In this article, I will evaluate the Best Bridging Aggregator For Lower Gas Fees. Bridging aggregators allow users to transfer tokens across different blockchains quickly and securely while minimizing gas fees.

They combine multiple bridges and optimize transaction routing to improve the speed, cost, and efficiency of cross-chain swaps, creating a streamlined user experience for DeFi and crypto enthusiasts.

Here’s a Clear Step-by-Step Guide To Choosing The Best Bridging Aggregator For Lower Gas Fees

Check Supported Blockchains

Always verify that the aggregator can bridge the chains you require, including Ethereum, BNB Chain, Polygon, Avalanche, and Solana. Cross-chain functionality provides greater flexibility.

Compare Gas Fees

Gas fees and transaction fees should also be examined. Aggregators that optimize routes and use liquidity pools tend to charge lower fees. It always helps to check a few aggregators and pick the best-priced option.

Consider Transaction Speed

Although low gas fees are appealing, transaction speed is equally vital. Some aggregators offer instant swaps via liquidity pools and Layer-2 networks, which in turn reduces the waiting time of transfers.

Check Token Support

Ensure the aggregator can bridge the tokens you wish to transfer, including stable coins, native tokens, DeFi assets, and many aggregators that support NFTs.

Evaluate Security

It is essential to check whether the aggregator has had its smart contract audited and what type of governance the protocol has, whether it is entirely decentralized, multi-sig, or both. Security helps in gaining more confidence against the risk of lost funds.

Inquiry on Multi-Bridge Aggregation

Li.Fi and Router Protocol aggregators bridge and DEXs and automatically determine the route with the lowest gas fees.

Key Points & Best Bridging Aggregator For Lower Gas Fees

| Bridging Aggregator | Key Point / Feature |

|---|---|

| Synapse | Fast cross-chain swaps with low gas fees and high security. |

| Router Protocol | Aggregates multiple bridges for cheaper transactions. |

| cBridge | Offers instant swaps and low-cost bridging. |

| Hop Protocol | Focused on fast Ethereum layer-2 transfers with low fees. |

| Across Protocol | Efficient bridging with reduced transaction costs. |

| Li.Fi | Aggregates DEXs and bridges for cheaper swaps. |

| Axelar | Cross-chain connectivity with cost-efficient transfers. |

| Connext | Low gas bridging with high transaction reliability. |

| Stargate | Unified liquidity pools reduce gas fees for cross-chain swaps. |

| Wormhole | Popular multi-chain bridge with optimized fee structure. |

10 Best Bridging Aggregators for Lower Gas Fees

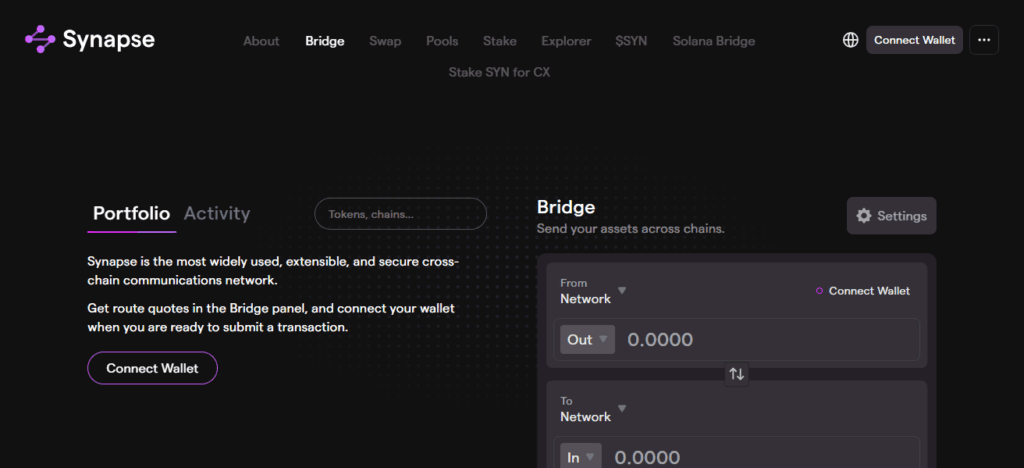

1. Synapse

Synapse is a multi-purpose cross-chain bridge that enables the connection of different blockchains, allowing users to transfer their tokens rapidly. Synapse is engineered to deliver the lowest gas fees while maintaining operational velocity.

