Making money with cross-chain yield optimizers involves stuggling and slowly gaining profits. Having decentralized finance tools can actually help you advance in your earnings.

The automated platforms can help you securely yield smarter profits, while also automating various aspects of your personal workflows.

While using these platforms, Diligent and smart investors can also set flexible multi-chain strategies, which help in minimizing risks and lower efforts. In the Crypt+Portfolio, these smart and automated cross-chain yield optimizers makes the toolkit fundamental.

What are Cross-Chain Yield Optimizers?

Cross-chain yield optimizing refers to DeFi platforms with the purpose of yield farming which allocates cryptocurrencies on numerous blockchains and protocols to achieve the maximum yield possible.

Unlike traditional yield farming, the cross-chain versions exploit the ability to profitably yield farm across protocols and blockchains like Ethereum, Binance Smart Chain, Avalanche, and numerous others.

Using automated and self executing smart contracts and bridging technologies, the platforms guarantee safe and effective access and transfer of funds, and in most cases, employ self-compounding and dynamic yield rebalancing strategies to maximize the yield further.

The users in return are offered surplus access to DeFi and innovations, while gaining maximum profit and low risk without the tedious management across chains.

Key Point

| Platform | Core Function | Key Feature |

|---|---|---|

| Beefy Finance | Yield Optimization | Auto-compounding vaults across multiple chains |

| Autofarm | Yield Aggregator | Strategy auto-switching for best returns |

| Yearn Finance | Vault-based Yield Farming | Smart contract strategies for passive income |

| Convex Finance | Curve Staking Enhancer | Boosts CRV rewards without locking CRV |

| APY.Finance | Automated Yield Farming | Risk-adjusted portfolio allocation |

| Stargate Finance | Cross-chain Liquidity Transfer | Unified bridge with instant finality |

| Symbiosis Finance | Cross-chain Swaps | One-click token swaps across multiple blockchains |

| Across Protocol | Cross-chain Bridge | Fast, low-cost transfers using optimistic relayers |

| Synapse Protocol | Interoperable Bridge | Asset swaps and messaging across chains |

| RoboFi | DAO-based Staking Platform | Governance token utility and staking rewards |

1. Beefy Finance

Beefy Finance is a multi-chain yield optimizer and was one of the first yield optimizers to automate and compound strategies across the Ethereum, BNB Chain, Avalanche, and more than 20 other blockchains. Users who want to grow their assets quickly deposit them to beefy’s vaults, where the team reinvests earnings regularly to maximize APY.

Beefy’s main differentiating factor is its gas-efficient vaults and its bridge-agnostic vaults, which allows users to save almost 40% on fees. Beefy also provides leveraged farming and strategies for optimizing earnings on stablecoins.

Distribution of the Beefy Finance’s governance and BIFI tokens is as a method of sharing profits with the users. Its vaulted assets also represent BIFI’s security collateral, which is crucial to Beefy’s security. As one of the most trusted cross-chain yield optimizers, Beefy Finance has more than 500 vaults that operate under a strict security framework.

Beefy Finance Features

- Auto-compounding vaults for LP tokens and single assets.

- 20+ blockchains supported, including Ethereum, BNB, and Avalanche.

- Governance via BIFI tokens with a fee-sharing model.

- Leveraged yield farming and stablecoin strategies available for users.

Pros

- The compounding APY is done frequently so users achieve a high yield.

- The multichain access is very wide.

- The community is strong, conducts regular audits, and is very secure.

- The interface is very easy to use so passive investors can use it.

Cons

- First-time users can be confused by the vault selection.

- Gas prices for every chain fluctuate.

- No clear strategies are published so users cannot be certain how strategies are constructed.

- Audits show smart contracts can be compromised so risks still remain.

2. Autofarm

Autofarm is a DeFi suite that provides users with automated yield farming, DEX aggregation, and portfolio management across nine chains, including the BNB Chain, Polygon, and Fantom. Autofarm clears trades using the best-priced routes, and its vaults use unique, cost-efficient methods that maximize returns.

Users can manage cross-chain assets from the Farmfolio dashboard. Users can govern Autofarm through revenue share with the AUTO token.

Users enjoy seamless, multi-chain farming with deflationary tokenomics and low fees through integrations with QuickSwap, Curve, and others, making Autofarm a top proposition for users who want yield farming with minimal input.

Autofarm Features

- Automated yield farming and strategy switching.

- DEX aggregator to achieve the best trade execution prices.

