Best Multichain Bridge Alternatives After Shutdown ceasing of operations has catalyzed users and developers to find safer and more dependable methods of transferring assets across blockchains. In today’s Multichain bridge market, there are safer and more reliable alternatives.

Non-ethereal multi-bridge options with faster, more efficient swaps and bridge options, user-friendly to users, and restored live cross-chain obstructions for better transactions.

How To Choose the Best Multichain Bridge Alternatives After Shutdown?

Evaluate Security Model

Bridges with active validators, audits, and public security disclosure are preferred. Multichain’s risks are avoided. Strong security guarantees after the shutdown are essential to safeguard your assets.

Check Bridge Chain Compatibility

Confirm that the bridge supports the destination and source networks. Greater chain compatibility reduces transfer risks and accelerates the process, reducing reliance on inefficient, insecure, and legacy infrastructure.

Check Transfer Cost and Price Slippage

Check for predictable pricing. Liquidity-based bridges, such as Synapse and Celer, are cost-efficient for token movement. Look for minimal slippage and transfer fees.

Check for Speed and Bridge Finality

For reliable finality and quick settlement, choose bridges with a high transfer rate. Especially for networks that are Ethereum Layer-2, Across and Hop offer good transfers

Check for Support of Native Assets

If the native asset, like ETH or BTC, is being moved, bridges that don’t use wrapped tokens, like THORChain, should be chosen. Real chain-to-chain swaps are provided

Evaluate Liquidity

If it is higher, swaps are smoother and the risk of transfer failure is lower. Cross-chain movement is successful and pricing is stable in protocols that have deep liquidity pools.

Use Aggregators for Route Optimisation.

With aggregator tools like LI.FI, you can swiftly compare multiple bridges and determine the safest, fastest, and most cost-effective route.

Review Project Activity & Updates.

Select bridges with active communities and constant maintenance. Active developer teams provide timely updates and audits, improving overall reliability and dependability.

Best Multichain Bridge Alternatives — Key Point Table

| Bridge / Protocol | What It Does | Key Strength / Why It’s Good |

|---|---|---|

| Wormhole Portal | Cross-chain token & messaging bridge | Wide chain support + fast transfers; strong ecosystem adoption |

| LayerZero | Omnichain messaging for cross-chain apps | Enables secure app-level bridging (e.g., Stargate) with low latency |

| Axelar | Decentralized cross-chain communication network | Reliable infrastructure with broad EVM & non-EVM coverage |

| Synapse Protocol | Bridge + cross-chain swap liquidity network | Great for DeFi traders due to fast swaps & low fees |

| Hop Protocol | L2-to-L2 & EVM chain bridge | Optimized for rapid Layer-2 transfers with minimal slippage |

| Celer cBridge | Multi-chain liquidity bridging | High-speed, cost-efficient transfers with large chain support |

| Across Protocol | Intent-based bridge for EVM networks | Extremely low fees and optimal capital efficiency |

| LI.FI (Aggregator) | Multi-bridge routing aggregator | Finds best route across many bridges for safer, faster transfers |

| Symbiosis Finance | Cross-chain AMM + router | Smooth asset swaps across EVM & some non-EVM chains |

| THORChain | Native asset cross-chain swaps | No wrapped tokens; ideal for native BTC, ETH, and altcoin swaps |

1. Wormhole Portal

The Wormhole Portal is a trusted cross-chain bridge for transferring tokens and NFTs, and for sending messages, across blockchains such as Solana, Ethereum, BNB Chain, and Polygon. With high throughput and excellent developer support, it is popular in GameFi and DeFi projects.

Moreover, Wormhole has a decentralised guardian network that ensures users bridging assets across chains have safety and peace of mind.

Therefore, in the middle paragraph of this document, it exemplifies its position as one of the Best Multichain Bridge Alternatives After Shutdown.

This is because it is able to have strong interoperability and it expands beyond the EVM chains. Developers and Traders in need of cross-chain liquidity will shift towards this portal.

