I will cover Best Aggregators for Bridging with Minimal KYC, paying attention to privacy, speed, and security during cross-chain transfers.

With the evolution of decentralized finance, the elimination of identity checks, while still dependable, becomes warranted. LI.FI, Rango Exchange, and Celer cBridge are considered aggregators that allow traders to transfer their crypto across different networks without restricting their control over it and without check identity.

How To Choose the Best Aggregators for bridging with minimal KYC?

Check for Full Decentralization and Non-Custodial Bridges

Your first step with any aggregator should be to determine whether they are fully decentralized and non-custodial. You want to ensure that you never lose control of your wallet and assets. LI.FI and Rango Exchange are examples of permission-less bridges that provide the user with contract-only arrangements and respect privacy.

Check for Bridge Integrations and Security Audits

It is crucial to only utilize aggregators that use audited and battle-tested bridges. Audits should come from top-tier certified companies (e.g., CertiK, Quantstamp). Celer cBridge and deBridge are safe to use for cross-chain transfers since they have gone through rigorous security evaluations.

Validate Which Networks are on Offer and Supported

Pick aggregators that span many blockchains, comprising both EVM-compatible and non-EVM chains like Solana, Cosmos, and Avalanche. Socket (Bungee Exchange) and Squid Router (Axelar) are perfect for users that routinely transfer resources between multiple ecosystems.

Check Fees & Speed of Transactions

It is crucial to have quick transfers and low fees. Some bridges add additional gas fees and liquidity fees. Odyssey and Celer cBridge are the best options for users with the best and fastest routing confirmations available at the least costs and rapid cross-chain confirmations.

Estimate Liquidity Depth

A bridge aggregator’s liquidity depth will influence how successful swaps are and the prices of swaps. Stargate Finance and LI.FI have large unified liquidity pools which lowers slippage and provides better execution on transfers of higher value.

Aim for Privacy & Minimum KYC

The primary target is minimum KYC, hence, the option of no identity verification, no centralized accounts, and no KYC is better. Jumper Exchange and Rango Exchange provide bridging without the need for customers to fill KYC, thus preserving user anonymity and adhering to the core principle of DeFi that users have unrestricted access.

Evaluate Community Trust & Openness

Look for platforms that have positive user reviews alongside visible open-source code and bridge integrations that are fully disclosed. Squid Router (Axelar) and deBridge publicly provide their auditing results, source code, and community governance, which is indicative of transparency.

Seek for Developer & Ecosystem Collaboration

In the case of expected long-term usage/ integration, aggregators should provide an SDK, API, or developer documentation. LI.FI and Socket promote developer collaboration, allowing their apps and wallets to add cross-chain transfers for users.

Assess Support and Trustworthiness

When problems arise, the customer’s situation should be prioritized and quick support should be provided. Responsive support is shown through active Discord or Telegram channels, and swift issue resolution comes from development teams like Celer and LI.FI. These teams frame better reliability.

Test Small Before Large Transfers

Prior to relocating big amounts, it is recommended to conduct a little test transfer. This will allow you to check how long it takes, test how much it will actually cost, and also check how stable the bridge is. This ensures that you confirm to the aggregator and themself that it works seamless without any issues.

Key Point

| Platform | Key Features | Unique Advantage |

|---|---|---|

| LI.FI | Aggregates multiple bridges and DEXs for best routing | Offers customizable SDK for seamless cross-chain swaps |

| Rango Exchange | Multi-chain swap aggregator across 60+ blockchains | Simplifies DeFi swaps via one unified interface |

| Socket (Bungee Exchange) | Fast cross-chain bridging with minimal slippage | Used by many dApps for instant liquidity routing |

| Jumper Exchange | One-click cross-chain bridge and swap aggregator | Focused on user simplicity and multi-wallet support |

| Odyssey | Cross-chain transaction router and liquidity optimizer | Optimizes pathfinding for cheaper gas and faster swaps |

| deBridge | Secure interoperability protocol using advanced validation | Prioritizes security and fast cross-chain messaging |

| Squid Router (Axelar) | Uses Axelar network for universal asset and message transfer | Enables cross-chain app-to-app communication |

| Celer cBridge | Efficient, low-cost cross-chain asset transfers | Known for fast and scalable Layer-2 connectivity |

| Stargate Finance | Unified liquidity bridge built on LayerZero protocol | Allows instant finality and native asset swaps |

1. LI.FI

LI.FI has established itself as one of the most sophisticated cross-chain liquidity aggregation protocols in the industry. It connects users to the most effective decentralized bridges and DEXs spanning various blockchains.

