This article focuses on Peer-To-Peer Bridging Aggregator To Avoid Centralized KYC. This enables customers to shift resources between blockchains safely and privately without involving centralized exchanges and KYC requirements.

By facilitating direct disengagement and wallet transactions within Ramses exchange integrations, routing optimization and minimal charges, they offer swift, uncentralized, and untrustworthy options to clients sensitive to privacy.

Key Points & Peer-To-Peer Bridging Aggregator To Avoid Centralized KYC

| Aggregator Name | Key Features |

|---|---|

| Rango Exchange | Multi-chain support, fast routing, privacy-first bridging |

| Jumper Exchange | Aggregates multiple bridges, no KYC, user-friendly interface |

| LI.FI Protocol | Modular bridging with privacy options, integrates with dApps |

| Across Protocol | Intent-based bridging, low fees, fast execution |

| Synapse Protocol | Highly scalable, supports EVM and non-EVM chains |

| Celer cBridge | Efficient cross-chain transfers with no KYC requirement |

| Allbridge | Solana and EVM support, decentralized and KYC-free |

| Stargate Finance | Unified liquidity layer, fast swaps, no KYC |

| Portal Bridge | EVM and non-EVM support, privacy-focused bridging |

9 Peer-To-Peer Bridging Aggregator To Avoid Centralized KYC

1. Rango Exchange

Rango Exchange is a non-custodial bridging aggregator that facilitates blockchain dierctions without a centralized exchange and without KYC(know your customer) checks.

By linking a considerable number of liquidity sources and protocols, Rango Exchange becomes a trustless and private means for users to execute cross-chain transfers.

In addition, users have the ability to directly link the wallets to the protocols. Rango Exchange, for users who care for the the price and the speed of the transaction

Provides optimized exchange routes for aggregated bridging, thus serving those who prioritize the unknown and untrusted systems.

Features Rango Exchange

Seamless blockchain swaps – Engage in swaps across various blockchains directly to/from your wallet and without KYC.

Aggregated liquidity – Connects various liquidity providers to improve rate and lessen slippage. 3 Smart routing – Automated tools determine the quickest and most affordable routes to a destination.

Decentralized – Users control and hold account information with no centralized control.

Easy to use – Provides a simple platform suitable for novice, as well as, experienced users.

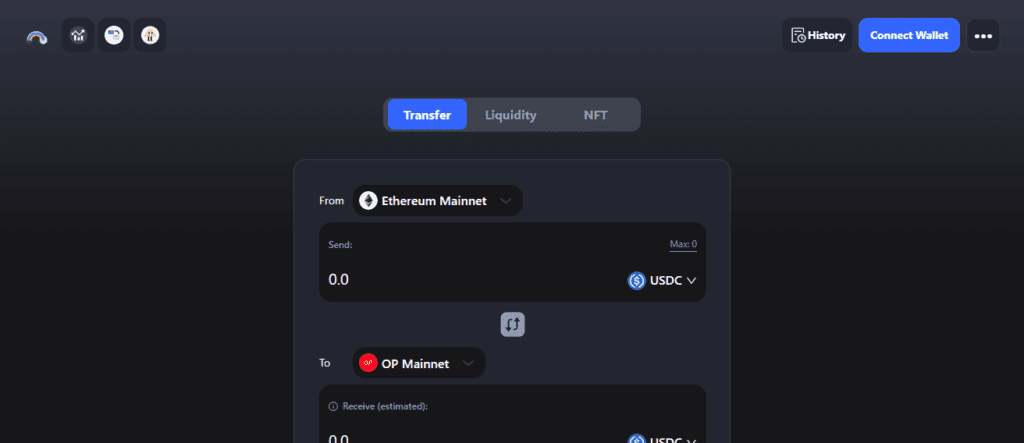

2. Jumper Exchange

Jumper Exchange eliminates the hassle of cross-chain transactions with its KYC-free decentralized wallet system.

Jumper Exchange is a multi-chain bridging aggregator that accesses unlimited cross-protocol and cross-asset liquidity.

Jumper Exchange eliminates KYC requirements through wallet-to-wallet transactions, putting user privacy and security first.

Jumper Exchange has a gas-optimized route with the lowest transaction failure rates with a customizable user-centric interface for advanced users.

Simplified Jumper Exchange user acts as a decentralized intermediary for their bridging transactions.

Jumper Exchange is designed with highly resilient and responsive smart routing to ensure a bridging transaction.

Features Jumper Exchange

Decentralized multiple blockchains – Jumper allows you to bridge your digital assets over numerous blockchains and does so in a decentralized manner.

Cross-chain transfer privacy – No KYC means users can transfer funds across borders freely and privately.