Wormhole Portal Key Features

- Messaging and token transfers across 20+ different networks

- Large validator network bridging messages

- Transfers tokens and NFTs, and also sends governance and application messages

- Integrated in many NFT, Web3, and DeFi applications

Pros

- Supports many different blockchains

- A fast and reliable messaging interface

- Lots of applications and developer instruments

Cons

- A past security incident

- Dependence on the Guardians for validation

2. LayerZero

LayerZero provides efficient, low-latency, secure messaging across multiple blockchains. After \Stargate Finance\ began utilising LayerZero’s cross-chain instant liquidity, LayerZero secured integrations with other protocols, including NFT, gaming, DeFi, and more, making LayerZero one of the most popular interchain protocols amid growing demand.

With LayerZero’s Ultra Light Node, exploitative risk is mitigated through trustless cross-chain communication. Keeping liquidity and composability in mind, LayerZero paved the way for truly multichain applications.

After receiving one of the Best Multichain Bridge Alternatives After Shutdown accolades, LayerZero’s rapid adoption is no surprise, given the demand for secure cross-chain infrastructure.

LayerZero Key Features

- Messaging across chains enabling arbitrary cross-chain applications

- Ultra Light Node (ULN) architectural trust minimization

- Custom security via pairs of Oracle + Relayer

- Top decentralized applications like Stargate Finance use it

Pros

- Uniquely adaptable

- Rapid cross-chain messaging

- Gaining many users

Cons

- New users may face obstacles in understanding the security model

- Deployed applications must use compatible pairs of Oracle and Relayer

3. Axelar

For Ethereum Virtual Machine (EVM) and non-EVM chains, such as Cosmos, Axelar provides secure cross-chain transfers through its Validator Node Network. Dapp developers can now effortlessly integrate cross-chain functionality, interoperability, transfer capabilities, and real-time contract execution.

Squid Router and Axelar’s bridge collaboration further simplifies interoperability by providing user-friendly multichain services with accessible, efficient token swaps and bridging solutions.

Axelar is now one of the Best Multichain Bridge Alternatives After the Shutdown, delivering real-time cross-chain adaptability.

With real-time Axelar provided cross-chain transfers, developers can now expand user bases and liquidity across their applications, providing limitless potential across platforms and ecosystems.

Axelar Key Features

- No other distributed proof of stake validator network

- Available for decentralized applications cross-chain, General Message Passing (GMP)

- EVM and non-EVM compatible

- High emphasis on security and enterprise-grade audits

Pros

- Enough security and has been audited

- Good cross-chain compatibility

- Suitable for enterprise applications in Web3

Cons

- Has high technical requirements for average users.

- Slower transactions than liquidity bridges

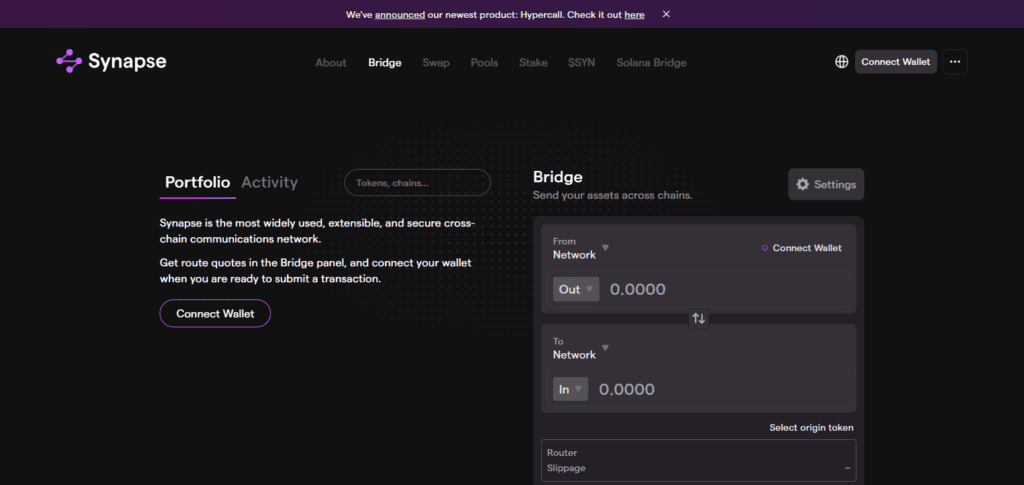

4. Synapse Protocol

Focusing on liquidity, Synapse Protocol is a bridge for stablecoin transfers and cross-chain swaps, with low slippage. With its support of major chains such as Ethereum, Arbitrum, Optimism, and BNB Chain, Synapse is a DeFi user favourite.

