Searching for the best CoinDCX alternatives? As one of India’s best cryptocurrency exchanges, CoinDCX rivals other platforms with competitive routing, a wide range of coins to trade, and a user-friendly interface for Indian traders and beginners.

Secure INR deposits, margin and staking options, and solid customer support are just a few of the unique offerings to help enhance your experience. Selecting the best choice for your needs can help optimize trading opportunities and improve your overall experience.

What is CoinDCX?

Since its inception in 2018 and its establishment in Mumbai, CoindCX has been one of the largest and most renowned cryptocurrency exchanges in India. Customers can conduct exchanges in Indian Rupees for payable transactions and trade multiple currencies, including Bitcoin and Ethereum.

With highly competitive fees suited for both casual and advanced traders, CoinDCX offers futures, spot, and margin trading. Customer education and educational resources onsite are focal points to the platform as are compliance and elevated protection of customer records.

With its robust 24/7 customer support and elevated customer confidence, CoinDCX is a highly advanced trading platform for cryptocurrency traders in India.

How To Choose the Best CoinDCX Alternatives?

Best CoinDCX alternatives will vary depending on your trading preferences, experience and objectives. Below are the points to consider.

Regulation & Trust Favor exchanges operating in India legally, as well as having a good reputation, complying with KYC and AML.

Fees & Charges Different platforms come with varying trading, withdrawal and deposit costs which will help find a cost effective platform.

Supported Cryptocurrencies Some exchanges may offer a greater variety of cryptos and more INR trading pairs.

Security Measures Advanced security measures are essential, which include cold storage wallets, two factor authentication and insured funds.

User Experience Having an easy-to-use and reliable trading interface on a mobile and/or web platform improves the trading experience, particularly for novices.

Liquidity & Speed: Greater liquidity enables faster transactions with less price slippage, thereby improving the value of a trade.

Customer Support Having contactable support at all times of the day is essential to expediently solve problems.

Extra Features Having added features for value added services like staking, lending and/or education is excellent.

Key Point

| Exchange Name | Key Feature | Highlight / USP |

|---|---|---|

| CoinSwitch Kuber | App-based crypto trading | Ideal for beginners and quick transactions |

| ZebPay | Trusted Indian platform | Strong security and low trading fees |

| Coinbase | A globally popular, highly regulated | User-friendly exchange |

| Giottus | Fast-growing Indian exchange | Excellent customer support |

| Unocoin | India’s oldest Bitcoin exchange | Great for long-term investors |

| Bitbns | Supports many cryptocurrencies | Offers staking and advanced trading options |

| KoinBX | High liquidity exchange | Strong compliance and smooth trading experience |

| SunCrypto | Jaipur-based exchange | Focused on transparency and local support |

| BuyUcoin | Multi-coin trading platform | Emphasis on security and reliability |

| Flitpay | Indian crypto platform | Easy INR deposits and withdrawals |

1. CoinSwitch Kuber

As one of the top platforms for crypto investments in India, CoinSwitch Kuber, was founded in 2017 (as part of CoinSwitch). It was introduced as CoinSwitch Kuber to focus on the Indian crypto market.

Kuber allows Indian users to perform crypto transactions in INR, and lets users deposit and withdraw in INR. Spot trading on CoinSwitch Kuber has a maker fee of ~0.10% and a taker fee of ~0.49%.

These rates will change based on the specific coin, the volume of the coin, and promotions that CoinSwitch has at a given time. Supported customer service is in-app and at helpdesks.

For its customer support and low transaction fees, CoinSwitch Kuber is one of the best CoinDCX alternatives for Indian customers. CoinSwitch Kuber has a wide selection of coins for trading and is best for users that prefer a trusted local option.

CoinSwitch Kuber Key Points

- Established: ~2017 (part of CoinSwitch)

- Area of Operation: India

- Transactions Supported: Multi major cryptocurrencies, INR (fiat) ↔ crypto pairs.

- Charges: Spot trading has a maker/taker tiered structure (ranges from {0.04}%→{0.04}%→0.40% based on trading volume) There can also be fees for withdrawals/network fees for every blockchain.

