yield-creating tools. Compound is one of the best DeFi crypto platforms because of its user-friendly interface and automation tools that provide easy DeFi access to all users.

Compound Key Features:

- auto Money market protocol

- Lending and borrowing

- COMP governance token

- Interest rate auto changes

Pros:

- Interest rate auto changes

- Lending and borrowing of crypto is easy

- Transparency and security audits

- Supported assets are many

Cons:

- Ethereum gas fees are really High

- Borrowing has collateral requirements

- A less-beginner-friendly interface

- Borrowing power may reduce due to market volatility

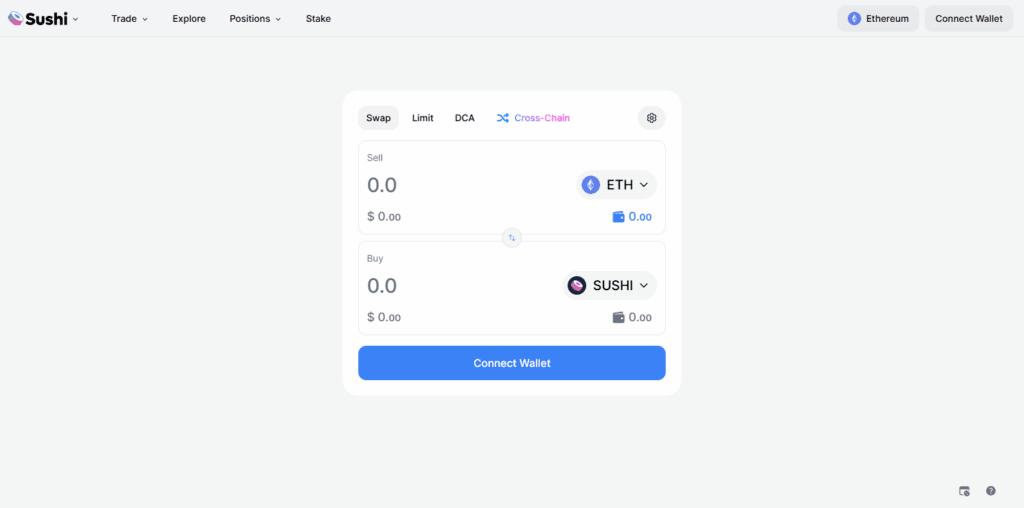

5. SushiSwap

SushiSwap is a flexible crypto DeFi platform that was initially a Uniswap fork. In addition to its services as a decentralized exchange (DEX), users can also yield farm, stake, provide liquidity, and earn rewards.

SushiSwap has integrated the BentoBox and Kashi lending systems and rewards liquidity providers with SUSHI. Governance of SushiSwap is also decentralized, allowing sushi holders to vote on and propose changes to the protocol.

Offered on multiple blockchains, it serves a large user base. SushiSwap offers a wide range of services, combining them in a single ecosystem to provide users with convenient cross-chain DeFi access. This is why it is among the best crypto DeFi platforms.

SushiSwap Key Features

- Decentralized token swaps exchange

- Yield farming

- Staking and earning SUSHI

- Cross-chain

Pros:

- Cross-chain compatibility

- Rewards for liquidity providers

- Farming and staking options

- Community governance via SUSHI token

Cons:

- Impermanent loss

- Competitive DEX landscape

- Smart contracts may break

- High gas fees on Ethereum

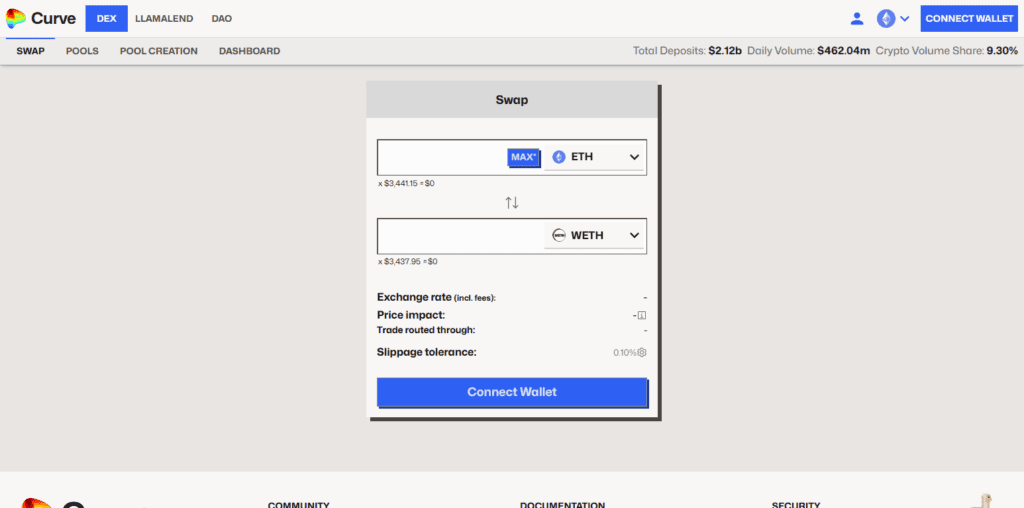

6. Curve Finance

Curve Finance stands out as one of the best crypto DeFi platforms for swaps involving stablecoins and pegged-asset. It reduces the fees and slippage when swapping assets of equal value, which is perfect for stablecoins like USDC, USDT, and DAI.

Curve’s AMM pools offer excellent liquidity, which allows users to earn yields by providing liquidity. Governance and voting on pool rewards and protocol changes are privileges of CRV token holders.

Curve works with lending protocols and yield optimizers to enhance returns. Its emphasis on stablecoins and operational effectiveness provides significant value to DeFi as users want low-risk, highly liquid swaps.

Curve Finance Key Features

- Swaps with Stablecoins

- Low slippage AMM Pools

- Governance token CRV

- Various DeFi protocol integrations

Pros:

- Best for stablecoins

- Minimal slippage and fees

- High liquidity

- Yield-linked lending protocols

Cons:

- Only low-value equivalent assets.

- Complicated for beginners.

- High Ethereum gas fees.

- Limited tokens outside stablecoins.

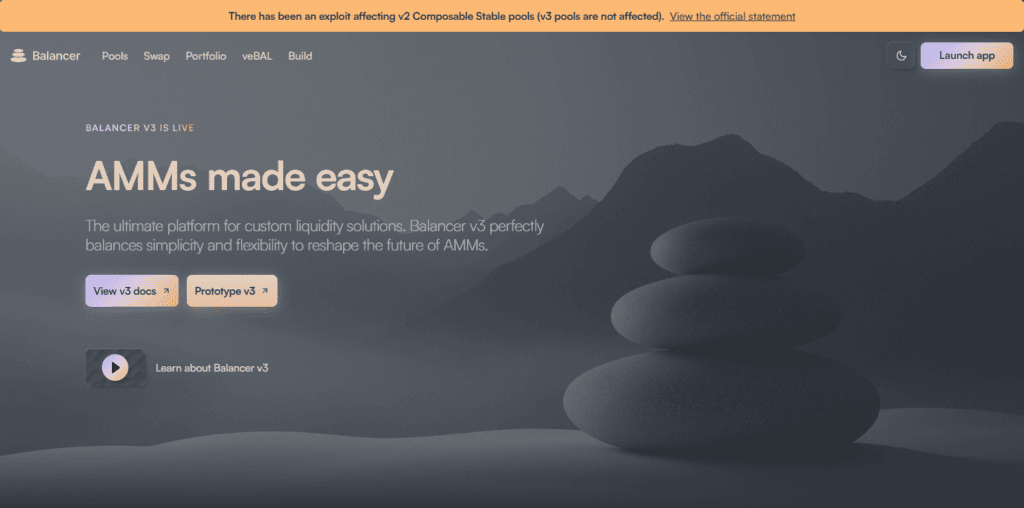

7. Balancer

The Balancer Protocol provides users with unique opportunities to unlock the full potential of any crypto asset not only as a crypto DeFi Platform but also as an automated portfolio manager.

Users earn balancing fees by managing customizable ‘smart pools’ which automatically self-balance their constituent assets. Users earn governance rights with the distribution of BAL tokens which gives users the ability to vote on proposals.

Balancer also allows for the creation of diverse funds and decentralized exchanges to trade assets.

Balancer design manages to combine asset management with the provision of liquidity in a way that provides a passive income for users. This unique provision of liquidity and passive income generation places Balancer as one of the premier DeFi platforms in the crypto space.

Balancer Key Features:

- Multi-token liquidity pools.

- Automated portfolio rebalancing.

- Earning fees as liquidity providers.

- Governance token: BAL.

Pros:

- Customizable pools for LPs.

- Passive income opportunities.

- Automatic portfolio management.

- Decentralized governance.

Cons:

- High gas fees on Ethereum.

- Complex setup for new users.

- You suffer impermanent loss.

- Limited adoption in the mainstream.

