In India’s crypto market, having a dependable, secure, and safe platform is the first step. This is why finding the right CoinSwitch alternative is important.

Beginners and advanced users need a trading interface that prioritizes fast INR deposits, low trading costs, many crypto options, and advanced security features so that users will have a frictionless experience.

ZebPay, CoinDCX, Binance, and Giottus are perfect options that will provide the confidence and tools necessary to optimize trading for one’s crypto investment.

What is Coinswitch?

CoinSwitch is a cryptocurrency exchange aggregator that enables users to purchase, exchange, and trade different cryptocurrencies within a single interface. CoinSwitch connects with different exchanges to provide users with the most favorable trade values and minimal costs.

Beyond global cryptocurrencies, CoinSwitch also accepts deposits and withdrawals in INR in India. CoinSwitch’s intuitive design and speedy dealings have built its reputation among users, whether novices or veterans, as being reliable.

How to Choose The Top Coinswitch Alternatives?

Selecting a cryptocurrency exchange influences the quality and safety of your trading operations. Here are some of the most important aspects you should focus on when selecting a leading CoinSwitch alternative in India:

Legal Standing and Security Issues

Prioritize cryptocurrency exchanges registered with the Financial Intelligence Unit of India (FIU-IND) to abide by anti-money laundering (AML) and know your customer (KYC) guidelines. This minimization of laundering and customer erosion affords a rare chance to gain legal repriaval and accountability in disputes.

Interface User Friendliness

Especially for novices, a trading platform’s birth curve should lean as close to horizontal as possible. Environments for consideration should allow seamless movement of the apparatus, instant reactions, analytics on the go, and mobile interfaces. Real-time trading opportunities, integrated predictive tools, and automated instruction fulfillment are some sought features.

Offered Cryptos and Pairs

Ensure the platform offers many different cryptocurrencies and trading pairs to provide the most investment flexibility. Access to the well-known coins such as Bitcoin (BTC) and Ethereum (ETH), and various other coins will be important to help balance your investments.

Liquidity and Trading Volume

When liquidity is good, buying and selling an asset happens without greatly changing its market price. Exchanges with greater trading volumes usually achieve this. These exchanges also have faster order executions, and spreads become tighter.

Fees and Transaction Costs

Different exchanges will have different costs for trading, making deposits and withdrawals, and other possible hidden fees. Platforms that offer clear pricing will help you save more on trading costs.

Customer Support

Customer support is sometimes overlooked. Having different support options, whether it be live chat, phone support, email, or help in your regional language, shows that the business values you.

Deposit and Withdrawal Methods

For seamless INR transactions, make sure the exchange offers the most convenient ways, like UPI, net banking, and IMPS, for deposits and withdrawals. Check how long these transactions take and if there are fees.

Tax Compliance and Reporting Tools

Buy exchanges that offer tax-compliant reporting tools and transaction tracking. This will allow you to accurately capture any tax for capital gains, and be ready to file your tax returns.

Key Point

| Exchange | Key Feature / USP | Notes / Highlights |

|---|---|---|

| ZebPay | Secure crypto trading & simple KYC | One of India’s oldest exchanges |

| CoinDCX | Wide range of cryptocurrencies & low fees | Supports INR deposits and multiple trading pairs |

| Unocoin | Recurring Bitcoin buy options | Pioneer in Indian Bitcoin trading |

| Bitbns | Instant INR deposits & margin trading | Offers variety of altcoins |

| Koinex | Fast crypto transactions | Focused on simplicity for Indian users |

| Giottus | User-friendly interface & quick support | Multiple INR trading pairs |

| BuyUcoin | Secure wallet & diverse crypto options | INR deposits available |

| PocketBits | Instant deposits & low fees | Beginner-friendly |

| Binance | Global crypto platform | Offers advanced trading options in India |

| FINEXBOX | Multiple coin listings & trading pairs | Indian-focused crypto exchange |

1. ZebPay

As one of the oldest and most trusted exchanges in India, ZebPay is one of the most secure places to trade bitcoin, ethereum and other cryptocurrencies. ZebPay is considered a Top Coinswitch Alternative because of the ease in which one can deposit INR to the account via UPI, net banking and NEFT.

Withdrawals can be made to an Indian bank account. In terms of trading, ZebPay charges competitive trading fees of around 0.15%, with zero fees for account deposits.

ZebPay primarily services India so it is only available via email and chat. ZebPay is one of the few exchanges that offers 24/7 customer support, which is great for trading from the mobile and web app console.

ZebPay Key Details

- One of India’s oldest crypto exchanges.

