As the world of blockchain continues to develop, the importance of interoperability become critical, in which case, the use of cross-chain transaction bridges become invaluable.

The bridges deal with the movement of assets, access to a myriad of DeFi services and entrance to various NFT ecosystems. Without the use of a bridge, users will be limited to a single-chain use and will be devoid of the many opportunities the decentralized systems offer.

In a world that combines Ethereum, BNB Chain, Polygon and Fantom, value and information will flow in a quick, safe and efficient manner.

What is a Cross Chain Bridge?

A Cross-Chain Bridge is a cutting-edge technology allowing the transfer of digital assets, tokens, or information between multiple blockchains. Although most blockchains operate independently and do not communicate with each other, cross-chain bridges improve the interoperability of blockchains within Ethereum, Binance Smart Chain, Fantom, and Polygon.

These bridges use lock-and-mint or burn-and-release systems which provide security and consistency for assets across multiple chains. Cross-chain bridges allow users to interact with decentralized applications (dApps), liquidity pools, and yield farming opportunities across different blockchains instantly.

These technology reduces the manual conversion of assets, thereby improving the speed, cost, and overall efficiency of several blockchain transactions.

How to Choose the Best Cross-Chain Transaction Bridges?

Security and Audits

An important thing to consider are cross-chain bridges that have had third-party security audits. Verifiable audits guarantee the audits are thorough and bridges smart contracts are not exploitable and have. Reputation and proven reliability are key indicators of a secure and trustworthy bridge.

Supported Blockchains and Tokens

Choose a bridge that supports numerous core networks such as Ethereum, BNB Chain, Fantom, and Polygon. The greater the support, the better the cross-ecosystem asset transfers and efficient access to various DeFi applications.

Transaction Speed and Fees

Understand the bridge’s transaction speeds and the fees they charge per transfer. The best cross-chain bridges provide a seamless and economical crossing of networks without the delays, ensuring the movement of assets at a reasonable price.

User Interface and Experience

Bridges should be simple to use, have clear instructions, and have responsive customer support. They should have cross-chain transaction systems that reliably track transfers. A well-designed interface minimizes confusion and increases the overall cross-chain experience.

Decentralization and Transparency

When selecting bridges, prioritize those that rely on decentralized protocols and offer public and clear records of transactions. Active community governance and open-source software suggest higher trust levels and less likelihood of abuse and central control of cross-chain transactions.

Key Point

| Bridge Name | Main Feature | Security Mechanism |

|---|---|---|

| Synapse Protocol | Enables seamless cross-chain swaps and liquidity transfers with low fees across major blockchains. | Uses decentralized validators and audited smart contracts to ensure transaction safety. |

| Wormhole | Connects 20+ chains for token and NFT transfers through a high-speed messaging layer. | Relies on a network of guardians (validators) and continuous monitoring for bridge integrity. |

| Stargate | Facilitates native asset transfers with instant finality via unified liquidity pools on LayerZero. | Built on LayerZero’s ultra-secure messaging protocol ensuring trustless cross-chain transactions. |

| Symbiosis Finance | One-click multi-chain swaps integrating DEX and bridge functions for a unified DeFi experience. | Employs smart contract audits and decentralized liquidity routing for added protection. |

| Celer cBridge | Offers fast, low-cost asset transfers across 40+ blockchains with high scalability. | Secured by Celer’s State Guardian Network, which validates and monitors cross-chain activities. |

| Axelar Network | Provides universal interoperability for assets and messages between diverse blockchains. | Uses a decentralized validator set that ensures secure cross-chain consensus. |

| Chainlink CCIP | Enables secure cross-chain data, token, and contract communication for Web3 applications. | Secured by Chainlink’s decentralized oracle network and anti-fraud mechanisms. |

| Axelar Network | Provides secure, decentralized cross-chain communication. | Unified interface for developers to connect multiple blockchains. |

| Chainlink CCIP | Standard protocol for cross-chain communication using oracles. | Uses Chainlink’s decentralized oracle network for reliability. |

| ChainPort | Focuses on easy token bridging across chains. | User-friendly and fast bridging solution. |