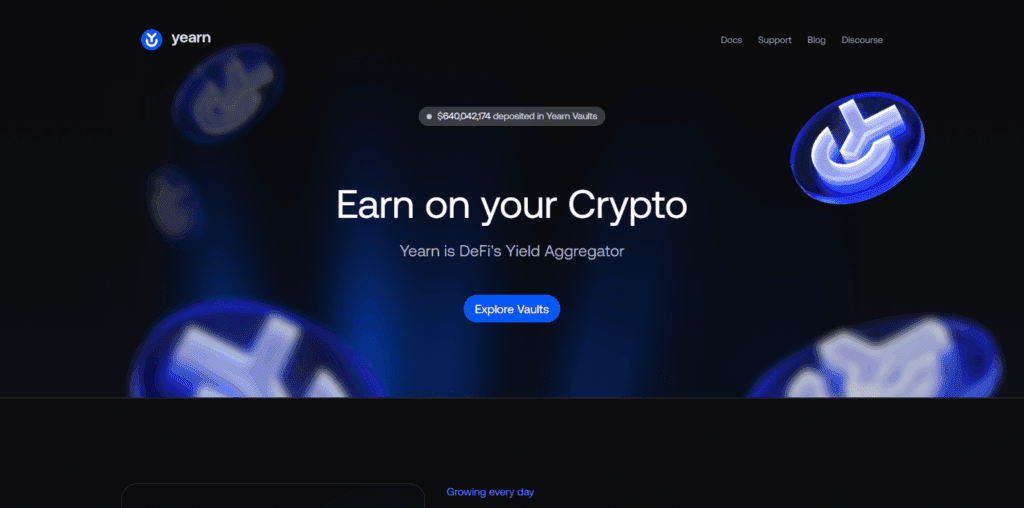

8. Yearn Finance

Yearn Finance serves as a yield aggregator, and is considered one of the best crypto DeFi platforms to optimize your return. Customers put money into automated strategies known as vaults, which scan and shift funds in and out of lending and liquidity protocols to return the greatest yield.

Yearn Finance offers simplicity in the DeFi world, especially in yield farming, to avoid the time-consuming task of multiple protocols management.

Yearn Finance is configured to withstand brute-force attacks, and security audits, as well as smart contract transparency, provide additional confidence.

Its automation and efficiency allow Yearn Finance to attract users of any experience, to maximize profits while minimizing efforts needed on earning active management.

Yearn Finance Key Features

- Yield aggregators with automated strategies.

- Vaults for different crypto assets.

- Governance token: YFI.

- Multiple DeFi protocol integrations.

Pros:

- Maximum yield automated.

- Simplified DeFi interactions.

- Audited and transparent strategies.

- Less manual management.

Cons:

- Loss of strategy if vaults fail.

- Smart contract vulnerabilities.

- Vault withdrawal fees.

- Complex for beginners.

9. PancakeSwap

PancakeSwap is a prominent crypto DeFi platform operating on the BNB Chain. It offers a decentralized exchange with minimal fees for BEP-20 tokens. Its services include token swaps, staking, providing liquidity, lotteries, and NFTs.

Apart from earning through farming and syrup pools, CAKE token holders can participate in governance. FAST transactions and a lower fee structure, as compared to Ethereum-based DEXs, increase its attractiveness among traders.

The platform also combines gamification and yield farming, further broadening its appeal. Overall, PancakeSwap is versatile and user-friendly, earning it recognition as one of the best crypto DeFi platforms for trading, staking, and earning passive income.

PancakeSwap Key Features

- DEX on the BNB Chain.

- Token swaps for BEP-20 tokens.

- Staking, yield farming, lottery, and NFTs.

- Governance token: CAKE.

Pros

- Transactions that are quick and low cost.

- Rewards structured as games for users.

- Offers functions that are beyond just a DEX.

- Offers rewards for staking and farming.

Cons

- Perceived as centralized because of BNB Chain.

- Impermanent loss for liquidity providers.

- Less integration with Ethereum.

- Risk involved with speculative token farming.

10. Synthetix

Synthetix is a crypto DeFi platform focusing on synthetic assets and derives offers. Users can trade assets backed by fiat currencies, commodities, equities, and crypto. It utilizes over-collateralization and smart contracts to stabilize and maintain the value of the underlying assets.

SNX token holders can also participate in governance, while staking enables fee earning. Synthetix provides on-chain access to real-world assets, and its derivatives, liquidity pools, and integration with other DeFi protocols position it as a leader in decentralized derivatives.

By linking crypto and traditional assets, Synthetix earns its place among the best crypto DeFi platforms for sophisticated traders and investors.

Synthetix Key Features:

- Creating and trading synthetic assets.

- Staking SNX and governance token.

- Access to fiat and crypto, commodity, and crypto derivatives.

- Decentralized liquidity.

Pros:

- Trade real-world assets on-chain.

- Staking liquidity provides you with incentives.

