In Japan, getting Tether (USDT) is simple and safe, primarily due to the country’s strong regulations and easily accessible exchanges.

Japan caters to all investors and traders, whether seasoned or novices, and also offers several reliable platforms, flexible payment options, minimal charges, and sophisticated trading features. This guide provides the essential information you need to purchase USDT in Japan in no time.

What is Tether USDT?

Tether USDT is classified as a stablecoin within the cryptocurrency market. It tries to maintain a constant value by being pegged to the US dollar. Tether keeps reserves in traditional fiat currencies for every USDT in circulation to maintain stability.

How to Buy USDT in Japan

Japanese users can purchase Tether (USDT) from Bybit, one of the most liquid exchanges in the world. Bybit is unlicensed by the Financial Services Agency (FSA) and is also still operating in Japan, though they are working towards some form of compliance.

Japanese Bybit users are able to fund their accounts in Yen thanks to Bybit’s P2P marketplace, where users buy USDT from verified sellers. Japanese bank accounts and the other Bybit accepted methods of payment are used. Bybit’s marketplace has strong liquidity and offers 2,000+ assets with USDT pairs.

- Open an Account: Register on Bybit, set up KYC, and get access to Japan’s P2P marketplace to buy USDT quickly and safely with Japanese Yen.

- Select Buy Option: Pick JPY and the amount of USDT desired to purchase using P2P or One-Click Buy.

- Choose Payment Method: Use a bank transfer or other local payment methods and Bybit will pair you with a verified seller to make your purchase.

- Confirm and Receive: Your Bybit USDT wallet will be instantly credited upon a payment confirmation. These USDT can be used for immediate trading or moved to other wallets.

Key Point

| Exchange | Cryptocurrencies | Trading Fees | Deposit Methods | Key Features |

|---|---|---|---|---|

| Bybit | 2,100+ | 0.1% | Apple Pay, Google Pay, Visa, Mastercard, JCB | Spot, Futures, Options, Earn, Copy Trading, Bybit Card |

| Binance | 350+ | 0.1% | Bank Transfer, Cards, Pay-easy, Convenience Store | Spot, Margin, Futures, Earn, Launchpad, Copy Trading |

| bitFlyer | 38 | 0.2% | Bank Transfer, Cards, Convenience Store, Line Pay | Licensed in Japan, Recurring Buy, Bitcoin Card |

| Bitbank | 30+ | 0.5% | Bank Transfers | FSA-licensed, Spot, Margin, Lending |

| LBank | 200+ | 0.1% | Bank Transfer, Visa, Mastercard, USDT | Spot, Futures, Margin, Launchpad |

| Bithumb | 100+ | 0.2% | Bank Transfer, Visa, Mastercard, Crypto | Spot, Margin, Staking, Security-verified |

| Bitfinex | 150+ | 0.2% | Bank Transfer, Crypto | Spot, Margin, Lending, Borrowing, Staking |

| Poloniex | 100+ | 0.2% | Bank Transfer, Crypto, PayPal | Spot, Margin, Lending, Token Sales |

