I will talk about the Best Crypto Liquidity Aggregator Companies For New Exchanges in this article, Crypto liquidity aggregators provide the new exchanges the ability to minimize the impact of low liquidity and high slippage on their operations.

The new exchanges will provide more competitive trading experiences. By offering access to sophisticated liquidity aggegrators, the exchanges can optimize cost efficient trade execution and professional trading experiences at lower latency and at cost effective trade executions.

What is Crypto Liquidity Aggregator Companies?

Crypto Liquidity Aggregation Company is a connector of several crypto exchanges, DeFi protocols, and liquidity pools, and provides the best prices and best executions for the user.

This type of company pools liquidity from many places and thus, provides less slippage and faster and better trades for less efficient traders, institutions and market making.

By looking at several markets at the same time, they optimize the routing of the trades, improve the depth of the market and the user is able to trade and have access to a larger number of assets without looking at and comparing the prices from several exchanges.

They are, in essence, middlemen of the system, maximizing the efficiency and cost of a trade in the system.

Why Use Crypto Liquidity Aggregator Companies for New Exchanges

Access to Deep Liquidity.

- High slippage is a result of low trading volume.

- New exchanges are connected to various liquidity sources through liquidity aggregators which ensures better trading opportunities.

- Large amounts of money can be traded without an impact on the pricing.

Better Pricing for Users.

- It is the aggregators that route the orders to obtain the best prices on the various exchanges.

- Users are attracted to the new exchanges due to the good prices.

- It helps build market credibility.

Faster Market Entry.

- New exchanges do not need to build market liquidity.

- The lesser the time needed to attract traders, the quicker the exchanges can offer a trading environment.

- Concentration can be shifted to user experience.

Enhanced Trading Experience.

- More trading pairs can be traded.

- Quicker order execution leads to less slippage.

- It provides a way for trading to support the growth of the exchange by offering features that encourage people to trade.

Key Points & Best Crypto Liquidity Aggregator Companies for New Exchanges List

| Aggregator | Key Features / Points |

|---|---|

| 1inch Network | Smart order routing for best prices, supports multiple DEXs, gas-efficient transactions |

| Matcha (by 0x) | Aggregates liquidity from DEXs and 0x API, intuitive interface, instant price comparisons |

| OpenOcean | Cross-chain aggregation, low slippage swaps, supports both CEX and DEX liquidity |

| KyberSwap (Kyber Network) | Multi-chain support, instant swaps, yield optimization for liquidity providers |

| Slingshot | Advanced trade routing, supports limit orders, integrates with multiple liquidity sources |

| DeFiLlama Meta Aggregator | Tracks TVL and liquidity across protocols, real-time analytics, multiple chains supported |

| Odos Protocol | Cross-chain DEX aggregator, multi-routing algorithm, gas-efficient swaps |

| Rubic Exchange | Interoperable swaps across chains, low fees, integrates bridges for seamless transfers |

| Symbiosis Finance | Cross-chain AMM aggregation, supports token bridging, optimized swap paths |

| LI.FI Protocol | Cross-chain routing aggregator, integrates DEXs and bridges, provides best execution paths |

1. 1inch Network

Due to its sophisticated smart order routing and access to numerous DEXs, 1inch Network has established a reputation as one of the most efficient crypto liquidity aggregator for new exchanges and offers the best prices to users.

The one of a kind PathFinder algorithm minimizes slippage and lessens the cost of transactions by splitting trades among varying liquidity sources and which is important for new exchanges.

Furthermore, 1inch has provided new platforms the opportunity to instantly participate in a multi-chain ecosystem with the ability to integrate through APIs, providing gas-efficient transactions. As a result, 1inch assists new exchanges in building credibility and attracting customers.

1inch Network

Features:

- Fetches liquidity from multiple decentralized exchanges (DEXs) in order to analyze and get optimal rates.

- PathFinder Routing is used to better split orders across the platforms for better rates.

- Services multiple chains such as Ethereum, BSC, Polygon and others.

Pros:

- Efficient execution of prices.

- Great liquidity from multiple supported DEXs.

- Additional features for trading such as limit orders and advanced trading options.

Cons:

- On certain chains, gas fees can be really high.

- Users that are new to the space may struggle with the complexity of the platform.

2. Matcha (by 0x)

Because it smoothly combines liquidity from several decentralized exchanges, Matcha (by 0x) stands out as one of the top crypto liquidity aggregator firms for new exchanges, guaranteeing consumers receive the most competitive pricing for every trade.

Its user-friendly interface and clever routing mechanism automatically divide orders to minimize slippage, making even big deals economical and efficient—essential for fledgling exchanges with modest trading volumes.

