This article examines the Best Cross-Chain DEX Tools, which are critical platforms for swapping tokens across different blockchains. Providing enhanced access to liquidity, reduced costs, and expedited transaction speeds independent of centralized exchanges, these tools are more than just trading alternatives.

Users can exchange native blockchain assets and employ the tools for multi-chain aggregation. The appropriate DEX tool hybridizes efficiency and security, facilitating cross-chain DeFi trading by making it profitable and user-friendly for novice and veteran cryptocurrency participants.

What Is DEX Tools?

DEX tools are focused applications that enable users to evaluate, monitor, and refine their activities on decentralized exchanges. Unlike centralized exchanges, DEXs use smart contracts for peer-to-peer trading and have no intermediaries.

DEX tools offer users real-time information on token pricing, liquidity pools, trading volume, and comprehensive wallet analysis. They are equipped with charting and portfolio tracking and cross-chain swap aggregators, which streamline the decision-making process and elevate users’ trading activities in the DeFi space.

How To Choose the Best Cross-Chain DEX Tools for Seamless Trading?

Check Multi-Chain Compatibility

Great cross-chain DEX tools will allow you to work with major blockchains like Ethereum, BNB Chain, Polygon, Avalanche, Solana, and a variety of Layer-2 ecosystems. Broad compatibility lets you swap your assets without bridging and wallet hassles. Always check if the service expands to new blockchain ecosystems regularly.

Evaluate Security and Transparency

When working with decentralized liquidity, you must consider security. Select DEX tools with independently audited smart contracts, non-custodial services, and fully transparent trackable services. A sign of a trustworthy and good service is the presence of a bug bounty policy and a transparent open-source code. Transparency promotes security.

Compare Fees and Slippage

Gas and service fees vary across all DEX aggregators and service bridges, so you must really assess the difference. Pick services with optimized routing to reduce your costs and slippage. Rango Exchange and 1inch are excellent tools to use because they offer the best value trades with smart trade path routing.

Evaluate User Experience and Interface

For multi-chain users, a well-organized and simple interface makes trading easier. Look for DEX tools providing clear swap data, estimated gas fees, and bridge times. Symbiosis Finance and XY Finance have particularly user-centric designs.

Assess Liquidity Depth

High liquidity decreases price impact and makes for smoother, faster trades. Look for DEXs that have integrations with multiple liquidity providers, like Uniswap, THORSwap, and OpenOcean, to ensure that execution and rates are consistent.

Assess Speed and Reliability of Transactions

There can be delays with cross-chain operations. Delta neutral and cross-chain tools like Orbiter Finance and Multichain provide quick confirmations and stable crossing. Make sure to look at the average transaction speeds and historical uptime for reliable data.

Assess Community and Ecosystem Support

Instruments are likely to be reliable when their community is active and they have partnerships with leading DeFi projects. Evaluate DEXs for ecosystem growth, developer activity, and frequency of updates, as these are signs of long-term sustainability.

Key Point

| DEX Tool | Key Feature | Main Advantage |

|---|---|---|

| Rango Exchange | Aggregates 50+ DEXs and bridges | Enables seamless cross-chain swaps with low slippage |

| 1inch | Smart DeFi aggregator | Finds best swap rates across multiple DEXs |

| LI.FI Protocol | Bridge and DEX aggregator | Optimizes routes for fastest and cheapest transactions |

| XY Finance | Multi-chain liquidity routing | Supports 20+ blockchains with high efficiency |

| THORSwap | Built on THORChain | Allows native asset swaps without wrapped tokens |

| Uniswap | Leading AMM DEX | Integrates cross-chain swaps via LayerZero and BNB Chain |

| Multichain | Formerly AnySwap | Supports 80+ blockchains for token and NFT transfers |

| Symbiosis Finance | Cross-chain liquidity aggregator | One-click swaps with automatic routing |

| Orbiter Finance | Layer-2 bridge | Enables fast, low-cost transfers between rollups |

| OpenOcean | Full aggregator for DEXs and CEXs | Provides best price discovery across all platforms |

1. Rango Exchange

Rango Exchange is one of the most powerful DeFi aggregators designed to connect users to multiple decentralized exchanges and bridges in a single platform.

Supporting over 50 blockchains and thousands of tokens, it allows effortless swaps between assets across networks like Ethereum, BNB Chain, Avalanche, and Solana.

As part of the Best Cross-Chain DEX Tools, Rango stands out for its smart routing system that automatically finds the most efficient and low-fee paths.

Its interface caters to both beginners and advanced users, offering transaction simulation, bridge comparisons, and slippage control for reliable cross-chain trading.

Rango Exchange Key Features

- Access to over 50 DEXs and bridges for cross-chain swaps.