LI.FI integrates more than 20 primary bridges and liquidity providers, making transactions between Layer 1 and Layer 2 networks. The Protocol offers one of the most seamless incorporations into dApps through the SDK and API, providing dApps various composability possibilities.

It is also one of the Best Aggregators for bridging with minimal KYC – LI.FI. Its KYC-free aggregation services, coupled with its user-first interface and non-custodial design, ensure the utmost privacy and security in digital transactions.

It offers cross-chain transfers with minimal gas and slippage, supporting Ethereum, Polygon, BNB Chain, and Arbitrum.

LI.FI Key Features

- Utilizes over 20 bridges and DEXs to optimize cross-chain paths.

- Easy integration for builders through the developer SDK and API.

- Network support for Layer 1 and 2 chains with adaptive gas prediction.

Pros:

- Amazing routing with impressive gas liquidity.

- Partially KYC free.

- Simple integration into DeFi and Web3 applications.

Cons:

- For beginners the interface gets confusing.

- During network congestion, the gas fees are higher.

2. Rango Exchange

Rango Exchange is a highly effective multi-chain swap aggregator spanning more than 60 blockchains, including several non-EVM networks. The platform’s routing is achieved through the automated consolidation of decentralized bridges, DEXs, and liquidity protocols.

Rango boasts a simple and user-friendly interface, allowing users to swap tokens in various blockchain ecosystems without the hassle of managing several wallets or bridges in a choreographed sequence.

It is important to underline that Best Aggregators for bridging with minimal KYC – Rango Exchange offers rapid transactions and seamless user onboarding with minimal verification, thereby enhancing privacy.

It supports top protocols like ThorChain, Synapse, and Osmosis, offering users versatility and effectiveness in different DeFi ecosystems.

Rango Exchange Key Features

- Multi-chain swap aggregator for 60+ blockchains.

- DEXs and bridges are integrated with liquidity ecosystems such as ThorChain, Osmosis, and others.

- Optimized routing for low fees and slippage.

Pros:

- Wide cross-chain support.

- Easy to navigate with an attractive interface.

- Rapid transactions, no custody involved.

Cons:

- Limited direct fiat options.

- Network congestion may cause routing issues.