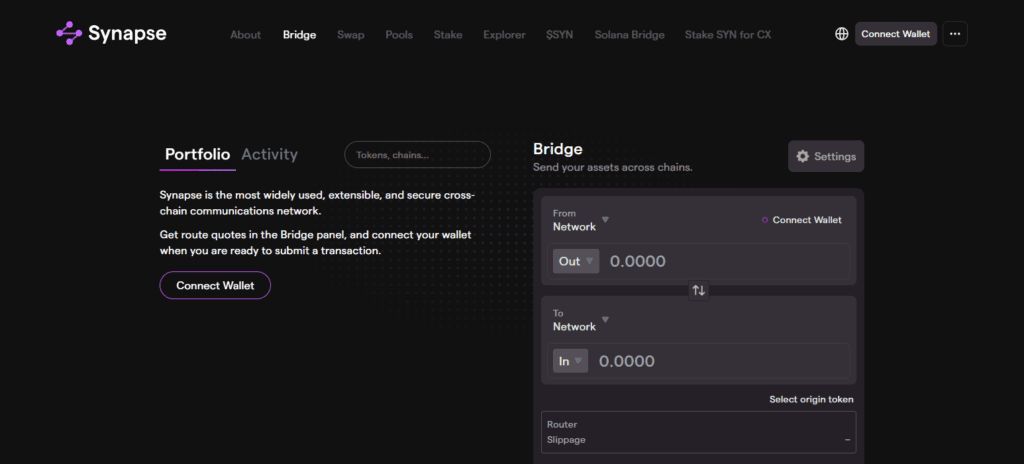

1. Synapse Protocol

Synapse Protocol is a multi-chain liquidity network which allows you to swap several blockchains and do it efficiently and at a low cost. It works with major chains like Ethereum, BNB, Avalanche, Arbitrum, Optimism, Polygon and Fantom.

Transfers through Synapse can be completed in a matter of seconds to a few minutes, depending on the congestion in the chain. Synapse is excellent for all DeFi users, as Synapse maintains low transaction fees and is perfect for affordable cross-chain swaps.

Synapse is safe as it is backed by audited smart contracts as well as a decentralized system of validators. Overall, Best Cross-Chain Transaction Bridges Synapse Protocol is ideal for liquidity providers and customers who are looking for fast, low-cost and secure cross-chain transactions.

Synapse Protocol – Key Features

- Synapse Protocol offers cross-chain swap and liquidity transfer for major blockchains.

- As a DeFi user, you will experience fast transaction confirmations while saving on transfer costs.

- Enhanced security is achieved through decentralized validators, complementing the system-audited contracts.

Synapse Protocol – Pros & Cons

Pros:

- Fast and low-cost cross-chain swaps.

- Multiple major blockchains supported including Ethereum, BNB Chain, Avalanche, and Fantom.

- Security provided through decentralized validators and audits.

Cons:

- Recently added or less-used chains poorly supported.

- Low liquidity on lesser-used chains.

- Advanced features may require understanding of multi-chain DeFi.

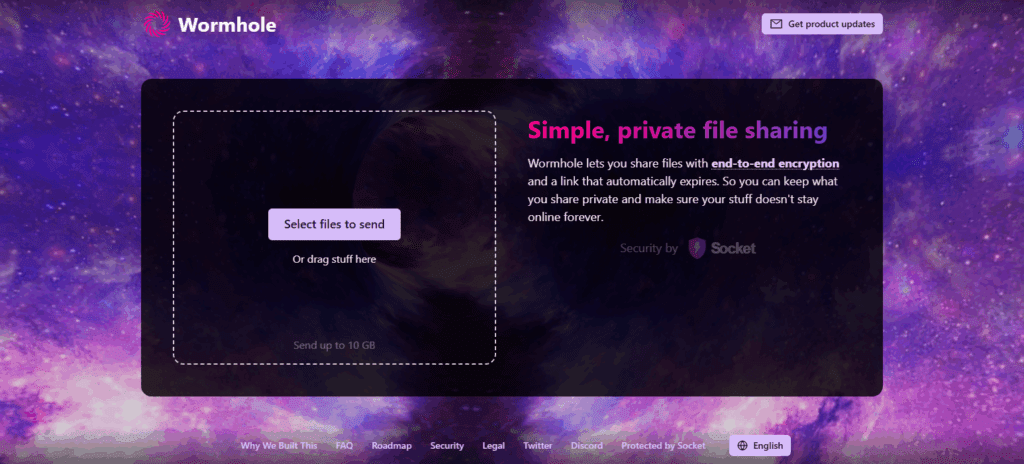

2. Wormhole

Wormhole is a decentralized interoperability protocol which connects more than 20 blockchains. It works with Solana, Ethereum, Polygon, BNB, Avalanche, and Aptos.