Additionally, Matcha facilitates simple API connection, enabling new platforms to access deep liquidity without requiring a large infrastructure. Matcha enables new exchanges to provide professional-grade trading experiences from the outset by fusing transparency, dependability, and streamlined transaction execution.

Matcha by 0x

Features:

- Allows sending tokens through a simple interface.

- Aggregates liquidity from DEXs in the 0x protocol.

- Offers limit orders with slippage protection.

Pros:

- The platform is very user-friendly, and beginners will have an easy time using it.

- Offers transparent pricing with no hidden fees.

- Transaction execution is very fast.

Cons:

- The platform does not have many advanced trading options.

- There is a more limited selection of supported blockchains.

3. OpenOcean

OpenOcean is a top cryptocurrency liquidity aggregator for new exchanges due to providing genuine cross-chain aggregation and pulling liquidity from a decentralized and centralized source to give the best price and least slippage.

With its advanced routing algorithm to split trades across networks, new exchanges can optimize their execution even with less volume. With the support of many blockchains and token pairs, new exchanges do not have to worry about building liquidity.

With an emphasis on usability, low fees, and fast API integrations, OpenOcean allows new exchanges to enter the market with a lot of liquidity, improving the user confidence and trading experience from the very beginning.

OpenOcean

Features:

- A DEX aggregator that is multi-chain and supports Ethereum, BSC, Solana, and Avalanche.

- Allows limit orders and smart routing as options.

- Facilitates integration with wallets and other DeFi tools.

Pros:

- Cross-chain aggregation guarantees the best prices.

- A large variety of tokens are supported.

- Tailored trading functionalities for advanced users.

Cons:

- Beginners may find the interface too cumbersome.

- Some other chains have less market liquidity than Ethereum.

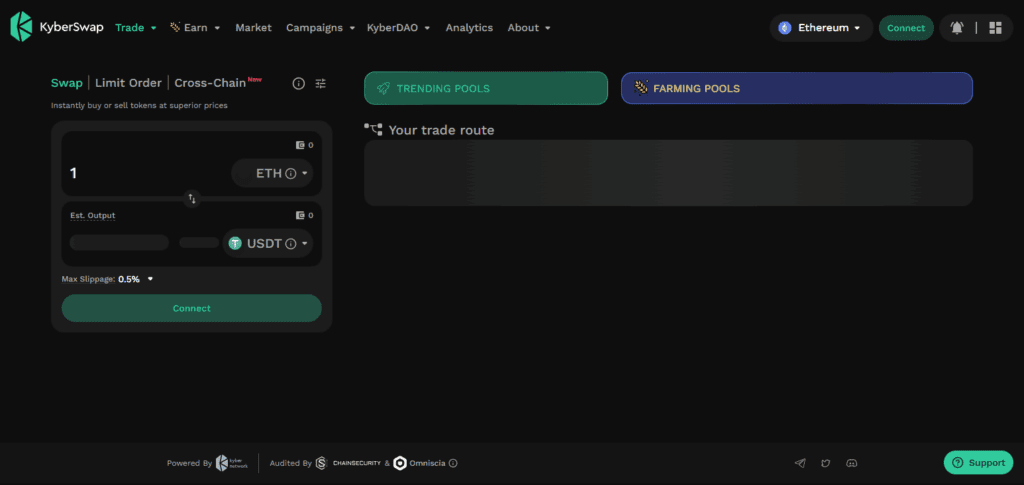

4. KyberSwap (Kyber Network)

KyberSwap (Kyber Network) is a multi-chain automated market-making (AMM) crypto liquidity aggregator which is new exchanges’ best bet for reliability and efficiency. KyberSwap’s smart routing engine captures the best prices for traders by actively seeking liquidity across various DEXs in real-time.

New exchanges no longer have to deal with establishing their own markets with the problems of high slippage, slow market order executions, and no liquidity. New exchanges scale more quickly with KyberSwap.

Yield optimization tools in liquidity provision create additional slot profitability for New Exchanges. Overall, KyberSwap is the best option for integrating professional trading tools in new exchanges with their operational efficiency.

KyberSwap (Kyber Network)

Features:

- Optimizes swap rates through an on-chain DEX aggregator.

- Implements capital-efficient swaps using the Kyber Dynamic Market Maker (DMM).

- Offers multi-chain liquidity and staking options.

Pros:

- There is low slippage and good routing.

- KNC stakers earn passive rewards.

- No central authority and lacks control.

Cons:

- New users may find themselves lost with the ecosystem’s advanced features.

- 1Inch presents a larger ecosystem.

5. Slingshot

Because Slingshot excels at sophisticated trade routing and smooth access to numerous liquidity sources, it is a top option for new exchanges looking to aggregate cryptocurrency liquidity.