- Smart routing for lowest cost and fastest swaps.

- Major chain support: Ethereum, BNB, Solana, Avalanche.

- Performance analytics and transaction simulation.

Pros:

- Efficient and secure cross-chain swaps.

- Token and chain coverage is expansive.

- Ease of use, and data is clearly presented.

- Slippage is low and fee structure transparent.

Cons:

- May take time to learn if you are new to decentralized finance (DeFi).

- Performance reliant on bridge uptime.

- Gas fees can peak.

- Mobile app is limited.

2. 1inch

1inch has become a top decentralized exchange aggregator. 1inch gathers liquidity from different decentralized exchanges to provide users with the best swap rates.

1inch also optimzie transactions with the Pathfinder algorithm across different liquidity pools. This method helps decrease slippage and lowers trading fees.

1inch also offers limit orders and a decentralized wallet. It has also integrated with Multiple DeFi Protocols making 1inch ideal for traders, uncompromised transparency, efficiency, and a multi-chain system. It expanded to support BNB Chain, Polygon, and Arbitrum networks.

1inch Key Features

- Most advanced DEX aggregator.

- Covers Ethereum, BNB Chain, Polygon, and more.

- Offers limit orders and DeFi staking.

- Multi-wallet and DeFi protocols.

Pros:

- Best price and route optimization for trades.

- Liquidity is deep enough for major exchanges.

- Non-custodial approach is secure.

- Smart contracts transparent to the public.

Cons:

- Gas fees are quite high.

- Complicated for beginners.

- Rare NFT or Layer-2 functionality.

- Routing delays are still possible under heavy load.

3. LI.FI Protocol

LI.FI Protocol is universal liquidity bridge, DEX aggregator and cross-chain trading for developers and users. LI.FI Protocol connects with major bridges and DEXs for efficient swap routing, exchanges and offers the best rates and lowest cost transactions.

LI.FI serves as a The Best Cross-Chain DEX Tools. It offers APIs and SDKs for dApp, wallet and DeFi service cross-chain functionality.

LI.FI Protocol’s attention to security, flexibility and the overall user experience for cross-chain functionality services makes it a critical cross-chain interoperability layer for Web3. LI.FI offers security and flexibility cross-chain to build Web3.–

LI.FI Protocol Key Features

- Cross-chain trading through bridges and DEXs is available.

- Provides developer APIs and SDKs for DeFi.

- Optimized for the best prices and lowest fees.

- Advanced risk and security monitoring.

Pros:

- Multip-chain app developers are provided for.

- DeFi Platforms are highly integrated.

- Cross border streamlined swaps.

- Informed Dependable infrastructure.

Cons:

- Not targeted for casual traders.

- Complex and less user-friendly for average traders.

- Limited retail trading capabilities.

- Losing bridges offered by third parties for liquidity.

4. XY Finance

XY Finance delivers strong liquidity aggregation and a routing protocol for over 20 blockchains for fast and cost-efficient cross-chain swaps. With its “One-Stop Cross-Chain Aggregator” design, users can trade assets without manual bridging and network switching.

XY Finance is regarded as one of the Best Cross-Chain DEX Tools for its cohesive interface, extensive analytics, and ability to handle DeFi and NFT transfers.

Its reward-earning ecosystem includes yield farming, bridging rewards, and liquidity pools that are engineered to provide deep, cross-chain liquidity that is stable and secure.

XY Finance Key Features

- Cross-chain liquidity aggregator.

- Supported 20+ blockchains and 1000+ tokens.

- DeFi and NFT bridging available.

- Provides liquidity mining and farming.

Pros:

- Streamlined and rapid multi-chain swaps.

- Efficient routing and low fees.

- Excellent UI for DeFi users.

- Expanding ecosystem and partnerships.

Cons:

- Small chains have fluctuating liquidity.

- Minimal institutional attention.

- Congestion can cause delays during swaps.

- Limited users compared to top DEXs.

5. THORSwap

THORSwap serves as the primary interface for THORChain, a decentralized liquidity protocol that allows cross-blockchain, native asset swaps without using wrapped tokens. THORSwap allows users to trade Bitcoin directly for Ethereum or BNB, a feature that most DEXs do not offer.

Among the Best Cross-Chain DEX Tools, ThorSwap stands out for transparency and decentralization, granting users full custody of all their assets.

With extensive support for principal crypto assets and the seamless addition of new chains, ThorSwap is unmatched in secure and trustless cross-chain liquidity provisioning.

THORSwap Key Features

- No wrapping of tokens is required.

- Decentralized with no custody liability.

- Multi-Asset liquidity pools underpinned by primary blockchains.

- Constructed on THORChain.

Pros:

- True cross-chain trading without intermediaries.

- Reputation and community governance.