It allows cross-chain transfers of tokens, NFTs, and data and provides near instant transactions. Wormhole maintains competitive fees for the services provided, which vary only slightly by network and keeps transfers affordable.

In regard to cross-chain message validation, system integrity, and tampering, there are 19 ‘guardian’ nodes responsible for security. Best Cross-Chain Transaction Bridges Wormhole is developer oriented, easily scalable, and is optimum for NFT projects and gaming platforms as well as developers needing cross-chain interoperability.

Wormhole – Key Features

- Wormhole provides linkages for more than 20 blockchains for token, NFT, and data transfers.

- Features near-instant cross-chain messaging with equally rapid confirmations, allowing for attack scaling.

- A guardian node network secures the system through transaction monitoring and validation.

Wormhole – Pros & Cons

Pros:

- Connects over 20 chains including Solana, Ethereum, and Polygon.

- Tokens and NFTs supported.

- Scalable with developer-friendly APIs.

Cons:

- Security incidents have happened in the past.

- Guardian node dependency can be a centralization risk.

- Fees vary a lot based on congestion on chains.

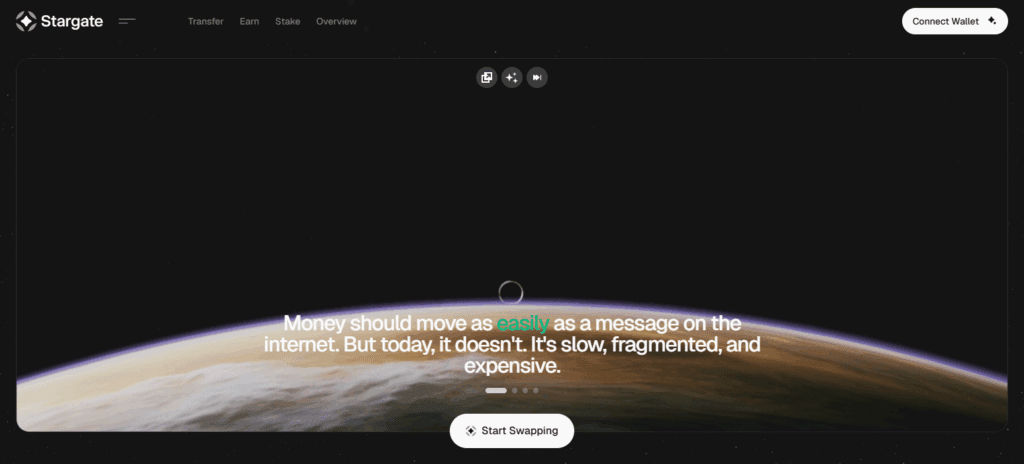

3. Stargate

Enabling the most critical blockchains within the Ethereum ecosystem, BNB chain, and Avalanche, as well as Polygon and Arbitrum, Stargate runs under LayerZero. Transactions complete within minutes and approach the instant.

Transfers are quick and achieve instant finality under LayerZero’s ultra-efficient messaging system. Transaction costs provide great value relative to cross-chain DeFi operations.

LayerZero’s ethos provides security, minimizing the use of wrapped tokens and offering an audit of the decentralized infrastructure. Best Cross-Chain Transaction Bridges Stargate is most suited for DeFi users seeking native asset swaps.

Stargate – Key Features

- Stargate allows for native asset transfers via LayerZero technology, especially for EVM-compatible chains.

- a array of unified liquidity pools, allowing for substantial cross-chain liquidity.

- Users enjoy instant finality and a nonlinear discourse on transaction costs.

Stargate – Pros & Cons

Pros:

- Unified liquidity pools with native asset transfers.

- Near-instant finality using LayerZero technology.

- Fees are transparent and reasonable.

Cons:

- EVM-compatible chains are the only connections available.

- Advanced use may require understanding of LayerZero concepts.

- Smaller ecosystems naturally provide lower liquidity.