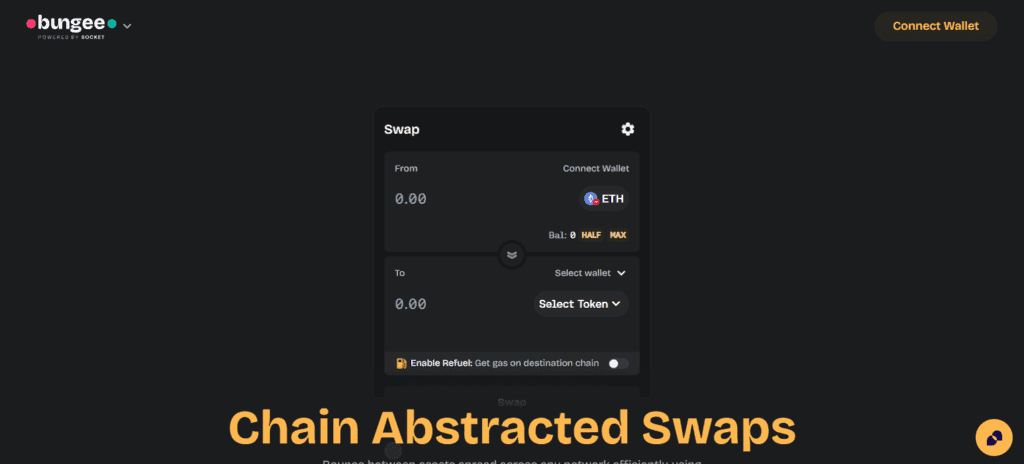

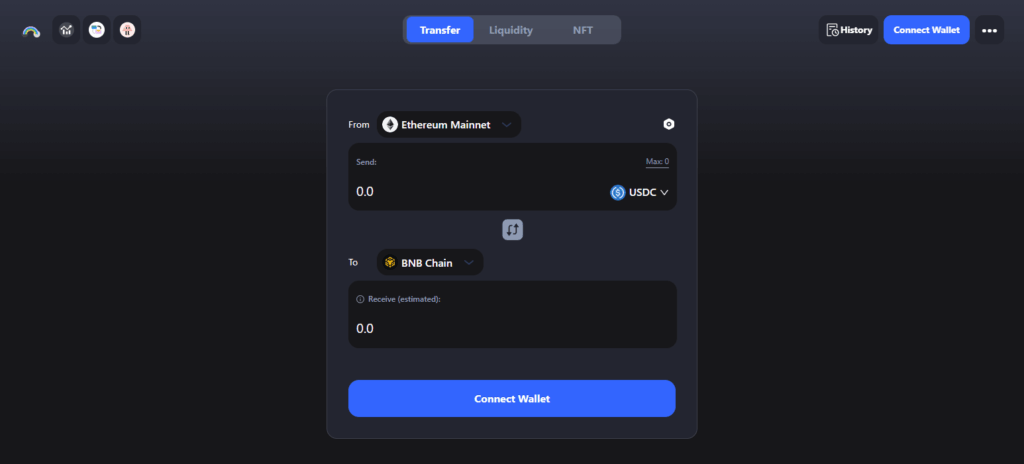

3. Socket (Bungee Exchange)

Socket, or Bungee Exchange as most people know it, is a secure, efficient, cross-chain bridge that reduces both transaction fees and slippage. As a layer for modular interoperability, it connects users to the most efficient routes for over 20 blockchains.

Bungee reduces the amount of time and money users spend by automatically determining the most efficient bridge and DEX route. As for privacy, Best Aggregators for bridging with minimal KYC – Socket (Bungee Exchange) permits users to do direct swaps in an uncustodial fashion.

Its SDK is widely used by developers to facilitate cross-chain transfers in apps, particularly in DeFi and GameFi.

Socket (Bungee Exchange) Key Features:

- Cross-chain swap aggregation through top tier bridges.

- 20+ EVM and non-EVM networks.

- Cross-chain transfer SDK for developer use.

Pros:

- Good, low slippage, routings.

- Ideal for dApp integrations and quick swaps.

- Little KYC needed, perfect for privacy-centric individuals.

Cons:

- Narrow analytics dashboard.

- May rely on third-party bridges for service.

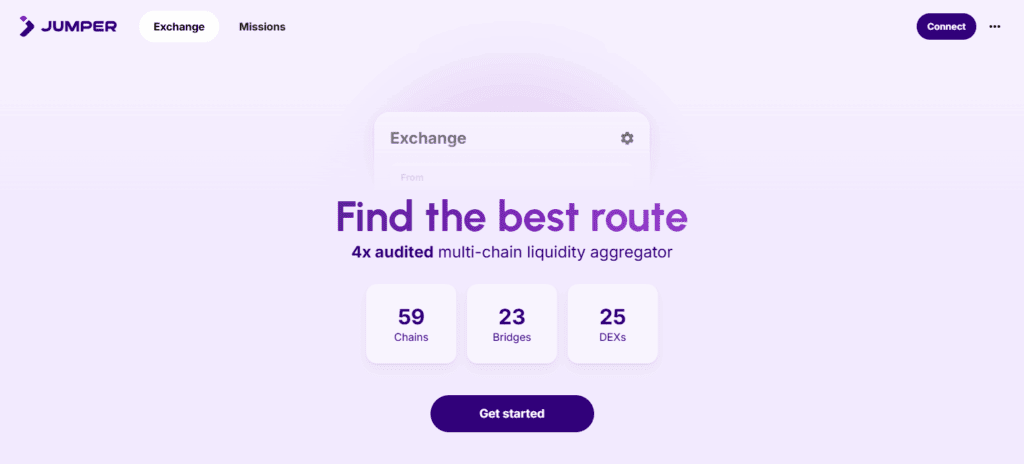

4. Jumper Exchange

Jumper Exchange enhances and streamlines cross-chain bridging by consolidating the top liquidity sources and bridging services in a single platform. It allows easy asset swaps on major chains, including Ethereum, Arbitrum, and Optimism.

The experience is designed around a one-click system where users just select a token, pick a destination chain, and Jumper Exchange handles the rest.