- Numerous blockchains are safely and transparently integrated into the system.

- New blockchains are added continuously.

Cons:

- User interface is complicated and confusing for newcomers.

- Some trading pairs may have low liquidity.

- New DeFi customers may find the system’s technologies difficult to grasp.

- DeFi system may become unstable for short periods.

6. Uniswap

Uniswap remains one of the largest and most powerful decentralized exchanges in the world and one of the first to adopt the automated market maker (AMM) model.

With upgrades and integrations, Uniswap now enables cross-chain swaps through LayerZero and cross-chain integrations with BNB Chain and Polygon, earning them the reputation as one of the Best Cross-Chain DEX Tools due to their unmatched liquidity depth and reliability.

Flexible Uniswap works over a variety of smart contracts, is the center of a flourishing developer community and, in turn, powerful decentralized and transparent trading hubs, serves the needs of users in the DeFi community that are looking for rational and low-cost trading alternatives.

Uniswap Key Features

- Independent Automated Market maker.

- Enhanced support for several blockchains: go to Ethereum, Polygon, or BNB chains.

- Limit orders, token swaps, assistance with liquid pools.

- Compatibility with major DeFi instruments and wallets.

Pros:

- The system has advanced the accessibility of liquidity and dependable execution with low slippage.

- The interface has been customized for trust and has gone through extensive audits.

- DeFi instruments and wallets have been integrated.

- The system has multiple active trading pairs with a worldwide presence.

Cons:

- Customers may have to pay high gas fees for Ethereum.

- Blockchains with Ethereum will have weak interoperability.

- No direct fiat onramps.

- Impermanent loss risk for liquidity providers.

7. Multichain

Multichain, formerly known as AnySwap, is a pioneer cross-chain bridge protocol that allows for the seamless transfer of tokens and NFTs across 80+ blockchains. With low-cost, fast, and secure bridging options for both EVM and non-EVM chains, Multichain is one of the most trusted cross-chain bridge protocols available today.

This is why they are recognized as one of the Best Cross-Chain DEX Tools. Multichain is one of the most important components to decentralized cross-chain interoperability and is used by many projects and users to cross bridge their assets with Ethereum, Fantom, and Avalanche. system router for efficient liquidity and fast transaction and swap completion.

Multichain Key Features

- Cross-chain bridge for 80+ blockchains.

- NFT and token transfers supported.

- Router system for liquidity optimization.

- High-speed and secure bridging protocol.

Pros:

- Extensive blockchain coverage.

- A high-speed and secure bridging protocol.

- High-speed and secure bridging protocol.

- Router system for optimized liquidity for bridging.

- Automated token and NFT transfers.

Cons

- Quick and inexpensive asset transfers.

- Effectively and reliably used over the years.

- EVM and non-EVM chains are supported..

8. Symbiosis Finance

Symbiosis Finance is a completely decentralized protocol of cross-chain liquidity aggregation. The protocol allows the users to simply swap tokens across blockchains with a single click. It dynamically scans for optimal routing to guarantee the best pricing and the lowest gas fees.

Because of its seamless user interface and extensive integration with all core DeFi protocols, Symbiosis is regarded as one of the Best Cross-Chain DEX Tools. Non-custodial, expanding chains, and cross-chain liquidity access means canvas for cross-chain liquidity access.

Symbiosis Finance Key Features

- Cross-chain liquidity aggregator enabling one-click swaps.

- Compatibility with EVM and non-EVM networks.

- Non-custodial and Permissionless.

- Automated routing, gas optimization, and swap execution.

Pros:

- Provides fast and simple services.

- Decentralization offers privacy.

- Minimal and economical fees.

- Wide range of chains and tokens available.

Cons:

- Some pairs have low trading volumes.

- Basic trading functionalities.

- Minor ecosystem compared with major competitors.

- Ecosystem is still shrinking.