For exchanges that are just getting started with lower trading volumes, its clever algorithm dynamically divides orders to guarantee optimal pricing and minimal slippage. Additionally, Slingshot offers real-time execution analytics and limit orders, providing new platforms with professional-grade trading tools without requiring complicated infrastructure.

It makes it possible for new exchanges to provide deep liquidity, effective trades, and an excellent user experience right away thanks to simple API integration and cross-platform interoperability, which helps them gain trust and draw traders fast.

Slingshot

Features:

- Provides liquidity focused on Ethereum and Polygon.

- Optimizes DEX aggregation for swaps.

- User-friendly design with gas fee optimization.

Pros:

- Transactions are quick and simple.

- Maintains a portfolio for users.

- Platform is optimized for low gas fees.

Cons:

- Cross-chain is rather limited.

- Smaller selection of tokens compared to major aggregators.

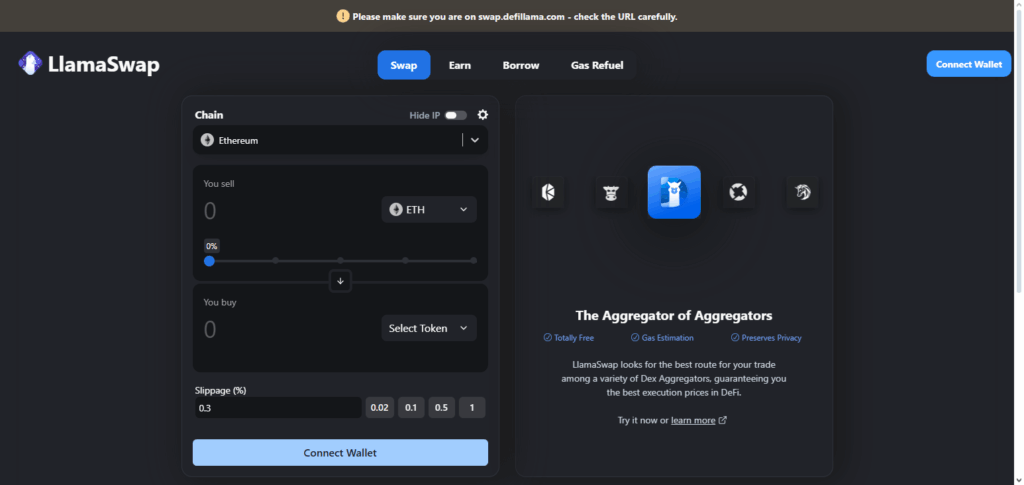

6. DeFiLlama Meta Aggregator

Aggregating of TVL and market depth across various DeFi protocols and providing analytical tools makes DeFiLlama Meta Aggregator a great fit for new exchanges seeking a complete crypto liquidity.

Newly formed exchanges can reduce slippage and gain better pricing on trades due to DeFiLlama’s unique meta-aggregation strategy on competively pricing liquidity trough various sources.

DeFiLlama’s multi-chain capabilities and market depth insights help new exchanges route trades optimally. New exchanges can offer a fully developed and professional trading experience from release due to DeFiLlama’s easy plugging and dependable service.

DeFiLlama Meta Aggregator

Features:

- Aggregates liquidity of several Defi protocols.

- Provides analytics to understand the yield on protocols.

- Primarily focused on multi-chain yield opportunities.

Pros:

- Provides excellent analytics and total value locked (TVL) tracking.

- Identifies high yield opportunities.

- Benefits from being open-source and community driven.

Cons:

- Token swaps are not the primary function.

- Limited functionality of trading interface.

7. Odos Protocol

The Odos Protocol is a first-class crypto liquidity aggregator designed for new exchanges due to its unique ability to specialize in cross-chain trade aggregation. Odos facilitates instant trade swaps across a multitude of blockchains with a slight slippage.

ODOs uses an advanced multi-routing protocol to determine the best price for users across the most optimized trade routing available. The multi-routing system determines the best price for users by optimizing for gas fees.

For new exchanges the Odos Protocol helps eliminate the headache of developing the liquidity depth on their own by permitting instant access to numerous trade pairs and markets.

Odos seamlessly allows new exchanges to easily integrate an API to support a unique, hybid, and decentralized liquidity source, allowing new exchanges to successfully go to market with premium trade execution and dependable, user-friendly liquidity in a matter of days.

Odos Protocol

Features:

- Aggregates cross-chain DEX services in multiple chains.

- Optimized for low gas fees while keeping slippage minimal.

- Partners with DeFi protocols for better liquidity.

Pros:

- Many chains are supported.

