In 2025, due to regulatory restrictions, higher KYC requirements, and heightened security concerns, traders are looking for BYDFi alternatives more than ever before. With low fees, high security, and various supported coins, the crypto space does meet all three criteria.

The crypto space does meet all three criteria. There are plenty of options for specialized trading, from beginner-friendly options such as Robinhood and Coinbase to advanced trading hubs like Binance and Kraken.

The most suitable alternative enables smooth trading, increased privacy, and dependable customer support. Hence, careful selection is vital.

Why Look for Bybit Alternatives?

Bybit is getting more and more unavailable to potential clients because of regulatory bans in key regions like the United States, United Kingdom, and Canada. When traders cannot use the platform, they start pursuing compliant exchanges.

Mandatory KYC policies rolled out in 2023 has also affected the Bybit platform user experience. Privacy-focused traders tend to stay away from exchanges that require full identification, and most user onboarding passes without full identification checks. Such traders are inclined to use exchanges with no KYC, or minimal KYC requirements.

A 2025 security breach which exposed Bybit’s weak customer protective measures, (albeit 2FA and cold wallets), affected user confidence.

Those exchanges which managed to maintain clear security records and *open transparency are now more sought after. Users also tend to gravitate to exchanges which do not charge *fiat deposit fees* to be more competitive.

More customer support personnel not directly resolving issues, escalates user frustration. Resting predominantly customer bases now require fast resolution of issues to maintain trading.

Key Point

| Exchange | Key Features | Best For |

|---|---|---|

| Kraken | Regulated, strong security, futures & margin trading | Advanced traders seeking compliance |

| Robinhood | Commission-free trading, simple UI, stock & crypto mix | Beginners and casual investors |

| Coinbase | Easy-to-use app, insured assets, learning rewards | New crypto users and investors |

| Binance | Wide coin selection, low fees, advanced tools | Global traders and active investors |

| KuCoin | Altcoin variety, trading bots, low fees | Users exploring emerging crypto assets |

| Gate.io | 1,700+ coins, copy trading, secure platform | Altcoin enthusiasts and traders |

| Huobi | Deep liquidity, global presence, staking options | Professional and institutional traders |

| MEXC | Zero-spot fees, high leverage, fast listings | High-frequency and futures traders |

| Bitstamp | Oldest exchange, transparent fees, reliable support | Long-term investors seeking trust |

| OKX | Web3 wallet, DEX access, futures & options | Traders wanting centralized & DeFi mix |

1. Kraken

Kraken is a U.S.-based exchange founded in 2011. It is registered as an exchange and offers 250 supported coins, including the most popular ones like Bitcoin, Ethereum, and Solana.

It has an active trading fee of 0.16% for makers and 0.26% for takers, and for margin traders, it offers a 5x maximum leverage. It has a KYC for all accounts.

Its key advantages are the institutional-grade security, support and response 24/7 customer service, and support for several foreign currencies.

Kraken is the best BYDFi alternative for traders who are looking for transparency and still willing for regulatory compliance and deep global-market liquidity.

Kraken Key Features

- 250+ Supported Coins

- Spot, futures, and margin trading (up to 5x)

- 24/7 live customer support

- Strong regulatory compliance & security

Pros:

- Excellent Reputation and safety

- Low trading fees

- Advanced charting tools

- Supports fiat deposits & withdrawals

Cons:

- KYC for all

- Less competitive trading leverage

2. Robinhood

Robinhood is a U.S.-regulated platform that started in 2013. It offers commission-free crypto trading for about 20 coins, including the popular Bitcoin, Ethereum, and Dogecoin.

It has 0% spot fees and relies on spread-based pricing. It has no leverage and KYC is required for compliance.

Its key advantages include an easy-to-use app, integration of stocks and crypto in one account, instant deposits and withdrawals, and withdrawals.

Robinhood is the best BYDFi alternative for beginners and casual investors who want simplified access to digital assets and a regulated environment to trade stock.

Robinhood Key Features

- Commission-free crypto trading

- Stock and crypto in one platform

- Instant deposits and withdrawals

- User-friendly mobile app

Pros:

- Best for beginners

- Intuitive interface

- No trading commissions

- Secure, U.S.-regulated platform

Cons:

- Limited number of supported coins

- No leverage and advanced trade tools

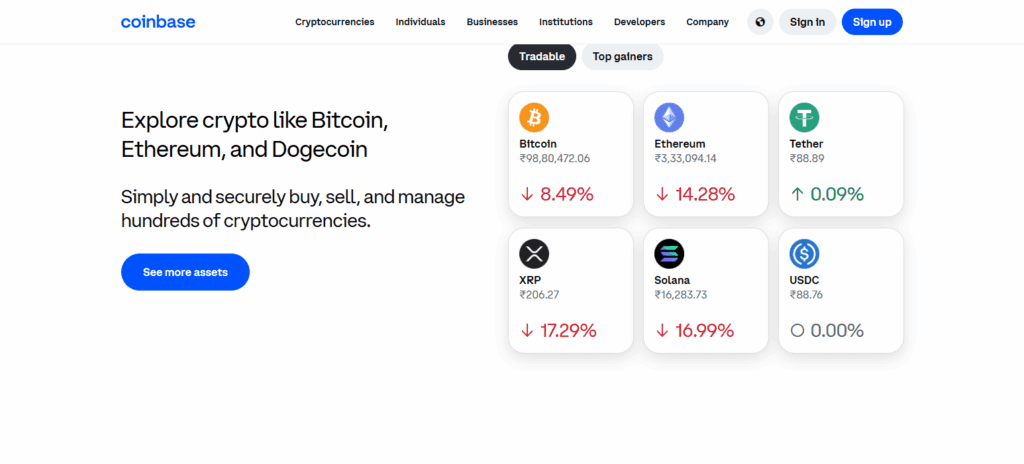

3. Coinbase

Coinbase, founded in 2012, has gained the trust of the U.S. clients and regulators and has more than 250 supported coins. It has 0.40% maker and 0.60% taker fees and spot trades and offers up to 3x leverage for professional merchants.

Full KYC verification has to be done to all accounts. Key advantages are: educational rewards, advanced trading dashboards and insured asset storage.

Best BYDFi Alternatives – Coinbase has an easy to use interface, superb compliance, and great liquidity, all of which are critical for starters compared to veterans.

Coinbase Key Features

- 250+ Cryptocurrencies

- Regulated U.S. exchange

- Educational rewards & learning hub

- High liquidity and easy-to-use interface

Pros:

- Great for beginners

- Institutional-level security

- Insurance for held assets

- Seamless fiat integration

Cons:

- Higher fees than most exchanges

- Limited features for pro traders

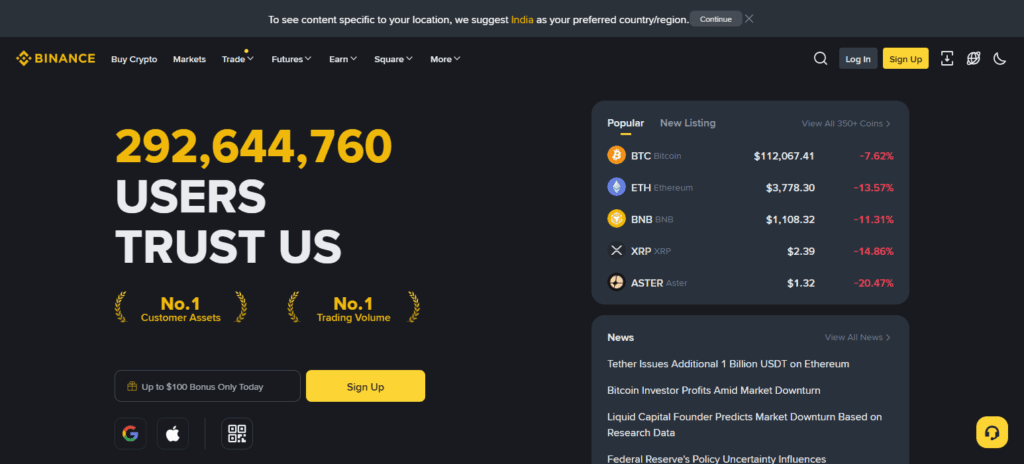

4. Binance

Founded in 2017, Binance has 350+ supported coins and is the biggest crypto trading exchange in the world with the lowest trading fees of 0.10% which can be further discounted if trading fees are payed with BNB.

It has up to 125x leverage for futures trading. KYC is needed for withdrawals and higher trading levels. Major advantages are staking, new token integration, liquidity and innovative trading tools.

Best BYDFi Alternatives – Binance offers the biggest and most advanced system for crypto trading with great analytics and covering all parts of the globe for institutional and retail traders.

Binance Key Features

- 350+ Coins & 1,000+ Pairs

- Spot fees: 0.1% (maker/taker)

- Leverage up to 125x

- NFT marketplace, staking, and launchpad

Pros:

- Low fees and deep liquidity

- Huge product ecosystem

- Excellent mobile and web platforms

- Wide global availability

Cons:

- Complex for new users

- Regulatory restrictions in some countries

5. KuCoin

Launched in 2017, KuCoin exchanges a total of 700+ cryptocurrencies and has a 0.1% maker/taker spot fee with discounts for KCS token holders.