Smart routing – Automated tools determine the quickest and most affordable routes to a destination.

Reduced risk of central failure – Smart contracts are used to execute transactions.

Low gas fees and fast execution – All transactions are optimized for reduced gas fees and fast transaction settlement.

3. LI.FI Protocol

LI.FI Protocol acts as an aggregator for cross-chain infrastructure, bridging multiple swapping and bridging systems under a unified interface.

LI.FI enables users to transfer cryptocurrencies between blockchains while avoiding the lengthy KYC processes and centralized exchanges.

LI.FI retrieves liquidity from many places which helps users pass liquidity and execute transactions quicker and cheaper because LI.FI calculates the optimal execution path.

Smart contract integration means LI.FI users execute control without trust and without letting others control their goods.

LI.FI Protocol assists many chains and diverse token standards and helps users of decentralized finance to assist a large crypto ecosystem anonymously.

Features LI.FI Protocol

Single bridge solution – One interface to access various bridges and swap protocols.

No KYC asset control – Fully decentralized asset control with no KYC. Users maintain complete ownership of their funds.

Reduced fees and time – Advanced tools determine optimal transaction routes reducing the fees and time significantly.

Multi-Chain Compatibility – Offers support for many blockchains and token standards.

Trustless Smart Contracts – Guarantees safe and legitimate cross-chain transitions.

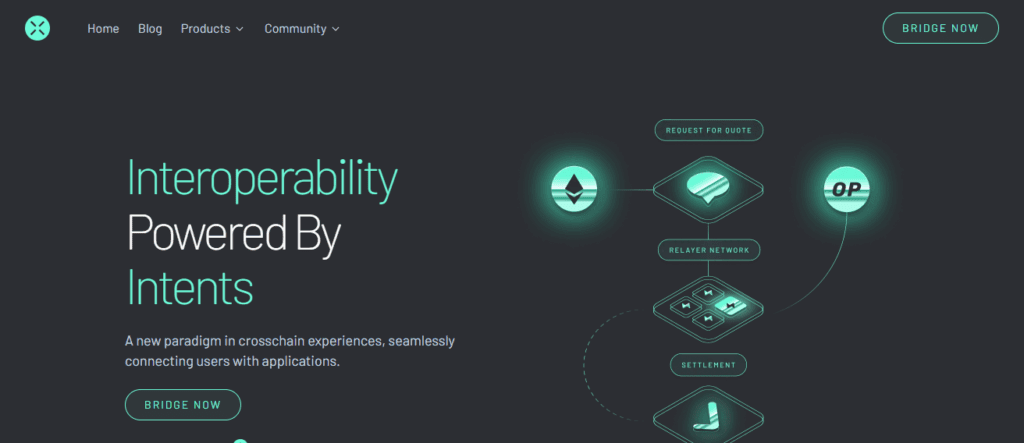

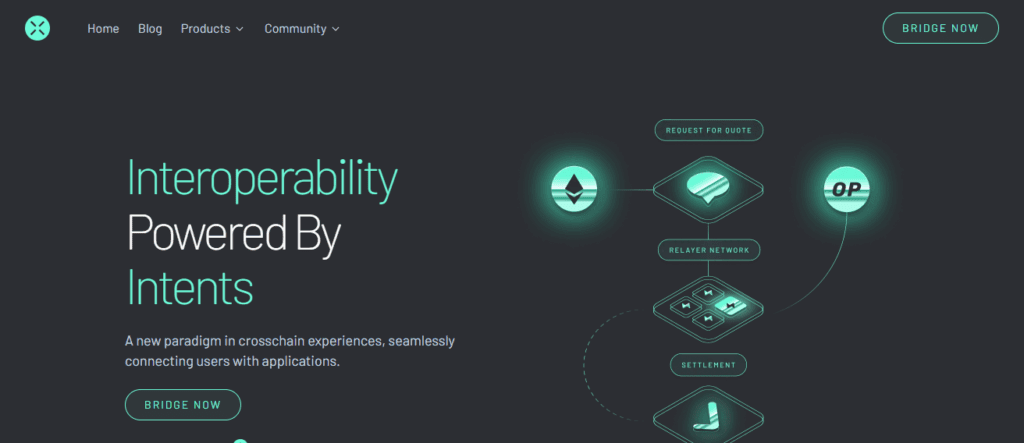

4. Across Protocol

Across Protocol is a decentralized bridge aggregator designed for trustless and convenient cross-chain token transfers.

It completely removes the need for custodians and KYC by employing smart contracts and safe liquidity networks.

Across Protocol is built for speed and security, minimizing transaction delays and expenses with cross-chain messaging systems.