It does this with the aid of routing algorithms and liquidity pools to achieve savings. It further accommodates stablecoins and native tokens, providing more options for DeFi users. There is also the issue of security, which the brilliant Jarvis, multi-signature smart contracts, and lower emotional controls address.

Synapse is particularly advantageous for Ethereum Layer-2 solutions. It provides users with instant swaps and excess bridging without high fees, which benefits users who frequently lend and borrow across different chains.

| Feature | Details |

|---|---|

| Cross-chain Support | Connects multiple chains including Ethereum, BNB Chain, and Polygon. |

| Low Gas Fees | Optimized routing and pooled liquidity reduce transaction costs. |

| Fast Transactions | Instant swaps between chains with minimal delays. |

| Security | Audited smart contracts and multi-signature governance. |

| Token Support | Supports stablecoins, native tokens, and DeFi assets. |

| Use Case | Ideal for DeFi users looking for frequent cross-chain swaps at low fees. |

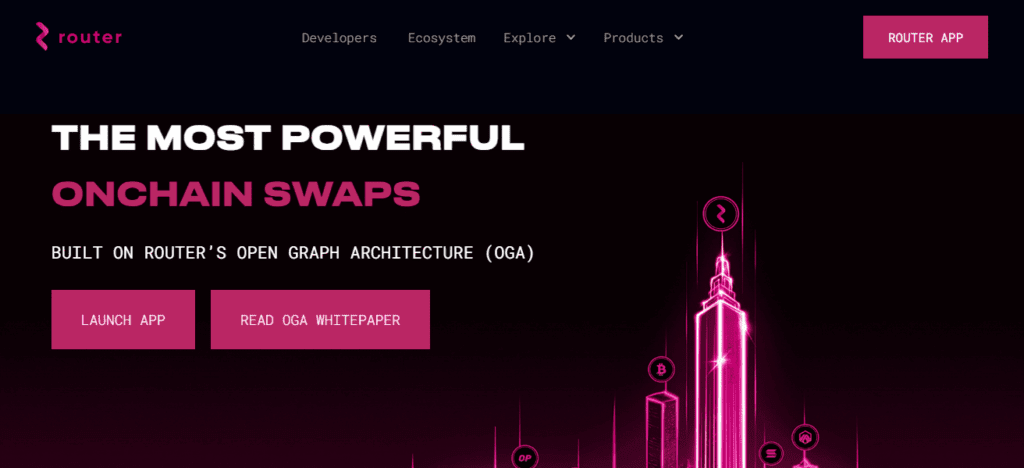

2. Router Protocol

Router Protocol serves as the cross-chain liquidity aggregator by bridging multiple bridges and DEXs to enhance liquidity token swaps. Its core strength lies in bridging with minimum fees by selecting the optimal route for bridging. Router supports Ethereum, BNB Chain, Polygon, and several other chains, allowing for effective cross-chain asset transfers.

The platform settles trades quickly, thanks to liquidity pools dispersed across the networks. Users gain easy access to simple interfaces with extensive transaction histories, as well as robust security in the form of audits and insurance.

Router Protocol combines several different bridges, reducing gas and slippage fees, and thus enhancing the quality of cross-chain swaps for the DeFi users.

| Feature | Details |

|---|---|

| Bridge Aggregation | Connects multiple bridges and DEXs for cost-effective transfers. |

| Low Gas Fees | Automatically chooses cheapest route for bridging. |

| Multi-chain | Supports Ethereum, Polygon, BNB Chain, and others. |

| Fast Settlements | Uses liquidity pools for near-instant transactions. |

| Security | Smart contract audits and insurance coverage. |

| Use Case | Suitable for traders and developers needing cheap cross-chain swaps. |