KuCoin offers up to 100x leverage for futures trading and optional KYC for small withdrawal, which KuCoin’s key advantages like automated trading bots, a vibrant community, and automated trading bots for new altcoins before they list elsewhere.

Best BYDFi Alternatives – KuCoin is ideal for traders who are dong and affordable and diverse trading with primary cutting-edge for new assets and low trading fee.

KuCoin Key Features

- 700+ cryptocurrencies

- Leverage up to 100x

- Trading bots and social features

- Optional KYC for basic use

Pros:

- Massive altcoin selection

- Low trading fees

- Passive income via staking and lending

- Active global community

Cons:

- No strong regulatory oversight

- Limited fiat on-ramps

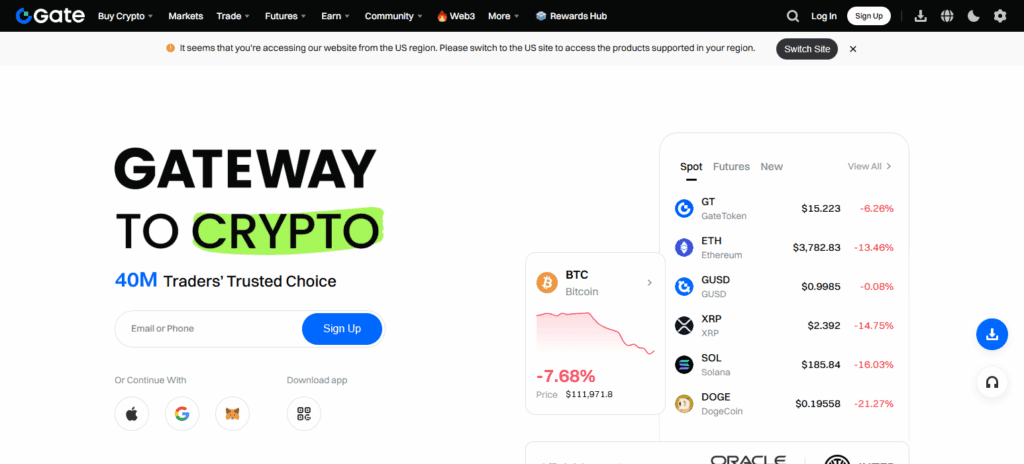

6. Gate.io

Founded in 2013, Gate.io is one of he crypto assets with 1,700+ supported coins. The exchange charges 0.2% maker/taker fee and supports futures with 100x leverage.

KYC is required for trader and for withdrawal too. The key advantages includes Copy trading, new token launches and platform security.

Best BYDFi Alternatives – Gate.io is for altcoin enthusiasts which attracts and experienced traders and strong global market presence and high liquidity, and a strong market presence, with high trading volumes and frequent listings.

Gate.io Key Features

- 1,700+ listed coins

- Spot and futures trading

- Copy trading and startup token sales

- Robust security infrastructure

Pros:

- Best for altcoin exposure

- Variety of trading options

- Frequent token launches

- Reliable and secure system

Cons:

- Interface can feel cluttered

- Mandatory KYC for all functions

7. Huobi.

Founded in 2013, Huobi supports over 600 cryptocurrencies and has a 0.2% fee structure for both makers and takers on spot trades. For derivatives trading, you can get up to 200x leverage. Huobi has mandatory KYC verification for compliance and security purposes.

Huobi’s key advantages includes deep liquidity, efficient mobile apps, and staking. Best BYDFi alternatives– Huobi, is suitable for advanced and institutional traders who seek a global exchange and high-performance trading infrastructures with multiple fiat gateways and reliable trading.

Huobi Key Features

- 600+ coins supported

- Leverage up to 200x

- Spot, futures, and staking services

- Global liquidity and fiat support

Pros:

- Deep liquidity and fast order execution

- Excellent for professional traders

- Multiple security and staking functionalities

- Variety of staking options

Cons:

- Full KYC needed

- Limited availability for users in the U.S.

8. MEXC

MEXC is a fast-growing exchange established in 2018. It has 1,600+ supported coins and 0% spot fees (0% maker/taker) for selected pairs. Similarly to MEXC, you can get 200x leverage on your futures trading.

KYC is optional for primary access but is mandatory for advanced restrictions. Main Benefits include quick listings, advanced charting software, and global coverage.

Best BYDFi Alternatives– MEXC suits high-frequency and professional traders who are cost-sensitive, require high speeds, and a variety of trading opportunities.