- The Farmfolio dashboard for cross-chain asset management.

- 9+ blockchains supported including BNB, Polygon, and Fantom.

Pros

- Very competitive pricing and excellent routing.

- The farming is very hands-off and easy to manage.

- Integrated management tools for finances.

- Governance and reward system with AUTO tokens.

Cons

- Compared to competitors the vault selection is still smaller.

- Usable educational tools for new users are very minimal.

- The strategies and updates are not always clear.

- There is less active engagement with the community

3. Yearn Finance

Yearn Finance was the first to create automated DeFi vaults, specializing on yield farming strategies for Ethereum. User assets in yVaults are pooled and lent to auto-compounding protocols like Curve, Aave, and Compound for maximum yield.

Although Yearn is not cross-chain, its strategies are highly optimized. Users govern the protocol through the YFI token and can vote on changes to the strategies.

Yearn is one of the first yield optimizers and remains one of the most simplistic and dependable options, making it a foundational yield optimzer for Ethereum users. It is still the standard in vault-based farming.—

Yearn Finance Features

- Smart vaults based on Ethereum with automated strategy layers

- Combination with multiple protocols (Curve, Aave, Compound)

- Community governance with YFI token

- Strategy management by multiple doctors with regular updates

Pros

- Proven safety and reliability

- Strategies of the platform are clear and transparent

- Active community focused on development and governance

- Perfect for passive investors of Ethereum

Cons

- Native multichain is absent

- Slower APYs than new competitors

- Lil asset variety

- Gas fees on Ethereum

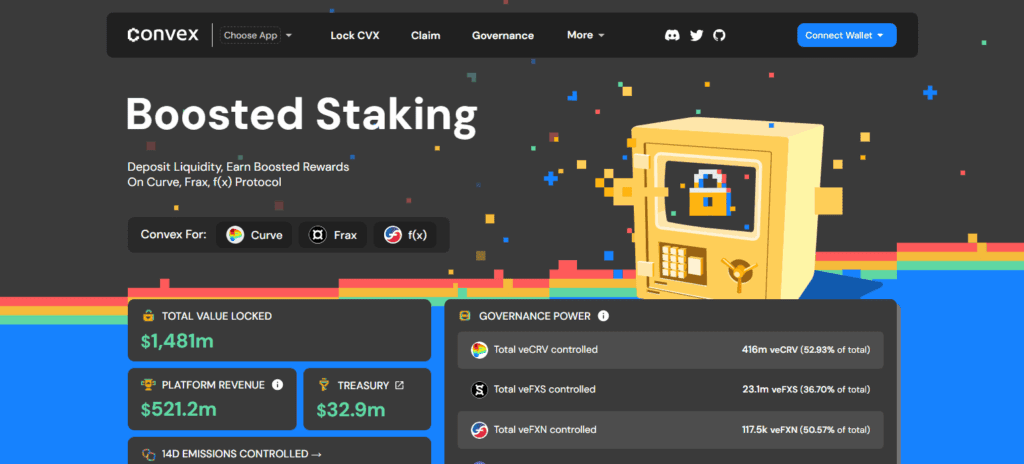

4. Convex Finance

Convex Finance Builds Upon Curve Finance By Enabling Users To Earn Boosted CRV Rewards And CVX Tokens Without Asset Locking. It Pools LP Tokens And Uses Voting Power To Control Rewards And Direct Them To specified Pools.

By Easing The Staking Process And Introducing Staking Dual Rewards, It Is A Great Option For Earning Passive Income. The CVX Token Is Used For Governance And Distribution.

Convex Is Built On Ethereum, But It Is Multi-Chain Thanks To Integrations With Curve. For Stablecoin Liquidity Providers That Want To Optimize Their Yield Farming With Low Effort, It Is Greatly Helpful.

Convex Finance Features

- Enhances Curve staking gains with no need to lock CRV

- Earns CRV and CVX tokens in dual rewards

- Boosted yields by aggregated LP tokens

- CVX token governance and voting

Pros

- High yield stablecoin LPs

- Easiest staking methods

- Powerful with Curve ecosystem

- Clear reward systems

Cons

- Ethereum only platform

- Curve’s performance heavily influences rewards

- Difficult for non-Curve users

- Limited asset variety

5. APY.Finance

APY.Finance Egan Automating Yield Farming By Aggregating User Deposits And Investing Them In A Variety Of Strategies That Include Convex And Curve. It Has Focus On Risk-Adjusted Returns And Leverages Smart Contracts To Adjust And Rebalance Portfolios.