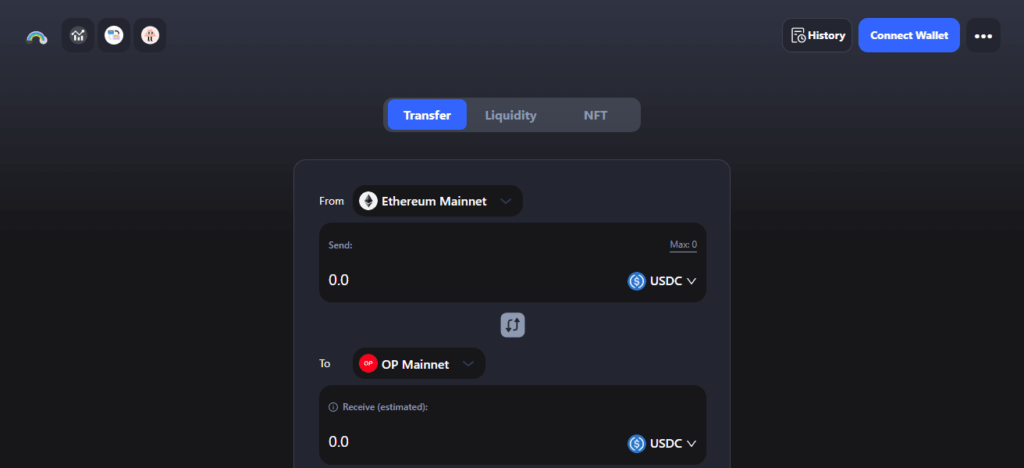

3.cBridge

cBridge, developed by the Celer Network, aims to facilitate quick cross-chain transactions with low gas fees. As a result of the liquidity networks, instantaneous token transfers are possible on Ethereum, Arbitrum, Optimism, and other supported chains.

cBridge avoids the costly and tedious on-chain confirmation, which lowers both cost and time. cBridge uses intelligent routing to find the most efficient route for bridging assets, saving on gas. cBridge is protected through decentralized nodes and regular audits.

Its growing adoption, exceeding that of conventional DeFi Applications, is now powered with both stablecoins and native token support. cBridge is inexpensive, making it a top choice for dependable cross-chain traders.

| Feature | Details |

|---|---|

| Fast Transfers | Uses Celer Network’s liquidity network to provide instant swaps. |

| Low Gas Fees | Optimized routing and off-chain transfers reduce costs. |

| Supported Chains | Ethereum, Arbitrum, Optimism, Polygon, and more. |

| Token Support | Stablecoins and major crypto assets. |

| Security | Decentralized nodes and audited smart contracts. |

| Use Case | Best for users wanting low-cost, instant cross-chain transfers. |

4.Hop Protocol

The preferred asset transfer method of Hop Protocol is asset transfer bridging to ‘zero gas’ layer 2 solutions on Ethereum. Hop utilizes liquidity pools on various networks to confirm transactions instantly allowing for near-real time transfers.

Hop can bridge USDC, USDT, ETH, and communicate efficiently between multiple L2s and the Ethereum mainnet. By relying on liquidity pools, Hop minimizes on-chain transactions, thereby offering off-chain gas fees at Hop. Sophisticated liquidity risk management and decentralized validation, along with smart contract audits, enhance the security of the system.

Hop is overwhelmingly popular in DeFi for rollup architecture, offering rapid, economical cross-chain swaps to high volume traders. Users with less technical expertise benefit from an intuitive interface.

| Feature | Details |

|---|---|

| L2 Focused | Bridges assets across Ethereum Layer-2 networks. |

| Low Gas Fees | Liquidity pools reduce on-chain interactions. |

| Fast Transactions | Instant transfers between rollups and Ethereum mainnet. |

| Token Support | ETH, USDC, USDT, and other L2 tokens. |

| Security | Audited contracts and decentralized validation. |

| Use Case | Ideal for Layer-2 users seeking fast, low-cost bridging. |

5.Across Protocol

Across Protocol targets affordable and efficient cross-chain transfers, especially on Ethereum and Layer-2. They use liquidity and gas optimization to lower transaction costs on assets like stablecoins and ETH.

Across Protocol uses pooled liquidity to support fast transaction confirmations and delayed transaction confirmations for security. It is integrated with leading DeFi platforms for high-margin swaps and low-margin bridging.