Synapse also has a cross-chain AMM that enables users to efficiently convert their assets. As one of the Best Multichain Bridge Alternatives After the Shutdown, Synapse is fast, secure, and cost-effective, especially for stablecoins and large transactions.

Strong liquidity pools and community governance make it a dependable choice for a cross-chain bridge in the DeFi space for active traders and protocols.

Synapse Protocol Key Features

- Cross-chain bridge with substantial liquidity pools

- Facilitates stablecoins, wrapped assets, and cross-chain swaps

- Designed for quick and inexpensive transactions

- Grows in popularity in DeFi ecosystems

Pros

- Low price difference between assets and consistent price outcomes

- Plenty of liquidity for key digital assets

- User-friendly interface

Cons

- Limited support for non-EVM chains

- Wrapped assets are sometimes transfered

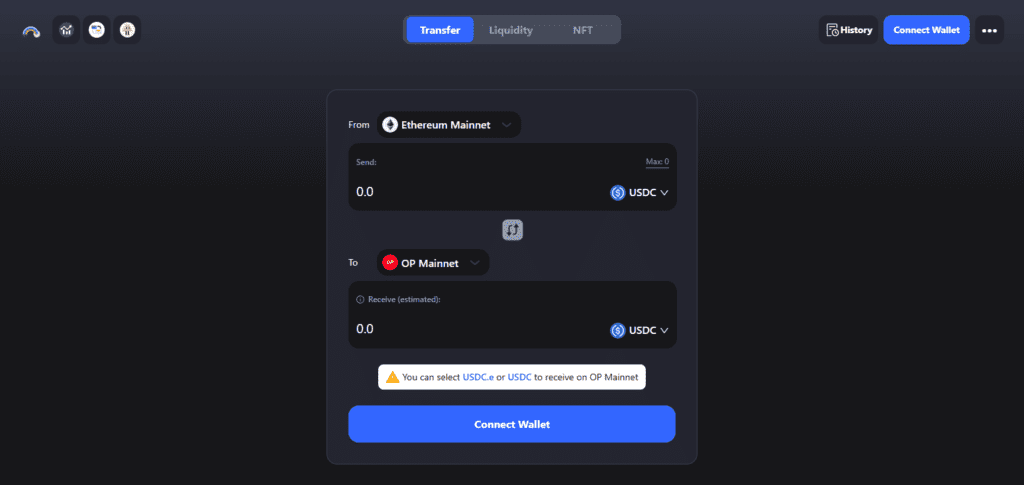

5. Hop Protocol

Hop Protocol enables fast, low-cost transfers across Ethereum Layer-2 networks such as Arbitrum, Optimism, and Polygon. It uses automated market makers (AMMs) and liquidity providers to bridge assets such as ETH, USDC, and DAI.

By focusing on L2 ecosystems, Hop makes a vital contribution to the scaling of Ethereum applications. As one of the Best Multichain Bridge Alternatives After a Shutdown, Hop Protocol allows users to move assets stuck in rollups to other networks without relying on slow native bridges.

Its contribution to the reliability and efficiency of the space makes it a key component of Ethereum’s scaling journey.

Hop Protocol Key Features

- Concentrated on Layer-2 bridging (Arbitrum, Optimism, Base, Polygon)

- AMM and Bonder collaborate for instant transfers

- Lightning-fast Layer 2-to-Layer 2 transactions

- Low-cost gas fees for rollup users

Pros

- Ideal for Layer 2 ecosystems

- Extremely rapid withdrawals

- Highly regarded and used by on-chain traders

Cons

- EVM-only for the most part

- Limited variety of assets

6. Celer cBridge

Celer cBridge is one of the cheapest, fastest, and most secure cross-chain bridges, supporting more than 40 blockchains, including Ethereum, BNB Chain, Polygon, and Avalanche. cBridge users can make smooth operations with decentralised security.

cBridge is the best alternative of cBridge in the Multichain Bridge, because of the best speed, low cost and chain coverage.