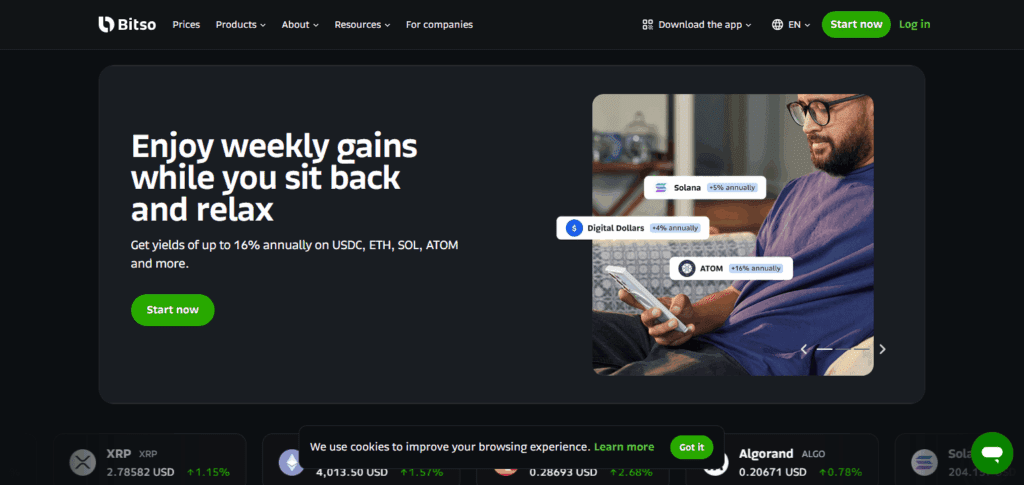

| Bitso | 30+ | 0.5% | Bank Transfer, Cards, Crypto | Spot, Earn, Crypto-to-Crypto, Remittances |

1. Bybit

Bybit is one of the leading exchanges for cryptocurrency in Japan which allows the purchase of Tether (USDT).

Bybit is one of the best-planned and user-friendly exchanges, with more than 2.1k different available cryptos with only a 0.1% trading fee. Bybit is also very flexible for Japan users in payment methods. It accepts Apple Pay, Google Pay, Visa, Mastercard, and JCB.

Bybit also allows the purchase of Tether (USDT) as well as all other USDT supported services through Apple Pay, Google Pay, and other methods that come with your bank card.

Bybit has several advanced trading functions. Spot trading, futures, options, earn programs, copy trading, and the Bybit Card all make Tether (USDT) and cryptos in general relatively easy, cheap and fast to purchase.

Bybit Key Point

- Cryptocurrencies: 2,100+

- Trading Fees: 0.1%

- Deposit Methods: Apple Pay, Google Pay, Visa, Mastercard, JCB

- Key Features: Spot, Futures, Options, Earn, Copy Trading, Bybit Card

| Pros | Cons |

|---|---|

| – Low trading fees (0.1%) | – Limited fiat deposit options in some regions |

| – Wide range of cryptocurrencies (2,100+) | – Not available for residents in some countries (e.g., US) |

| – Advanced trading options (Spot, Futures, Options) | – May be complex for beginners |

| – Copy trading and Bybit Card | – No fiat-to-crypto trading for all regions |

| – Apple Pay and Google Pay support | – Customer service can be slow at times |

2. Binance

Binance is also a place where you can buy Tether in Japan/Buys Tether (USDT) in Japan. With over 350 cryptocurrencies, Binance has a 0.1% trading fee. Binance has multiple ways to make deposits.

These deposits can be made via bank transfers, cards, Pay-easy, and convenience stores. This makes it very stackable to users in Japan.

To buy Tether (USDT) in Japan via Binance: You can use any method to deposit Japanese yen (JPY) and buy USDT once you have funds in your Binance account.

There are additional features like a copy trading for users who prefer automated trading strategies. Along with these, there are multiple services like spot trading, margin trading, futures, and a launchpad for new tokens.

Binance Key Point

- Cryptocurrencies: 350+

- Trading Fees: 0.1%

- Deposit Methods: Bank Transfer, Cards, Pay-easy, Convenience Store

- Key Features: Spot, Margin, Futures, Earn, Launchpad, Copy Trading

| Pros | Cons |

|---|---|

| – Low trading fees (0.1%) | – Regulatory concerns in some countries (e.g., US, UK) |

| – Supports a wide range of cryptocurrencies (350+) | – Complex interface for beginners |

| – Multiple deposit methods (bank transfer, cards) | – Limited fiat options for certain countries |

| – Wide range of trading options (Spot, Margin, Futures, etc.) | – Customer service can be difficult to reach |

| – Launchpad for new tokens | – Risk of security breaches due to its popularity |

3. bitFlyer

bitFlyer, one of Japan’s most popular crypto exchanges, allows users to purchase Tether (USDT) and other crypto assets. With support for 38 different cryptocurrencies and a 0.2% trading fee, bitFlyer is a good value for Japanese crypto traders.