- Customer Support: In-app chat, ticket / helpdesk support

Pros

- Low fees (competitive for Indian users)

- Simple UI, good for beginners

- Strong domestic presence and trust

- Access to many cryptocurrencies via INR on-ramp

Cons

- Less advanced trading features compared to global exchanges

- Hidden or variable blockchain / gas / network fees can impact cost

- Occasionally, discrepancies in price due to aggregation

2. ZebPay

As one of India’s oldest crypto exchanges, ZebPay was founded in the mid-2010s. Users can trade different cryptocurrencies for Indian Rupees or cryptocurrencies associated with ZebPay.

Among all crypto exchanges in India, ZebPay has a fairly reasonable fees structure (while most do not openly provide the exact fees for makers and takers, ZebPay makes a considerable effort to show users low trading fees).

ZebPay extends its services to Singapore and Australia. ZebPay’s customer support comprises a ticketing and helpdesk system, in-app support, and help center resources.

ZebPay has a solid reputation, so Indian users seeking a stable and trusted platform can regard ZebPay as a CoinDCX alternative.

ZebPay Key Details

- Founded: ~2014

- Regions / Country: India (also expanded presence in some other countries)

- Supported currencies: INR ↔ crypto pairs, many popular crypto assets

- Fees: Competitive trading fees; exact maker/taker splits depend on volume tiers

- Customer Support: Ticketing, helpdesk, in-app support

Pros

- Longevity and brand trust

- Emphasis on security (e.g. cold storage)

- User-friendly platform

- Good for INR-crypto trading

Cons

- Limited advanced trading instruments

- Fee transparency (maker/taker) not always clearly published

- Support responsiveness may vary

3. Coinbase

A fully-fledged crypto exchange, Coinbase was founded in 2012. It allows crypto and fiat trading in USD, EUR and some cross-fiat regions, and also provides trading in a variety of cryptocurrencies.

Since regulatory constraints dictate full INR on-ramp/off-ramp functionality, in India Coinbase crypto-to-crypto trading (coin swapping) is much easier. The Coinbase fee structure is region and product-based (maker/taker fees, spreads, etc).

Although the company claims to provide global services, full fiat deposit/withdrawal functionalities are restricted in most jurisdictions. Automated support is provided via email and a help center, while higher support tiers include concierge or premium support.

It is also one of the services listed as a “best alternatives to CoinDCX” in India, and for good reason, as Indian users seeking access to international markets are attracted to it’s global reputation, security, regulatory compliance, and track record.

Coinbase

Key Details

- Founded: 2012

- Regions / Country: Global (U.S. headquartered)

- Supported currencies: Many global fiat currencies and a wide range of cryptocurrencies

- Fees: Region-dependent; spread + maker/taker or fixed commission depending on product

- Customer Support: Email / help center / tiered support

Pros

- Security and regulatory compliance are strong. Reputation too.

- Support for many coins and global coverage.

- Users seeking global access will find it beneficial.

Cons

- In India, limits exist for fiat (INR) on-ramp/off-ramp

- Fees are high for smaller trades or users lacking volume.

- Advanced features are restricted in certain jurisdictions.

4. Giottus

Giottus was established in November 2017 and started trading in April 2018. Giottus is an Indian platform built for Indian customers, offering INR deposits and withdrawals, as well as a range of cryptocurrencies.

As for fees, for INR-based trading pairs, maker and taker fees are usually around 0.05%, and for crypto-to-crypto pairs the fees are generally higher, starting around 0.30% or more. Giottus usually adjusts these fees based on the trading volume of the customer.

As for support, Giottus provides a helpdesk, ticketing system, and customer service in various Indian languages and puts a strong emphasis on support responsiveness and localization.

Giottus is an India-first platform, and because of the India-focused customer support, lack of obfuscation in the fees structure, and strong fee transparency, Giottus is considered one of the best CoinDCX alternatives especially for users who need support and trust from the local community.

Giottus Key Details

- Founded: 2017 (trading started in 2018)

- Regions / Country: India

- Supported currencies: INR deposits/withdrawals; many popular crypto coins (100+ list)

- Fees: Maker/taker tiers (e.g. 0.05% for some INR pairs; higher for crypto-to-crypto)

- Customer Support: Helpdesk, ticketing, multilingual support

Pros

- Localized support (multiple Indian languages)

- Transparent operations, good customer focus

- Competitive fees for INR pairs

- Feature set (staking, etc.)