- Offers CryptoPacks for diversified portfolios.

- User-friendly interface with advanced features.

Pros:

- ✅ Beginner-friendly with curated investment packs.

- ✅ Supports multiple cryptocurrencies.

- ✅ Secure and compliant with Indian regulations.

Cons:

- ❌ Limited advanced trading tools compared to global platforms.

- ❌ Not available in the U.S..

2. CoinDCX

As one of India’s leaders in the cryptocurrency market, it hodls the most coins of any indian exchange with 200+ cryptocurrency and coin pairs for spot and margin trading.

It is considered a Top Coinswitch Alternative and one of the fast growing exchanges because of the customer friendliness and the deposit systems.

It supports INR deposits through UPI, net banking and wallet transfers with withdrawals through bank accounts.

Trading fees are 0.1% to 0.2% with deposits being free, which is primarily for indian customers with global access to crypto. The customer support is available through email, chat, help center documentation.

CoinDCX Key Details

- 2018 launch; Coinbase-backed.

- 500+ offered cryptocurrencies.

Pros:

- ✅ Highly liquid and secure.

- ✅ Features for beginners and pros.

- ✅ Has partnerships outside India.

Cons:

- ❌ Users complain of slow support.

- ❌ India’s regulations remain unclear.

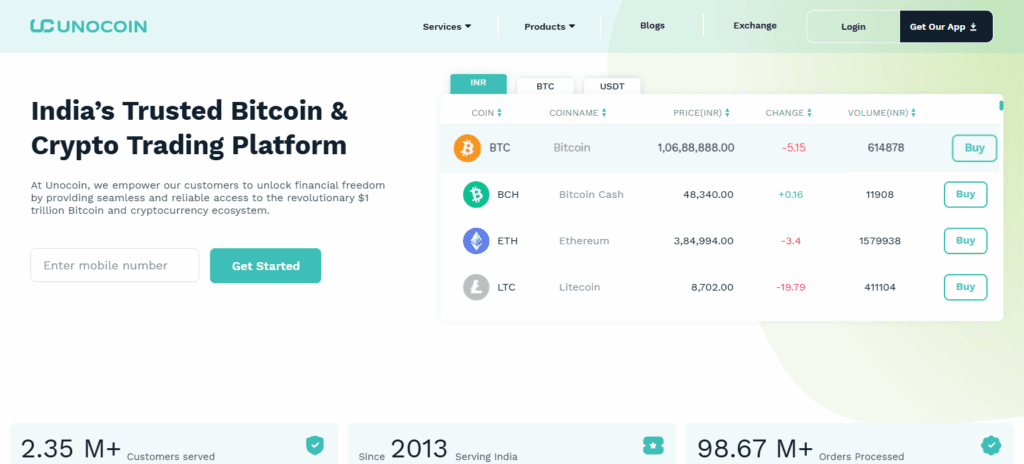

3. Unocoin

Unocoin specializes in the secure buying and selling of Bitcoin in India. As a Top Coinswitch alternative, Unocoin offers the ability to make Bitcoin purchases on a recurring basis and accepts Bitcoin purchases through UPI, IMPS, and net banking.

Withdrawals offer the ability to send to Indian Bank Accounts with a minimal fee. Trading fees per transaction are approximately 0.5%.

The exchange is India centric in customer support via email, chat, and a separate FAQ area, making it best suited for beginners and Indian users. Unocoin provides dependable service for users.

Unocoin Key Details

- Founded in 2013, focused on Bitcoin.

- Offers point-of-sale solutions and OTC desk.

Pros:

- ✅ Strong presence in India with over 1.5 million users.

- ✅ Simple interface for beginners.

- ✅ INR support and wallet services.

Cons:

- ❌ Limited coin offerings beyond Bitcoin.

- ❌ No global expansion yet.

4. Bitbns

Bitbns offers various different altcoins as well as spot and margin trading in India. The platform is recognized as a Top Coinswitch alternative and permits direct INR deposits through net banking, UPI, and wallet transfers.

There are direct bank withdrawals. Other fees consist of 0.25% for trading and no fees for deposits. Bitbns offers service all over India with 24/7 support through chat, email, and a ticketing system. This offers a comprehensive service for all levels of trading.

Bitbns Key Details

- Indian exchange with 100+ cryptocurrencies.

- Offers fixed income plans and SIPs in crypto.

Pros:

- ✅ Wide range of coins and trading pairs.

- ✅ Fast transaction processing.

- ✅ SIP and margin trading options.