Users can fund accounts via bank transfer, credit cards, and Japan’s Line Pay, as well as payment at convenience stores. This makes bitFlyer a good option for people using Japan’s local payments. Buying Tether (USDT) in Japan using bitFlyer is simple.

After setting up an account, a user can choose to deposit JPY using one of the many payment options. Yen can also be used to buy bitFlyers Bitcoin card.

Trade and deposit limits will be explained via a Japanese smartphone app. BitFlyer’s licensing in Japan provides security to locals seeking to buy USDT on the exchange.

bitFlyer Key Point

- Cryptocurrencies: 38

- Trading Fees: 0.2%

- Deposit Methods: Bank Transfer, Cards, Convenience Store, Line Pay

- Key Features: Licensed in Japan, Recurring Buy, Bitcoin Card

| Pros | Cons |

|---|---|

| – Licensed in Japan (FSA-regulated) | – Limited number of cryptocurrencies (38) |

| – Supports multiple payment options (Line Pay, Convenience Store, etc.) | – Higher trading fees (0.2%) compared to others |

| – Recurring buy feature available | – Not as feature-rich as other major exchanges |

| – Bitcoin Card for payments | – Limited to Japan in terms of advanced services |

| – Trusted and secure platform | – Not ideal for advanced traders |

4. Bitbank

Bitbank is another exchange in Japan that the FSA licenses. It offers over 30 crypto assets, including Tether (USDT). It has a higher trading fee of 0.5%. You can also deposit through bank transfer,s which are higher compared to other exchanges, but because of the higher exchange rates, Bitbank can be trusted in Japan.

How to Buy Tether (USDT) in Japan via Bitbank: After you deposit JPY through a bank transfer, you can then exchange your funds to USDT. It has also offers services like spot trading, margin trading, and lending. The trust is even higher because they are compliant to Japan’s Financial Services Agency (FSA).

Bitbank Key Point

- Cryptocurrencies: 30+

- Trading Fees: 0.5%

- Deposit Methods: Bank Transfers

- Key Features: FSA-licensed, Spot, Margin, Lending

- Notable: Trustworthy Japanese exchange with FSA licensing.

| Pros | Cons |

|---|---|

| – FSA-licensed and highly regulated in Japan | – Higher trading fees (0.5%) compared to other exchanges |

| – Multiple deposit methods (bank transfer) | – Limited number of cryptocurrencies (30+) |

| – Supports margin trading and lending | – Interface can be difficult for beginners |

| – Good reputation in Japan | – No support for some advanced features like options or futures |

| – Security measures in place | – Limited fiat-to-crypto pairs |

5. LBank

LBank is a global crypto exchange that has over 200 cryptocurrencies, including Tether (USDT), and charges a trading fee of 0.1%. It also has JP bank deposits, Visa and MasterCard, and USDT transfers, which make it easy to move your money and purchase crypto.

How to Buy Tether (USDT) in Japan via LBank: You can deposit JPY or other payment options to purchase USDT. LBank provides spot, futures, and margin trading.

While it may not be as popular in Japan as other exchanges, LBank is a great option to purchase USDT. The bank-level security and diverse crypto are great for many.

LBank Key Point

- Cryptocurrencies: 200+

- Trading Fees: 0.1%

- Deposit Methods: Bank Transfer, Visa, Mastercard, USDT

- Key Features: Spot, Futures, Margin, Launchpad

- Notable: Offers Futures and has very low trading fees.

| Pros | Cons |

|---|---|

| – Low trading fees (0.1%) | – Not as widely recognized as other top exchanges |

| – Supports over 200 cryptocurrencies | – Limited deposit methods in some countries |

| – Multiple trading features (Spot, Futures, Margin) | – Limited advanced trading tools |

| – Simple user interface | – Customer support can be slow |

| – Global accessibility | – Smaller user base compared to larger exchanges |

6. Bithumb

Bithumb is also a cryptocurrency exchange based in South Korea that allows Japanese users to buy Tether (USDT). Bithumb has over 100 different cryptocurrencies that you can buy and has a 0.2% trading fee.