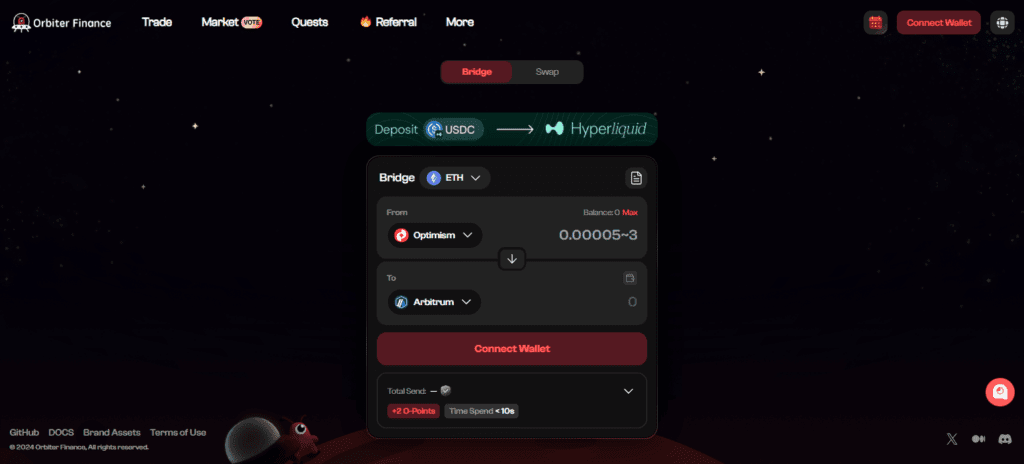

9. Orbiter Finance

Layer-2 Loopers cross-chain Orbiter Finance is one of the lowest cost and fastest cross-chain Ferries, and cross-chain DEX Tools. Orbiter is uniquely positioned to serve users focused on Layer-2.

Loopers and mainnets in modern blockchains as Arbitrum, Optimism, zkSync, and StarkNet. Orbiter’s gas efficient, secure, and rapid transactions place it among the best in the industry. Orbiter ensures decentralized, and trustless transfers in seconds, passing through rollups and mainnets.

Orbiter Finance Key Features

- Focus on Layer-2 transfers of Arbitrum, zkSync, and Optimism.

- Instant finality and low gas.

- Non-custodial bridging.

- Cryptographic proofs secures high level of security.

Pros:

- Fast Layer-2 swaps.

- Very cheap.

- Ideal for roll-up based ecosystems.

- Consistent and high reliability.

Cons:

- Layer-2 networks are the only supported.

- Limited tokens.

- No Direct Trade or liquidity pools.

10. OpenOcean

OpenOcean is a full aggregator. It combines swap liquidity from both decentralized and centralized exchanges. This means that users get the most optimal swap rates.

It covers over 20 blockchains and utilizes advanced algorithms to determine the best trading routes. OpenOcean is ranked among the Best Cross-Chain DEX Tools because of its unparalleled trading flexibility.

It allows users to conduct cross-chain swaps, derivatives, and spot trading within a single interface. It is a complete DeFi trading aggregator because of its advanced trading bots, analytics dashboards, and simple interface.

OpenOcean Key Features:

- DEX and CEX Liquidity Aggregation.

- Smart price comparison and order routing.

- Supports 20+ blockchains & trading pairs.

- Availability of derivatives and spot trading.

Pros:

- Smart routing gives best market prices.

- Cross-chain and CEX integration flexibility.

- User-friendly with an integrated analytics dashboard.

- Supports numerous blockchains and tokens.

Cons:

- May experience routing lags during market volatility.

- KYC may be needed for some cross-exchange routes.

- Novice users may find advanced options overly complex.

- Liquidity may be thin for smaller market options.

Conclusion

With the advent of cross-chain DEX tools, traders can execute cross-chain transactions rapidly, seamlessly, and securely. Rango Exchange, 1inch, LI.FI Protocol, XY Finance, THORSwap, Uniswap, Multichain, Symbiosis Finance, Orbiter Finance, and OpenOcean are examples of cross-chain DEX tools that allow users to access various cryptocurrencies at minimal costs while retaining full custody of their assets.

Selecting the most appropriate Cross-Chain DEX Tools is contingent upon your trading preferences—whether you are interested in rapid bridging, multi-chain swaps, or the exchange of native assets across blockchains. Rango Exchange and others are setting the new standard for DEX tools and pioneering the new era in trading of decentralized assets to enhance liquidity.

FAQ

Cross-chain DEX tools are decentralized platforms that allow users to swap or bridge tokens between different blockchains without relying on centralized exchanges. They use smart contracts to provide secure, permissionless, and transparent trading across networks like Ethereum, BNB Chain, Polygon, and more.

They solve the interoperability problem in DeFi by connecting isolated blockchains. With these tools, users can easily transfer assets, access broader liquidity pools, and explore multiple ecosystems without leaving decentralized control.

The Best Cross-Chain DEX Tools include Rango Exchange, 1inch, LI.FI Protocol, XY Finance, THORSwap, Uniswap, Multichain, Symbiosis Finance, Orbiter Finance, and OpenOcean — each offering unique features like multi-chain routing, fast swaps, and low fees.

They aggregate liquidity and bridges across blockchains, using smart routing algorithms to find the best paths for token swaps. When you initiate a trade, the DEX tool automatically selects the most cost-efficient route while maintaining security and decentralization.

Yes, most reputable DEX tools are safe when used correctly. Always choose audited platforms like THORSwap, 1inch, or LI.FI Protocol, verify smart contracts, and avoid phishing links. Non-custodial designs ensure you retain full control of your funds.