Cons:

- ❌ No margin leverage.

- ❌ KYC mandatory for withdrawals.

5. Koinex

Koinex is another Top Coinswitch Alternative. Koinex is an Indian crypto exchange. Koinex simplifies crypto trading for users in India. Customer support is responsive and quick to answer. Koinex is an Indian crypto exchange.

Koinex facilitates INR deposits using UPI, NEFT, and IMPS, and withdrawals to bank accounts are also and withdrawals to bank accounts are also enabled. Koinex trading fees are competitive at 0.2% per trade.

Koinex is mainly focused on India, and offered email and chat support. Koinex is focused on India, and offered email and chat support. Koinex is focused on simplicity, and also offers features for advanced users. Koinex supports instant crypto trading and supports instant crypto trading.

Koinex Key Details

- Once India’s largest exchange (2017–2019).

- Shut down in 2019 due to RBI banking ban.

Pros (historical):

- ✅ High trading volumes and diverse coin offerings.

- ✅ Transparent and user-friendly.

Cons:

- ❌ No longer operational.

- ❌ Regulatory challenges led to closure.

6. Giottus

Giottus exchange is also fast growing, and offers secure crypto trading for Bitcoin, Ethereum, and others. Giottus is also a Top Coinswitch Alternative. Giottus facilitates INR deposits using UPI, IMPS, and net banking, and withdrawals are also to Indian bank accounts.

Their fees are competitive at 0.25% and deposits are also free. Primarily Giottus focuses on Indian customers. Giottus offered quick support via chat, email, and also social media.

Giottus Key Details

- Launched in 2018, India-based.

- Focuses on security and customer support.

Pros:

- ✅ Cold storage, 2FA, multi-signature wallets.

- ✅ 24/7 customer support.

- ✅ Good for beginners.

Cons:

- ❌ Limited coin selection.

- ❌ May lack advanced trading features.

7. BuyUcoin

BuyUcoin is an Indian crypto exchange providing safe wallets and straightforward trading INR for over 100 coins. Considered a Top Coinswitch Alternative, BuyUcoin enables deposits through UPI, IMPS, and net banking with bank account withdrawals.

Free deposits and trading fees of 0.25% makes BuyUcoin a reasonable choice. Support is responsive through chat, email, and helpdesk serving Indian users. Beginners and advanced users alike experience seamless crypto trading with BuyUcoin.

BuyUcoin Key Details

- Founded in 2016, Indian exchange.

- Offers NFT marketplace and cashback rewards.

Pros:

- ✅ Low fees and INR support.

- ✅ NFT marketplace and EzBack rewards.

- ✅ OTC desk with zero fees.

Cons:

- ❌ Only available to Indian residents.

- ❌ Limited global reach.

8. PocketBits

PocketBits is a beginner friendly Indian Crypto Exchange offering fast deposits and withdrawals which makes it a Top Coinswitch Alternative. You can deposit INR using UPI, net banking, IMPS, abd bank accounts for withdraws.

They charge deposit fees of 0.3% and no withdrawal fees. PocketBits serves india and supports users through chat and email. This is an ideal cryptocurrency exchange for first time and beginner users with a focus on simplicity and ease of use for new users.

PocketBits Key Details

- Founded in 2017, India-based.

- Offers fast transactions and INR withdrawals.

Pros:

- ✅ No deposit or withdrawal fees.

- ✅ Simple interface and quick processing.

- ✅ Market and limit order support.

Cons:

- ❌ User reviews disagree on the platform’s reliability.

- ❌ Limited offerings of coins.

9. Binance

As a global cryptocurrency exchange, Binance has seamlessly integrated support for Indian users, earning it a place among the best Top Coinswitch Alternatives. Indian users can make UPI, bank transfer, and third-party wallet deposits, as well as withdraw funds to bank accounts and crypto wallets.

Binance offers a flat 0.1% fee per trade, with discounts for Binance Coin holders. Binance has also excellent customer support available for Indian users via chat, email, and ticketing systems, as well as beginner and advanced tutorials and guides for self-service.

Binance Key Details

- Largest crypto exchange in the world.

- Spot, derivatives, NFTs, and staking offered.

Pros:

- ✅ 1,500+ pairs and worldwide access.

- ✅ Highly liquid and low fees.

- ✅ All levels of traders.

Cons:

- ❌ Multiple countries question regulations.

- ❌ Beginners find the platform complex.