Also, it can be seen that it has the best interfaces and developer ecosystems, thus it can help many users apply cross-chain or help many users apply cross-chain to many financial systems.

Celer cBridge Key Features

- Multi-chain liquidity bridge with support for over 30 blockchains

- Cross-chain security available with the State Guardian Network

- Transfers are available with low fees and at high speed

- Many tokens and wrapped assets are supported

Pros

- One of the most supported blockchains

- Low fees with increased accessibility

- Great infrastructure with the Guardian Network

Cons

- There is a possibility of impact from a liquidity-based model on large transfers.

- Certain pathways are reliant on wrapped assets.

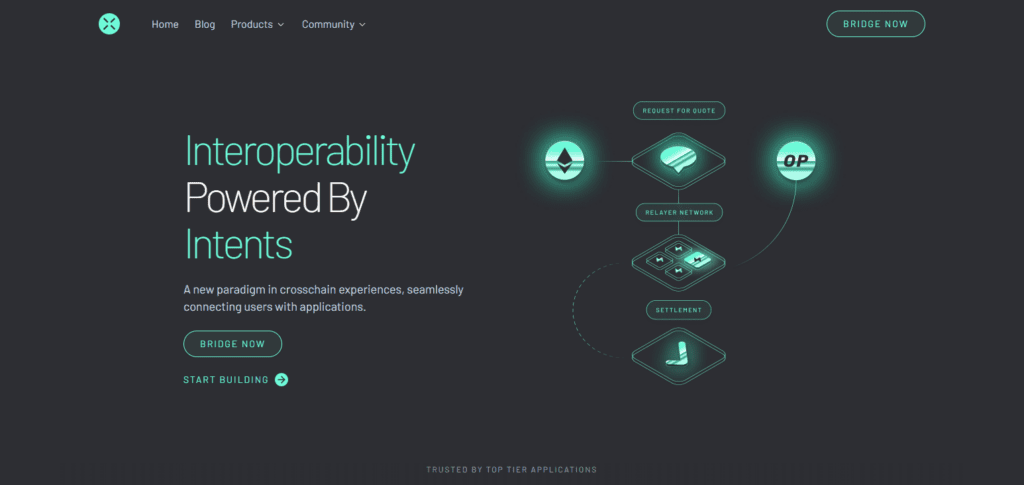

7. Across Protocol

Across Protocol is specialised for quick and inexpensive transfers that involve both Ethereum and Layer-2\, such as Arbitrum and Optimism. It uses relayers and liquidity providers to achieve instant finality and keep costs to a minimum. Across’s bridging security and simplicity comes at a cost of streamlining the user experience.

One of the Best Multichain Bridge Alternatives After Shutdown\, is ideal for anyone who frequently moves assets between Ethereum and its L2. With low, reliable fees\, it’s an excellent resource for DeFi traders and dApps.

Across Protocol Key Features

- Intentional bridging for EVM chains

- Unified liquidity model which minimizes fragmentation

- Optimistic verification for rapid settlement

- Decentralized relayers are used for execution

Pros

- Extremely low fees

- Efficiency of capital at a high rate

- Transfers are fast and dependable

Cons

- EVM ecosystems only are supported

- Compared to other large bridges, the asset options are slightly lesser

8. LI.FI

LI.FI is a DEX aggregator and bridge that combines multiple bridges and liquidity sources to find the most efficient route for a transaction. Dozens of chains and tokens support it and provides an API that enables developers to embed cross-chain swaps into their applications. LI.FI ensures users receive the cheapest, most efficient route for their transfers.

Due to its flexibility and the ability to act as a meta-layer for cross-application interoperability, LI.FI is one of the Best Multichain Bridge Alternatives After the Shutdown. Its aggregation model reduces the risk of relying on a single bridge and serves as a multi-chain tool for end users and developers.