As noted in Best Aggregators for bridging with minimal KYC – Jumper Exchange, it is particularly exceptional for privacy, offering swap services that seamlessly bypass KYC requirements and centralized controls.

The appeal of Jumper is its speed, simplicity, and ease of use with multiple wallets, which makes it a good option for newbies and active DeFi traders alike.

Jumper Exchange Key Features

- Aggregates and swaps in one seamless action.

- Single interface compatible with multiple wallets.

- Bridges integration includes Stargate, Celer, and Synapse.

Pros:

- User-friendly and uncomplicated interface.

- Effortlessly supports multiple chains and tokens.

- KYC requirements are non-existent for users.

Cons:

- Limited advanced settings for professional users.

- API value for developers is limited.

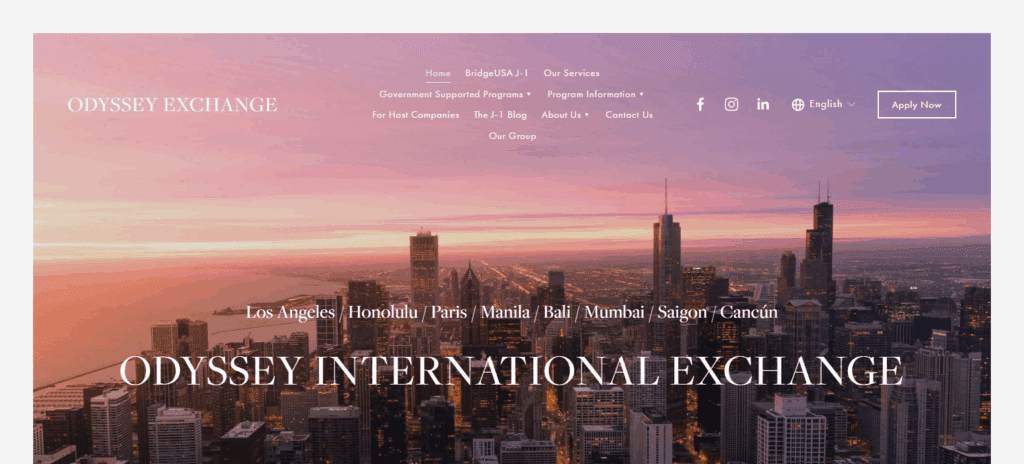

5. Odyssey

Odyssey is designed for cross-chain routing with the ultimate goal of optimizing the transfer of assets and liquidity. It seeks to optimize transfer speed and minimize gas costs by automatically finding the best blockchain routes.

Before a swap is executed, its engine evaluates the bridge’s reliability and the associated fees using advanced algorithms. Midway in its capabilities, Best Aggregators for bridging with minimal KYC – Odyssey caters to user privacy with a secure, no KYC approach.

Odyssey’s main focus is on achieving seamless interoperability, connecting the most extensive and top-tier DeFi ecosystems.

Odyssey Key Features

- Protocol for cross-chain routing, optimizing gas and costs.

- Sophisticated algorithms determine the optimal route for swaps.

- Works with the main chains and DeFi liquidity hubs.

Pros:

- The transfers are efficient and optimized for costs.

- Secure routing architecture that is also transparent.

- Little or no KYC during transactions is a plus.

Cons:

- Smaller ecosystem because it is relatively new.

- For developers, the documentation is limited.