Cons

- Fewer advanced derivatives / margin trading options

- Some limitation in coin selection compared to large global exchanges

- Funding / withdrawal limits sometimes

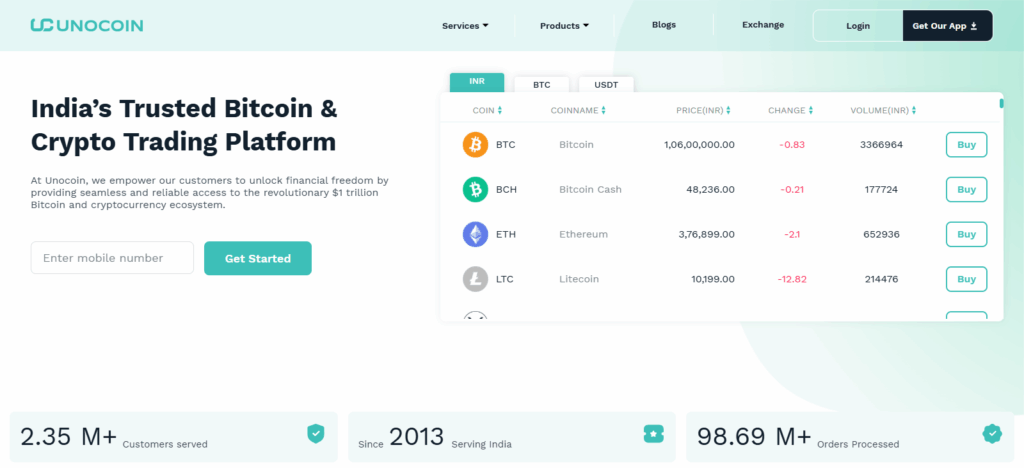

5. Unocoin

Unocoin is one of the first Indian crypto exchanges, starting around 2013. It is still one of the Indian Bitcoin exchanges and allows trades of Bitcoin and various other cryptocurrencies against Indian Rupees (INR).

Unocoin employs different fee structures depending on the type of trade and the volume as well as the maker-taker models although the precise published rates may vary over time. Unocoin is mainly focused in India and serves Indian users.

For customer support, they use email, ticketing, and a helpdesk. Due to Unocoin’s long history in the Indian crypto ecosystem, it has built tremendous credibility and earned users’ trust, making it a viable CoinDCX alternative for those seeking a stable, established local platform.

Unocoin Key Details

- Founded: ~2013

- Regions / Country: India

- Supported currencies: INR ↔ selected cryptocurrencies

- Fees: Varies by trade type and volume (maker / taker)

- Customer Support: Email, ticketing / helpdesk

Pros

- Among the first crypto exchanges in India, which bodes well for expertise and credibility.

- For long-term holding trades, the exchange provides a simpler-user interface, which is more dependable.

- The exchange operates on a dependable interface.

Cons

- For more experienced users, the exchange provides a lack of further refined trading functions.

- For less active users, fees may be higher, creating the impression of exaggerated costs.

- The company appears to be less innovative and provides slower development cycles for more advanced functions.

6. Bitbns

Established in December 2017, Bitbns provides cryptocurrency services across more than 100 cryptocurrencies, including various altcoins. In addition to staking, Bitbns provides margin trading (where legal) and multiple order options.

For fiat, it supports INR deposits and withdrawals through bank transfers, UPI, and more. Even in the Indian landscape, Bitbns provides competitive pricing and varied pricing based on trading volume, the coin traded, and the service utilized.

Bitbns operates in India (serving Indian users). Customers can reach support through in-app help, email, and the help desk. For its extensive feature set, wide range of cryptocurrencies, and versatile trading options, Bitbns ranks among the best CoinDCX alternatives for users seeking sophisticated trading features and local services.

Bitbns Key Details

- Launched in December 2017

- Based in India

- Facilitates INR transactions, several cryptocurrencies including altcoins, and other crypto trading.