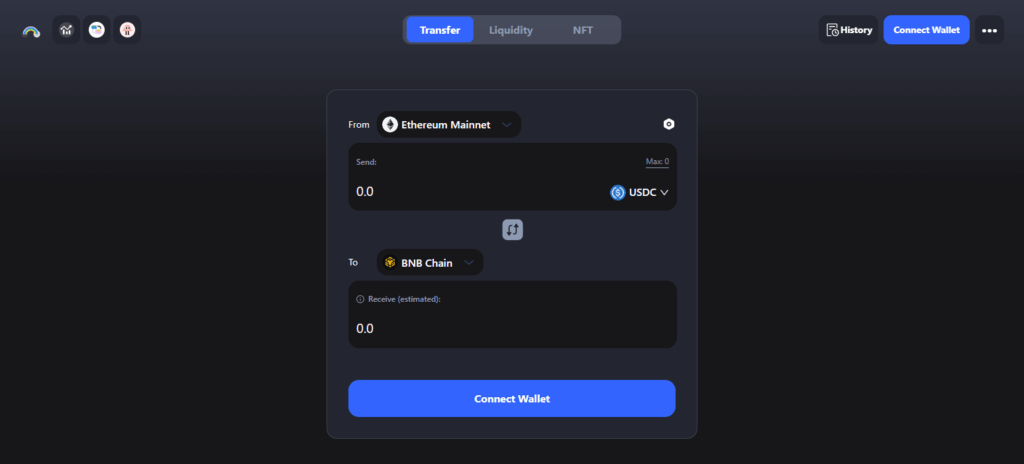

4. Symbiosis Finance

Symbiosis Finance combines the interoperability of several blockchains with the seamless DEX functionality of one-click token swaps. This crossing functionality is available on Ethereum, Polygon, Avalanche, BNB Chain, zkSync, and Arbitrum, bridging within minutes. Symbiosis Finance provides seamless and responsive transfers for smooth bridging.

The fees, which are calculated within the swap, are reasonable and ensure that all transactions are clear and efficient. Trust is maintained by decentralized liquidity provisioning and audited smart contracts.

Best Cross-Chain Transaction Bridges Symbiosis Finance caters to DeFi traders who appreciate a user-friendly platform and need immediate multi-chain liquidity access within a single interface.

Symbiosis Finance – Key Features

- Features one-switch options of cross-chain, DEX, and bridge functionalities toward multi-chain swaps.

- Systems encompass the networks: Ethereum, BNB Chain, Polygon, and Avalanche.

- As a safety measure, decentralized liquidity management, in concert with smart contracts, liquidity will be audited.

Symbiosis Finance – Pros & Cons

Pros:

- One-click multi-chain swaps integrating DEX and bridge functionality.

- Supports popular networks like Ethereum, Polygon, and Avalanche.

- Audited smart contracts and decentralized liquidity routing.

Cons:

- Transfer speed can vary depending on network congestion.

- Fees are moderate, not always the lowest.

- Fewer advanced customization options for professional traders.

5. Celer cBridge

Celer cBridge is part of the Celer network and allows rapid, economical transfer of assets between 40+ blockchains, like Ethereum, Arbitrum, Optimism, BNB Chain, Avalanche, and Fantom. Depending on the network, transfers can settle within a few seconds.

For frequent users, cBridge is preferred as it has some of the lowest market fees. State Guardian Network (SGN) protects assets through real-time validation of cross-chain activities and monitors frequent transfers within a secured tunnel.

Best Cross-Chain Transaction Bridges Celer cBridge is mainly for users and businesses that cross larger volumes of coins and need speed, reliability, and increased scalability.

Celer cBridge – Key Features

- Celer cBridge provides rapid and budget-friendly cross-border transfers across more than 40 networks.

- Validation of transfers is secured by Celer’s State Guardian Network.

- Very High scalability designed for large and high-frequency transfers.

Celer cBridge – Pros & Cons

Pros:

- Ultra-fast transfers across 40+ chains.

- Low transaction fees suitable for frequent users.

- Secured by State Guardian Network for real-time validation.

Cons:

- May require familiarity with Celer ecosystem tools.

- Occasional network congestion can slightly delay transfers.

- Limited support for non-EVM chains in some cases.

6. Axelar Network

Axelar Network offers the ability to transfer assets and messages between blockchains, including Ethereum, Cosmos, Avalanche, Polygon, and Moonbeam, and it is universal as it includes numerous different blockchain ecosystems. The transactions are done with a focus on maintaining a reasonable compromise on decentralization and speed, and they are done within a few minutes.

Prices are reasonable and automatically adjusted according to demand and usage. The decentralized validator set cryptographically secures and maintains uniformity across all chains. Best Cross-Chain Transaction Bridges Axelar Network focuses on developers and organizations needing programmable secure cross-chain communication infrastructure.

Axelar Network – Key Features

- Allows seamless inter-chain transfers of assets and messages.

- Decentralized validator group guarantees secure communication and consensus.

- Programmable cross-chain environments for developers and businesses.

Axelar Network – Pros & Cons

Pros:

- Universal interoperability across diverse chains including Ethereum, Cosmos, and Avalanche.