- Transactions are executed quickly.

- Complex trades can utilize advanced routing.

Cons:

- Adoption is low for this new platform.

- Beginners may find the interface somewhat technical.

8. Rubic Exchange

Rubic Exchange is an optimal liquidity aggregator for new exchanges since it is highly adaptable to new environments and offers interoperability and seamless cross-chain swaps. Rubic allows trades across various blockchains and offers low-friction trades.

Integrating a multitude of liquidity sources and bridges together allows for low slippage. Fast execution is necessary for exchanges who are starting out and have a smaller trading volume.

Rubic has an API that allows new platforms to access tier 1 liquidity with little infrastructure. Rubic allows new exchanges to provide a professional trading experience and helps them gain traction to build boutique status in the crypto space.

Rubic Exchange

Features:

- Cross-chain swaps through multichain aggregator.

- Liquidity aggregation and token bridging.

- Supports many blockchains like Ethereum, BSC, Polygon.

Pros:

- All-in-one platform with cross-chain capabilities.

- Broad access to numerous tokens and liquidity.

- Simple for users.

Cons:

- Varying liquidity depending on the blockchain.

- Less feature-rich for advanced users.

9. Symbiosis Finance

Due to its superior cross-chain automated market-making capabilities, which facilitate smooth swaps across several blockchains, Symbiosis Finance is a top option for new exchanges looking to aggregate cryptocurrency liquidity.

By dividing orders among the most liquid sources, its intelligent routing technology maximizes trade execution while decreasing slippage and transaction costs—all crucial for platforms with low starting liquidity.

Additionally, Symbiosis offers multi-chain interoperability and includes bridges for seamless token transfers, enabling new exchanges to offer a variety of assets without creating liquidity from scratch.

Symbiosis enables new exchanges to open rapidly while offering consumers a dependable, professional-grade trading experience with simple API integration and effective trade pathways.

Symbiosis Finance

Features:

- Protocol for cross-chain swaps and liquidity.

- Provides aggregation with automatic market maker (AMM) and smart routing.

- For best rates, multiple DeFi ecosystems are supported.

Pros:

- Cross-chain swaps are executed efficiently.

- Optimized low slippage and fees.

- Multiple liquidity sources are integrated.

Cons:

- Lacks recognition outside of the DeFi community.

- Token support is less than 1inch or OpenOcean.

10. LI.FI Protocol

LI.FI Protocol is a great crypto liquidity aggregator for new exchanges because it cross-chain routes aggregating liquidity from DEXs and bridges to get the most optimal trade execution. They’re a pioneer in the field.

Their algorithm cross routes to determine a slippage and gas efficient route critical to successful low volume exchanges. Their modular API gives new platforms the ability to plug and play to access sophisticated infra to access deep liquidity and customize token pairs on demand.

Through multi-chain, fast for the user trade execution, and a low cost for the exchange, LI.FI gives new exchanges the ability to foster a professional and seamless trading environment. This allows new exchanges to attract users, and catalyze growth.

LI.FI Protocol

Features:

- Cross-chain bridge and DEX aggregator.

- Supports liquidity routing for multi-chain swaps.

- Compatible with many wallets and DeFi protocols.

Pros:

- Seamless cross-chain experience.

- Aggregates best rates from multiple sources.

- Strong developer support and documentation.

Cons:

- Can be complex for beginners.

- Dependent on multiple protocols’ liquidity health.

Conclusion

New crypto exchanges must have reliable liquidity partners and access to deep markets for optimal prices and reduced slippage from the very beginning of their trading journey.

1inch Network, Matcha, OpenOcean, KyberSwap, Slingshot, DeFiLlama Meta Aggregator, Odos Protocol, Rubic Exchange, Symbiosis Finance, and LI.FI Protocol are smart order routing and cross-chain swapping liquidity partners capable of adding advanced functions and custom APIs.

With the help of these order routing services, new exchanges able to control liquidity and sustain their trading activity will be able to accumulate a positive reputation and professional trading offer in crypto trading marketplace.

That position will sustain their competitive marketplace position and help them gain their users and liquidity partners in competent marketplace conditions.

FAQ

New exchanges often start with low trading volumes, leading to poor liquidity and higher slippage. Aggregators provide access to multiple liquidity sources instantly, enabling competitive pricing, faster trades, and a better user experience.

A crypto liquidity aggregator is a platform that combines liquidity from multiple exchanges and DeFi protocols to provide the best prices and trade execution for users. It minimizes slippage and ensures deep market access, which is especially important for new exchanges.

Key features include smart order routing, cross-chain support, minimal slippage, low fees, API integration, multi-chain compatibility, and access to both decentralized and centralized liquidity sources.