- Customer service via in-app messages, an email ticketing system, and standard ticket support.

Pros

- A large selection of coins is available.

- Advanced functionalities such as staking has been incorporated.

- Satisfactory liquidity for a wide range of pairs

Cons

- Previous complaints regarding support delays and problems with withdrawals

- Potential difficulty for new users due to complexity

- Issues with fees and lack of transparency in times of market volatility

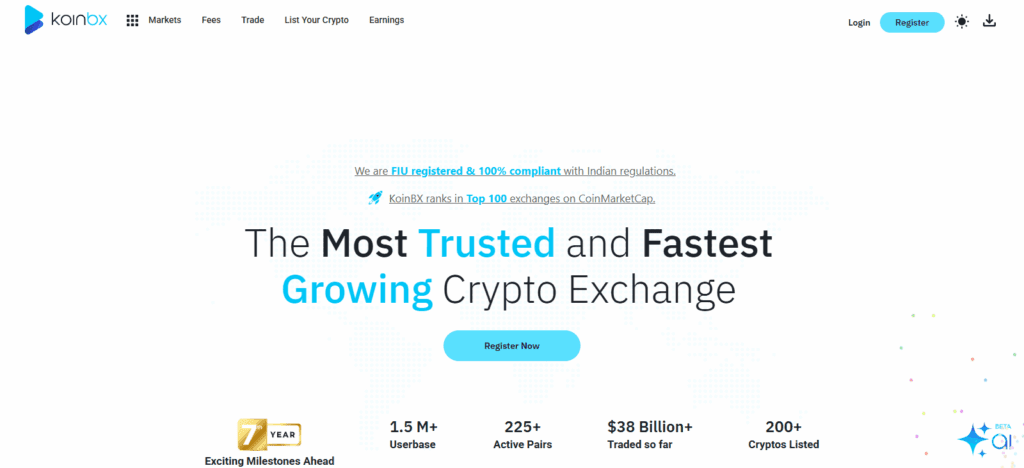

7. KoinBX

KoinBX is an Indian exchange that focuses on compliance, liquidity, and trust. Information on the founding year and exact fees is limited compared to larger exchanges. It supports INR deposits and withdrawals, as well as select major cryptocurrencies.

The fee structure is estimated to be on the lower side compared to other Indian exchanges and is adjusted based on an individual user’s activity and volume tiers.

KoinBX primarily operates in India. Regarding customer support, KoinBX likely provides standard helpdesk or ticket support systems as is common with Indian crypto platforms.

Due to its focus on compliance, reliability, and liquidity, KoinBX is seen as a CoinDCX alternative primarily for traders who require dependable order execution and clarity on regulations in India.

KoinBX Key Details

- Founded: (less publicly documented)

- Regions / Country: India

- Supported currencies: INR deposits/withdrawals; major cryptocurrency pairs

- Fees: Likely competitive among Indian exchanges (volume-based)

- Customer Support: Standard helpdesk / ticketing

Pros

- Focusing on liquidity and compliance on Indian regulations

- Indian-centric trading experience

- Possibly good execution for high volume trades

Cons

- Less known / less tested compared to big names

- Limited public information on features or reliability

- Potentially smaller user base, less liquidity in niche coins

8. SunCrypto

SunCrypto is a transparent and community-focused crypto exchange based in Jaipur, India. It allows users to perform INR deposits and withdrawals for most cryptocurrencies.

While it is optimized for Indian users as a domestic platform, it is difficult to know details such as the exact fee structure and when the platform was established, as these have not been published.

SunCrypto seems to focus on the Indian community for participants, most probably receiving support through in-app chat, emails, or local offices, which is a testament to its local trust emphasis and transparency. Thus, SunCrypto becomes a worthy CoinDCX alternative.