It allows users direct wallet-to-wallet swaps, and privacy is maintained, as users’ funds will always be within their control.

The protocol designed for users also delivers dependability by providing various routing choices and fallback systems.

Features Across Protocol

Cross-Chain Messaging – Employs smart contracts for rapid and safe transfers.

KYC-Free Operations – Offers decentralized wallet-to-wallet swaps for user confidentiality.

Fallback Mechanisms – Ensures alternative routes for transfers if the primary route fails.

Low Cost – Achieves cost-effective transaction fees with optimized liquidity routing.

Secure & Audited – Guarantees the safety of all funds through auditing contracts.

5. Synapse Protocol

Synapse Protocol provides fast, secure, and decentralized multi-chain bridging. Asset transfers and cross-chain swaps can be done KYC-free, directly from wallets.

They have privacy, users maintain control over their funds, and legally, they have jurisdiction. Synapse uses routers with liquidity pools to reduce fees and slippage.

They have audits, all users heuristically know and trust Synapse secure against hacks, slippage, and other systemic failures.

A multi-chain architecture and wide token support means they offer decentralized reliable Synapse Protocol user experience and floating access regions cap users over KYC limitations.

Features Synapse Protocol

Decentralized Multi-Chain Transfers – Provides asset bridging across different blockchains with no KYC.

Optimized Liquidity Pools – Cuts transaction fees and slippage.

Direct Wallet Transfers – User funds are under their complete control.

Security-Focused – Audited smart contracts lower the potential for hacks.

Fast & Reliable – Assures cost-effective and smooth bridging.

6. Celer cBridge

Celer cBridge provides a decentralized no KYC solution to cross-chain bridging. Celer cBridge links cross-chain liquidity pools averaging time to cross chains and reducing fees with smart contracts and oracle functions.

Celer cBridge guarantees control over funds with trustless transfers. Celer cBridge has high throughput and low latency rates which means they have fast, reliable transfers and high, secure decentralization.

They are used in DeFi cBridge to cross chains to reduce costs, maintain privacy, and access bridging services.

Features Celer cBridge

High-Speed Cross-Chain Transfers – Quick execution is a priority between blockchains.

Decentralized & KYC-Free – Privacy and control over funds are guaranteed.

Multiple Liquidity Sources – Aggregated liquidity improves rates and reduces slippage.

Scalable Architecture – Effectively manages rapid transfers with minimal loss.

Smart Contract Security – Trustless transfers with smart contract safeguards.

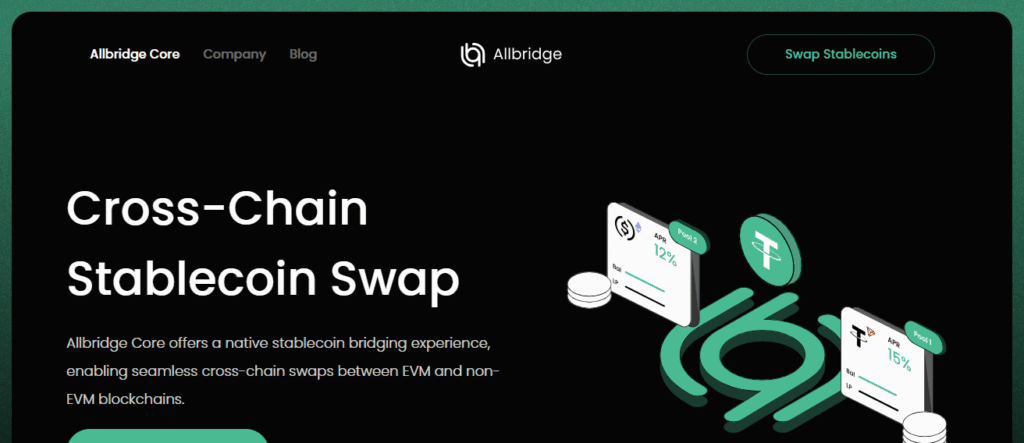

7. Allbridge

Allbridge is a decentralized bridging aggregator that transports assets across chains. Users can swap and move assets seamlessly without a KYC.

Allbridge maintains privacy and customers’ control over their assets. Allbridge actively communicates with several blockchains and liquidity network providers to optimize cost-efficient transaction routing.

Allbridge’s user interface is simple to use and effective even for the most inexperienced users. Allbridge is decentralized, reliable, and secure especially with the complete and detailed audits that are regularly performed to the smart contract systems that protect the bridged assets.

Features Allbridge

Simple Decentralized Bridging – Straightforward interface for cross-chain asset transfers.

Privacy-First – No identity verification needed; users keep control of their assets.

Multiple Network Support – Bridges assets over different blockchains.