- Decentralized validators ensure secure and trustless transfers.

- Programmable infrastructure ideal for developers.

Cons:

- Slightly slower compared to some instant bridges.

- Fees can fluctuate based on network usage.

- Complexity may deter casual users.

7. Chainlink CCIP

Chainlink CCIP (Cross-Chain Interoperability Protocol) provides effortless, secure communication of data, tokens, and smart contracts across disparate chains like Ethereum, Avalanche, and Polygon.

Rapid transfers are made possible and reliable by Chainlink’s decentralized oracle network. Although optimized for enterprise-grade performance, fees are primarily determined by network gas prices.

Security is virtually unbreakable due to integrated anti-fraud and monitoring systems that utilize Chainlink oracle’s technology. Best Cross-Chain Transaction Bridges Chainlink CCIP is aimed at developers, enterprises, and DeFi platforms that demand extremely secure and dependable cross-chain data transfer.

Chainlink CCIP – Key Features

- Safe cross-chain communication for tokens, data, and smart contracts.

- Backed by Chainlink’s decentralized oracle network providing high reliability.

- Incorporates anti-fraud measures along with automated security checks and monitoring.

Chainlink CCIP – Pros & Cons

Pros:

- Secure cross-chain communication for tokens, smart contracts, and data.

- Chainlink’s decentralized oracle network is used for enhanced reliability.

- Enhanced security through built-in fraud detection and monitoring systems.

Cons:

- Designed for enterprise and developer use cases; not as user-friendly for everyday individuals.

- Costs are variable based on oracle and gas prices.

- Initially, there’s less direct support for some of the smaller chains.

8. Axelar Network

Axelar Network is aimed to ease and safeguard cross-chain interactions involving distinct blockchains, all with universal protocols. This allows various blockchains to interoperate without several bridge systems, thus facilitating seamless asset transfers, configurable communication, and smart contracts across the chains.

Developers building cross-chain apps can forgo much of the custom extensive infrastructure typically required for each endpoint. This eliminates all the complicated sets of cross-chain infrastructures, which is especially helpful for multi-chain dApps and DeFi systems.

Transactions can only be challenged via a decentralized network of validators which helps guarantee security and removes single failure points.

Axelar’s extensive design support and architecture for multiple different chains is why people service Axelar Networks the best cross-chain transaction bridges. This is even more so for developers looking for cross-communication integration.

Axelar Network Key Features:

- First fully decentralized cross-chain communication protocol.

- Supports seamless asset transfers and data transfers across multiple chains.

- Supports cross-chain smart contract calls without the need to build custom bridges.

- Secure and trustless verification of transactions using a decentralised validator network.

- Consolidated interface for developers, making multi-chain dApp creation easier.

Pros:

- Security is high, owing to decentralised validators.

- Simplifies the multi-chain application development process.

- Unified protocol supports multiple blockchains.

- DeFi and NFT projects of cross-chain interoperability and scale can be built with Axelar.

Cons:

- For decentralized bridges, Axelar may have slightly higher transaction latency.

- Developers have to directly implement Axelar’s APIs or SDKs.

- More for developers and less for users.

9. Chainlink CCIP (Cross-Chain Interoperability Protocol)

Imagine having a world where smart contracts, no matter where they are, could be executed seamlessly and securely. Built on Chainlink’s decentralized oracle network, CCIP takes smart contract interoperability with other blockchains and cross-chain communication to a whole new level.

CCIP operates on generalized inter-chain contract calls and cross-chain programmable tokens. Constructing complex decentralized applications with smart contracts over a number of blockchains to a sophisticated degree is possible with complete trust and absence of centralized control.

Hack-resistant decentralized cross-Chainlink oracle transactions complete the flexible and secure interface needed to power innovative cross-chain NFTs and other dApps with complex multi-chain inter-operability. For projects with security and interoperability in mind, it is one of the top cross-chain transaction bridges.

Chainlink CCIP (Cross-Chain Interoperability Protocol) Key Features:

- Employs Chainlink’s decentralised oracle network for cross-chain messaging.

- Enables generalized smart contract calls on multiple blockchains.

- Assured safe and dependable cross-chain token transfers and data transfers.

- Standardised protocol provisions for multi-chain interoperability.

- Geared for DeFi and complicated applications across multiple blockchains.

Pros:

- Unwavering security through decentralised oracle verification.

- Extends support for sophisticated cross-chain logic, beyond mere token transfers.

- Well accepted and trusted in DeFi.