Users benefit from their transparency, multi-chain accessibility, and thorough progress monitoring. It ensures secure operations with community governance and audited smart contracts. Across Protocol is perfect for traders who want to bridge Ethereum and Layer-2 chains cost-effectively.

| Feature | Details |

|---|---|

| Optimized Transfers | Uses liquidity pools and routing to reduce costs. |

| Low Gas Fees | Efficient bridging for Layer-2 and Ethereum. |

| Token Support | Stablecoins and ETH. |

| Multi-chain Support | Ethereum, Polygon, Arbitrum, Optimism, and more. |

| Security | Audited smart contracts and secure pooled liquidity. |

| Use Case | Suitable for traders seeking reliable, low-cost cross-chain swaps. |

6.Li.Fi

Li.Fi is a bridging aggregator that optimizes token swap by combining several cross-chain bridges and DEXs. Its main efficiency goal is lowering gas fees and enhancing the quality of transactions by automatically routing transfers to the cheapest available path.

Li.Fi is versatile for DeFi users because it supports Ethereum, BNB Chain, Polygon, Avalanche, and many other chains. Security is bolstered by audits of smart contracts and reputation bridges.

Li.Fi also ensures transparency by providing instant swaps with enriched visibility of the transactions. Its users don’t have to worry about gas fees because they are able to achieve reliable and optimal swaps from the multi-chain aggregation approach of Li.Fi.

| Feature | Details |

|---|---|

| Aggregator | Combines multiple bridges and DEXs for cost-effective swaps. |

| Low Gas Fees | Automatically routes transactions through cheapest path. |

| Multi-chain Support | Ethereum, Polygon, BNB Chain, Avalanche, and more. |

| Instant Swaps | Quick execution without heavy on-chain costs. |

| Security | Audited contracts and integration with reputable bridges. |

| Use Case | Best for DeFi users needing fast, low-fee swaps across chains. |

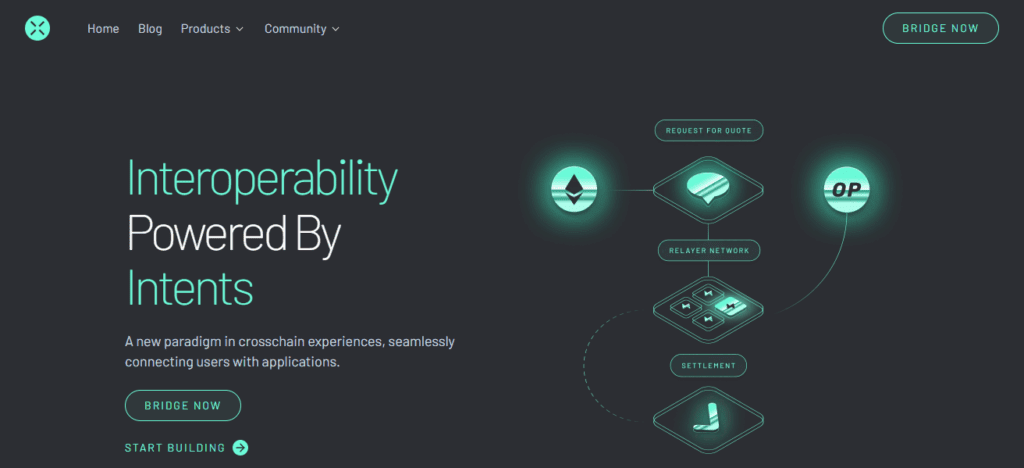

7.Axelar

Axelar’s network is decentralized and secured when it comes to cross-chain assets transfers as it has lower gas fees. It allows users to transfser tokens for decentralized finance, NFTs, and more on multiple blockchains.

Axelar’s major focus is on asset interoperability, such that it must movement securely and freely, which is maintained through decentralized validations and crypto proofs. Transactions gas fees are gas through transaction routing and optimal path determination, as well as pooled liquidity.

For cross-chain applications, there are Axelar SDKs and APIs for developers. Users are benefited too as they carry out instant swamps and reliable transfers. Its reliable infrastructure, which aims to cut bridging costs, is widely appreciated among both institutional and retail users.

| Feature | Details |

|---|---|

| Cross-chain Network | Decentralized network for multi-chain asset transfers. |

| Low Gas Fees | Efficient routing and pooled liquidity minimize costs. |

| Multi-chain Support | Ethereum, Solana, BNB Chain, Avalanche, and more. |

| Developer Friendly | SDKs and APIs for cross-chain apps. |

| Security | Decentralized validators and cryptographic proofs. |

| Use Case | Ideal for developers and users seeking cost-effective interoperability. |

8.Connext

The Connext protocol is a cross-chain bridge resource which is trust minimized, and prioritizes keeping gas fees low as well as fast transfer speeds. Connext employs state channels and liquidity pools in the movement of ETH and stable coins across various networks.