Recognition For Daily Yield Is Given Upon Deposit, And The Yield Is Paid Automatically Compounding, Enabling Users To Benefit From Yield Farming Instantly. It Is Focused On Stablecoin Farming And Low-Risk Strategies, Making It A Great Option For Cross-Chain Yielding Farm.

Users Capture The Value Without Having To Manage The Strategy On Their Own, Making It A Great Option. APY.Finance Is Now Integrated With CortexDAO, Which Expands Its Governance And Functionality, Making It A Great Option.—

APY.Finance Features

- Automated portfolio allocation across DeFi protocols

- Risk adjusted yield farming

- Yield is generated instantly on deposit

- Governance through CortexDAO

Pros

- Multiple strategies are used to diversify exposure

- Low-risk stablecoin farming options

- Hands-off experience for users

- Transparent performance metrics

Cons

- Limited control over strategy selection

- Smaller user base and ecosystem

- Fewer supported chains

- Less frequent strategy updates

6. Stargate Finance

Stargate Finance is a liquidity protocol that allows users to transfer and yield farm assets across 80+ blockchains. It is built on LayerZero and offers fixed liquidity pools with unified pools and instant finality.

Users can supply liquidity in USDC, ETH, and STG, among other assets, and yield is on an auto-compounding basis. Stargate’s architecture enables lending, staking, and farming on Ethereum, BNB Chain, Polygon, and other chains.

STG provides governance and incentive alignment. Stargate is one of the primary infrastructures for omnichain DeFi, enabling efficient and easy cross-chain yield farming and liquidity provision.

Stargate Finance Features

- Cross-chain liquidity transfer via LayerZero

- Unified liquidity pools with instant finality

- Supports farming and staking of STG token

- Bridges assets across 80+ blockchains

Pros

- Trus omnichain interoperability

- Fast and secure asset transfers

- Strong developer backing and integrations

- STG token utility for governance and rewards

Cons

- UI can be complex for new users

- Still evolving in terms of ecosystem reach

- Limited farming options compared to vault platforms

- Requires understanding of LayerZero architecture

7. Symbiosis Finance

Symbiosis Finance is a cross-chain AMM DEX with liquidity aggregation spanning over 45 chains, both EVM and non-EVM. Users can swap assets in one click and ease the burden of managing wrapped assets, which lowers smart contract exposure.

Users can provide liquidity to multi-coin pools and farming programs to earn passive income. Symbiosis comes equipped with MPC technology for secure cross-chain communication and offers gas abstraction to pay for multiple transactions in a single fee.

The SIS token allows the purchase of staking and DAO governance. With over 4B in volume and 4M+ transactions, Symbiosis is among the best cross-chain optimizers.—

Symbiosis Finance Features

- Cross-chain AMM and liquidity aggregator

- Supports EVM and non-EVM chains

- One-click token swaps without wrapped assets

- Uses MPC for secure cross-chain communication

Pros

- Seamless interoperability across chains

- Gas abstraction simplifies transactions

- No need for wrapped tokens

- Strong security model with MPC

Cons

- Limited farming and staking options

- Higher slippage on low-liquidity pairs

- Smaller community and ecosystem

- The relayer model may confuse users

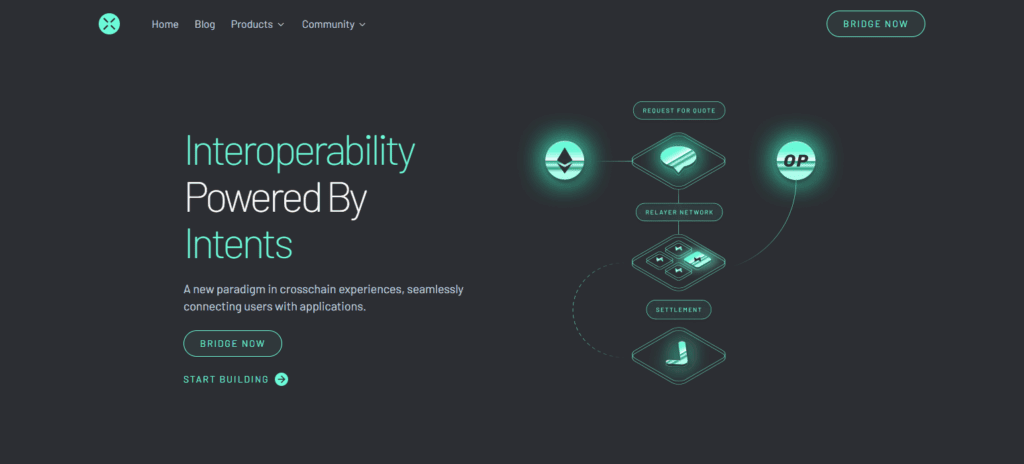

8. Across Protocol

Across Protocol is among the various protocols that act as cross-chain yield farms that do asset swaps for yield farming and do so in a great time and cost efficient manner. It uses optimistic relayers to sweep across the chains and do the asset transfers in the fastest and cheapest manner.