Bithumb accepts deposits via bank transfer (which is the only option available for users in Japan), Visa, Mastercard, and cryptocurrency.

How to Buy Tether (USDT) in Japan via Bithumb: You can buy USDT after you load your account from any of the available deposit options and trade on the exchange.

Bithumb also offers other services like spot trading, margin trading, and staking. Although Bithumb is in Japan to a lesser degree than South Korea, it is still a decent option to buy USDT.

Bithumb Key Point

- Cryptocurrencies: 100+

- Trading Fees: 0.2%

- Deposit Methods: Bank Transfer, Visa, Mastercard, Crypto

- Key Features: Spot, Margin, Staking, Security-verified

- Notable: South Korea exchange with strong security standards.

| Pros | Cons |

|---|---|

| – Supports a variety of cryptocurrencies (100+) | – Limited fiat deposit options (bank transfer only in some regions) |

| – Offers spot trading, margin trading, and staking | – Higher fees (0.2%) |

| – Security-verified and reputable | – Less intuitive interface for beginners |

| – Popular in South Korea | – Limited to specific regions for advanced features |

| – Customer service available | – Regulatory issues in some countries |

7. Bitfinex

Bitfinex is another major cryptocurrency exchange that has a wide range of cryptocurrencies, including Tether (USDT), and has a trading fee of 0.2%. Bitfinex users can deposit funds through bank transfers, cryptocurrencies, and many other methods.

How to Buy Tether (USDT) in Japan via Bitfinex: You can exchange your JPY or other fiat to USDT after you load your account using one of the offered methods. Bitfinex also has margin trading, lending, and borrowing features, which is great for beginner and advanced users in need of USDT.

Bitfinex Key Point

- Cryptocurrencies: 150+

- Trading Fees: 0.2%

- Deposit Methods: Bank Transfer, Crypto

- Key Features: Spot, Margin, Lending, Borrowing, Staking

| Pros | Cons |

|---|---|

| – Advanced trading options (Margin, Lending, etc.) | – High trading fees (0.2%) |

| – Large number of cryptocurrencies (150+) | – Complex for beginners |

| – High liquidity for large trades | – Regulatory concerns in some countries |

| – Support for both fiat and crypto deposits | – Past security breaches and hacks |

| – Trusted by institutional investors | – Customer support is sometimes slow |

8. Poloniex

Poloniex has more than 100 cryptocurrencies for trade, including Tether (USDT). This platform has a 0.2% trading fee and accepts deposits via bank transfers, cryptocurrencies, and PayPal.

Interested in buying Tether (USDT) in Japan via Poloniex? You can perform fiat money USDT purchases by Poloniex deposit.

This platform is less popular for buying USDT in Japan, but it does offer spot trading, margin trading, and token sales. Poloniex does offer flexible trading features. This may help offset its marginal popularity.

Poloniex Key Point

- Cryptocurrencies: 100+

- Trading Fees: 0.2%

- Deposit Methods: Bank Transfer, Crypto, PayPal

- Key Features: Spot, Margin, Lending, Token Sales

- Notable: Poloniex gives wide margin and lending trading range and is known for wide pairs. It allows token sales and IEOs.

| Pros | Cons |

|---|---|

| – Low trading fees (0.2%) | – Limited fiat deposit methods |

| – Supports over 100 cryptocurrencies | – High fees for margin and lending |

| – Token sales and IEOs (Initial Exchange Offerings) | – Confusing interface for new users |

| – Offers spot and margin trading | – Customer support is often slow |

| – Low spread on trades | – Not available in some regions (e.g., US) |

9. Bitso

Bitso is one of the world’s leading crypto exchanges, especially in Latin America. It supports Tether (USDT), and the trading fee is 0.5%. Users can fund their accounts via bank transfer, bank cards, and crypto.