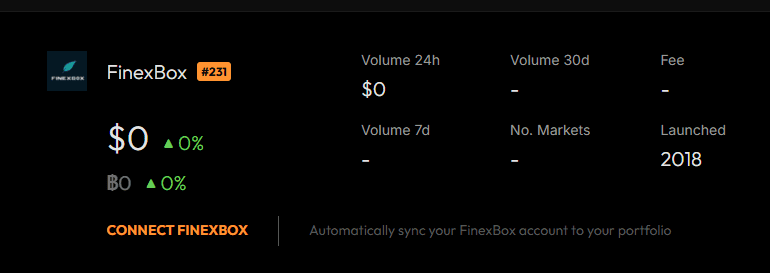

10. FINEXBOX

As a India-centered crypto exchange, FINEXBOX has built a reputation as a Top Coinswitch Alternative for offering easy trading and multiple coin options. It also offers easy UPI, net banking, and IMPS for Indian users to deposit.

Users can withdraw to Indian bank accounts, and net trading fee of 0.3% and 0.2% and ni addition FINEXBOX has no deposit fee.

FINEXBOX also offers social and email customer support, in addition to supplies chat, to support user during complex il hugh and problematic steps of the trading to streamline their user experience to assist them in easy trading.

FINEXBOX Key Details:

- Located in Hong Kong.

- Margin trading and P2P funding.

Pros:

- ✅ Multiple coins and trading.

- ✅ Global presence and 7+ languages.

- ✅ P2P system.

Cons:

- ❌ Cluttered platform.

- ❌ No credit card payments.

- ❌ Trust and reputation are questionable.

How is Crypto Taxed in India?

In India, cryptocurrencies fall under the category of Virtual Digital Assets (VDAs). Profits made from selling crypto are taxed at a flat rate of 30% under Section 115BBH, along with any applicable surcharge and cess.

Investors can only deduct the cost of acquisition and lose the benefit of unclaimed losses, as losses cannot be set off or carried forward. Excaping tax crypto received as gifts might be taxed under Section 56(2)(x).

All crypto transfers are subject to 1% TDS (Tax Deducted at Source) under Section 194S. The tax is deducted by exchanges or payers at the time of the transfer. For most users, the annual limit is ₹10,000 and for specified persons, it is ₹50,000. This TDS is credited against the final tax liability when doing income tax returns.

Profits from crypto for businesses are taxed as per the corporate or income tax rates. The fees charged by exchanges for services are subject to 18% GST. This only applies to the services and not the value of the crypto. Tokens received from mining, staking, or airdrops are taxed as income at the time of receipt and again, at 30%, when they are transferred.

💡 Example: Crypto Trade in India

- Profit from selling BTC: ₹2,00,000

- Tax at 30%: ₹60,000 plus cess

- TDS: 1% deducted at sale, credited against final tax

Key takeaway: Crypto trading in India involves a 30% tax on profits, 1% TDS on transfers, and 18% GST on platform fees, making accurate record-keeping essential for compliance.

Conclusion

Selecting the best CoinSwitch alternative is integral to crypto trading in India being secure, smooth, and economical. There are platforms like ZebPay, CoinDCX, Unocoin, Bitbns, Giottus, BuyUcoin, PocketBits, Binance, Koinex, and FINEXBOX where you can find low fees, fast INR deposits, reliable customer service, support for many cryptocurrencies, and other benefits.

When picking an exchange, the most important factors include compliance, security, liquidity, trading fees, and the overall experience from the user’s standpoint.

This way, the traders and investors can achieve optimal risk mitigation, seamless and compliant transactions within India’s crypto taxation regime.

For all these reasons, you can find a strong and reliable ecosystem at these alternatives, which is ideal for novice and advanced traders needing something better than CoinSwitch.

FAQ

CoinSwitch alternatives are cryptocurrency exchanges or platforms that offer similar services, including buying, selling, and swapping digital assets, often with competitive fees, better features, or wider coin selections.

Some of the top alternatives include ZebPay, CoinDCX, Unocoin, Bitbns, Giottus, BuyUcoin, PocketBits, Binance, Koinex, and FINEXBOX. These platforms provide secure INR deposits, fast withdrawals, and a wide range of cryptocurrencies.

Yes, as long as you choose exchanges that follow KYC regulations, are FIU-IND registered, and implement security measures like 2FA and cold storage, your funds remain secure.

Fees vary by platform but generally include trading fees (0.1–0.3%), deposit/withdrawal charges, and GST on service fees. Global platforms like Binance may have slightly different fee structures.

Yes, most Indian CoinSwitch alternatives support INR deposits via UPI, net banking, and IMPS, with withdrawals directly to bank accounts.