Connext facilitates the movement of value with minimized costs and delays by reducing the amount of on-chain transactions required.

Its protocol is compatible with Ethereum and Polygon, as well as other Layer-2 networks which is beneficial for DeFi use cases. Connext employs verified smart contracts to maintain security and undergoes regular audits.

Transaction monitoring and automated exchange means instant swaps for the user. Connext infrastructure is favored by developers and traders interested in safe counter cross fees owing to its low cost.

| Feature | Details |

|---|---|

| Low Gas Fees | Uses state channels and pooled liquidity to minimize costs. |

| Fast Transfers | Instant swaps across Ethereum, Polygon, and other L2 networks. |

| Token Support | ETH, stablecoins, and popular DeFi tokens. |

| Security | Verified contracts and regular audits. |

| Trust-Minimized | Decentralized infrastructure ensures safety. |

| Use Case | Suitable for frequent cross-chain users looking for cheap, fast swaps. |

9.Stargate

Stargate is a cross-chain bridge with the primary aim of providing unified liquidity and minimizing gas fees for token transfers. They focus on pooling liquidity on different blockchains which allows the user to swap assets instantly and at extremely low costs. The platform focuses on major tokens and stablecoins, providing fast and reliable settlement for their services.

Their robust security is enhanced by audits and decentralized systems of verification. Stargate has unmatched integration with DeFi applications which allows users to efficiently swap across Avalanche, BNB Chain, Ethereum, and many others.

Their unique mechanism for liquidity pooling guarantees low gas fees, making them the preferred platform for cross-chain traders who value low-cost solutions.

| Feature | Details |

|---|---|

| Unified Liquidity | Pools assets to reduce gas fees for cross-chain swaps. |

| Fast Transactions | Instant token swaps across supported chains. |

| Token Support | Major tokens and stablecoins. |

| Multi-chain Support | Ethereum, BNB Chain, Avalanche, and more. |

| Security | Audited smart contracts and decentralized verification. |

| Use Case | Perfect for traders wanting low-cost, fast cross-chain transfers. |

10.Wormhole

Wormhole is a multi-chain bridge that allows users to move assets between blockchains while minimizing gas costs. It allows users to bridge between Ethereum, Solana, BNB Chain, Avalanche, and others.

Wormhole employs off-chain validation and liquidity pools to reduce costs and allow swaps that are fast and efficient. This bridge is used widely for NFTs and DeFi assets. It is secured by decentralized guardians and audits of smart contracts, minimizing loss exposure.

User-friendly design, combined with low costs of transfers, makes Wormhole a preferred bridge for developers and users wanting low gas fee cross-chain bridge transfers.

| Feature | Details |

|---|---|

| Multi-chain Support | Ethereum, Solana, BNB Chain, Avalanche, and more. |

| Low Gas Fees | Off-chain validation and liquidity pools reduce costs. |

| Fast Transfers | Efficient cross-chain swaps for NFTs and tokens. |

| Token Support | Supports stablecoins, ETH, and NFTs. |

| Security | Decentralized guardians and audited smart contracts. |

| Use Case | Best for users needing reliable, low-fee multi-chain transfers. |

Conclsuion

To sum up, the leading bridging aggregators targeting reduced gas fees, namely Synapse, Router Protocol, cBridge, Hop Protocol, and Li.Fi, also provide rapid, safe, and low-cost services for cross-chain transfers.

Routing optimization, liquidity pool utilization, and multi-chain support facilitate minimal-cost transactions and dependable cross-chain token swaps, catering to users’ robust demand for rapid cost-efficient Defi services.

FAQ

No. Fees depend on blockchain congestion, transaction size, and the specific routing path selected by the aggregator. Aggregators aim to minimize these fees automatically.

Yes. Bridges like Wormhole and Axelar support NFTs and tokenized assets across multiple chains, reducing gas costs for NFT transfers.

Yes. Aggregators like Hop Protocol, Across Protocol, and Connext specialize in Layer-2 networks, offering faster and cheaper transfers compared to Ethereum mainnet.