Buying Tether (USDT) in Japan using Bitso is simple. Once you deposit funds into your account, you can purchase to your heart’s content.

Aside from that, Bitso conveniently enables international customers in Japan to use the additional services of crypto-to-crypto trading and remittances.

Bitso Key Point

- Cryptocurrencies: 30+

- Trading Fees: 0.5%

- Deposit Methods: Bank Transfer, Cards, Crypto

- Key Features: Spot, Earn, Crypto-to-Crypto, Remittances

- Notable: Bitso’s customer financing model, which supports crypto-to-crypto trades and remittances, makes it an outstanding option for cross-border transactions and transfers.

| Pros | Cons |

|---|---|

| – Competitive trading fees (0.5%) | – Limited number of cryptocurrencies (30+) |

| – Supports a wide range of payment methods (Bank Transfer, Cards, Crypto) | – Higher fees compared to major global exchanges |

| – Crypto-to-crypto trading and remittances | – Limited features for advanced traders |

| – Ideal for cross-border remittances | – Not available in certain regions (e.g., US) |

| – Simple user interface | – Limited educational resources for beginners |

Tax Implications for Tether (USDT) in Japan

According to Japan’s National Tax Agency, cryptocurrencies, such as Tether (USDT), are taxable assets. There isn’t a distinct cryptocurrency tax law in Japan, but profits gained from cryptocurrencies are taxed as income. Furthermore, transfers of cryptocurrency are exempt from Japan’s Consumption Tax.

For Individual Taxation, Profits gained from trading, swapping, spending USDT, and rewards from staking and mining are classified as miscellaneous income, and are taxed at progressive rates. Tax rates including local taxes can exceed 50%. Loss offsets are limited and cannot be applied against salary or stock gains.

For Corporate Taxation, net profits are taxed at the standard corporate income tax rates. Corporate holdings and gains in cryptocurrencies must be marked to market for tax purposes if an active market exists, and monthly unrealized gains and losses must be recognized for mark to market purposes

Under Japanese law, all transfers of cryptocurrencies, including USDT, are exempt from the Consumption Tax since 2017.

Taxable events include the sale of USDT for yen, the purchase of another token, the purchase of a good or service, receipt of USDT as payment for a service, or as income. The taxable value for all these events is the yen equivalent at the time of the event.

Individuals must file a return for the previous calendar year from February 16 to March 15. Corporate tax returns must also be submitted by the same date, and thereafter, returns must be submitted based on the company’s fiscal year. All records, including trades and currency conversions, must be kept.

Final Thoughts

Buying Tether (USDT) in Japan is easy and safe. The Japanese It has strong rules for buying crypto and has trustworthy exchanges..

You can easily access Coinbase and enjoy its low fees, trade on Bybit for its advanced features and range of digital currencies, and access bitFlyer for its range of Japanese local services. Local crypto services make deposits into your stablecoin account easy, even via Pay-easy and convenience stores.

Be careful and pick an exchange that matches your skill for trading. Buying and selling USDT should be easy and rewarding and there should be no problems passing Japanese regulations.

FAQ

Yes, cryptocurrency is legal in Japan, and Tether (USDT) can be bought and traded on regulated platforms. Japan has a robust regulatory framework for crypto exchanges, ensuring safe and secure transactions.

Some popular exchanges where you can buy Tether (USDT) in Japan include Bybit, Binance, bitFlyer, Bitbank, and LBank. These platforms are regulated, easy to use, and offer various payment methods.

Exchanges in Japan typically support a variety of deposit methods, including bank transfers, credit/debit cards, Pay-easy, convenience store payments, and crypto deposits.

Trading fees for USDT transactions in Japan vary between exchanges but generally range from 0.1% to 0.5%. Platforms like Bybit and Binance typically offer lower fees.

You can deposit JPY into your exchange account via bank transfer, credit card, or local payment methods like Pay-easy and convenience store deposits, depending on the exchange.