SunCrypto Key Details

- Founded / Background: Jaipur-based Indian platform (less public documentation)

- Regions / Country: India

- Supported currencies: INR deposits/withdrawals; selection of major cryptocurrencies

- Fees: Not widely published — expected to follow Indian norms

- Customer Support: Regional / localized support (in-app, email)

Pros

- Local support, closer engagement

- Emphasis on transparency and community trust

- Good choice for users preferring regional platforms

Cons

- Limited scale and liquidity

- Fewer advanced tools / features

- Lack of visibility and decreased trust due to global oversight

9. BuyUcoin

BuyUcoin emphasizes the security of its exchange and the many cryptocurrencies it allows users to trade. It also allows INR deposits and withdrawals and supports trade across many coins.

Its fees are based on the Indian exchange standards and vary by user volume, coins, and trading pairs. Customer support can be received by ticketing and emails and is incorporated in the app.

BuyUcoin is India based which is then why it offers security and a wide range of coins. For these reasons, it is regarded as one of the best CoinDCX alternatives.

BuyUcoin Key Details

- Founded: (public info indicates it’s established Indian Crypto exchange)

- Regions / Country: India

- Supported currencies: INR deposits/withdrawals; multiple cryptocurrencies

- Fees: Standard Indian exchange model (varies by coin/trade volume)

- Customer Support: Ticketing, email, app support

Pros

- Multi-coin support

- India-centric operations. Understanding of local regulations

- Good balance of features and security

Cons

- Support speed and responsiveness may lag

- Lower scale compared to top-tier exchanges

- Some fees/limits might be higher for smaller users

10. Flitpay

Since its start in 2017, Flitpay has grown into a complete crypto exchange. It allows UPI, IMPS, NEFT/RTGS deposits and withdrawals in INR and lets you trade several cryptocurrencies (BTC, ETH, SHIB, etc.) as well. Instant Buy/Sell (OTC) services are available, and Flitpay may offer them without charging a trading fee (i.e., free trading in OTC mode).

Other exchanges in India offer trading fees as Flitpay does. It offers customer support in-app chat, WhatsApp/Telegram support, and helpdesk.

Due to its low fees, user-friendly app, and India-specific custom features, Flitpay has become a modern and appealing CoinDCX alternative. It is intended for both novice and advanced traders, and Flitpay is often perceived as an ideal option for Indian crypto traders.

Flitpay Key Details

- Founded: ~2017 (transitioned into full exchange)

- Regions / Country: India

- Supported currencies: INR deposits/withdrawals via UPI, NEFT etc.; many cryptocurrencies

- Fees: Zero/minimal in some modes (e.g. OTC) and competitive trading fees generally

- Customer Support: In-app chat, WhatsApp/Telegram, helpdesk

Pros

- Very low costs (especially in some trading modes)

- Simple UI, good for everyday users

- Strong INR integration/ease of deposit & withdrawal

Cons

- May lack advanced trading tools (derivatives, margin)

- Smaller platform scale and liquidity for niche coins

- Support / service reliability needs thorough user feedback

Conclusion

As has been said, CoinDCX is the leading crypto exchange in India – but that doesn’t mean there are not other viable options. Other sites may work better for a customer’s particular needs, whether lower costs, better security, or other distinguishing features.

Other crypto exchanges offer user support in Indian currency and have a reputation for being easy to use. For instance, CoinSwitch Kuber, ZebPay, Giottus, Bitbns, and Flitpay are some reliable options.

Unocoin, BuyUcoin, and KoinBX may have fewer trading options, but in exchange, they offer better compliance and local accessibility.

In the end, it all comes to personal preference in trading tools, experience and objectives. Therefore, it is is wise to identify the site that aligns with your crypto goals, maintaining a balance of security and full operational transparency.

FAQ

CoinDCX alternatives are other cryptocurrency exchanges that offer similar services such as buying, selling, and trading cryptocurrencies, often with INR support in India.

Alternatives may offer lower fees, more cryptocurrencies, better customer support, advanced trading features, or improved security, allowing users to choose a platform that fits their needs.

Popular alternatives include CoinSwitch Kuber, ZebPay, Giottus, Unocoin, Bitbns, KoinBX, SunCrypto, BuyUcoin, and Flitpay.

Consider fees, supported cryptocurrencies, security measures, customer support, liquidity, and user experience to find the platform that matches your trading goals.

Most alternatives follow KYC/AML regulations, use cold wallet storage, and provide security features like two-factor authentication. Always check each platform’s track record before trading.