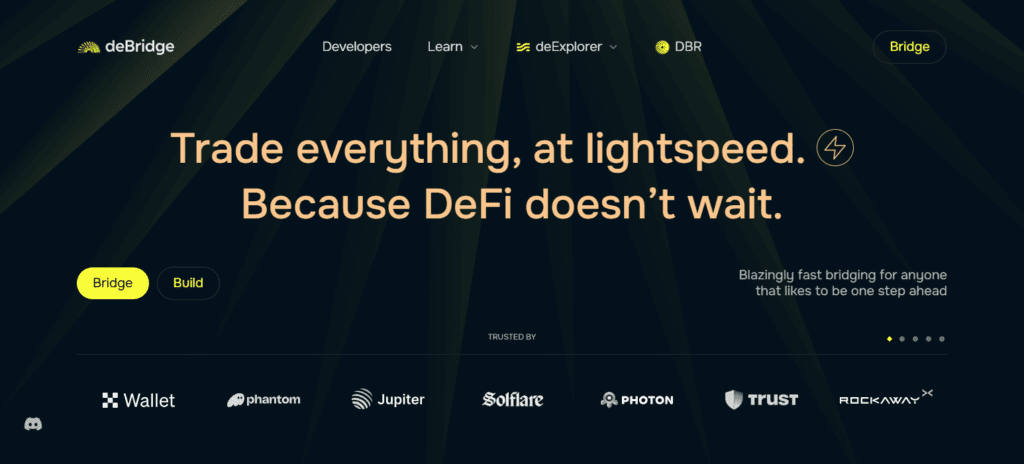

6. deBridge

deBridge is a protocol for secure interoperability and cross-chain messaging that facilitates and enhances the transfer of assets and smart contracts through multiple chains. It utilizes decentralized validation combined with cryptographic proofs to secure cross-chain transactions.

It is the only platform to offer message-based interoperability which helps developers safely transfer data and liquidity between ecosystems. As recorded in Best Aggregators for bridging with minimal KYC – deBridge, deBridge offers reliable cross-chain transactions without verifying the user’s identity.

This feature is particularly valuable in DeFi for its privacy-preserving components. Many enterprise-grade projects utilize it for scalable cross-chain deployments.

deBridge Key Features

- Secure interoperability protocol using decentralized validation.

- Enables cross-chain swaps and smart contract calls.

- Supports enterprise-grade messaging and liquidity transfer.

Pros:

- High security through multi-validator consensus.

- Reliable for both token and data transfers.

- Best for users needing minimal KYC verification.

Cons:

- Interface might be confusing for first-timers.

- Transaction confirmations could be improved.

7. Squid Router (Axelar)

Squid Router built on the Axelar network supports universal cross-chain asset and message transfer. Axelar’s secure infrastructure offers secure cross-chain swaps, NFT transfers, and application calls. Squid provides the means for developers to construct cross-ecosystem interoperable dApps.

Dominating its features, Best Aggregators for bridging with minimal KYC – Squid Router (Axelar) enables transfers without restrictions and the decentralized structure removes KYC. Its integration with Cosmos, Ethereum, and Avalanche is expanding multi-chain capabilities.

Squid Router (Axelar) Key Features

- Built on Axelar for universal cross-chain messaging.

- Allows swaps, NFT transfers, and contract interactions.

- Cosmos, Ethereum, Avalanche and more.

Pros:

- Great interoperability.

- Permissionless and no KYC.

- Multi-chain dApp for developers.

Cons:

- Difficult to set up for unfinished projects.

- Features still in beta.

8. Celer cBridge

Celer cBridge is a rapidly cross-chain bridge and scalable cross-chain bridge to fast and cheap digital to cross digital to assets. It works with more than 40 blockchains and with Layer-2, thus, seamless liqudue movement.

The platform uses the Celer Network’s State Guardian Network (SGN) to safe and validate cross-chain transactions. Midway in its benefits, Best Aggregators for bridging with minimal KYC – Celer cBridge enables KYC-free non-custodial transactions.

Its notable feature is the extremely fast confirmation times for transfers and its various DeFi protocol spanning EVM and non-EVM chains.

Celer cBridge Key Features

- Fast, affordable cross-chain bridging through Layer-2.

- 40+ blockchains and liquid pools.

- Secured through Celers State Guardian Network (SGN).

Pros:

- Very low fees with speedy transfers.

- Decentralized validation and secured.

- No KYC means more privacy.

Cons:

- Smaller chains might be congested.

- Confusing UI.

9. Stargate Finance

Stargate Finance is a liquidity transport protocol built on LayerZero, providing instant and native asset swaps between multiple chains. It maintains unified liquidity pools that eliminate the need for wrapped tokens.

Users can transfer assets like USDC, ETH, and USDT easily across networks with guaranteed finality. Halfway through its operations, Best Aggregators for bridging with minimal KYC – Stargate Finance ensures and promotes anonymity, as it works through decentralized contracts without KYC friction.

LayerZero Labs strongly backing it makes it a safe, efficient, and future-ready solution for cross-chain liquidity transfers in DeFi ecosystems.

Stargate Finance Key Features

- Built on the LayerZero protocol for a liquidity bridge.

- Allows native asset swaps.

- No wrapped tokens, unified liquidity pools.

Pros:

- Large liquidity and minimal transaction times.

- Complete decentralization.

- No KYC, no citizenship.