- Risks are mitigated compared to other conventional bridges.

Cons:

- More complex to integrate than basic token bridges.

- Primarily for developers; less friendly for average users.

- Costs might increase due to oracle fees.

10. ChainPort

ChainPort is a simple bridge solution for fast and reliable token transfers across several blockchains. Compared to other cross-chain solutions that may be complex and confusing, ChainPort is simple and efficient, catering to the needs of everyday users and projects seeking to cross-chain migrate their assets.

ChainPort works with many blockchains, and cross-chain token transfers with ChainPort are quick, low-cost, and cheap. ChainPort is designed with the needs of DeFi multi-chain projects in mind, offering automated liquidity management to deliver a hassle-free experience.

For its speedy and user-friendly services, and support for many blockchains, ChainPort is regarded as one of the best cross-chain transaction bridges for simple token transfers and portfolio management.

ChainPort Key Features:

- Easy to use for token transfers across different blockchains.

- Covers most popular blockchains.

- Mainly focuses on speed, ease, and low costs.

- Primarily on token migration and liquidity management.

- Designed for user and project ease.

Pros:

- Quick and easy token transfer.

- Very user friendly and easy for those without technical expertise.

- Very low transfer fees compared to other multi-chain offers.

- Multi-chain support adds versatility for DeFi users.

Cons:

- Primarily for token transfers, does not support complex cross-chain smart contracts.

- Security is based on bridge and imv mechanisms, therefore it is not as strong as decentralized networks of validators for blockchains.

- Limited operations compared to Axelar or Chainlink CCIP.

Best Practices for Cross-Chain Bridges

Without a doubt, cross-chain bridges can allow for smooth blockchain transactions. However, users can be exposed to a lot of risks if these bridges are misused. Make sure to stay safe and efficient by applying the best practices for cross-chain bridges below:

Make Small Test Transfers First

When testing the reliability of a cross-chain bridge, start with a small amount of crypto. This way, the possible losses from technical problems, network congestion, and security challenges won’t be too big during the first use.

Verify the Address of the Destination

As blockchain transactions are irreversible, you need to make sure that the wallet address and blockchain are the right destination for the crypto you are sending. To make sure that the destination is right, use a QR code or a copy-paste method.

Look at the Fees and Gas Prices

Varied transaction networks come with different fees and gas prices. Always check to see that the fees do not exceed the amount you are sending, especially with smaller transactions.

Use Bridges That Are Reputable

Backed by security audits and strong community trust, reputable platforms are the expected choice. Steer clear of new or unverified platforms that claim to have low fees, as the reunion of cost and security should be prioritized.

Watch Out for Fraudulent Websites

Within crypto, phishing and counterfeit bridge sites are ubiquitous. Ensure you access a bridge using its recognized domain or other trusted routes. Avoid suspicious links from social media and emails. Never divulge private keys or any sensitive information.

Conclusion

Cross-chain bridges provide blockchain networks interoperability and open new avenues within decentralized finance (DeFi), non-fungible tokens (NFTs), and cross-chain applications. Notable cross-chain transaction bridges such as Synapse Protocol, Wormhole, Stargate, Symbiosis Finance, Celer cBridge, Axelar Network, and Chainlink CCIP display distinct competitive differentiators (supported networks, speed to transfer, transfer fees, and level of security).

Selecting an appropriate bridge is dictated by one’s purpose; Synapse Protocol and Celer cBridge are best suited for quick and economical exchanges, Wormhole and Axelar Network are perfect for NFTs or cross-border messaging, and Chainlink CCIP is optimal for enterprise-class protected communication. Attention to security, liquidity, and network compatibility permits users to cross-bridges for optimal streamlining, security, and versatility.

FAQ

A cross-chain bridge is a protocol that allows users to transfer digital assets, tokens, or data between different blockchain networks, enabling interoperability between ecosystems like Ethereum, BNB Chain, Polygon, and Fantom.

Cross-chain bridges let you access liquidity, DeFi applications, and NFT platforms across multiple blockchains without selling or converting your assets. They save time, reduce fees, and expand opportunities for crypto trading and investment.

The top bridges include Synapse Protocol, Wormhole, Stargate, Symbiosis Finance, Celer cBridge, Axelar Network, and Chainlink CCIP. Each differs in supported chains, speed, fees, and security, catering to various user needs.

While reputable bridges are generally secure, risks remain. Always use bridges with audited smart contracts, decentralized validators, and strong community trust. Test small transfers first to minimize potential losses.