Users supporting the USDC, ETH, BTC and many others, can do yield farming by providing liquidity to the Across pools. Across integrates with leading DeFi platforms and provides cross-chain stablecoin farming strategies on Ethereum, Arbitrum, and Polygon.

It is built with a focus on speed and security for yield farmers. Across is quickly gaining a reputation in the cross-chain DeFi market.

Across Protocol Features

- Optimistic cross-chain bridge with rapid transfers

- Yield farming liquidity pools

- Supports ETH, USDC, BTC, and more

- Integrates with major DeFi platforms

Pros

- Low transaction costs

- Minimal latency bridging of all cross-chain assets

- Secure and scalable infrastructure

- Active yield farmers breakeven quickly

Cons

- Limited assets available

- More Relayer model confusion

- Lacking farming ecosystem

- Less popular than other bridging solutions

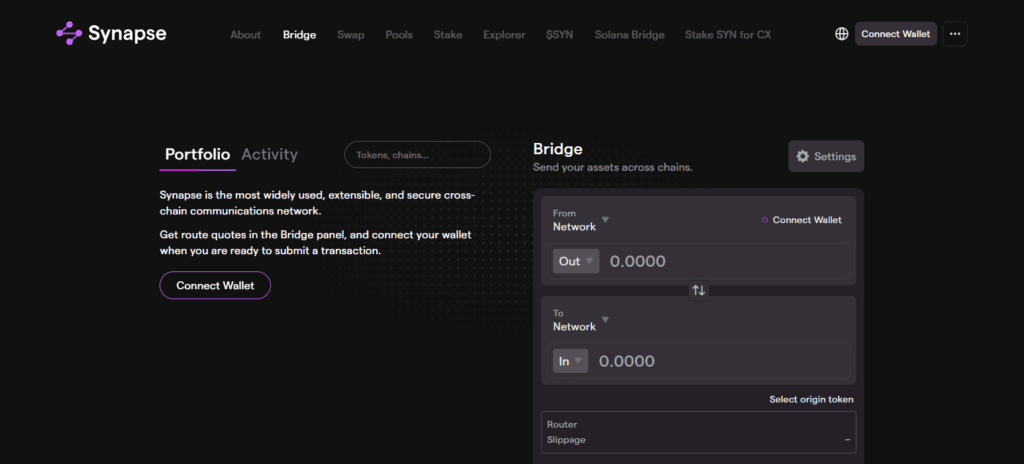

9. Synapse Protocol

Synapse Protocol allows the exchange of digital assets in a decentralized setting and use cross-chain yield farming with Ethereum and many layer 2s like BNB Chain, Polygon and more. Synapse uses its self-built Hop Protocol to transfer the wrapped assets and securely transfer the data that is needed to operate.

Users who bridge assets and put them to work in high APY strategies can earn yield. All operations are trust less and the decentralized design Synapse uses means that it’s architecture is built to operate seamlessly with asynchronous consensus on the blockchain to ensure correct and timely finality of all transactions.

DeFi protocols and users looking for efficient yield across chains will find Synapse to be a valuable asset to their toolkit.—