LI.FI (Bridge Aggregator) Key Features

- Aggregator across multiple bridges including Stargate, Celer, Synapse and Across

- Best price, speed and security is determined through smart routing

- In one step, bridge and swap transactions can be completed

- Integrations for developers are plenty along with wallets

Pros

- Flexible options for users as a result of multi-bridge routing

- Users are saves time through the comparison all bridges provide

- Great for wallets, dApps, and omnichain UX

Cons

- Underlying bridge security governs the situation

- Some users including beginners may find the interface is advanced

9. Symbiosis Finance

Working across 30+ blockchains and 400+ token pairs, Symbiosis Finance is a decentralised cross-chain liquidity protocol with a simple interface that lets users swap tokens across different chains without having to use multiple platforms or wallets.

It enables non-custodial, secure asset transfers via MPC (multi-party computation) technology. Symbiosis is one of the best multichain bridge alternatives after the shutdown, thanks to its accessibility and coverage.

It also connects non-EVM and EVM ecosystems, providing a versatile solution for interoperability across multiple blockchains for both projects and traders.

Symbiosis Finance Key Features

- Cross-chain AMM supporting swaps across multiple chains

- EVM and a few selective non-EVM networks are supported

- Multi-chain swapping experience with a single click

- Provides a smooth routing experience with liquidity pools

Pros

- The interface is very user-friendly.

- Token and stablecoin swaps are great.

- Coverage for retail users is good across chains.

Cons

- Major bridges have larger liquidity.

- This is less appropriate for large institutional transfers.

10. THORChain

One of the best cross-chain bridges for trading assets without token wrapping is THORChain. As a decentralised liquidity protocol, THORChain enables native asset swaps across multiple chains, including Bitcoin, Ethereum, and BNB Chain.

THORChain is the best multichain bridge alternative after the shutdown because it facilitates the movement of native assets such as BTC and ETH.

For customers who need security, decentralisation, and genuine cross-chain liquidity, its decentralised framework and emphasis on native interoperability set it apart.

THORChain Key Features

- Allows seamless cross-chain swaps without token wrapping.

- BNB, LTC, ATOM, and major coins like BTC, ETH, and others are included.

- The vaults are decentralized for asset security.

- AMM-style liquidity pools are available for the native assets.

Pros

- There’s true interoperability with native assets.

- There are no need for custodial bridges or wrapped tokens.

- Perfect for native cross-chain or BTC <-> ETH swaps.

Cons

- Lower liquidity results in higher slippage.

- It is more like a swap protocol than a conventional bridge.

Conclusion

No one will dispute that Multichain’s shutdown impacted cross-chain activities. This activity prompted users and developers to seek out safer, more reliable cross-chain alternatives. Luckily for developers and users, there are now numerous alternatives available, offering better protection and more transparent, scalable solutions.

If users are looking for instant liquidity, cross-chain messaging, random swaps, or multi-bridge hopping, there are numerous options to empower seamless inter-chain connectivity. These include Wormhole, LayerZero, Axelar, Synapse, Hop, Celer cBridge, Across, and LI.FI, Symbiosis Finance, and THORChain.

Users can connect assets across chains with confidence that the protocols are software-defined, audited, and well-maintained, enabling them to adapt to the post-Multichain era without a hitch.

FAQ

Multichain’s shutdown created risks for cross-chain transfers, leaving users without a reliable way to move assets across networks. To avoid stuck funds and security threats, users must rely on safer, audited, and actively maintained bridge alternatives.

Some of the safest options today include Wormhole Portal, LayerZero, Axelar, Synapse Protocol, Across Protocol, and THORChain. These projects have active development, audits, transparent security models, and strong community support.

Synapse Protocol, Celer cBridge, and LI.FI (as an aggregator) are among the best for stablecoin transfers due to high liquidity, low slippage, and wide network support.

THORChain is the top choice for native swaps because it supports real BTC, ETH, and other L1 assets without using wrapped tokens.

Symbiosis Finance and LI.FI offer the easiest user experience, featuring simple interfaces, automatic routing, and single-click cross-chain swaps.