Efficient Routing – Cost-efficient and attentive to transfer needs through strategic routing.

Audited & Secure – Transactions are reliable and safe through audited smart contracts.

8. Stargate Finance

Stargate Finance is a cross-chain bridging aggregator that enables users to transfer assets cross multiple blockchains quickly and safely without the need for centralized KYC.

It leverages liquidity pools and advanced routing for transaction cost optimization. Users perform wallet-to-wallet transfers directly, completely decentralized, and unrestricted sanitized KYC.

It auto-executes transfers across blockchains. It emphasizes transparency, rational security, performance efficiency and security to be decentralized and community submitted for governance.

The platform, and Flex, is a sponsored St. Jude Finance. It enables private, seamless and low-cost bridging across multiple token and blockchains. It is a seamless, decentralized, low-cost bridging solution for blockchain users.

Features Stargate Finance

Liquidity Pool-Based Transfers – Lower costs with faster cross-chain swaps.

KYC-Free Decentralization – Users preserve their privacy while bridging assets.

Multiple Chain & Token Support – Support for several systems and ecosystems.

Transparent & Secure – Audited smart contracts safeguards fund misuse.

Optimized Routing – Algorithms designed to minimize costs and slippage.

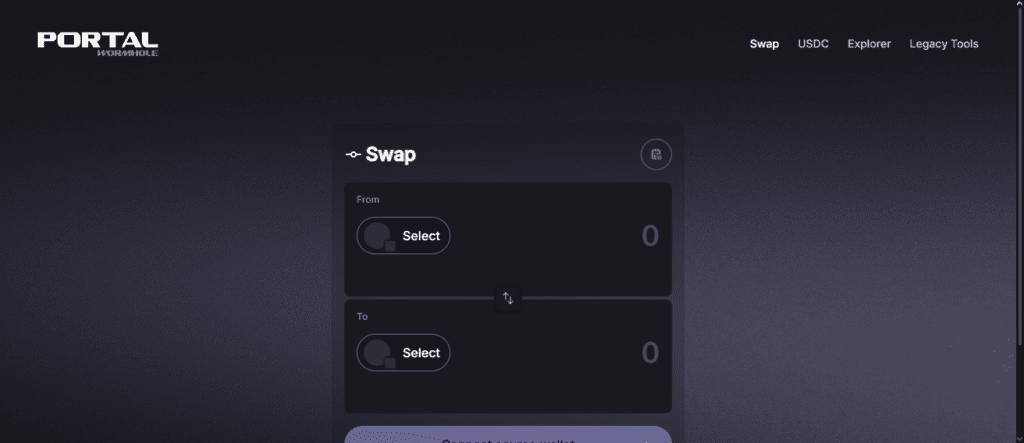

9. Portal Bridge

Portal Bridge is a non-custodial cross-border change-over asset aggregator. At a proof-of-stake Portal Bridge network, users can avoid providing personally identifiable information and centralized supervision.

Portal Bridge seamlessly integrates a myriad of blockchains, optimizing transactional paths for cost-effectiveness and minimal fees, avoiding high transaction fees. It facilitate direct wallet-to-wallet swaps, which are custodial and privacy preserving.

Portal Bridge is immutable, due to self-enforced contracts executed on the blockchain, providing a higher degree of certainty around custodial and non-custodial hacks.

It provides a seamless bridge for users of all technical competencies and is a morally sound platform for users demanding privacy.

Features Portal Bridge

Decentralized Cross-Chain Aggregator – No central authority for bridging assets.

Wallet-to-Wallet Transfers – Private and direct control swaps.

Multi-Chain Support – Works with several blockchains and token standards.

Optimized Fees & Routes – Smart paths and balanced routes for efficiency.

Smart Contract Security – Trustless systems make cross-chain transfers safe.

Conclsuion

In conclusion, Peer-to-Peer Bridging Aggregators To Avoid Centralized KYC facilitate multi-blockchain asset transfers securely, privately, and efficiently.

By removing centralized control and KYC policies, these aggregators allow users to fully self-custody their funds.

Offering low-cost, optimally routed, and trustless transactions, these services are a must-have for any privacy-oriented crypto user.

FAQ

It’s a platform that allows users to transfer assets across multiple blockchains directly from wallet to wallet without centralized intermediaries.

No, most P2P bridging aggregators operate without centralized KYC, maintaining user privacy.

Yes, they rely on smart contracts and audited protocols to ensure trustless and secure transfers.

Support varies, but top aggregators connect multiple major blockchains like Ethereum, BNB Chain, Polygon, and more.

Fees are generally optimized through smart routing and liquidity aggregation, making them lower than traditional bridges.