- You can trade derivatives that are decentralized.

- Access multiple asset classes.

Cons:

- Complexity that is more than necessary for beginners.

- Needs over-collateralization.

- Risk of liquidation.

- Underlying smart contracts risks.

How Decentralized Finance (DeFi) Works

Decentralized finance (DeFi) operates on blockchain technology, primarily on Ethereum, though Binance Smart Chain (BSC) and Solana are beginning to gain popularity. The foundation of DeFi are smart contracts, self-executing contracts where all terms are programmed. These contracts interface and perform exchanges without the need for middlemen once the conditions are satisfied.

Smart Contracts

Smart contracts are the automated transaction facilitators of DeFi platforms. They eliminate the need for a third party to perform a transaction. For lending platforms, these automated contracts are able to supervise and control loans, stream interest payments, and disburse payments in a secure and efficient manner.

Liquidity Pools

Liquidity pools are a collection of assets that are contributed by users and which are subsequently used for trade, loans and borrowing. The liquidity pool contributors receive rewards in the form of transaction fees and/or tokens. This system makes it possible to efficiently leverage DeFi development services.

Decentralized Exchanges (DEXs)

DEXs let users exchange tokens directly through their wallets and bypass a central controlling system. This increase the privacy, control, and security of the user. For users, DEXs is the go to platform.

Lending and Borrowing

Users lending and borrowing on DeFi platforms can earn interest on capital as well as take out loans as long as collateral is provided. Most interest on loans is earned through capital on Aave due to the interest being offered as competitive based on loans being offered.

Yield Farming and Staking

Users of DeFi protocols can earn passive income through yield farming and staking. Yield farming is the process of earning rewards through the deposit of assets while staking is the process of earning rewards by locking assets to support the network of the platform.

Advantages of DeFi for Investors

Investors have the opportunity to earn DeFi services and products bow because of the additional opportunities DeFi and the services built on top of it has to offer.

DAO Governance – Investors can help shape the evolution of a platform and participate in its governance when it is run through a DAO.

Yield Farming and Staking – Lending, yield farming and staking tokens all offer returns.

Tokenization – Investing opportunities have increased as real world assets, such as real estate and stocks, can be tokenized.

Diversification – DeFi offers diversification through access to cryptocurrencies, stablecoins, and tokenized assets.

Self-Custody – Investors can hold funds in wallets and decreased reliance on institutions.

Transparency – Users can track and audit all transactions on the blockchain. Smart contracts and the transactions executed within them provide streams of verifiable activity for all platform users.

Cost Savings – Cross-border transaction fees decline when there are no intermediaries.

Greater Automation – More time and money are saved when lending, borrowing, and trading processes are completed using automated smart contracts.

Democratization of Investment – The internet enables universal access to DeFi and to invest from virtually any location.

No Restrictions on Time – Having no ceilings on time allows the unrestricted execution of trades and the making of investment decisions anytime.

Mitigated Centralization Risks – Reduced exposure to risks associated with banks or government interference is partly due to the decentralized nature of the systems.

Conclusion

In summary, the top Best crypto DeFi platforms have changed how people engage with various services by providing an alternative that is decentralized, transparent, and more efficient than what the old systems offer.

Uniswap, Aave, MakerDAO, and Yearn Finance let people trade, lend, borrow, and complete other value maximizing actions with smart contracts in a safe manner.

Investors are able to reach the full advantage of DeFi to increase their digital-assets and avail themselves to the new financial-tech by selecting dependable platforms, evaluating and controlling their exposure to losses, and being active participants.

FAQ

DeFi platforms are decentralized finance applications built on blockchain networks, allowing users to trade, lend, borrow, and earn yield without relying on traditional banks or intermediaries. They use smart contracts to automate financial operations securely and transparently.

Some of the top DeFi platforms include Uniswap, Aave, MakerDAO, Compound, SushiSwap, Curve Finance, Balancer, Yearn Finance, PancakeSwap, and Synthetix. Each platform offers unique features such as decentralized exchanges, lending, yield farming, or synthetic assets.

You can earn by providing liquidity, staking tokens, lending assets, or participating in yield farming and liquidity mining. Platforms often reward participants with native tokens (e.g., UNI, AAVE, CAKE) which can be reinvested to compound returns.

While reputable platforms have undergone security audits, risks still exist, including smart contract bugs, impermanent loss, or market volatility. Always research the platform, diversify investments, and avoid committing more than you can afford to lose.

Yield farming is the process of earning rewards by providing liquidity or staking assets on DeFi platforms. Users receive returns in the form of interest or governance tokens, and the returns can vary depending on pool performance and market conditions.