Synapse Protocol Features

- Messaging and decentralized bridging protocol

- Cross-chain yield farming and asset swaps

- Wrapped assets for cross-chain transfers

- Governed by SYN holders

Pros

- Large cross-chain asset support

- Trustless and secure bridging

- Strong developer and community support

- DeFi application infrastructure is scalable

Cons

- Smart contract risks for wrapped assets

- More complicated UIs

- Few farming opportunities

- Complex system for most features

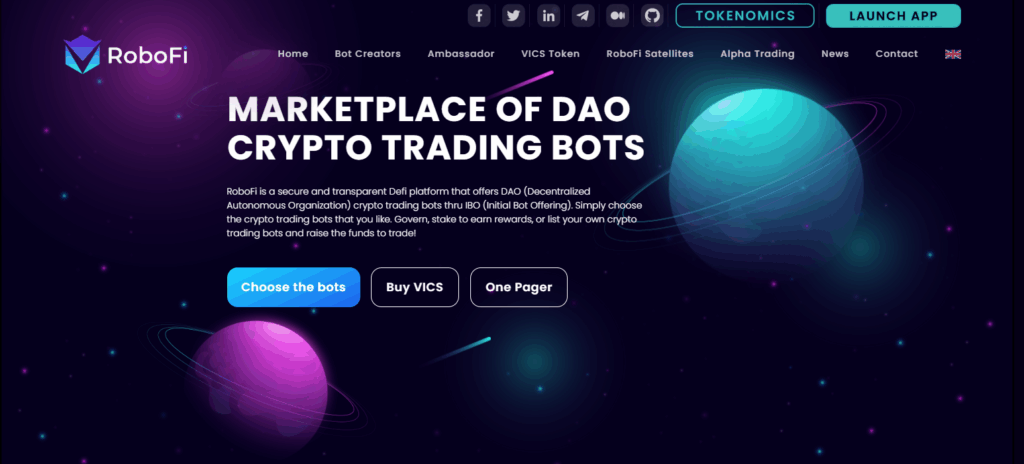

10. RoboFi

A RoboFi is a staking and yield earning platform with a unique approach to automated farming governance strategy. Users can stake crypto assets and use RoboVi to vote on protocol decisions.

RoboFi allows cross-chain staking and yield generation with diverse strategies Ethereum and other blockchains ecosystems.

Its cross-chain yield generation and stake pools, governance voting, and rewards distribution makes RoboFi a winner. Users who seek passive income with community and automation control, will find RoboFi a unique opttion in the DeFi space.

RoboFi Features

- Cross-chain Able to stake and yield with community farms

- DAO governance VICS token

- Automated farming community driven strategies

Pros

- Easy passive income through staking

- community decides simple strategies

- Cross-chain availability

- Distinct mixture of automation and governance

Cons

- Less developed ecosystem and user base

- Minimal farming integrations available

- Less liquidity than leading platforms

- Engagement in governance may be difficult for new users

The Future of Cross-Chain Yield Optimizers

The outlook for cross-chain yield optimizers seems promising as DeFi grows and covers more blockchains. With demand for greater returns and the effortless mobility of assets, such platforms are expected to embrace more sophisticated interoperability technologies, enabling even quicker and more secure cross-chain transactions.

Yield optimization will also become smarter through the incorporation of AI-driven yield strategies, real-time risk assessment, and automated portfolio rebalancing.

Greater capital inflows may result from integration with enterprise DeFi solutions and institutional-grade protocols. Improved regulatory clarity will allow investors to access cross-chain yield optimizers, minimizing risk, maximizing return, and providing a truly DeFi experience.

Conclusion

The way investors maximize returns in the DeFi ecosystem has been changed by cross-chain yield optimizers. Automated yield strategies, auto-compounding, multi-chain liquidity, and cross-chain seamless asset movement unlock yield optimization and risk diversification on Beefy Finance, Autofarm, Yearn Finance, Convex Finance, APY.Finance, Stargate Finance, Symbiosis Finance, Across Protocol, Synapse Protocol, and RoboFi.

These tools minimize the user’s required effort while maximizing profit and risk leveling, making them perfect for the truly capital efficient investor as well as the beginner. In the growing world of DeFi, cross-chain yield optimizers remain the most effective and secure mechanisms for obtaining high yield from any set of blockchains for the investor.

FAQ

Cross-chain yield optimizers are DeFi platforms that automatically move assets across multiple blockchains to maximize returns. They leverage liquidity pools, staking, and auto-compounding strategies to generate higher yields while reducing manual effort

These platforms analyze multiple chains and DeFi protocols to find the most profitable opportunities. They automatically allocate funds, compound earnings, and bridge assets securely between blockchains to optimize overall APY.

Most top platforms like Beefy Finance, Autofarm, and Yearn Finance use audited smart contracts and decentralized governance for security. However, risks include smart contract bugs, network congestion, and market volatility.

Some of the leading platforms include Beefy Finance, Autofarm, Yearn Finance, Convex Finance, APY.Finance, Stargate Finance, Symbiosis Finance, Across Protocol, Synapse Protocol, and RoboFi.

Yes. Most optimizers provide simple interfaces, automated compounding, and step-by-step guides, making them accessible even for users with limited DeFi experience.