MEXC Key Features

- Over 1,600 coins to trade

- No spot trading fees (0% maker/taker fees)

- Up to 200x leverage on futures

- Fast order matching

Pros:

- Cost-effective trading

- Addition of new tokens happens at a rapid pace

- Efficient and quick user interface

- Non-KYC accounts available for small traders

Cons:

- User interface can be confusing

- Withdrawal of fiat currency is very limited

9. Bitstamp

Bitstamp has been offering cryptocurrency trading since 2011 and is one of the regulated European exchanges. It has over 85 digital currencies and crypto assets with 0.3% maker and taker fees.

Also, It has the option of 5x leverage on various currencies. KYC is offered on all accounts. It has been one of the most sought after exchanges because of the wihtout a doubt the well founded global market trust, transparent pricing, and trustable support.

Best BYDFi Alternatives – Bitstamp is suited for institutional clients and long term investors because of the ease of use and user compliant nature of the platform.

Bitstamp Key Features

- 85 coins are available

- Regulated exchange in Europe

- 5x leverage on some trading pairs

- Transparency in pricing

Pros:

- Grade-A customer service

- Fully compliant to EU

- Simple and easy to use interface

Cons:

- Smaller number of coins

- More expensive for lower volume traders

10. OKX

OKX since 2017 has provided trading for over 400 digital currencies combining both centralized and decentralized trading features. It has 0.08% maker and 0.1% taker fees with 125x leverages for futures trading.

In the crypto market the OKX has one of the most integrated features with a with a self custodial wallet and also various trading features.

Being one of the most secure environments for advanced crypto trading in the world. Best BYDFi Alternatives – OKX Provides tools for global traders and most integrated trading tools in the industry.

OKX Key Features

- Over 400 coins

- 125x futures leverage

- Web3 wallet and NFT marketplace

- Advanced analytic tools

- Diverse staking and other earning options

Pros:

- Seamless trading between DeFi and CeFi

- Low fees

- Staking, DeFi, and advanced mobile apps for trading

- Multiple ways to earn (staking, DeFi).

Cons:

- KYC for high volume trading

- Complex for new users

How To Choose the Best Bydfi Alternatives?

Regulatory Compliance. Choose exchanges that have proper licenses in your country to guarantee safe and legal trading wherein sudden limitations such as account bans are avoided.

Trading Fees. Analyze the maker and taker fees, spreads, and the fees associated with deposits in order to find cost-effective platforms for starters in trading as well as for advanced traders.

Supported Coins. Choose exchanges with a good number of cryptocurrencies to allow for more trading and investment strategies.

Security Measures. Choose exchanges that have cold storage, multi-factor authentication, and proof of reserves in order to protect from getting your exchanges getting hacked or unauthorized access.

KYC Requirements. Select exchanges that have flexible or absent KYC requirements for a much quicker signup dealing.

Leverage Options. Establish the leverage on futures and margin trading to meet your trading experience and objectives.

Customer Support. Go for exchanges with full time endlessly repeatable customer support in multiple languages.

Deposit & Withdrawal Methods. Prioritize systems with multiple methods of payment and low cost and fast payment.

Trading Tools & Interface. Use systems with easy to understand and use interfaces, and mobile systems for efficient and analytic trading.

Conclusion

Selecting best BYDFi Alternatives depends on personal trading style, location, and privacy concerns. Kraken, Binance, KuCoin, MEXC and OKX have established strong global presence and offer low fees and sophisticated trading options.

Coinbase and Bitstamp place tiered trading options within the context of safety and trustworthiness. For trading a wider variety of altcoins, Gate.io and Huobi are good options. Robinhood is a good option for beginners for its simplicity.

Alternatives offer different benefits i.e. leverage, security and compliance. The ideal option offers a combination of BYDFi’s core aspects of crypto trading safety, low cost, and variety.

FAQ

Top BYDFi alternatives include Kraken, Binance, KuCoin, OKX, MEXC, Coinbase, Gate.io, Huobi, Bitstamp, and Robinhood, offering secure, compliant, and low-fee trading environments.

Users may switch due to regulatory restrictions, KYC requirements, security concerns, or deposit fees. Alternatives often provide better accessibility, transparency, and flexible verification options.

Platforms like KuCoin and MEXC allow partial or no-KYC trading, giving privacy-focused traders faster onboarding and access to markets without compromising on features.

Binance and MEXC are known for 0% or very low maker/taker fees, making them ideal for high-volume and frequent traders seeking cost efficiency.

Robinhood and Coinbase are great for beginners, offering simple interfaces, educational tools, and strong regulatory protection for a safer start.

Yes, most top exchanges use cold storage, multi-factor authentication, and proof-of-reserves to protect funds. Always enable personal security settings for added safety.