Cons:

- Lower variety of tokens compared to other networks.

- Depends on LayerZero network availability and quality.

- Would you like a summary comparison table next? It will include speed, supported chains, and the best use case for each platform.

Important Considerations Best aggregators for bridging with minimal KYC

These are some important considerations when selecting the best aggregators for bridging with minimal KYC:

KYC Requirements

Prefer aggregators that are decentralized and non-custodial. Some platforms, like LI.FI, Rango Exchange, and Socket (Bungee), prioritize privacy and do not require KYC, meaning users can transfer their assets without any personal data attached.

Audits and Bridge Security

Security is vital. When selecting aggregators, see that they use audited and reputable bridges such as Celer cBridge, deBridge, and Stargate Finance. Also check that their smart contracts are externally audited. This helps prevent hacks and the loss of funds.

The Chain and Token Options Available

The best bridging aggregators will be able to support multiple blockchains and assets, EVM and non-EVM. Rango Exchange, Squid Router (Axelar), and LI.FI enable the seamless exchange of assets and support multiple chains such as Ethereum, Polygon, BNB Chain, and Cosmos.

Speed and Cost of Transactions

For DeFi users, time efficiency is essential. Socket and Celer cBridge aggregators focus on efficient transfers, shortening confirmation time and gas fees. Before performing a swap, ensure you check estimated fees.

Liquidity Depth & Slippage

Greater liquidity translates to better swap rates with less slippage. Stargate Finance and LI.FI have deep liquidity pools with significant assets like USDC, ETH and USDT. A well-integrated aggregator will always find the route with the most optimal execution price.

Integration & UI

Usability is enhanced with thoughtful designs. Jumper Exchange and Odyssey have streamlined one-click bridging, while platforms like LI.FI and Socket provide developer SDKs for advanced users seeking custom integration into their dApps or wallets.

Decentralization & Transparency

Choose aggregators operating with fully decentralized frameworks that utilize smart contracts instead of centralized third parties. Axelar-based Squid Router and deBridge shine in on-chain validation and provide open-source governance, giving transparency to their customers.

Community & Developer Support

Robust ecosystems of developers and community members provide an assurance that a project is trustworthy and will endure. Active developer documentation, public GitHub repos, and reliable communication lines for issue resolution, mark the projects LI.FI and Celer cBridge as outstanding examples.

Bridge Reliability & Uptime

Check the historical reliability and uptime of the bridges the aggregator has integrated. Frequent downtime or delays in cashing out can cause stuck or failed transactions. Stargate Finance and deBridge demonstrated consistent uptime and execution reliability over the years.

Future Compatibility

Pick aggregators with scalable architecture in order to accommodate future integrations with chains and token standards. Ecosystem connection growth still characterizes LI.FI, Axelar, and Celer to ensure long-term prominence and relevance in the ever-evolving multi-chain space.

Conclusion

Finding the best aggregators for bridging with the least KYC requirements necessitates consideration of privacy, efficiency, and security trade-offs. Options such as LI.FI, Celer cBridge, Bungee’s Socket, and Rango Exchange provide non-custodial cross-chain transfers without KYC and transfers’ custodians remain in the user’s hands.

These services provide quick transfers, low fees, and access to sufficient liquidity. This combination is perfect for DeFi traders, offering sufficient cross-chain interoperability without compromising privacy.

FAQ

Minimal KYC means users can transfer assets across blockchains without submitting personal identification or undergoing centralized verification. These aggregators use non-custodial wallets like MetaMask or WalletConnect, ensuring full privacy and control.

Top platforms include LI.FI, Rango Exchange, Socket (Bungee Exchange), Jumper Exchange, Celer cBridge, and Stargate Finance. They are decentralized, audited, and allow permissionless swaps across multiple blockchains.

Yes—if they use audited smart contracts and reliable bridges. Protocols such as deBridge, Celer cBridge, and Stargate Finance employ advanced security models and decentralized validation to protect users’ funds.

Absolutely. Platforms like Rango Exchange and Squid Router (Axelar) support 50+ blockchains, enabling seamless swaps between EVM and non-EVM networks such as Ethereum, Cosmos, and Avalanche.

Non-custodial bridges ensure you retain control of your funds at all times. Unlike centralized exchanges, they don’t store user assets or data, minimizing risks of theft, censorship, or privacy breaches.